International Corporate Reporting Assignment Sample

Introduction

In this piece of study, we shall be culturing information related to corporate reporting of Diageo Plc. The basic aim of this study will be to implicate the depth of understanding of corporate information which are established in annual reports and accounts of a company. It shall be developing our ability to interpret financial and non-financial data of this company and establish knowledge about corporate reporting. In this case study, we will be acknowledging the portfolio of this said company along with critical reflections about such sourced information. It shall be dealing with the performance of this company during the past 5 years.

Portfolio of Diageo Plc

This assignment will be discussing the whereabouts of Diageo Plc which is a UK based multinational company (Diageo, 2021). It is invested in the business of alcoholic beverages such as wine, beer, and other spirits. This company is headquartered in London, United Kingdom. This company came into existence with the merger of Guinness Breweries and Grand Metropolitan. It was established in 1997 (Diageo, 2021). It is currently being cultivated under the management of Javier Ferran, chairman of this company, Ivan Menezes, CEO of this firm, and Lavanya Chandrashekhar, CFO of this business unit. This company has been reported to have earned a humongous revenue of 11.75 billion pounds during 2020 (Reuters, 2021).

According to the chairman of this company, it has performed outstandingly during 2021. He has mentioned that this company has been able to move with adapted agility and pace and has successfully grabbed relevant opportunities to commit success for this company. He also expects that this company will likely improve in the near future which will multiply these existing figures. He has appreciated the efforts of this firm in attaining such numbers by delivering continuous efficiency during these financial periods (Haller et al., 2017). According to him this firm has been able to manufacture sufficient trails with its consumers and trade partners.

There are certain words that could be searched in these financial statements which will explain the prospects of a business in a more refined manner. Such words directly link the user to such information which could help them gain substantial knowledge about this company’s financial and non-financial performance (Güleç, 2017). According to me, market is one such determinant which will explain the operational capability of a firm that will be required to obtain success in such a place of operation. According to me, it can be described in 100 words. I have also noted that strategy will be another word which could explain what a firm is planning to commit in upcoming years to fulfil their objectives (Dyduch, 2018). It can be discussed in 150 words or more. Again, competitors are another such word that could certainly describe what challenges are supposed to be claimed by a firm while operating in that market (Prodanova et al., 2020). It could be discussed in 50 words. Another word that could be searched for is potential opportunity. It shall gather favourable market conditions for a firm in its operating environment. It could be discussed in another 50 words. Potential threats could be another determinant for a person to understand what unfavourable conditions could hinder the perceivable success for a company. It could be described in 50 words or less. Marketing is an important determinant that will explain how a firm is planning to associate their products with the general public (Prodanova et al., 2019). It could be briefed in 50 more words. Target of a company will establish what a company is planning to perceive by the next financial period. It could be managed in 100 words or less. Other words could be customer segmentation, expansion possibilities, and dividend pay-out which could be explained in 150 words or more (Alali et al., 2017).

Profitability of a firm is one such phenomenon which is discussed throughout the financial statements. Thus, it is evident that it will play an important role in linking each of these statements. As per Adegboyegun et al. (2020), higher retention of profits would certainly imply an increase in the reserves for this company that will appear in the balance sheet of this business entity. Accordingly, such profit is also used to compute cash flows in this firm. Therefore, it shall be important to retain the majority of their incomes to ensure that all 3 financial statements are reported at its best figures (Davydova et al., 2019).

Figure 1: Segmental split of Revenue for past 5 years

(Source: Refer to excel)

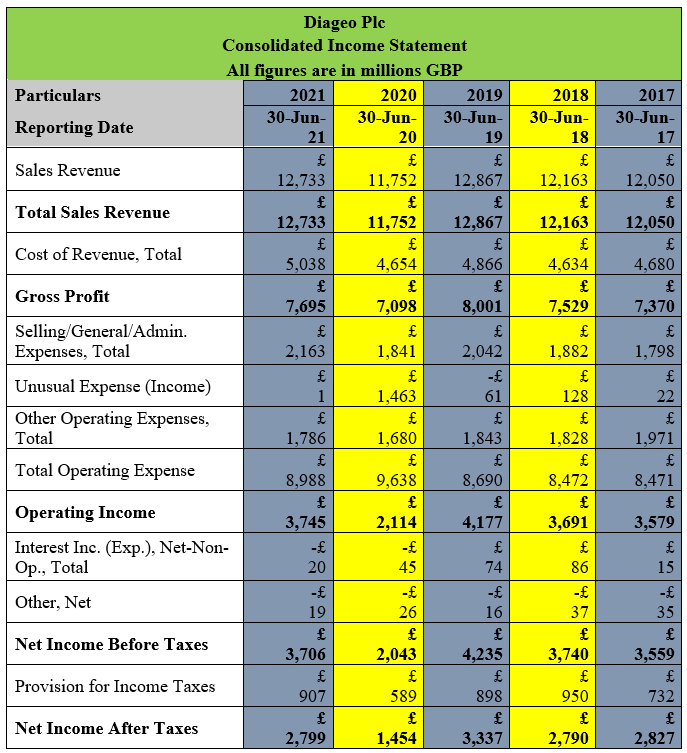

From this information, we have deployed some ratios to interpret such given information to understand the performance of this company during these past 5 years. We have certainly computed 3 profitability ratios that will progress towards explaining how this company has been able to retain its income against such expenses that this company had to bear. Thus, operating profit margin, gross profit margin, and net profit margin will give us a brief view of these values in this above figure.

| Profitability Ratios | 2021 | 2020 | 2019 | 2018 | 2017 |

| Operating Profit Margin | 29.41 | 17.99 | 32.46 | 30.35 | 29.70 |

| Operating Income *100 | |||||

| Total Sales Revenue | |||||

| Gross Profit Margin | 60.43 | 60.40 | 62.18 | 61.90 | 61.16 |

| Gross Profit * 100 | |||||

| Total Sales Revenue | |||||

| Net Profit Margin | 21.98 | 12.37 | 25.93 | 22.94 | 23.46 |

| Net Income after Taxes * 100 | |||||

| Total Sales Revenue |

Table 1: Profitability Ratios of Diageo Plc during past 5 years

(Source: Refer to excel)

These figures obtained through calculation, indicate that this company has performed better with every passing year. As we look through these figures, it can be said that Diageo Plc has outperformed every past year but had sincerely dropped during 2020. It could possibly be due to the invasion of a pandemic which affected every business in a very gruesome manner. But this firm has also managed to reboot such figures during 2021. There is a substantial improvement in every margin for this company since the past year. Thus, it can be said that this company has managed to comply with this market and its prevailing trends.

Figure 2.a: Segmental Split of Financial Position for past 5 years

(Source: Refer to excel)

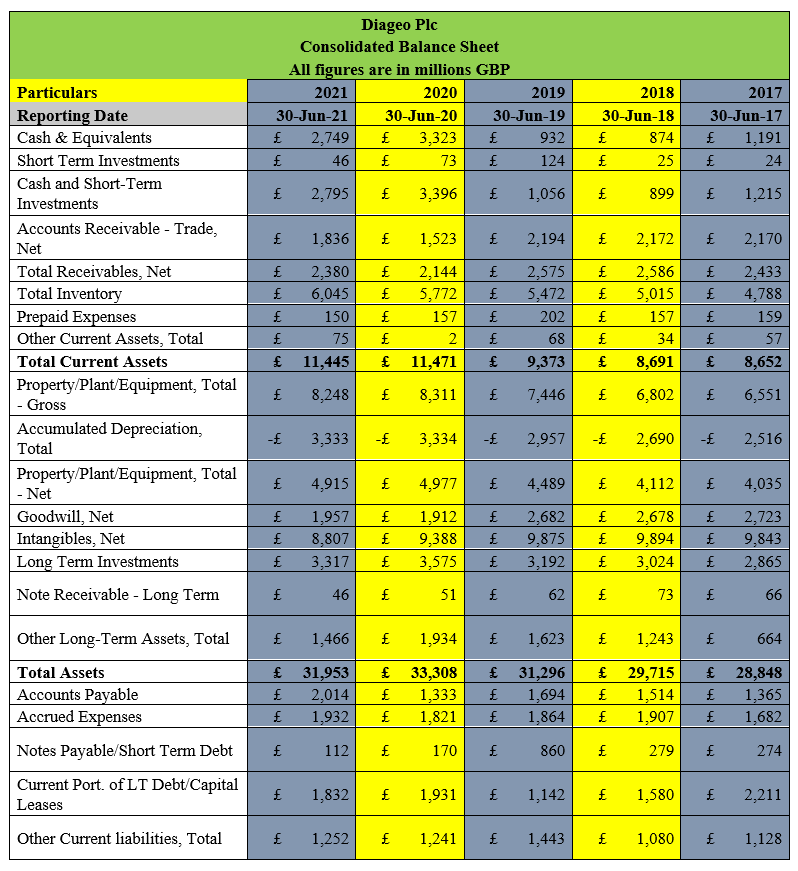

The above figures shall explain financial strengths and position of this company with provided values. It can be understood that this company has successfully been able to maintain its outstanding number of shares for the past 5 years. It can be noticed that these numbers have gradually reduced in the recent past as this company’s management desk has planned to obtain majority shares from the stock market to create demand for it in the long run with gradual success of their firm. We have carried out a ratio analysis to understand how these figures have compelled this firm to such an extent.

| Ratio Analysis | 2021 | 2020 | 2019 | 2018 | 2017 |

| Current Ratio | 1.60 | 1.77 | 1.34 | 1.37 | 1.30 |

| Current Assets | |||||

| Current Liabilities | |||||

| Total Debts to Assets Ratio | 0.47 | 0.52 | 0.41 | 0.34 | 0.32 |

| Total Debts | |||||

| Total Assets | |||||

| Quick Ratio | 0.76 | 0.88 | 0.56 | 0.58 | 0.58 |

| Current Assets – Inventory | |||||

| Current Liabilities | |||||

| Debt to Equity Ratio | 2.19 | 2.55 | 1.52 | 1.01 | 0.89 |

| Total Debts | |||||

| Total Equity |

Table 2: Ratio Analysis of Balance Sheet Figures

(Source: Refer to excel)

It can be seen that this company has recently increased the quantity of debts during these past 5 years. This is reflected in these ratios very clearly which could possibly increase operating expenses of this company. It can certainly hinder their profitability in the long run. Thus, the quantity of debts is double of equity according to this present situation. Flexibility of this company against its current liabilities are certainly at a better position according to these figures. Thus, it can be cited that this company can presently manage to erode any financial risk that might affect this company. According to me, it could be ascertained from these figures that this company has successfully been able to convert the available investment into revenues for these past years. Thus, it has a bright opportunity for multiplying its profits given the potential of this company to recalibrate its ratios from that of 2020. The information displayed on these given tables suggests that this company can further extend their market with other countries to establish a worldwide customer base.

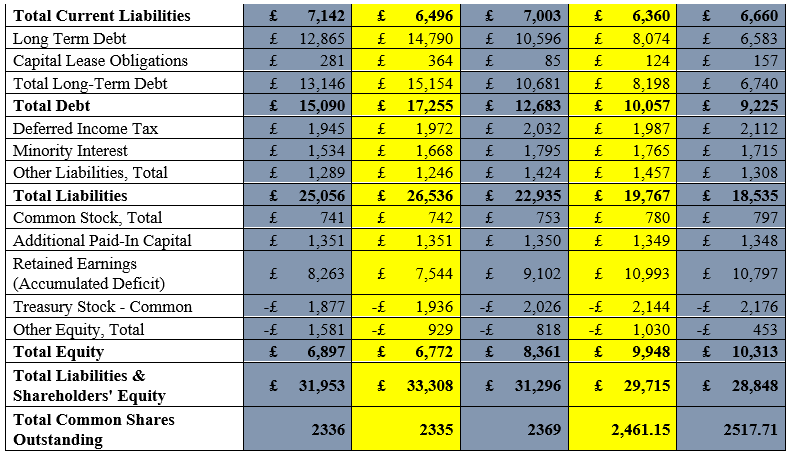

Figure 3: Consolidated Cash Flow of last 5 years

(Source: Refer to excel)

This cash flow shall explain how the funds have flown throughout the past years for this business organization. It can be seen that this company has been able to sustain substantial inflow of money through its operating, investing, and financial activities. This could be presumed as critical information of how the company has managed its funds while operating in this market (Humphrey et al., 2017).

Critical Reflection

In this scope of study, we shall be specifically discussing consolidated income statements, consolidated balance sheets, and narrative reporting in annual reports and accounts of Diageo Plc. It can be understood that financial information is important to have knowledge about a company’s performance (Antonini and Larrinaga, 2017). But it is equally important to secure non-financial information about such a company to perceive ideas about functionaries and other prospects about that company.

While contemplating this assignment, I have come across various such information which are non-financial in nature but are consistently providing knowledge about the futuristic movements of this firm. I have also felt that this type of narrative information is important for a user to have sheer guidance about understanding these financial statements. As opinionated by (Sahari et al., 2019), they are supplementary to these financial notes of a company. I have thoroughly discussed the income statements and balance sheets of this company which enhance a few notable features that I shall be disclosing and discussing below.

Corporate reportings can usually be helpful for the stakeholders of a company. As opined by (Smith et al., 2019), it will provide them with elaborate information about how a company has performed in the past and is supposed to commute in future. It shall explain multiple aspects of a company by determining their goals and objectives. According to me, it will not only cater to investors but will provide comparative analysis to the management of this company which can be used to formulate useful decisions for this business entity. According to (Albu et al., 2017), it will help the company’s management desk to contemplate areas of concern with adequate considerations for better results in upcoming periods.

As per my notice, income statements of this company have suggested that revenue generated by this firm is usually more than 12000 billion pounds every year. But it had seemingly dropped during 2020 at around 11750 billion pounds. This is possibly due to the influence of the pandemic around that time. It was a sheer challenge for this company to buckle up from such a dreadful situation. This company had actually been able to manage to reboot its sales in 2021. It certainly raised up to a margin of 12700 billion pounds. As per my opinion, this is a considerable effort from the company’s end as they have successfully been able to convert their areas of weakness to turn tables for this financial period. Similarly, gross profit this firm has also been able to compute substantial figures with comparison to 2020. It has managed to score its second-best figures in 2021 as compared to its last 5 years’ performance. Thus, I have notably considered the efforts of management to have been able to achieve such heights during this period. But one thing could be cited in this region of information that this company has a better potential to result in better figures if they can manage to reduce their direct cost in operating their business. It has been cited that labour cost concerns for this business organization have been a challenge over these past years (Babajani and Adlzadeh, 2021). Thus, as per my opinion, if the management desk of this company can manage to curtail that same, it could be beneficial for the profitability of this business.

As I take note of their expenses during these periods, it has been prominent that interest expenses for this company have increased from the past. Thus, it will be important for executives and other managerial personnel to concentrate on this matter. It shall contribute by retaining more profits in upcoming periods. In my critical commercial opinion, I have noticed that gross profit margins are usually lingering around 60 percent but these operating ratios have come down to 30 percent on average. This is possibly due to the large amounts of indirect costs that this company has had to bear throughout these past 5 years. It is evident that indirect costs will comprise a considerable portion of expenses but this is an area which can be managed to secure competitive advantage over other firms in this industry. I have also noticed a downpour in operating profits during 2020 because this company had to bear humongous quants of expenses in order to survive this explicit period. As per my commercial opinion, these figures are low but competitive in this industry because it has managed to stay at a positive note. According to Al-Hajaya and Sawan (2018), they failed to upkeep their profits due to closure in business in many parts of the world. In my opinion, net profit margins have been maintained by this company throughout its establishment. But as we take note of these past 5 years.

This business entity has performed very well in my personal opinion as they have been able to maintain such a rate above the margin of 21 percent on average. Similarly, during 2020, there was a downpour at around 12.3 percent but it can be understood that it was a critical period of business. Out of all these years, the financial numbers of 2021 impress me the most because it has been able to display its maximum potential by reviving those figures by a huge margin. It could possibly be due to the doubling demands from their customers after lockdown ended. It had been a challenging period but this company has managed to manufacture considerable profits in these following years. Again, as I take note of 2017, 2018, and 2019, it is prominent that this company has been able to commit higher numbers every year. 2019 could probably be assessed as the most favourable year for this company as they were able to secure maximum revenues and profits during this period.

As we come to discuss their financial position it can be stated in my particular opinion that this company has been able to grow its assets during these past 5 years. During 2017, their assets were totalled at around little less than 29000 million pounds. But by the end of 2021, it has shown a steady growth at around 32000 million pounds. This is one of the most exciting regions for this company as it marks their successful expansion capabilities. Fixed assets of this firm have steadily grown from a margin of 4000 to 5000 million pounds in just 5 years. As per my commercial citing, it is also visible that this firm has been able to successfully generate funds from their debtors. Previously, during 2017, 2018, and 2019, debtors amounted to 2180 million pounds. But in 2021, they have managed to sum them up by 1830 million pounds by availing higher revenue than 2017 and 2018. This is a striking note according to me because if we compare those figures against 2021, this company could be cited to have outperformed itself since these past few years. Short-term investments made by this company were maximum during 2019 but it has been compromised and currently stands at 46 million pounds. It could possibly mean that this company will have lower interest incomes in comparison to 2019. But has definitely been able to maintain a higher number from 2018 and 2017. Long-term investments, on the other hand, are maintained at around 3200 on average. But it has been raised since 2019. As described by Oberwallner et al. (2021), this increases their earning capacity in terms of interest and dividend income. Accounts payable for this company has considerably increased from these past few years.

It usually had been around 1500 million pounds but during 2021 their figures have crossed the mark of 2000 million pounds. As per my commercial knowledge, it is possible that this company has been able to efficiently manage their flow of funds in this market to conserve and commence their business after 2020. It has allowed them to upkeep their available funds. Long-term debts of this firm had increased by a huge margin by 2020 but it has managed to drop such figures again by 2021. Thus, in my opinion, the management is looking forward to reducing their expenses by paying off their previous debts. As suggested by Prodanova et al. (2018), it will help them to reduce their expenses and retain their profits up to the maximum limit.

Conclusion

It can be concluded that this company is a promising entity that can make huge profits in the future. They can likely increase their profitability margins by proceeding with this same concept of reducing loanable funds. The company had suffered greatly in 2020 due to this outburst of a pandemic but has sincerely managed to cope with that situation to commence their business at a high pitch. Their figures have elevated largely which has shown glimpses in their money-making capabilities. According to my critical opinion, it must be mentioned that this company has been able to manufacture profits in its past and has certainly proved its diligence by securing such numbers in 2021. This is a noticeable factor as it will determine their future capabilities. Ratio analysis of these figures have displayed a prospective future for this company with their determination to outscore themselves from the previous years. Again, it must also be cited those narratives suggested by their chairman suggest that this company could eventually emerge as a financial giant in their respective industry.

Reference List

“Diageo.com, (2021)” viewed on 21.12.(2021) available at: https://www.diageo.com/en/investors/annual-report-(2021)/

“Diageo.com, (2021)” viewed on 21.12.(2021) available at: https://www.diageo.com/en/contact-us/

“Reuters.com, (2021)” viewed on 21.12.(2021) available at: https://www.reuters.com/companies/DGE.L/financials/income-statement-annual

Adegboyegun, A.E., Ben-Caleb, E., Ademola, A.O., Madugba, J.U. and Eluyela, F.D., (2020). Fair value accounting and corporate reporting in Nigeria: a logistics regression approach. International Journal of Financial Research, 11(2), pp.301-310.

Alali, F., Sophia, I. and Wang, L., (2017). Characteristics of financial restatements and frauds: An analysis of corporate reporting quality from 2000–2014. The CPA Journal, 87(11), pp.32-41.

Albu, N., Albu, C.N. and Filip, A., (2017). Corporate reporting in Central and Eastern Europe: Issues, challenges and research opportunities. Accounting in Europe, 14(3), pp.249-260.

Al-Hajaya, K. and Sawan, N., (2018). The future of internet corporate reporting–creating the dynamics for change in emerging economies: A theoretical framework and model. Corporate Ownership and Control, 15(3), pp.172-188.

Antonini, C. and Larrinaga, C., (2017). Planetary boundaries and sustainability indicators. A survey of corporate reporting boundaries. Sustainable Development, 25(2), pp.123-137.

Babajani, J. and Adlzadeh, M., (2021). Structural analysis of the drivers affecting the future of corporate reporting in Iran. Accounting and Auditing Review, 27(4), pp.523-545.

Davydova, A.S., Prodanova, N.A., Sotnikova, L.V., Shevchenko, S.S., Bochkareva, N.G. and Polyanskaya, T.A., (2019). Fundamental approaches for the formation of integrated corporate reporting. International Journal of Economics and Business Administration, 7(3), p.293.

Dyduch, J., (2018). Methods of measurement of CSR disclosure level in corporate reporting. Prace Naukowe Uniwersytetu Ekonomicznego we Wrocławiu, (520), pp.46-53.

Güleç, Ö.F., (2017). Timeliness of corporate reporting in developing economies: Evidence from Turkey. Journal of Accounting and Management Information Systems, 16(3), pp.219-239.

Haller, A., Link, M. and Groß, T., (2017). The term ‘non-financial information’–a semantic analysis of a key feature of current and future corporate reporting. Accounting in Europe, 14(3), pp.407-429.

Humphrey, C., O’Dwyer, B. and Unerman, J., (2017). Re-theorizing the configuration of organizational fields: the IIRC and the pursuit of ‘Enlightened’corporate reporting. Accounting and Business Research, 47(1), pp.30-63.

Oberwallner, K., Pelger, C. and Sellhorn, T., (2021). Preparers’ Construction of Users’ Information Needs in Corporate Reporting: A Case Study. European Accounting Review, 30(5), pp.855-886.

Prodanova, N., Plaskova, N., Bochkareva, N., Babalykova, I., Gazizyanova, Y. and Zherelina, O., (2019). Integrated corporate reporting as an innovative business reporting model. International Journal of Engineering and Advanced Technology, 8(5), pp.2075-2078.

Prodanova, N.A., Plaskova, N.S., Popova, L.V., Maslova, I.A., Dmitrieva, I.M., Kharakoz, J.K. and Sitnikova, V.A., (2018). Corporate Reporting of the Future: On the Path towards New through the Analysis of Today. Eurasian Journal of Analytical Chemistry, 13(4), pp.296-303.

Prodanova, N.A., Savina, N.V., Dikikh, V.A., Enina, Y.I., Voronkova, O.Y. and Nosov, V.V., (2020). Features of the coherent presentation of information in order to prepare integrated corporate reporting. Entrepreneurship and Sustainability Issues, 7(3), p.2227.

Sahari, S., Nichol, E.O. and Yusof, S.M., (2019). Stakeholders’ Expectations on Human Capital Disclosure vs. Corporate Reporting Practice in Malaysia. International Business Research, 12(1), pp.148-155.

Smith, T., Paavola, J. and Holmes, G., (2019). Corporate reporting and conservation realities: Understanding differences in what businesses say and do regarding biodiversity. Environmental Policy and Governance, 29(1), pp.3-13.

………………………………………………………………………………………………………………………..

Know more about UniqueSubmission’s other writing services: