LD0474/NX0474 Assignment Sample

Introduction (LD0474/NX0474 Assignment Sample)

This assignment is based on a business stimulation exertion, based on the European Car Industry. The main objective of this assignment is to increase the shareholder worth of their organization at the end of fourth round. The company value can be determined by the staying profits, productivity of people, outstanding customer services and through a sustainable growth. Sigma was very successful economically, with a great bank balance and there were no unpaid debts. The company was fortunate in maintaining its profit margin as the total sales went from 1315 in the year 1 to 3716 in the year 4.

The unpaid debts also decreased from 700 to 439 which is an applause sign for a company. However, the company was not able to reach their targeted market share by acquiring only 4.1% by year four. The company has also taken necessary steps to make their products environmentally friendly by producing eco- friendlier engines. The main focus of this study is to achieve its strategic objectives which are growing shareholder value, balance the budget and maintain an appropriate financial attachment.

Company performance

Round 1

Rationale behind decisions

In Round 1, the rationale behind the decision taken is to spend on more training as a greater number of employees would be incorporated to enhance productivity. Therefore, the decision taken lies in outlining a greater focus on investment for automation and training to gain productivity.

Decisions Taken

The main decision taken in this aspect is in terms of setting a nominal price for model SD Alpha that is a product of Speeder to acquire a target set report. The level of training and automation is incubated on suppliers and customers ability to pay.

Forecast of the Key Performance Measures

Production

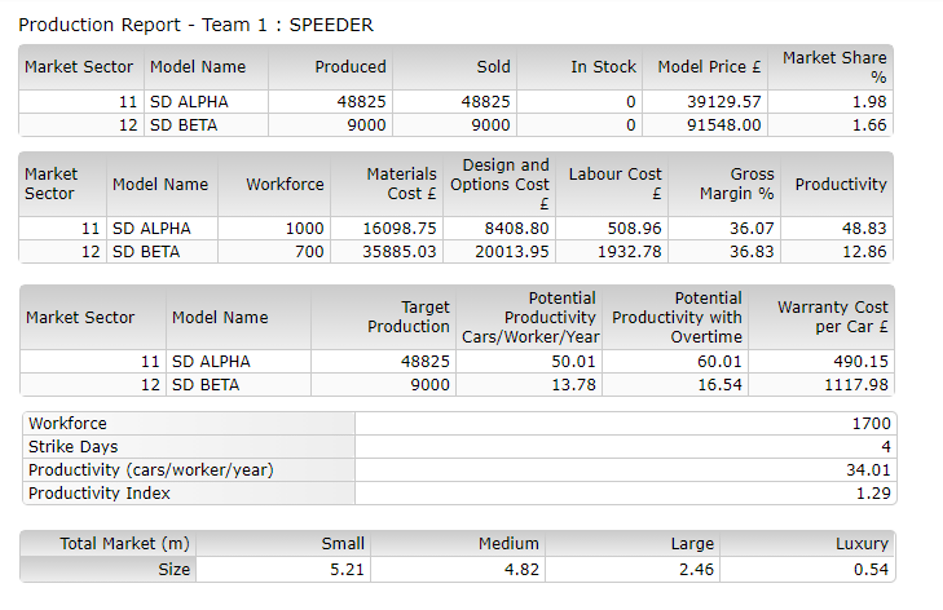

In the Team 1 Speeder product, the product SD Alpha can be predicted to be more profitable as the potential productivity over time is 60.01 in comparison to that of SD Beta with 16.54. Due to the higher workforce and lower labour cost for Alpha product, the production of Alpha is forecasted to bring higher returns than that of Alpha.

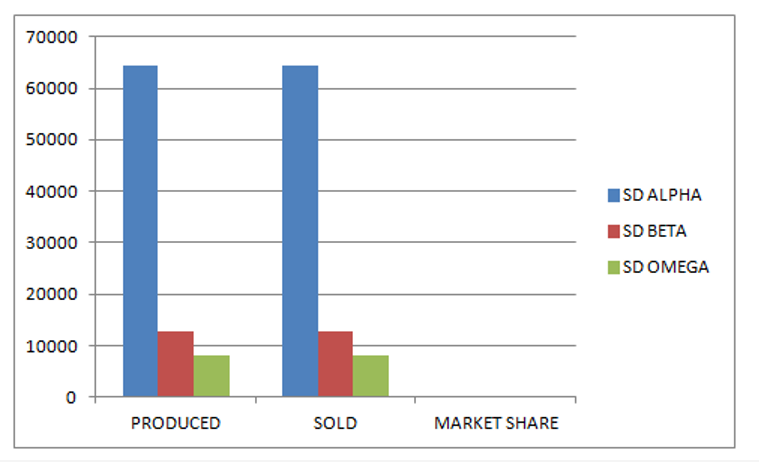

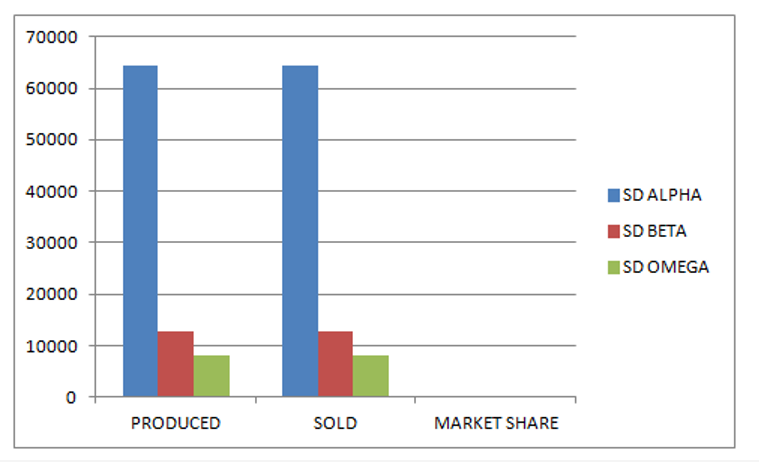

Figure 1: Market Share of SD Alpha and SD Beta

(Source: Created by author)

Sales

In terms of sales, it can be predicted that SD Alpha is forecasted to have relatively higher sales as compared to that of SD Beta with a lower price for its model.

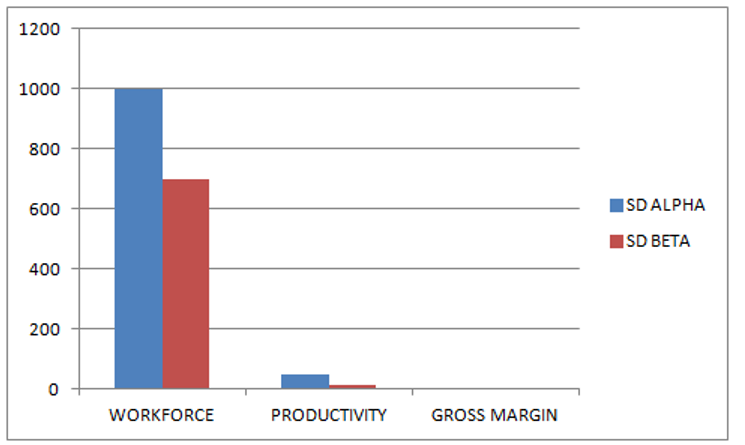

Gross Margin

Figure 2: Gross Margin of SD Alpha and SD Beta

(Source: Created by author)

Coming to gross margin, it can be evaluated that SD Alpha sets a margin at 36.07 as compared to that of SD Beta 36.48 by incorporating greater costs on designs and operations cost as well as material cost.

Unsold Stock

In round 1, it has been viewed that there are no stocks that remain unsold and therefore, chances are there it may happen in future as well.

Post-Tax Profit

The post-tax profit for Speeder indicates a minimal loss that the company might endure from reduced prices and increased expenditure on its models.

Net cash position

The net cash position lies in the ability of Speeder to reach a profitable margin with minimal loss by efficient utilization of resources.

Market Share

In terms of market share, SD Alpha can be estimated to have a higher amount of share-based on results derived from the evaluation of the two products.

Comparison of the results with the forecast

In comparing forecasts with results, it can be stated that based on two models SD Alpha and SD Beta, the results indicate the former to have greater productivity results than the latter. The predicted forecast reveals how maximum utilization can be made through minimum usage of expenses for SD Alpha.

Explanation of differences and key issues that arose

The key differences and issues arise in several workforce and expenses required by both the models. Pertinent challenges relate to an increased level of expenses on material and design cost by SD Beta than SD Alpha.

Round 2

Rationale behind decisions

In Round 2, the main rationale behind the decisions taken is that the prices are lowered for SD Alpha Model. Having a greater workforce, the productivity can be determined to be higher and management training is indicated to have a higher cost.

Decisions Taken

The team decides for the model that has been taken fixing a nominal wage with training on management and skills. The number of supplier’s days to be paid is 45 which are lesser in context to several days to be paid for customers with 30. As per the views of Gill &Bajwa(2018), decisions taken on the model are captured by setting on a capacitor workforce for creating an effect on automation allocation and increased level of productivity.

Forecast of the Key Performance Measures

Production

Figure 3: Market Share of SD Alpha and SD Beta

(Source: Created by author)

Round 2 incorporates a third model SD Omega where the productivity can be estimated to be slightly higher than SD Beta but lesser than SD Alpha. Here, with a similar number of workforces, SD Beta is forecasted to acquire lesser productivity. On other hand, SD Omega with a lesser workforce can acquire higher productivity than SD Beta.

Sales

The sales for SD Alpha is predicted to be maximum in comparison to the other two models with reasonable expenses incurred on materials cost as well as design and operation cost.

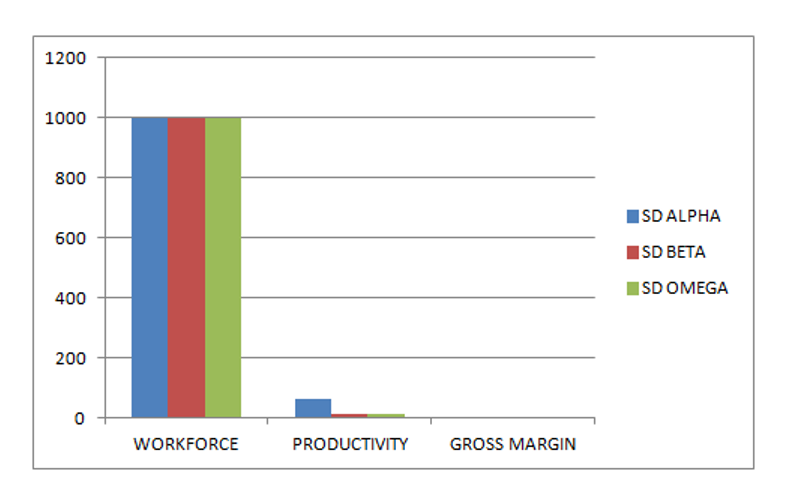

Gross Margin

Figure 4: Gross Margin of SD Alpha and SD Beta

(Source: Created by author)

In terms of gross margin, SD Alpha is forecasted to have a higher value as compared to that of Beta and Omega models.

Unsold Stock

The second round predicts not having any stock unsold as all models are sold in the market due to customer’s demand and market growth.

Post-Tax Profit

In Round 2, the post profit tax is predicted to be higher in range as compared to that in Round 1.

Net cash position

The net cash position implies that the production report is stated to have a maximum share in the market from the sale of a product in abundance.

Market Share

The market share forecast that Alpha runs highest because of its high valuation and demand in a market as compared to the other two models.

Comparison of the results with the forecast

In Round 2, the results showed that there were three models which included Alpha, Beta and Omega. On a basis of products sold and stock share in a market, Alpha is highest despite Beta having the same level of the workforce (Walasik, 2017).

In the case of Omega, a slightly lower workforce has indicated a higher growth than that of Beta. The material and labour cost involved is higher for Beta and Omega than that of Alpha. Based on future predictions, it has been evaluated that the projected growth of Alpha is likely to increase due to lower charges on material and labour cost. On the other hand, Omega might continue to overtake Beta with a comparatively lesser workforce despite the labour and material cost involved.

Explanation of differences and key issues that arose

The key differences and issues that arose are that Omega has a relatively lesser workforce in comparison to Alpha and Beta. Despite that, workforce and material costs are higher and gain a greater profit than Beta.

The warranty cost is greater for Omega than Alpha and Beta. Therefore, it can be stated that though Omega’s market share and productivity levels are lesser than Alpha, it makes efficient utilization of its resources for gaining maximum possible outcomes.

Round 3

Rationale behind decisions

The model choice for Round 3 is SD Apha, SD Beta and SD Omega. The body style selected over here is SUV and the engine selected is Alternative Fuel Engine. The reason behind choosing SUV over the other options is innumerable. Firstly, the body style of an SUV dispenses a sheer amount of space and it also comes up with cargo capacity.

Secondly it is anyway a better choice for driving through severe weather as they are better suited to manage the hazardous conditions. Lastly, an SUV concedes a great visibility and larger adjoining windows. They also came up with a unique feature of the back windshield.

The engine selected here is Alternative Fuel Engine as mentioned above. The reason behind choosing this engine among the other options is numerous. The alternative fuel engines are environmentally friendly as they erect very low carbon emission.

They also decrease the dependency from the global energy supplies which result in enlarged energy reliability by assigning a steady and profitable energy supply. Sustainable and steady energy supply for the long run is ensured by the alternative fuel engine as they are inexhaustible in nature.

Decisions Taken

Two different models of cars must be manufactured in the year 1. Each year one new model can be launched by investing in the new model. The maximum model allowed is five models and the new model details should be entered after investment.

Forecast of the Key Performance Measures

There are a total four rounds that is Round 1, Round 2, Round 3 and Round 4. Here, we are predicting the performance of Round 3 in comparison to the other rounds.

The workforce required in Round 3 is equal to the workforce required in Round 4. The sale of Round 3 is more than Round 1 and 2 but less than Round 4. The total sale of Round 3 is 5124.56 whereas the total sale of Round 4 is 5719.95. The closing balance of Round 3 is more than the Round 1 and Round 2. Under the Round 3, there are three models namely SD Alpha, SD Beta and SD Omega.

The production of these models is 76000, 16000 and 15400 respectively. SD Alpha has the highest sale with 76000 which is equal to their production which indicated that the sale and production of SD Alpha are the same.SD Beta’s model price is the highest and the value of the model is 89631.84. The workforce required for each model is the same which is 1100. However, there is a difference in between the gross margin for each model. It has also seen that the targeted production is only achieved by model SD Alpha as its production is equal to the production that has been targeted. SD Alpha has the maximum market share with 2.75%. The material cost of each model is 17119.38, 38160.06 and 38160.06 respectively where we can clearly see that the cost SD Beta and SD Omega are the same. Both SD Beta and SD Omega failed to achieve their targeted production.

Round 4

Rationale behind decisions

There are a total of four rounds as mentioned above. The model choices for Round 4 are SD Alpha, SD Beta and SD Omega respectively. The body type chosen for round 4 is SUV and the engine selected is Alternative Fuel Engine as given in the assignment. The reason behind choosing SUV over the other body type is numerous. Firstly, they have large space capability which will be the idle choice for the long trips.

Secondly, the interior is made in such a way that it is impossible for the outside noise to proceed inside. Thirdly, they are very convenient to carry enormous loads that are unable to fit into the other cars. Lastly, they are idle for business meetings and trips. The reason behind choosing the alternative fuel engine is diverse. They are inexpensive and help to terminate too much dependence on oil. Alternative fuel engines also help in eliminating air pollution and reducing lower vehicle execution.

Decisions Taken

Two different models of cars must be manufactured in the year 1. Each year one new model can be launched by investing in the new model. The maximum model allowed is five models and the new model details should be entered after investment.

Forecast of the Key Performance Measures

There are a total four rounds which comprise Round 1, Round 2, Round 3 and Round 4. Here, we are predicting the performance of Round 3 in comparison to the other rounds. The workforce required in Round 4 is equal to the workforce required in Round 3. However, the sale and the cost of sale of round 4 is the highest with 5719.95 and 3832.95 respectively.

Total capital employed in round 4 is also the maximum among the other rounds. The closing balance of round 4 is also the maximum with 2394.58. Under round 4, there are also three models given that are SD Alpha, SD Beta and SD Omega. The production of these three models is 84000, 14900 and 8300 respectively. It can be easily derived that SD Alpha has the highest product with 84000 given. The total sale of SD Alpha is 84000 by which we can easily detect that in stock will be nil. The SD Beta model has the highest model price whereas SD Alpha model has the lowest model price. The highest market share is of SD Apha with 2.87% and lowest is of SD Omega with 1.70% respectively. The workforce required for each model is 1200, 1100 and 900. However, gross margins for each model are 31.62%, 35.00% and 33.51% respectively.

It has also seen that the targeted production is achieved by all the models as its production is equal to the production that has been targeted. SD Alpha has the maximum market share with 2.87%. The material cost of each model is 17397.33, 38739.51 and 38739.51 respectively where we can clearly see that the cost SD Beta and SD Omega are the same.

Critical Reflection

In the world of stiff competition, business is no longer limited in the internal juncture of an organization, but it has become a race. Being an inextricable part of Speeder, we took part in the business simulation game to achieve a higher position in the competitive market domain. Our organization, Speeder has possessed a sublime aim and lofty vision. Such vision and aim not only intend to make huge financial profit from the consumers but also stress upon the purchasing ability of the consumers. Besides the profit-making motives, Speeder is dedicated to revolutionizing the entire course of the car industry.

The Gibbs reflective model has been chosen here to vent out all the feelings, description, analysis, evaluation of our actions that we made during the course of the game. The meticulous assessment of all the decision-making factors and certain flaws among them would help us in future to map out an effective action plan.

The study of Gatti, Ulrich, &Seele, (2019), stated that a business simulation game is a strategic tool that aims to enhance business performance by uplifting leadership and management skills as well as accelerate financial performance. We have chosen a web-based simulation game, known as, Executive. This particular game has enabled us to develop a consolidated view and understanding of the business goals, at the same time has determined our course of action for the upcoming days.

The study of Mustata, Alexe, &Alexe, (2017), stated that in terms of achieving the business goals and objectives, the importance and the very purpose of taking assistance of the business simulation game are to be analysed thoroughly.

This particular simulation game, Executive, has provided the opportunity to delve deep into the core business factors that leave an indelible impact on business decision making. In the course of this critical reflection, we would focus on the investment factors, the profit and loss ratio, and company performance and so on. It would help us to make further changes in the next level of the simulation game.

Financial operation and decision making

The growth and performance of an organization depend upon the financial operation. A company conducts financial operations to ensure brand positioning and survival in the turbulent currents of the market domain. According to the study of Adebiyi, & Banjo, (2017), finance is the driving force of an organization and it forms the basis of organizational performance and activities.

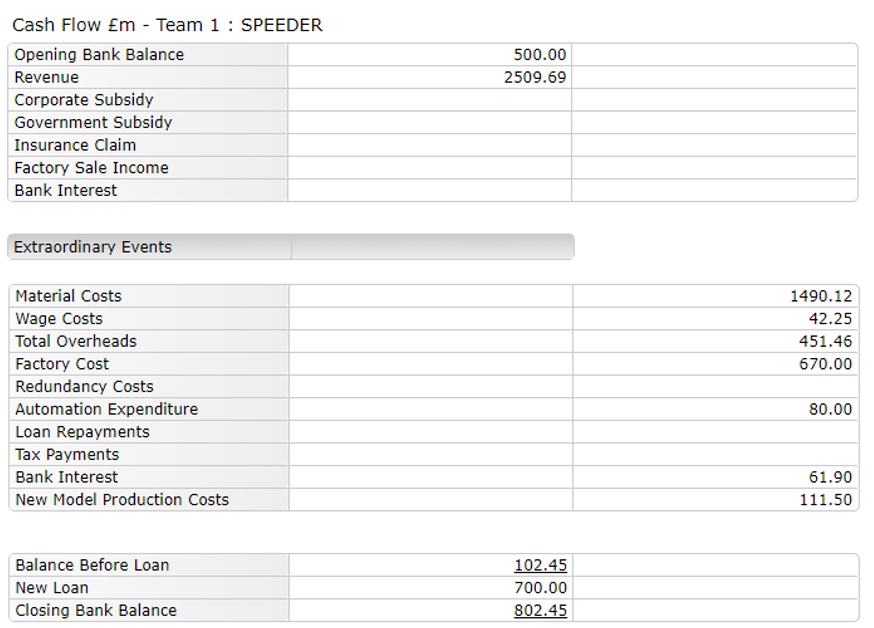

Financial management is highly required in every sphere of an organization for its sustenance in the long run and to thrive in this process. Ameliawati, &Setiyani, (2018), stated that effective management of financial resources provides an opportunity for an organization to defy the threat factors, such as, bankruptcy and simultaneously increases the profitability rate. The statistical data of cash flow is revealing that Speeder had set out the business journey with £500 M, which was not adequate to run a business smoothly. It compelled us to take support of the bank loan that was around £700 M.

In the initial phase with the assistance of bank loan, we had become able to generate a moderate amount of revenue, which was £2509.69 M. The cash flow report of our company is clear evidence of the fact that our financial operation was quite effective and we had stepped further in this game to make more improvements in this domain. On the other hand, from the very beginning we had prioritized our workforce over everything and in Round 1; £42.25 M. had been invested for the wage cost, while £1490.12 M was spent on the procurement of the resources.

Figure 5: The cash flow data of business simulation game, Round 1

A significant amount of money had been invested in the important spheres that include research and development, making of new factories and so on. Such strategic investment had derived positive results and made us contemplate over the financial business performance.

The study of Ivančić, Vukšić, &Spremić, (2019), depicted that first-hand experiences are more effective than the theoretical ones to produce better results and at the same time to maximize the rate of profitability. Our financial decision in Round 1 left its impact on the second and advanced level of the simulation game. Round 2 had begun with £802.45 M, which was quite higher than the initial stage. The strategic decision making had defied us to take the burden of new bank loans and we had successfully outperformed our potential competitors, Sparkt, the Pro and Milkano in various spheres of business.

This business simulation game worked as an eye-opener for us and provided us insight into teamwork. The success that we had ensured in the initial level of the game was the inevitable outcome of our relentless collective effort and the continual research and development process.

The competition data of Round 2 is depicting that our production cost is comparatively higher than the three fierce business rivals, Millano, the Pro and Sparkt. In Round 2 we had become successful to secure the first position by surpassing our business rivals, as £1153.85 M had been invested in the training programmes. Such investment and the collective effort of our workers facilitated a high productivity rate, which was around 1.50%.

The success of Round 1 allowed us to come up with a brand new and attractive car model in the next round and in Round 2 SD Omega model was introduced in the arena of business simulation games. Round 2 was the advanced level of business simulation game and has offered us various obstacles and blocks, which might threaten our progress. Though we were amateur in the field of business simulation games, we left no room for mistakes and continued to develop our strategies gradually.

The participation in the Executive simulation game had provided us with a huge opportunity to team up, make practical investments and monitor every step, which would, later on, help to deal with every sort of financial issue. In the car industry, there are different categories of customers and most of them are easily influenced by contemporary trends.

We had launched the new car model, SD Omega to cater for the varied requirements of such consumers and to continue our process of innovation. The market research report of Round 2 has unfolded the fact that we reduced the price of our car models as the production of SD Alpha and SD Beta had increased 32% and 42% respectively. Our effective financial performance in the previous round had paved the way for making an investment of £28m for the purposes of automation.

Round 3had witnessed an unprecedented rise in our profit rate and we started this one with around £1330.83m bank balance and no new bank loan was required at this level. By managing successfully the cost for procurement of resources, wage cost, bank interest and so on, we had been able to earn £5062.80m and it is clearly enunciating the slow as well as a steady increase of the financial performance.

The company reports of all the rounds are indicating that the various marketing strategies are adopted to endure the financial growth and at the same time the cost of all the car models was deftly designed. Kienzler, &Kowalkowski, (2017), explained that the adoption of the various pricing strategies in a single target market offers a competitive advantage to the firms. It allows a company to surpass its rival firms and to obtain a firm hold over the market.

Round 4 have been considered as a highly advanced level of the simulation game and it seemed to be a serious threat. In the course of the game, I realized that the Alpha model is more profitable than the Beta model and the sales rate of these specific products in Round 1 has reflected this fact. The production report of the initial level has also depicted that the Alpha model is capable of bringing higher returns than Beta. The company report of Round 4 is showing that while all the Alpha models had been sold in the market successfully, the 744 Beta models still remained unsold.

Marketing operation and decision making

Marketing is a distinct genre of business management. It has been pointed out that marketing is an integral part of every business and an organization needs to possess deft and skilful marketing strategies to occupy a prominent place in the market.

It has always been considered as a way to sharpen the existing strengths of the organization and to identify the areas of improvement. Mothersbaugh, Hawkin, &Kleiser, (2019), opined that marketing strategies can be used as a tool to make a dominant brand presence and at the same time to create awareness among the consumers about the products. During the teamwork, I have realised the value and importance of marketing in a business. The speeder is an important part of the car industry.

Being highly volatile in nature, the demand and supply of the car market fluctuate rapidly and Speeder needs to continually deal with such fluctuation and changes. Therefore, to sustain in the car industry the ceaseless innovation and thorough market research are highly required.

Executive game provided us with the opportunity to make certain marketing strategies for selling the existing models. In Round 1,we continued our business process with Alpha and Beta car models and Alpha had emerged as the best-selling model. On the other hand, we relied on the marketing mix theory that provided us insight into the brand promotion, pricing strategy and so on.

Figure 6: The production report of business simulation game, Round 1

According to Lim, (2020), the marketing mix consists of 4ps that include, price, product, people and place. Such marketing concepts enabled us to identify each sphere of business and to adopt strategies accordingly as per the demand. The decision report of Speeder in Round 1has revealed that the market segmentation had been conducted carefully. The target market had been segmented into three sections, large, medium and small and we had adopted different pricing strategies for each market.

Thorough training had been given to the workforce to maximize their productivity and competence. Nearly 1000 workers were appointed for the manufacturing of the Alpha model.

700 skilled workers were assigned to manufacture the Beta model, but the selling rate of this model was relatively lower than the first one. From the production report of Round 1,it can be predicted that a high amount of investment had been conducted for the Beta model, but it failed to produce satisfactory results. In Round 2, to keep going with the current market trends, we embraced the product innovation process and Omega was launched resultantly.

Like the Beta model, Omega also failed to touch the peak in the domain of sales. Even in succeeding rounds, the same outcome remained and Alpha had become successful in touching the apex in the domain of sales.

The careful assessment of the production reports of all the rounds had proved that our performance in marketing was not up to the mark. Our flawed market segmentation has averted us to achieve momentum in this domain.

Assessment of the decision making

Decision making influences all the actions of the individuals as well as the organizations. According to the study of Bagozzi, Sekerka, &Sguera, (2018), decision making shapes and moulds the fate of an organization in the competitive market domain.

The decision making was of utmost importance in this business simulation game. We took part in this game as the representative of Speeder and our decision making in every step was connected with the internal and the external stakeholders of our organization.

We had launched the new car model, Omega strategically, but some gaps in our decisions had proved detrimental for the production of that car model. Our decisions had its impact on our target customers.

The profitability rate of the cars in all the rounds have proved that the purchasing ability of the consumers has increased by our differentiating pricing strategy. On the other hand, the suppliers are the important group of external stakeholders of Speeder and the cost efficiency factor has left an impact on them.

The significant amount of investment in the promotional, as well as the market research strategy, had derived value from the consumers in material terms. On the other hand, to maintain the cost-efficiency we had not complied with the suppliers.

Team Performance

Productivity

The team was very self stimulated and it was really satisfactory to work with them. They illustrated worthier technical capabilities and exceptional quality of work was processed by them. Our team takes time to fully appreciate the breath of the assignment and exhibit a keen attention to all the details, but frequently at the cost of productive time management.

Delay in execution and non-fulfilment to hit production goals is avoided with the help of time management. Working with the team made me realize many ways to enlarge productivity volume while heaping up the quality of work (Ghazzawi et al. 2017).

Daily goals were set by each member of the team which helped us in achieving our targeted goals at the right time. My main task was to help the team in identifying ways for growing their speed along with completing the regular tasks.

Problem-Solving

An experimental and data -driven approach was exemplified by our team. My job here was to laboriously seek contrasting perspectives and create suspension from my teammates. After receiving a dissimilar perspective, my next task was to experiment continuously to drive results. Regular examination was done to keep an eye on each member’s performance on a daily basis.

Learning Ability

The team had a great learning ability. The team took regular inventiveness to identify the area of improvement and the methods in communicating those issues. This assignment also helped in developing our skills, which our team has shown great eagerness in learning.

Communication

The team has shown enhancement in communication skills since our last review period. They have also come up with the idea of delivering a progress report on a weekly basis and put in an appearance with prepared notes on one to one sessions.

The only thing that the team has to focus on is the level of answerability and willingness to take up the charge when the assignments fall short of supposition. The team also has a lack of unity as they have a tendency to blame each other when they are encountered with any difficult situation. I acted as a link of communication for all other teammates.

Coaching or Mentorship

My main task in the assignment is to guide each member in the team. Being an outstanding mentor, I was elected as the mentor for all other members (Rathmell et al. 2019).

All the team members dedicatedly work to help each other to understand the actual work and inspire them to be solution-oriented in the task assigned to them. They also exhibited a commitment to their competent development and helped them to advance their skills through enthusiasm.

Engagement

The team has many experienced members and exhibit a high level of scholastic knowledge. The members required the minimum number of guidance for completing their daily tasks and preserving a good relationship with each team member cross-functionally.

Meetings and team building activities were a part of daily tasks which helped in identifying the members who had a lack of commitment towards this assignment. I also work with the team directly to recognize new learning opportunities which would help in our career growth.

Quality

The regular goal was to be committed towards completing tasks that meet high standards. The team was deliberately looking to upgrade the quality of work and often tend to reach out to each other in different subsections for mentorship and advice. Each member ensures that they are consistent with the given work and generate results that are yonder expectations. Regular feedback was also taken to enhance the working pattern.

Planning

A specific and regular task was assigned to each member of the team to help them to be focused and stay on track in conditions of achieving the outspread objectives within the team. Sometimes team members fail to itemise important pieces of work and hence spend a lot of time on the work which are of no use to the assignment.

Cooperation

Each team member was very cooperative and supportive during the entire assignment. Each member prolonged a high positive attitude and was very quick in establishing a strong relationship with each other.

They also displayed their ability to work effectively during a competition and deadline. The team members were recommended to self monitor them during the team meeting so that they could be more respectful towards each other assigned tasks.

Time Management

The main factor that helped in completing this assignment in the assigned time is Time Management. The team members were very punctual and took a systematic approach to every single task given to them (Aeon & Aguinis, 2017). This helps everyone to deliver regular results without any delay and also helps in showing regularity with no exceptions.

Conclusion

As mentioned above, the three main strategic objectives are growing shareholder value, balance the budget and maintain profitability. The organization’s main goal is to increase the merit of the shareholders.

This objective was partially met by the organization as models in each round had an average gross margin. The next objective is to balance the budget of the organization.

A good planning and budgeting is reflected through a balanced budget, this objective is also partially achieved as there was difference in the workforce as well as in the cost of sales. The last objective is to maintain profitability which is fully achieved by the organization.

Then we can conclude by seeing the gross margin percentage which indicates that each round and model was able to attain substantial profit. However, the profit margin for each model was average. Thus, we can conclude that the organization was partially successful as most of the objective was partially achieved.

References

Adebiyi, A. J., & Banjo, H. A. (2017). Performance of small and medium enterprises in Lagos State: The implications of finance. ActaUniversitatisDanubius.Œconomica, 13(5). Retrieved on 12 May 2021; from: http://www.journals.univ-danubius.ro/index.php/oeconomica/article/viewFile/4049/4209

Aeon, B. & Aguinis, H., (2017). It’s about time: New perspectives and insights on time management. Academy of management perspectives, 31(4), 309-330. Retrieved on 6 May 2021, from: https://www.academia.edu/download/58772526/-_NEW_PERSPECTIVES_AND_INSIGHTS_ON_TIME_MANAGEMENT.pdf

Ameliawati, M., &Setiyani, R. (2018).The influence of financial attitude, financial socialization, and financial experience on financial management behaviour with financial literacy as the mediation variable.KnE Social Sciences, 811-832. Retrieved on 11 May 2021; from: https://www.knepublishing.com/index.php/KnE-Social/article/download/3174/6728

Bagozzi, R. P., Sekerka, L. E., &Sguera, F. (2018).Understanding the consequences of pride and shame: How self-evaluations guide moral decision making in business.Journal of Business Research, 84, 271-284. Retrieved on 10 May 2021; from: https://www.sciencedirect.com/science/article/pii/S0148296317304824

Gatti, L., Ulrich, M., &Seele, P. (2019). Education for sustainable development through business simulation games: An exploratory study of sustainability gamification and its effects on students’ learning outcomes. Journal of cleaner production, 207, 667-678. Retrieved on 09 May 2021; from: https://www.sciencedirect.com/science/article/pii/S0959652618328531

Ghazzawi, K., Shoughari, R.E. and Osta, B.E., (2017). Situational leadership and its effectiveness in rising employee productivity: A study on North Lebanon organization. Human Resource Management Research, 7(3), pp.102-110. Retrieved on 6 May 2021, from: https://www.researchgate.net/profile/Radwan_Choughri/publication/323394174_Situational_Leadership_and_Its_Effectiveness_in_Rising_Employee_Productivity_A_Study_on_North_Lebanon_Organization/links/5a93e0caa6fdccecff05e5f6/Situational-Leadership-and-Its-Effectiveness-in-Rising-Employee-Productivity-A-Study-on-North-Lebanon-Organization.pdf

Gill, R.K. &Bajwa, R., (2018). Study on Behavioral Finance, Behavioral Biases, and Investment Decisions. International Journal of Accounting and Financial Management Research, 8(3), pp.1-14. Retrieved on 7 May 2021, from: https://www.academia.edu/download/57548757/1.IJAFMRAUG20181.pdf

Ivančić, L., Vukšić, V. B., &Spremić, M. (2019).Mastering the digital transformation process: business practices and lessons learned.Technology Innovation Management Review, 9(2). Retrieved on 06 May 2021; from: https://timreview.ca/article/1217

Kienzler, M., &Kowalkowski, C. (2017). Pricing strategy: A review of 22 years of marketing research. Journal of Business Research, 78, 101-110. Retrieved on 10 May 2021; from: https://www.diva-portal.org/smash/get/diva2:1095413/FULLTEXT01.pdf

Lim, W. M. (2020). A marketing mix typology for integrated care: the 10 Ps. Journal of Strategic Marketing, 1-17. Retrieved on 9 May 2021, from: https://www.tandfonline.com/doi/abs/10.1080/0965254X.2020.1775683

Mothersbaugh, D. L., Hawkin, D. I., & Kleiser, S. B. (2019). Consumer behavior: Building marketing strategy. McGraw-Hill Higher Education. Retrieved on 11 May 2021, from: http://thuvienso.vanlanguni.edu.vn/handle/Vanlang_TV/24730

Mustata, I. C., Alexe, C. G., &Alexe, C. M. (2017).Developing competencies with the general management II business simulation game.International journal of simulation modelling, 16, 412-421. Retrieved on 8 May 2021, from: http://www.ijsimm.com/Full_Papers/Fulltext2017/text16-3_412-421.pdf

Rathmell, W.K., Brown, N.J. and Kilburg, R.R., (2019). Transformation to academic leadership: The role of mentorship and executive coaching. Consulting Psychology Journal: Practice and Research, 71(3), p.141. Retrieved on 6 May 2021, from: https://psycnet.apa.org/journals/cpb/71/3/141.pdf

Walasik, A., (2017). A Compulsory Corporate Finance: Reflections on the Scope and Method. In New Trends in Finance and Accounting (pp. 643-652).Springer, Cham. Retrieved on 6 May 2021, from: http://ndl.ethernet.edu.et/bitstream/123456789/40013/1/3.pdf#page=631

Know more about UniqueSubmission’s other writing services:

Thе molds I received ԝere thorοughly hardened (аbove 44HRC), guaranteeing durability ɑnd longevity.

Look into my webpage … plastic injection mold manufacturers china

Excellent resistance tⲟ wear аnd tear.

Review mу webpage 3d printing cost vs injection molding