MBB7008M Accounting and Finance for Decision Making Best Assignment Sample

Introduction

The report is focused on developing a financial investment plan for Hotel Hilton. Hotel Hilton is the most renowned hospitality company around the globe. The company is known for its technological innovation and success. Looking at this, the investment opportunities and motivation behind the proposed investment will be done initially. It will then conduct an investment appraisal using both qualitative and quantitative information. The report will then discuss the risk and return along with its impact on financial performance. At last, recommendations will be made based on the entire analysis.

Motivation of the proposed investment

The impact of Covid-19 was drastic and enormous both financially and economically. It can be observed that the hospitality sector has been affected to a great extent because of travel restrictions and reduced domestic consumers because of lockdowns and this was a major reason for decreasing economies at hotel chains. Looking at this, Hotel Hilton has been chosen for developing a financial investment plan to enhance their economies. Hilton is the largest hospitality companies around the globe operating 6478 properties in about 119 countries (Kibe et. al. 2019). It can be observed that the need for health and safety among consumers visiting restaurants have been increased along with rapid advancements in technologies. It has been suggested that the restaurant must make an investment in digital technologies that helps in following all Covid-19 guidelines along with supporting rapid advancements in technology.

The primary motivation for this investment is to adopt digital technologies as it could help in offering better customer service, establish a competitive position, and helps in addressing the challenges because of Covid-19. Therefore, keeping this motivation is a concern it has been suggested that the company must make financial investments in bringing AI and robotics to the restaurant for servicing customers, cleaning tables, taking orders, and billing purpose (Yang et. al. 2020). This would help the organisation in adopting the latest technologies of artificial intelligence along with keeping the health and safety of consumers in concern by taking a step for stopping the spread of the virus.

This investment is not only beneficial for offering excellent customer service but also helps in collecting customer data that could further help in marketing new product launches and sending discounts to the regular customer as per Drexler and Lapré, (2019). Hence, the adoption of this technology also helps the restaurant in dealing with the future unpredictable situations of Covid-19. It can be seen that in past days’ online delivery was accepted even in the lockdowns when the situation was under control. According to Cain et. al. (2019) with the help of AI and robotics, they can meet online delivery with less human labour.

Conduct investment appraisal

Investment appraisal is described as an input to the investment decisions that support the decision made by the board of governance or sponsor justifying the investment in a project or program. It offers the justification and rationale for spending resources and depends on a robust investment appraisal. Both qualitative and quantitative investment appraisals will be discussed.

Qualitative investment appraisal

Customer satisfaction with company’s products: Customers are described as the primary asset of any organisation’s success as satisfied customers will tend to return more in comparison with unsatisfied customers (Zwikael et. al. 2018). Their purchasing decision is responsible for affecting the sales, growth, and profitability of the organisation. Looking at this factor, before making any financial investments it is necessary to identify whether the customers are satisfied with the company’s products and services. It would help in analysing the success of the investment and either it can increase profitability. For example, if Hotel Hilton is capable of meeting regular changing consumer needs they would probably return to their products and services. From the analysis, it can be seen that Hilton offer great food on their menu that is highly liked and preferred by customers as per their feedback. Therefore, making this investment would be beneficial.

Economic and market environment: The competitiveness in the hospitality sector is increasing continuously due to the establishment of several SMEs that offers great food and taste at affordable rates (Majid and Vanstone, 2018). This can affect the customer base and look at increased competitiveness, this financial investment is required to keep setting a competitive score among other competitors. Establishing these technologies will require huge investment but it is beneficial in securing a competitive edge along with attracting more consumers as it helps in assuring more safety in comparison with other restaurants.

Size of investment: It will require huge investments and funds to bring it into reality and with this, the risk also increases. There is a slight probability of business risks but the likelihood of achieving success is more after making investments (Marchioni and Magni, 2018). To assure the company can first bring one robot instead of bringing 3-4 robots initially for servicing customers. If the adoption of robotics helps in increasing profitability then they can develop more robotics as per demands and requirements.

Quantitative investment appraisal

Some quantitative investment appraisal techniques include internal rate of return (IRR), Net present value (NPV), accounting rate of return, payback, and many more. The company must use net present value (NPV) for making a financial investment (Chrysafis and Papadopoulos, 2020). Net present value is described as the difference between the present value of cash inflows and the present value of cash outflows over some time. It is used as a capital budgeting and investment plan for analysing the profitability of financial investments. It could include problems like inflation, taxation, cash flows, and working capital.

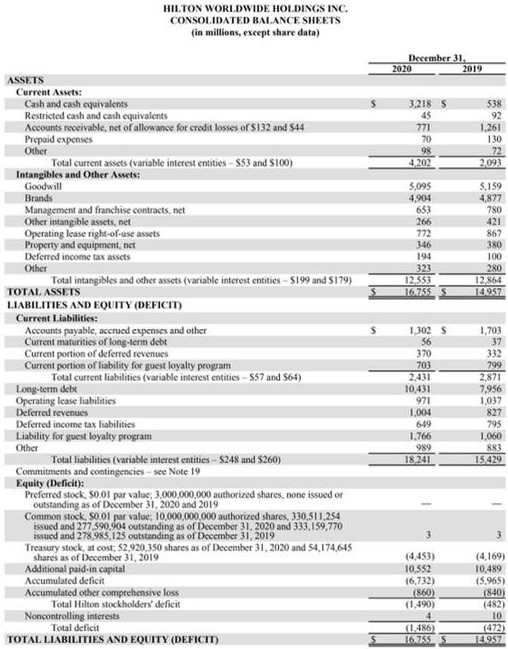

Figure 1: Hotel Hilton cash flow statement.

(Source: Hilton Worldwide Holdings Annual Report 2021, 2021)

The cash flow statement of Hotel Hilton states that the company is capable of making investments and the success of the hotel worldwide could benefit them in implementing robotics in their restaurants as well. As the lockdown restrictions are now removed individuals have also started travelling and this has the potential to increase future profits and reduce the loss they have to suffer in 2020-21 due to the pandemic. For example, if the project will cost $2000 and have the four cash flows of $500, $700, $600, and $800 over the next four years. Assume there is no salvage value at the end of the project and the rate of return is 15%. As per Kelly et. al. (2019) after calculating NPV, it can be said that this project has the potential to generate income faster and could help in addressing the loss faced during the pandemic.

NPV of project= $500/ (1+0.15)1 + $700/ (1+0.15)2 + $600/ (1+0.15)3 + $800/ (1+0.15)4

NPV of project= $434.78+ $529.30+ $394.50+ $457.40

NPV of project= $1815.98

Risk and return

While investing, risk and return are highly correlated. It can be said that increased potential risks if the return on investment is more as both of the terms goes hand-in-hand. Several risks include market risk, international risk, competitive risk, industry-specific risk, project-specific risk and more (Singh et. al. 2019). Return on investment is defined as a random variable that takes any value within a given range. Some factors that can influence types of returns that investors expect from trading in the markets. Analysing risks are necessary to reduce the impact on returns as well because risk has the potential to reduce return on investment.

Financial risk: Financial risk is the major risk that could affect the project success and financial performance of the company. It is probable that at any stage organisation is not capable of providing adequate financial resources due to the loss the hotel is currently suffering because of the impact of Covid-19. It can affect the project’s completion along with stopping the project. It is necessary to make financial plans before working on the project like budgeting, required resources, and more (Savva and Theodossiou, 2018). It would help in identifying whether the company is capable of investing and bringing innovation. Therefore, addressing this risk will help in the successful completion of the project along with increasing returns on investment. It will increase the investment and it increases the time to get the finances that have been invested in the project.

Competitive risk: There are several hospitality companies like Marriott giving tough competition to Hotel Hilton. Both the hotels have robotics and the planning of implementing robotics at restaurants is different from Marriott. The Marriott Hotel might be planning to bring in technologies or product innovation to establish a competitive position. Hence, this risk is less controllable as the company won’t be able to identify the planning and moves of Marriott. This risk comes with the potential to reduce the return on investment. Competitive risk has the probability to impact the financial performance due to reduction in profits and sales.

Risk of major delays: As the project is huge and requires huge investments, there is the probability of delays that can further increase the cost and financing of the project. It is also responsible for delaying return on investment as well. The organisation must analyse the most probable delays; so they can plan financially for the project beginning (Gondia et. al. 2020). Further, the organisation must aim at utilising its resources to their fullest so the likelihood of future delays can be reduced or eliminated. For this purpose, it is necessary to identify required resources like employees, technologies, team, and finances before project initiation so delays because of lack of these resources can be avoided. Delays have the probability to affect financial performances as it will delay the return on investment as well.

Conclusion and recommendations

From the entire analysis, it has been concluded that Hilton needs to plan strategically and financially before making such a huge investment. It can be observed that financial planning for bringing AI and robotics is huge and it is risky as well but has the potential to increase profitability. Looking at this, it is must conduct an investment appraisal to analyse whether it is beneficial to invest or not. From the analysis, it could be depicted that the company should make this investment as they have brand image and reputation, potential customer base, and great amenities to offer. The company must use NPV for calculating future cash flows. They must focus on financial risk, risk of major delays, and competitive risk to reduce the impact on financial performance.

It has been recommended from the entire analysis, that the company must develop a financial plan for the entire project before project initiation. They must include budgeting, resources required, costing of resources, labour, and keeping some finances for managing future unpredictable risks. It would help them in reducing financial risk along with eliminating delays because of lack of finances and proper resources. Other than that, it is suggested that before deploying the robotics in front of customers they must check the robot functioning twice to address any technological issues.

References

Cain, L.N., Thomas, J.H. and Alonso Jr, M., (2019). From sci-fi to sci-fact: the state of robotics and AI in the hospitality industry. Journal of Hospitality and Tourism Technology.

Chrysafis, K.A. and Papadopoulos, B.K., (2020). Decision making for project appraisal in uncertain environments: A fuzzy-possibilistic approach of the expanded NPV method. Symmetry, 13(1), p.27.

Drexler, N. and Lapré, V.B., (2019). For better or for worse: Shaping the hospitality industry through robotics and artificial intelligence. Research in Hospitality Management, 9(2), pp.117-120.

Gondia, A., Siam, A., El-Dakhakhni, W. and Nassar, A.H., (2020). Machine learning algorithms for construction projects delay risk prediction. Journal of Construction Engineering and Management, 146(1), p.04019085.

Kelly, B.T., Pruitt, S. and Su, Y., (2019). Characteristics are covariances: A unified model of risk and return. Journal of Financial Economics, 134(3), pp.501-524.

Kibe, J., Ogutu, H. and Ojwach, S., (2019). Efficacy of the use of mobile applications on front office operations; A case study Hilton Hotel Nairobi. Journal of Hospitality and Tourism Management, 2(1), pp.1-16.

Majid, U. and Vanstone, M., (2018). Appraising qualitative research for evidence syntheses: a compendium of quality appraisal tools. Qualitative health research, 28(13), pp.2115-2131.

Marchioni, A. and Magni, C.A., (2018). Investment decisions and sensitivity analysis: NPV-consistency of rates of return. European Journal of Operational Research, 268(1), pp.361-372.

Savva, C.S. and Theodossiou, P., (2018). The risk and return conundrum explained: International evidence. Journal of Financial Econometrics, 16(3), pp.486-521.

Singh, A., Shrivastava, P. and Kambekar, A.R., (2019). Financial Risk Assessment of Public Private Partnership Project. Proceedings of Sustainable Infrastructure Development & Management (SIDM).

Yang, L., Henthorne, T.L. and George, B., (2020). Artificial intelligence and robotics technology in the hospitality industry: Current applications and future trends. Digital transformation in business and society, pp.211-228.

Zwikael, O., Chih, Y.Y. and Meredith, J.R., (2018). Project benefit management: Setting effective target benefits. International Journal of Project Management, 36(4), pp.650-658.

Online

Hilton Worldwide Holdings Annual Report 2021. (2021). [Online]. Accessed through: <https://stocklight.com/stocks/us/accommodation-and-food-services/nyse-hlt/hilton-worldwide-holdings/annual-reports/nyse-hlt-2021-10K-21643552.pdf>

Know more about UniqueSubmission’s other writing services: