Risk & Procurement Management Assignment Sample

Master of Science Project Management

Introduction

The British Airports Authority (BAA), a major airport operator, realised in 1986 that it would need to develop a new method of project delivery in order to finish projects on time and within budget. This realisation occurred in 1986. Several years before the start of construction on the airport, the British Airports Authority (BAA) conducted a two-year in-depth study of every major UK construction project worth more than GBP 1 billion that was completed in the previous decade, as well as of every international airport that had been in continuous operation for more than 15 years (Picciotto,2019). A result of the study, the project’s planning phase was successfully completed in 2002, and the project’s construction phase, which began in 2003 and was successfully completed in 2004, was successfully completed.

Key Risk areas involving risk management BAA Heathrow Terminal 5

Following the findings of this benchmarking investigation, it was discovered that no large-scale construction project in the United Kingdom has ever been successfully completed on time and within budget while also meeting contractual quality standards; in addition, only a small number of projects have a positive safety record, according to these findings (Chofreh,2019). As a result of the ongoing investigation, the conclusions of this study indicated that no new airport had opened on time the previous year, as had been predicted.

Multi Risk Management Process

T5 is expected to cost more than GBP 1 billion more than it can afford unless a radical new approach is adopted. It is also expected to be two years late, resulting in the deaths of six people as a result of the delays, according to BAA. According to the BAA, a lack of communication among project participants, as well as a client’s reluctance to assume project risk on their own, are two of the most significant reasons for the poor performance of megaprojects. It was necessary for BAA to recognise that it would be necessary to change the “rules of the game” by entering into a new style of partnership with its first-tier vendors in order to achieve the desired results on time and within budget in order to successfully complete a significant project on time and within budget. (Tereso,2019)

Risk Breakdown Structure

It was a relationship-based contract between BAA and all first-tier suppliers, which included architects and engineering design consultants, general and specialised contractors, and manufacturers. It served as the foundation for BAA’s project management approach and was signed by all of the parties involved. Traditional construction contract concepts were not used in this case, which was a departure (Farashah,2019). As a result of the agreement’s signing in December 2007, it produced a framework that differed from normal construction contract principles and served as the foundation for BAA’s project management strategy going forward (Chen,20129).

Identifying the risk using bow tie diagram

BAA’s legal and commercial divisions worked together on the writing of the contract, which was intended to decrease the number of issues that are often encountered with large-scale construction projects. In contrast to other agreements, the T5 agreement attempted to reward constructive problem-solving behaviours that would prevent failures from occurring in the first place rather than merely attempting to shift responsibility and collect money from suppliers. According to the traditional approach, a set of conditions must be established that admit the risk of failure before an attempt to shift responsibility and collect money from suppliers may be made. The BAA thinks that this position is crucial in the establishment of fully integrated project teams with suppliers, allowing them to achieve great results in their respective domains of expertise. (Ika,2020)

Cause and Effect diagram using fish bone diagram

In order to break away from the traditional practise of infrastructure clients selecting the lowest-priced bidder for their projects, which is widespread in the sector, the T5 agreement was developed. Customers had a prevalent idea that suppliers were attempting to take advantage of design errors and omissions in order to claim additional work that would help to balance the bid’s poor profit margins; however, this assumption proved to be incorrect. Disagreements between suppliers and clients over the legitimacy of these claims resulted in costly litigation in the majority of cases, resulting in production disruptions and delays throughout the process. However, the T5 agreement was created to encourage suppliers to follow best practises and achieve high performance while also actively seeking and providing reasonable and superior solutions to their customers, as opposed to the T4 agreement. (Larsson,2020)

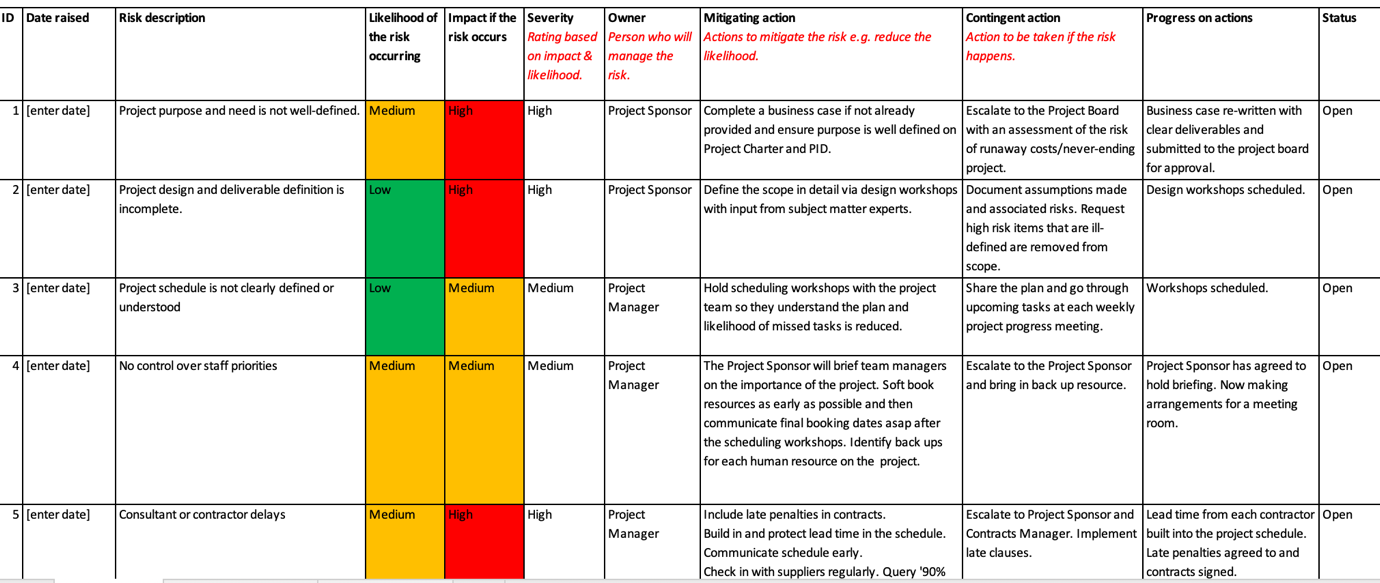

Risk Register

Probability Impact Matrix

The risk management strategy devised by BAA in T5 was both imaginative and innovative. The decision was reached that accepting entire responsibility for all risks would be the most effective method for the organisation in order to achieve price certainty and profitability. As a result, the contractors’ risk contingency was lowered, resulting in a reduction in the overall number of bids received. In order for this programme to be successful, incentives were required to urge all parties involved to work together in order to limit the likelihood of risk occurring.

Individual Risks

I couldn’t stress how important it was to avoid adopting the mindset of “it doesn’t matter, it’s not my bill” at all costs. In order to control risk, it was determined to employ financial incentives to compensate service providers who deliver high-quality services in exchange for compensation (Bjorvatn,2021). In 2004, it was observed that, despite the fact that risk mitigation was incorporated into each project during the design stage, the cost targets may be more onerous than originally anticipated. It was decided to move a total of £100,000,000,000 (GBP) from a number of different initiatives to a single central pot, which will enable for the deployment of risk contingency funds if and when they become necessary in the future. As a result of this contingency, the company was able to increase overall budget control because it provided better control over the financial implications of risk on a more global scale than previously. (Borkovskaya,2018)

Risk Mitigation Strategies

T5’s success was made possible on a number of levels by the establishment of trust through contractual processes; the formation of integrated teams, as well as the adoption of a novel contract style, all contributed to the establishment of trust among those participating in the project. The inherent risk associated with large and hard projects, it has been suggested by industry professionals, may inspire clients to seek out and reward innovation not only from contractors and suppliers, but also from members of the general public and other stakeholders. As a result of their proactive project risk management efforts on their own, the BAA was able to implement a strategy that rewards success while also fostering innovation from all of the stakeholders (Bjorvatn,2018). The amount of capital that the airport operator commits to investing in the following quinquennial period, as well as the amount of profit that the firm is permitted to earn in order to cover the amount of capital invested in the previous quinquennial period, determines the amount of inflationary price caps that are raised from one quinquennial period to the next. Therefore, the more money a private airport operator is authorised to invest in infrastructure improvements by the CAA, the more likely it is that the private airport operator will be able to charge higher fees to its passengers as a result of the CAA’s authorization.

Evaluation risk by qualitative and quantitative analysis

As a result, if specific trigger requirements are completed by the airport operator, airport fees will gradually increase as a result of this. As a result of failing to meet triggers, the operator’s maximum billable amount for an activity in which a trigger was violated is decreased by the amount by which the trigger was breached. On the other hand, price capping limits the amount of control that operators have over how and where their money is invested; the system forces operators to collaborate with the airline community and the CAA in order to decide the most efficient use of the funds. A further advantage of participating in the Quinquenchurium is that all airlines contribute to it and pay the same fees as an operator, putting them in a competitive position to gather resources for the Quinquenchurium. Because all airlines participate in it and pay the same fees as an operator, they are in a competitive position to gather resources for the Quinquenchurium. In the instance of T5, when a significant sum of money is invested in a new terminal that only benefits a small number of airlines, it is likely that other airlines may harbour animosity toward the new terminal. This was the situation in the instance of T5. The following question was posed by Mark Johnson, a Star Alliance officer based at Heathrow, who caused the flight to T5 to be delayed, resulting in the trip being delayed as a result.

Conclusion

Several Star Alliance member airlines, as well as their subsidiaries and affiliates, are contributing to the establishment of an international university on the T5 campus, with Star Alliance members providing more than a quarter of the funds for the project. It is predicted that the T5 campus will open its doors for the first time in the fall of this year. It is plausible to question if competitive parity will be attained for all Star Alliance member countries at the same time as a result of these revisions, taking all of these factors into consideration.

Recommendations

Additional penalties can be levied by the CAA against operators that fail to deliver on the promises they made to airlines when they initially began operating during the first year of the quinquennial period. Without first demonstrating to both the airlines and the CAA that the increased spending was justified, it is not allowed for operators to raise fees to recoup additional costs if they go over the agreed-upon budget for a particular project.

References

Armenia, S., Dangelico, R.M., Nonino, F. and Pompei, A., 2019. Sustainable project management: A conceptualization-oriented review and a framework proposal for future studies. Sustainability, 11(9), p.2664.

Bjorvatn, T. and Wald, A., 2018. Project complexity and team-level absorptive capacity as drivers of project management performance. International Journal of Project Management, 36(6), pp.876-888.

Chawla, V., Chanda, A., Angra, S. and Chawla, G., 2018. The sustainable project management: A review and future possibilities. Journal of Project Management, 3(3), pp.157-170.

Chen, T., Fu, M., Liu, R., Xu, X., Zhou, S. and Liu, B., 2019. How do project management competencies change within the project management career model in large Chinese construction companies?. International Journal of Project Management, 37(3), pp.485-500.

Chofreh, A.G., Goni, F.A., Malik, M.N., Khan, H.H. and Klemeš, J.J., 2019. The imperative and research directions of sustainable project management. Journal of Cleaner Production, 238, p.117810.

Farashah, A.D., Thomas, J. and Blomquist, T., 2019. Exploring the value of project management certification in selection and recruiting. International Journal of Project Management, 37(1), pp.14-26.

Ika, L.A., Söderlund, J., Munro, L.T. and Landoni, P., 2020. Cross-learning between project management and international development: Analysis and research agenda. International Journal of Project Management, 38(8), pp.548-558.

Larsson, J. and Larsson, L., 2020. Integration, application and importance of collaboration in sustainable project management. Sustainability, 12(2), p.585.

Müller, R., Drouin, N. and Sankaran, S., 2019. Modeling organizational project management. Project Management Journal, 50(4), pp.499-513.

Picciotto, R., 2020. Towards a ‘New Project Management’movement? An international development perspective. International Journal of Project Management, 38(8), pp.474-485.

Tereso, A., Ribeiro, P., Fernandes, G., Loureiro, I. and Ferreira, M., 2019. Project management practices in private organizations. Project Management Journal, 50(1), pp.6-22.

Wu, C., Wu, P., Wang, J., Jiang, R., Chen, M. and Wang, X., 2021. Ontological knowledge base for concrete bridge rehabilitation project management. Automation in Construction, 121, p.103428.

………………………………………………………………………………………………………………………..

Know more about UniqueSubmission’s other writing services:

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. https://accounts.binance.com/sv/register?ref=DB40ITMB