7FNCE042W Blockchain Technologies and Cryptocurrencies

Introduction

The process of announcement, management, and negotiation of different assets and investments has been revolutionized by the arrival of Bitcoin. This revolution has become instrumental in opening up a fresh dimension in the assets and investment world. Different types of “Distributed ledger technology” has been used in the making of the first blockchain, and cryptocurrency of the world. Different floodgates have been held by the “Distributed ledger technology” for various ways of investment (Ross et al. 2019). The blockchain process will be used to administer various financial landscapes. Assets can be torn into different small fractions by the usage of blockchain technology. In the case of illiquid assets, the adjustment of various assets has been encouraged by this technology. The researcher has been using python language to make the prospectus of the tokenized assets to get a better understanding.

Deal Structure

The housing property is a 4 BHK expensive penthouse in the centre of the town. This housing property is very close to restaurants, shops, and schools. There are many hospitals present also near this area. The residents of the house can enjoy the panoramic views through the large windows. Dual glazing and central air conditioning have been offered in this tastefully decorated and newly refurbished housing property.

There is one big fireplace present which is designed as the old British design of a fireplace. Many large window frames and different mouldings have been present in this residential property (Series, 2020). The kitchen has been designed in the rustic style having cupboards made of oak. Various new appliances have been added to give the kitchen a modern look. There has been plenty of space to be used for storage purposes. The oven present in the kitchen is a 3-burner gas oven. That said housing property has one big garden and two swimming pools attached with it on the exterior of the building but inside the area of that said residential property. The residential property is situated in a secluded and calm area. The hospitals and schools are within walking distance from the house. Various playgrounds, parks, sports facilities, and gyms are at a close distance from the housing property.

There are many benefits of tokenization of assets like housing properties.

The research has been discussing five benefits of tokenizing residential property that has been proven as a game changer in the world of management of assets such as housing property. The benefits are (i) the creation of fresh opportunities, (ii) savings in cost management, (iii) payment processes being streamlined, (iv) enhancement in settlement processes, and (v) improvements in the eligibility process for the clients and KYC. The historically known inefficient and opaque private markets have been presenting a valid aspect for applying tokenization. Due to the presence of different factors such as long lockup periods, clumsy subscription process, relative liquidity, and a higher range for minimum investment, various investors try to avoid investing in private properties. This problem has been solved by applying the tokenization methods on the housing property.

In blockchain technology, smart contracts have been executed different complex transactions if the conditions are met with each other. Smart contact put light on the benefits of blockchain technology such as cost savings (Harwood-Jones, 2020). When the traditional versus step processes have been reduced in both downstream and upstream, then savings can be gained. When interest payments have been provided periodically by an investment then one can realize various advantages of tokenizations of different housing properties. With the help of tokenization, in order to make regular payments, the only required information can be made available in the token so that the amount can be sent to the investor’s digital money wallet directly.

Digitization

The digitization involved the process of the proposal identifier and the section of the financial model of the minimum investment of the database that has been chosen in the report. Other than that, the process of the Ethereum blockchain has been defined with the configuration of the extraction key information (van der Linden and Shirazi, 2023). Along with that, the process of the build of the ERC-20 tokens and the specific tracker, the definition of the tokenization management, and the section have been identified with the analysis of the digitization model of the summary and the significance of the dataset.

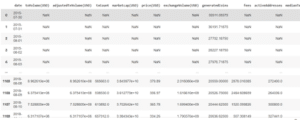

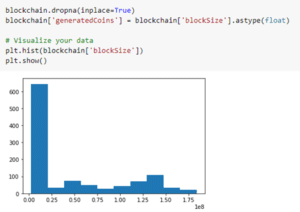

Figure 1: Dataset visualization

The figure simplifies the implementation of the Ethereum request and the significance of the identifier number and the analysis of the technical standard that has been defined with the token implementation. On the other hand, the process of the blockchain and the received and the configuration of the instead of the different blockchain network (Lambert et al. 2021). The selection of the blockchain network has been transferred with the analysis of the dataset array of the null values. The development of the standardization process of the analysis of the interaction tokens of the allocated areas of tokens.

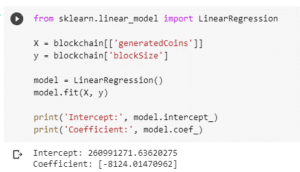

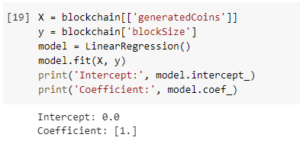

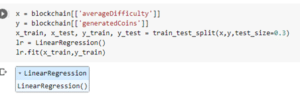

Figure 2: Intercept and coefficient values

The figure simplifies the process of the model and the configuration of the linear regression of the model fit and the identification of the Sklearn model and the linear regression and the section has been signified in the report. The figure simplifies the process of the model coefficient values of the definition of the balances token and the significance of the implementation of the allocated process of the token variables has been implemented (Brühl, 2021). The transaction process of the standard section of the mandatory function of the optional data and the specification of the listing structures.

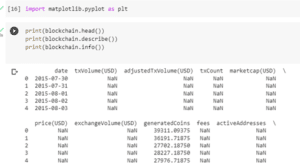

Figure 3: Blockchain evaluation

The figure simplifies the process of the blockchain and the configuration of the evaluation process of the mandatory functions and the definition of the transfer methods of the section of the total supply. On the other hand, the response of the generated coins has been signified as one of the efficient columns in the dataset. The numerical values have been signified with the active address and the importation of the transfer tokens of the selection of the approval and the balance of the standardization of the total supply process. The selection of the implementation of the verification of the smart contract process of the allocation reference.

Primary Distribution & Post-Tokenization Management

In this research paper, the researcher has tried to plan a primary distribution plan and post-tokenization plan for the investors of the residential property using the Ethereum blockchain technology with the help of python language. Primary distribution can be taken as the original selling of any security of an asset to any investor in exchange for some monetary benefits. The “initial public offering” can be termed an example of the primary distribution. In the initial public offering(IPO), shares of a new company have been sold for the first time since its inception to the general public in exchange for taking money from the general public. The issuance of structured notes, preferred shares, and debt securities has been involved in the case of primary distribution management (Nassr, 2021).

In this research paper, the primary distribution of the housing property has been offered to the general public through tokenization of the whole property.

The management of post-tokenization processes has been widely discussed by the researcher.

After tokenizing the housing property, the owner can opt to have agreed to some deal to sell the property. The full form of “REPO” is the “Repurchasing option” rate. When various financial organizations face a money crunch, then they go to the central bank to get some money using the “REPO” rate option. In the case of tokenization, the “DeFi” can be represented as a coin used as a token to generate value for different assets like real estate, artworks, and commodities.

Business model

The business model configures the selection of the data columns and the selection model of the definition of the portfolio structure of the investors and the unique opportunity and the analysis of the income model of the estate assets and the attractive returns of the investors. The appreciation of the underlying assets of the significance of the REIT generation of the investment strategy and the significance of the strong demand (Gill, 2021). Along with that, the identifying opportunities and the management of the quality real estate and the analysis of the investment opportunities with the business analysis overview through the Ethereum coins.

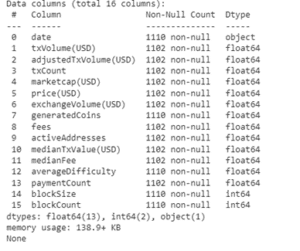

Figure 4: Data columns

The figure simplifies the process of the payment count and the configuration of the experienced and the sequence of the underlying assets and the analysis of the tokenized form of the holders. Other than that, the process of the team and the significance of the responsible and the analysis of the opportunities, and the significance of the strong demands.

Figure 5: Line plot

The figure simplifies the analysis of the line plot significance and the configuration of the strong demand and the analysis of the investment and the unique process of the real estate investment and the section on the experience of the execution effect. Other than that, the underlying assets and the configuration of the token holders, and the selection of the implementation of the token holders.

Figure 6: Intercept of the blockchain

The figure simplifies the idea of the blockchain and the configuration of the model regression and the definition of the coefficient and the selection of the management of the portfolio and the section on the execution of the investment policies (Brummer, 2022). The variable that has been declared with the analysis of the investor’s management facilities of the model business analysis.

Coding

The process of the Ethereum and the blockchain analysis of the configuration of the section of the diversified and the portfolio and the configuration of the tokenization of the platform-based analysis of the properties, price, and area has been signified with the blockchain process of the digital contract.

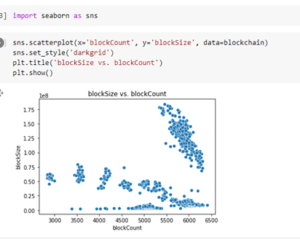

Figure 7: Scatterplot visualization

The figure simplifies the process of the scatterplot analysis and the visualization and the analysis of the tokenization plan have been addressed with the configuration of the dark grid and the scatterplot has been signified in the report (Schletzet al. 2022). On the other hand, the response has been identified with the Ethereum blockchain analysis of the configuration of the definition of the property price.

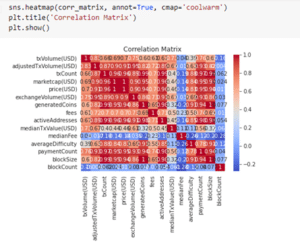

Figure 8: Correlation matrix

The figure simplifies the analysis of the correlation matrix and the configuration of the definition of the adjusted volume and the generation of the generation address. Along with that, the process of the extraction of key information and the selection of the median fee, and the analysis of the identification of the response generator of the confusion matrix that has been extracted with the analysis of the investment trust. The process of the correlation matrix analysis of the tokens analysis of the object-oriented analysis.

Figure 9: Linear regression

The figure simplifies the analysis of the x_train and y_train and the configuration of the considering process of the blockchain and the defining factor of the analysis of the train test split data. The dataset has been considered with the transfer method of the analysis of the Ethereum address and the selection of the blockchain property. The significance of the definition of the Ethereum blockchain and the configuration of the decentralized applications of the financial instruments. Along with that, the decentralized with accessible for the process of the transaction times.

Conclusions

In order to conclude this research paper, it can be said that the researcher has searched and studied various past research papers to understand the usage of the task in a better manner. The housing property has been described properly using proper words and figures. The researcher also used the “Ethereum” blockchain technology in this case to tokenize the housing property. The details of the house and various related aspects of this housing property have been discussed in detail so that a better understanding can be generated after reading the article. Post-tokenization and digitization have been analyzed in this research. The researcher uses python language to perform the analysis of the said topic to get better output from the result.

References

Brühl, V., 2021. German title: Decentralised Finance (DeFi)–wie die Tokenisierung die Finanzindustrieverändert (Decentralised Finance–The Impact of Tokenization on the Financial Industry).

Brummer, C., 2022. Disclosure, Dapps and DeFi. Forthcoming, Stanford Journal of Blockchain Law and Policy.

Gill, J.O.C., 2021. The Perfect Union: An Expansion of the Accredited Investor Definition and Potential Impacts on the Emergent Tokenized Real Estate Market. Iowa L. Rev., 107, p.2311.

Harwood-Jones, M., 2020. Digital and crypto-assets: Tracking global adoption rates and impacts on securities services. Journal of Securities Operations & Custody, 12(1), pp.49-57.

Lambert, T., Liebau, D. and Roosenboom, P., 2021. Security token offerings. Small Business Economics, pp.1-27.

Nassr, I.K., 2021. Understanding the tokenisation of assets in financial markets.

Ross, O., Jensen, J.R. and Asheim, T., 2019. Assets under Tokenization. Available at SSRN 3488344.

Schletz, M., Nassiry, D. and Lee, M.K., 2020. ADBI Working Paper Series.

Series, O.B.P., 2020. The tokenisation of assets and potential implications for financial markets. The Secretary General of the OECD.

van der Linden, T. and Shirazi, T., 2023. Markets in crypto-assets regulation: Does it provide legal certainty and increase adoption of crypto-assets?.Financial Innovation, 9(1), p.22.

Know more about UniqueSubmission’s other writing services: