BSBFIM601 Budget Variance Report Assignment Sample

Here’s the best sample of BSBFIM601 Budget Variance Report Assignment, written by accounting expert.

A. Issues

Issues can be identified based on the below budget variance reports:

Preparation of budget variance report

| Houzit Pty Ltd | |||||||

| Variance to Budget | |||||||

| First Quarter ended Sep 2011 | |||||||

| Actual Results | Budget-1st Q | Actual-1st Q | $ Variance | % Variance | F or U | ||

| Sales | 3,394,247 | 3,371,200 | (23,047) | -1 | U | ||

| – Cost Of Goods Sold | 1,934,721 | 1,955,296 | 20,575 | 1 | U | ||

| Gross Profit | 1,459,526 | 1,415,904 | (43,622) | -3 | U | ||

| Gross Profit % | 43% | 42% | 0 | -2 | U | ||

| Expenses | |||||||

| Accounting Fees | 2,500 | 2,500 | 0 | 0 | F | ||

| Interest Expense | 21,127 | 28,150 | 7,023 | 33 | U | ||

| Bank Charges | 400 | 380 | (20) | -5 | F | ||

| Depreciation | 42,500 | 42,500 | 0 | 0 | F | ||

| Insurance | 3,348 | 3,348 | 0 | 0 | F | ||

| Store Supplies | 750 | 790 | 40 | 5 | U | ||

| Advertising | 200,000 | 150,000 | (50,000) | -25 | F | ||

| Cleaning | 3,256 | 3,325 | 69 | 2 | U | ||

| Repairs & Maintenance | 16,068 | 16,150 | 82 | 1 | U | ||

| Rent | 660,127 | 660,127 | – | 0 | F | ||

| Telephone | 2,999 | 3,100 | 101 | 3 | U | ||

| Electricity Expense | 5,356 | 5,245 | (111) | -2 | F | ||

| Luxury Car Tax | 12,000 | 12,000 | 0 | 0 | F | ||

| Fringe Benefits Tax | 7,000 | 7,000 | 0 | 0 | F | ||

| Superannuation | 37,404 | 37,404 | 0 | 0 | F | ||

| Wages & Salaries | 415,600 | 410,500 | (5,100) | -1 | F | ||

| Payroll Tax | 19,741 | 19,741 | 0 | 0 | F | ||

| Workers’ Compensation | 8,312 | 8,312 | 0 | 0 | F | ||

| Total Expenses | 1,458,488 | 1,410,572 | (47,917) | -3 | F | ||

| Net Profit (Before Tax) | 1,038 | 5,333 | 4,294 | 414 | F | ||

| Income Tax | 311 | 1,600 | 1,288 | 414 | U | ||

| Net Profit | 727 | 3,733 | 3,006 | 413 | F | ||

Debtors ageing ratio

| 2009/10 | 2010/11 | 2011/12 | |

| Trade Debtors | 850,000 | 975,000 | 1,118,325 |

| Sales | 14,550,100 | 15,714,108 | 16,971,237 |

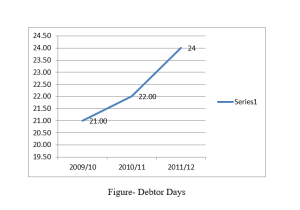

| Debtor Days | 21 | 22 | 24 |

From the above budget variance report, it is identified that there are different issues concerned with the variance of budget and actual results in the company. It is because it has a difference in the value of budget and actual results and the sales are also declined as per the budgeted value. This variance may affect the firm’s financial performance.

B. Performance

Financial performance

From the above analysis, it is determined that the organization is performing well at the industry level. It is because the actual net profit of Houzit in the first quarter is more as compared of budgeted net profit and included variance with the amount of $3006 (Arnaboldi et al., 2015.). In addition to this, the gross profit rate of the firm is 42% that is more as per the retail industry gross profit rate such as 25%. During the period, Houzit is also able to produce sufficient sales and profits with the increasing trends. Additionally, the wages and salaries have the industry average of 11% but in this part, the company has a little more with 12.2% as a sales percentage (Banerjee and Katul, 2013). The advertisement expenses also saved $50000 that increases the net profit of the company in comparison to gross profit.

Responses to performance questions

The board of Houzit provided the proper responses to the performance questions that are provided by the CEO. In which, the company has financial visibility according to the profit of the first quarter because this quarter is a seasonally slowest quarter over the year (Bititci et al., 2012). In addition to this, the gross profit margins can be maintained as per the variance report because of the gross profit margin something like the budget. So, it can be said that the organization is able to maintain the gross profit margins.

Determination of trend of average debtor days

According to this variance report, it is identified that the financial parameter of Houzit has an increasing trend. The gross profit and sales of the company showing increasing trend so it is impacting on the cash flow. The determination of average debtor days is also in the increasing trend in the financial years from 2009/10 to 2011/12 (Tessier and Otley, 2012). It shows that the company is providing relaxation in the credit policy where the customer can repay the credit amount on some extra days. This may impact on the sales and the credit sales would increase. Additionally, it would impact on the cash flow where the company may face the cash issue.

C. Recommendations

On the basis of the above situation, it can be suggested to the firm that there is a need of adoption of better policies for a reduction in the gross profit variances, sales variances and net profits variances (Bedford, 2015.). For this, it is suggested that the firm should focus on the cost reduction strategy that would control the operational cost and also minimize the cost of reduction. At the same time, the firm should increase the sales by using the aggressive marketing for improving the financial performance. It is also recommended to the organization that it should monitor and report on the monthly basis for a better result.

D. Evaluation

From the above financial analysis, it is evaluated that an organization develops the budgets for properly allocating the resources and get the competitive advantages in the industry. In addition to this, budgets are prepared to determine the flow of cash and managing the cash in the organization (Grabner and Moers, 2013). The variance analysis identifies the gap between budget and actual results so that the organization can fill the gap for improving the financial performance by adopting the best strategy. It is also evaluated that the firm must focus on the development of competitive position by reduction in the cost of goods sold and operational costs.

References

Arnaboldi, M., Lapsley, I. and Steccolini, I., 2015. Performance management in the public sector: The ultimate challenge. Financial Accountability & Management, 31(1), pp.1-22.

Bedford, D.S., 2015. Management control systems across different modes of innovation: Implications for firm performance. Management Accounting Research, 28, pp.12-30.

Bititci, U., Garengo, P., Dörfler, V. and Nudurupati, S., 2012. Performance measurement: challenges for tomorrow. International journal of management reviews, 14(3), pp.305-327.

Grabner, I. and Moers, F., 2013. Management control as a system or a package? Conceptual and empirical issues. Accounting, Organizations and Society, 38(6-7), pp.407-419.

Tessier, S. and Otley, D., 2012. A conceptual development of Simons’ Levers of Control framework. Management Accounting Research, 23(3), pp.171-185.

________________________________________________________________________________

Know more about UniqueSubmission’s other writing services: