BMG704 International Finance Sample

Introduction

International finance analyses monetary and macroeconomic aspects of an organisation. It also helps in analysing performance of company in international market. The study sheds light on financial performance of British American Tobacco (BAT) which is multinational company. BAT was established in 1902 and is headquartered in London, UK. It manufactures and sells, tobacco, other nicotine products, and cigarettes. British Tobacco is listed in LSE as BATS. As of 2019, BATS is largest company that sells tobacco based on net sales. The company has profit of £5849m in 2019 and £6564m in 2020. The study sheds light on two recent developments in international financial environment that have impacted performance of BATS. Analysis of source of finance, dividend policy and financial ratios of BATS have been also included in this study.

a. Two recent developments in the international financial environment

International financial environment signifies financial environment around the world or global economy. Governments, corporations, communities and investors around world are part of international financial environment (Alexander and Britton, 2017). Recent developments for BAT are discussed as under:

Brexit Fuels BAT’s Bid for Reynolds American

Brief description of development

Brexit was withdrawal of UK from EU. The country voted to leave EU in 2016 who was its nearest and biggest trading partner. However, both EU and UK agreed to maintain many things same until 31st December 2021 (Bbc, 2021). Due to Brexit, real per capita income of UK has been significantly reduced. In case of businesses, leaving EU lead to incur additional tariffs, administrative changes along with supply chain interruption. However, Brexit deal leads to more opportunities for business. Brexit has facilitated deeper talent pool and includes fewer onerous regulations.

Effect of development on the financial performance

Brexit deal of UK has positive impact on BAT. Brexit vote has made it easier for BAT to finance proposed deal. BAT has offered $47bn for taking full control over Reynolds American Inc. This investment was profitable for BAT as it would make it largest listed tobacco company in world as per market share and revenue (Bat, 2021). At time, BAT had 42.2% shares of Reynolds and company wanted to acquire another 57.8% shares to become large tobacco company. BAT has been shareholder in RJ Reynolds since 2004 and benefited from growth of US market. As per chief executive of BAT, merger between these two companies would be logical progression in global tobacco market. Thus, company offered $20bn cash and shares worth $27bn to Reynolds. Brexit can be assessed as recent development in international business environment that has fuelled proposed investment of BAT (Wsj, 2021). Brexit acted as key factor behind BAT’s decision to take remaining shares of Reynolds. Despite fact that occurrence of Brexit has led to declining trading and slowed down general deal making of UK, tie-up between two major tobacco selling companies took place. Merger between Reynolds and BAT took place as 42% Reynold’s stake was taken by BAT. Fall in pounds and cheap debt has made decision of BAT easier even when share prices of Reynolds were rising. Thus, Reynolds’s acquisition by BAT took place after Brexit.

BAT boosts revenue outlook for 2020

Brief description of development

Covid-19 pandemic has an adverse impact on individuals and economy. It is responsible for 3m excess deaths in 2020 and infected more than 82m people (Who.int, 2021). Business face ample issues to continue operations in pandemic, pay off dues and earn profit. Under this downward scenario, economies all over world have faced shrinkage by almost 8% (Worldbank.org, 2021). UK faced long-term GDP losses and market instability due to pandemic situation.

Effect of development on the financial performance

In pandemic situation of 2020, demand for goods and services were drastically impacted. Many companies faced financial losses and tended to temporarily shut down operations. The lucky strike market company BAT raised revenue outlook of 2020 to upper end of its previous estimation due to smaller than expected hit to cigarette demand. As per forecast, sales impact from health crisis would be 2.5% which is lower than 3% expected previously. As BAT is market leader in global tobacco industry, it was expected that pandemic situation would decrease demand for tobacco products. Moreover, it was estimated that individuals would speed less on tobacco products as it is injurious to health and avoiding these products might be helpful for living well during Covid-19 situation. However, it has been found that Covid-19 pandemic have provided more time for smoking and spending on these goods. With cigarette brands like Rothmans and Dunhill, company is able to adjust revenue growth on constant currency basis. As per WTO, smoking would make it difficult to recover from Coronavirus and smokers catching this virus are more likely. Thus, discontinuing smoking would be helpful for preventing severe illness and Covid-19 virus (Reuters, 2021). However, BAT focused on its “new category” business including tobacco heating product glo and vapour brand vype. As per forecast, it would help BAT in increasing revenue to $6.70bn by 2025. Thus, company increased its revenue forecast from 1% to 3% in pandemic situation of 2020.

b. Dividend policy and source of finance

Dividend policy and source of finance are crucial aspects of business. Maintaining strong dividend policy and source of finance facilitates strong market position of business. Through analysis of dividend policy and source of finance has been made as under:

Dividend policy

Dividend policy is used by ventures for paying cash dividends to investors. Structuring dividend pay-out becomes easier by help of dividend policy (Jacque, 2014). A company can use dividend policy if it wants to increase its dividend at later stage. As argued by Lucky and Onyinyechi (2019), dividend payment is irrelevant as shareholders can sell shares if they need funds.

Dividend theories

Dividend theories play crucial role in setting dividend pay-out and structuring dividend payment. As per Gordon’s model of dividend, an organisation’s dividend payment and rate of return are interrelated (Singh and Tandon, 2019). Besides, this dividend theory helps in setting stock prices by using unbounded series of per share dividends. Walter’s dividend model projects relation in cost of capital, dividend payment and hurdle rate (Ningsih and Soesetio, 2018). This model does not use debt or equity financing. Modigliani & Miller’s Hypothesis shows pattern of dividend does not affect share value (Charness and Neugebauer, 2018). Besides, future earrings of venture can be developed by cutting dividends.

Dividend of British Tobacco

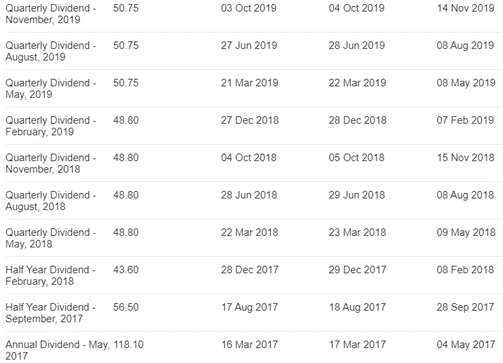

Dividend history of BAT

(Source: Bat, 2021)

BAT has paid constant dividend in last three years. It pays dividend quarterly or 4 times year (Bat, 2021). BAT has paid 53.9p dividend per share in 2019 and 2020. The company has satisfactory dividend history as its financial position is strong. BAT has dividend yield 8.2%annual dividend payment $2.95, 3 year median pay-out ratio 75% and dividend growth rate in last 3 years is 5.49% (Aasdaq, 2021). As per dividend data of BAT it has been found that the company uses residual dividend policy which means dividend is paid from leftover profits. BAT pays dividend from remaining profits after paying off capital expenses and working capital costs. However, BAT’s earnings were in under pressure as BAT is responsible for exploitation of Malawian farming families and child labour for driving profits (Theguardian, 2021).

Risk management strategy

Current pandemic situation has hampered ability of BAT to pay dividends. Expected dividend payment in 2021 is $0.741 per share. The company has not admitted allegations of Malawian farming families and said that BAT maintains long lasting commitment to human rights. Besides, company maintains strong corporate governance, honesty and transparency in business (Bat, 2021).Currently, company is working on preventing unethical behaviour from business model in supply chain (Bat, 2021).

Source of finance

Sources of finance are crucial aspects for financing long-term and short-term business operations. As per Bekaert & Hodrick (2014), debt and equity capital are considered as strong sources of finance. Selection of finance sources have significant impact of capital structure of business.

Capital structure theories

Using capital structure theories provides systematic measure for financing business decisions. As per net income approach, worth of firm is influenced by value of debt in capital structure (Budagaga, 2017). As debt and equity are crucial elements in capital structure, summarising these elements helps in understanding worth of business. Besides, net operating income approach, presence of debt does not affect capital structure of business (Almabekova et al., 2018). By understanding financial leverage, company can assess risk factors in business.

Source of finance of British Tobacco

In BAT, equity financing and debt financing are used as sources of finance. The company has £59575m debt financing in 2020, £58022m debt financing in 2019 and £64,325m debt financing in 2018. Besides, shareholders’ equity were £65,688m in 2018, £64160m in 2019 and £62955m in 2020 (Bat, 2021). The total current liabilities of company was £16,329m in 2018, £18823m in 2019 and £15478m in 2020. Thus, company has higher proportion of debt capital in capital structure as compared to equity capital.

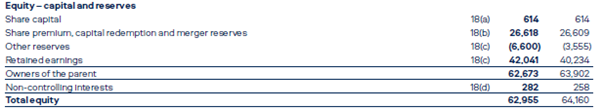

Equity financing of BAT

(Source: Bat, 2021)

Breakdown of equity financing shows share capital, share premium, retained earnings and other reserves. The company has slight improvement in share capital and retained earnings in 2020 as compared to 2019.

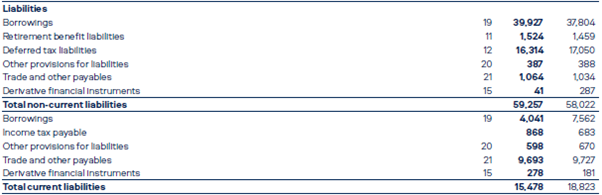

Debt financing of BAT

(Source: Bat, 2021)

Breakdown of debt financing shows borrowings, deferred tax liabilities, trade payables and derivative financing instruments. Both long-term and short-term liabilities of BAT increased in 2020 as compared to 2019.

Risk management strategy

While operating in pandemic situation of 2020, external financing has been raised in BAT. An increased operating cash flow of £9786m have been found in 2020 and cash balance of £3139m that has helped in maintaining strong liquidity position (Bat, 2021). The company was able to pay off debts and dividends in 2020. However, dealing in pandemic situation of 2020 created excess spending and harmed financial position. Thus, company required additional sources of funding.

c. Ratio analysis

Profitability ratios

Return on equity (Net income/Shareholders fund)

| Return on Equity | ||

| Entity: British Tobacco | ||

| Items | Sum(£m) [31.12.20] | Sum(£m) [31.12.19] |

| Net profit | 6564 | 5,849 |

| [/] Equity | 62,955 | 64,160 |

| Return on Equity | 10% | 9% |

Return on equity is profitability ratio that analyses how much profit is obtained by use of equity. According to Lubis and Alfiyah (2021), earning higher profit helps in maintaining strong financial position. BAT has return on equity of 9% in 2019 and 10% in 2020. In 2020, equity figure of company was reduced by £1,205m but profit improved by £715m. So, even if equity has reduced, the company has made sound utilisation of it.

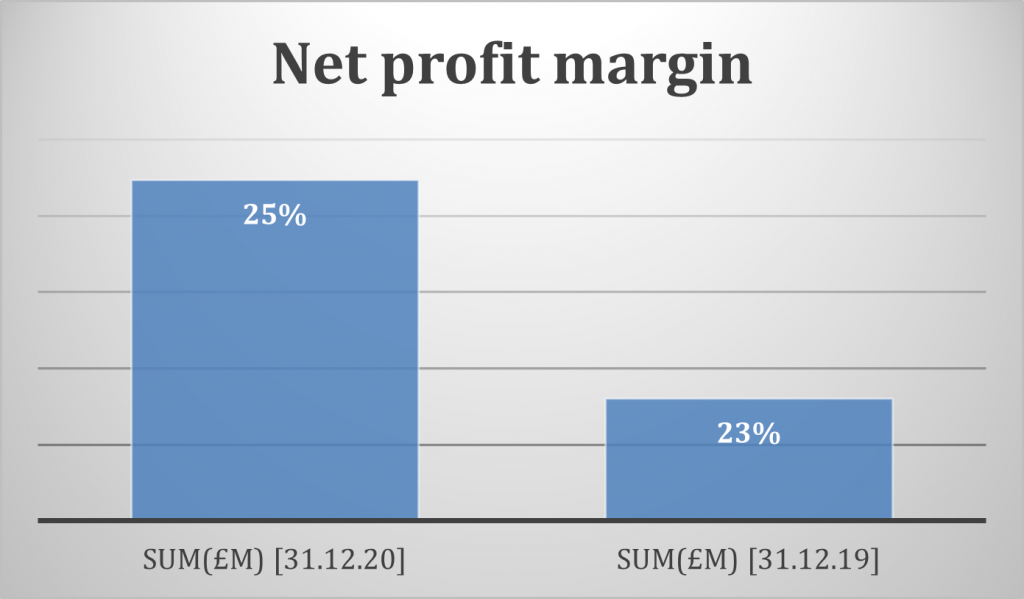

Net profit margin (Net profit/Sales revenue)

| Net profit margin | ||

| Entity: British Tobacco | ||

| Items | Sum(£m) [31.12.20] | Sum(£m) [31.12.19] |

| Net Profit | 6564 | 5,849 |

| [/] Total Sales | 25,776 | 25,877 |

| Net profit margin | 25% | 23% |

Net profit margin compares net profit with net sales (Atrill and Mc Laney 2017). As per this ratio, BAT has 23% profitability in 2019 and 25% profitability in 2020. So, 2% improvement in profit has taken place. In 2020, sales of BAT reduced to £25776m from £25877m but profit improved by £715m.

Efficiency ratio

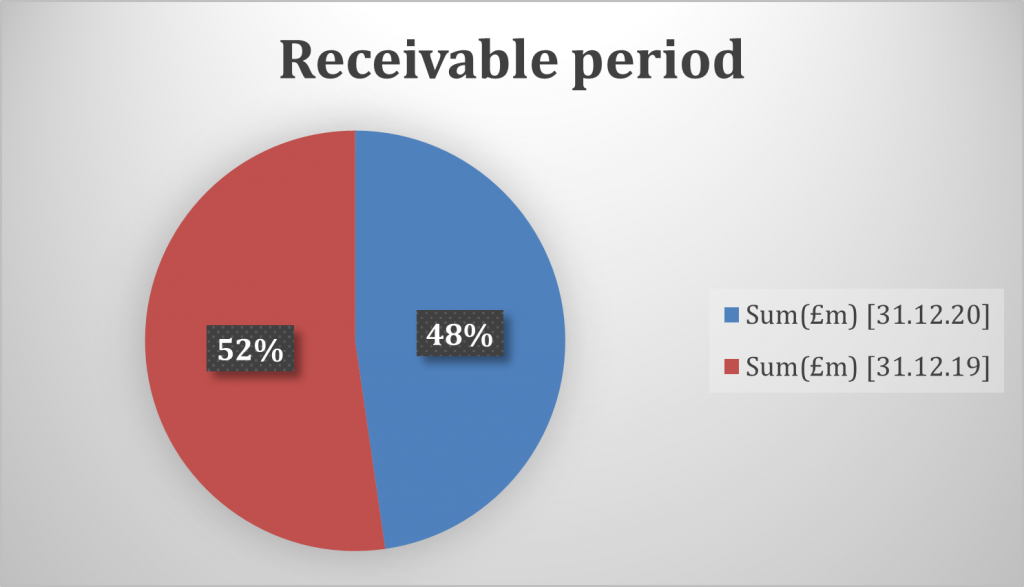

Receivable period (Trade receivables*365 days/Sales revenue)

| Receivable period | ||

| Entity: British Tobacco | ||

| Items | Sum(£m) [31.12.20] | Sum(£m) [31.12.19] |

| Receivables | 3,721 | 4,093 |

| [*] Operating-Days (365) | 1358165 | 1493945 |

| [/] Revenue | 25,776 | 25,877 |

| Receivable period | 53 | 58 |

Receivable period is efficiency ratio that indicates how well company is managing its credit sales. If company collects dues in less time, it has sound efficiency (Jikia and Kharabadze, 2018). BAT has taken 58days to collect dues in 2019. However, receivable days in 2020 is 53days which indicates improvement in performance.

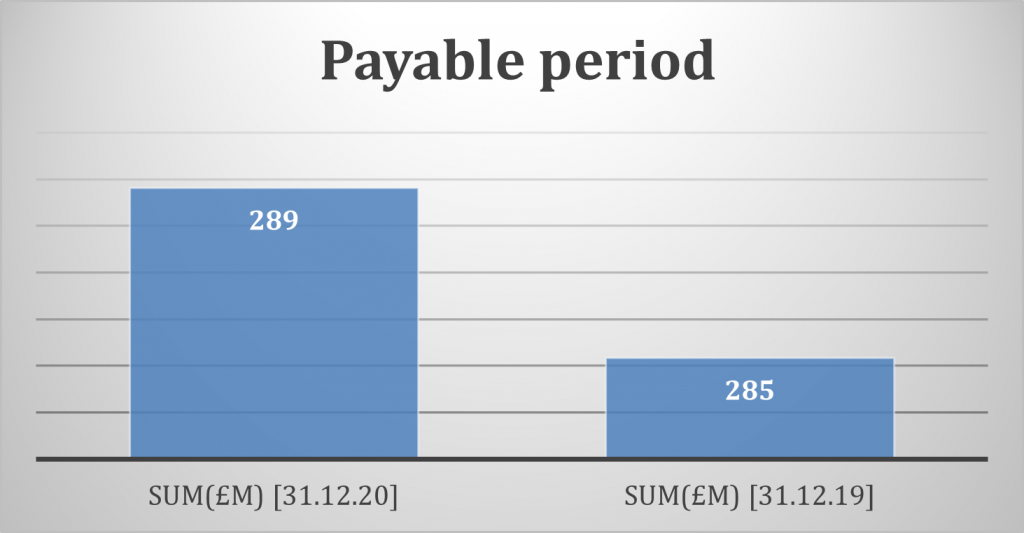

Payable period (Trade payables*365 days/Cost of sales)

| Payable period | ||

| Entity: British Tobacco | ||

| Items | Sum(£m) [31.12.20] | Sum(£m) [31.12.19] |

| Payables | 9,693 | 9,727 |

| [*] Operating-Days (365) | 3537945 | 3550355 |

| [/] Cost of Sales/goods sold | 12,250 | 12,450 |

| Payable period | 289 | 285 |

Payable period is efficiency ratio that indicates how well company is managing its credit purchases. If company pays dues in less time, it has sound efficiency (Nguyen and Van Nguyen, 2018). BAT has taken 285days to pay dues in 2019. However, payable days in 2020 is 289days which indicates slight reduction in performance.

Liquidity ratios

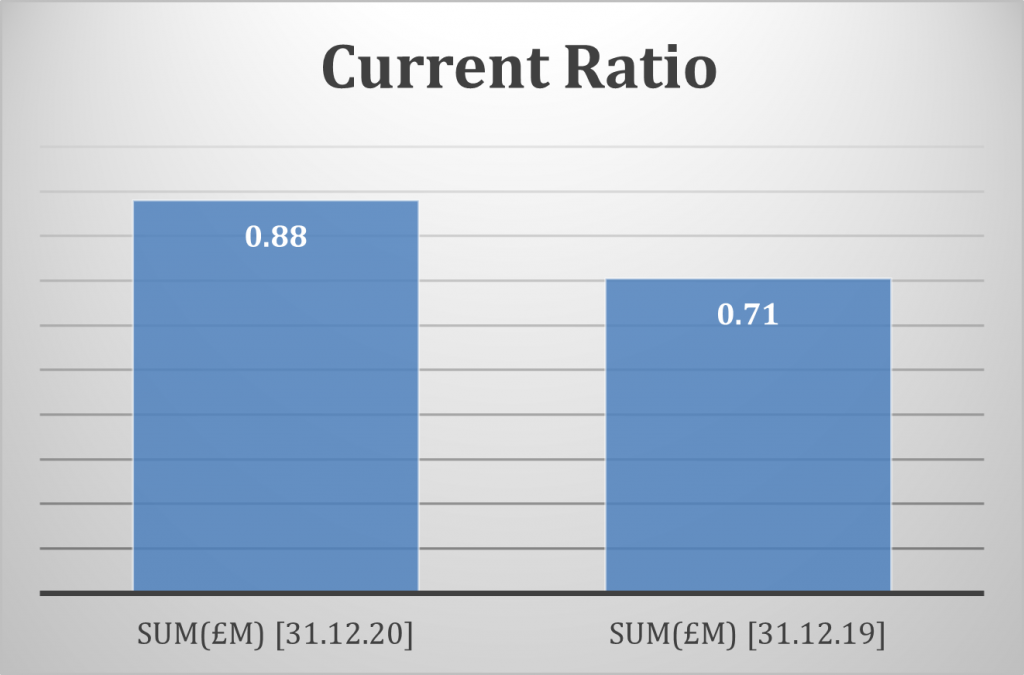

Current ratio (Current assets/Current liability)

| Current Ratio | ||

| Entity: British Tobacco | ||

| Items | Sum(£m) [31.12.20] | Sum(£m) [31.12.19] |

| Current assets | 13,612 | 13,274 |

| [/] Current liabilities | 15,478 | 18,823 |

| Current Ratio | 0.88 | 0.71 |

Current ratio is liquidity ratio that compares current assets with current liabilities (Amanda, 2019). BAT has 0.71times liquidity in 2019 and 0.88times liquidity in 2020. So, slight improvements in liquidity position took place in 2020. Besides, current assets are in increasing trend and current liabilities are in decreasing trend in 2020.

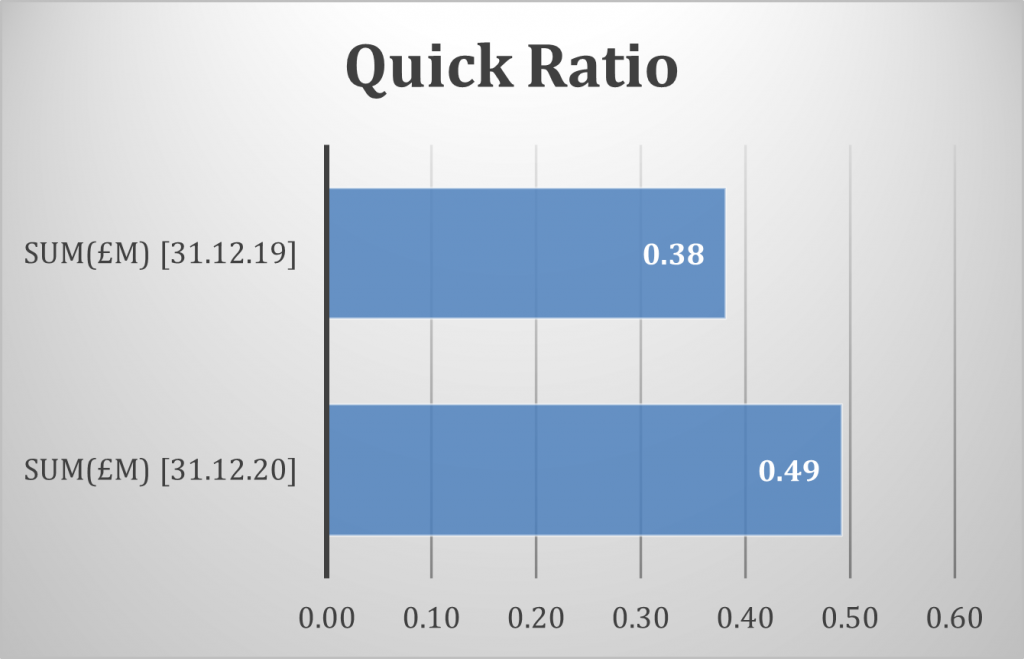

Quick ratio (Current assets-Inventories/Current liability)

| Quick Ratio | ||

| Entity: British Tobacco | ||

| Items | Sum(£m) [31.12.20] | Sum(£m) [31.12.19] |

| Current assets | 13,612 | 13,274 |

| [-] Inventories | 5,998 | 6,094 |

| [/] Current liabilities | 15,478 | 18,823 |

| Quick Ratio | 0.49 | 0.38 |

Quick ratio is liquidity ratio that compares current assets less inventories with current liabilities (Jun, 2018). BAT has 0.38times liquidity in 2019 and 0.49times liquidity in 2020. So, 0.11times improvements in liquidity position took place in 2020. Besides, presence of lowing closing stocks have boosted liquidity.

Investment ratios

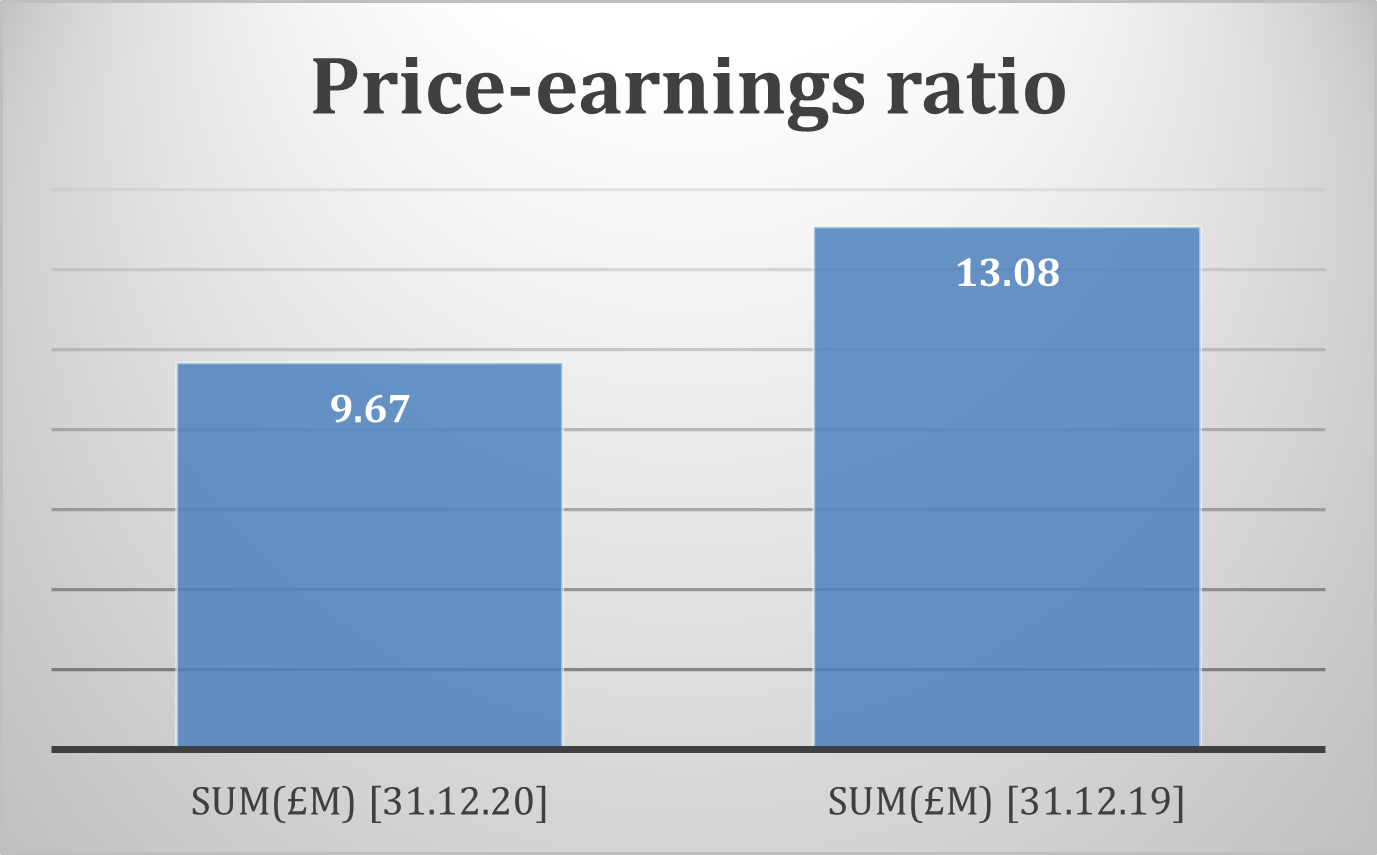

Price-earnings ratio (Market price per share/Earnings per share)

| Price-earnings ratio | ||

| Entity: British Tobacco | ||

| Items | Sum(£m) [31.12.20] | Sum(£m) [31.12.19] |

| Market price per share | 2708 | 3266 |

| [/] Earnings per share | 280 | 249.7 |

| Price-earnings ratio | 9.67 | 13.08 |

Price-earnings ratio is an investment ratio that determines whether the company is undervalued or overvalued in market. As per Kumar (2017), price-earnings ratio compares share’s market price and per share earnings. BAT has 13.08 price-earnings in 2019 and 9.67 price-earnings in 2020. The ratios shows slight improvement in earnings per share and reduction in market price of shares. So, company’s shares are undervalued which is better than having overvalued shares.

Price-earnings ratio is an investment ratio that determines whether the company is undervalued or overvalued in market. As per Kumar (2017), price-earnings ratio compares share’s market price and per share earnings. BAT has 13.08 price-earnings in 2019 and 9.67 price-earnings in 2020. The ratios shows slight improvement in earnings per share and reduction in market price of shares. So, company’s shares are undervalued which is better than having overvalued shares.

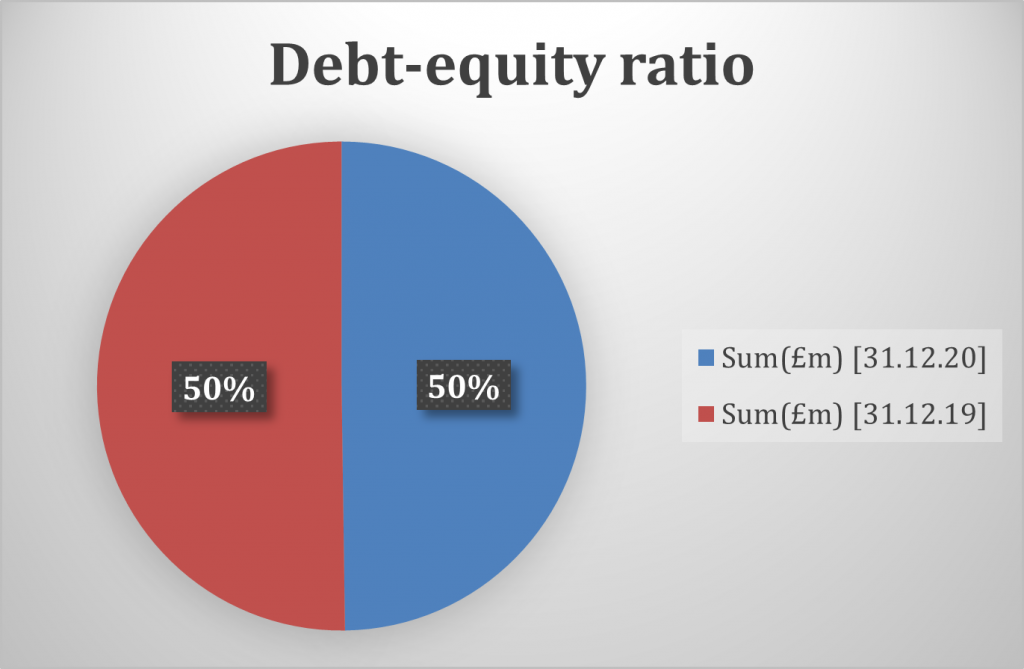

Debt-equity ratio (Debt financing/Equity financing)

| Debt-equity ratio | ||

| Entity: British Tobacco | ||

| Items | Sum(£m) [31.12.20] | Sum(£m) [31.12.19] |

| Debt capital | 74735 | 76845 |

| [/] Equity capital | 62,955 | 64,160 |

| Debt-equity ratio | 1.19 | 1.20 |

This ratio compares debt financing with equity financing in capital structure. If company maintains lower debt financing then it is less leveraged (Das and Swain, 2018). BAT has 1.20 debt-equity ratio in 2019 and 1.19 debt equity ratio in 2020. Both debt capital and equity capital have declined in capital structure of BAT in 2020.

Recommendation

As per analysis of BAT’s financial performance it has been found that the company has sound performance, profitability and growth in international market. It has gains significant growth from Brexit and Covid-19. However, it can be recommend that the company should strengthen its dividend payments for providing sound dividend in post-pandemic situation. Inclusion of more sources of funding would be helpful for improving capital structure and liquidity position of BAT. Also, it is recommended to BAT to use strong policies for payment and collection of dues for improving efficiency. Financial analysis of BAT reflects sound position of company. So, it can be recommended to potential investors to invest in BAT for gaining favourable returns.

Conclusion

International finance focuses on both financial and non-financial aspects of company in economy. BAT is leading tobacco company of UK. Occurrence of Brexit had significantly impacted on UK economy and international trade. Occurrence of Brexit as advantageous for BAT as it has facilitated acquisition of RJ Reynolds by BAT. Even in pandemic situation if 2020, demand of cigarette were risen in UK. This has helped BAT in generation higher revenue. As per dividend policy, company has not provided adequate dividend in 2020. Debt and equity are key source of finance of BAT. The company has £59575m debt financing and £62955m equity financing in 2020. As per profitability ratio, profit of BAT have been increased in 2020. Investment ratio shows better performance of BAT in 2020 as compare to 2019. As per liquidity ratio, BAT has maintain sound working capital position in 2020. Further, the company has strong efficiency position in 2020.

References

Alexander, D. and Britton, A., (2017). International financial reporting and analysis. 7th ed. London: Cengage. ISBN 978-1-473-72545-4

Almabekova, O., Kuzmich, R. and Antosik, E., (2018). Income approach to business valuation: Russian perspective. Zagreb International Review of Economics & Business, 21(2), pp.115-128.

Amanda, R.I., (2019). The Impact of Cash Turnover, Receivable Turnover, Inventory Turnover, Current Ratio and Debt to Equity Ratio on Profitability. Journal of research in management, 2(2), pp.55-59.

Atrill, P., and Mc Laney E. (2017). Accounting and finance for non-specialists. 10th Edition. Harlow: FT Prentice Hall. ISBN 9781292135601 (also available as e-book)

Bat (2021). About BAT, UK. Available at: https://www.bat.com/annualreport# [Accessed on 5th October 2021]

Bat (2021). About BAT, UK. Available at: https://www.bat.com/group/sites/UK__9D9KCY.nsf/vwPagesWebLive/DOALSC3V [Accessed on 11th October 2021]

Bat (2021). About BAT’s dividend history, UK. Available at: https://www.bat.com/group/sites/UK__9D9KCY.nsf/vwPagesWebLive/DO538FK6#[Accessed on 12th November 2021]

Bat (2021). About BAT’s governance policy, UK. Available at: https://www.bat.com/governance [Accessed on 14th October 2021]

Bat (2021). About BAT’s human rights policy, UK. Available at: https://www.bat.com/humanrights/respond [Accessed on 15th October 2021]

Bbc (2021). About BAT, UK. Available at: https://www.bbc.com/news/uk-politics-32810887 [Accessed on 8th October 2021]

Bekaert, G. J., and Hodrick, R.J., (2014). International Financial Management, 2nd Ed., Pearson, London. ISBN-10: 129202139X

Budagaga, A., (2017). Dividend payment and its impact on the value of firms listed on Istanbul stock exchange: A residual income approach. International Journal of Economics and Financial Issues, 7(2), pp.370-375.

Charness, G. and Neugebauer, T., (2018). A test of the Modigliani-Miller invariance theorem and arbitrage in experimental asset markets. Journal of Finance, forthcoming, 2(1), pp.88-89.

Das, C.P. and Swain, R.K., (2018). Influence of capital structure on financial performance. Parikalpana: KIIT Journal of Management, 14(1), pp.161-171.

Jacque, L. (2014). International corporate finance. London: Wiley. ISBN 1-118-78186-4

Jikia, M. and Kharabadze, E., (2018). Certain aspects of accounts receivable and payable analysis. Archives of Business Research, 6(6), pp.101-105.

Jun, F., (2018). Study of Relationship between Liquidity Risk (Quick Ratio) and Internal and External Factors in NIKE Company, 2(1), pp.55-59.

Kumar, P., (2017). Impact of earning per share and price earnings ratio on market price of share: a study on auto sector in India. International Journal of Research-Granthaalayah, 5(2), pp.113-118.

Lubis, I. and Alfiyah, F.N., (2021). Effect of Return on Equity and Debt to Equity Ratio to Stock Return. Financial Review, 1(1), pp.17-31.

Lucky, L.A. and Onyinyechi, U.G., (2019). Dividend Policy and Value of Quoted Firms in Nigeria: A Test of Miller and Modigliani Irrelevant Hypothesis. Australian Finance & Banking Review, 3(2), pp.16-29.

Nasdaq (2021). About BAT’s dividend, UK. Available at: https://www.nasdaq.com/market-activity/stocks/bti/dividend-history [Accessed on 12th October 2021]

Nguyen, A.T.H. and Van Nguyen, T., (2018). Working capital management and corporate profitability. Foundations of Management, 10(1), pp.195-206.

Ningsih, L.R. and Soesetio, Y., (2018). How Do Free Cash Flow and Dividend Policy Affect Stock Return?. Social Sciences, 8(3), pp.333-343.

Reuters (2021). About BAT, UK. Available at: https://www.reuters.com/article/uk-brit-am-tobacco-outlook-idUKKBN28J0PG [Accessed on 6th October 2021]

Singh, N.P. and Tandon, A., (2019). The effect of dividend policy on stock price: Evidence from the Indian Market. Asia-Pacific Journal of Management Research and Innovation, 15(1-2), pp.7-15.

Theguardian (2021). About BAT’s Malawi child labour issue, UK. Available at: https://www.theguardian.com/business/2021/jun/25/uk-tobacco-firms-fail-in-bid-to-have-malawi-child-labour-case-struck-out [Accessed on 13th October 2021]

Who.int (2021). About Economic situation in Covid-19 pandemic. Available at: https://www.who.int/news-room/spotlight/the-impact-of-covid-19-on-global-health-goals#:~:text=COVID%2D19%20responsible%20for%20at,more%20than%201.8%20million%20worldwide. [Accessed on 9th October 2021]

Worldbank.org (2021). About economic outlook during Covid-19 pandemic. Available at: https://www.worldbank.org/en/news/feature/2020/06/08/the-global-economic-outlook-during-the-covid-19-pandemic-a-changed-world#:~:text=Businesses%20might%20find%20it%20hard,by%20almost%208%25%20in%202020. [Accessed on 10th October 2021]

Wsj (2021). About BAT & Brexit, UK. Available at: https://www.wsj.com/articles/brexit-fuels-british-american-tobaccos-bid-for-reynolds-american-1477057439 [Accessed on 7th October 2021]

Know more about UniqueSubmission’s other writing services:

Thank you very much for sharing, I learned a lot from your article. Very cool. Thanks. nimabi