UMACLK-15-M Financial Statement Analysis Assignment Sample

Module code and Title: UMACLK-15-M Financial Statement Analysis Assignment Sample

Introduction

Equity analysis reports are comprehensive summation of both financial and non-financial data that provides insight upon any company. It is prepared by a research analyst to guide investors about reconsidering their investment portfolios. It shall refer to one company caressing its financial nuances along with qualitative aspects. This is supposed to surround typical information about such company that will guide its investors whether to purchase, sell, or hold their stocks for that firm. In this assignment, Next Plc will be ascertained with such data that could help investors to develop their opinion based on cited information.

Analyst’s Tearsheet

This tearsheet is prepared by scheming information from reliable sources that cite various information on Next plc’s perspectives during upcoming years. Similarly, it has information about current operatives and scope of the company.

| Particulars | Information |

| Market Price of Company’s Shares | Share opened at 6130.00 GBX

Share closed at 6190.00 GBX (Finance.yahoo, 2022) |

| Beta Value of Company’s Shares | Company’s current risk factor is valued at 1.4085. |

| Number of Shares Traded by the Company | Currently, Next Plc has traded 593.65k shares in the securities market. |

| Earnings per Share | 524.00 GBX |

| Price Earnings Ratio | 11.81 times |

| Consensus Recommendation | Recent recommendations suggest to hold this stock as it has utmost potential to outperform its value in upcoming periods. It is supposed to maximise its range to overcome this dip it has experienced during 2021. Suggestions have seemed to improve from their past bearings as experts qualify to buy this stock, marginally. |

| Forecast of Share Price | Experts have opined that the price target of this share is supposed to experience a height of 9680.00 GBX during next 12 months with a low of 6000.00 GBX only (Markets.ft, 2022). Median target for this company is expected to remain balanced at 7184.50 GBX during that same period. An estimated growth rate in this region is expected to marginalise by 16.07%. |

| Dividend Forecast of Next Plc | During 2022, this company has surfaced an amount of 1.27 GBP. It is expected to grow by a minimal margin of 71.18% during 2023 to result in 2.17 GBP (Markets.ft, 2022). experts have further coined this value to increase up to 2.34 GBP in 2024. |

| History and Estimate of Earnings | During 2021, this company had failed miserably by earning only 221.9 per share. This is expected to double in 2022 at 524 per share (Markets.ft, 2022).

Further, it shall make a statement of continuity in its performance by 547 and 564 during 2023 and 2024, respectively. |

| Revenue Expectations | During 2021, revenue suggested for this company has borne 3.53 billion experiencing a major drought in its last few years. Thereafter, in 2022 such revenue shall grow up to 4.63 billion (Markets.ft, 2022). Finally, estimates suggest par 5 billion during 2023 and 2024. |

Company Profile with Segmental Analysis

Next plc is a renowned British multinational organisation that was established in 1864, almost 150 years ago. There were subtle changes made to its operating regime to accept the name of Next under the conceptualisation of George Davis. This company has been into fame for their explicit range in context of footwear, clothing, accessories, home, and beauty products (Londonstockexchange, 2022). They are regarded as exceptional retailers with an amazing strength of 700 stores across UK. It has been learnt that they are headquartered in Enderby of England in UK. This company is known to categorise their operations across Asia, Middle East, and Europe along with UK as its base. They have been regarded as one of the largest retailers of clothing in UK having surpassed Marks and Spencer during early 2010s.

This company has been listed on LSE and are a consistent constituent of index led by FTSE 100. It is known for operating on both physical and online mediums. They have an extensive reach in as many as 36 countries through franchise partners that operate almost 190 stores apart from UK (Forbes, 2022). Next Plc is currently operating with an employee strength of 25.49k across this globe. Being incorporated in 2002, they have excelled their revenue figures to 4.63 billion in 2022 with an exciting retention of 677.50 million pounds. Management of this company are praised for their effective distribution network that is facilitated by a superior combination of logistic operations and warehouses.

Segments of this company are reallocated in terms of online, retail, finance, international retail, and sourcing. Amongst them Next Online has performed incredibly during period ended 2021 causing segmental revenue of 2279.5 million pounds. This was followed by retail sector that claimed 952.2 million pounds. Thirdly, their sourcing department upheld their collection with an astonishing figure of 401.4 million pounds elevating their scope of profitability by far. International retail and finance managed to score 283.5 million only. Profitability steeped for online and finance but were severely affected in terms of retail that incurred losses of 205.9 million (Statista, 2022). Similarly, sourcing and international retail also shot down by 50% margin since last year. Such breakdown in their economy during this phase resulted in a downfall by more than 52%. Trading profits were as much as half during 2021 than what was reported in 2020. Loss from property management further scaled this margin to increase and result in more losses than reconciled in 2020.

Competitor Analysis through Porter’s Five Forces Model

Next Plc has an effective range of competitors listed with the likes of Burberry Group, LPP SA, Zalando SE, Associated British Foods plc, and H&M. They have been running shoulder to shoulder to match their grades while competing in this industry. H&M are leading this track offering them competition with a market cap of 15.07 billion pounds. Projecting Porter’s 5 forces model into this frame shall give an effective view of multiple aspects that should be considered while choosing to invest in their operations (Kurnianto et al., 2019). It will categorically visit rivalry enforced by such peers in that market, bargaining power of buyers and suppliers along with threat of new entrants and substitute products in that market. Apart from those mentioned in this above list of peers, there are other peers who seek to attract customers by their effective pricing and quality. Moreover, covid 19 pandemic has certainly made this foreground more dynamic and challenging for existing retailers in this business.

Figure 5: Porter’s Five Forces Model (Source: Kurnianto et al., 2019)

Figure 5: Porter’s Five Forces Model (Source: Kurnianto et al., 2019)

Number of peers suggest tough competition for Next Plc in this particular industry. There are stupendous chances of declining margins of profitability with so many participants in this race. It also marks their availability of substitutes in that market which makes it more tough for Next Plc to reverberate their sales figures. Incompetency shall flow in with this context of competition received from external forces in that operating sector (Anastasiu et al., 2020). Peers with larger capital forces always have an advantage over low scale operators in this industry. Improvised machinery and low cost production techniques will square them off that grid with economies of scale being enforced. Although this market has been declining since past few years and international competitors forging in, Next Plc is likely to be suppressed with malignancy of profits during recent years. It is critical on their part to develop forces by expanding their production to countries with low labour costs.

Suppliers are fascinated by this trial as they enjoy such autocracy of sincerely bargaining their profitability due to existence of so many retailers. Similarly, buyers are also at a gaining position due to such a flare of variety at their disposal. In this case, they are open to choose from such a wide range of products that are competent with each other in terms of quality and pricing. Bargaining power of buyers are at their best since they have such an option to give up one choice for another. Thus, companies will have to secure their place by compromising on their course of profitability (Stål et al., 2022). New entrants are not that feasible in this context since Next Plc has already secured its market position by effectively crafting their way through prepared market bases. It shall take heavy investment on part of new entrants to compete in this market. Moreover, diversification and selective marketing from this organisation’s end can fetch them a larger market proportion than currently optimised.

Business Model of Company and Corporate Strategy

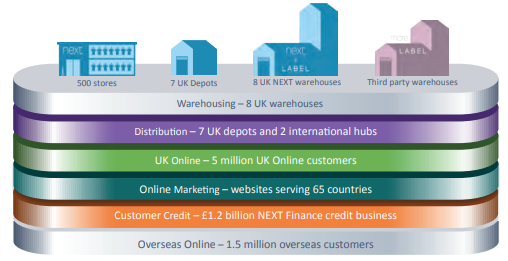

Next Plc has an effective business model through which they seek to survive on this platform. They operate in routes on both online and offline shores to expand their wings of operation by cultivating sales through physical stores, their own website, and third party websites. Alongside, their operations are not limited to selling their own products only. It has been extended to sharing their platform with third party businesses that seek their medium to distribute their goods. In this process, they earn through commission subjected from such sales (Nextplc, 2022). Apart from that they also own subsidiaries that manufacture and sell their own products to equip profits at end of each period. Since establishing their online mechanism, stores have been sorted as their supplementary units that facilitate spinning their stocks around this wide market. As mentioned earlier, their effective network of warehousing and logistics create larger opportunities for them to excel in this context.

Figure 6: Business Model of Operation (Source: Nextplc, 2022)

Figure 6: Business Model of Operation (Source: Nextplc, 2022)

Apart from 500 stores in UK itself, there are 7 depots, 8 warehouses, and 2 international hubs through which they manage their business operations. Maximum stock for international online retailing is cleared through those 2 international hubs and UK warehouses. Label, their online business is invested in selling more than 1000 third party branded products over which they claim substantial commission. Lipsy is another brand considered as their wholly owned subsidiary that caters to products for young women (Theguardian, 2022). They strictly aim to fulfil customer satisfaction by enduring them services which are competitive in this market. Moreover, they source their products from suppliers that guarantee quality and design for a long time. Alongside, they focus on maintaining their margin through controlling costs by means of managing their stocks and sourcing their products efficiently. An overall strength of 1.5 million overseas customers infuriates their magnitude of sales in other countries.

Summary of Financial Statements

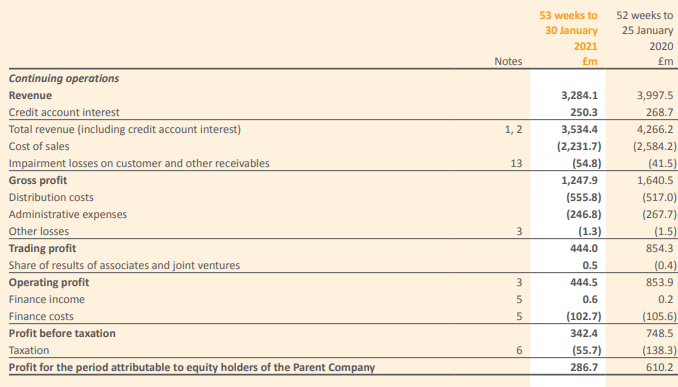

Discussing financial statements of this company shall include various details about their income statements, balance sheet, and cash flow. It will necessarily excavate information that qualifies their profitability, financial position, and liquidity position. Revenues of this company have experienced a sudden downturn by 700 million GBP resulting in only 3534 million GBP during 2021. Previously, it was recorded at 4266 million GBP (Nextplc, 2022). This shall inevitably reduce their profitability by substantial extents. Alongside, cost of sales had also dropped but marginally by 250 million GBP. It can be said that their scale of operations had been reduced during this period due to pandemic. Consequently, gross profit also scaled down to qualify only 1248 million GBP.

This is only 35% of their income generated during 2021. Distribution costs had elevated marginally but administrative expenses ruled downwards. Both changes were marginal but that affected their operating profit by subsequent margins. Operating profits during 2021 was computed at 444.5 million GBP whereas it projected 853.9 million GBP during 2020 (Nextplc, 2022). Therefore, 50% downfall is experienced in this region. Contrastingly, their financial costs remained similar to previous year’s context. It further derailed their opportunity to report substantial profitability during 2021. Averaging such expenses in comparison to their income generated caused them an effective downpour by 324 million GBP since 2020. Profits recorded for that period totalled at 286.7 million GBP.

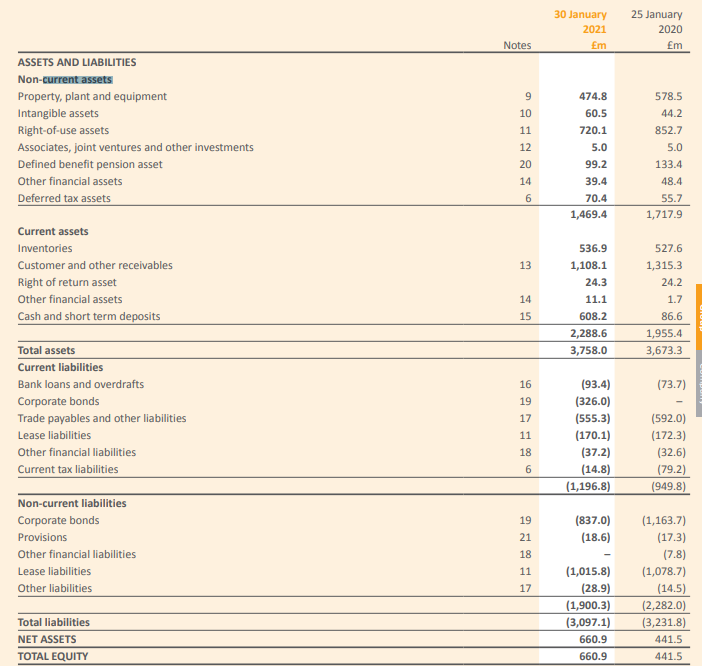

Fixed assets of this company were reduced during 2021 by almost 250 million GBP. This was a significant change in their financials during this period. Inventory levels were maintained at same square like that of previous year. Trade receivables were affected by almost 200 million GBP. Contrastingly, it was computed that their cash equivalents rose by substantial margins. It was reported at 608.2 million GBP experiencing a growth of 7 times their previous holdings (Nextplc, 2022). Current liabilities spiked up due to incoming funds through corporate bonds subscribed during that year. Non-current liabilities rather reduced to marginalise their growth options by subtle margins. Interestingly, equity was raised by this firm by 220 million GBP during this phase. Cash flow suggested that this firm had reduced their financial outflow by substantial margins by reconsidering their repayment of bank loans. Although investing activities also forged outflow, cash from operations compensated for these incremental expenses.

Financial Ratio Analysis, Trend Analysis, and Industrial Comparison

| Ratios | Next Plc | Industrial Figures | Trend Analysis |

| Price Earnings Ratio | 11.81 times | 11.6 times | 0.21 times |

| Gross Profits Margin | 43.25% | 40.46% | 2.79% |

| Net Profits Ratio | 14.65% | 12.1% | 2.55% |

| Return on Equities | 81.09% | 67.06% | 14.03% |

| Returns on Assets | 17.51% | 15.2% | 2.31% |

| Inventories Turnover Ratios | 4.49 times | 4.24 times | 0.25 times |

| Dividend Pay-outs Ratio | 50.85% | 21.79% | 29.06% |

Table 1: Industrial Analysis (Source: Ons.gov, 2022)

Following these facts and figures, it can be said that Next Plc is operating on a sound scale due to their effective positioning against different financial ratios. In depth analysis will project that their management has been very efficiently managing their trail by optimising funds at their best utility. Price earnings ratio has shown significant continuity since past years to report higher than industrial trends. Similarly, profit recovery has also been in favour for this company. Gross margin too has lead over industrial figures commanding resistance from direct expenses. Returns on equity for this company have an effective display of comfortability for its shareholders. Enhancing their scope by substantial margins will suggest more investors to bank for their stocks. Similarly, returns displaced on assets are also higher than industrial figures. This gives Next Plc an edge over its competitors to magnify their income opportunities in future.

High returns shall pool new investors in their capital comprehension thereby facilitating increased management of working capital. Such an amount of funds will suggest smoothness in their operations thereby halting their losses for upcoming periods. Inventories turnover is in parity with industrial figures which can be focussed by their managers for improvement in their future transactions. It must be noticed that their dividend pay-out is way higher than industrial abilities. This will attract investors due to its positive implications. Managers of this firm must comply with effective pricing of their products to increase their volume of sales. This will help them to secure greater market proportions thereby declaring autonomy in their lead for sales in this industry. It will although affect their profitability in the short run but shall certainly increase their operational capacity reaping profits later.

Company Valuation and Relevant Models

Company valuation is the most important phenomenon while deciding an investment in that firm. It is supposed to affect their interest upon such an organisation by concluding what such organisation has to offer on their capital investment at a given point of time. For this purpose, various models are equipped to understand what a person has to pay or receive in terms of transacting that firm. It is reportedly understanding value of that firm for negotiating its economic or fair price in terms of commercial context.

As per dividend discount model, price of an organisation is interpreted as summation of all such dividend payments it is supposed to make in future. Such values are considered at their present value (Bask, 2020). As per this model, value of stock is decided by computing dividend per unit of stock divided by excess of required return over growth rate of dividend. It is also referred to as Gordon Growth model which assumes that an organisation is existent forever and is reported of constant growth in terms of dividend.

Asset based method of valuation is another context of evaluating a firm’s worth. It can be done by summing up different assets held by an organisation. Then such sum is deducted by all outstanding liabilities pursued during any period (Ma et al., 2018). Thus, NAV is computed to evaluate if replacement cost is sufficient enough to compensate for the worth of a company. It is also regarded as an asset based approach.

Free Cash Flow Model

| Factor | Amount (GBP) |

| Cash Flow generated through operating activities of Next plc | 824.8 million |

| Add: Expense in terms of Interest paid by that company | 102.7 million |

| Less: Taxation Shield for Expense of Interest | (55.7 million) |

| Less: Capital Expenditure for 2021 | (159.3 million) |

| Therefore, free cash flow of Next plc for 2021 is, | 712.5 million |

This model is prepared by every company to understand what amount of liquidity it has been able to maintain for meeting its creditors and investors. This is an efficient calculation for adjusting all non-cash expenses along with working capital modifications and capital expenditure of such company. Company is likely to manage their funds effectively during their next course of 5 years since they plan to execute their profitability by maximising their scale of operations. In this process, they shall be gaining subsequent gains that will be restored to their reserves while rest shall be used to pay out dividends and creditors. Dividend rates are also expected to rise, communicating investors to thrive for their stocks. Currently available funds shall be maximised in future with further issuance of shares for extracting substantial premium to organise their working capital (Essel and Brobbey, 2021). This computed amount of 712.50 million GBP shall be used by this company at their disposal for paying off their debts and investors with dividends and interest.

Conclusion

This assignment has concluded various details about Next Plc that is supposed to enhance investor portfolios. It can be assessed that this company has experienced a certain dip in their profitability but has an optimistic scope of growth in its upcoming periods. There is subtle movement in their stock prices since 2021 when their revenues dropped by significant margins. Following its expected increase during 2024, such shares are preferable to be obtained at this stage. Investors are likely to experience a capital gain by next two years if they hold on to their stock by this period. Surfacing substantial opportunities for new estimates, investors will have a scope for appreciated stock prices.

Reference List

Anastasiu, L., Gavriş, O. and Maier, D., (2020). Is human capital ready for change? A strategic approach adapting Porter’s five forces to human resources. Sustainability, 12(6), p.2300.

Bask, M., (2020). Pure announcement and time effects in the dividend-discount model. The Quarterly Review of Economics and Finance, 77, pp.266-270.

Essel, R. and Brobbey, J., (2021). The Impact of Working Capital Management on the performance of Listed Firms: Evidence of an Emerging Economy. International Journal of Industrial Management, 12(1), pp.389-407.

Finance.yahoo, (2022). About share prices of NEXT PLC. Available at: https://finance.yahoo.com/quote/NXT.L/ [Accessed on 4.4.(2022)]

Forbes, (2022). About stores and employee strength of Next Plc. Available at: https://www.forbes.com/sites/callyrussell/2019/09/24/next-knowing-the-customer-and-growing-full-price-sales/?sh=d38dcf0d4474 [Accessed on 4.4.(2022)]

Kurnianto, A.M., Syah, T.Y.R., Pusaka, S. and Ramdhani, D., (2019). Marketing Strategy on the Project Planning of Retail Business for Garage Shop. International Journal of Multicultural and Multireligious Understanding, 6(1), pp.217-228.

Londonstockexchange, (2022). About Next Plc’s whereabouts. Available at: https://www.londonstockexchange.com/stock/NXT/next-plc/our-story [Accessed on 4.4.(2022)]

Ma, J., Zhang, J., Li, L., Zeng, Z., Sun, J., Zhou, Q.B. and Zhang, Y., (2018). Study on livelihood assets-based spatial differentiation of the income of natural tourism communities. Sustainability, 10(2), p.353.

Markets.ft, (2022). About tearsheet analysis of Next PLC. Available at: https://markets.ft.com/data/equities/tearsheet/forecasts?s=NXT:LSE [Accessed on 4.4.(2022)]

Markets.ft, (2022). About tearsheet analysis of Next PLC. Available at: https://markets.ft.com/data/equities/tearsheet/charts?s=NXT:LSE [Accessed on 4.4.(2022)]

Markets.ft, (2022). About tearsheet analysis of Next PLC. Available at: https://markets.ft.com/data/equities/tearsheet/profile?s=NXT:LSE [Accessed on 4.4.(2022)]

Markets.ft, (2022). About tearsheet analysis of Next PLC. Available at: https://markets.ft.com/data/equities/tearsheet/summary?s=NXT:LSE [Accessed on 4.4.(2022)]

Nextplc, (2022). About business model of this company. Available at: https://www.nextplc.co.uk/~/media/Files/N/NextPLCV2/documents/companymeetings/business-model-jan20.pdf [Accessed on 4.4.(2022)]

Nextplc, (2022). About financial statements of this company. Available at: https://www.nextplc.co.uk/~/media/Files/N/Next-PLC-V2/documents/2021/annual-report-and-accounts-jan21.pdf [Accessed on 4.4.(2022)]

Ons.gov, (2022). About industrial statistics of UK retail sector. Available at: https://www.ons.gov.uk/businessindustryandtrade/retailindustry [Accessed on 4.4.(2022)]

Stål, H.I., Bengtsson, M. and Manzhynski, S., (2022). Cross‐sectoral collaboration in business model innovation for sustainable development: Tensions and compromises. Business Strategy and the Environment, 31(1), pp.445-463.

Statista, (2022). About profitability of Next Plc. Available at: https://www.statista.com/statistics/980346/next-plc-retail-and-online-sales-profit/ [Accessed on 4.4.(2022)]

Theguardian, (2022). About Lipsy. Available at: https://www.theguardian.com/business/2008/oct/03/next.retail [Accessed on 4.4.(2022)]

Appendices

Appendix 1: Balance Sheet

Appendix 2: Income Statement