THE ECONOMIC ENVIRONMENT OF BUSINESS

1. Introduction

The automobile industry is one of the growing industries in the UK; the growth of the industry has decreased as a result of Brexit. In the year 2018 the industry has shown a growth of 3.4%. In this aspect the study will present the analysis of the UK car industry.

It will present the analysis of trend of sale in the UK car industry. Along with that it will give an idea about the market structure and the barriers in making entry into the market. It has also focused on the future trend of the UK car industry.

2. Outline the trend in sales of the car company

a) The main competitive companies and market share

The UK has one of the biggest automobile markets in the world. There are several top companies that have the largest amount of market share in the car industry of the UK. The main competitive companies are mentioned below:

- Volkswagen- It has a market share of around 9.3 %. The total sales done by Volkswagen in the year 2019-2020 is £ 131967.

- Ford- Ford has second-highest shares in the automobile market of the UK. Market share of Ford is 9.1%. Ford sold more than 16000 vehicles in the financial year 2019-2020 and claimed the top spot in selling vehicles.

III. BMW- The market share of BMW in the UK is 3rd highest and stands at nearly 7.1 % across the automobile market. It is one of the premium brands and in the UK it sells around 10000 vehicles in 2019-2020.

- Mercedes- Mercedes-Benz has fourth highest market share in the automobile market of the UK. It has more or less 7% market share. In terms of selling cars in the year 2019-2020, it has registered more than 11000 cars in the UK.

- Audi- Audi is one of the most precious brands in the market of the UK as they have a share of around 6.3 %. It sold almost 9500 vehicles in the year 2019-2020.

Apart from these Toyota, Opel, Nissan, Kia, Landrover and many more are the other top competitors in the UK automobile industry.

Car industry of the UK follows an oligopoly market structure. There are few characteristics of oligopoly and the characteristics of this market structure align with UK automobile industry is mentioned below:

- In oligopoly, few firms dominate the market and it has been seen that in the UK few firms such as Volkswagen, Ford, BMW, Audi, Mercedes-Benz and few others dominate the market. As stated by Ahrens, Pirschel, and Snower (2017) they have more than 50%of the market share and sell almost 80% of the vehicles.

- Homogeneous and differentiated products can be seen in this market type. In the UK car industry, innovation is constantly happening and thus every company is launching several vehicles with different features to attract customers.

- Companies in the car industry of UK are aiming to achieve profit and want to run their business for a long term which makes this market structure as Oligopoly (Choji, and Sek 2017).

The new companies have to face barriers in order to take entry to the market as the e company may face several risks that can lead to a loss of the company. The main barriers that the company can face areas follow

- Economies of scale– In the UK, car industries per unit cost price decrease with the increased volume of production. As mentioned in the study by Amin, and Smith (2017), new entrants can increase the manufacturing volume which has a risk of sales. They can decrease the volume which is going to increase the cost price. Thus, it is a huge challenge.

- Complex government policies– The UK government limits the entries of new brands in the car industry which is one of the main barriers for new entries.

- The need for capital is the high- UK car industry needs huge initial investment which acts as a significant barrier for the new entries.

- High switching costs for customers- Customer’s need to spend a huge sum of money in employee training, technical support, new equipment and many more for switching the brand Bailey, and De Prepress (2017). This is a significant barrier for new entries.

- Non-availability of Different products – New entries in this industry are dependent on innovative products which help them to grab customers. In this car industry, differentiated products manufacturing is tough (Sharma, Singhi, and Mittal, 2019).

- Access to distribution channels is tough- Distribution channels in this industry are fixed and this channel does not prefer to sell new brands due to the market reputation and sales rate of old ones. Thus, it is tough for new entries to access the distributors.

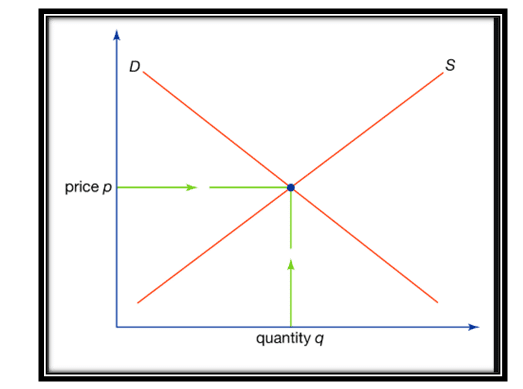

The UK car industry is facing a huge demand in recent years that has enhanced the price of the car; this is explained by the Theory of demand and supply. As Mentioned by Kim, and Kim (2018), the theory of demand and supply depicts that with an enhancement in the price of the product the demand for the product decreases (Cabello 2020). On the other hand, if the price of the product decreases then it will enhance the demand for the product. In this aspect, if the price of a product enhances then it will enhance the supply of the product.

Figure 1: Demand and Supply curve

(Source: Kim, and Kim 2018)

In this carve when the demand falls due to price hike, an upward movement in the demand curve can be seen vice versa if this initiates downward movement of the curve.

As discussed in the study by Berentsen, Huber, and Marchesiani (2018), keeping the price constant if other factors such as the taste of people towards the vehicles change then change in demand indicates an upwards or downwards shift. Evaluating this curve the market dynamics of the UK car industry can be analyzed which indicates the demand and price of the vehicles.

4. Future growth of UK car industry

The UK car industry is heavily affected by Brexit; there it has caused the export and import of cars to the other European countries. This situation has decreased the sale of the car industry.

As mentioned by Mehmood, and Younas, (2019), this current state of affairs in the country has decreased the exports by about 1.2 million cars. On the other hand, if the price of the product decreases then it will enhance the demand for the product.

In this aspect, if the price of a product enhances then it will enhance the supply of the product. If this state continues, then, this will result in uncertainty in the market; this will lead to a fall in the demand and sale of the company.

As mentioned by Berkeley, Jarvis, and Jones (2018), it is expected that the demand for the car in the UK market could fall by 10%. The breaking away of the UK from the EU can cost manufacturers of vehicles almost more than 2.8 million sales in the next few years.

Figure 2: UK car manufacturing unit

(Source: Berkeley, Jarvis, and Jones 2018)

A drop in the deliveries of almost 200,000 vehicles in the world is predicted in the year of 2018. According to Iyengar, and Bharathi, (2018) before the impact of Brexit, strategic location was perceived by the UK for penetrating the rest markets of Europe. New entrants can increase the manufacturing volume which has a risk of sales.

They can decrease the volume which is going to increase the cost price. Thus, it is a huge challenge. As a result of this the largest car manufacturers in the UK have decreased their production. For example, BMW has decreased their production by 11% that has resulted in a great loss of the company.

As mentioned by Krugman, Obstfeld, and Melitz, (2017), the progressive loss in the value of the pound can force this car company to increase the price of sales. The breakaway from the EU is expected for introducing a number of new complications in the supply chain of the automobile industry.

Therefore, sales in the UK car industry are decreasing over the year, in order to enhance the sale in the industry the government will have to take necessary steps. The Bank of England will have to take major steps by increasing or decreasing the rate of interest.

Based on the above study it can be analysed that the growth of the UK car industry has slowed down as an impact of Brexit. The report has presented an analysis of the future trend of sale of the UK car industry. In presenting this the report has provided an about the market structure, and the barriers to take entry into the market.

Furthermore, this has provided an explanation of the theory of money demand and supply by proper graph. The report has also analysed the future growth of the industry, which has been slowed down by Brexit. The Government of the UK and the Bank of England should have to take necessary steps in order to enhance the sale of the car further in the market of the UK.

Ahrens, S., Pirschel, I. and Snower, D.J. (2017) ‘A theory of price adjustment under loss aversion’. Journal of Economic Behavior & Organization, 134, 78-95.

Amin, A. and Smith, I. (2017) ‘Vertical integration or disintegration? The case of the UK car parts industry’. In Restructuring the global automobile industry (169-199). Routledge.

Bailey, D. and De Propris, L.(2017) ‘What does Brexit mean for UK automotive and industrial policy’. The political economy of Brexit, 45-62.

Berentsen, A., Huber, S. and Marchesiani, A. (2018) ‘Limited commitment and the demand for money’. The Economic Journal, 128(610),.1128-1156.

Berkeley, N., Jarvis, D. and Jones, A. (2018) ‘Analysing the take up of battery electric vehicles: An investigation of barriers amongst drivers in the UK’. Transportation Research Part D: Transport and Environment, 63, pp.466-481.

Cabello, A. (2020) ‘Market efficiency and long run purchasing power parity disequilibria of the Mexican peso under changing exchange rate regimes’. International Journal of Banking and Finance, 2(1), pp.63-82.

Choji, N.M. and Sek, S.K. (2017) ‘Testing for purchasing power parity for ASEAN-5 using asymmetric cointegration tests’. International Journal of Advanced and Applied Sciences, 11(4), 155-159

Iyengar, V. and Bharathi, S.V.(2018) ‘Bibliometric Analysis of Lean, Agile, and Leagile Supply Chains in Automobile Industry (1990-2017)’. International Journal of Information Systems and Supply Chain Management (IJISSCM), 11(3), 22-45.

Kim, I. and Kim, C. (2018) ‘Supply chain efficiency measurement to maintain sustainable performance in the automobile industry’. Sustainability, 10(8), 2852.

Krugman, P., Obstfeld, M. and Melitz, M (2017) International Economics: Theory and Policy, the latest edition. Addison-Wesley.

Mehmood, R. and Younas, Z., (2019) ‘Purchasing Power Parity Hold in Major SAARC Countries? Panel Cointegration Analysis’. Quarterly Journal of Econometrics Research, 5(1), 1-16.

Sharma, G., Singhi, D. and Mittal, D. (2019) ‘Lean and Green Supply Chains–Key Practices, Inter Linkages and Effects on Sustainability-A Case Study with Reference to Automobile Industry’. International Journal of Mechanical Engineering and Technology, 10(3).