Calculation of Taxable Income

Introduction

Income tax is a kind of the liability of a person that has to payable on the net income of the people and company. In the world, each country has different policies regarding the income tax. In the concept of the Government of Australia, there are two kinds of the income that are taxable compensation and non taxable compensation.

Both include the different terms in the business. In this, taxable compensation includes wages, salaries, commission, self – employment income, alimony and maintenance and non taxable combat pay. On the other hand, non taxable compensation includes earning and profit from property, interest and dividend income, pension or annuity income.

At the same time, it also includes deferred compensation, income from certain partnerships and income from other resource. In this manner, this report develops the various accounts that provide the full information regarding the work related income, other income, capital gains, rental property, deductions (Arulampalam et al., 2012).

Work Related Income

| Work Related Income | Income |

| Income | Amount |

| Salary | 64000 |

| Net income from business | 91,624 |

| Total | 155624 |

The above table determine the work related income of the client as FinForensics Pty Ltd. It shows that salary of client is $64000 and net income from the business $91624.

Other Income

| Other Income | |

| Dividend get by father’s investment | 3845 |

| Profit on the sales of BHP and MYR | 14407 |

| Rent received | 12800 |

| Capital gains | 350050 |

| Rebate | 113 |

| Total | 381215 |

The above table is based on the Australian Taxation law, Dividend assessed as statutory income: s 44 ITAA36. The client’s father had the some portfolios that were inherited from its father. In this, it is found that $3845 earned from this as the dividend on these portfolio. At the same time, $14407 is earned as the profit on the sales of BHP and MYR share in this year. The table also shows that capital gain and rebate are $350050 and $113.

Capital Gains

| Capital Gains | Amount |

| Purchase price of property | 140000 |

| other investment on the property | 9950 |

| Total cost | 149950 |

| Sold price | 500000 |

| Capital gains | 350050 |

Capital gain table shows that client as FinForensics Pty Ltd earned 350050 as the capital gains this year. The calculation of capital gains is done on the basis of the s100-45 ITAA97 in the Australian taxation law.

Rental Property

| Rental Property | Amount |

| Purchase price of property | 140000 |

| Other investment on the property | 9950 |

| Total rent | 12800 |

| Sold price of property | 500000 |

In order to prepare the table for rental property, subsection 20-20(3) of the Income Tax Assessment Act 1997 is concerned.

Deductions

| Deductions | Amount |

| Personal contributions to superannuation | 12500 |

| Donations | 3200 |

| Financial Advisors Membership Fees | 840 |

| Vogue Living | 120 |

| Insurance | 3000 |

| Compensation for medical expenses | 8000 |

| Private health insurance | 1260 |

| Entitled to deductions on salary | 1200 |

| Interest paid on home loan | 15000 |

| Loan repayments (interest only) | 7,600 |

| Insurance | 685 |

| Total | 53405 |

The above table shows all the deduction for client that it can claim in this financial year. The income taxation law of Australia provide the clear guideline on the deductable items on the income tax. The above tables contain the some items that are tax deductable for FinForensics Pty Ltd

Calculation of the taxable income

| Income statement | $ |

| Work Related Income | 155624 |

| Other Income | 381215 |

| Total income | 536839 |

| Less: expenses | 165134 |

| 371705 | |

| Less: Deduction | 53405 |

| Taxable income | 318300 |

| Tax | 1,16,467 |

| Net income | 2,01,833 |

On the basis of the above table, it is found that total income of FinForensics is $536839. At the same time, expenses and deduction are $165134 and $53405 respectively.

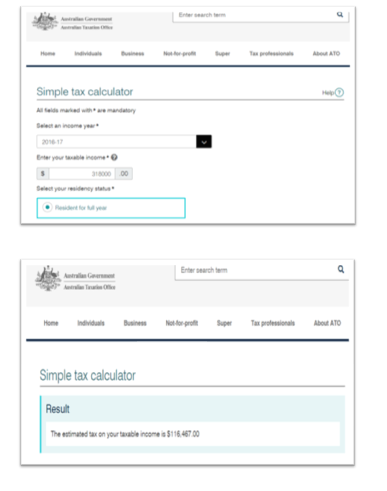

From the calculation, it is found that taxable income is $318300. According to Australian Income Tax slab, it is found that client is liable to pay $116467 as the tax. Hence, the net income of the client is $201833 for the financial year 2016-2017 (Saad, 2014).

Recommendation for improvement of current situation

On the basis of above income tax treatment for Fin Forensics, it is found that Fin Forensics is earning good for its various sources of income. In this, it is analysed that company is performing well in the market. The income statement of Fin Forensics shows that taxable income of the client is $318300 on which it is paying$116467 as income tax to the government of the Australia.

At the same time, it is also found that the taxable income of the client is comes in the last slab of the income tax that is prepared by the government of the Australia. $1,16,467 is approx 36% of the income of Fin Forensics (Saez and Zucman, 2016).

The provided case study shows that it is very serious for saving the tax and for investment. It is because spends lots of money on the insurance. However, it can also improve its current situation by the help of the some actions. It can be recommended to Fin Forensics that it should invest with the thinking of expanding the business.

It will help to expand the business and earn more profit at the end of financial year. Every business has various kinds of the operating expenses that come under the expense. In the similar manner, Fin Forensics can shows expenses as the business expenses (Woellner et al., 2011).

On the other hand, Health insurance deduction can be increased by taking the more health insurance plan for the family. It is one of the main tax advantages of running a sole proprietorship.

However, there is a certain limitation of the regarding to this. Fin Forensics can be recommended for getting the advantage of the self employment tax. There is an assumption that if a person is doing business then its responsible for self-employment taxes.

Fin Forensics can pay money for security and Medicare of the employees (Haupt and Haupt, 2013). It will help to Fin Forensics to reduce the tax liability. At the same time, it can also be recommended to Fin Forensics that it should concern on the recoding of the transaction.

References

Arulampalam, W., Devereux, M.P. and Maffini, G. (2012) The direct incidence of corporate income tax on wages. European Economic Review, 56(6), pp.1038-1054.

Haupt, P. and Haupt, P. (2013) Notes on South African Income Tax, 2013. H & H Publications.

Saad, N., (2014) Tax knowledge, tax complexity and tax compliance: Taxpayers’ view. Procedia-Social and Behavioral Sciences, 109, pp.1069-1075.

Saez, E. and Zucman, G. (2016) Wealth inequality in the United States since 1913: Evidence from capitalized income tax data. The Quarterly Journal of Economics, 131(2), pp.519-578.

Woellner, R., Barkoczy, S., Murphy, S., Evans, C. and Pinto, D. (2011) Australian Taxation Law Select: legislation and commentary. CCH Australia.

Appendix