7FNCE043W Artificial Intelligence and Machine Learning in Financial Services

Part A -Review of Research Literature

Research question

- How to develop and identify key elements for wealth as risk management with the help of the techniques of machine learning?

- How to improve knowledge regarding financial services by using the techniques of data mining and tools?

- How to develop the applications of machine learning in the domain of finance with the help of “Artificial intelligence”?

- How to evaluate “Artificial Intelligence” and “Machine Learning” in Financial Services with the help of Python coding?

- How to improve the potential stability of financial services with the help of “Artificial intelligence”?

Hypothesis

The hypothesis that has been looked after in this entire project is as follows.

- H0 (Null Hypothesis): Portfolio optimization as well as artificial intelligence has no impact on the identification of the effectiveness of financial services such as mutual funds.

- H1(Alternative Hypothesis): AI or artificial intelligence as well as the portfolio optimization algorithm has an impact on the identification of the effectiveness of financial services such as s mutual funds.

Literature review

The application of “Artificial Intelligence” as well as “Machine Learning” has been embraced by a wide range of the industry of financial services. It exists as necessary to start assuming the implications of financial stability of such utilization. This report explains the importance of the potential stability of financial services with the help of “Artificial Intelligence” as well as “Machine Learning”. Therefore, the deployment of AI in finance exists as expected to expand endeavor competitive benefits for financial enterprises,

by enhancing their efficiency via cost reduction as well as productivity enhancement, and by improving the grade for services as well as products proposed to consumers. On the other hand, the competitive advantages which can help consumers to get benefits in the financial domain by furnishing increased quality as well as personalized products, and can unlock perspicuity from data to report investment strategies as well as potentially improve financial inclusion with the help of allowance for the study of the creditworthiness for the clients along with inflexible credit history (Fernández and A. 2019). The applications of AI in the domain of finance can create and intensify financial as well as non-financial risks and even provide advancement to a possible financial consumer as well as investor security considerations such as ( hazards of biased, discriminatory and unfair consumer results, and even data management as well as usage concerns).

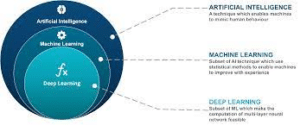

The systems of “Artificial intelligence (AI)” exist as machine-based systems with the utilization of varying levels of liberation which can, for a provided collection of objectives which are human-defined, produce predictions, and recommendations as well as decisions. Therefore, the techniques of AI exist increasingly exploiting massive amounts for the utilization of interchange data sources as well as data analytics that can be directed to “big data” (Donepudi and P.K. 2017). This type of data feeds the models of machine learning (ML) which utilize such data to comprehend as well as enhance predictability and even performance completely via experience as well as data, it can be performed without any program to accomplish by humans. Therefore, the implementation of “Artificial Intelligence” as well as “Machine Learning” can assist the clients’ organizations of financial services that can solve the issues as well as create prospects with the help of enhancing proper processes such as fraud detection as well as produce processing but can allow more engagement of clients that can face experiences via custom as well as personalized offers. Hence, the firms assume that the application of machine learning can present a vast extent of uses (Johnson et al. 2019).

There are various types of identified benefits which can improve data as well as analyze capabilities, and even can increase functional efficiency, as well as enhance the detection of different types of fraud as well as money laundering. As per the requirement, the utilization of computational instruments to define tasks traditionally mandating “human sophistication” which is vastly termed “Artificial Intelligence”. Moreover, these applications exist as already existing utilized to drive cars, translate languages, and diagnose diseases as well as they exist increasingly being utilized in the sector of finance as well.

Figure 1.1: Artificial Intelligence and Machine Learning in Financial Services

(Source: Johnson et al. 2019)

Critical analysis

The application of “Artificial Intelligence” and “Machine Learning” exists as essential to trigger supposing the importance of financial stability of such utilization. This report clarifies the significance of the potential stability alongside financial services by using “Artificial Intelligence” as well as “Machine Learning”. The applications of “Artificial Intelligence” in the field of finance can form as well as intensify financial risks and non-financial risks and even furnish advancement to a probable financial consumer as well as investor security contemplations such as “hazards of biased, discriminatory and unfair consumer results, and even data management as well as usage concerns”. As per the requirement of “machine learning,” it can help organizations to assist the approach of cost optimization as well as can sweeten the knowledge of the customer and likewise increases the services. Therefore, the utilization of “Artificial Intelligence” as well as “Machine Learning” can assist the financial services of the industry to improve their cybersecurity as well as the operations of “anti-money laundering”. The systems of “Artificial intelligence (AI)” describes a machine-based system along with the utilizing of inconsistent levels of autonomy which can, for an equipped pool of objectives which are “human-defined”, deliver “predictions, and recommendations as well as decisions”.

Research gaps

The gaps in the literature are defined as the missing piece or the missing link in the information. The gaps in research or literature act as a burden in the way of understanding the literature or the topic. It is one of the most important tasks of a researcher or the participants of a project to identify the gaps in the literature. The gaps are required to be identified so that they can be mitigated and the gaps can be fulfilled. It is required to provide a bridge to understand the link between two different aspects of the literature. It can be seen that the same has been followed in this project as well.

The gaps in the literature can act as a limitation of the entire literature review. On the other hand, it can be seen as an opportunity for future researchers. Detailed research can be executed so that the gaps can be fulfilled during future research works (Kumar, 2020). The gaps in the literature regarding this particular topic have been identified in this case.

The machine learning algorithm has been implemented for the mitigation of financial issues that can be seen in the real life. It can be seen that mutual fund has been looked after for these purposes. It has been seen that an appropriate dataset is required for the task to implement a machine-learning model for financial services. The trial runs are very costly in some cases and that can be addressed as one of the major limitations in this case (Andriosopoulos et al. 2019). These gaps in the research have been identified in this case based on the topic that has been selected for the task. The same has been tried to be fulfilled as well.

Methodology

“Process automation” exists as the most important application of “machine learning” in the sector of finance. Therefore, technology helps to “increase productivity, automate the repetitive task and replace manual work performance”. As per the requirement of machine learning it can enable organizations to help the process of cost optimization as well as can enhance the experience of the customer and even increases the services (Xie and M. 2019). Therefore, the utilization of “Artificial Intelligence” as well as “Machine Learning” can assist the financial services of the industry to improve their cybersecurity as well as the operations of “anti-money laundering”. Typically, the domain of finance is based on the approaches of normative as well as descriptive, usually depending on statistical as well as econometric techniques for making different types of theories about the occurring knowledge of the financial domain. As important from the financial theory, the approach of predictive as well as prescriptive which are even significant to make decisions for getting appropriate financial services, as well as can provide the functional guidance to produce decision makers such as policymakers, investors, and managers on the particular object of financial decision issues.

Nevertheless, the context has explained for the domain of financial services can pose different challenges to the evolution of realistic as well as persuasive analytic models as well as techniques in this financial field (Sandeep et al. 2019). Therefore, the purpose of this paper is to furnish a summary of recent as well as present developments in this domain that focuses on computational as well as approaches to data analytics. Because of the vast range of this domain as well as the analytical methodologies can involve, more information can gather in these two specific domains of financial services. These are “portfolio management” as well as “credit risk analysis”. In this section there are various models of optimization can be developed that are utilized for risk management, asset allocation, as well as financial planning. Therefore the models for financial optimization can initiate from the essential work on the section of the portfolio (Nozari et al. 2021). Hence, financial optimizations have been increased as well as shields in different areas of corporate finance, banking, and insurance, as well as investments. Therefore, the models become more significant, and standard solutions for algorithms exist not constantly attainable from a “computational point” of the idea. Therefore, financial services have evolved into a “data-intensive sector”.

The approaches of Artificial intelligence depend on machine learning which is typically well-suited as the tool of data analytics that can enable the evolution of predictive, descriptive, as well as prescriptive models for making decisions in the financial domain (Milojević et al. 2021). These types of models permit the designation of non-trivial designs within massive as well as financial data which is ill-structured. Therefore, the techniques of supervised as well as unsupervised learning for classification as well as regression exist as most typically utilized, along with their systems of intelligent optimization. Hence, AI approaches, which usually assume automated methods for making decisions, and the techniques of decision analysis depend on the field of knowledge as well as the expertise of the financial decision-makers. Therefore, technology allows to “increase productivity, automate the repetitive task and replace manual work performance”. Consequently, the tools for decision analysis are usually executed to provide support for decision-making, systems, which incorporate reporting tools, analytics, visualization, and data management (Harmon et al. 2021). “Portfolio management” is an important domain to study the objectives of “financial decision-making”.

In the domain of financial service portfolio management can include the design part as well as management of financial investments, which typically consisted of assets that are taken from equity markets and funds and even “fixed income investments”, commodities as well as currencies. However, the multiple principles, as well as techniques utilized within portfolio management, even apply to portfolios of actual investment, insurance as well as banking. The process of portfolio management includes different issues that can follow subsections, portfolio allocation, asset screening, as well as trading that focuses on methodologies of computational as well as data analytics are utilized (Parker et al. 2021).

Project Plan

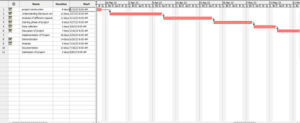

Figure 1.2: Project plan

(Source: Self-created using MS Project)

The planning of the project has been structured at the very beginning of the project so that a particular path can be followed. It can be seen that the entire project has been classified into a few subtasks so that all the objectives of the project can be fulfilled. It has been done so that time management can be addressed along with cost reduction. All the tasks can be seen in the image above and the duration of the same has been displayed with the help of a graphical representation as well.

Part B: Application of the machine learning techniques

Demonstration of the software

Python is one of the most used and important programming languages that can be applied to the data mining processes. It can be seen that the software has the ability to connect with the dataset and the data mining can be done with the help of the same. The software as well as the platform that has been used in this case has an in-built structure. Dynamic binding along with dynamic typing has been one of the most useful features of the software from the point of view of data mining (Sadgali et al. 2019). It can also be seen that scripting or glue language is used to connect all the components of the software.

Real-world financial problem

A real-world financial problem has been taken into account for the task and it can be seen that the same has been fulfilled with the help of machine learning algorithms. The issues regarding the “Mutual Funds” have been looked after in this section and different machine learning algorithm has been used. An “Investment Portfolio” has been taken into account for the task as well as the same has been addressed in the software task (Arnott et al. 2019).

Adopted Methodology

A machine learning algorithm has been followed for the task and it has been done using Python programming language. It can be seen that all the required libraries, as well as the dataset, have been imported at the very beginning of the task. The data has been collected with the help of a secondary approach. Thus, it can be stated that a quantitative research approach has been followed for the task. The usage and applicability of software have been demonstrated in the following sections along with all the potential results.

Validity, Quality and Robustness

The quality, as well as the validity of a project, is one of the most required tasks that must be followed in the project. It can be seen that the same has been done in this project as well. The data for the task has been collected using a secondary data collection approach and they have been collected from a valid data source (Nabipour et al. 2020). Thus, the quality, as well as the validity of the dataset and software task, can be identified as well. On the other hand, if the same output can be achieved with the help of the same dataset, methods, tools and techniques, the task can be declared as reliable.

Flexibility and Creativity

The flexibility of the machine learning model that has been followed in the task has been defined as the adaptation quality of the software as well as the machine learning model. It can be seen that continuous data has been used in the task and based on the same a regression model has been developed for data mining (Barra et al. 2020). On the other hand, the uniqueness of the task has been addressed in the project so that the quality can be maintained throughout all the steps. A creative approach has been executed in the task for the design as well as the codes.

Results and Conclusion

All the results of the software task have been displayed in the image above and it can be seen that the screenshots have been extracted from the software. The task of data mining based on a time series model has been executed in this task with the help of “Python Programming Language”. It can be seen that “Jupyter Notebook” has been used as the platform to do the task (Sezer et al. 2020).

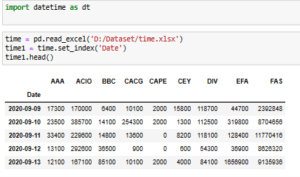

Figure 2.1: Dataset

(Source: Self-created using Jupyter Notebook)

The dataset that has been used to serve the purposes has been displayed in the image above and it can be seen that the same has been imported at the beginning of the task. The required libraries that have been used for the time series model can be seen as well (Masini et al. 2023).

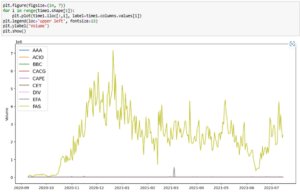

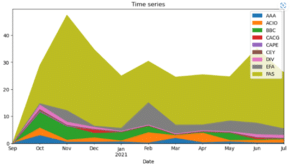

Figure 2.2: Graphical representation of data

(Source: Self-created using Jupyter Notebook)

The trend line of the FAS mutual fund has been visualized with the help of a line plot and continuous ups and downs have been identified in the graph.

Figure 2.3: Visualization

(Source: Self-created using Jupyter Notebook)

The data that has been preprocessed has been displayed with the help of a bar plot using the stated software and it can be seen that the same can be seen in the image as well. A spike can be seen in the middle of the image defines the highest value of the dataset at that period of time regarding that particular mutual fund.

Figure 3.4: Forecasting model

(Source: Self-created using Jupyter Notebook)

Forecasting has been addressed with the help of a time series model and the same can be seen in the image above. The forecasting results have been displayed using a graphical representation. It can be seen that the results for 9 different mutual funds have been shown using different colors so that the difference can be identified with ease (Rundo et al. 2019).

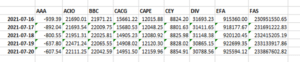

Figure 4.5: Forecasting results

(Source: Self-created using Jupyter Notebook)

The result of the forecasting has been shown in the image above and it can be seen that the results have been extracted with the help of “MS Excel” as the analytical tool. The forecasting has been done for the next 5 days from the dates that have been used in the task.

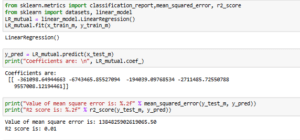

Figure 4.6: Linear Regression model

(Source: Self-created using Jupyter Notebook)

A linear regression model has been created based on the dataset that has been used for the task. It can be seen that the success of the regression model has been defined with the help of “Mean square error” and “R2 score”.

Conclusion

The applicability of artificial intelligence and machine learning techniques for financial services has been one of the most important points of talk in the business field. A real-life financial problem has been addressed in this case and it can be seen that “Mutual Fund” has been taken into account for the task. A brief literature review has been added to the document and the data mining along with forecasting has been done using Python programming language. The method that has been used in the tasks has been mentioned in the document along with the validation of the task.

References

Andriosopoulos, D., Doumpos, M., Pardalos, P.M. and Zopounidis, C., 2019. Computational approaches and data analytics in financial services: A literature review. Journal of the Operational Research Society, 70(10), pp.1581-1599.

Arnott, R., Harvey, C.R. and Markowitz, H., 2019. A backtesting protocol in the era of machine learning. The Journal of Financial Data Science, 1(1), pp.64-74.

Barra, S., Carta, S.M., Corriga, A., Podda, A.S. and Recupero, D.R., 2020. Deep learning and time series-to-image encoding for financial forecasting. IEEE/CAA Journal of Automatica Sinica, 7(3), pp.683-692.

Donepudi, P.K., 2017. Machine learning and artificial intelligence in banking. Engineering International, 5(2), pp.83-86.

Fernández, A., 2019. Artificial intelligence in financial services. Banco de Espana Article, 3, p.19.

Harmon, R.L. and Psaltis, A., 2021. The future of cloud computing in financial services: A machine learning and artificial intelligence perspective. In The Essentials of Machine Learning in Finance and Accounting (pp. 123-138). Routledge.

Johnson, K., Pasquale, F. and Chapman, J., 2019. Artificial intelligence, machine learning, and bias in finance: toward responsible innovation. Fordham L. Rev., 88, p.499.

Kumar, T.S., 2020. Data mining based marketing decision support system using hybrid machine learning algorithm. Journal of Artificial Intelligence, 2(03), pp.185-193.

Masini, R.P., Medeiros, M.C. and Mendes, E.F., 2023. Machine learning advances for time series forecasting. Journal of Economic Surveys, 37(1), pp.76-111.

Milojević, N. and Redzepagic, S., 2021. Prospects of artificial intelligence and machine learning application in banking risk management. Journal of Central Banking Theory and Practice, 10(3), pp.41-57.

Nabipour, M., Nayyeri, P., Jabani, H., Shahab, S. and Mosavi, A., 2020. Predicting stock market trends using machine learning and deep learning algorithms via continuous and binary data; a comparative analysis. IEEE Access, 8, pp.150199-150212.

Nozari, H. and Sadeghi, M.E., 2021. Artificial intelligence and Machine Learning for Real-world problems (A survey). International Journal of Innovation in Engineering, 1(3), pp.38-47.

Parker, H. and Appel, S.E., 2021. On the path to artificial intelligence: the effects of a robotics solution in a financial services firm. South African Journal of Industrial Engineering, 32(2), pp.37-47.

Rundo, F., Trenta, F., di Stallo, A.L. and Battiato, S., 2019. Machine learning for quantitative finance applications: A survey. Applied Sciences, 9(24), p.5574.

Sadgali, I., Sael, N. and Benabbou, F., 2019. Performance of machine learning techniques in the detection of financial frauds. Procedia computer science, 148, pp.45-54.

Sandeep, S.R., Ahamad, S., Saxena, D., Srivastava, K., Jaiswal, S. and Bora, A., 2022. To understand the relationship between Machine learning and Artificial intelligence in large and diversified business organizations. Materials Today: Proceedings, 56, pp.2082-2086.

Sezer, O.B., Gudelek, M.U. and Ozbayoglu, A.M., 2020. Financial time series forecasting with deep learning: A systematic literature review: 2005–2019. Applied soft computing, 90, p.106181.

Xie, M., 2019, April. Development of artificial intelligence and effects on financial system. In Journal of Physics: Conference Series (Vol. 1187, No. 3, p. 032084). IOP Publishing.

Know more about UniqueSubmission’s other writing services: