LD7164 Assessment Sample – International Financial and Contractual Management 2022

Introduction-

Finland’s reorganisation of the Industrialization Fund project will satisfy funding requirements and set up the Fund to support Finland’s growth. This project will consist of: a) an increase in the Fund’s resources, b) a capital structure which, together with tax and other preferences, should provide a reasonable return on its equity and permit the development of a financially sound institution; c)

strengthening of the Fund staff, management and organization to enable it to appraise projects, provide technical assistance to its clients and assist in the development of a capital market; d) reorientation of the Fund’s mode of operations from indirect lending’s through its shareholding banks to all forms of direct operations that normally are undertaken by financing institutions. Finland needs continued industrialisation.

Although the country’s industry expanded fast in the aftermath, it remains less industrialised than other nations in Western Europe. Finland’s industry growth was particularly rapid in the aftermath of the war as a result of the world pulp and paper consumption which allowed the country to increase its income levels and therefore increase demands for domestically manufactured as well as imported manufacturing products, which resulted in significant expansions in wood-processing capacity and foreign exchange revenue.

Discussion-

Historic Relevance-

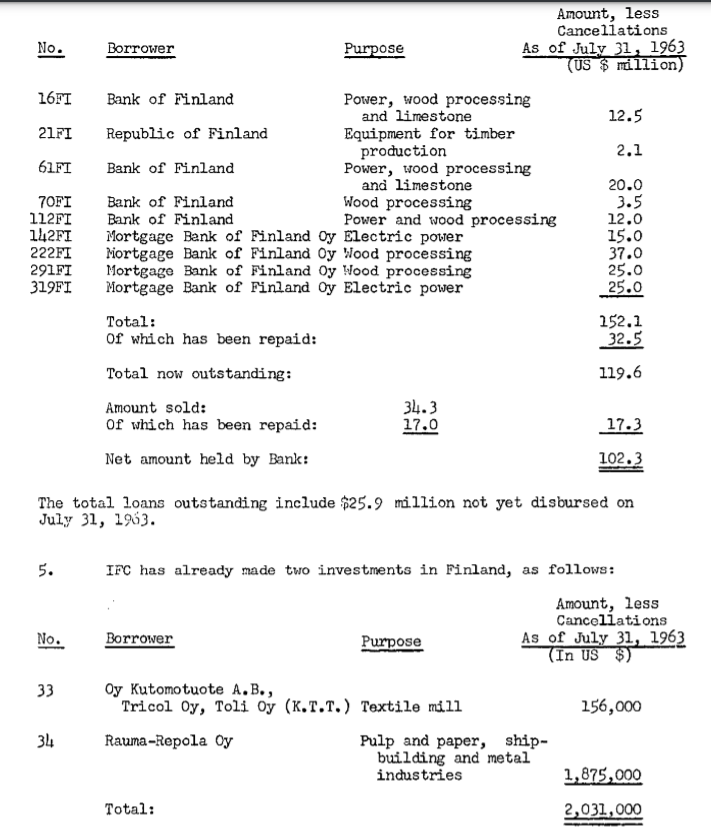

After talks with the Finnish delegation in Washington in the course of its Annual Meeting in 1962, Finland visited in November 1962 and April 1963 to address Finnish industry financial requirements and to revisit the Finnish restructuring plan for the Fund, which the Bank and the IFG requested financial help. Negotiations were held in July 1963 with the Fund and the Finnish Government. The Bank has already made the following loans in Finland-

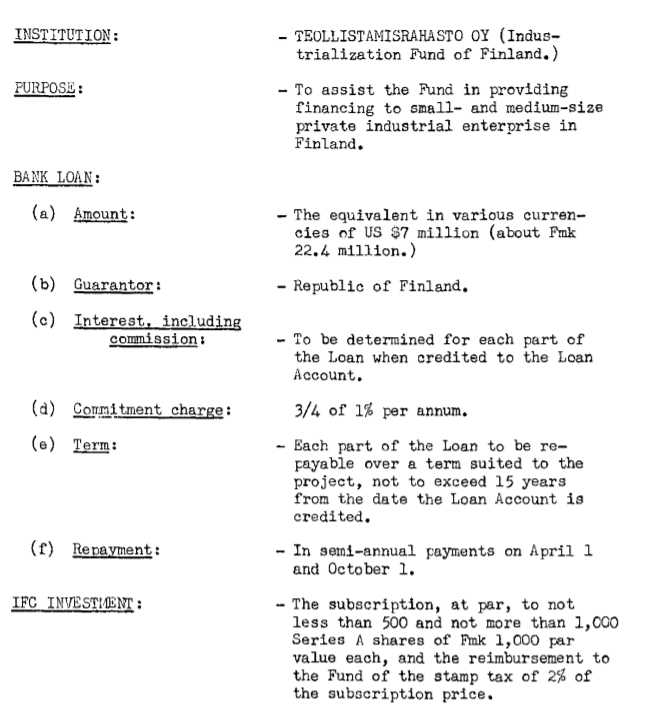

An appraisal of the project (DB-6a) is attached with the report and recommendations to the IFO Investment in TEOLLISTAMISHASTO OY and to the Industrialization Fund, thereafter referred to as Finland. The loan from the Bank is worth $7 million in a number of currencies and IFC is worth an FMK 510,000 to FMK 1,020,00C investment (equal to $159,375 to $18,750 US).

Description of the Proposed Loan and Investment

Necessity of the Project-

Finland has good circumstances for continuous industrial expansion: the availability of suitable public infrastructure, a high degree of education and a high level of technical education, extensive management skills, high savings and investment and political and social stability form an excellent basis for the growth of manufacturing industries.

The proportion of its people engaged in a naturally unproductive agricultural is far too large and its workers are also rather quickly growing. In view of the recent widespread expansion in Finland’s forestry industry and the prospect of some surplus world capacity in the sector over the next years, other industries currently appear to have the best opportunity for additional economic growth.

In areas like specialised technical items, chemicals and quality consumer items for export, excellent potential has been identified. Finland will also have to continue to enhance the competitiveness of its domestic market industries with the gradual lowering of tariffs arising from its participation in EFTA. Both activities require and will require a significant volume of additional investment. Fall on small and medium-sized enterprises largely.

This already large and mostly unfulfilled industry-financed demand is increasing further. Many enterprises are now substantially disabled by modernising and expanding their pro-capital support. In the past, the mid-size contractor had no alternative source of financing. In the past, there was no other source of funding for the medium-sized contractor except commercial banks which gave the larger and financially strong enterprises priority.

He cannot go to the capital market, which is extremely underdeveloped for a country as economically advanced as Finland. The Fund was reformed to meet part of the medium and long-term lending, equity capital and another services shortfall. (Yudelman, 2019)

The Fund-

In 1954, the Fund was established to help SMEs in Finland as a limited responsibility organisation with long-term credit. Fmk 0.5 million had a share capital of 85% of which was held by five private sectors commercial and savings banks and the postal savings bank. Fmk 0.5 million. The overwhelming bulk of the shares were private. At the end of 1962, it had a total of FMK 12 million (USD 3.7 million) in new resources, comprising FMK 6 million government loans and FMK 4.5 million in debentures, which were owned by FMK and Bank of Finland shareholders.

But that money was committed at that time and activities fell off. The fund was largely a conduit for the equity banks that borrowed. It did not do financial, technical or commercial analyses of its supported initiatives. In fact, the main tasks of the bank were to set priority among the numerous applicants after the separate shareholder banks had obtained preliminary approval. (Appiah et al., 2021)

The rearrangement presently being suggested has the major aims of the following-

- Expand funds to enhance Finnish industry’s support to small- and medium-sized businesses by providing financial help for them;

- To create a capital structure that would offer, in conjunction with taxes and other benefits, an appropriate return on equity and promise a financially strong organisation capable of securing money from traditional sources on their own credit through a conservative reserve strategy;

- Strengthening the Funds’ staff and organisation to enable them to evaluate projects, give technical support to their customers and help Finland to build a capital market;

- To transform the operational mode of funds from indirect lending to direct financing that is generally within the scope of an investment firm by means of its shareholder banks without liability and risks to the Fund. (Kruse et al., 2021)

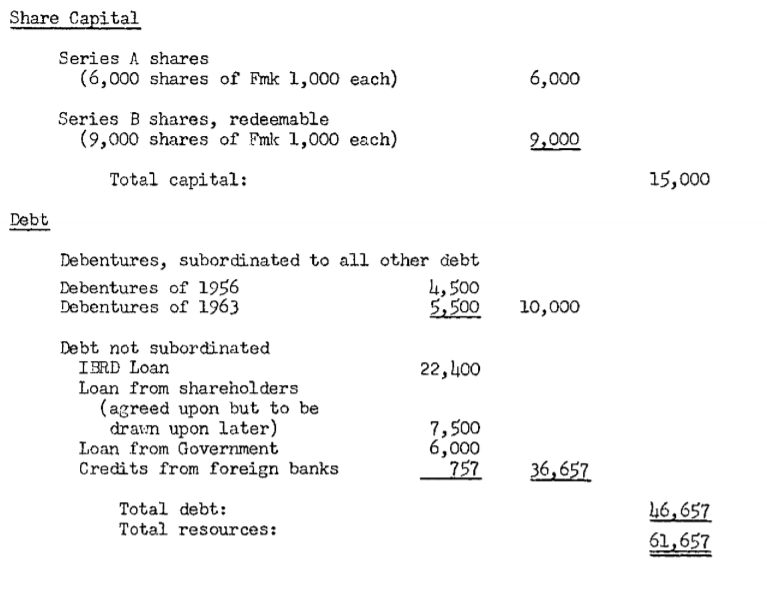

These goals have already been fulfilled. In March 1963 it increased its share capital by 13 million FMK; 4.2 million US shares, of which 4 million were shareholder series Fmk A and 9 million share capital of Fmk Series B subscribed to Banco de Finland. The capital of the Fund increased to Fmk 13 million. Series B shares may be redeemed from earnings before taxes over 30 years.

They have 1/10 voting power with a non-cumulative dividend in Series A shares. In addition, a total of ten million outstanding debentures have been issued for fresh debentures. In the event of liquidation, the debentures are subordinated to all other debt. Of the total, Fmk 5.5 million will mature in the year 2000 and the balance between 1994 and 2004.

Furthermore, the main shareholders agreed to make a Fmk 7.5 million long-term loan to the Fund to be drawn as needed. (The proposed text of the agreement for this loan is attached as previously mentioned. (Graham, 2021)

The Fund’s share capital Series A, planned by foreign shareholders and IFC, would further expand by Fik2 million, and the $7 million (FMk 22,4 million) of banking credits, would provide further funding. The overall FMK 61.7 million (US$ 19.3 million) will be used by the FMk when the restructuring plan was implemented including, but not limited to:

Of the Fmk 61,8 million described above, government lending (Fmk 6 million) is to be borne by the Fund since it collects lending from its ultimate borrowers from foreign banks previously issued (Fmk 0,8 million). As a result, only roughly 55 million Fmk will be available to the Fund for its new operations. (Huan and Ni, 2019)

Upon issuance of all Series A shares, combined with IFC (Series A shares) private shareholders shall own 77 percent of the voting rights as follows: Finnish shareholders will own 48 percent, international shareholders will control 22 percent and IFC will have 7 percent.

The remaining 23% of government shareholders (Fmk 0.7 million Series A shares of the Savings Bank Public Post as well as Fmk 9 million Series B shares of the Finnish Bank). Withdrawal of the B-shares increases the voting power of private shareholders and IFC; withdrawals of the B- shares are completed and 88% of the vote powers of the Fund belong to private shareholders and the IFC.

707 shares, or 8.5% of total Series A shares held by the Post Office Savings Bank, are the sole public holdings of series A shares that have played an important role in promoting the reorganisation of the Fund. The institution is expected to lower its investment in the equity of the Fund in time. The Articles of Association of the Fund have been revised to reform and extend its area of action.

First steps to establish a workforce have been done, and more employment expansion is planned. A new General M4 Manager was elected and he was supported by a Board of Directors. The Fund also wants to recruit an international advisor for financial reasons. The Fund has agreed to cooperate with the Bank before modifying its management structure and employees. (Xiao, 2020)

For the effectiveness of the loan, the Board of Directors of the Fund approves a policy statement created with the Bank and IFC setting out the norms and procedures regulating the operations of the Fund (Annex 3 to the Appraisal Report).

The Loan Agreement should provide a limitation of three times that of the fund’s share capital to the debt of free reserves and debentures subject to all other debt (series A and B). This would give a substantial loan cushion (38 million Fmk or an equivalent of around 12 million FMK). Finnish law has waived the net wealth tax to corporations of 1% provided that the Articles have a requirement to limit distributions of their dividends to 5%.

The Fund’s Articles have a restriction but Finnish stockholders must remove the limitation from the Articles as soon as it becomes desirable. In this sense, the Finnish action holders are linked to a drafted agreement.

The Fund seems to have decent financial prospects and a fair possibility of finance. Assuming that by the end of 1965 or soon afterward the Fund will have distributed a total of $16 million, the Fund will be able to recover its Series A capital of around 10 percent.

After reorganisation, the Fund should build on its resources to demonstrate that it is good and lucrative and successful in helping to boost industrial growth, diversification and the development of the Capital Markets in Finland. (Rivera-Quiñones, 2021)

The Bank loan Proposal-

The terms of the proposed loan are mostly consistent with the standard for bank loans to businesses in the industry. The Fund should not bear the currency risk of lending from bank credit income. Legislation has been introduced to allow the Government of Finland to carry up to Fmk 500 000 for each credit given by the Fund, to the extent that the Foundation borrowers accept this risk the risk will be passed on to it. (Popkova et al., 2021)

Procurement of equipment will be based upon active competition among Finnish and international suppliers. A huge share of Finland Industrial equipment is developed or manufactured either fully locally with imported components, and the demand for capital of a business therefore does not relate to its necessity to imports of commodities.

Therefore, the fund will offer loans to cover a share of the expenses Projects financed without foreign exchange reference Project component. Since foreign exchange is freely available for imports, borrowers may cover their foreign exchange needs through normal banking channels. The need and justification of local currency financing was recognized in past Bank loans to Finland where the proceeds were used in part to cover the cost of locally produced goods.

Such flexibility is all the more necessary in the case of the Fund in order that it may make an effective allocation of its resources. (Zhang et al., 2021)

The Proposed IFC Investment-

The IFC subscribes to a maximum of FMK 1,000 par value of 500 of the Fund’s Series A capital shares. In addition, the IFC would undertake to subscribe no more than 500 more shares unless private institutions in Europe and in the USA subscribe to 1.500 shares, however, in any case, the liability of IFC is subject to a subscriber obligation of European and American banks to at least 1,000 shares to bring a total of the newly issued shares to 2,000.

In the restructuring, participation by IFC and the Bank has been an important component, and IC must be a shareholder and closely monitor the Fund’s success in bringing together the United States and European shareholders. The Fund’s involvement has been significant. At this moment of subscription, all shares of the new issue are paid in full.

The issuing company is responsible, in line with Finnish law, a stamp duty of 2 percent in addition to the par value of the shares; However, the tax should thereafter be passed on to the subscribers in Finnish business procedure. The tax was paid on the shares of the fund to which all Finland shareholders, including the Bank of Finland which has special tax immunities.

Tax immunity of IFC itself do not influence the Fund’s need to pay this tax. It is consequently requested that IFC compliance with Finnish practises and pay the Fund for the subscription tax. The least cost, for IFC, would be US $159,375 and the highest cost would not be US $3,125, including US $6,250, including US $318,750 for investment.

In a letter to IFC, the Bank of Finland needs to certify that the new share issuance of the Fund which is subscribed to by IFC may freely convert, repatriate and appreciate the capital thereof, and that any dividends paid by the Fund to it may be freely or easily converted and transferred. (Appiah et al., 2021)

Economic situation-

In the Report of 6 August 1962, “The Economic Position and Prospects for Finland” The economic framework against which the proposed loan and investment should be examined (R62-63). Major developments since then have been summed up in an annexed Memorandum.

The proposed loan is very much within the capacity of Finland to serve. Finland’s external national debt, excluding Soviet loans, was US$ 326 million as of 31st December 1962, and the yearly service now constitutes around 3p of Western currency exchange revenue. The following draft documents are attached: –

- Loan Agreement between the Bank and the Fund;

- Subscription Letter of IFC to the Fund;

- Guarantee Agreement between the Republic of Finland and the Bank;

- Fin mark Loan Agreement;

- Subscription Agreement between the Fund and potential foreign subscribers;

- Five percent Dividend Agreement;

- Also attached is the report of the Committee provided for in Article III, Section 4 (iii) of the Articles of Agreement of the Bank

The Bank Loan-

The terms of the Loan and Guarantee Agreements allow the Bank practically equal rights to loan to industrial finance businesses. The following characteristics are very interesting:

Subject to the prior permission of the Bank, all projects financed under the proceeds of the loan shall, unless otherwise approved, be amended by section 4.01 of the Loan Regulations of 15 February 1961 to allow the Fund to make withdrawals on account of local currency spending;

- A policy and procedure statement authorised for its operations shall be developed by the Fund and such a statement shall not be modified until approved by the Bank;

- Conditions of effectiveness include, inter alia,, all necessary action, satisfactory to the Bank, relating to (i) the subscription and full payment of shares of the Fund (ii) the borrowing by the Fund of Fmk 7,500,000, (iii) arrangements for the removal in due time of the dividend limitation in the Fund’s Articles of Association, (iv) the exemption of the Fund from the provisions of Finnish law concerning the right of foreigners to own fixed property and shares , and (v)

- the exemption of the Fund from certain provisions of tax legislation; If the conditions under exemptions referred to in (c)(iv) and (v) above have altered without the agreement of the EIB, the Bank shall be entitled to suspend or cancel the loan. (Inshakova et al., 2019)

The IFC Investment-

In other comparable investment corporation initiatives, IFC’s subscription letter follows the usual structure. The requirement of IFC to agree to the following terms, among others, is subject to: The following:

- No fewer than 1,000 Series A shares of the share issued in 1963 shall be subscribed by non-Finnish private investors and paid the total subscription price in cash of its par price;

- The Bank’s Loan Agreement shall have become effective;

- The Bank of Finland has forwarded to IFC a letter saying, among other things, that the registered holders of an issuance from 1963 subscribed to the IF Contracting Fund may freely convert and repatriate money and any appreciation thereon, represented by the said shares. (Campos, 2021)

Conclusion-

Compliance with articles of the agreement, the loan provided by the Bank meets the criteria set forth in the Articles of the Bank’s Agreement and the investment offered by the IFC fulfils the requirements set forth in the IFC Articles. The Government of the Republic of Finland is not opposed to IFC’s proposed/planned investment.

With the recommendations that the Bank shall provide a loan with a loan to TEO LISTA-IJSRAHASTO OY with guarantee to the Republic of Finland, equivalent to US $7 million in various currencies, at such interest levels and substantially on such other terms and conditions as the draught Loan and Guarantee Agreements attached, and shall make a resolution to it adopted by the Managing Directors of the Bank as well as the proposed IFC subscription to the TEOLUISTAI

[SRA,HASTO OY Capital Stock], shall be authorised, subject to adequate formal and substantive legal arrangements of IFC management and in the form attached, by the Board of Directors of the IFC, in large measure on the basis of the aforementioned provisions.

References;

Simchenko, O., Grakhov, V., Krivorotov, V., Chazov, E. and Suntsov, A., 2021, March. The Integrated Economic Model of Oil Field Development in the Context of New Industrialization. In VIII International Scientific and Practical Conference’Current problems of social and labour relations'(ISPC-CPSLR 2020) (pp. 629-635). Atlantis Press.

Reese, A.T., Chadaideh, K.S., Diggins, C.E., Schell, L.D., Beckel, M., Callahan, P., Ryan, R., Thompson, M.E. and Carmody, R.N., 2021. Effects of domestication on the gut microbiota parallel those of human industrialization. Elife, 10, p.e60197.

Appiah, M., Li, F. and Korankye, B., 2021. Modeling the linkages among CO 2 emission, energy consumption, and industrialization in sub-Saharan African (SSA) countries. Environmental Science and Pollution Research, pp.1-16.

Rivera-Quiñones, M.A., 2021. Late industrialization in the Sustainable Development Goals: a critical perspective from the Argentine experience. Globalizations, pp.1-16.

Kruse, H., Mensah, E., Sen, K. and de Vries, G., 2021. A manufacturing renaissance? Industrialization trends in the developing world (No. wp-2021-28). World Institute for Development Economic Research (UNU-WIDER).

CHINA, N.P., The Impact of Current Industrialization and Development Process on Health Sector in Tanzania.

Liu, S.Y., Wang, Z.Y., Han, M.Y., Wang, G.D., Hayat, T. and Chen, G.Q., 2021. Energy-water nexus in seawater desalination project: A typical water production system in China. Journal of Cleaner Production, 279, p.123412.

Graham, S., 2021. The Origins of Centenary Collegiate Institute: A Story of Industrialization, Wealth, and Natural Resources. New Jersey Studies: An Interdisciplinary Journal, 7(1), pp.226-249.

Zhang, L., Hao, X., Zhang, Y. and Wang, Y., 2021. Research on the Industrial Economic Development Driving by Scientific and Technological Service System Innovation. In E3S Web of Conferences (Vol. 235, p. 02008). EDP Sciences.

Campos, P.H.P., 2021. Building the Dictatorship: Construction Companies and Industrialization in Brazil. In Big Business and Dictatorships in Latin America (pp. 63-89). Palgrave Macmillan, Cham.

Hijazi, M., 2021. Relationship Between Project Manager’s Gender, Years of Experience, and Age and Project Success (Doctoral dissertation, Walden University).

Campos, P.H.P., 2021. Building the Dictatorship: Construction Companies and Industrialization in Brazil. In Big Business and Dictatorships in Latin America (pp. 63-89). Palgrave Macmillan, Cham.

Yudelman, M., Finland-Industrialization Fund Project.

Peng, X., Lu, C. and Wang, F., 2020, April. Industrialization Path of Agricultural Intelligent Equipment. In Journal of Physics: Conference Series (Vol. 1533, No. 3, p. 032066). IOP Publishing.

Appiah, M., Li, F. and Korankye, B., 2021. Modeling the linkages among CO 2 emission, energy consumption, and industrialization in sub-Saharan African (SSA) countries. Environmental Science and Pollution Research, pp.1-16.

Xiao, W., 2020. Scientific and Technological Progress and the Transformation of Industrial Development Mode: New-Type Industrialization. In Technological Progress and the Transformation of China’s Economic Development Mode (pp. 217-254). Springer, Singapore.

Döscher, H., Schmaltz, T., Neef, C., Thielmann, A. and Reiss, T., 2021. Graphene Roadmap Briefs (No. 2): industrialization status and prospects 2020. 2D Materials, 8(2), p.022005.

Kruse, H., Mensah, E., Sen, K. and de Vries, G., 2021. A manufacturing renaissance? Industrialization trends in the developing world (No. wp-2021-28). World Institute for Development Economic Research (UNU-WIDER).

Popkova, E.G., Haabazoka, L. and Ragulina, J.V., 2020. Africa 4.0 as a Perspective Scenario for Neo-Industrialization in the Twenty-First Century: Global Competitiveness and Sustainable Development. In Supporting Inclusive Growth and Sustainable Development in Africa-Volume II (pp. 275-299). Palgrave Macmillan, Cham.

Inshakova, E.I., Ryzhenkov, A.Y. and Inshakova, A.O., 2019. Neo-industrialization of the Russian economy: technological and digital development. In Ubiquitous Computing and the Internet of Things: Prerequisites for the Development of ICT (pp. 239-250). Springer, Cham.

Pudpong, N., Durier, N., Julchoo, S., Sainam, P., Kuttiparambil, B. and Suphanchaimat, R., 2019. Assessment of a voluntary non-profit health insurance scheme for migrants along the Thai–Myanmar border: a case study of the migrant fund in Thailand. International journal of environmental research and public health, 16(14), p.2581.

Huan, S. and Ni, Y., 2019. Industrialization of Old-age Tourism in Yunnan. Journal of Landscape Research, 11(6), pp.136-140.

Chung, Y.B., 2019. The grass beneath: conservation, agro-industrialization, and land–water enclosures in postcolonial Tanzania. Annals of the American Association of Geographers, 109(1), pp.1-17.

González de Molina, M., Soto Fernández, D., Guzmán Casado, G., Infante-Amate, J., Aguilera Fernández, E., Vila Traver, J. and García Ruiz, R., 2020. The Social Metabolism of Spanish Agriculture, 1900–2008: The Mediterranean Way Towards Industrialization (p. 281). Springer Nature.

Megbowon, E., Mlambo, C. and Adekunle, B., 2019. Impact of china’s outward fdi on sub-saharan africa’s industrialization: Evidence from 26 countries. Cogent economics & finance, 7(1), p.1681054.

Berger, T., 2019. Railroads and rural industrialization: Evidence from a historical policy experiment. Explorations in Economic History, 74, p.101277.

Know more about UniqueSubmission’s other writing services: