Information System

Introduction

The information system (IS) strategy generally refers to information technology (IT) strategy as a strategic planning document to guide the use of information system and technologies to support different departments to achieve its priority goals (Tallon and Pinsonnealt, 2011). The IS strategy form an integral part of strategic business planning. From a business perspective, IS strategy guides in the investment, consumption and management of the information technology to plan the function of information systems and define the shared view role of information systems to seek innovation and competitive edge (Peppard and Ward, 2016). Thus, the management of information technology is essential to effectively manage technology resources according to business needs and priorities. This report studies the information system strategy and IT management framework business firm. The chosen business firm is Amazon Inc. The report discusses the existing governance structures, processes, and policies to understand how these meet regulatory requirements. The report also explains the role of corporate officers and risk mitigation strategies employed by the Amazon business. Lastly, the report reflects on the impact of internal and external factors and possible improvement for Amazon in upcoming years.

The nature of the business

Amazon.com Inc. is an American based leading online retailer in the market. In the year 1995, the company was founded by Jeff Bezos and opened its virtual doors as an online bookstore and went online as Amazon.com. The company headquarters is located in Seattle, Washington State. The company is operating as an e-commerce and cloud computing company in more than 160 countries to more than 12 million customers (Amazon.com, 2016). The company is dealing in internet services for cloud infrastructure services as Amazon Web Services and online retailing for a wide assortment of products ranging from Books, electronics, mobiles, tablets, home furnishing products, apparel, jewellery, furniture, sports and outdoor products, movies developing and TV shows in Prime and music category for Bluray, MP3, CD/DVD, video downloads/streaming, video games, health and beauty products, toys, food, grocery and kindle ecosystem and software. Shopping is the central part of business in Amazon.com. The major source of revenue comes from the electronic and general merchandise division, third party sellers and by advertising used and new products on its e-commerce site and subsidiaries like SmallParts.com (Morningstar, 2016). Some other revenue sources are Amazon Web Services, kindle fire prime subscription, media and content.

The governance structures, processes, and policies

Corporate governance structures

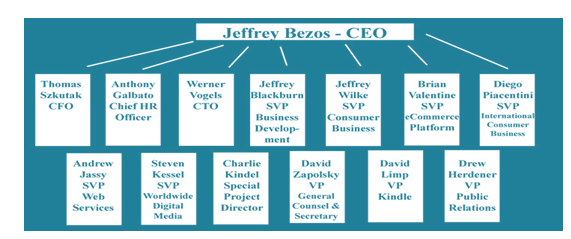

The governance structure of Amazon is divided into major layers as a vertical hierarchy comprising of Board of Directors, management team comprising of independent directors, vice presidents and department managers such as business managers, procurement managers, contract managers etc.

Figure 1 Corporate structure of Amazon.com

Corporate governance focuses on the investment decisions directed towards customers to achieve the long term profitability of its e-commerce (Rothaermel, 2015). The management at Amazon makes certain that the shareholders understand its investments decisions for business productivity and profitability and to create a high shareholder value. The investments decisions are focused to generate more revenue sources and building long-term leadership capabilities with a core focus on its customers. The information strategy on the company stresses innovation and commitment to building leadership as an e-commerce retailer to provide benefits to creditors, investors, customers and broader society. The accounting policies focus on increasing the future value of cash flows along in alignment with accounting reporting standards such as GAAP (Ritala et al., 2014). The stock incentive plan of the company emphasise on the long-term value of the stockholders. The stock option of Amazon.com provides an opportunity for the directors, corporate officers, staff, independent contractors and subsidiaries to retain and involve in the growth of the company through stock ownership (Price III, 2013). The company supports the managers and staff of developing a cost-conscious culture to maintain the lean culture. The recruitment function hires and retains flexible and multi-skilled employees with negotiation and contracting skills and provide employee stock ownership. Also, the executive-level compensation is through equity and the stock-based compensation is in billions.

Policies

According to the business conduct and ethics code of the company the employees need to act in an ethical and follow lawful practices that are in the best interests of the business. The code of conduct provides the guideline for the staff to adhere to rules and regulations and use of judgement to avoid any conflict of interest. It also states guidelines for disclosure of gifts or benefits received from partners, suppliers, vendors, competitors or customers. In case of any unethical conduct or unlawful activity, the legal department takes necessary action to resolve the matter. Similarly, the company has a supplier code of conduct to follow ethical and legitimate practices in conducting its business (Ritala et al., 2014). The suppliers’ key areas of focus include occupational safety and health aspect in the production, suitable working hours, appropriate hourly wage and overtime pay, prevention of forced labour and fair treatment without any discrimination.

According to Khan and Khan (2013), contract management is a procedure of management of creation, execution and successful implementation to increase operational performance and maximise financial gain by reducing financial risk. The efforts of senior managers at Amazon.com are directed towards reducing costs and improve the business performance of its different business units. The management of contracts in Amazon.com deals with the administration of contracts that are made between the company and its business partners, vendors, employees and customers. The contract administration also forms a core feature in the procurement cycle in online retailing services (Griffis et al., 2012). Thus, the contract management in Amazon.com maintains the complete lifecycle of business operations towards the fulfilment of its customer requirements.

Organisational processes

One of the contributing factors in the Amazon is the organisational processes that are well-linked to the infrastructure and technology. The company invest heavily in billions on developing IT infrastructure and adapting to new technologies. The IT strategy of the company reflects on its investment in the IT infrastructure and resources and to acquire technologies to guide the functioning of departments on how the business achieves operation excellence by use of technology (Doelitzscher et al., 2011). The management of information technology in its warehouses has helped the company to achieve speedy shipping than another online retailer. The warehouses of the United States have achieved delivery within the same day to 36 hours. The company has invested in robot technologies and has 30,000 robots in its warehouses (Amazon.com, 2016). Moreover, the use of Drones by the company has helped to reduce the delivery time intensively. The drones in the US are designed to deliver a package in thirty minutes. Another technology implementation is seen in the more developed market of Amazon which is an electronic rod known as Dash to take voice commands and scan barcodes in its Amazon fresh for foods so that inventory is well managed. The online retailer shipping cost in the third quarter was $1.2 bn (Ritala et al., 2014). The retailer is making investments in logistics operation in its warehouse and seeks directly to door delivery options. The retailer has delivery contracts with logistic leading players like FedEx and UPS but its investment in delivery is seen to strengthen the negotiation power of Amazon with the logistic partners.

Procurement method: The procurement method at Amazon is the most important core activity of its business as the company efforts are directed towards selling goods and services fast and at a competitive rate than its rivals. The logistic services are aligned with the business goal to deliver goods faster and safer to customer doorsteps to enhance the shopping experience (He et al., 2015). To provide goods at a cheaper rate the company puts immense pressure during negotiating with its suppliers to avail maximum discount possible to pass the benefits to Amazon customers. The desire of the supplier to continue its business with the company gives an upper hand to its vendor contract managers in negotiating contracts with its suppliers (Manoranjetha and Prasanna, 2014). Moreover, supplier to sustain its contract with Amazon due to its massive size and market dominance provides deep discounts and provides insight about the customer demands and requirements so it stock as per market needs. The company do not employ fixed-price contracts with its suppliers and vendors. Amazon seems to follow an indefinite delivery-indefinite quantity (IDIQ) contract with its vendors. This type of contact comes under an indefinite delivery contract which provides flexible scheduling of delivery for better management of the logistic function. This kind of indefinite-delivery/quantity contract allows the company to provide an indefinite quantity of products for indefinite delivery for a fixed period of time (Rueda-Benavides and Gransberg, 2014).

Apart from this, the policy of Amazon for with its vendor/suppliers is very stringent if the second party vendor sells restricted products or illegal goods with an Amazon store and if the supplier provides inferior quality products and receive a certain per cent of continuously negative reviews then the company immediately suspend or remove the services from such vendors or suppliers and towards its commitment with its customers for quality products. Thus, for effective monitoring of its purchasing and procurement function, the purchase is grouped based on the product or type of product (Luzzini and Ronchi, 2011). This contract type allows the company to be flexible with its suppliers and vendors and assigning multiple orders for products and delivery.

The corporate officers and their roles as described in public documentation

The Board of Directors control and provide direction to the company and are accountable to the shareowners of Amazon. The management team at Amazon hold responsibility for financial management, contractual and legal management. The independent directors take the role of a decision-making body for projects in coordination with the leaders. The responsibility of the committee is to make certain that strategy is being implemented and valued for Amazon strategic business units. The monitoring is done through budget validation and contractual change such as the addition of new suppliers or partners (Smit and Trigeorgis, 2012). The managers and leaders hold responsibility and accountability for achieving business objectives and implementation of the decisions. These leaders identify future risk and current business issues and suggest strategies to mitigate risk (Trkman and Desouza, 2012). The department managers especially procurement managers play a crucial role in the management of supply chain activities and in negotiating terms with suppliers to get the best price and with vendors to discuss terms of delivery such as fast delivery at low costs, safe delivery, guarantee delivery as per schedule, etc. The procurement managers in coordination with vendor contract management also discuss the corrective actions that can be taken if the agreed-upon terms and quality standards are not met by vendors or suppliers. The contract managers and assistant contract managers play a role to ensure the contract is managed successfully between the parties involved as per contractual terms, quality and delivery terms and other commercial commitments.

Governance structures and policies in the context of regulatory requirements

The role clarity of the independent directors, senior managers, departmental and contract managers supports the fine supremacy of regulators in the corporate governance structure of Amazon.com. This role clarity is vital for the regulatory requirements and to avoid any conflict of interest arising between stakeholders (Hazarika et al., 2012). According to Perry and Hendrick (2012), it is essential to define the nature of policy role or accountability and to collaborate with other stakeholders in a transparent and unbiased manner.

In the context of contact management, the contract between Amazon.com with Consumer Financial Protection Bureau (CFPB) for the cloud computing services lists the responsibility and role of the two contracting parties (Gupta and Raj, 2013). The contract document covers the expectation of service –level and security requirements are also defined (Perry and Hendrick, 2012). The CFPB also have an agreement of non-disclosure to preserve sensitive information.

The policies laid down by the company the reflected on the regulatory requirements as it covers the guiding principle for the employees, suppliers and labour practices to meet with the applicable business laws. It can be said that the company supports the development of lawful practices such as the prevention of child labour and preventing workers to work more than 60 hours per week and being permitted to take one day off a week as permitted by law. The policy of anti-discrimination, health and safety, working hour, wages and benefits to workers, involuntary labour practices and fair treatment reveal the regulatory requirement fulfilled by the company (Hazarika et al., 2012). On the other hand, the company has faced issues in the past related to patent infringement lawsuits, copyright issues, avoidance of tax, etc, and has negative publicity for compensation issues of the workers in its distribution centres. This indicates that these policies are not implemented as per the regulations. In response for these issues, the company had two resolutions discussed in the Annual General Meeting in 2016 which would be implemented by the taken shareholders in the coming year on the issue of social and corporate governance practices.

Identification of organisation risk and mitigation strategies

The management at Amazon has a well-developed strategic plan for the identification of risks and to implement control to manage the risk. In the process of risk identification, the senior managers re-evaluate the business plan two to three times for a financial year. This is useful to identify the current and potential risk and this way the independent directors know to recognise the risk in its responsibility areas and take decisions to manage the identified risk in particular departments.

The strategies for risk mitigation in the company involve the senior managers taking decisions after conducting a risk assessment of the business issue (Smit and Trigeorgis, 2012). For Amazon, the recognition of skill is a risk that impacts on compliance, regulatory requirements and can impact the ethical aspects. The risk mitigation decision involves avoiding and controlling the risk (Trkman and Desouza, 2012). The skill recognition and knowledge is incorporated in the recruitment process of the company and it also includes training sessions and educating on the ethical practices according to the ethical codes and standards. For the risk of compliance with the code of conduct, applicable laws and industry standards, the company has developed internal control processes and audit controls.

Possible improvements/impacts of internal changes/external factors for upcoming years

The use of new technology solutions by Amazon can lead to possible improvements such as achieving a high degree of precision in the administration of stocks leading to a better inventory control and management function, personalised customer offering and better management of product and services offering and provide fast response to demands fluctuation and changing customer need through its omnichannel development. The internal factors such as CRM management by the use of information technology like big data analytics, investment in developing IT infrastructure and investment in streamlining its supply chain and logistics operations can positively impact the business in the near future. On the other hand, the value proportion of low cost with high convenience to customers can lead to the high costs associated with delivery services (Fagerstrøm and Arntzen, 2013). Moreover, additional of new categories in online retailing product lines such as automotive might confuse the customers and can potentially damage the brand reputation (Griffis et al., 2012). In the coming years, certain external environmental factors such as the intense competition from other large retailers and recession can impact the business of Amazon.com. For instance, the competition from Wal-Mart is based on its profits, revenue and resources such as the largest trucking fleet in the United States, 5,000 global stores and more than 150 distribution centres (Attaran, 2012). Thus, the giant retailer with its economies of scale and its increased investments in stores, increased wages and delivery pick up program has the potential to fiercely compete with Amazon in the one-channel competition. Another factor could be a potential recession that can impact the high-priced stock and demand tends to fall in the markets as the value proposition of the company business is build on low cost but more on convenience which can put pressure on these stocks.

Conclusion

From the above discussion points, it can be said that Amazon.com is a forward-thinking business that considers investing in IT infrastructure and new technologies to discover an innovative way to improve its organizational processes. The company in a vertical hierarchy has a specific role for its independent directors, senior managers and departmental managers and stock options policy to increase the value and retain the interest of stakeholders in Amazon growth. The company also has policy strict code of conduct for its employees to fulfil the regulatory requirements and equally stringent policy for its vendor and supplier management. The strength of the business depends on its procurement department as the supply of quality products at low cost and fast delivery attract the customer to shop with Amazon.com. Thus, supply and shopping are central factors for the business of Amazon.com for continued success as the leading online retailer.

Reference

Amazon.com (2016). Amazon. Retrieved from: https://www.amazon.com/

Attaran, M. (2012). Critical success factors and challenges of implementing RFID in supply chain management. Journal of supply chain and operations management, 10(1), 144-167.

Doelitzscher, F., Sulistio, A., Reich, C., Kuijs, H., & Wolf, D. (2011). Private cloud for collaboration and e-Learning services: from IaaS to SaaS. Computing, 91(1), 23-42.

Fagerstrøm, A., & Arntzen, E. (2013). On motivating operations at the point of online purchase setting. The Psychological Record, 63(2), 333.

Griffis, S. E., Rao, S., Goldsby, T. J., & Niranjan, T. T. (2012). The customer consequences of returns in online retailing: An empirical analysis. Journal of Operation Management, 30(4), 282-294.

Gupta, P., Seetharaman, A., & Raj, J. R. (2013). The usage and adoption of cloud computing by small and medium businesses. International Journal of Information Management, 33(5), 861-874.

Hazarika, S., Karpoff, J. M., & Nahata, R. (2012). Internal corporate governance, CEO turnover, and earnings management. Journal of Financial Economics, 104(1), 44-69.

He, J., Wen, Y., Huang, J., & Wu, D. (2014). On the Cost–QoE tradeoff for cloud-based video streaming under Amazon EC2’s pricing models. IEEE Transactions on Circuits and Systems for Video Technology, 24(4), 669-680.

Khan, A. W., & Khan, S. U. (2013). Critical success factors for offshore software outsourcing contract management from vendors’ perspective: an exploratory study using a systematic literature review. IET software, 7(6), 327-338.

Luzzini, D., & Ronchi, S. (2011). Organizing the purchasing department for innovation. Operations Management Research, 4(1-2), 14-27.

Manoranjetha, E., & Prasanna, S. (2014). Resource procurement mechanism scheme for cloud Computing. Elysium Journal of Engineering Research & Management, 1(3).

Morningstar (2016). Amazon.com Inc . Retrieved from: http://financials.morningstar.com/ratios/r.html?t=AMZN

Peppard, J., & Ward, J. (2016). The strategic management of information systems: Building a digital strategy. US: John Wiley & Sons.

Perry, R., & Hendrick, S. D. (2012). The business value of Amazon web services accelerates over time. White Paper, IDC.

Price III, R. A. (2013). Cash flows at Amazon. com. Issues in Accounting Education Teaching Notes, 28(2), 23-38.

Ritala, P., Golnam, A., & Wegmann, A. (2014). Coopetition-based business models: The case of Amazon. com. Industrial Marketing Management, 43(2), 236-249.

Rothaermel, F. T. (2015). Strategic management. USA: McGraw-Hill.

Rueda-Benavides, J., & Gransberg, D. (2014). Indefinite Delivery-Indefinite Quantity Contracting: Case Study Analysis. Transportation Research Record: Journal of the Transportation Research Board, (2408), 17-25.

Smit, H. T., & Trigeorgis, L. (2012). Strategic investment: Real options and games. US: Princeton University Press.

Tallon, P. P., & Pinsonneault, A. (2011). Competing perspectives on the link between strategic information technology alignment and organizational agility: insights from a mediation model. Mis Quarterly, 463-486.

Trkman, P., & Desouza, K. C. (2012). Knowledge risks in organizational networks: An exploratory framework. The Journal of Strategic Information Systems, 21(1), 1-17.