Corporate Accounting

Executive Summary

The key objective of this report is to enhance the knowledge in concern of financial reporting aspects within the three different companies named as DGO Gold limited, Dynasty resources limited, and Element 25 limited and these are from the mining industry.

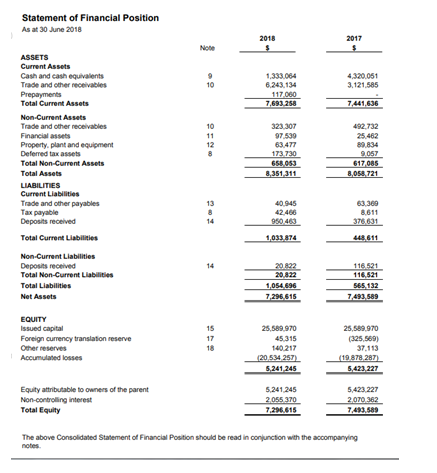

In addition, the changes in equity and the debt-equity position of the companies are discussed in order to analyze the financial position of the company. In this analysis, it is determined that Element 25 limited has high equity as compared to other two companies under the mining industry.

At the same time, the financial report of the company is also analyzed in order to examine the cash flow statement and other comprehensive statements. Apart from this, the accounting for corporate income tax is also done in the context of these three selected companies who operate their business under the mining industry and have critical accounting books.

The concept of corporate accounting is the same for all companies. It includes the various activities such as accounting, bookkeeping, and collection of the financial information, analysis, and verification of the financial and non-financial information.

In this way, the main aim of this report is to improve the knowledge and understanding of corporate accounting (Hao and Shi, 2017). As concerning this, three companies from the mining industry are selected that are DGO Gold limited, Dynasty resources limited, and Element 25 limited.

These companies are listed in ASX. This report analyses the financial report of these companies where it presents the critical discussion on the owner’s equity, cash flow statement, other comprehensive statements, and accounting for corporate income tax.

Equity of companies and evaluation of equity changes

Under the financial management, the equity analysis has significant in concern of managing the return for the investors. The company’s equity provides the suggestions to the firms for making a plan for best utilization of capital in the future.

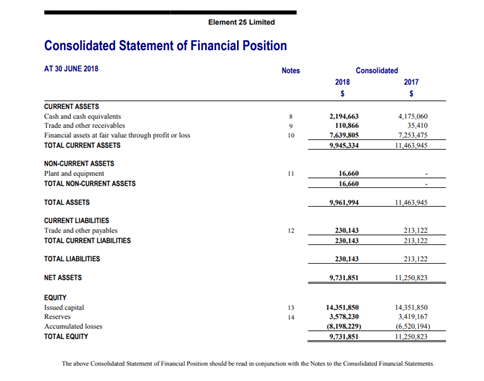

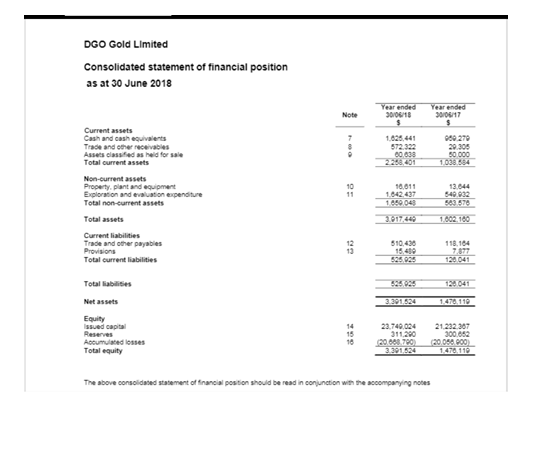

In this manner, the total equity amount of DGO Gold Ltd is $ 1,476,119 as per 2017. In which, issued capital ($21,232,367), reserves ($300,652) and accumulated losses ($ 20,056,900) are included.

In this manner, it is also found that the amount of equity increased from $ 796,484 in 2016 to $ 1,476,119 in 2017 (DGO Gold Ltd, 2017). The reason behind this increment is increased issue capital as well as decreased accumulated losses.

In addition, while discussing Dynasty resources limited, it is examined that the owner’s equity of the company has increased as it was $ 6,241,848 in 2016 but it was $ 7,493,589 in the year 2017 (Dynasty resources limited, 2017).

On the basis of the company’s annual report, it is determined that there are several reasons for increased owner’s capital of Dynasty resources limited. In this, increased issued capital, increased reserves are included along with the non-controlling interest and equity attributable.

However, the annual report also depicts that foreign currency translation reserve and accumulated losses have increased in the year 2017. In the end, the annual report of Element 25 limited reflects that the owner’s equity of the company is $ 11,250,823 in the year 2017.

In this manner, it is also found that the owner’s equity increased from $ 8,075,575 in the year 2016 to $ 11,250,823 in the year 2017 and the reason of this increment is increased issued capital, increased reserves and the decreased accumulated losses within the business from 2016 to 2017 (Element 25 limited, 2017).

Hence, after analyzing all the facts above in concern of owner’s equity, it is found that DGO Gold Ltd has the highest owner’s equity in its company.

The position of debt and equity of companies

The Debt-Equity ratio is found essential as it is used to determine the debt and equity ratio which describes the capital structure of the company as well as future financing planning. In this manner, there is a need to determine the debt and equity position of the selected companies so the calculation of the debt-equity ratio is represented below:

| In the year 2017 | DGO Gold Ltd | Dynasty resources limited | Element 25 limited |

| Debt | 126,041 | 565,132 | 213,122 |

| Equity | 1476119.00 | $7,493,589 | $11,250,823 |

| Debt/Equity | 0.09 | 0.08 | 0.02 |

In the concern of debt-equity ratio, it is found that DGO Gold Ltd has its complete focus on equity financing within its capital structure. In this way, it is found that this capital structure has enhanced its creditworthiness in concern of contingency period in its future.

This situation occurs as there is probability to increase its loans within the company in respect of its future investments as well as managing the contingency situations in the future. Though, due to more dependability on the equity, there is a possibility of bankruptcy while having critical conditions (DGO Gold Ltd, 2017).

Apart from the above, Dynasty resources limited’s debt is less in against of its equity and it can be examined in the above table that reflects the debt-equity ratio of the company.

On the behalf of this, it can be defined that the company also depends on its equity as its borrowings are less and this impacts the company’s financial position in its capital structure (Dynasty resources limited, 2017).

In this way, the creditworthiness has also increased in concern of future contingencies. The equity position of Dynasty resources limited is stronger as compared to its debt.

At the same time, in concern of Element 25 limited, it is also found that company has more equity in comparison to its debts under its capital structure that means the company does not depend on its debts whereas it has more dependability on its equity financing.

In support of this, the debt-equity ratio can be seen in the above table as it reflects 0.02 ratio of Element 25 limited company (Element 25 limited, 2017).

Changes and their reasons within each item of cash flow statement

| DGO Gold | |||

| 2018 | 2017 | 2016 | |

| Cash flows from operating activities | |||

| Payments to suppliers and employees | -4,52,177 | -3,56,268 | -4,71,253 |

| Payments for exploration and evaluation activities | -1,72,279 | -36,763 | -1,58,015 |

| Net cash by operating activities | -6,24,456 | 42,353 | -6,29,279 |

| Cash flows from investing activities | |||

| Interest received | 4,294 | 3,899 | 1,566 |

| Receipt of research and development | 2,34,033 | 68,127 | 0 |

| Payments for plant and equipment | -10,064 | ||

| Payments for exploration and evaluation activities | -12,26,312 | -4,57,205 | -1,42,208 |

| Payments for deposits | -4,83,827 | ||

| Net cash generated/(used) by investing activities | -14,81,876 | -3,85,179 | 3,91,176 |

| Cash flows from financing activities | |||

| Proceeds from issues of equity securities | 26,08,833 | 9,42,065 | 1,62,500 |

| Proceeds from issues of equity securities | -1,51,796 | -5,628 | -15,975 |

| Proceeds from share application monies | 3,15,456 | ||

| Net cash generated by financing activities | 27,72,493 | 9,36,437 | 1,46,525 |

| Net increase in cash and cash equivalents | 6,66,162 | 5,93,611 | -91,578 |

| Cash and cash equivalents at the beginning of the financial year | 9,59,279 | 3,65,668 | 4,57,246 |

| Cash and cash equivalents at the end of the financial year | 16,25,441 | 16,25,441 | 3,65,668 |

(DGO Gold Limited, 2018)

| Dynasty | Element | |||||

| 2018 | 2017 | 2016 | 2018 | 2017 | 2016 | |

| Cash flow from operating activities | ||||||

| Net leasing inflow / (outflow) | -23,26,135 | 15,72,688 | -40,52,218 | |||

| Payments to suppliers and employees | 7,60,908 | -14,86,976 | -7,42,342 | -8,53,116 | -5,02,481 | -5,72,012 |

| Interest received | 15,017 | 50,932 | 30,849 | 60,903 | 1,15,926 | 1,34,530 |

| Tax refund | 1,08,274 | -1,07,151 | -74,792 | |||

| GST refund | -17,059 | 41,810 | ||||

| Finance costs | -21,561 | -9,127 | ||||

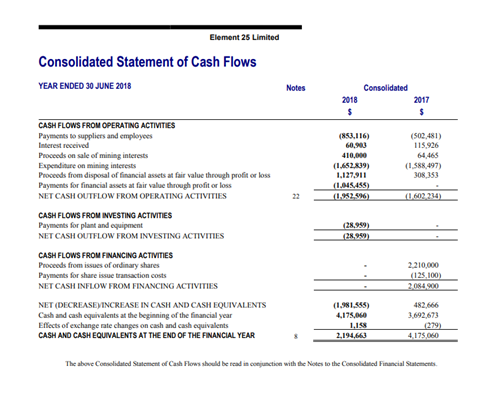

| Net cash outflow from operating activities | -30,64,771 | -9,127 | -47,96,693 | -19,52,596 | -16,02,234 | -29,84,290 |

| Cash flow from investing activities | ||||||

| Purchase of property, plant, and equipment | -6,999 | -98,243 | -28,959 | |||

| Proceeds on sale of investment securities | 22,482 | |||||

| Equity investment from non-controlling interest | 20,42,071 | |||||

| Net cash (outflow) / inflow from investing activities | -6999 | -98,243 | 20,64,553 | -28,959 | ||

| Cash flow from financing activities | ||||||

| Proceeds from issue of share capital | 23,01,483 | 42,58,109 | 22,10,000 | |||

| Payment for share issue costs | -57,690 | -43,362 | -1,25,100 | |||

| Cash received from lease factoring | 2,02,953 | |||||

| Repayment of lease factoring | -2,02,953 | |||||

| Repayment of the amount due to directors under the purchase agreement | ||||||

| Net cash inflow from financing activities | 20,40,840 | 44,17,700 | 20,84,900 | 0 | ||

| Net increase in cash and cash equivalent | -3071770 | 19,33,470 | 16,85,560 | -19,81,555 | 4,82,666 | -29,84,290 |

| Cash and cash equivalents at beginning of period | 4320051 | 22,88,866 | 6,17,851 | 41,75,060 | 36,92,673 | 66,74,413 |

| Effects of exchange rate changes on cash | 84783 | 97,715 | -14,545 | 1,158 | -279 | 2,550 |

| Cash and cash equivalents at the end of period | 133064 | 43,20,051 | 22,88,866 | 21,94,663 | 41,75,060 | 36,92,673 |

(Dynasty Resources Limited and Element 25 Limited, 2017- 2018)

The above are cash flow statements for DGO, Dynasty and Element. From them, it can be analysed that each cash flow is divided into three major categories such as cash from operating activities, investing activities and financial activities.

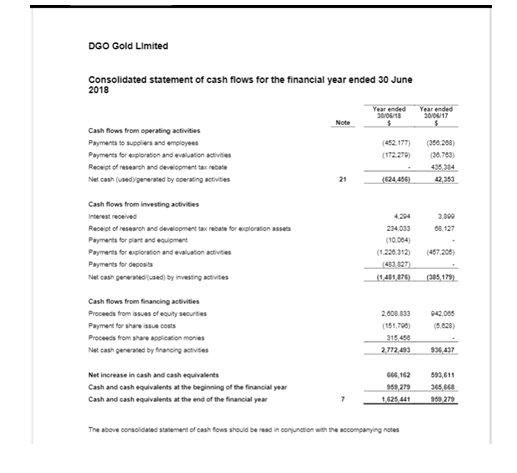

In the cash flow of DGO, it can be seen that net cash from operating activities and financial activities are declined and it is negative cash flow. The main reason of decline in the operating cash flow is that there is as increase payment to suppliers, employees, exploration and evaluation activities.

Moreover, the reason of increase in the investing activities is that there is increase in payment for exploration and evaluation activities and payment for debtors (DGO Gold Limited, 2018.). An improvement can be seen in the net cash generated by financial activities because it is increased 2772493 from 936437. It is because company issued new equity shares in market.

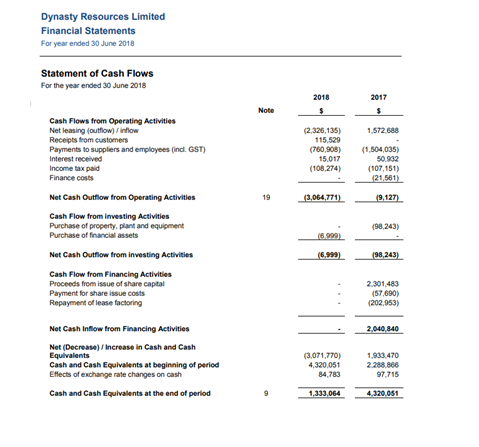

In the list of the cash flow items of Dynasty, it is found that cash flow from operating activities is declined negatively. It is because the expense of the company has increased in the context of leasing cost (Dynasty Resources Limited, 2017- 2018).

Moreover, it also found that cash from investing activities has improved because company made les payment in this year for purchasing property, plant and equipment.

The cash flow from the financial activities is zero in year 2018. In the cash flow of Element 25, it is analysed that cash flow from the operating activities and investing activities are found negative. At the same time, there is no activity in the cash flow from financial activities (Element 25 Limited, 2017-18).

Comparative analysis of companies for three broad categories of cash flow

| DGO Gold | Dynasty | Element | |||||||

| 2018 | 2017 | 2016 | 2018 | 2017 | 2016 | 2018 | 2017 | 2016 | |

| Net cash by operating activities | -6,24,456 | 42,353 | -6,29,279 | -30,64,771 | -9,127 | -47,96,693 | -19,52,596 | -16,02,234 | -29,84,290 |

| Net cash generated/(used) by investing activities | -14,81,876 | -3,85,179 | 3,91,176 | -6999 | -98,243 | 20,64,553 | -28,959 | ||

| Net cash generated by financing activities | 27,72,493 | 9,36,437 | 1,46,525 | 20,40,840 | 44,17,700 | 20,84,900 | 0 | ||

Insight from comparative analysis

From the above analysis, it can be said that liquidity performance of the company is not well because all companies are in loss and negative cash flow from the operating activities. It means that the company is not able to generate the sufficient sales to meet the financial obligation in the business.

Part: C other comprehensive income statements

Description of items in Comprehensive Income Statement

While discussing the company’s balance sheet, the comprehensive income statement leaves a greater impact on the company. In addition, the comprehensive statement of DGO Gold Ltd reflects the loss of $ 201,964 in the financial year 2017 (DGO Gold Ltd, 2017).

In a similar manner, Dynasty resources limited’ comprehensive statement shows the loss of $ 992,052 that is more in comparison to DGO Gold Ltd. Instead of above, Element 25 limited’s comprehensive income is $ 1,002,717 in the year 2017.

In this manner, it is examined that the other comprehensive statement of these companies mainly includes the shareholder’s profit and loss, and the non-controllable interest etc.

Reasons for not reporting items in income statements

In concern of the other comprehensive statements of the selected companies, it is examined that there are several attributes associated with comprehensive income statement that are not reported under the comprehensive statement

because these attributes are not determined profitable until they are sold out under the market (Nejad et al., 2018). But, these attributes are required to be involved under the income statements after defining them.

Comparative analysis of the items shown in the other comprehensive income statement

As per the shareholder’s equity statement, the stock amount, dividend, and the sales value are enlisted. Due to this, the reported attributes are not provided any kind of existence under the comprehensive statements.

Examine whether other comprehensive income is included in evaluating the performance of the company’s managers

As per the comprehensive financial statements of the company, the manager’s performance of the company is reflected under the profit and loss statements which are prepared by the help of shareholder’s equity within the company’s annual report.

Moreover, it is also found that fair financial statements are important for the companies as well as its shareholders as these provide the information of the actual return of their investments within the company (Bratten et al., 2016).

That is why it is important to prepare the comprehensive financial statements with more efficiency by the manager so that these documents can be helpful to increase the shareholder’s interest within the company. These statements are also essential because these provide the value of the total owner’s equity (Būmane, 2018).

Part: D accounting for corporate income tax

Tax expenses shown in the latest financial statements

The annual report of DGO Gold limited shows that the company did not earn the profit in this year so that there is a not liability of the income tax on the company.

In this, it is also found that the value of the loss from continuing operation is $611,890 on which income tax benefit is calculated with the rate of 27.5% and amount of income tax benefit is calculated $168270 (DGO Gold Limited, 2018).

Moreover, the annual report Dynasty resources limited also shows that the company did not get the profit. It also gets the tax benefit of the amount $22543 in the financial year 2018 (Dynasty Resources Limited, 2018). Hence, there is not a liability of tax on the company.

In addition, the annual report of Element 25 limited also depicts that the company was also unable to generate the profit from the operating activities. So that it also has not liabilities of the tax. Hence, the amount of the income tax expense is also zero here (Element 25 Limited, 2018).

Effective tax rate calculation for selected companies

From the analysis of the annual report of all companies, it is found that all companies are facing the loss so that it is difficult to calculate the income tax rate (Gendron, 2018).

But, at the same time, it is analyzed from the additional information that the tax rate that is followed by companies is 30% on profitability. The Australian Taxation office has determined that all companies in Australia are liable to pay 30% tax of their income.

Reasons behind inclusion of deferred tax assets and liabilities in the balance sheet

The term deferred tax assets and liabilities are part of the current assets and liabilities. The situation of the deferred tax assets can be seen when income taxes payable is more than the income taxes paid by the company. Besides this, the deferred tax liabilities create when the income taxes paid is high than the income taxes payable.

In the balance sheet of DGO Gold limited, it is found that the value of the deferred tax assets is recorded by the $457989 in the financial year 2018 (DGO Gold Limited, 2018). Moreover, the value of the deferred tax liability is found the same as $457989.

At the same time, the annual report of Dynasty resources limited depicts that the amount of deferred tax assets is $173730 in the balance sheet (Dynasty Resources Limited, 2018). It is shown that income tax payable is high compared to the income tax paid.

The annual report of Element 25 limited determines that amount of the deferred tax assets is $2,038,156 (Element 25 Limited, 2018). The main reason for including in the balance is that it is part of the assets and liabilities.

Changes in deferred tax assets or liabilities

In the reference of the DGO, it is determined that in the current year the amount of the deferred tax assets has increased by $303993. It is because the value of the deferred tax assets in the year 2017 was 153996 that increased by $457989 in the year 2018 (DGO Gold limited, 2018).

In the reference of the deferred tax liabilities, it is found that there is no change in the number of deferred tax liabilities. The annual report of Dynasty determines that deferred tax assets of the company increased in the current year. It is because the deferred tax amounted of 173730 in the financial year 2018 that was only 9057 in the year 2017 (Dynasty resources limited, 2018).

It is showing that the deferred tax asset of the company is increased by $164673 in the one year. But, there is no information on the deferred tax liabilities in the annual report of the company. Moreover, it is also analyzed from the annual report of Element 25 limited that an increase in the deferred tax assets is found because it is found that it was increased $ 2,038,156 from $1,495,773 in the financial year 2018 from 2017.

At the same time, the deferred tax liabilities of the company declined by 819972 from 1157541 in the financial year 2018 from 2017 (Element 25 limited, 2018).

Calculation of cash tax amount

By analysis the annual report of all companies such as DGO Gold limited, Dynasty resources limited, and Element 25 limited, it is found that companies have no cash tax amount because these all companies are running under the loss. Due to this, there is no liability of the tax.

Without the information of the tax expense is not possible to calculate the amount of the cash tax paid. In the corporate accounting, it is found that there is a significant difference between the cash tax amount and the provision for tax. Basically, the tax is paid by the preparation of the annual report and most of the companies cannot pay accurately the amount of the tax so that they pay an approximate amount of the cash (Kukah et al., 2016).

Calculation of tax rate for companies

As determined that there is no cash tax amount in the annual report of these companies so that it is difficult to calculate the cash tax rate for the companies. Moreover, it is also found that the formula of calculating the cash tax rate is cash tax amount divided by income before tax * 100.

At the same time, due to lack of cash tax amount and cash tax rate, it is difficult to determine which company has the highest cash tax rate (Suzuki, 2015).

Reason for difference in cash tax rate and book tax rate

In the accounting, the cash tax and book tax are two different aspects of the income tax. In this, it is determined that the book-tax can be determined as an amount that determined the government of Australia in the concept of the certain % on the profit of the company.

It is a liable obligation for a company to pay the book tax. The cash tax amount is different from the book tax. Cash tax includes the book tax + net deferred tax. The mean from the net deferred tax meaning is from the minus the deferred tax liability to deferred tax assets (Bhasin, 2015).

From the above discussion and analysis, it can be said that the area of corporate accounting is very wide. A person can analysis the whole financial statements of a company if it has sufficient knowledge and understating of corporate accounting.

The findings of this report determined that DGO Gold limited, Dynasty resources limited, and Element 25 limited belong from the mining industry of Australia. These are also trading in Australian Stock exchange but market performances of the companies are not good.

It is because companies are not generating the profit. Due to this, these companies are also not paying the tax to the government. It is also found that the book tax and cash tax are both different elements of the income tax. A company that is doing business in Australia is liable to pay the 30% income tax to the government.

Bhasin, M.L., 2015. Corporate accounting fraud: A case study of Satyam Computers Limited.

Bratten, B., Causholli, M. and Khan, U., 2016. Usefulness of fair values for predicting banks’ future earnings: evidence from other comprehensive income and its components. Review of Accounting Studies, 21(1), pp.280-315.

Būmane, I., 2018. The methodology of the statement of comprehensive income and its impact on profitability: the case of Latvia. Entrepreneurship and Sustainability Issues, 6(1), pp.77-86.

DGO Gold Limited. 2018. Annual Report. [Online] Available At: http://www.dgogold.com.au/asx-announcements/ (Assessed: 22-01-19)

Dynasty Resources Limited. 2017. Annual Report. [Online] Available At: http://www.dmaltd.com.au/public/news_release/annual_reports/dma_annualreport_2016.pdf (Assessed: 22-01-19)

Dynasty Resources Limited. 2018. Annual Report. [Online] Available At: http://www.dmaltd.com.au/public/news_release/2018/2018-09-28,2018_Annual_Report.pdf (Assessed: 22-01-19)

Element 25 Limited. 2017. Annual Report. [Online] Available At: https://www.element25.com.au/site/PDF/1664_0/AnnualReporttoShareholders (Assessed: 22-01-19)

Element 25 Limited. 2018. Annual Report. [Online] Available At: https://www.element25.com.au/site/PDF/997_0/AnnualReporttoshareholders (Assessed: 22-01-19)

Gendron, Y., 2018. Beyond conventional boundaries: Corporate governance as inspiration for critical accounting research. Critical Perspectives on Accounting, 55, pp.1-11.

Hao, S., Li, W. and Shi, G., 2017. Religion and Corporate Accounting Conservatism.

Kukah, M.A., Amidu, M. and Abor, J.Y., 2016. Corporate governance mechanisms and accounting information quality of listed firms in Ghana. African Journal of Accounting, Auditing, and Finance, 5(1), pp.38-58.

Nejad, M.Y., Ahmad, A. and Embong, Z., 2018. Value Relevance Of Other Comprehensive Income. Asian Journal of Accounting and Governance, 8, pp.133-144.

Suzuki, T., 2015. National Accounting, Corporate Accounting, and Global Standardization. Wiley Encyclopedia of Management, pp.1-5.

Apendix 1: Cash Flow Statement of DGO Gold Limited

Apendix 2: Balance Sheet of DGO Gold Limited

Apendix 3: Cash Flow Statement of Dynasty resources limited

Apendix 4: Balance Sheet of Dynasty resources limited

Apendix 5: Cash Flow Statement of Element 25 limited

Apendix 6: Balance Sheet of Element 25 limited