Financial Insights and Business Intelligence Assignment Sample

Introduction

FinTech solutions are effective in financial, business operation and investment decision making in an advanced way of digital intelligence. This study is going to analyse the effectiveness of the FinTech solution in the fashion company Burberry in various decision making by disrupting traditional processes in the global business.

FinTech solutions for financing in Burberry

The inner meaning of a FinTech solution refers to a synergy between technology and finance that can enhance business operations in Burberry in the international market. Moreover, its effective software, big data analytic, business intelligence, and the financial applications services have prominent applications in automated investment apps, mobile payment, online leading business, crowd funding platforms and crypto currency.

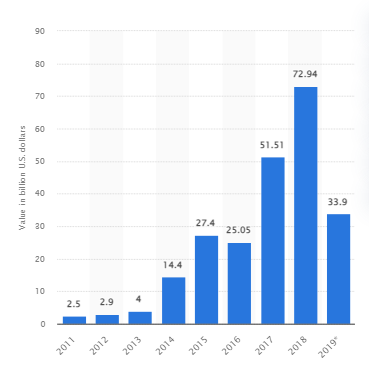

Figure 1: Value of investment in the FinTech sector

The above statistic presents an effective investment growth in FinTech solutions from 2011 to 2019 of about 33.9 billion USD (Statista.com, 2021). Hence, Burberry can effectively use this financial software solution to increase its business operational efficiency in the global market significantly. Apart from that, Cojoianu et al. (2021) have argued that the computational power and advanced data science of FinTech store and analyse a large financial relevant data set, visible features raise innovative start-up among the global business operation effectively. In addition, the company can emerge from new ventures in the fashion sector with effective IT knowledge, financial innovation capabilities in frosting sales targets, profits with complementary views in the current era. On the other hand, AI (artificial intelligence) and ML (machine learning ) technology are the most effective part of FinTech that helps companies in financial applications through fraud detection, wealth management, regulatory compliance, credit scoring and offers more potential technology to customers and business operational service that is effectively applicable in Burberry. On the other hand, Leong and Sung (2018) have illustrated that big data analytics of FinTech helps companies to understand the new market of the fashion sector and customer preference, spending habits and investment behaviours. Apart from that, the fashion company Burberry can use its block chain technology to securely store transaction records and reduce risks of cyber-attacks in financial services and any business operations.

FinTech solutions for investing decisions in Burberry

The most effective and efficient technology is of FinTech in the digital revolutions that leveraged advanced technology in the investment decision in the business. Burberry has a business of online fashion retailers that focuses on integrating investment areas with fresh banking services without any companies. In this case, the company can use the cloud computing and AI technology of FinTech due to its lower operational cost, heightened connectivity and reducing capital expenditure in the fashion sales with affordable maintenance and management in financial services. Apart from that, Nubank, a Brazilian digital bank raised most capital investment decisions through FinTech solutions and came up with a UK-based revolt of about 917 million USD in 2015 (Statista.com, 2021).

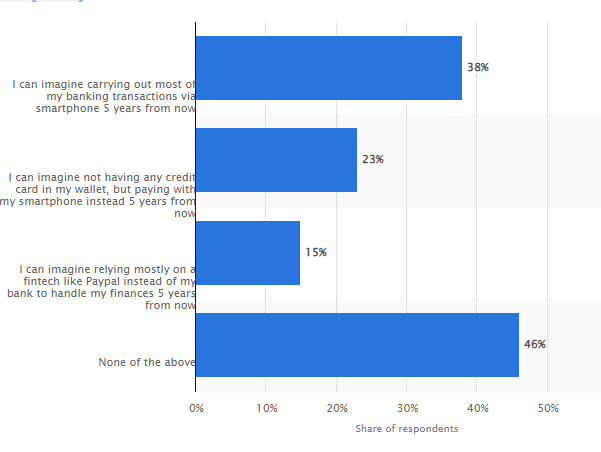

Figure 2: Customers statements about FinTech solutions in the mobile payment system

On the other hand, Fayda et al. (2021) have argued that FinTech is a dynamic segment at the intersection of the technology revolution and financial services that created an organized fund to invest, improve diversity and quality of services by integration of new solutions and technology through API systems and AI-based software. In addition, n, the global FinTech solution, and its application in investments decision-making have increased by 75% in 2015, from 9.6 billion to $22.3 billion according to CB insights data (Fayda et al. 2021). Hence, Burberry can utilize FinTech solutions for managing investment banking teams through its cloud-based platform in the transformative process. Moreover, FinTech offers argumentation services that meet booth talent and tech needed in the business that effectively improves Burberry’s international business operation and help in maintaining competitiveness in the global fashion market. As per the viewpoint of Mention (2021), FinTech investment rate has raised in the global market from US$50.8 billion in 2017 to US$111.8 billion in 2018 due to its multiple challenge operation that helps in investment decision making, financial services through its FS technology models. Hence, the company brings effective innovations in intra- and intra-organizational, business models, products, services and systems through its five beneficial dimensions such as data techniques, hardware and infrastructure, privacy and security, service model, application and management.

FinTech solutions for operating decisions in Burberry

The leading companies in the global market faced challenges with increasing regulations, combined with a global economic slowdown in retail banking operation among top priority banks. Similarly, Burberry faces issues with creating an efficient operational value chain, leading to an easier and secure application process in the fashion sector. As per the viewpoint of Gomber et al. (2018), IT interventions and flexible products of FinTech reduce operational costs, transformations with reducing required manual work outside of systems, changes taking time in different functional areas. However, Burberry can utilize this solution to ensure profits and revenue by reducing operational and system costs in disparate systems, numerous handoffs between various functional units and departments in fashion sales, supply chains and transactions process.

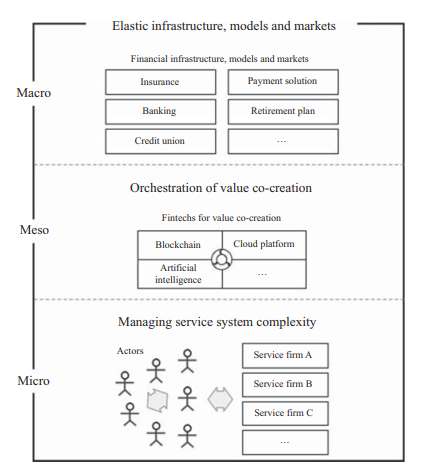

Figure 3: Operational changes through FinTech solution

Moreover, the high level of configures of FinTech solutions brings all stakeholders to abandon technology-driven approaches to deliver better decisions in business activities, rule-based escalation, a notification with a unified view of fashion sense and a competitive environment in the current market operation. Apart from that Breidbach et al. (2019) have pointed out that FinTech solutions are effective in micro, macro and meso, environmental change in business operation through planning software emergence in incubators and start-ups in B2C (business-to-customer) context. Hence, Burberry can utile this software in the leading fashion business to manage its service ecosystem by enabling smart devices of FinTech that has a cost analytical framework.

Conclusion

The FinTech solution is effective for business functions in operational, financial and investment decision making to manage data-driven financial services, identify the behavioural patterns, and understand the consumer’s financial preferences in business. Burberry can take advantage of FinTech solutions for Improving the value proposition of the business, managing the incubators, start-ups, and proliferation of crypto currencies in the fashion sector in the future.

Reference List

Cojoianu, T.F., Clark, G.L., Hoepner, A.G., Pažitka, V. and Wójcik, D., 2021. Fin vs. tech: are trust and knowledge creation key ingredients in fintech start-up emergence and financing?. Small Business Economics, 57(4), pp.1715-1731.

Fayda, S.N.A., Sencan, A., Aksoy, O. and Yazici, S., 2021. A Qualitative Research On Selected Performance Indicators For Investment Decision Process: A Framework For Fintech Startups In Turkey. Journal of Business Economics and Finance, 9(1), pp.28-41.

Gomber, P., Kauffman, R.J., Parker, C. and Weber, B.W., 2018. On the fintech revolution: Interpreting the forces of innovation, disruption, and transformation in financial services. Journal of management information systems, 35(1), pp.220-265.

Leong, K. and Sung, A., 2018. FinTech (Financial Technology): what is it and how to use technologies to create business value in fintech way?. International Journal of Innovation, Management and Technology, 9(2), pp.74-78.

Mention, A.L., 2021. The age of FinTech: Implications for research, policy and practice. The Journal of FinTech, 1(01), p.2050002.

Statista.com, 2019. Statements about mobile payment and fintech in the UK 2017. Available at: https://lb-aps-frontend.statista.com/forecasts/1020327/statements-about-mobile-payment-and-fintech-in-the-uk [Accessed on 13 January 2022]

Statista.com, 2021. Leading digital banks worldwide as of 2020, by capital raised. Available at: https://www.statista.com/statistics/1238854/leading-digital-banks-worldwide-by-capital-raised/ [Accessed on 13 January 2022]

Statista.com, 2021. Value of investment in Fintech sector worldwide from 2011 to 2019. Available at: https://www.statista.com/statistics/557237/value-of-fintech-financing/ [Accessed on 13 January 2022]

………………………………………………………………………………………………………………………..

Know more about UniqueSubmission’s other writing services: