Financial Regulation And Fraud Management Assignment Sample

1. Introduction

Fraud mainly signifies false interpretation of facts and information to deprive a victim from their legal rights. At present, it can be argued that the covid-19 pandemic has significantly affected every nation whether it is positive or negative. Most countries went into lockdown, which led to the halt and downfall of the global economy. On contrast, digital transformation and opportunities to use online platform has boomed. Thus, this pandemic has changed the operation of every nation and since the economies have been affected, there are many chances for the increase of financial frauds in the upcoming years. Many people lost their jobs during this pandemic that changed the way they live their lives. Since so many people have lost their jobs and their means of income, there are many chances that those individuals would take the initiative to conduct financial fraud. The purpose of the project is to systematically analyse and assess the current and past regulations regarding financial frauds and how effective they are to deal with such frauds.

2. Literature Review

2.1 Concept of Variables

2.1.1 Covid-19

Covid-19 is a serious disease that spreads from one person to another and causes some serious health issues. The “SARS-CoV-2 virus” causes this disease and if this virus infects a person, they would experience respiratory illness. Some people only experience respiratory illness and they recover without any serious medical attention, however, in certain cases, it was seen that some people suffered from very serious illnesses, such as their mouth becoming tasteless, having very high fever and having difficulty in breathing. As stated by Velavan and Meyer (2020), older people were more prone to this virus, because of their weak immune systems and they experienced more serious and chronic respiratory problems. This virus could spread through physical touch, or when an infected person sneezes or coughs in front of people.

2.1.2 Frauds

In simple words, fraud can be defined as an unfair means used by a certain individual to gain unauthorized benefits by the method of deception and false suggestions. In terms of financial fraud, any fraud that has money involved can be defined as financial fraud. Financial fraud can affect a person or an organisation when someone deprives them of their money through unfair and illegal means. According to Karpoff (2021), these frauds can be challenged in a civil court, as that is the only place where a person can recover their stolen money. These frauds can be done through various ways such as by stealing identity or by investment fraud.

2.2 Theories And Models

2.2.1 Fraud Triangle

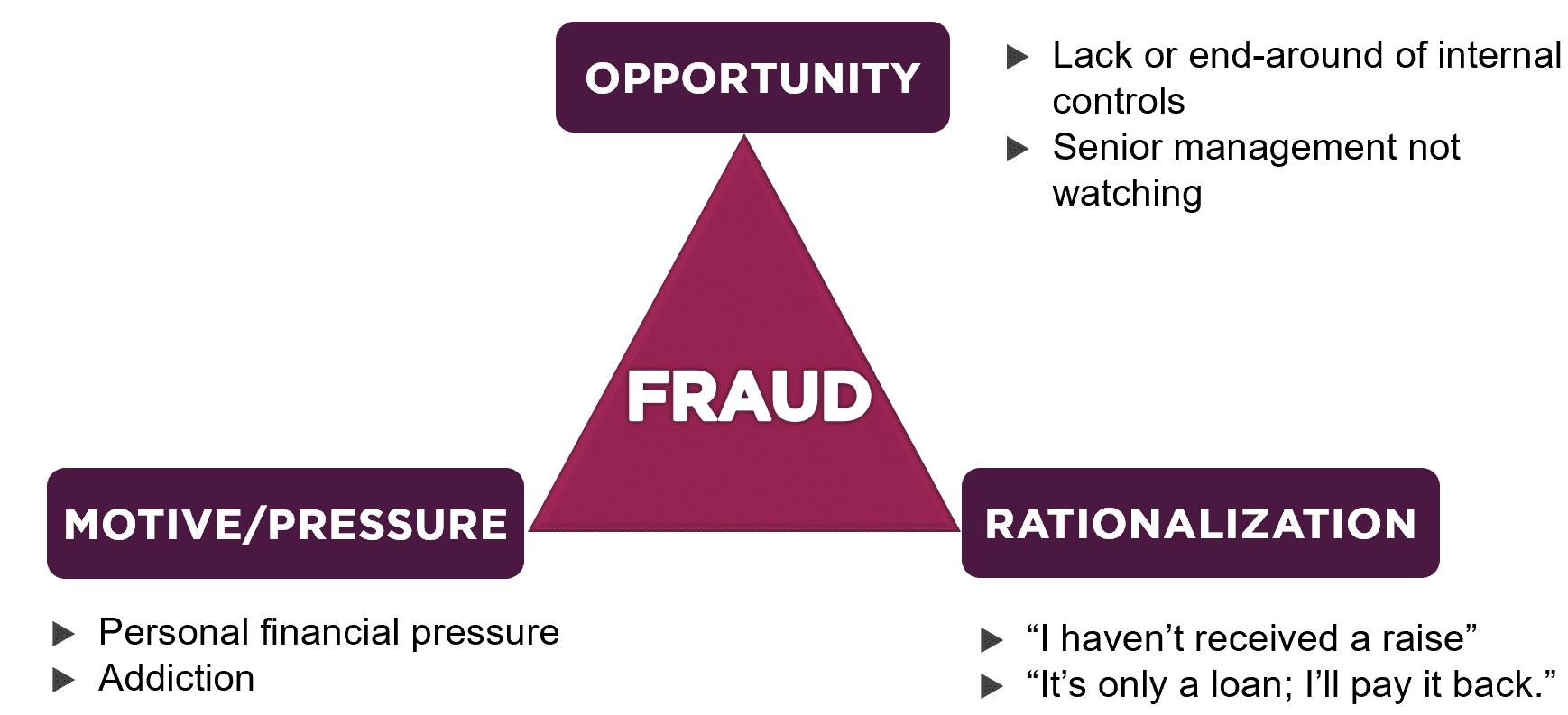

Figure 1: Fraud Triangle

(Source: Schuchter and Levi, 2016)

Fraud can occur for various reasons, such as an employee trying to steal and misuse the resources of a company, corruption is another method of fraud that involves bribery or extortion on the basis to have huge financial gains, and the most common are frauds that involve falsification of financial statements. Fraudsters look for ways to gain finance by hampering the company’s resources. This makes them find reasons that could help them in achieving such unfair finance that brings many various reasons that could lead to an occurrence of fraud.

Poor Senior Management (Opportunity)

Senior management in the company usually works on the basic look over the management to ensure that every employee is working effectively. They also work on the basis to ensure that no such issues or conflict arises, however, it has been discovered that 86% of the fraud cases occur due to asset misappropriation, which means that the senior management in an organisation is not working effectively (Amazonaws.com, 2020). Employees work in order to fulfil the organisation’s aims and objectives but certain companies fail to retain their employees which causes some of them to use unfair means to harm a company. Unsatisfied employees either resign from a company or else they try different ways to harm a company by committing financial fraud.

Financial Pressure or Greed of an Individual (Motive)

During the pandemic, many individuals lost their means to earn since they lost either their jobs or business. This caused many people to suffer from financial issues and sometimes these issues could cause a person to commit fraud. In case a person is suffering from financial issues, he may find a way to earn by unfair means by damaging the company’s financial resources (Schuchter and Levi, 2016). Around 43% of cases arise due to corruption within an organisation. Some examples of fraud in these cases could be unfair sales schemes, economical extortion and illegal gratuities. There are also those individuals and employees who have the greed to earn even more. These employees could perform fraud in a company just for the purpose to gain more finance.

Poor Company culture (Rationalization)

Certain companies might have a poor working environment or culture that could demotivate employees. In certain companies, there are also issues where they make their employees work more according to their given salary (Roden et al. 2016). In these cases, an employee might try to commit financial statement fraud by falsifying the journals and leader of a company. Around 10% of cases are related to such fraud however, these frauds cause most losses to a company in the end.

2.3 Forces that could cause more frauds

2.3.1 Covid Pandemic and its effect on the economy

The covid pandemic can be considered as one most serious and major pandemics that affected the economy worldwide. Many businesses were shut down and many employees lost their jobs. This economical issue caused huge financial damages to many firms, which could lead to an increase of the fraudster to commit frauds over such companies. The demand of every customer changed during this pandemic since most customers started buying essential products and for saving money, they started avoiding luxurious brands. These major changes shift the focus of most of the senior management into finding ways to earn profits. This change of focus can get fraudsters to use this opportunity to do fraud in a company for their financial gain. According to Van Akkeren and Buckby (2017), financial issues are some of the main reasons why a person commits financial fraud. This pandemic has already damaged the business and service industry and has made them weak against future frauds. This major change in the business can cause many small or big frauds in the future.

2.3.2 Informational and behavioural frictions

Consumers are the main purpose for a business function. According to Rotman et al. (2018), a consumer knows when a firm cheats and once they know about it they shift their focus to a company that provides them with better benefits. When information about a company’s fraudulent behaviour is exposed in the long run it becomes cost-intensive for a company to manage and defuse those claims. Some firms, when trapped in these issues, try to come up with an irrational reason to keep the reputation of the company intact, however, this information and behavioural frictions could cause issues in the future that could be related to even more frauds.

2.3.3 Income inequality and institutional mistrust

There are many companies and organisations where it has been discovered that there was an inequality of income among employees. It can be argued that if a company acts partially among their employees, conflict arises which causes many employees to distrust the company they work for. According to Solt (2016), an increase in income inequality could cause a decrease in security laws. This decrease of law would make an employee very poor whereas making the owner of a company very rich. However, there are also certain employees who do not accept unjust treatment and instead commit fraud over the company’s resources to earn their own benefits. In the long run, income inequality can cause more fraud in the company. Institution mistrust is also a major issue since it makes a company go into loss. As stated by Richman (2017), a breakdown in the institution’s trust can cause a downfall of a company and make it prone to many frauds. When a company is not able to stand up to its moral values and ethics, people working for that company tend to develop a sense of mistrust, which could make a company prone to many different frauds.

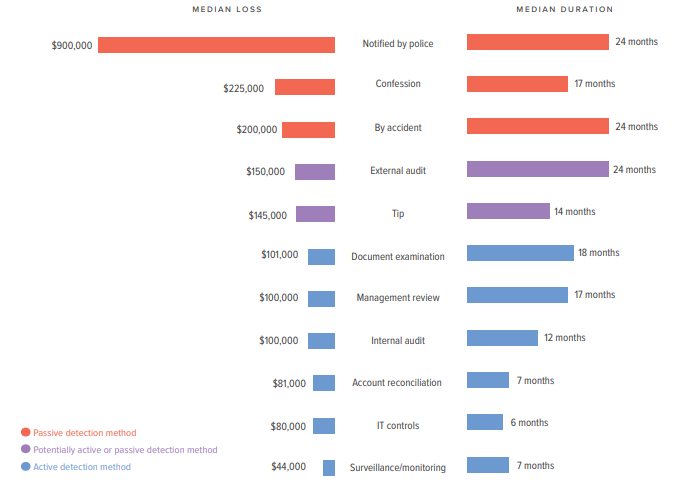

2.4 Detection

Detection of fraud is most important since at what speed the fraud has been detected can have a major impact on the size of the fraud. If the fraud is detected early the overall size of the fraud can be minimized, however, if the fraud is not detected the company would keep incurring losses. It can be argued that, if a company are not able to provide a proper resource for effective detection of fraud in the end a company might suffer major losses. Fraud can be detected by anyone, it can be an employee or a customer or it may even come from an anonymous source, however, determining the methods of fraud is also important so that steps could be taken to rectify such frauds. According to Mangala and Kumari (2017), an employee detects most of the information related to fraud. In the below table it has been mentioned accordingly how different detected sources might increase or decrease the duration of the fraud. It can be stated that if the detection of the fraud comes from an authentic source, mitigating the fraud becomes easier, however, if the source is not authentic the company might suffer from even more median losses.

Figure 2: Detection method related to fraud loss and duration

(Source: Amazonaws.com, 2020)

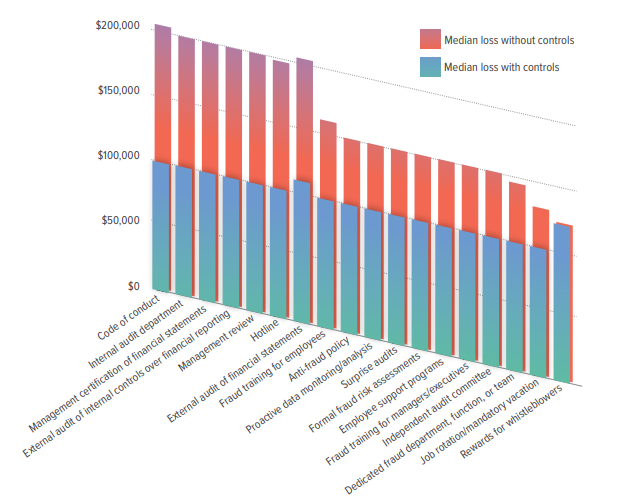

2.5 Anti Fraud Controls

Anti Frauds controls play a major role to ensure that an organisation are able to take initiative to fight and protect itself from any sort of fraud. These controls might not be able to ensure that an organisation might be properly protected from fraud; however, it ensures that measures are taken to prevent any manor frauds from happening. Anti-fraud control also ensures that in case of fraud has already occurred, proper measures are taken to detect the source of fraud and who committed the fraud (Levi and Doig, 2020). One of the most common anti-fraud controls is to hire an external auditor who effectively reviews the financial statement of a company. They check over the financial audit of a company and identify different places where fraud is occurring so that proper initiative can be taken by the company to handle the fraud. However, anti-fraud controls are not always effective since it is time-consuming and could cause company median losses in the long run. The only benefit is that the overall median loss of a company might reduce a little, but the company would suffer from losses.

Figure 3: Median losses with and without anti-fraud controls

(Source: Amazonaws.com, 2020)

3. Analysis- Discussion

The covid pandemic is still not over and this pandemic is still creating devastating impacts all over the globe. The number of people who are being infected due to this disease keeps increase, which makes the government of most nations start lockdown at times when the spread of the disease is uncontrollable. According to Mofijur et al. (2021), this lockdown has affected the growth of many organisations and businesses and has led many nations to suffer from economical crises. Therefore, it can be said that these issues can create a ground where fraudsters can commit fraud in a company for their own benefit. The combination of the crisis on both finance and health has made many people and companies prone to fraud. In some countries, sit has already been reported that many local and criminal gangs have targeted businesses premises to steal products and stocks. Many employees have already lost their jobs and those who still have their jobs are less motivated to work because of the extra work pressure. This work pressure can also cause many employees to commit fraud in the company. Since many companies are still unable to assess the response of the employees in this economic crisis, there are major chances that for financial benefit an employee might try to commit fraud.

Various key points have been discovered during the pandemic that might increase the risk of fraud. One of the first discovers risks are tracking down new suppliers and business partners so that the business can be continued. As stated by Lüdeke-Freund et al. (2019), before engaging in a business with a new partner it is important to analyse if it is safe to conduct a business with them. Certain companies are trying to take this risk, which is increasing the risk of them getting affected by fraud. Since they are also hiring new suppliers and agents to conduct business without analysing these agents would make them prone to frauds.

Another issue has been that this pandemic has caused many businesses to change their strategy and model to conduct business. The newer business models and strategies focus more on managing operations rather than taking measures to fight fraud. Since fewer employees are working the work pressure has already increased. This has caused many companies to temporarily transfer the staffs that were working in the anti-fraud department to the operation department. This transfer of employees could cause a company to suffer from financial fraud in future. Every company have suffered financial loss during this pandemic, which has reduced the resources of the company to keep itself secure from any upcoming frauds.

Even though many companies friend to retain their employee by providing various benefits, certain employees quit jobs because of the fear of being infected. This has led many companies to hire newer employees, but since the resources are low, companies are not able to assess these employees, which make them prone to any future frauds. According to Mofijur et al. (2021), many people understood the importance of money during the pandemic. There are many chances that some hired employees might be suffering from financial issues. These certain employees can initiate asset misappropriation, steal company resources, misuse and later company data and cause fraud in the financial audit of a company that could affect a company financially. This makes it important for the companies to not lose their focus during the pandemic. Companies but work on creating models and strategies that can keep a lookout on frauds as well as ensure that company operation work is effective. It can be argued that if a company fails to put the required resources to keep a check over upcoming frauds, in future a company might face a major risk that might permanently shut down its operations.

4. Conclusion

According to discussion, it can be concluded that the Covid pandemic has negatively affected business operations all over the world. This has caused many businesses to change their strategy and has made them shift their focus to improving their operational activities. This had diverged the focus of the company to keep a lookout on any upcoming fraud that a company might face. This pandemic is not yet over which makes it important for companies to create a business plan that would make sure that the company is secure from any future frauds as well as their business operation are improved. During this pandemic, a company must be more aware and alert about its internal structure so that no financial issue or fraud occurs.

References

Journal

Karpoff, J.M., 2021. The future of financial fraud. Journal of Corporate Finance, 66, p.101694.

Levi, M. and Doig, A., 2020. Exploring the ‘shadows’ in the implementation processes for national anti-fraud strategies at the local level: aims, ownership, and impact. European Journal on Criminal Policy and Research, 26(3), pp.313-333.

Lüdeke‐Freund, F., Gold, S. and Bocken, N.M., 2019. A review and typology of circular economy business model patterns. Journal of Industrial Ecology, 23(1), pp.36-61.

Mangala, D. and Kumari, P., 2017. Auditors’ perceptions of the effectiveness of fraud prevention and detection methods. Indian Journal of Corporate Governance, 10(2), pp.118-142.

Mofijur, M., Fattah, I.R., Alam, M.A., Islam, A.S., Ong, H.C., Rahman, S.A., Najafi, G., Ahmed, S.F., Uddin, M.A. and Mahlia, T.M.I., 2021. Impact of COVID-19 on the social, economic, environmental and energy domains: Lessons learnt from a global pandemic. Sustainable production and consumption, 26, pp.343-359.

Richman, B.D., 2017. An autopsy of cooperation: Diamond dealers and the limits of trust-based exchange. Journal of Legal Analysis, 9(2), pp.247-283.

Roden, D.M., Cox, S.R. and Kim, J.Y., 2016. The fraud triangle as a predictor of corporate fraud. Academy of Accounting and Financial Studies Journal, 20(1), pp.80-92.

Roggeveen, A.L. and Sethuraman, R., 2020. How the COVID-19 pandemic may change the world of retailing. Journal of Retailing, 96(2), p.169.

Rotman, J.D., Khamitov, M. and Connors, S., 2018. Lie, cheat, and steal: How harmful brands motivate consumers to act unethically. Journal of Consumer Psychology, 28(2), pp.353-361.

Schuchter, A. and Levi, M., 2016. The fraud triangle revisited. Security Journal, 29(2), pp.107-121.

Solt, F., 2016. The standardized world income inequality database. Social science quarterly, 97(5), pp.1267-1281.

Van Akkeren, J. and Buckby, S., 2017. Perceptions on the causes of individual and fraudulent co-offending: Views of forensic accountants. Journal of Business Ethics, 146(2), pp.383-404.

Velavan, T.P. and Meyer, C.G., 2020. The COVID‐19 epidemic. Tropical medicine & international health, 25(3), p.278.

Website

Amazonaws.com, 2020 Global study on occupation Fraud and Abuse available at: https://acfepublic.s3-us-west-2.amazonaws.com/2020-Report-to-the-Nations.pdf [Retrieved on: 8th December 2021]

………………………………………………………………………………………………………………………..

Know more about UniqueSubmission’s other writing services:

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://www.binance.com/en/register?ref=YY80CKRN

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.