Accounting and Finance Assignment Sample

Part A

Introduction

Accounting and finance is the scientific management of business various information and decision-making processes. It deals with providing necessary data to both stakeholders as well as managers for the decision-making process. the following assignment is based on a multinational corporation named Coca Cola company which operates its activity in the whole world. It deals with the beverage industry which has the aim to become a leading organisation leading branded beverage solutions. this study sheds light on the context overview ratio and evaluation (CORE) analysis of the company which shows its financial position in the market as well as its performance in the world. Apart from this,

Core analysis

1 Context

1.1PESTLE

Political Factors

Coca-cola has lost a large number of losses during the pandemic situation and the government has not taken any initiative to save this industry. As cited by Kalashnikov and Lutsenko (2020), Brexit has affected almost every industry and available financial resources are necessary to have available financial support to make new strategies to recover this crisis. Political environment is not same in every country and political support through easy rules is important for the development of company.

Economic

Tax rules are different in countries where Coca-cola has faced a lot of complications to make effective strategies that will be universally applicable. As opined by Kalaitzi et al. (2021), a large number of employees are fired during this period because of continuous loss during pandemic situations. The UK has failed to manage its inflation rate in 2020 and it has increased to almost 5 % in 2021. Coca-cola has suffered to make products for their potential consumers and a big gap arises between demand and supply.

Social

Society is used to consuming a large number of junk foods of Coca-cola. Consumer has become conscious of their health because of health promotion campaigns.

Change in demand has affected Coca-Cola’s production activity.

Technology

Coca-cola has implemented efficient AI and robotic technologies to sustain their business activities for a long period. Robotic technologies are used because it consumes the least money to make a particular food. Implementation of AI technologies has improved the decision-making ability of companies and managed the sales price of products in a competitive market.

Environment

World has faced different types of crises for change in the environment. Countries have taken effective measures to control climate change. As opined by Fujii et al. (2018), reusable source and carbon emission plan has affected business operation of Coca-cola and influenced to implementation of new technology for

Legal

Necessary elements are collected from different regions for making junk foods in Coca-cola but diverse rules in different countries have affected company’s daily operation. Labour laws and competition are different in different countries and Coca-cola has made separate strategies for different countries.

1.1 Porter five theory

| Factors | Impact | Description |

| Suppliers | low | A large number of suppliers are available in the market so that there is no impact during pandemics. As opined by Anastasiu et al. (2020), Coca-cola has its regular suppliers who give quality products at a reasonable price that there is no impact on suppliers. |

| Customers | Medium | Consumers are influenced by the brand of Coca-cola but they have become health conscious that affected their business. |

| Substitutes | Medium | A lot of substitute foods are supplied against cold drinks. There is an impact of substitute goods in Coca-cola. |

| New entrants | High | Engagement of new entrants is high and it is hard to maintain brand value and sustain business activities for a long period. |

| Competition | High | Market competition is high in the junk food industry that Coca-cola has suffered to compete in a price rouse condition. Entrepreneurs have come with effective decisions that have increased market competition because consumers are influenced by attractive advertisements. |

Table 1: Porter’s Five Forces

(Source: Anastasiu et al. 2020)

1.3 Internal Environment

- Internal environment is another major factor on which whole business activity is dependent. Business sustainability can be ensured through proper internal control and mechanism (Radzi et al. 2017). As Coca-cola has mainly dealt with providing beverage items such as cold drinks Soda, energy drinks and soft drinks to its customers, it mainly focused on fulfilling customer expectations. In order to perform well, it is necessary for any business to implement an effective strategy to maintain better control in a business. On the analysis of coca-cola current strategy in business,

it has been found that recently it mainly focused on choice, convenience and customer. In order to get business sustainability, it is necessary for a business to attract as well as retain its customers as it is the key factor for business (cokeconsolidated.com, 2020). Thus, Coca-cola is mainly focused on producing such a product that is suitable for the customer’s choice. As The prime aim of this business is to be a leading business for the beverage industry in the world market it is necessary to have an effective strategy that primarily focuses on the customer and is customer-oriented.

- Comparison of coca-cola products with marks & spencer has also been conducted to find the actual variances. Marks and Spencer is one of the leading industries in the UK which deals with providing groceries and household products (Ayofe et al. 2018). On the analysis of two companies, it has been found that the price of coca-cola products is relatively higher than the Marks & Spencer. Thus in order to operate a business effectively in the whole market, Coca-cola needs to fix the price of its product according to the local market which increases its pricing strategy (Chu, 2020). Apart from this, focusing on a cost reduction program is another major factor that provides scope for the coca-cola company to provide great quality of product at a great price.

iii. On the other hand, various strategies to attract customers such as performing better CSR strategy and building good brand value in the market operate its activity by maintaining proper ethics considerations which increase it effectively in terms of managing its business activity throughout the whole world (Ahmed et al. 2019. ). Apart from this on the analysis of the current strategy of business it currently has the intention to launch a new product in favour of its AHA sparkling water mango +black tea (cokeconsolidated.com, 2020). This product has numerous features which attract customers and increase the performance of a business in terms of satisfying its customers in better ways. This product contains 30 milligrams of caffeine and is sugarless. Attractive features of this new product launch increase its brand value and performance in the market.

iv SWOT analysis

| Strength | Weakness |

| ● Having consistent liquidity maintaining of 1.33

● Higher gross margin of 35.29 in the year 2020 ● High brand value in the market

|

● Absence or less of health beverage item

● Weak policies and strategies regarding and water management\

|

| Opportunity | Threats |

| ● Increase in supply chain management

● Inclusion of new digital technology to provide better customer satisfaction ● Increase in employee engagement and stakeholder engagement

|

● The economic condition of the world market

● Technology development and advancement ● Continuous change in government policies and regulation |

Table 1: SWOT Analysis

(Source: Cokeconsolidated.com, 2020)

Based on the table it can be seen that the water management in the coca-cola company is one of the major issues which is faced by the company. An ineffective water management policy negatively impacts business performance. Thus in order to perform effectively in the world market, it needs to implant an effective strategy regarding water management strategies to boost its costs control (Mekimah and Sayad, 2020). Apart from this on the SWOT analysis, it has been found that it has an opportunity to strengthen its supply chain management which increases its overall performance in the market.

2 Overview

2.1 Income statements

The income statement of a business provides detailed information about company income and expenditure for a certain period. As stated by Decker, and Kizirian, (2017), the income statement is an indicator of a business ability to generate profitability. On the basis of income statement business, the total amount of income and its expenditure can be analysed.

Revenue

On the analysis of income statements of Coca-cola for four consecutive years, it has been found that in the year 2017 its total amount of revenue stood at 4288 million Dollars which increased to 4625 million dollars in the year. There is an increment in the 7.86% in tidal between two years sales of the company. As stated by an increase in Teplická and Szalay, (2021), increase in total revenue positively impacts the profitability of the business. . On the other hand, in the comparison of 2019 sales to 2020 it has been found that in the year 2019 there is total revenue at 4827 million pounds and in the year 2020 there are total sales of 5007 million dollars (wsj.com 2020). There is also an increase of 3.69% though this business has been affected by the pandemic caused by covid-19 at the end of 2020. Thus it can be seen that it increased its sales as compared to 2017 which shows its ability to increase its total income.

Profitability

On the other hand, income shows various profitability of business such as gross profit, operating profit and net profit. Based on income statement business various profitability can be measured (Tsui et al. 2017).In the analysis of total profitability, it has been found that in the year 2017 total gross margin of this company stood at 1502 million doppler and there is an increase in its gross margin by 4.62% in the next financial year (wsj.com 2020). Apart from this net profit in the year 2017 stood at 97 million dollars and the next year it faced a loss of 20 million dollars in the year 2018. On the other hand, operating profit change in between two years showed a decrease by 30.47 which affected the financial position of a business. However, in 2020 there is an increase in operating profit as well as in net profit and stood at 311 million and 172 million respectively. Thus, on the basis of the income statement, it has been found that in the year 2018 the company faces a loss in operating and net profit but it increased its profitability and revenue in the past two years which benefits the company.

2.2 Balance sheet

A balance sheet of any business is a snapshot of its financial position which shows its total value of assets and liability on a particular date. As stated by Felber et al. (2019), it is an important tool which various investors and stakeholders use for making various decisions regarding investments. Apart from this, it is also an important tool that management uses for making various decision-making processes. In the analysis of the balance of the business, it has been found that total current assets in the year 2017 stood at 795 million dollars and in the year 2018, there is an increase in tidal current assets by 2 million USD (wsj.com 2020). Increase in current financial benefit for the business as it increases the liquidity capacity of any business. On the other hand, in comparison to 2017 and 2018 total equity there can be seen that total equity of business reduces by 4 million dollars. In this situation, it can be seen that in 2018 business reduces total equity to reduce owned capital of the fund. Apart from this, in the years 2019 and 2020 it has been found that current assets in the year 2019 stood at 830 million dollars and 851 million in the year 2021 which saw a total increase in current assets of 21 million which financial benefits business. On the other hand, the percentage increase in total current assets in 2020 stood at 2.51% (Cokeconsolidated.com, 2020).

On the analysis of the Coca balance sheet of four consecutive years, it has been found that there is also an increase in total non-current liability. Non-current liability of business reflects those assets which are used by a business for productivity purposes (Hertati et al. 2020). On the other hand, proper utilisation of these assets is quite necessary for business as it increases business productivity as well as the quality of a product. Thus, proper multistation of its assets may reduce the costs of products and ensure customer satisfaction. Total non-current liability in the year 2017 stood at 2276 million dollars which increased in the year 2018 to 2494 million dollars. In this scenario, it has been that there is a total non-current asset by 0.25%. An increase in total non-current in two years increases the business opportunity to produce at a large scale. On the other hand in the year 2019 total non-current assets in the coca-cola company stood at 2590 million dollars which will increase in the next financial year to 2836 million years. An increase in the percentage of total non-current assets in the year stood at 9.49% which was financially beneficial for the business.

Current liability of the business is another major aspect of business that has a direct impact on the liquidity performance of the business (Brown, 2018. ). On the analysis of current liability, it has been found that total current liability in the year 2017 stood at 639 million dollars and in the year 2018, it reduces to 602 million dollars. Reduction in total current liability increases business working capital management. Apart from this, in the year 2019 total, the current liability of business stood at 622 million and in the year 2020, it increased to 647 million dollars. In the year 2020 total current liability increased by 4.19% (Cokeconsolidated.com, 2020) Which reduces business liquidity capacity

3. Ratio evaluation

|

Ratio Analysis |

|||||

| 2020 | 2019 | 2018 | 2017 | ||

| 1 | Gross margin | 35.29 | 32.33 | 31.79 | 29.28 |

| 2 | Operating margin | 9.4 | 7.89 | 8.67 | 5.29 |

| 3 | ROCE | 5.03 | |||

| 4 | Current ratios | 1.32 | 1.33 | 1.33 | 1.24 |

| 5 | Quick ratio | 0.97 | 0.97 | 0.98 | 0.96 |

| 6 | Receivable Turnover | 10.29 | 9.11 | 9.07 | 8.1 |

| 7 | Payable turnover | 47.164969 | 47.0333541 | 47.5091892 | 54.3924907 |

| 8 | EPS | 18.29 | 1.2 | -2.13 | 10.3 |

| 9 | Gearing | 14.73 | 10.28 | 11.14 | 11.2 |

| 10 | Interest cover | 7.55102041 | 13.1054131 | 19.6153846 | 15.498155 |

Table 3: Ratio Analysis

(Source: wsj.com 2020)

4. Evaluation

- On analysis of the ratio of Coca-cola Company it has been found that gross margin it has been found that total gross profit in the year 2017 stood at 29.28 which increases in each year. In 2020 it gross profit stood at 35.29 % which shows that the company increased its ability to generate profitability in each year. Apart from this, it also increases business efficiency in terms of satisfying its customers as it increases gross profit incurred due to an increase in sales. On the other hand, the operating margin of this company also increases each year. In the year 2017 total operating margin stood at 5.29 and in 2018 it increased to 8.67. Based on this figure it can be shown that business operating expenses are being reduced in the year 2018 which cause an increase in operating profit. In the year 2020, its total operating profit margin stood at 9.4 which is significantly good for the business in terms of financially as it increases stakeholder trust towards business. On the current ratio of business, it has been found that its total current ratio stood in the year 2017 at 1.24 and in the two consecutive years 2018 and 2019 stopped at 1.33. Through this, it can be said that this company will be able to maintain its liquidity capacity to meet short term liability (Sentana et al. 2017). Earning power share of this company in the year 2020 is much higher than the previous year which reflects that this company’s market value per share in the year 2020 will increase which strengthens its financial position in the market.

- In the analysis of the Ratio of the Coca Cola company it is noted that gross profitability in the year 2020 increased by approx 3% as compared to the previous year. On the other hand, the gearing ratio of 2020 increased by 4.45% as compared to its previous year 2019 (wsj.com 2020) ). On the other hand, the interest coverage ratio is 2020 decreases by 5.665 which is a financial benefit for businesses. Reduction in interest coverage ratio is not suitable for business as it increases the high amount of risk of falling to meet debt liability (Curfman and Kandrac, 2018).

iii. Increasing the gross profit margin of a business increases its ability to generate a profit margin of the business. Apart from this, on the analysis of payable turnover ratio, it can be seen that the company is maintaining a constant rate of 47 days in three consecutive years since 2018 which reflects its ability to meet its short term liability (Benitez et al. 2018). Apart from this, on the analysis of debtors turnover ratio, it can be seen that receivable turnover ratio in the number of days has been increased which reflect that it increases the time taken by the debtor to pay debt amount. In this situation, a company needs to reduce the debtor turnover ratio to perform well in the market.

Part B

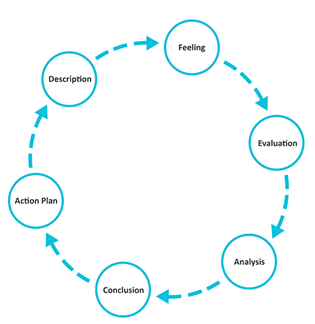

In this section of the assignment, the whole method and process through which the whole study has been conducted are being analysed. Various Feeling and methods and action plan which is being analysed in this study. Various Constraints in which have been faced during this assignment are being analysed.

Self-reflection

- As this research is based on the evaluation of the financial position of a company named Coca-cola I can easily obtain various required information for the purposes of analysis of various financial data of business. In order to assess the financial position of a business, it is necessary to have proper information such as an annual report and financial statement. These books of account provide necessary information about business profitability and business aim (Markonah et al. 2020). In this study, I may not be able to cover some other financial aspects such as the stakeholder aspect.

ii.when I come to know that my first attempt failed I feel sad as I spent a lot of time on this assignment and covering various aspects of a business. Apart from this, I am also worried about next time as I have to speed up the month for the preparation of this assignment.

iii. the major goal of every student is to ensure that post the submission of their paper helps them achieve the required pass marks in the end. However, in my case, I was unable to achieve the same. The major reason that I have listed for being unable to pass was not having a good understanding of the subject matter that left me behind which began because of me missing a lot of classes in the initial days. It was because of these factors, I believe that I found it increasingly difficult to present a correct view of the topic and committed several mistakes. The major learning that I derived from this case is to make the effort of not missing my classes anymore. I also need to immediately contact my professors whenever I am facing issues with a topic instead of trying to solve it on my own. The help of my professor would have helped in alleviating my problems and making it easier for me to study.

Figure 1: Gibbs Model

(Source: Adani et al. 2020)

- One of the major reasons that I missed a lot of my initial classes was because I was working late at night at my part-time job which caused me to get up late in the morning. The scholarship that I am provided to study is not enough to sustain my daily needs which have caused me to tackle up a job as a Barista in the nearby coffee shop. However, since it is a 24-hour coffee shop, therefore it causes me to work quite late in the night which causes me to miss my morning classes. However, the moment I realised that this was impacting my studies I immediately changed my work hours. Secondly, because of my initial missed classes, I was very sceptical of approaching the professor for the fear of getting reprimanded. Hence, the issues that I had with the subject, I tried to solve on my own actually yielded no positive results as can be seen from me failing the paper. Hence, these are the reasons why it made me do badly on my assignment.

- on the analysis of the whole study I can be able to know that in order to assess the financial position of business CORE analysis of significance which covers all aspects of a business. Apart from this, I know that in order to increase the financial position of a business portability needs to be increased (Huang et al. 2019). I also came to know that it is necessary for a business to analyse both stakeholder and customer approaches to perform well in the market.

Conclusion

On the analysis of the whole aspect of coca-cola company, it can be concluded that coca colas over four years increase its total revenue which increase its profitability. Apart from this, an increase in the gross margin of the business is found through which it can be concluded that it can be baked to generate more profit throughout its total news. On the basis of ratio analysis, it can be said that maintaining liquidity capacity and turnover growth as well as earning per share at standard level increase business effectively in terms of providing better services. Apart from this, on the analysis of the financial statement of a business, it can be seen that the company is increasing its overall financial and nonfinancial aspects in a better way.

References

Journals

Adeani, I.S., Febriani, R.B. and Syafryadin, S., 2020. USING GIBBS’REFLECTIVE CYCLE IN MAKING REFLECTIONS OF LITERARY ANALYSIS. Indonesian EFL Journal, 6(2), pp.139-148. Available at: http://journal.uniku.ac.id/index.php/IEFLJ/article/download/3382/2034

Ahmed, E., Khan, A.W. and Minhas, S., 2019. Role of Organizational Public Relations in Image Building of Publics: A Case Study of Coca Cola Pakistan. Global Regional Review, IV, pp.95-104. Available at: https://www.researchgate.net/profile/Shahid-Minhas-2/publication/345792310_Role_of_Organizational_Public_Relations_in_Image_Building_of_Publics_A_Case_Study_of_Coca_Cola_Pakistan/links/5fae0d7192851cf7dd195eb3/Role-of-Organizational-Public-Relations-in-Image-Building-of-Publics-A-Case-Study-of-Coca-Cola-Pakistan.pdf

Ayofe, N.A., Oladoye, P.O. and Jegede, D.O., 2018. Extraction and quantification of phthalates in plastic coca-cola soft drinks using high performance liquid chromatography (HPLC). Chem. Int, 4(2), p.85. . Available at: https://publication.babcock.edu.ng/asset/docs/publications/BASC/9576/2459.pdf

Benitez, J., Chen, Y., Teo, T.S. and Ajamieh, A., 2018. Evolution of the impact of e-business technology on operational competence and firm profitability: A panel data investigation. Information & Management, 55(1), pp.120-130. Available at: https://www.researchgate.net/profile/Thompson-Teo/publication/319038784_Evolution_of_the_impact_of_e-business_technology_on_operational_competence_and_firm_profitability_A_panel_data_investigation/links/5fade74292851cf7dd1956e9/Evolution-of-the-impact-of-e-business-technology-on-operational-competence-and-firm-profitability-A-panel-data-investigation.pdf

Brown, D., 2018. Business models for residential retrofit in the UK: a critical assessment of five key archetypes. Energy Efficiency, 11(6), pp.1497-1517. Available at: https://link.springer.com/article/10.1007/s12053-018-9629-5

Chu, B., 2020, November. Analysis on the Success of Coca-Cola Marketing Strategy. In 2020 2nd International Conference on Economic Management and Cultural Industry (ICEMCI2020) (pp. 96-100). Atlantis Press.. Available at: https://www.atlantis-press.com/article/125947132.pdf

Curfman, C.J. and Kandrac, J., 2018. The costs and benefits of liquidity regulations: Lessons from an idle monetary policy tool. Available at SSRN 3273580. Available at: https://www.federalreserve.gov/econres/feds/files/2019041pap.pdf

Decker, J. and Kizirian, T., 2017. Potential Indicators Of Balance Sheet And Income Statement Fraud. Journal of Business Case Studies (JBCS), 13(4), pp.109-114. Available at: https://www.clutejournals.com/index.php/JBCS/article/download/10032/10137

Felber, C., Campos, V. and Sanchis, J.R., 2019. The common good balance sheet, an adequate tool to capture non-financials?. Sustainability, 11(14), p.3791. Available at: https://www.mdpi.com/2071-1050/11/14/3791/pdf

Hertati, L., Widiyanti, M., Desfitrina, D., Syafarudin, A. and Safkaur, O., 2020. The effects of economic crisis on business finance. International Journal of Economics and Financial Issues, 10(3), p.236. Available at: https://pdfs.semanticscholar.org/867e/27fefca8c6f8374d9799a9c6cf06cd68a8d1.pdf

Huang, J., Jain, B.A. and Kini, O., 2019. Industry tournament incentives and the product-market benefits of corporate liquidity. Journal of Financial and Quantitative Analysis, 54(2), pp.829-876. Available at: https://www.researchgate.net/profile/Jian-Huang-104/publication/321485564_Industry_Tournament_Incentives_and_the_Product_Market_Benefits_of_Corporate_Liquidity/links/5a24c60f4585155dd41eb5d3/Industry-Tournament-Incentives-and-the-Product-Market-Benefits-of-Corporate-Liquidity.pdf

Markonah, M., Salim, A. and Franciska, J., 2020. Effect of profitability, leverage, and liquidity to the firm value. Dinasti International Journal of Economics, Finance & Accounting, 1(1), pp.83-94. Available at: https://dinastipub.org/DIJEFA/article/download/225/164

Mekimah, S. and Sayad, N., 2020. The Impact of Food Safety Management System ISO 22000 on Customer Satisfaction and Loyalty, Case Study of Coca-Cola Company in Algeria. Economics and Business, 34(1), pp.246-260. Available at: https://www.researchgate.net/profile/Sabri-Mekimah/publication/346896185_The_Impact_of_Food_Safety_Management_System_ISO_22000_on_Customer_Satisfaction_and_Loyalty_Case_Study_of_Coca-Cola_Company_in_Algeria/links/5fd1d725299bf188d406fe59/The-Impact-of-Food-Safety-Management-System-ISO-22000-on-Customer-Satisfaction-and-Loyalty-Case-Study-of-Coca-Cola-Company-in-Algeria.pdf

Radzi, K.M., Nor, M.N.M. and Ali, S.M., 2017. The impact of internal factors on small business success: A case of small enterprises under the FELDA scheme. Asian Academy of Management Journal, 22(1), p.27. Available at: https://pdfs.semanticscholar.org/b10f/ee7b37c0e3f04a8319da1e200ca2a2d53c76.pdf

Sentana, E., González, R., Gascó, J. and LLopis, J., 2017. The social profitability of business incubators: a measurement proposal. Entrepreneurship & Regional Development, 29(1-2), pp.116-136. Available at: https://journals.sagepub.com/doi/pdf/10.1177/23409444211054510

Teplická, K. and Szalay, Z., 2021. SIGNIFICANCE OF LOGISTIC CONTROLLING AS A BASE FOR FILLING GOALS OF BUSINESS STRATEGY. Acta Logistica, 8(3), pp.209-216. Available at: http://actalogistica.eu/issues/2021/III_2021_02_Teplicka_Szalay.pdf

Tsui, W.H.K., Balli, F., Tan, D.T.W., Lau, O. and Hasan, M., 2018. New Zealand business tourism: exploring the impact of economic policy uncertainties. Tourism Economics, 24(4), pp.386-417. Available at: https://www.researchgate.net/profile/Faruk-Balli/publication/320040637_New_Zealand_business_tourism_Exploring_the_impact_of_economic_policy_uncertainties/links/5b5a32c60f7e9bc79a668b8e/New-Zealand-business-tourism-Exploring-the-impact-of-economic-policy-uncertainties.pdf

Kalashnikov, S. and Lutsenko, R., 2020. Investment analysis of Coca Cola Hellenic Bottling Company. Вісник Харківського національного університету імені ВН Каразіна серія «Економічна», (98), pp.145-157.Available at: https://periodicals.karazin.ua/economy/article/view/16101

Kalaitzi, D., Matopoulos, A., Fornasiero, R., Sardesai, S., Barros, A.C., Balech, S. and Muerza, V., 2021. Megatrends and trends shaping supply chain innovation. In Next generation supply chains (pp. 3-34). Springer, Cham.Available at: https://library.oapen.org/bitstream/handle/20.500.12657/46112/2021_Book_NextGenerationSupplyChains.pdf?sequence=1#page=18

Fujii, Y., Ding, Y., Umezawa, T., Akimoto, T., Xu, J., Uchida, T. and Fujino, T., 2018. Detection and Quantification of 4-Methylimidazole in Cola by Matrix-assisted Laser Desorption Ionization Mass Spectrometry with Fe2O3 Nanoparticles on Zeolite. Analytical Sciences, 34(2), pp.221-225.Available at: https://www.jstage.jst.go.jp/article/analsci/34/2/34_221/_article/-char/ja/

Anastasiu, L., Gavriş, O. and Maier, D., 2020. Is human capital ready for change? A strategic approach adapting Porter’s five forces to human resources. Sustainability, 12(6), p.2300.Available at: https://www.mdpi.com/665670

Websites

cokeconsolidated.com 2020 financial information Available at: https://investor.cokeconsolidated.com/static-files/4df74450-9c10-4e3f-b0fb-86b914457e1c[accessed on 27 November 2021]

wsj.com 2020, financial information Available at: https://www.wsj.com/market-data/quotes/COKE/financials/annual/balance-sheet [accessed on 27 November 2021]

Appendixes

Appendix 1

Income statement

| Revenue | 4288 | 4625 | 7.86% | 4827 | 5007 | 3.69% |

| Cost of sales | 2786 | 3059 | 10.15793252 | 3167 | 3240 | 2.305020524 |

| Gross profit | 1502 | 1566 | 4.260985353 | 1659 | 1767 | 6.50994575 |

| Operating Profit | 105 | 73 | -30.4761905 | 171 | 311 | 10.26512576 |

| Finance Cost | 42 | 51 | 19.04761905 | 46 | 37 | -19.56521739 |

| Net profit/profit for year | 97 | -20 | 79.3814433 | 11 | 172 | 9.090909091 |

(Source: wsj.com 2020)

Appendix 2

Balance sheet

| Current Assets | 795 | 797 | 0.25% | 830 | 851 | 2.53% |

| Non Current Assets | 2276 | 2494 | 1.25 | 2590 | 2836 | 9.498069498 |

| Current liabilities | 639 | 602 | 6.146179402 | 622 | 647 | 4.019292605 |

| Non-current Liabilities | 1829 | 2250 | 6.61563696 | 2315 | 2450 | 4.967602592 |

| Total equity | 459 | 455 | -0.87145969 | 451 | 513 | 13.74722838 |

(Source: wsj.com 2020)

Appendix 3

Ratio analysis

| Gross Margin | Gross profit x 100 | 1767 | 1659 | 1566 | 1502 |

| Revenue | 5007 | 4827 | 4625 | 4288 | |

| 35.2905932 | 34.3691734 | 33.8594595 | 35.0279851 | ||

| Current ratio | Current asset/ current liabilities | 851/647 | 830/622 | 797/602 | 795/639 |

| 1.32 | 1.33 | 7:55 | 1.24 |

(Source: wsj.com 2020)

………………………………………………………………………………………………………………………..

Know more about UniqueSubmission’s other writing services:

Your article helped me a lot, is there any more related content? Thanks! https://www.binance.com/ka-GE/register?ref=IJFGOAID