Financial Risk Modelling Assignment Sample

Introduction

Financial risk modelling determines the process of how the amount of risk is exhibited in an investment, business or cash flows. This is calculated in volatility. Discounted Cash Flow (DCF) model shows the valuation techniques which are used for estimating the expected cash flow of the future on the basis of the investment. In this modelling which is based on financial risk analysis there is some discussion and calculation. In the literature review section there will be discussion about researchers who are connected with financial modelling & risk analysis. In the next section of methods there will be discussion about the process of calculations. The next part of discussion & findings will consist of the results which have been analyzed in the method section & the interpretation of the result. The next part will consist of recommendations about financial analysis model & risk analysis on the basis of the given report analysis. The last part will be the conclusion.

Literature review

According to Bian et al, 2018, The proposal that credit hazard models be used as an establishment for banks’ administrative capital estimations has started significantly more revenue in credit hazard models. Credit chances have become more attractive because of expanded attractiveness.

Banks’ fixation on evaluating monetary danger has caused pressures in the framework. The Basel Accord of 1988 set up an administrative system. In that specific circumstance. Under the system, banks should have capital equivalent to at least 8% of their private area income openings.

According to Pivorienė, 2017, the motivation behind the limited income model is to gauge the value of a concern. In any case, the resources of the monetary record are at first esteemed. Worth of Interest-bearing obligation is then deducted to get the value esteem. Convey revenue liabilities barring conceded expenses and exchange credits (creditor liabilities and others Short-term obligation). Credit as payables payable without interest however the overhead is higher (ie. e., higher price tag of unrefined substances) and is so it’s a greater amount of a functional part than a monetary one. This appears to be a backhanded way to deal with appraisal resources and deduct interest liabilities to get value (for example it appears to be a more straightforward valuation of investor value, by limiting anticipated future profits). Notwithstanding, this circuitous methodology is the suggested one, as it prompts greater clearness and less mistakes in the assessment cycle.

According toStankovićet al. 2020, organization exercises that are absolute resources less attractive protections esteemed utilizing the WACC technique. At the end of the day, free income from tasks refreshed to current worth utilizing WACC. Then, at that point, there’s the issue of simultaneousness identified with WACC. In particular, the worth of obligation and value went into WACC weight. Be that as it may, total assets is the thing that the model expects to decide.

According toYazdi, 2017, for the future the free income from tasks is determined dependent on projections pay proclamation and accounting report. This implies that free income starts from an intelligible situation, as dictated by the figure fiscal summaries. This is presumably the fundamental strength of the limited income model since it is hard to make a sensible estimate of direct free income. The fiscal summaries are given in ostensible terms. This suggests that the ostensible free income is limited at the ostensible markdown rate.

Methods

The method used to calculate is statistical method conducting in MS excel with their descriptive statistics and correlation & regression. The answers of the given questions are discussed below.

| Uncertain inputs | “Parameter 1” | “Parameter 2” | “Parameter 3” |

| Investment cost | £90,000.00 | £1,00,000.00 | £1,50,000.00 |

| “Year 1 revenue” | £80,000.00 | £1,00,000.00 | £1,10,000.00 |

| “Annual fixed cost” | £32,000.00 | £35,000.00 | £38,000.00 |

| “Annual revenue growth rate” | 5% | 8% | |

| “Annual variable cost percentage” | 50% | 2% |

| Known inputs | |

| Discount rate | 12% |

| Initial Seed | 12345 |

Here the WACC is 12% which is given and it is the discount rate.

NPV formula

1. ans.

“Net Present Value (NPV)”: It is the difference between the recent worth of pay and consumption throughout a given time span. This is a computation utilized in capital planning and venture intending to decide the benefit of a proposed task or speculation.

“NPV = [cash flow/ (1 + i) ^t] – Initial investment”

Where, “i = discount rate” = 12% = 12/100 = 0.12

t = time period

Cash flow = £80,000

NPV for 10 years will be-

NPV = £[80,000/ (1 + 0.12)^10] – 90,000

= 25757.86 – 90,000

=£ – 64242.14

Here the value is negative which means this is not the right place for investing money because it will give loss to the company.

Discounted Cash Flow (DCF):

“DCF = ∑cash flow/ (1 + r)^t”

Where, “i = discount rate” = 12% = 12/100 = 0.12

r = time period

cash flow = £80,000

DCF = 80,000/ (1 + 0.12)^1 + 80,000/ (1 + 0.12)^2 + 80,000/ (1 + 0.12)^3+ 80,000/ (1 + 0.12)^4+ 80,000/ (1 + 0.12)^5 + 80,000/ (1 + 0.12)^6 + 80,000/ (1 + 0.12)^7 + 80,000/ (1 + 0.12)^8 +80,000/ (1 + 0.12)^9 +80,000/ (1 + 0.12)^10

= £(71428.57 + 63775.51 + 56942.42 + 50841.47 + 45394.15 + 40530.49 + 36187.94 + 32310.66 + 28848.81 + 25757.86)

= £452017.88

Here the DCF value is positive but it is decreasing time after time. The DCF value is greater than the investment cost so the outcome of the firm will be positive.

2. ans.

| Row1 | Row2 | Row3 | |||

| Mean | 113333.3333 | Mean | 96666.66667 | Mean | 35000 |

| Standard Error | 18559.21454 | Standard Error | 8819.171037 | Standard Error | 1732.051 |

| Median | 100000 | Median | 100000 | Median | 35000 |

| Mode | #N/A | Mode | #N/A | Mode | #N/A |

| “Standard Deviation” | 32145.50254 | “Standard Deviation” | 15275.25232 | “Standard Deviation” | 3000 |

| “Sample Variance” | 1033333333 | “Sample Variance” | 233333333.3 | “Sample Variance” | 9000000 |

| “Kurtosis” | #DIV/0! | “Kurtosis” | #DIV/0! | “Kurtosis” | #DIV/0! |

| “Skewness” | 1.545392 | “Skewness” | -0.93521953 | “Skewness” | 0 |

| “Range” | 60000 | “Range” | 30000 | “Range” | 6000 |

| “Minimum” | 90000 | “Minimum” | 80000 | “Minimum” | 32000 |

| “Maximum” | 150000 | “Maximum” | 110000 | “Maximum” | 38000 |

| Sum | 340000 | Sum | 290000 | Sum | 105000 |

| Count | 3 | Count | 3 | Count | 3 |

| “Confidence Level(95.0%)” | 79853.85511 | “Confidence Level(95.0%)” | 37945.83034 | “Confidence Level(95.0%)” | 7452.413 |

3.ans.

| Uncertain inputs | Parameter 1 | Parameter 2 | Parameter 3 |

| “Year 1 revenue” | £90,000.00 | £1,00,000.00 | £1,50,000.00 |

| “Annual fixed cost” | £80,000.00 | £1,00,000.00 | £1,10,000.00 |

| “Annual revenue growth rate” | £32,000.00 | £35,000.00 | £38,000.00 |

| R^2 | 0.87 |

| R | 0.933273808 |

| CORRELATION (1,2) | 0.986911573 |

| CORRELATION (2,3) | 0.935856728 |

| CORRELATION (1,3) | 0.980433583 |

Findings & discussion

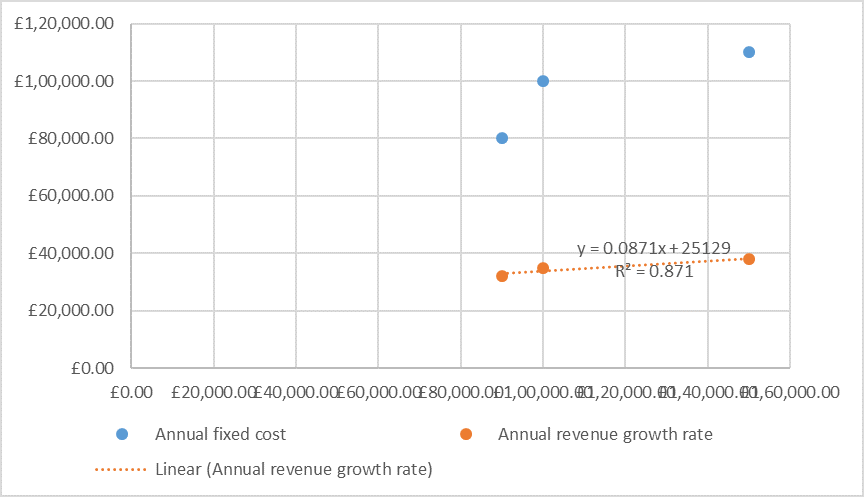

Figure 1: Correlation and Regression of parameters

(Source: MS Excel)

The upper figure is the graph of regression and correlation. The scattered plots are mentioned on the graph. The regression equation is also there.

The mean values are 113333.3333, 96666.666, 35000 for the three parameters respectively which are taken. The calculation was done in excel. The R^2 value is 0.87. This value means 87% of the variables are dependable and they are explained by independent variables (Carras et al, 2020).

Recommendations

Monetary danger is consistent in each business, and the most effective way to deal with these dangers fluctuates across ventures. A monetary danger evaluation can assist with recognizing hazards explicit to business, focus on those dangers, foster ways of staying away from them, and distinguish stages to oversee them assuming they happen. A monetary danger appraisal additionally assists with understanding danger craving. To foster answers to diminish monetary dangers should distinguish and dissect monetary dangers, and afterward foster a proactive monetary danger in the board plan.

The premise of all the material in this MAG is the reason that the principal objective of monetary danger of the board is to help the executives in controlling the dangers that might influence them to accomplish hierarchical objectives. Not accessible The main danger the board bundle is great, however the danger will be overseen most successfully if practical insight and sound judgment the faculties are joined with the utilization of a smart combination of subjective and quantitative testing. Hazard the board is understanding and dealing with the dangers an association faces in its endeavors to accomplish its objective. These dangers will normally address dangers to the association like dangers, misfortune. Hazard the executives has custom with respect to chance administration of occasions that could hurt the association.

Conclusion

The independent variables of the model have a great impact on the dependable variables. Various investment opportunities & comparison of the business firms are measured by risk analysis. Risk analysis has been used for the identification of potential issues which can affect the firm’s business or project works or modelling negatively. To effectively and monetarily get their information security, associations need to perceive the dangers associated with the use of the information frameworks. In an assortment of techniques, hazard examination might help an organization in working on its security. While assessing the imminent awards of taking on drives or gaining another firm, WACC is likewise vital. Assuming a partnership feels that a consolidation, for instance, would yield a return more prominent than its expense of capital, it is no doubt a strong venture. Assuming that the organization’s business anticipates a more modest return than its own investors, they’ll need to put their cash to more noteworthy use. Associations can use the consequences of hazard investigations, because of the sort and extent of the examination.

Reference list

Journals

Bian, Y., Lemoine, D., Yeung, T.G., Bostel, N., Hovelaque, V., Viviani, J.L. and Gayraud, F., 2018. A dynamic lot-sizing-based profit maximization discounted cash flow model considering working capital requirement financing cost with infinite production capacity. International Journal of Production Economics, 196, pp.319-332.

Carras, M.A., Knowler, D., Pearce, C.M., Hamer, A., Chopin, T. and Weaire, T., 2020. A discounted cash-flow analysis of salmon monoculture and Integrated Multi-Trophic Aquaculture in eastern Canada. Aquaculture Economics & Management, 24(1), pp.43-63.

Liu, X., Liu, J., Zhu, S., Wang, W. and Zhang, X., 2019. Privacy risk analysis and mitigation of analytics libraries in the android ecosystem. IEEE Transactions on Mobile Computing, 19(5), pp.1184-1199.

NikoofalSahlAbadi, N., Bagheri, M. and Assadi, M., 2018. Multiobjective model for solving resource‐leveling problem with discounted cash flows. International Transactions in Operational Research, 25(6), pp.2009-2030.

Pivorienė, A., 2017. REAL OPTIONS AND DISCOUNTED CASH FLOW ANALYSIS TO ASSESS STRATEGIC INVESTMENT PROJECTS. Economics & Business, 30.

Saługa, P.W., Szczepańska-Woszczyna, K., Miśkiewicz, R. and Chłąd, M., 2020. Cost of equity of coal-fired power generation projects in Poland: Its importance for the management of decision-making process. Energies, 13(18), p.4833.

Stanković, M., Stević, Ž., Das, D.K., Subotić, M. and Pamučar, D., 2020. A new fuzzy MARCOS method for road traffic risk analysis. Mathematics, 8(3), p.457.

Yazdi, M. and Kabir, S., 2017. A fuzzy Bayesian network approach for risk analysis in process industries. Process Safety and Environmental Protection, 111, pp.507-519.

………………………………………………………………………………………………………………………..

Know more about UniqueSubmission’s other writing services:

I am a student of BAK College. The recent paper competition gave me a lot of headaches, and I checked a lot of information. Finally, after reading your article, it suddenly dawned on me that I can still have such an idea. grateful. But I still have some questions, hope you can help me.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://accounts.binance.com/pt-PT/register?ref=UM6SMJM3

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.