PGBM143 Global Strategy and International Trade

Module Code And Title – PGBM143 Global Strategy and International Trade

Part A

Question 2

Introduction

Diageo is a multinational company that produces alcoholic beverages and maintains subsidies in 180 countries across the world. The company has 140 sites all over the planet and it is headquartered in London (Diageo.com, 2020). This study emphasises the open innovation of the Diageo Company along with the perspectives of the theory of disruptive innovation.

Understanding of Disruptive innovation theory

Clayton Christensen introduced the theory in the mid-1990s by stating the way about how the new entrants in an industry disrupt the business of the other existing company in the particular industry. This disrupts all the existing companies if the new company has been introduced in a manner to repudiate the existing ones (Petzold et al. 2019). It is to note that disruptive innovation helps a company to maintain its function in a way that the company may increase its growth.

A company that has fewer resources in order to maintain its function may follow disruptive innovation to increase its growth. It helps to maintain the operations with fewer resources in the market and allows them to enter the market by introducing the products. However, the goods or services that are going to be introduced must increase the value of the company in order to sustain itself in the market (Christensen et al. 2018). This company has to challenge the existing company and must follow the protocols of the industry. The company may be incumbent in the matter and this may allow the existing company to promote the products often more than usual.

The investment of the existing company may have to increase in order to compete with the new entrants in the market. The new entrants enter the market at the bottom line of the market and aim to move up their business to the top by following disruptive innovation (Adegbile and Sarpong, 2018). There are certain steps that help the new entrants to follow the disruptive innovation and maintain its growth in the market. The steps are enumerated in the following:

The first step incorporates that the incumbent businesses focus on the services or goods to maintain their existing customers in the market. They usually ignore the demands that the downmarket has. The theory states that the new entrants must focus on the services or goods of the downmarket.

The second step of the new entrants is to maintain its downmarket segments and focus on the cost and the quality of the services or products that are going to be introduced by the company (Si and Chen, 2020). As opined by Kumaraswamy et al. (2018), the cost must be less in comparison to the existing market so that the customers get attracted by the products and the services of the company.

The third step enumerates that the incumbent companies do not focus on the new entrants and aim to maintain their business to get more profits.

The next step occurs when the new entrants resolve the solution for the incumbent business’s customers.

The last step describes that the new entrants disrupt the business of incumbent companies when they attract the mainstream customers of the existing companies.

Concept of Open innovation

The major concept of open innovation comes by evaluating the fact that the company or firms may use external and internal ideas in order to increase the growth of the company. As per the view of Long and Blok (2018), the company may also use the paths of external and internal sources to maintain its sustainability in the market.

Merits

Access Talent

The accessing function of the talent is the crucial advantage that the company may occur. This is one of the best benefits for accessing talents. 57% of the executives of the company states that the absence of skills or talents in the employees is creating a lack for the company in its growth. It is creating a lack in the company and is restricting the ability for innovation that might increase the growth in the market (Badir et al. 2020). Open innovation allows the internal teams to communicate with outer communities and this helps to increase the skills or talents of the company within the wider network.

Right infrastructure accessing

Small companies fear developing their business due to any lack of source or that the company has the significant idea to maintain the quality of the services or goods with a small resource (Canh et al. 2019). Open innovation helps the company to its growth by building relationships with larger companies in order to run the business more efficiently and smoothly.

New streams for revenues

Open innovation helps the companies to maintain their ideas and to develop the same internally but does not fit with the core business model of the company. According to Bacon et al. (2019), it allows the company to increase its ideas externally so that the core business model does not get affected and also new streams of revenue are developed.

Demerits

Revealing information

Open innovation helps to share ideas or the projects of the company that has been created internally for the company’s growth. It is to note that the information must be revealed in order to increase the growth externally for the company (Goto, 2019). This allows the risk of the company and the unintended information also is shared often.

Losing competitive advantages

The company may be affected by the company in order to maintain the sharing attitude for the increase of revenues of the company. The company may lose competitive advantages as a result of sharing information of the intellectual property.

Increasing complexity

The way of sharing information of the internal source with the external source creates complexity for the company in order to control the innovation in a proper way. As per the view of Hu and Diao (2021), the contributors’ attitudes are also to be regulated by the company in order to observe the affected condition of a project.

Management of senior manager on open innovation

Diageo Company leads the company by its management in a significant way and the board of directors of the company is trained and skilled members of the company. They have the knowledge to maintain its open innovation by implementing various innovations in the recent days for the company in order to increase its sustainability in the global market (Sun et al. 2020). The company focuses on the values of the company and acts responsibly to deal with the strategies that need to increase the validity of the company.

It is to be argued that the growth of the company is stable r not in terms of the global market as the importance of the same is to be maintained for the new entrants and the substitutes of the products that the company produces (Podmetina et al. 2018). However, it is to note that Diageo focuses on the strategies to maintain open innovation in its perspectives and allows the industry to evaluate the same. The company started “Diageo Technology Ventures” in 2014 that incorporate certain technologies that help the company to increase the quality of the products.

The company aims to the forefront of innovation along with the ability to manage the same. The company is the world’s largest producer of spirits and this helps the company’s management to stick to the focus to maintain sustainability. The management of Diageo took up the idea to increase its sustainability by exploring to change the current business model into a higher aspect of the industry (Urbinati et al. 2020). The way to operate the facilities is the main program that helps the company to increase its sustainability in the near future.

The company focuses on improving the technologies for the production of spirits in a way to maintains sustainability. However, it is to note that the company aims to start the program in 2014 but due to unavoidable circumstances, the company fail to implement the same in the year 2014 and the innovation has started after some years from the proposed year (Wu and Hu, 2018). The company make a partnership with ThinFilm company that is a Norwegian company of digital technology and this helped the company to introduce the concept of “smart bottle” (Diageo.com, 2020).

Implications of senior management’s abilities

The top management of Diageo Company has the knowledge of the importance of the company and thus the management of the company deals with a certain perspective to maintain its innovation at a certain level of amusement (Diageo.com, 2020). The management of the company also focuses on the shared values of the company so that the internal source may retrieve the external ideas and combine them with a significant idea (Naqshbandi and Jasimuddin, 2018). This implementation of the management may allow the company to focus on certain perspectives and implement certain ideas.

The management of the company shared an open invitation to digital innovators worldwide to maintain the growth of the company. The management shared this invitation in order to modernise the firm’s drinking brands and the management shows its ability to offer 100,000 dollars to each pilot of the selected digital innovators (Richter et al. 2020). The company aims to improve the technologies by their new venture of technology and this helps the management in maintaining sustainability in the global market.

The aim of the management of Diageo is to develop and maintain the piloting of the innovators so that the technology gets prepared within a prescribed time period. In order to boost up the pilots, the management decided to offer them to join the company by the leading talent ventures of the company (Gentile-Lüdecke et al. 2020). This is followed by the “International Innovation Programme” of Diageo that helps in boosting up the employees by a cash investment of the company.

The Chief of the marketing officer, Syl Saller states in a report that tech start-ups are taking the market in disruptive innovation and this leads to enhancing the strategies more frequently than before. The important note of the company may be argued in a manner to maintain the possibilities of the modernisation and the technologies that the company intends to implement are creating risks for the company or not (Albats et al. 2020). However, it is reported that the company does not report the importance of the same in a manner as the technologies that are being used in the company help the company to maintain sustainability and is combating with disruptive innovation of the new entrants in the market. According to Abbate et al. (2019), the prior aim of the company is to maintain sustainability in the market by making the customers drunk responsibly and to design a proper platform or technology for fulfilling the same.

Implications of senior management’s competency to balance

The top managers of Diageo maintain the proper structure to balance the strategies of the company by implementing certain policies in relation to the company’s growth. This is the support system of the teams of the company that helps in creating the company more sustainable through its competencies. The management aims to hire knowledgeable workers and train them to implement the proper strategies for the growth of the company (Limaj and Bernroider, 2019). The management took the decision to implement the theory of open innovation and open a new centre in Scotland for the production of spirits. It is also a research centre that helps in implementing certain strategies and improves its competency. This shows the balance of the management to maintain their growth in the industry.

The distilling industry faces innovation in this decade by Diageo’s management and implements the state-of-the-art innovation in Scotland along with the research centre. This increases the sustainable growth of the company and allows attracting customers by its open innovation strategies (Adnan Bataineh, 2019). Sustainable strategies are the major competencies of the management of Diageo that include having the strength in the proper way to maintain the policies of the company (Diageo.com, 2020). The management aims to increase the strategies through implementing their competency to maintain the balance of the company.

Ivan Menezes, the CEO of Diageo aims to maintain the sustainability of the company along with the Executive committee members that show the performance through their competencies in the market. The general managers and the regional presidents of Diageo have the responsibility in the frontline market strategies (Diageo.com, 2020). The company aims to improve its frontline marketing in the local markets and this allows the company to get closer with the consumers. These deliberate steps of the company aim to improve the open innovation for the company by understanding the demands that the disruptive innovation may take place. “Global Sustainability Director” along with the team members are in the place of the company to continue the equilibrium of the company and this allows the company in its growth (Bourne et al. 2018). The members of the Executive Committee are also a part of marketing in the local markets that helps them to maintain the global functions of the company. The competency of the management is thus established in accordance with the functions that allow them to identify the loopholes of the company and focus on the same.

Demands for exploitation and exploration management

Exploration is the term that includes various activities such as innovation, discovery, experimentation, risk-taking, variation, and search. These activities are to be implemented by the company in order to maintain the sustainable growth of the company. However, the term Exploitation indicates certain different activities such as execution, implementation, selection, efficiency, and refinement (Lu et al. 2019). It is to be argued whether exploration or exploitation takes the advancement of the increasing element of Diageo or not. The argument must be clear in accordance with the managerial fact of the company and can be discussed further.

The organisations in different sectors deal with certain perspectives and this allows introducing the exploitation-exploration dilemma in the industries. However, it is to note that Diageo faces some of the problems in accordance with the disruptive innovations that take place in the market (Diageo.com, 2021). It is also known as the Probabilistic problem and deals with the repetitive manner in order to manage the functions of the organisation.

The demand for exploitation and exploration depends on the circumstances when the disruptive innovation takes place in a certain industry and this may lead to inculcating the facts with the present situation. However, it is to state that Diageo faces such problems in the market in the present days and this allows the company to maintain the open innovation strategy in their perspective. As stated by Du and Chen (2018), the management of the company maintains the hygiene quality of production and thus the cost of the spirit is a bit higher than the expectation. The new entrants took this price into consideration and they managed to maintain the low-priced accommodation for the customers.

The technologies that the company intends to introduce in their strategies are the result of this exploitation and exploration system and this may lead to maintaining the growth of the company. As the global context of this dilemma aims to innovation part, the management of the company aims to introduce the ‘smart bottle’ concept in their book. The introduction of unique products helps the industry to get flourished by its concept and this allows the company to sustain itself in the market (Cillo et al. 2019). However, the introduction of certain technologies helps the company to get attracted to new customers as well as the existing mainstream customers in their pockets.

Conclusion

The study may be concluded by stating that the important factor of the industry is to maintain the equilibrium of the market by implementing proper strategies. Disruptive innovation takes place at any time of the period of business and this may be inculcated by introducing open innovation through proper management of the company. Therefore, the study can be concluded by mentioning that the management of the company must be well skilled in order to cope up with disruptive innovation in the industry.

Part B

Question 4

Introduction

In recent studies, it has been seen that after Brexit, internal and external trade of the United Kingdom and Europe have been harmed and the way of trade has changed in a significant manner. In addition, the external and internal economies of scale of both the countries have been confronted with several hindrances due to the post-pandemic situation that has caused a drastic change of the intra-industry trade between the UK and EU. Based on these facts, this essay has been aimed to exhibit knowledge about differences between internal and external economies of scale. In light of this factual knowledge, this essay will include a discussion regarding the impact of Brexit on the UK-EU intra-industry trade.

Difference between external and internal economies of scale

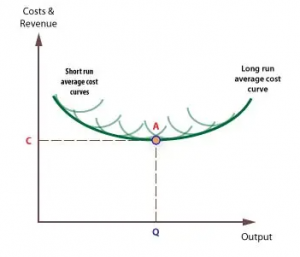

Figure 1: Illustration of Economies of Scale (Source: Zhong et al. 2021)

Figure 1: Illustration of Economies of Scale (Source: Zhong et al. 2021)

The term, “economies of scale” has been referred to the phenomenon when it has been observed that the organizational production has been increased and the cost per unit has been decreased at the same time. In accordance with the opinion stated by Schimmelfennig (2021), two types of the economy of scale exist with certain distinguishable attributes. In order to put both concepts in a single line, it can be stated that the internal economies of scale measure the production efficiency of an organization. On the contrary, the external economies of products have been referred to as the phenomenon caused by positive or negative externalities of an industry.

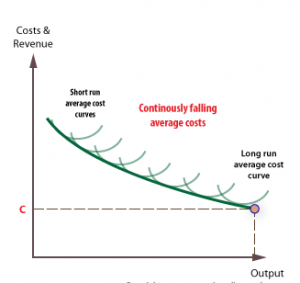

Figure 2: External economies of scale (Source: Hervas-Oliver et al. 2021)

Figure 2: External economies of scale (Source: Hervas-Oliver et al. 2021)

It has been seen in several economic studies that the average cost of business drops when an industry starts to grow (Hervas-Oliver et al. 2021). This particular circumstance has possessed the power of influencing the occurrence of external economies of scale. The positive attributes of external economies of scale can be innovation, specialized workforce and the relationship between suppliers. On the other hand, the negative aspects of external economies of scale can be the external dynamics of the industry (Aysun, 2022). In another sense, external economies are the advantages that have been obtained by an organization for the reason of different external factors of the organizational business.

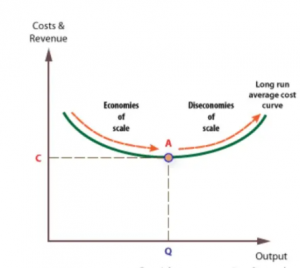

Figure 3: Average costs will eventually rise because of diseconomies of scale (Source: Wu et al. 2021)

Figure 3: Average costs will eventually rise because of diseconomies of scale (Source: Wu et al. 2021)

In the case of internal economies of scale, in accordance with several theories related to the economy, the long-run cost curve of the majority of the companies needs to be “U” shaped as per the assumption (Wu et al. 2021). This phenomenon has been assumed in the internal economies because of the impact of economies and diseconomies of scale on the business and production of the organization. This phenomenon can have the influence of the independent factors of the industry or the organization for being more specific, such as machinery, production measures and more.

On the basis of the above discussion, it can be stated that internal economies of scale have the ability to offer more competitive advantages in the industry to an organization in comparison to the external economies of scale. It has been stated that “If borrowing costs decline across the entire economy because the government is engaged in expansionary monetary policy, the lower rates can be captured by multiple firms” (Wang and Han, 2021). On the contrary, a greater degree of exclusivity has been embodied by the internal economies of scale.

Based on the parameter of reflected attributes, it can be stated that movement along the curve of LAC has been reflected in internal economies of scale whereas shift in the LAC curve has been reflected on the external economies of scale (Kumar and Saikia, 2020). In light of benefits, the external economies have offered fewer benefits as the attributes are based on massive external changes of a farm. On the contrary, the internal economies of scale possess the ability to reduce the long-term costs that contribute to the up-gradation of competition from a global perspective.

Concept of Intra Industry trade

The exchange of similar products belonging within the same industry has been called the term intra-industry trade. This phenomenon has offered two countries situated within the same industry to produce economic gains by allowing companies and professionals to learn and do innovations in products (Drelich-Skulska and Bobowski, 2021). In some of the cases, intra-industry trade helps in magnifying some particular parts of the value chain of the organizations situated within the simmer industry but in different countries. In accordance with the opinion of several studies, intra-industrial trade needs to be a two-way trade.

As per the concept demonstrated through the theory of comparative advantage, it can be stated that often the intra-industry trade (IIT) has happened between homogeneous goods or products. For instance, it can be stated as per the “Heckscher–Ohlin model” that there are two organizational factors that can be considered as homogeneous ones, such as labour and capital (Luptáková, 2021). The initial one can be considered as the mobile factor for both the organizations whereas the second one, capital is an industry-specific factor. Therefore, in order to sum up all that has been stated so far, the intra-industry, in a usual term refers to the phenomenon where two countries allow themselves to export and import the same kind of product while remaining in the same industry in order to achieve cost-effectiveness and effective innovation of the product.

Besides promoting trade between homogeneous goods, this particular scenario has been categorized in other two categories such as, “Trade in Horizontally Differentiated Goods” and “Trade in Vertically Differentiated Goods”. On the basis of different theories of economy, it can be stated that the trade-in horizontally differentiated goods has been associated with a cost that is of low adjustment from trade liberalization and regional integration between the two states such as the United Kingdom and Europe (Becuwe et al. 2021). On the other hand, in the case of trade in vertically differentiated goods, without increasing the variety of the goods the costs of the goods have been increased for the high quality of the products that have been imported or exported by two countries who belong to the same industry.

Intra-industry trade between UK and EU

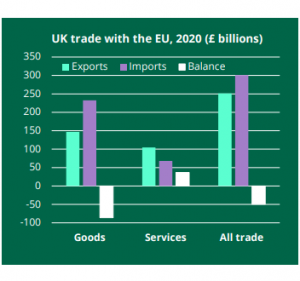

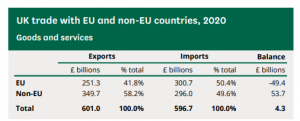

Figure 4: UK trade with EU in 2020 (Source: Research briefings.files.parliament.uk, 2021)

Figure 4: UK trade with EU in 2020 (Source: Research briefings.files.parliament.uk, 2021)

From the above figure, it has been seen that the country of the United Kingdom had expired the goods to the country of Europe in 2020, which had been worth £251 billion. This amount was equal to the 42% of total exports done by the United Kingdom. On the other hand, the number of imported goods or services from the European Union to the United Kingdom was “£301 billion” dollars that are similar to 50% of the total imports of the United Kingdom (Ec.europa.EU, 2020). On the other hand, in accordance with the above figure, it can be stated that the United Kingdom has witnessed an overall trade deficit of -£49 billion with the European Union.

Figure 5: UK intra-industry trade with EU in 2020 (Source: Statista.com, 2021)

Figure 5: UK intra-industry trade with EU in 2020 (Source: Statista.com, 2021)

On the basis of this phenomenon, it can be stated that the internal and external economies of scale have had a significant impact on the changing economy of the UK. Despite signing the “Trade and Cooperation Agreement“, the flaws of having skilled workers and the other attributes of internal economies of scale have not been utilized fully to improve the intra-industry trade balance of both countries (Eur-lex.europa.eu, 2021). On the other hand, the changed external factors of intra-industry trade of the United Kingdom has been performed as the main reason for having a huge rate of a deficit on trade in goods with the European Union.

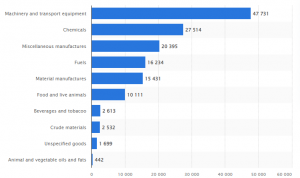

Figure 6: largest exported goods and commodities with the United Kingdom with European union in the year 2020 (Source: Statista.com, 2021)

Figure 6: largest exported goods and commodities with the United Kingdom with European union in the year 2020 (Source: Statista.com, 2021)

In accordance with the above figure, it has been seen that in the fiscal year 2020, the most expert commodity of the United Kingdom traded with the European Union is machinery and transport equipment with a worth of 47,731 million dollars (Statista.com, 2021). As per the statistical data of the intra-industry trade, it has been represented that a trade surplus has been witnessed by the United Nation with the European countries as well.

Figure 7: Intra-industry trade comparison between 2019 and 2020 (Source: Ec.europa.eu, 2020)

Figure 7: Intra-industry trade comparison between 2019 and 2020 (Source: Ec.europa.eu, 2020)

The statistical data of EU trade with the UK has shown that the EU has accounted for “47% of UK goods exports and 36% of services exports”. On the contrary, it has come to the forefront that the 43% of services and the 53% of goods that the UK imported in 2020 had been imported from the European Union. In terms of cash, it can be stated that the UK exports value to the EU had fallen by a percentage of 14 between the fiscal year 2019 and 2020 (Researchbriefings.files.parliament.uk, 2021). This disruption has been mainly caused by the sudden outbreak of the Coronavirus pandemic all over the world at the end of the transition period of Brexit.

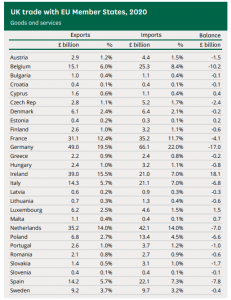

Figure 8: UK trade with UK member states in 2020 (Source: Statista.com, 2021)

Figure 8: UK trade with UK member states in 2020 (Source: Statista.com, 2021)

The above figure depicts that the major deficit in UK exports has been recorded with France that has fallen by 9 billion Euros. From the perspective of the imports, the largest deficit in imports has been recorded with Germany. With Germany, the terms of imports have fallen by the amount of 11 billion Euros.

Impact of Brexit on UK-EU intra-industry trade

After Brexit happened, the United Kingdom was in need of developing new policies regarding trade as most of the economical dynamics have been changed for the UK after Brexit. During going through the changes caused by Brexit in the UK, the many supporters of Brexit demanded new policies for UK politics taking into consideration the UK trade.

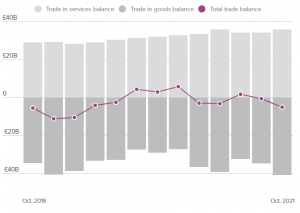

Figure 9: UK-EU intra-industry trade statistic at the end of the Brexit transition period (Source: Politico.eu. 2022)

Figure 9: UK-EU intra-industry trade statistic at the end of the Brexit transition period (Source: Politico.eu. 2022)

The above figure demonstrates that in 2021, the country of the United Kingdom witnessed a deficit of nearly 45 per cent of total exports in comparison to the previous fiscal year. This significant fall in export services in the UK has occurred because of the last transition period of Brexit (Jafari and Britz, 2020). Maintaining the similarity of the impact of Brexit, the European Union also has experienced a 13% deficit in the trade as well in the past fiscal year.

In addition to the above discussion, the UK and EU, both have developed some new custom check policies in order to secure the trade between these two states. As a consequence of these newly developed policies, the goods have started arriving delayed on the other side of the border of the EU that has contributed to creating various unwelcome logistic problems in the land of the United Kingdom (Kumar and Saikia, 2020). For the exact reason of this scenario, the trade relationship between the EU and UK has started falling and the trust of each state in the other is harmed in a significant manner.

Figure 10: Trade flows of UK and EU in 2021 (Source: Politico.eu. 2022)

Figure 10: Trade flows of UK and EU in 2021 (Source: Politico.eu. 2022)

Brexit has been the cause that in the third quarter of 2021, the government of the United Kingdom has discovered the lowest value of GDP in comparison to the one ever encountered in 2009 (Latorre et al. 2020). This particular phenomenon has disclosed that the business with European continental suppliers has been harmed immensely by Brexit. In the perspective of the European Union, the non-EU countries have started losing the accessibility of the current free trade agreements of the European Union. In addition, as the biggest trade partner of the UK, EU countries have started witnessing various issues regarding cost-effectiveness in trade for the changed policies of logistics on both sides of the border. Therefore, it has been seen that the core purpose of intra-industry trade, which is economic gain, has not been achieved by these two states for Brexit as the supply chain has been hampered by both regions.

Policies and strategies to be undertaken to improve intra-industry trade after Brexit

Keeping an investigational eye on the impact of Brexit on the intra-industry trade of the UK and EU, some recommendations for the improvement of policies and strategies have been suggested in the below section:

Based on the issues related to distributional consequences both the states need to revise and improve the trade policies. It has been seen and discussed so far in this essay that the changes in policies caused by Brexit have been the main reason for issues that have occurred in trending (Politico.eu. 2022). In order to avoid the issues of trade policies, both nations have to develop such policies that can be beneficial for both the states and can bring economic success, the basic goal of intra-industry trade.

In order to minimize the issues of logistics, the policies developed based on supply chain logistics of the UK needs to be less harsh. It has been seen previously that the products have been started reaching lately for the strict logistic policies of the United Kingdom which are developed at the transition period of Brexit (Drelich-Skulska and Bobowski, 2021). Therefore, based on this phenomenon it can be stated that the UK needs to ensure that the trade partner EU can supper steady shipment in order to maintain a healthy trade balance within both the regions.

In addition to the above discussion, the compilation of all three kinds of laws regarding international law is highly required in order to maintain a well-established trade partnership. It has been discussed earlier that for Brexit the internal and the international policies of trading has been changed in a rapid manner for the UK. The EU has gone through a sort of similar experience too but the number of vital changes of the policies remains less than the UK (Hosoe, 2018). Therefore, the three complainants of international trade law need to be compiled in such a way in the trade agreements of the UK that never be able to create any kind of hindrance in maintaining the regulations of the agreement terms of maintaining international trade relation with the EU.

Conclusion

The study has cast light on the distinguishable features of the internal and external economies of scale where it has been seen that the internal economies of scale have the ability to offer a more competitive advantage to both the countries who trade within the same industry. In addition, it has been seen in this study that for the Brexit and other external value changes of the UK, the economic gain of both the countries, especially of the UK, has fallen at a severe rate. At the transition period of Brexit, the UK has seen a deficit of -49 billion euros in trading in the past few fiscal years with the EU. In addition to this, several logistic issues have been encountered by both the region as Brexit has changed the internal and international policies of trading of the UK and EU. Based on these scenarios, several recommendations for improving intra-industry trade policies and strategies have been provided as well.

References

Part A

Journals

Abbate, T., Codini, A.P. and Aquilani, B., 2019. Knowledge co-creation in open innovation digital platforms: processes, tools and services. Journal of Business & Industrial Marketing.

Adegbile, A. and Sarpong, D., 2018. Disruptive innovation at the base-of-the-pyramid: Opportunities, and challenges for multinationals in African emerging markets. critical perspectives on international business.

Adnan Bataineh, K., 2019. Impact of work-life balance, happiness at work, on employee performance. International Business Research, 12(2), pp.99-112.

Albats, E., Alexander, A., Mahdad, M., Miller, K. and Post, G., 2020. Stakeholder management in SME open innovation: Interdependences and strategic actions. Journal of Business Research, 119, pp.291-301.

Bacon, E., Williams, M.D. and Davies, G.H., 2019. Recipes for success: conditions for knowledge transfer across open innovation ecosystems. International Journal of Information Management, 49, pp.377-387.

Badir, Y.F., Frank, B. and Bogers, M., 2020. Employee-level open innovation in emerging markets: linking internal, external, and managerial resources. Journal of the Academy of Marketing Science, 48(5), pp.891-913.

Bourne, M., Franco-Santos, M., Micheli, P. and Pavlov, A., 2018. Performance measurement and management: a system of systems perspective. International Journal of Production Research, 56(8), pp.2788-2799.

Canh, N.T., Liem, N.T., Thu, P.A. and Khuong, N.V., 2019. The impact of innovation on the firm performance and corporate social responsibility of Vietnamese manufacturing firms. Sustainability, 11(13), p.3666.

Christensen, C.M., McDonald, R., Altman, E.J. and Palmer, J.E., 2018. Disruptive innovation: An intellectual history and directions for future research. Journal of Management Studies, 55(7), pp.1043-1078.

Cillo, V., Rialti, R., Bertoldi, B. and Ciampi, F., 2019. Knowledge management and open innovation in agri-food crowdfunding. British Food Journal.

Du, J. and Chen, Z., 2018. Applying Organizational Ambidexterity in strategic management under a “VUCA” environment: Evidence from high tech companies in China. International Journal of Innovation Studies, 2(1), pp.42-52.

Gentile-Lüdecke, S., Torres de Oliveira, R. and Paul, J., 2020. Does organizational structure facilitate inbound and outbound open innovation in SMEs?. Small Business Economics, 55(4), pp.1091-1112.

Goto, K., 2019. The Role of Open Innovation and Platform in Agriculture. In Entrepreneurship and Innovation in Japanese Agriculture (pp. 115-132). Springer, Singapore.

Hu, R. and Diao, X., 2021. Exploring the open innovation information spillover effect: Conceptual framework construction and exploratory analysis. IEEE Access.

Kumaraswamy, A., Garud, R. and Ansari, S., 2018. Perspectives on disruptive innovations. Journal of Management Studies, 55(7), pp.1025-1042.

Limaj, E. and Bernroider, E.W., 2019. The roles of absorptive capacity and cultural balance for exploratory and exploitative innovation in SMEs. Journal of Business Research, 94, pp.137-153.

Long, T.B. and Blok, V., 2018. Integrating the management of socio-ethical factors into industry innovation: towards a concept of Open Innovation 2.0. International food and agribusiness management review, 21(4), pp.463-486.

Lu, R., Hong, S.H. and Yu, M., 2019. Demand response for home energy management using reinforcement learning and artificial neural network. IEEE Transactions on Smart Grid, 10(6), pp.6629-6639.

Naqshbandi, M.M. and Jasimuddin, S.M., 2018. Knowledge-oriented leadership and open innovation: Role of knowledge management capability in France-based multinationals. International Business Review, 27(3), pp.701-713.

Petzold, N., Landinez, L. and Baaken, T., 2019. Disruptive innovation from a process view: A systematic literature review. Creativity and Innovation Management, 28(2), pp.157-174.

Podmetina, D., Soderquist, K.E., Petraite, M. and Teplov, R., 2018. Developing a competency model for open innovation: From the individual to the organisational level. Management Decision.

Richter, N., Jackson, P. and Schildhauer, T., 2018. Outsourcing creativity: An abductive study of open innovation using corporate accelerators. Creativity and Innovation Management, 27(1), pp.69-78.

Si, S. and Chen, H., 2020. A literature review of disruptive innovation: What it is, how it works and where it goes. Journal of Engineering and Technology Management, 56, p.101568.

Sun, Y., Liu, J. and Ding, Y., 2020. Analysis of the relationship between open innovation, knowledge management capability and dual innovation. Technology Analysis & Strategic Management, 32(1), pp.15-28.

Urbinati, A., Chiaroni, D., Chiesa, V. and Frattini, F., 2020. The role of digital technologies in open innovation processes: an exploratory multiple case study analysis. R&D Management, 50(1), pp.136-160.

Wu, L. and Hu, Y.P., 2018. Open innovation based knowledge management implementation: a mediating role of knowledge management design. Journal of Knowledge Management.

Part B

Aysun, U., 2022. Identifying the External and Internal Drivers of Exchange Rate Volatility in Small Open Economies. Available at SSRN 4019925.

Becuwe, S., Blancheton, B. and Meissner, C.M., 2021. The French (Trade) Revolution of 1860: Intra-Industry Trade and Smooth Adjustment. The Journal of Economic History, 81(3), pp.688-722.

Drelich-Skulska, B. and Bobowski, S., 2021. Intra-industry trade and implications of the European Union-Japan Economic Partnership Agreement from the perspective of the automotive industry. Entrepreneurial Business and Economics Review, 9(2), pp.183-206.

Hervas-Oliver, J.L., Sempere-Ripoll, F. and Boronat-Moll, C., 2021. Technological innovation typologies and open innovation in SMEs: Beyond internal and external sources of knowledge. Technological Forecasting and Social Change, 162, p.120338.

Hosoe, N., 2018. Impact of border barriers, returning migrants, and trade diversion in Brexit: Firm exit and loss of variety. Economic Modelling, 69, pp.193-204.

Jafari, Y. and Britz, W., 2020. Brexit: an economy-wide impact assessment on trade, immigration, and foreign direct investment. Empirica, 47(1), pp.17-52.

Kumar, R. and Saikia, P., 2020. Forest resources of Jharkhand, Eastern India: socio-economic and bio-ecological perspectives. In Socio-economic and Eco-biological Dimensions in Resource use and Conservation (pp. 61-101). Springer, Cham.

Latorre, M.C., Olekseyuk, Z., Yonezawa, H. and Robinson, S., 2020. Brexit: Everyone loses, but Britain loses the most. Peterson Institute for International Economics Working Paper, (19-5).

LUPTÁKOVÁ, A., 2021. THE EUROPEAN UNION’S FOREIGN TRADE COOPERATION WITH EURASIAN ECONOMIC UNION: SELECTED INDICES. Ekonomické Rozhl’ady/Ecomomic Review, 50(2).

Schimmelfennig, F., 2021. Rebordering Europe: external boundaries and integration in the European Union. Journal of European Public Policy, 28(3), pp.311-330.

Wang, Q. and Han, X., 2021. Spillover effects of the United States economic slowdown induced by COVID-19 pandemic on energy, economy, and environment in other countries. Environmental Research, 196, p.110936.

Wu, W., Wang, H. and Wu, Y.J., 2021. Internal and external networks, and incubatees’ performance in dynamic environments: entrepreneurial learning’s mediating effect. The Journal of Technology Transfer, 46(6), pp.1707-1733.

Zhong, X., Ren, L. and Song, T., 2021. Different effects of internal and external tournament incentives on corporate financial misconduct: Evidence from China. Journal of Business Research, 134, pp.329-341.

Websites

Part A

Diageo.com, 2020, About Us, Available at: https://www.diageo.com/en/society-2030/doing-business-the-right-way/our-governance-and-reporting/management-and-governance/ [Accessed on: 10th February 2022]

Diageo.com, 2021, Diageo opens new innovation & research centre in Scotland, Available at: https://www.diageo.com/en/news-and-media/features/diageo-opens-new-innovation-research-centre-in-scotland/ [Accessed on: 10th February 2022]

Part B

Ec.europa.eu, 2020. EU-UK Trade and Cooperation Agreement. Available at: https://ec.europa.eu/commission/presscorner/detail/en/qanda_20_2532 [Accessed on 10th February 2022]

Eur-lex.europa.eu, 2021. TRADE AND COOPERATION AGREEMENT. Available at: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:22021A0430(01)&from=EN [Accessed on 10th February 2022]

Politico.eu. 2022. How Brexit and the pandemic changed UK trade in 4 charts. Available at: https://www.politico.eu/article/how-brexit-and-the-pandemic-changed-uk-trade/#:~:text=Trade%20with%20the%20EU%20dropped,imports%20decreasing%20by%2033%20percent. [Accessed on 10th February 2022]

Researchbriefings.files.parliament.uk, 2021. Statistics on UK-EU trade. Available at: https://researchbriefings.files.parliament.uk/documents/CBP-7851/CBP-7851.pdf [Accessed on 10th February 2022]

Statista.com, 2021. Largest export goods commodities of the United Kingdom (UK) traded with the European Union (EU) countries in 2020 (in million GBP), by trade value. Available at: https://www.statista.com/statistics/1118016/largest-exports-goods-commodities-of-united-kingdom-uk-and-the-eu/ [Accessed on 10th February 2022]

Know more about UniqueSubmission’s other writing services: