Business Analytics and Statistics

Good Harvest Grows is considered as an Australian company which deals in the organic food products and it also functions their business into various sections such as in wholesale box delivery system, retail sector and harvest kitchen etc (Good Harvest, 2017).

It is identified that the Good harvest grows is still in the introduction phase in their second year and there is high cost of goods sold is recorded. The company contains limited resources such as it includes the staff of 6 team members, one delivery van, retail outlet and the cold store warehouse etc.

In addition to this, the issues which is facing by the Good harvest grows is regarding to the revenue, COGS margins and average sales.

Based on this, this report gives the detail understanding to the director of harvest kitchen so that they easily address the issues due to which they are lacking in achieving high growth. For, this report presents the data into the table and graph form and allows the analyst to predict the right result in regards to reduce the issues.

Problem identification and business intelligence’s required

It represents the problems questions which is reported into the good harvest grows and it mention below:-

The following questions will be addressed:

- What are the top/worst selling products in terms of sales?

- Is there a difference in payments methods?

- Are the differences in sales performance based on where the product is located in the shop? How does this affect both profits and revenue?

- Is there a difference in sales and gross profits between different months of the year?

- Are their differences in sales performance between different seasons?

- How does this relate to rainfall and profits?

Furthermore there are additional questions that are also need to address which are as follows:-

- Do you record any differences in the average sales of different seasons?

- Is it true that the differences in the total order are occurred due to the differences in days of week? How does it impact the total orders.

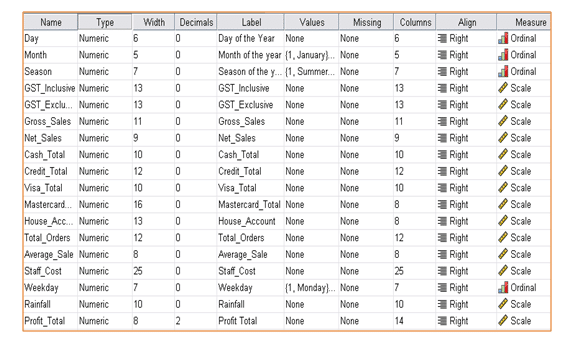

Thus, the product mix data set and sales data are gathered with the aim to deal with the above questions and presented into the proper scales of variables that are as follows:-

SPSS 17 is used for the statistical analysis of data set and to address the research problems and questions. In this, there are methods are used by the analyst to analyze the data and these are the regression & correlation analysis, Pareto curve and descriptive statistics. Such practice provides the clear and precise value presentation to the reader (Groebner et al., 2011).

Visualisation of Descriptive Statistics

This part discusses about the sales mix data and product mix data set of the Good harvest grows.

Firstly present the descriptive of sales mix dataset

Table 3: Descriptive Statistics of sales mix data

| Descriptive Statistics | ||||||

| N | Minimum | Maximum | Sum | Mean | Std. Deviation | |

| Day of the Year | 366 | 1 | 366 | 67161 | 183.50 | 105.799 |

| Month of the year | 366 | 1 | 12 | 2384 | 6.51 | 3.456 |

| Season of the year | 366 | 1 | 4 | 915 | 2.50 | 1.117 |

| GST Inclusive | 366 | 0 | 271 | 41876 | 114.42 | 48.723 |

| GST Exclusive | 366 | 0 | 2492 | 340583 | 930.56 | 303.827 |

| Gross Sales | 366 | 0 | 2642 | 382460 | 1044.97 | 326.285 |

| Net Sales | 366 | 0 | 2370 | 371220 | 1014.26 | 313.986 |

| Cash Total | 366 | 0 | 1195 | 147969 | 404.29 | 153.643 |

| Credit Total | 366 | 0 | 1407 | 214036 | 584.80 | 228.860 |

| Visa Total | 366 | 0 | 1407 | 203441 | 555.85 | 244.870 |

| Mastercard Total | 366 | 0 | 399 | 8086 | 22.09 | 67.823 |

| House Account | 366 | -264 | 1113 | 13684 | 37.39 | 113.204 |

| Total Orders | 366 | 0 | 129 | 20327 | 55.54 | 15.844 |

| Average Sale | 358 | 8 | 61 | 6631 | 18.52 | 3.985 |

| Staff Cost | 366 | 170 | 351 | 91022 | 248.69 | 52.418 |

| Weekday | 366 | 1 | 7 | 1463 | 4.00 | 1.998 |

| Rainfall | 365 | 0 | 63 | 1452 | 3.98 | 9.811 |

| Profit Total | 366 | -33.98 | 271.97 | 1.12E4 | 30.7098 | 30.05661 |

| Valid N (listwise) | 357 | |||||

Secondly present the descriptive of product mix data set

Table 4: Descriptive Statistics in Product Mix data Set

| Descriptive Statistics | ||||||

| N | Minimum | Maximum | Sum | Mean | Std. Deviation | |

| Product Class (number) | 1034 | 1 | 30 | 15464 | 14.96 | 8.515 |

| Quantity | 1034 | 1 | 3769 | 74348 | 71.90 | 212.400 |

| Weight | 209 | 0 | 2913 | 16156 | 77.30 | 242.323 |

| Total Sales ($) | 1034 | 0 | 17276 | 382540 | 369.96 | 1014.719 |

| Cost of Goods ($) | 1034 | 0 | 8573 | 212203 | 205.22 | 561.072 |

| Net Profit ($) | 1034 | 0 | 8703 | 170338 | 164.74 | 482.106 |

| Location of product in shop | 1034 | 1 | 5 | 3218 | 3.11 | 1.526 |

| Total Profit | 1034 | .00 | 8702.93 | 1.70E5 | 1.6473E2 | 482.10651 |

| Valid N (listwise) | 209 | |||||

Outcomes of the analytics method

Based on the analytics method, the following questions, answer is to be addressed in this part

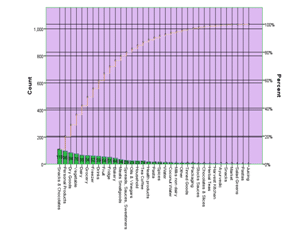

- What are the top/worst selling products in terms of sales?

Pareto curve indicates the differences between the total sales and product class and based on that, it provide the answer of top/ worst selling products in regards to sales (Berenson et al., 2012).

Pareto curve indicates that when the Y axis at 80% intersects with X axis in a parallel manner then it is showing the top/ worst selling products. The products which are top/worst are also shown separately at the X axis intersection point.

On the left side of X axis dictates about the top selling product which has a high demand and these are the dairy products, vegetables, bakery products, chocolates, meats small goods, sauces and sweeteners etc (Sebastianelli & Tamimi, 2011).

Besides that, right side of X axis indicates the worst product that does not work for the Good Harvest grows. From this Pareto curve, it is clear define that good harvest grows only 20% products are come under the top selling products out of total products of 80%.

- Is there a difference in payments methods?

One sample T-test has been conducted to identify the difference which is arised between the payment methods.

| One-Sample Test | ||||||

| Test Value = 0 | ||||||

| t | df | Sig. (2-tailed) | Mean Difference | 95% Confidence Interval of the Difference | ||

| Lower | Upper | |||||

| Cash Total | 50.340 | 365 | .000 | 404.287 | 388.49 | 420.08 |

| Credit Total | 48.885 | 365 | .000 | 584.798 | 561.27 | 608.32 |

| Visa Total | 43.427 | 365 | .000 | 555.849 | 530.68 | 581.02 |

| Mastercard Total | 6.232 | 365 | .000 | 22.094 | 15.12 | 29.07 |

| House Account | 6.318 | 365 | .000 | 37.388 | 25.75 | 49.02 |

The table mention that P-value is greater 0.05 (< 0.05) and such indicates that null hypothesis is rejected and alternative hypothesis is accepted. It means that there is significant differences between the payments method exist.

- Are the differences in sales performance based on where the product is located in the shop? How does this affect both profits and revenue?

In this question, Pareto curve depicts the connection which present between total sales of company with the location of company.

Figure 2: location of product in shop

The above figure clearly defines that there is variation present in the sales performances due to location of product display in shop. It is identified that product which display at back position has high selling with $96493 as comparatively to the product which are displayed at the front of shop.

Parito curve shows the relationship between the Total profits with the displaing process of product in shop and it is mention below:-

Figure 3: Pareto curve for location of product in shop

Thus, it can be stated that products which displayed under the rear position of the shop are provided more profit to the business with $39073.98 (González-Rodríguez et al., 2012). Whereas, products which is positioned at the outside or front side of shop makes the business earn less with $21715.52

3 Is there a difference in sales and gross profits between different months of the year?

In order to identify the differences in sales and gross profit between different months of the year, for that the regression tests is conducted.

| ANOVAb | ||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |

| 1 | Regression | 201321.056 | 1 | 201321.056 | 1.896 | .169a |

| Residual | 3.866E7 | 364 | 106201.063 | |||

| Total | 3.886E7 | 365 | ||||

| a. Predictors: (Constant), Month of the year | ||||||

| b. Dependent Variable: Gross_Sales | ||||||

The regression table indicates the P value that shows 0.169 is greater than 0.05 (0.169>0.05). This signifies that alternative hypothesis is rejected and null hypothesis is accepted (Pal et al., 2014). Based on this, it can be depicted that there is no significant variations is exist between in sales with the different months of the year.

The table explains the regression analysis in regards to profit of different methods which are as follows:-

| ANOVAb | ||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |

| 1 | Regression | 17979.279 | 1 | 17979.279 | 20.992 | .000a |

| Residual | 311761.675 | 364 | 856.488 | |||

| Total | 329740.954 | 365 | ||||

| a. Predictors: (Constant), Month of the year | ||||||

| b. Dependent Variable: Profit Total | ||||||

This table the P-value by indicating that 0.00 is less than 0.05 (0.00<0.05) (Forejt et al., 2012). It signifies that the alternative hypothesis is accepted instead of null hypothesis. It means that no significant differences exist between the variables such as profits in different months in a year.

- Are their differences in sales performance between different seasons?

To understand the variation in sales performances between the seasons, in such case the ANOVA test is used to analyse the data set.

Table 8: ANOVA- sales performances between seasons

| ANOVAb | ||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |

| 1 | Regression | 14613.958 | 1 | 14613.958 | .137 | .712a |

| Residual | 3.884E7 | 364 | 106713.994 | |||

| Total | 3.886E7 | 365 | ||||

| a. Predictors: (Constant), Season of the year | ||||||

| b. Dependent Variable: Gross_Sales | ||||||

P-value which occur with this table is 0.712 which is greater than 0.05 (0.712>0.05). This means that no variation exist in the sales performances with different seasons.

- How does this relate to rainfall and profits?

In context to find the relationship between the rainfall and profit, the correlation analysis is used to show accurate figures.

| Correlations | |||

| Rainfall | Profit Total | ||

| Rainfall | Pearson Correlation | 1 | .008 |

| Sig. (2-tailed) | .885 | ||

| N | 365 | 365 | |

| Profit Total | Pearson Correlation | .008 | 1 |

| Sig. (2-tailed) | .885 | ||

| N | 365 | 366 | |

This represents that there is no significant relationship occur between the rainfall and profits as the rainfall season does not have an impact on the profits of the company.

Additional Questions:-

- Do you record any differences in the average sales of different seasons?

In order to find the differences in the average sales of different seasons, for that ANOVA table is used to analysis the actual result. It is mention below:-

Table 10: ANOVA- average sales in different seasons

| ANOVAb | ||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |

| 1 | Regression | 4.713 | 1 | 4.713 | .296 | .587a |

| Residual | 5664.770 | 356 | 15.912 | |||

| Total | 5669.483 | 357 | ||||

| a. Predictors: (Constant), Season of the year | ||||||

| b. Dependent Variable: Average_Sale | ||||||

It present the P-value that is 0.587 and it is greater than 0.05 (0.587>0.05). This reflects that no differences are occurring in the average sales with changing of seasons and it means that null hypothesis is accepted.

- Is it true that the differences in the total order are occurred due to the differences in days of week? How does it impact the total orders.

To identify the solution of this question, for this Pareto curve is followed with the aim to appropriately analysis the data set.

Figure 4: sales order differences in the days

Yes, it is true that there is differences occurred in the orders in different week. It is estimated that people is more placing an order on Thursday comparatively to other days in week (Groebner et al., 2011). On the other hand, Sunday is the day where people placed less order on the store.

Discussion on Result and Recommendation

From the above discussion, it is find that Good Harvest Grows has 20% products which is come under the top sellers out of 80% of product sales (Good Harvest, 2017).

These products are the dairy & bakery product, meat, chocolates, sauces, spreaders and sweeteners etc. so in that case, it is recommended that Good Harvest Grows should use digital marketing to promote their worst selling product or try to innovate some feature for attracting target customer towards product.

Moreover, they also need to display the product into the rear and front side of the store so that audience can easily observe and take interest in product.

It is also observed that there is no correlation exists between the sales of company with the changing season. So it clearly indicates that season factor does not provide any sort of impact on the company sales.

On that basis, it is suggested that Good Harvest Grows does not need to concentrate more on the season aspects in regards to take future decision. Instead of this, firm require to focus on increasing the sales in different days also beside Thursday only. This can be done through offering schemes, discounts, and coupons to the consumers. It proves to be effective for the company to generate the sales and achieve the growth in their second year.

Berenson, M., Levine, D., Szabat, K. A., & Krehbiel, T. C. (2012). Basic business statistics: Concepts and applications. Pearson higher education AU.

Forejt, V., Kwiatkowska, M. Z., & Parker, D. (2012, October). Pareto Curves for Probabilistic Model Checking. In ATVA (Vol. 12, pp. 317-332).

González-Rodríguez, G., Colubi, A., & Gil, M. Á. (2012). Fuzzy data treated as functional data: A one-way ANOVA test approach. Computational Statistics & Data Analysis, 56(4), 943-955.

Good Harvest 2017. [Online] Available at: http://www.goodharvest.com.au (Accessed: 06 October 2017)

Groebner, D. F., Shannon, P. W., Fry, P. C., & Smith, K. D. (2011). Business statistics: A decision making approach. Prentice Hall/Pearson.

Pal, M., Rao, P. M., & Manimaran, P. (2014). Multifractal detrended cross-correlation analysis on gold, crude oil and foreign exchange rate time series. Physica A: statistical mechanics and its applications, 416, 452-460.

Sebastianelli, R., & Tamimi, N. (2011). Business statistics and management science online: Teaching strategies and assessment of student learning. Journal of Education for Business, 86(6), 317-325.