7028SMM Service Operations Assignment

Introduction

Hotel revenue is one of the most essential concepts within this hospitality industry as it allows the owners of the hotel to predict demand of the public and optimize the pricing and availability to reach the best profitable outcomes. It also allows the hoteliers to increase yields and revenues through using big data and advanced tech. The main aim of revenue management in the hotel industry is to monitor the market need and respond to improvements in the market effectively (Smith 2020). Its specific parameters transform over time due to modern artificial intelligence technology, automation, processes, and the industry based tools’ modernization and advancement but in the central part it stays just the same. It includes promoting the perfect accommodations to the proper client at the correct prices and at the appropriate times by the use of aimed channels of distribution. This gives a cost-effective suggestion when helping to assure the satisfaction of the consumers. Revenue management is one of the most important techniques to remain effective in the hospitality industry.

Relevance: The importance of hotel Revenue

The simple definition of hotel revenue is anticipating the behaviors of the customers to sell the item every day at an exquisite price. The hotel revenue can be described by some interconnected elements such as segmentation of the consumer, inventory management, forecasting ther requirements, pricing and managing the yield. Each element greatly affects the final outcomes of a hotel. But the hotels are facing some challenges nowadays due to insufficient data, irregular requirement partners, modern health laws issued by the government, and also reduced budgets and the reduced budgets (Iswanto 2019). Hotel Le Bonheur is facing some problems both in the international and domestic areas in the near summer season. The global situation of the economy seems to impact mainly the international market as well as some slowdown in the domestic sides. The international markets are encountering GDP figures which have fueled the central bank to down rates of interest. The domestic markets research suggests a zero development rate. Because of the increased capability in the industry, there would be ovecapabilty during the summer next. The usage rate can be down. As the numbers of the hotels are increasing day by day, the industry can receive a personal shortage. So the costs of recruitment for permanent employees have risen again (Rhudy, et al. 2019).The younger people get popular while working in a hotel, the tv series called hotel has helped to find some staff. The international markets are now regaining their strength by the increase in numbers of tourists. Business travelers are lessening the fairs of trading and conference tours due to the present economic situation. As per the research of some specialists, several hotels are fixing promotional campaigns and gatherings to keep developing business consumers coming, and also to attract the modern ones. It makes sense to try to attract the consumers especially in connection to the increased difference between off-peak and peak seasons.

Theoretical Concept

Hotel revenue management has developed as one of the most essential modern business approaches in current times. To make the process more efficient, some approaches can be taken to provide the best management possible so that the hotels can have a better financial result.

Customer Segmentation

Customer segmentation is an essential part of pricing and marketing as it enables to define teams of travelers which visit the hotel and address severally. Every traveler has different requirements and preferences and the hotel management should be aware of the customer’s needs with some offers which fit every group (Ungelenk 2021). There are some other possible areas which one might want to recognize and market to, such as the demographic sides like gender, age, marriage status and other. The purpose of the tour, the status of the traveler whether its new, retiuring, or regular, the booking medium, the tour duration of the traveler are some other factors which also include the customer segmentation strategy. Offerings discounts, creating attractive packages for the families, discussing rates with organizations enable a hotel to receive extra profits.

Demand Forecasting

The requirements of the consumers are never stable. It is dependent on several things such as important events, seasons, and the economic situation as well. Demand forecasting is the evaluation of data from past needs and requirements, and also present and future events over all the segments of the customers (Rafalski and Mullner 2022). It will suggest the time of increasing and decreasing the demand and grow the correct marketing, pricing, and distribution ideas. To forecast the demands the artificial intelligence advancement can be beneficial as a strategy for the hotel to increase the revenue.

Social Media Marketing

Social media marketing is one of the most effective ways to reach the customers. It helps the hotels to connect more with the guests. It is way easier than even to promote the services of a hotel and its activities on the platforms of instagram, facebook, twitter (Irvine 2019). Posting about the rates, discounts, offers, and exciting packages with attractive pictures of the hotel lobby and all can seriously add value and help a hotel to reach the consumers and engage them in their services. These are some of the strategies that can benefit the hotel to increase the revenue.

Swot Analysis of the Hotel

| Strengths | Weaknesses |

| ● A successful boutique hotel of 20th century with 100% fill-rates around a year

● Permanent efficient employees

● More leisure- tourist driven location

● Seasonal high demand |

● Ultraconservative laws for the singles to dwell in the same room

● Legal disputes

● Fragmented in the early 80’s

● Seasonal downfall |

| Opportunities | Threats |

| ● Investment for better furnishment of the rooms

● Additional room capacity of the hotel ● Renovation of the overall quality of the hotel ● Engage some exciting discounts and packages ● Operation expanding in a new market |

● Operating and administrative costs

● Upcoming challenges in both domestic and international market

● Not achieving the needs of customers in a new market |

Third Part: round1

Objectives

The objectives of simulation games of the Hotel Le Bonheur are to increase its revenue and the hotel is looking to establish new works abroad as well to power the demands of the season.

- To agree with those particular channels that are binding mutually for the volumes and prices of the hotel.

- To employ some permanent staff who can give high efficiency and also some temporary staff who can give the easement that is required to manage the business seasonality.

- To engage the required personnel to receive the financial and operational goals.

- To be leaner, better, and more effective in case of the administrative and operative costs.

Decisions

For the permanent employees the company has decided to give some compensation. The temporary staff will be hired at the basis of pre-discussed salary. It decided to use training to raise the efficiency and motivation of the personnel. Investments are planned to add rooms and also renovation of the present situations (Zeidler 2021). In both the cases, it gets one stage to have the investment operational and ready. As renovation always increases the entire quality of the hotel the hotel has decided to invest in this area.

Display results

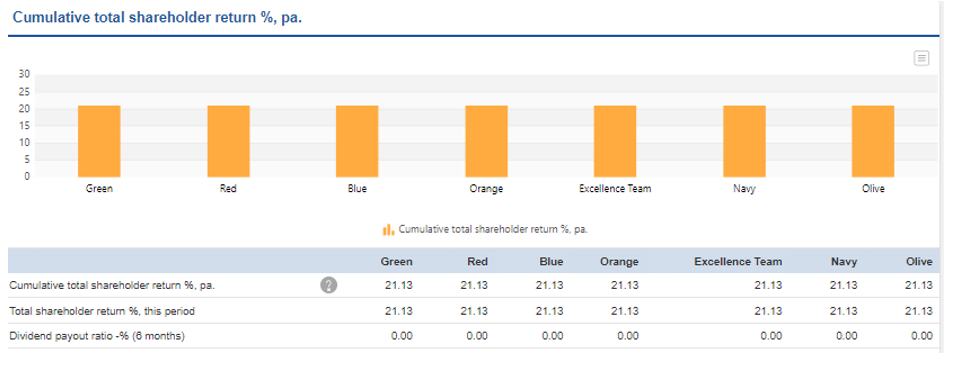

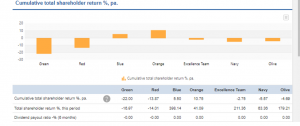

Figure 1: Cumulative Total Shareholder Return%, pa of Round 1

(Source: Provided)

The cumulative total shareholder return of navy is 21.13% pa. The total in this period is similar and the dividend payout ratio is 0.

Figure 2: Market Value of Share of Round 1

(Source: Provided)

After round 1, the total sales revenue of the navy is 444 29. It only includes the domestic revenue as the international market scored 0 after round 1. The personnel expenses were 72 000 and the direct cost is 33 239. It doesn’t include the temporary staff expenses. The gross profit here is a totaling of 339 055 (Pithon 2021). There are other operating expenses such the administration expense was 48 210, the marketing expense of round 1 is 7 000, the rental payments include 62 500, the recruitment and layoff was 734, and the personnel training includes 4 000. The cost saving efforts and maintenance resulted in 8 000 and 18 750. The total expense is 149 193 with 189 861 EBITDA, 50 000 Depreciation and EBIT 139 861. The financing expenses and income include the income of 63 908 before taxes and the net profit for the period is 44 736.

Reflection

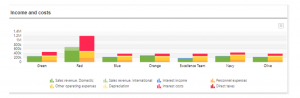

Figure 3: Income and Costs of Round 1

(Source: Provided)

After the completion of round 1, it seems that the navy part is similar with the others in terms of sales revenue. The personnel expenses are nearly 100 000 and the other operating expenses are nearly 300 000. The depreciation is over 300 000. The interest cost is over 400 000 and the direct taxes are leveling with 400 000. Lastly, interest income is over 400k.

Round2

Objectives

- To evaluate the market value of shares.

- To analyze the cumulative total shareholder return %, pa.

- To evaluate the sales revenue and personnel expenses.

- To analyze the other operating expenses and financing income and expenses

- To get the final income and cost value of each team after the completion of the round.

Decisions

The company has decided to evaluate the present shares’ market value with an analysis. After round 1, the direct costs of personnel expenses have decreased. The personal training was done within 4 000 and the maintenance process was also done with 18 750. The maintenance is decided to increase as their team looks forward to renovating the existing room and to do a modification of the hotel overall.

Display results

Figure 4: Cumulative Total Shareholder Return%, pa of Round 2

(Source: Provided)

After round 2, the market value of share is 28.72 and the gross profit ratio is 76.21. The annual asset turnover is 0.13.

Figure 5: Market Value of Share of Round 2

(Source: Provided)

The cumulative total shareholder return is 0%, pa. The total sales revenue after round 2 is 440 531. In round 2, the personnel expenses’ gross profit is 335 128 including the permanent staff with 72 000 and direct cost of 32 803. The other operating expenses total is 149 660. The other operating expenses include expense of administration which is 48 210, the marketing expense is 7 000, the rental payments are a total of 62 500, the layoff and recruitment expense is 1 200, the personnel training expense is 4 000 and the maintenance cost 18 750. The EBITDA is 186 069 and the depreciation is 50 000, the EBIT is 136 069 (Bhaskaran, et al.2020).In terms of financing income and expense, the income is 49 796 before taxes and the net profit of the period is 34 857.

Reflection

Figure 6: Income and Costs of Round 2

(Source: Provided)

The total sales revenue here has decreased after round 2. The interest income is over 400 000, the personnel expenses are nearly 100 000, the other expenses are below 300 000, the depreciation is 300 000. The other operating expenses are over 200 000. The EBIT has increased at the end of round 2. Most of the areas seem to be changed if compared with the first one.

Round3

Objectives

- To calculate the overall position for the downfall in the business

- To increase the salary of permanent staff

- To increase the maintenance of the navy after seeing a loss in the revenue

- To evaluate the current shares in the market

- To analyze the final income and cost

Decisions

After the damage in the overall revenue of the hotel, the members have decided to properly analyze their opposition and value in the market. The salary of the permanent staff is decided to be increased. The maintenance is also undertaken with an increased budget than earlier. On the decision of finance the company has decided to get loan based payments. If the loan decision is taken then it also should be in mind that the short term and expensive loans are received automatically if the organization does not have enough funds to operate the required businesses. The dividend process can be successful when the organization has the relevant amount of finance under the retained incomes on the balance sheet.

Display results

Figure 7: Cumulative Total Shareholder Return %, pa of Round3

(Source: Provided)

The cumulative total shareholder return is on the negative side, with -30.86. The total shareholder return percentage of this period is also on the negative side, with -65.48.

Figure 8: Market Value of Share of Round 3

(Source: Provided)

After round 3, the market value of share has been down, with 9.91. The numbers of shares are currently 100 000. The annual asset turnover has also decreased, at 0.11. The overall sales revenue has badly decreased, and stands at 269 116. The salary of the permanent staff has decreased but the gross profit is 155 341. The other operating expenses which include the administration expense of 44 454, the marketing expense of 7 000, the rental payment is similar, at 62 500, the personnel training expense has decreased with 6 000 and the maintenance is even near double than the early round, at 35 000 (Sanderson 2021). The net profit of the finance income and expenses is running on negative, with -163 995. The income before taxes is similar, at -163 995.

Reflection

Figure 9: Income and Costs of Round 3

(Source: Provided)

After the display results of round 3, it can be seen that the costs have increased so much and the profit is present nowhere. The company is running on a huge loss. The interest cost over 1 million. The sales revenue is nearly 200 000 for the navy team.

Final Round

Objectives

- To expand business in a new market

- To either build a hotel or to take a hotel on lease

- To invest before the start of the operation

- To advertise about the hotel in the new region

- To get access to formal education which is available at the hotel schools

Decisions

The company is looking for a new option such as to operate its work in a new market in a more leisure-tourists driven area. The names can be improved by the instructors. To establish a presence in the new market, two options are available. One option is to build a new hotel and the other to take a hotel on lease from some other agencies. In these two cases, the land is on lease. Proper investment before the operation must be done properly. The sales of channels are possible in the same round while the investment decision has already been taken. In the new market the sales of the room takes place through the channels (Connors, et al. 2019). Advertising plays a major role as the channels have many hotels to select from. It is important to create enough hype with advertising to create the channels more interested. Costs levels and salary of the permanent and temporary staff are also crucial here. A safe side is present as the quality expectations of the customers are not as high as the market. This type of service fault can be forgiven in the new market.

Display results

Figure 10: Cumulative Total Shareholder Return %, pa of Final Round

(Source: Provided)

From the above figure it is clearly noticed that the shareholder returns of the Navy category are decreasing compared to other categories like Green, Red, Blue, Orange, Excellent Team and Olive. Though it is also noticed in the figure that the decrease in the shareholder return associated with the Navy is not much compared to Green and Red categories (Sharif 2020). The table shows that the shareholder return of the Navy is negative five dot fifty seven percent and the total shareholder return percentage at the same period compared to other categories.

Figure 11: Market Value of Share of Final Round

(Source: Provided)

In the final round, the numbers of shares are the same. The overall sales revenue is 439 833. The personnel expense’s gross profit is 344 999. The other expenses totaled 154 501. And the maintenance has decreased.

Reflection

Figure 12: Income and Costs of Final Round

(Source: Provided)

After the final round, the company has revived and got back its previous position in the market. It has a total sales revenue of 439 833. The interest cost is even higher than the previous round and is positioned over 1.5 million. After taking the decision to a new market, the company saw a good recovery.

Findings

The hotel revenue is associated with many factors like understanding the demand and pricing factors to get excellent return on the capital invested. Companies doing business in the leisure category often face downturn associated with the spending cycle of the consumers. To manage the different categories that the hotel generally associates itself are inventory management, demand of its service and managing the capital return. Hotel Le Bonheur is facing difficulties because of various problems like macro-economic downturn and the demand slump in the domestic side. It is critical to forecast the demand requirement of the hotel industry to get fair share of return on the capital invested. Analyzing the problems, the company has got a new plan to enter a new market to regain its reputation. And after analyzing the four rounds it can be said that the company has seen positive results in terms of executing this new plan. The final round shows the situation of the hotel and the navy department’s development is clear.

Conclusion

To conclude it can be stated all the required elements have been established in the paper. The importance of hotel revenue management is described above. The issues that a company faces in this case are also established. The Hotel Le Bonheur total planning’s and actions are described with four rounds. The loss and reviving period are analyzed properly. Facing loss in terms of revenue the hotel planned to enter a new market which resulted in success and the company has regained the strength. With the provided strategies to manage and increase the hotel revenue, the company can perform according to that way to see benefit and revolver from the downfall. The findings of the project are also established by the researcher.

Reference List

Journals

Barata-Salgueiro, T., 2021. Shops with a history and public policy. The International Review of Retail, Distribution and Consumer Research, 31(4), pp.393-410.

Bearden, W., anD FrienDs!. Delta, 8, pp.5-2021.

Beretta, M. and Brenni, P., 2022. Lavoisier’s Sites of Experimental Practice: From the Field to the Laboratory (1764–1794). In The Arsenal of Eighteenth-Century Chemistry (pp. 50-72). Brill.

Bhaskaran, R.K., Ting, I.W.K., Azizan, N.A. and Yelubolu, K.V., 2020. Determinants and market performance of Fortune 100 best companies: evidence from Islamic perspective. Journal of Islamic Accounting and Business Research.

Connors, J.D.N., Binkley, B.L., Graff, J.C., Surbhi, S. and Bailey, J.E., 2019, March. How patient experience informed the SafeMed Program: Lessons learned during a Health Care Innovation Award to improve care for super-utilizers. In Healthcare (Vol. 7, No. 1, pp. 13-21). Elsevier.

Connors, J.D.N., Binkley, B.L., Graff, J.C., Surbhi, S. and Bailey, J.E., 2019, March. How patient experience informed the SafeMed Program: Lessons learned during a Health Care Innovation Award to improve care for super-utilizers. In Healthcare (Vol. 7, No. 1, pp. 13-21). Elsevier.

Irvine, M., 2019. Imagining Women at War: Jane Dieulafoy’s 1913 Campaign. Women in French Studies, 27(1), pp.119-130.

Iswanto, A.H., 2019. Lean Implementation in Hospital Departments: How to Move from Good to Great Services. Productivity Press.

Pernot, D., 2021. Internet shopping for Everyday Consumer Goods: An examination of the purchasing and travel practices of click and pickup outlet customers. Research in Transportation Economics, 87, p.100817.

Pithon, R., 2021. French Film Propaganda July 1939-June 1940. In Film & Radio Propaganda in World War II (pp. 78-93). Routledge.

Rafalski, E.M. and Mullner, R.M. eds., 2022. Healthcare Analytics: Emergency Preparedness for COVID-19. CRC Press.

Rhudy Jr, J.P., Lewis, J.C., Alexandrov, A.V. and Alexandrov, A.W., 2019. Resolving Clinical Trial Subject Disengagement in Socioeconomically Disadvantaged Subjects. Journal of Neuroscience Nursing, 51(4), pp.164-168.

Sanderson, C.D., 2021. The future of nursing: Creating a culture of equity. Journal of Christian nursing, 38(1), pp.24-27.

Sharif, M., 2020. Écriture-dévoilement ou la méthodologie historique au service de la littérature: Mes soixante ans de Constance de Salm. Çédille, revista de estudios franceses, (17), pp.347-370.

Slaoui, H., 2021. The Impact of Covid-19 on the Hospitality Industry and How to Recover from Such Global Pandemic (Doctoral dissertation, HEC Montréal).

Smith, D., 2020. Un bonheur d’Orly: the airport, modernity and nostalgia for a lost future. Modern & Contemporary France, 28(1), pp.71-86.

Ungelenk, J., 2021. Émile Zola and the Literary Language of Climate Change. Nottingham French Studies, 60(3), pp.362-373.

Zeidler, H., 2021. Henri Matisse’s medical history: Multiple health problems and impact on creativity. Journal of Medical Biography, 29(2), pp.63-70.

Know more about UniqueSubmission’s other writing services: