33150 Operations and Information Management

Introduction of the company:

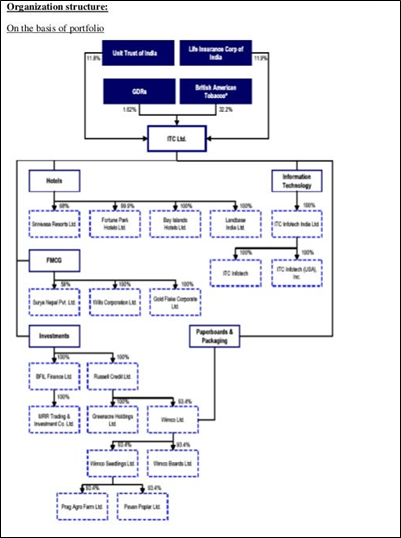

The “FMCG” stands for “Fast-moving consumer goods industry”, is among the biggest throughout India, but also there seem to be several businesses or organisations that do great throughout this segment. “ITC Limited” is, however, one investment firm that is primarily involved throughout the industrial production and investing in general merchandise. The corporate operates in a variety of industries, along with FMCG, Resorts, Computer Technology, Agriculture, as well as Paper products and Labeling. ITC Limited manufactures materials throughout the FMCG segment, including Foodstuffs, Tobacco items as well, Cigars, Personal Care, Essential Oils and Safety Matches, as well as Recognised Garments. The corporation has received numerous nationwide and worldwide honours for its manufacturing amenities and resorts throughout aspects of reliability, security, ecological managerial structures, and efficiency.

Process Design and Facility Layout of the company:

ITC is engaged in creating and production of distinctive items in an inventive manner across everything of its primary areas, including Fast-moving consumer goods, “Agri-Business, Resorts, Paperboards and Specialized Boards, Wrapping, and Computer Technology”.

Luxury hotel

ITC is, however, involved throughout the company of premium hospitality chain system throughout India. The operations of the ITC resort have been focused on providing the finest potential elegance while adhering to world-class environmental initiatives. ITC Hotels does have around 100 resorts including around seventy locations as well as has described benchmarks of expertise inside the hospitality market in various establishments, including culinary traditions, Hospitality, Customer Protection, and Surroundings (Panigrahi and Mohapatra, 2020). ITC has created four different types of lodging: Towers, “ITC One”, “Executive Lounge”, and “Eva”.

ITC Hotels’ Pricing Model: ITC Hotels offers a premium dedication to consumers as well as an exceptional valuation statement of eco-friendly property developers, and most of its premium resorts are located in relaxation and corporate tactical locations.

Solutions in Software Development (IT)

“ITC Infotech”, its information technology corporate altitude, furthermore offers IT facilities. This division comprises industry-friendly remedies to help customers succeed by combining virtual competence as well as intense database competence from ITC’s collective companies (Charles, Aparicio and Zhu, 2021). ITC Infotech’s major priorities often offer additional technology-oriented remedies and assistance to various ventures in various firms such as Medical Sector, Customer items, Finance and Insurance Assistance, Leisure and Tourism, and production.

IT component pricing model: “ITC Infotech” does provide worldwide virtual remedies to various companies. It affords distinguishable price concepts by constructing functionality all over multiple innovations, such as online and obstructive, and by doing so, it assists customers with virtual conversion.

Agri-Business

ITC also works inside the farming segment, along with the product, has established a powerful placement as a foremost business throughout India inside the farm company as a result of its involvement in reshaping and revolutionising the remote farming market. ITC has always been involved in operations such as global trade and residential investing of various farm brands, as well as it seems to be India’s widest supplier of such brands (Beriya, 2022). It supplies a few brands from Grain Production, Nutrient Condiments, Maritime Items, beverages, and Packaged Foods (both exports and national investing).

Pricing Model of Agricultural segment: ITC’s Agricultural investment contains a variety of goods, including caffeine, corn, wheat, soy protein, packaged veggies, wheat bread, and so on. Such goods aim to give consumers a distinctive valuation proposal by providing them with Agro-based resource alternatives via the powerful “e-Choupal” system, customised distribution connection, custom fit vulnerability managerial remedies, powerful farmworker collaborations, and so forth (Beriya, 2022). ITC has a unique remote virtual connectivity chain and in-depth understanding of farming methods, allowing it to offer buyers with high and inventive agro-based items.

Fast-moving consumer goods:

ITC seems to be an industry leader inside the FMCG industry throughout India. ITC’s FMCG sector’s brand investment contains “Food products, Hygiene Products, Schooling goods, Safety Matches, Tobacco products, Fashion Wholesaling, and Agarbattis”. “Sunfeast, Candyman, Aashirvaad, Bingo”, and other good lines inside the sector of labelled processed meals; “Vivel, Fiama, Wills, and Superia” inside the portion of skincare goods (Verma et al., 2021). “WLS” inside the stock sector of Fashion Garments; “Papercraft and Classmate” inside the merchandised segment of Education & Stationaries; Objective in matches, and “Mangaldeep in Agarbattis” are examples of item development.

ITC’s FMCG Sequence Pricing model: ITC seems to have diverse investments of products to function in various consumer sections, and such products possess valuation assertions at a competitive rate. For instance, the “Vivel” manufacturer provides a deluxe selection of high-quality goods such as personal hygiene products.

Figure 1: ITC operation management process flowchart

(Source: Designed by Author)

Reference List:

Beriya, A., (2022). India Digital Ecosystem of Agriculture and Agristack: An Initial Assessment (No. 68). ICT India Working Paper. https://www.econstor.eu/handle/10419/250913

Charles, V., Aparicio, J. and Zhu, J., (2021). Data science for better productivity. Journal of the Operational Research Society, 72(5), pp.971-974. https://www.tandfonline.com/doi/full/10.1080/01605682.2021.1892466

Panigrahi, R. and Mohapatra, E., (2020). CSR: A Tool for Rural Development-An Indian Paradigm. IPE Journal of Management, 10(1), pp.65-87. https://www.ipeindia.org/wp-content/uploads/2020/10/Vol.10-No.1-Jan-June-2020.pdf#page=69

Verma, S., Mandal, S.N., Robinson, S., Bajaj, D. and Saxena, A., (2021). Investment appraisal and financial benefits of corporate green buildings: a developing economy case study. Built Environment Project and Asset Management. https://www.emerald.com/insight/content/doi/10.1108/BEPAM-06-2020-0108/full/html

Know more about UniqueSubmission’s other writing services: