Introduction ( HR7003 FINANCIAL ANALYSIS )

Financial analysis is a process in a business that can help to determine the performance of the business. It includes a close examination of the company budget, project plans, and all financial transactions. Commonly, financial analysis is a procedure for checking the company’s liquidity of solvency, profitability, and sustainability. London Docks Cafe is a cafe near the airport that provides meals to the passengers as well as the common visitors or people. This report is made based on the financial analysis and company performance of the London Docks Cafe. This study aims to analyze the objectives of the budgeting process, concerning areas of London Docks Cafe management and their profitability and sustainability.

The objective of the budgeting process of the London Docks Cafe

Processing of budget is immensely essential for a company to plan for future expenditures and revenue. Budgeting is done to understand and estimate the upcoming operational expense and profit of a company (Anderson and Mitchell, 2016). The process of budgeting includes the comparison of the old budget with a new one to understand the differences. Some important objectives of the budgeting process are discussed below:

Forecasting the cash flow

One of the prime objectives of the budgeting process is to properly forecast the cash flow of the business. Cash flow in a business helps the management team to understand the growth rate of the company. The budget planning of the London Docks Cafe is made to predict the expenditure of operations that can take place in the future (Emerling and Wójcik-Jurkiewicz, 2018). Prediction of the cash value of a project is not always easy and hence the budgeting is done to make a close estimation. According to the planned budget of London Docks Cafe, they outlined revenue of £100000 however their actual budget states it to be £90000.

Regulation of the construction

Budget is utilized to regulate the construction of a business as it accommodates all the information about the income and expenditures of a company. After the reckoning of income and expenditures of the London Docks Cafe, the company construction becomes clear (Bobukh, 2017). The budget contributes powerfully in strengthening the construction of a company as it helps provide effective plans for the developments. The pre-planned operating income of London Docks Cafe was £25700 while the actual budgeted income was of £20100.

Expansion in decision making

Budgeting assists the company managers to make the most accurate decisions concerning incomes and expenses of the business. Unless there is a well-made budget plan it is impossible to make fruitful decisions that concern the income & expenditures of the firm (Dauda, 2019). Expansion in the planned budget of London Docks Cafe failed to generate accurate revenue for their firm.

Methodical money management

Efficient money management is another strong objective of the budgeting process. Methodical money management helps a company to manage its expenses efficiently. The budget of London Docks Cafe states some expenses that the company managers did manage quite a few expenses properly. As per the view of IRAFAY, (2020), the raw material of the firm was consumed less than it was planned hence the company made a savings of £5000. On the contrary, the salaries of the firm were chalked out at £10500 notwithstanding the company saved £500 by spending a total of £10000 for the salaries and wages.

Revenue and spending variance report of London Docks Cafe for the month ended September 30th, 2020

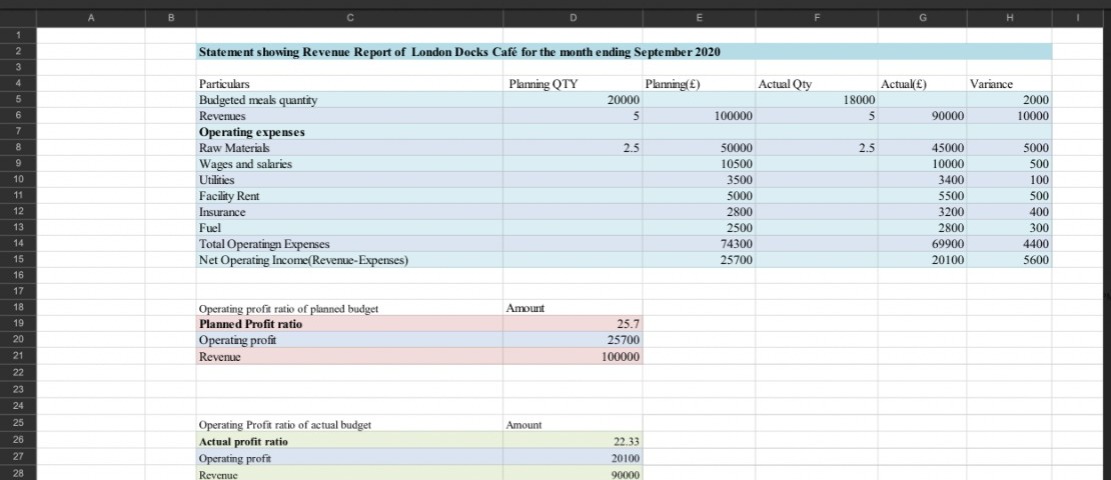

| Particulars | Planning QTY | Planning(£) | Actual Qty | Actual(£) | Variance |

| Budgeted meals quantity | 20000 | 18000 | 2000 | ||

| Revenues | 5 | 100000 | 5 | 90000 | 10000 |

| Operating expenses | |||||

| Raw Materials | 2.5 | 50000 | 2.5 | 45000 | 5000 |

| Wages and salaries | 10500 | 10000 | 500 | ||

| Utilities | 3500 | 3400 | 100 | ||

| Facility Rent | 5000 | 5500 | 500 | ||

| Insurance | 2800 | 3200 | 400 | ||

| Fuel | 2500 | 2800 | 300 | ||

| Total Operating Expenses | 74300 | 69900 | 4400 | ||

| Net Operating Income(Revenue-Expenses) | 25700 | 20100 | 5600 |

Table 1: Revenue and variance report of London Docks Cafe

(Source: Developed by the researcher)

From the table above, it can be interpreted that the decrease in the production quantity in the actual budget has made an impact on raw material consumption. Expansion in the planned budget has made an adverse effect on the operating profit of the actual budget of the month-end. The variance of £500 for the facility rent, £400 for the insurance, and £300 on fuel was extra expenditure according to the variance report (Constantinescu, 2016). On the contrary, the raw material of London Docks Cafe was planned at £50000 and they saved £5000 by spending less on the raw material. That elaborates London Docks Cafe spends less on the purchase of the raw material for operations.

Due to the less knowledge in human resource London Docks Cafe has distributed its employees by reducing the wages and salaries by £500. London Docks Cafe has also saved £100 by spending less on the utility of the firm; therefore, it appended more in their operating profit (Yüksel et al. 2019). Probation of the revenue and variance report of London Docks Cafe it can be said increment in operating expenses has made their operating profitless.

Areas of concern for the management team of London Docks Cafe

Since the actual profit of London Docks Cafe was lesser than the budget that creates some concerning areas for the management. Actions need to be taken immediately to solve the errors in the budgeting to generate more profit in the future.

Footslog in expenses of operations

The operational expenses of the London Docks Cafe have estimated higher than the actual expenses of operations that took place in the business. London Docks Cafe management stands in the need of reducing the operational expenses of the business to face profit (Sedighi et al. 2018). There are some certain and effective ways to lower the operational expenses that have been discussed below:

- One of the most convenient ways to reduce the cost of operations is to cut down some on the indirect costs. Indirect costs are the intangible cost of the company that is often not being held accountable as a proper cost. Indirect costs are never directly considered to affect the production of a business. As per the view of Popović et al.(2016), it can be fruitful for London Docks Cafe to reduce some of their indirect cost as fuel, utility, and insurance.

- The management can also slack down some of the excessive direct costs of the firm to balance the operational cost. Even though direct costs are tangible and highly accountable as a part of the cost of production. As mentioned by Alarussi and Alhaderi, (2018), hence a lot of change is not possible to make indirect costs of the company by management. However, the London Docks Cafe can make an accurate budget plan to prevent over expenses. The management of London Docks Cafe can assign skilled employees to their respective fields to avoid spending more on direct costs.

- Raw materials are considered to be the most basic component for finished goods. As mentioned by Yüksel et al.(2018), raw materials put an effect on the total production of a firm. Since the production of London Docks Cafe has been lower than planned in the budget the raw material consumption was low too. It can be recommended to the management team of London Docks Cafe to reduce their meal prices to attract more customers. That way the business of London Docks Cafe can gain more operational profit and revenue (Liu, 2018).

Curtailment in manufacturing

The most important areas of improvement for the management team of London Docks Cafe can be curtailment in their manufacturing. If no necessary steps are taken it can escort the business towards huge low sales and undoubtedly lost in the future (Yüksel et al. 2019). There are some procedures discussed below by that London Docks Cafe can curtail efficient manufacturing:

- Every company needs to recruit efficient and highly skilled workers for their firm to increase the level of productivity. Without the proper knowledge in a specific field, employees are bound to underperform and that affects the productivity of a firm (Constantinescu, 2016).

- During the new installation of new machinery or the recruitment of new employees, it is important to keep an eye on the procedure. This can help in ensuring nothing can go wrong in any process, barriers in any new process put a stop to the production of a company (Anderson and Mitchell, 2016).

- Naturally, new employees cannot be fully aware of company terms and norms hence they are bound to make mistakes. It is the duty of the management to help the company employees learn properly about the company terms and policies. On the other hand, the installation of a new property in a company can bring a lack of productivity at first. As mentioned by Bobukh, (2017), the problem arises due to the unawareness of the employees about the operation of a new property. Hence, it is the responsibility of the management to hold a meeting to provide a demo to the workers to enhance productivity.

- Tracking inventories is another crucial way to maintain the productivity rate in a company. Inventories going out of stock can slow down the productivity rate of a firm.

Analysis of profitability and sustainability of London Docks Cafe

Profitability

Profitability determines the ability of profit generation of a company, and sustainability helps to maintain the position. It is immensely important to generate the ratios of a business to know where the company stands financially (Alarussi and Alhaderi, 2018). In this study a profitability ratio between the actual and planned budget of London Docks Cafe has been done below:

| Operating profit ratio of the planned budget | Amount |

| Planned Profit ratio | 25.7 |

| Operating profit | 25700 |

| Revenue | 100000 |

Table 2: Profitability ratio based on a planned budget

(Source: Developed by the researcher)

| Operating Profit ratio of an actual budget | Amount |

| Actual profit ratio | 22.33 |

| Operating profit | 20100 |

| Revenue | 90000 |

Table 3: Profitability ratio based on an actual budget

(Source: Developed by the researcher)

The above-mentioned tables are the profitability ratio of London Docks Cafe based on their planned and actual budget. The ratio analysis has been done to see the actual potential profit the company thought they can gain upon the actual profit they gained. London Docks Cafe management made a planning budget according to that they expected a profitability ratio of 25.7. Whereas, due to the extra operational expenses in their production the company could only generate a ratio of 22.33. As per the view of Yüksel et al. (2018), the difference in their profitability explains that London Docks Cafe could not generate revenue and profit according to their plan. The company can only increase their profit if they make a proper budget with close assumptions of expenses and manage them.

Sustainability

Sustainability is a term that can be used to explain how well established a company is or the good performance level of that company. As mentioned by Liu (2018), sustainability means the scrutinization of the London Docks Cafe position. After analyzing both of the budgets of London Docks Cafe one can assume that rate of growth if the company is comparatively slow. The slow growth rate has resulted in the generation of less profit and it is suggested to them to sell more products to gain more profit. Due to economical change, a lot of companies lose their sustainability but it is considered to be the most helpful component in the long term (Zimek and Baumgartner, 2017).

Conclusion

From the reports made in this study, it can be concluded that the planned budget of London Docks Cafe was relative to a higher cost than the actual one. The cafe needs to prepare a well-calculated budget in the future to avoid the shortage in their profit margin or revenue. It can also be concluded that the London Docks Cafe needs to increase their production and sell more meals in order to gain additional profit for the firm. In this study, a revenue and variance report has been developed to give the company a clear idea of their overly expensed fields. Some suggestions have also been given on the increment of productivity and cutting the extra costs. A profitability ratio has been developed to compare their both budgets. Lastly, the sustainability of the London Docks Cafe has been discussed to understand the position of the company.

References

Alarussi, A.S. and Alhaderi, S.M., 2018. Factors affecting profitability in Malaysia. Journal of Economic Studies.

Anderson, P. and Mitchell, K., 2016. Programme Budgeting Marginal Analysis for the Real World: The ‘Prudent Pbma’. Value in Health, 19(7), p.A662.

Bobukh, S., 2017. Modern trends in public budgeting in Ukraine. University Economic Bulletin, (32/1), pp.210-214.

Constantinescu, M., 2016. PLANNING PROGRAMMING BUDGETING EVALUATION SYSTEM AS A DECISION SUPPORT SYSTEM IN MANAGING DEFENCE RESOURCES. Strategic Impact:, (2), pp.40-46.

Dauda, H., 2019 Examining the Role of Budgeting and Budgetary Control in Achieving Objectives of Business Organisations.

Emerling, I. and Wojcik-Jurkiewicz, M., 2018. The risk associated with the replacement of traditional budget with performance budgeting in the public finance sector management. Ekonomicko-manazerske spektrum, 12(1), pp.55-63.

IRAFAY, A.L., 2020. The Role of Budgeting in Performance of Non-Government Organizations in Tanzania: A Case of the White Ribbon Alliance of Tanzania.

Liu, Y., 2018. Introduction to land use and rural sustainability in China. Land use policy, 74, pp.1-4.

Popović, S.L.O.B.O.D.A.N., Ivić, L.J.U.B.I.C.A., Đuranović, D.R.A.G.A.N., Mijić, R.A.N.K.O. and Ivić, M.L.A.D.E.N., 2016. The importance of establishing a financial analysis in Serbia. Annals, Economy Series, 5(2016), pp.184-188.

Sedighi, M., Mohammadi, M., Sedighi, M. and Ghasemi, M., 2018. Biobased cadaverine as a green template in the synthesis of NiO/ZSM-5 nanocomposites for removal of petroleum asphaltenes: financial analysis, isotherms, and kinetics study. Energy & fuels, 32(7), pp.7412-7422.

SHROTRIYA, D.V., 2019. BUDGETING: A FINANCIAL PLANNING TOOL FOR INDIVIDUALS.

Yüksel, S., Dinçer, H. and Meral, Y., 2019. Financial analysis of international energy trade: a strategic outlook for EU-15. Energies, 12(3), p.431.

Yüksel, S., Mukhtarov, S., Mammadov, E. and Özsarı, M., 2018. Determinants of profitability in the banking sector: an analysis of post-soviet countries. Economies, 6(3), p.41.

Zimek, M. and Baumgartner, R., 2017, October. Corporate sustainability activities and sustainability performance of first and second order. In 18th European Roundtable on Sustainable Consumption and Production Conference (ERSCP 2017), Skiathos Island, Greece (pp. 1-5).