MOD007667 010 Element Individual Assignment Sample

Introduction

HSBC is one of the banking sectors in the global overview and it has been seen that the company has faced several issues during the time of the Covid-19 pandemic and it has been seen that there have been several impacts on the business overview as well as business operations. These problems have mainly occurred by the problems in the logistics sections and this could not be helped by the restrictions in the pandemic situation. In order to recover from this situation, different planning for the improvement of the different segments will be discussed in this paper. In this paper different sections have been created in order to discuss different segments of the business improvements. In these sections, the improvement in financial performances of the company as well as the planning for the investments in the next ten years will be addressed properly.

Section 1: Ratios

Ratios are the major coefficient matrices under any category related to the performances of the organisations and it has been seen that the improvement in the different matrices and ratios helps the companies to improve in the different categories (Nurwulandari, 2021). Several categories must be improved in order to improve the overall performance of the company. It has been seen that the major categories that the company needs improvement in order to recover the loss faced in the pandemic situation are Profitability, Efficiency, Liquidity, and Investment.

Profitability– This is one of the major categories of the financial performance of the company and the improvements in the different ratios under this category help the company to get the better aspects of the business profitability and reduction of the operational costs. Price-earnings ratio is one of the major components of the profitability section and it has been seen that, this is one of the major ratios that is valuable for the investors (HSBC, 2022). In the pandemic situation, the company has faced several issues in the return and share price in the market and hence the improvement in this section is required. Price-earnings ratio is taken care of and checked by the stakeholders and investors about the overvalued and undervalued market share prices of the company (Rialdy, 2019). These help the investors to get the better aspects of the earnings of the company and pay back the investors.

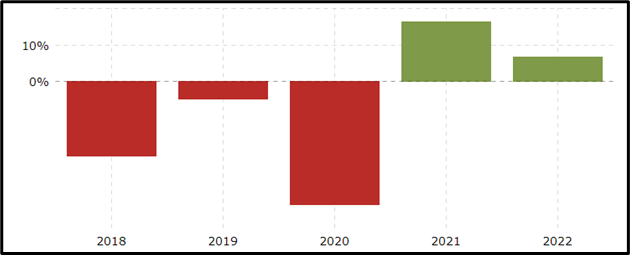

This particular ratio can be calculated by dividing the market share price by the earnings per share. It has been seen that HSBC is one of the banking sectors that usually have a gradually increasing market value. However, in the past five years, the market share has dropped as the pandemic situation created disruption in the profitability.

Figure 1: Stock price of HSBC in the last 5 years

(Source: HSBC, 2022)

In the pandemic situation, the stock price has fallen down to a large extent and the decrease was around 34 % from the previous year. The price was around 17.20 in the financial year 2020. Hence, the earnings of the company and the payback to the investors both have faced issues. Hence this section requires improvements in the future.

Efficiency- It is one of the categories that focus on the different aspects of the organisation’s ability to maintain different operations of the businesses in the different sections. There are several ratios under this category that focus on the different sections of the company’s performance in the liabilities and the ongoing responsibilities. One of the major ratios of this category is the working capital ratio and it has been seen that this ratio has been important for the performance analysis of the company (Anton and Afloarei Nucu, 2020). This ratio focuses on the different sections regarding the abilities of the company and the capacity of managing the liabilities and responsibilities with the ongoing assets of the company. Current liabilities are the best paid by the current assets like cash or the cash equivalent. It can be calculated by the company’s efficiency and the availability of its assets. In this context, it can be said that this section focuses on the different aspects of the efficiency of the company in managing the company’s performance and operations (Rohini et al. 2020). It has been seen that during the pandemic situation, the company has faced issues in the different sections and in order to recover the situation, the major improvement that is needed by the company is on the working capital ratio.

Liquidity– Liquidity is one of the major aspects of the company and it describes the market performance and the achievement of the company it has been seen that the company has faced several losses in the different sections and on this factor, the major unimportant factor related to the company performances, and the difficulties faced by the company (Bintara, 2020). During the time of Covid-19, the company faced several issues in the different sections and the business performance of the company has been decreased (HSBC, 2022). It is one of the major aspects of the company and liquidity aspects have been one of the major resulting factors in the pandemic situation. There are several ratios of the liquidity factors and one of the major ratios is the Acid-test ratio. It is one of the major ratios that have helped the company to get a better aspect of the situation. In this context, it can be said that this ratio helps the company to get the ratio of the current assets and the current liabilities apart from the inventory expenses. This is connected to the payback to the investors (Ukwueze and Ohagwu, 2020). This ratio is calculated by dividing the net value of current assets by the current liabilities.

Investment– It is one of the major categories for the company where the company has faced several issues (Lalithchandra, 2021). In this context, it can be said that there are several ratios in the investment segments and HSBC bank must focus on the different ratios. Return on equity (ROE) is one of the major types of investment ratio. In this section, the company needs to focus in order to get the better aspects of accurate and effective investments. This ratio indicates the rate of return against the equity value of the stakeholders. The company needs improvement in this particular section as this section focuses on the different aspects of this ROE as the distribution of the stakeholders were not proper and effective for the company in the FY 2020 and it caused several issues in the different sections of the company operations (Kartini et al. 2019).

Section 2: Budgeting

Budgeting is one of the most important approaches in the financial ground for the organisations that helps them to focus on the different income and expenses and the proper planning of the individual section expenses. As per the thoughts of Irnawati (2019), it helps the companies to get a better picture of the finance in the individual section and this is one of the most important factors for the companies. In the case of HSBC, the company has faced several issues in the different sections of the business and in this paper. The budgeting for the next years will be done, budgeting is one of the most important factors for the company, and in this regard, it can be said that there are both the advantages and disadvantages in the different segments.

The major advantages of the budget creation are as follows-

- It helps the company to get a better picture of the planning in the financial section and in this aspect, it has been seen that there were some extra expenses and some the expenses that were difficult to calculate (Arihta et al. 2020). In this aspect, a budget is needed. It is one of the major factors as ot focuses on the end goal of the company and the formation of each step. It eventually helps the company to get the better aspects of the expenses and the planning is better.

- One of the biggest advantages of budgeting is the savings and the limited amount of expenses. It helps the company to understand the fact that the expenses come after the availability of the money (Ewens et al. 2019). It helps the company to get a better aspect of the financial calculation and the proper distribution of the expenses and the investment only in the necessary sections.

The major disadvantages of the budget creation are as follows-

- One of the most important aspects of the company is that there are several aspects of the chances of inaccuracy and it has been seen that sometimes, the inaccuracy creates several disadvantages for the company (Duqi et al. 2018). one single mistake can create big issues in the whole budgeting

- One of the most important aspects of budgeting is rigid decision making. The rigidity in the previous planning and the equivalent can cause several issues as the environmental situation keeps changing.

There are several approaches to budgeting and the most common budgeting has both the pros and cons in the different aspects (Akhmetshin et al. 2018). It has been seen that different approaches to budgeting allow creators to create budgets using different methods and ways. The two most common approaches are Zero-Based budgeting (ZBB) and Rolling or continuous Budgeting.

ZBB is one of the finest approaches to budget creation as it focuses on a new clean sheet of budgeting irrespective of the previous budgeting and expenses. In this type of budgeting, the major aspect is the justification of each expense. In the creation of the budget types, the creator has to give the proper reason for every stage of planning and it is one of the most effective ways of budgeting (Beredugo et al. 2019). It helps the companies to get a better approach to creating the expenses structure and the unnecessary expenses can be restricted. The necessary amounts are only on the list. It has been seen that using this type of budgeting, the major benefit of the company is the efficient budgeting and the maximum amount of the chances of accuracy. In addition, there are several disadvantages of the ZBB approach. One of the most important disadvantages of this approach is the limitation in the calculation of the parameters having intangible outcomes such as research and development and marketing.

Rolling or continuous Budgeting is one of the most important aspects of budgeting as it focuses on the different aspects of the continuation of the previous budgeting (Al-attara et al. 2020). It has been seen that one of the most important aspects of this type of budgeting is the contribution and the references of the previous works. This budgeting has both advantages and disadvantages in the different aspects of the financial field. The major advantage of this budgeting is the relevance of the budget with the previous years and it helps the company to get the better aspects of the financial budgeting; it is one of the budget aspects that allow the creators to not get deviated freeman the previous budgeting. The most important disadvantage of this type of budget is the similarity and the lack of change adaptation in the budget (Su, 2018). Sometimes, it has been seen that the budgeting is done with respect to the different aspects of the previous years and in this case, no massive changes are taken in the case of any type of requirements.

Performance management is one of the most important aspects of business operations and it can be managed well by the proper implementation of the planning (Arimany-Serrat et al. 2022). It has been seen that the performance management can be managed well by the implementation of the budgeting in it and it can produce several positive impacts on the financial performance of the company. HSBC is one of the major companies that have faced several issues in the different sections in the pandemic situations and the improvement in the financial aspects. One of the major aspects taken by the company is the different aspects of the Financial Statement analysis. It is one of the major factors taken by the company, it helps the company to get the better aspects of the financial overview, and it will help HSBC to cover the losses in the financial section and to perform well in the different segments of the company (Heng-Jie, 2018). In addition, the financial statement analysis will help the company to get better aspects of the financial picture and the idea of the company about the financial performance. Budgeting is one of the most important aspects of the financial statement analysis and hence, it can be said that budgeting helps performance management to be improved.

Section 3: Investment appraisal

Net present value (NPV) is a process for determining the current value for every future cash flow that comes through a project along with the initial as well capital investment. It is commonly applied in capital budgeting to determine the projects that would generate the greatest profitability. Internal rate of return (IRR) on the other hand, is the method of discounting cash flows, which give a return rate generated by a project (Sarsour and Sabri, 2020). NPV considers the fact that the worth of future dollars is less than it is today. Discount is made in the cash flow in every period by another period of the cost of capital. Money’s time value is considered by NPV which translates future cash flows. Managers can use NPV to effectively compare initial cash outlay against the current value of the return. The technique of IRR helps in measuring any business project, capital expenditure, or performance of investment over time. The internal return rate has many uses (Saługa et al. 2020). This technique helps firms in comparing one investment to another or establishing the fact whether the project is viable or not. NPV is effective in a business environment where the cash flow directions or multiple discount rates vary over time. Besides that, it helps in calculating the total value of the potential investment opportunities of an organisation.

IRR is highly useful for comparing various projects or in business situations where it becomes difficult to establish a discount rate. Investment over 22% is considered a good IRR and the companies doing it are capable of dealing with every kind of uncertainty in business.

Investment appraisal involves a calculation process to analyse the profitability of any firm’s investment by considering the factors of affordability and strategic fit (Battisti and Campo, 2019). It is a kind of fundamental analysis and assessment of capability of a company in terms of the long-term profitability of projects that would be done in the future. Business leaders need to know the technique of using NPV or IRR for making investments in business processes.

Formula for NPV: “Net cash flow at time t”/ (“discount rate+time of the cash flow”)

Formula for IRR: “Summation of cash flow/ (1+internal rate of return)^n”

Where non-negative integer

Hence, the two formulas for calculating NPV and IRR are different and the employees of the companies should have enough skills and knowledge to make effective use of these techniques to deal with the risks and uncertain tires involved in any investment. For calculating NPV, the first step is to determine the expected return rate (Sarsour and Sabri, 2020). The second step to be performed is to make an effective assessment of the project’s cost. In the case of maintenance expenses, a different formula is to be followed to find the current cash flow values. For calculating IRR, it is required to estimate discount rates, and calculate the total present value, which gives the final result of IRR. Both IRR and NPV can be calculated in excel sheets by placing correct formulas to get accurate results. IRR is used for budgeting a project to be proposed.

| Period | Cash Flow | Net Present Value |

| Month 1 | $25,000 | $24,841.02 |

| Month 2 | $25,000 | $24,683.05 |

| Month 3 | $25,000 | $24,526.08 |

| Month 4 | $25,000 | $24,370.11 |

| Month 5 | $25,000 | $24,215.13 |

Table 1: NPV analysis

(Source: Self-created)

The NPV of the first month was $24,841.02 in the case of the cash flow $25, 000. According to the formula, the 2nd and 3rd-month NPV values are $24,683.05 and $24,526.08. In the last month, $24,215.13 is the NPV value if the cash flow is not changed (HSBC, 2022).

| 2020A | 2021P | 2022P | 2023P | 2024P | 2025P | ||

| Initial Investments | 250000 | ||||||

| After-tax cash flows | 100000 | 150000 | 200000 | 250000 | 300000 | ||

| IRR 56.72% |

Table 2: IRR analysis

(Source: Self-created)

The IRR value of the company is 56.72% in the initial investment is 250000. In the year 2021, the value is 100000 while the value increases to 150000.

Conclusion

HSBC is one of the major banking sectors in the global overview and in the pandemic situation; the company has faced several issues in the different sections of the financial segments. In order to mitigate the issue, budgeting and financial planning are needed. In this paper, the financial structure and planning are done for the next few years. one of the major categories of financial performance is the profitability category. One of the major ratios in this category is the price-earnings ratio. It is one of the major ratios as this contains the prime factors of the company like the market share and the value of the share and earning from the share values. These define the performances of the company on the financial ground. It has been seen that the stock price has decreased in the year 2020 and it has been one of the major losses in the profitability of the company. Budgeting is one of the major factors of the company and the major advantage of budgeting is the proper and accurate structure of the expenses. One of the most important approaches to budgeting is ZBB and it allows the companies to create budgets based on the different aspects of the new budgets. Performance management is one of the most important aspects and the financial statement analysis has been one of the most important aspects of financial management. Hence, it can be said that budgeting is one of the major important factors for the company.

References

Akhmetshin, E.M., Kovalenko, K.E., Mueller, J.E., Khakimov, A.K., Yumashev, A.V. and Khairullina, A.D., 2018. Freelancing as a type of entrepreneurship: Advantages, disadvantages and development prospects. Journal of Entrepreneurship Education, 21(2), pp.1528-2651.

Al-attara, H.A., Mashkourb, S.C. and Hassanc, M.G., 2020. Zero-based budget system and its active role in choosing the best alternative to rationalise governmesnt spending. International Journal of Innovation, Creativity and Change, 13, pp.244-265.

Anton, S.G. and Afloarei Nucu, A.E., 2020. The impact of working capital management on firm profitability: Empirical evidence from the Polish listed firms. Journal of risk and financial management, 14(1), p.9.

Arihta, T.S., Damanik, D.C., Manalu, S.H. and Khairani, R., 2020. Pengaruh Return On Asset (ROA), Return On Equity (ROE), Current Ratio (CR) terhadap Harga Saham pada Perusahaan yang Terdaftar Di Bursa Efek Indonesia Periode 2015-2018. Ekonomis: Journal of Economics and Business, 4(2), pp.426-433.

Arimany-Serrat, N., Farreras-Noguer, M. and Coenders, G., 2022. New developments in financial statement analysis. Liquidity in the winery sector. Accounting, 8(3), pp.355-366.

Battisti, F. and Campo, O., 2019. A methodology for determining the profitability index of real estate initiatives involving Public–Private partnerships. A case study: The integrated intervention programs in rome. Sustainability, 11(5), p.1371.

Beredugo, S.B., Azubike, J.U. and Okon, E.E., 2019. Comparative analysis of zero-based budgeting and incremental budgeting techniques of government performance in Nigeria. International Journal of Research and Innovation in Social Science, 3(6), pp.238-243.

Bintara, R., 2020. The Effect of Working Capital, Liquidity and Leverage on Profitability. Saudi Journal of Economics and Finance Abbreviated, 4(1), pp.28-35.

Duqi, A., Tomaselli, A. and Torluccio, G., 2018. Is relationship lending still a mixed blessing? A review of advantages and disadvantages for lenders and borrowers. Journal of Economic Surveys, 32(5), pp.1446-1482.

Ewens, H. and van der Voet, J., 2019. Organizational complexity and participatory innovation: participatory budgeting in local government. Public Management Review, 21(12), pp.1848-1866.

Heng-Jie, X., 2018. Educating Users on the Key Factors that Contribute to the Usefulness of Financial Statement Analysis. In Proceedings of the 3rd Annual International Conference on Education and Development (ICED 2018) (pp. 87-92).

HSBC, 2022. Home. Available at: https://www.hsbc.com/investors/results-and-announcements/annual-report. [Accessed on 3 May, 2022]

Irnawati, J., 2019. Pengaruh Return On Assets (Roa), Return On Equity (Roe) Dan Current Ratio (Cr) Terhadap Nilai Perusahaan Dan Dampaknya Terhadap Kebijakan Deviden. Jurnal SEKURITAS (Saham, Ekonomi, Keuangan dan Investasi), 2(2), pp.1-13.

Kartini, P.T., Maiyarni, R. and Tiswiyanti, W., 2019. Pengaruh Return on Asset (ROA), Return on Equity (ROE) dan Ukuran Perusahaan Terhadap Corporate Social Responsibility Disclosure. Jurnal riset akuntansi dan keuangan, 7(2), pp.343-366.

Lalithchandra, B.N., 2021. Liquidity Ratio: An Important Financial Metrics. Turkish Journal of Computer and Mathematics Education (TURCOMAT), 12(2), pp.1113-1114.

Li, J., 2020, January. Research on Limitations of Financial Statement Analysis: Based on Data of Listed Companies. In 5th International Conference on Economics, Management, Law and Education (EMLE 2019) (pp. 378-382). Atlantis Press.

Nurwulandari, A., 2021. The Influence of Company Size, Company Growth, Price to Book Value, Investment Opportunity Set, and Operating Cash Flow Againts Price Earnings Ratio in Food and Beverage Sub Sector Manufacturing Companies Listed In BEI from 2015 To 2017. Budapest International Research and Critics Institute (BIRCI-Journal): Humanities and Social Sciences, 4(2), pp.1882-1893.

Rialdy, N., 2019. Influence of Return on Equity (ROE), The Price Earnings Ratio (PER) and the Capital Structure of The Company’s Share Price Against the Sub Sectors of Transport Registered in Bursaefek Indonesia (BEI) the Period of 2015-2018. International Journal of Accounting & Finance in Asia Pasific (IJAFAP), 2(3), pp.46-53.

Rohini, U., Malarkodi, K. and Vanitha, P., 2020. Working capital management and its impact on firm’s financial performance. International Journal for Modern Trends in Science and Technology, 6(8), pp.10-17.

Saługa, P.W., Szczepańska-Woszczyna, K., Miśkiewicz, R. and Chłąd, M., 2020. Cost of equity of coal-fired power generation projects in poland: Its importance for the management of decision-making process. Energies, 13(18), p.4833.

SARSOUR, W.M. and SABRI, S.R.M., 2020. Evaluating the investment in the Malaysian construction sector in the long-run using the modified internal rate of return: a Markov chain approach. The Journal of Asian Finance, Economics, and Business, 7(8), pp.281-287.

Su, T.T., 2018. Public budgeting system in Taiwan: Does it lead to better value for money?. VALUE FOR MONEY, p.79.

Ukwueze, N.T. and Ohagwu, G.C., 2020. An assessment of the critical need and acid test ratios as a manufacturing firm liquidity measure. A study of golden penny company in South East Nigeria. Academic Journal of Current Research, 7(4), pp.24-34.

Know more about UniqueSubmission’s other writing services: