BMG704 International Finance Assignment Sample

Introduction

International finance has played a major part in helping a business to expand. Finance represents monetary support taken by an organization from internal and external sources. In order to provide a practical approach, Apple is chosen as a company. The report is divided into 3 sections, Section A focuses on two developments of Apple and its impact on the organization. In Section B the sources of finance are highlighted. Under this discussion of dividend policy, equity, debt and changes in working capital are shown. In Section C financial analysis is shown with the help of ratio analysis. The main objective is to provide in-depth information regarding the performance of Apple.

1. Section A

1.1 Development 1: Implementation of Virtual reality

Apple has provided different major software updates in the past couple of years. Recently the organization is planning to work on Virtual reality. It had made a new set of tools such as VR headsets so that it could able to provide a 3D environment.

Effect

This development technique will help Apple to enter the VR industry. Apple is always known for its ecosystem. It focuses on reliability, flexibility, and comfort ability. Making VR gadgets can provide its customer with a different set of experiences. Apple products are preferred by digital artists, voice artists, and filmmakers. Providing a facility of virtual reality can help them to get a new set of support from the customers (futurism.com, 2022). If Apple brings this facility to their existing device then it can improve the chances of sales. This will require updates in their software as it can internally make their existing device capable of using a VR facility.

Strategies

- Major updates in the existing IOS device through software updates so that all the existing users can implement these benefits.

- Launching a new product lineup in the Apple segment is profitable and improves its versatility.

1.2 Development 2: Ambient computing for ecosystem build-up

After Apple had launched their new music sound box that is a home pod. Apple has not only provided a stereo sound atmosphere in their ecosystem but this device can be connected with other smart electrical instruments such as lighting (investor.apple.com, 2022). This allows an atmosphere that can help the organization improve its approach to Ambient computing.

Effect

Implementing this type of facility will allow users to bring Siri into their homes. The ecosystem of Apple is already preferred by its customer base. After this type of action, the customers will pick up their home pod lineup for use as a smart assistant (Kusuma et al. 2018). Flexibility is improved as the home pod can be used for typing purposes as well. It can also track work out facility or other activities that are generally done by the user.

Strategies

- Apple introduced a new set of products that can connect with the rest of its lineup and work as virtual assistants.

- Implementation of AI is also provided that makes it convenient so that it could help in typing, and taking any type of activity.

- The approach of ambient lighting is possible by providing software updates to their existing products. The home pod is made in such a way that it could blend with other electronic devices.

2. Section B

2.1 Sources of finance

2.1.1 Definition

Sources of finance refer to the medium from which a company gets the source of money to fund its activities. The sources can be gathered from intern and external mediums (Shrotriya, 2019). Retained earnings, debt, issues of shares and debentures are some of the internal sources. Loans on working capital, venture funding, and letter of credit are some external sources.

2.1.2 Source of finance for Apple

One of the biggest sources of finance for Apple is its retained earnings. The retained earnings of the company are estimated to be $ 14966 million for 2020. The company is able to collect a debt of $ 9613 million in 2021, and the value of its shareholder’s equity is $ 63090 million for 2021.

2.1.3 Equity

The value of a common stock is paid at $0.00001 for each value; the number of shares authorized by the company is 16,426,786 and 16,976,763 as outstanding. It had successfully generated an income of $ 163 million in 2021, compared to a loss of $ 406 million last year.

2.1.4 Debt

Under current liability, the company has a debt of $9613 million and under the non-current segment; the debt valuation is $109,106 million. In order to gather finance the company made its debut marketable (Cumming and Groh, 2018). A high credit rating is the type of instrument that is used to measure the debt condition.

2.1.5 Gearing ratio

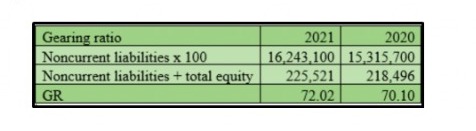

Figure 1: Evaluation of gearing ratio

(Source: Excel)

Analysis

It can be seen that the non-current liabilities had increased from $162431 to $ 153157. This is the reason behind the increase in the gearing ratio from 72.02 to 70.10. Increasing gearing can create a sustainable downturn for Apple. Decreasing liability can be a good option for prevention.

2.1.6 Working capital

The working capital for Apple in the year 2021 is $ 40.821 billion, was $ 31.754 billion. It can be clearly identified as the working capital has increased and this can influence the cash flow of the company in a negative way.

2.1.7 Conclusion

It can be concluded that the importance of maintaining the sources of finance can improve the sustainability of the company. The equity, debt and working capital of Apple have been saturated. Evaluation of the gearing ratio is also done for a better understanding.

2.2 Dividend Policy

2.2.1 Definition

This policy refers to the structure that a company follows to pay its dividend to the shareholders. An organized dividend payout can help the business to attract more investors for funding the business (Kadim et al. 2020). This states that if the dividend of a company is maintained in the proper way it can improve the business function of the company.

2.2.2 Types

- A stable dividend policyrefers to the continuous systematic payout of dividends by the company.

- The constant dividendis when a company shares a portion of its profit every year with its dividend holder (Pattiruhu and Paais, 2020).

- Residual dividend policy depends on the payout of the dividend on the residual profit.

2.2.3 Dividend Policy of Apple

Considering the dividend payout structure it can be stated that Apple follows a stable dividend policy. It is because the holders got a portion of the profit as a regular base, however, the rate of payout is variable.

Figure 2: Dividend pay structure of Apple

(Source: investor.apple.com, 2022)

2.2.4 Theory of Dividend followed by Apple

The rate of the dividend influenced the share price of Apple. It is because a better rate of dividend had encouraged investors to invest in the company and thus the prices of shares had already increased.

2.2.5 Relation between dividend policy and share value

The relation between dividends and share value is positive. It is because when any new dividend is issued then the price of shares increases (Pieloch-Babiarz, 2018). However, the number of outstanding shares of the company remains the same, which can dilute the value of shares and decrease their value in the long-run.

2.2.6 Correlation between Dividend Policy & Share Value

It can be seen that the appropriate dividend policy is the P/E ratio and it helps to identify the value of P and its influence on dividend policy (Purnamasari and Nugraha, 2020). The correlation is positive, however in the long-run the value of the dividend gets decreases.

2.2.7 Conclusion

It can be concluded that Apple provides its dividend policy in a systematic way. The relation between dividends and shares is also shown. The theory that Apple follows for their dividend payout is explained.

3. Section C

3.1 Profitability

3.1.1 Return on Capital Employed (ROCE)

Meaning

It is considered a financial matrix that is used for understanding the efficiency and profitability of the company. It also represents the percentage of profit that is generated by using the employed capital (Umobong and Agburuga, 2019). The higher the ratio the better will be the earning ability of the company.

Return

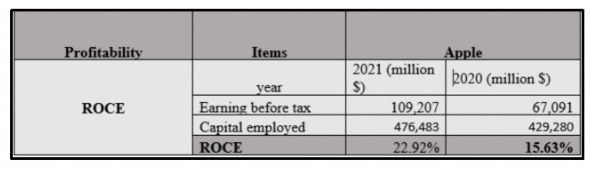

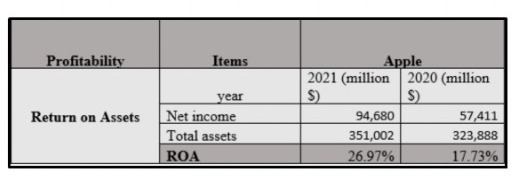

Figure 3: ROCE calculation

(Source: Excel)

Analysis

It can be seen the rate had increased from 15.36% to 22.92%, which is because of the hike in earnings before tax that is from $ 67091 to 109207. This reflects the return from the employed capital has improved. The stability of Apple in terms of using its employed capital is good.

3.1.2 Return on Assets (ROA)

Meaning

From the viewpoint of total assets, how an organization is managing it to generate profit has been highlighted. The maintenance of activities in the business also represents the environment of maintaining the role of the business (Alpi and Gunawan, 2018). It states the relationship between income and assets.

Figure 4: Calculation for ROA

(Source: Excel)

Analysis

The return on assets has increased from 17.73% to 26.97% in 2021. It is because the value of total assets of $ 351002 had helped to increase the income from $ 57411 to $ 94680. The increase in ROA will help Apple to provide better management of assets.

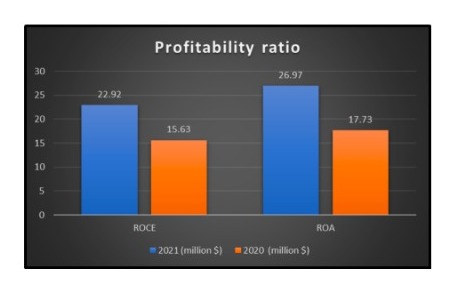

Figure 5: Graphical representation profitability ratio

(Source: Excel)

3.2 Liquidity

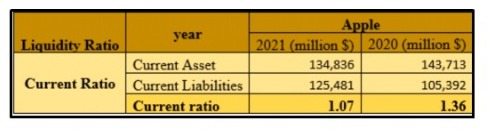

3.2.1 Current ratio

The evaluation for maintaining the balance between current assets and current liability is considered the current ratio. It helps to identify how the assets of a company are managed compared to its liabilities (Nuryani and Sunarsi, 2020). CR is reviewed by investors before investing in a business.

Figure 6: calculation of the current ratio

(Source: Excel)

Analysis

A decrease in the value of current assets can be noticed from 1.36 to 1.07 in 201. It is because the liabilities had increased from $ 125481 and compared to that the value of assets had decreased from $143713 to $134836. This shows that the liquidation state of Apple is deteriorating.

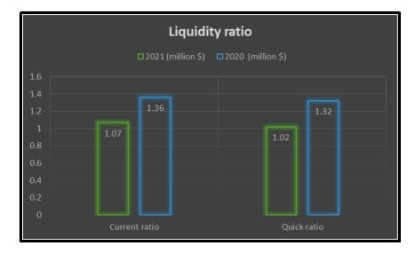

3.2.2 Quick ratio

This asset represents the evaluation of liquid sources of assets compared to the inventory. It reflects how the inventory of a company is managed. It suggests whether the balance needs to be revised or not (Wijaya and Sedana, 2020). It highlights the relation between inventory, current liability and current assets.

| Liquidity Ratio | year | Apple | |

| 2021 (million $) | 2020 (million $) | ||

| Current Ratio | Current Asset | 134,836 | 143,713 |

| Current Liabilities | 125,481 | 105,392 | |

| Current ratio | 1.07 | 1.36 | |

| Quick ratio | Current Asset | 134,836 | 143,713 |

| Inventories | 6,580 | 4,061 | |

| Current laibnility | 125,481 | 105,392 | |

| QR | 1.022 | 1.325 | |

Table 1: Calculation for quick ratio

(Source: Excel)

Analysis

It can be seen that the value of the quick ratio also decreased from 1.32 to 1.02. This means the value of inventory has increased. Apple is not able to clear its stock this is the result the value had increased from $105392 to $125481. This condition is creating a negative impact on the functions of the company. [Referred to appendix 2]

Figure 7: Graphical representation of liquidity ratio

(Source: Excel)

3.3 Efficiency

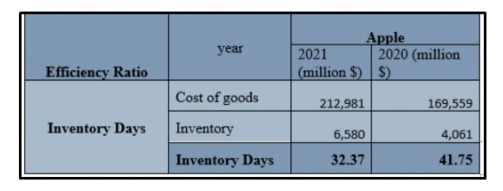

3.3.1 Inventory days

This reflects the time range the company is taking to clear its inventory. It helps to understand the volume of an idle stock in a business. The lower the value the better it is for the company (Sharma and Patil, 2020). The financial tool also shows an indication for managing the inventory in a proper way.

Figure 8: calculation for inventory days

(Source: Excel)

Analysis

The time range for recovering the inventory has decreased from 4175 days to 32.37 days. This reflects that the ability to clear stock of Apple is improving. However, the COGS of the company need to be reviewed for better estimation in future.

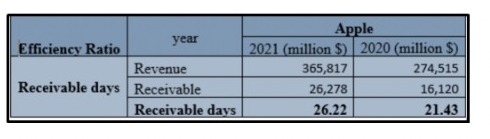

3.3.2 Receivables days

It is considered the time range a customer or debtor takes to pay back the company. It highlights the ability of a company to recover its money (Rahayu et al. 2020). The lower the number of days the more efficient the function of the company.

Figure 9: calculation for receivable days

(Source: Excel)

Analysis

Apple had delayed the time range to recover its value from the debtors. In 2020, it had taken 21.43 days and in 2021, it had taken 26.22 days. This will reduce the interest of investors to further invests in this company. In order to improve the condition, the recovery timeline needs to be decreased. [Referred to appendix 2]

3.4 Investment

3.4.1 Earnings per Share

It considers the value of profit that is earned by using the shares in a business. It also indicates the earning ability of the company (Hidajat, 2018). A high EPS attracts more investment opportunities for the company.

Analysis

Apple successfully increased its earnings per share from $ 3.31 in 2020 to $ 5.67 in 2021. This was possible when the number of outstanding shares had decreased to 16701272 and the profit had maximized to $ 94680000. It shows as the profit is divided into less number of shares thus the value of EPS has increased. It also shows that Apple is moving forward toward a better position in future.

3.4.2 Dividend Pay-Out ratio

It highlights the proportion of dividends provided to the shareholders of the company based on the earnings it generated. If the company follows a systematic approach then the health of the company can be maintained (Rivandi and Ariska, 2019). This is reviewed by any new investors before considering a new project.

Analysis

It can be seen that the rate of payout for the dividend is $ 0.24 and it has been reduced to $ 0.15. This shows that the maintenance of the dividend policy is reducing. If the EPS of the company is maintained in a proper way then the chances of investment also get increased. The improvement plan for the business can be done if the payout of dividends can be increased. The value of the dividend had also decreased from $ 1 to $ 0.85. [Referred to appendix 3]

Figure 13: Graphical representation of investment ratio

(Source: Excel)

Conclusion

It can be concluded that the need for international finance is immense for improving business activities. In this report, the mode of business activities of Apple is portrayed. Two different developments of the company that are virtual reality and ambient computing are discussed in detail. In section b an introduction of dividend policy as a source of income is mentioned. The type of dividend policy Apple follows is also discussed in this segment.

It also involves the debt, equity and working capital of Apple. In section c interpretation of financial data is presented from the annual report of Apple. After estimating the ratios, it can be suggested there are several areas in which Apple needs to improve its mode of function. However, the organization is at a profitable stage and future growth of the company is ensured. It is suggested the company should look after liability management so that the rate of sustainability gets increases.

References

Journals

Alpi, M.F. and Gunawan, A., 2018. Pengaruh current ratio dan total assets turnover terhadap return on assets pada perusahaanplastik dan kemasan. JurnalRisetAkuntansiAksioma, 17(2), pp.1-36.

Cumming, D. and Groh, A.P., 2018. Entrepreneurial finance: Unifying themes and future directions. Journal of Corporate Finance, 50, pp.538-555.

Hidajat, N.C., 2018. Pengaruh return on equity, earnings per share, economic value added, dan market value added terhadap return sahamperusahaansektorpertanian yang terdaftar di bursa efekindonesiaperiode 2010-2016. Jurnal Ekonomi, 23(1), pp.62-75.

Husain, T. and Sunardi, N., 2020. Firm’s Value Prediction Based on Profitability Ratios and Dividend Policy. Finance & Economics Review, 2(2), pp.13-26.

Kadim, A., Sunardi, N. and Husain, T., 2020. The modeling firm’s value based on financial ratios, intellectual capital and dividend policy. Accounting, 6(5), pp.859-870.

Kusuma, P.J., Hartoyo, S. and Sasongko, H., 2018. Analysis of factors that influence dividend payout ratio of coal companies in Indonesia stock exchange. JDM (JurnalDinamikaManajemen), 9(2), pp.189-197.

Nuryani, Y. and Sunarsi, D., 2020. The Effect of Current Ratio and Debt to Equity Ratio on Deviding Growth. JASa (JurnalAkuntansi, Audit dan SistemInformasiAkuntansi), 4(2), pp.304-312.

Pattiruhu, J.R. and Paais, M., 2020. Effect of liquidity, profitability, leverage, and firm size on dividend policy. The Journal of Asian Finance, Economics and Business, 7(10), pp.35-42.

Pieloch-Babiarz, A., 2018, June. Long-term stock returns of companies implementing diverse dividend policy: evidence from Poland. In European Financial Systems 2018 Proceedings of the 15th International Scientific Conference (pp. 509-517).

Purnamasari, I. and Nugraha, N., 2020, February. Testing Theory of Dividend Policy: Evidence in the Real Estate Sector in Indonesia. In 3rd Global Conference On Business, Management, and Entrepreneurship (GCBME 2018) (pp. 117-120). Atlantis Press.

Rahayu, K.E., Ardina, C. and Sumartana, M., 2020. Analysis of uncollectible receivables and their impact on profitability at The Legian Bali. Journal of Applied Sciences in Accounting, Finance, and Tax, 3(2), pp.152-157.

Rivandi, M. and Ariska, S., 2019. PengaruhIntensitas Modal, Dividend Payout Ratio Dan Financial Distress TerhadapKonservatismeAkuntansi. JurnalBenefita, 4(1), pp.104-114.

Sharma, D.S. and Patil, Y., A Study on Inventory Management System: A Case Study of Hindustan Aeronautics Limited (HAL), Nashik. IITM Journal of Management and IT, 1(1,182.28), p.23.

Shrotriya, V., 2019. Internal sources of finance for business organizations. International Journal of Research and Analytical Reviews (IJRAR), 6(2), pp.933-940.

Umobong, A.A. and Agburuga, U.T., 2019. Agency Cost of Equity and Growth Rate in Relation to Returns on Capital Employed and High and Low Leveraged Firms in Nigeria. International Journal of Economics, Business and Management Studies, 6(2), pp.318-337.

Wijaya, D.P. and Sedana, I.B.P., 2020. Effects of quick ratio, return on assets and exchange rates on stock returns. Am. J. Humanities Soc. Sci. Res, 4, pp.323-329.

Websites

futurism.com, 2022, Retrieved on 25th July, 2022 from: https://futurism.com/tim-cook-reveals-apples-10-year-plan-for-future-tech

investor.apple.com, 2022, Retrieved on 25th July, 2022 from: https://investor.apple.com/dividend-history/default.aspx

Know more about UniqueSubmission’s other writing services: