BUS7B30 Financial Insights and Business Intelligence

1. Introduction

The assignment is based on financial insights and business intelligence of a company named Tesco. This study is reviewing the background of a company which consists of financial, operational and investing decisions of financial and business insights. Additionally, also discuss how a company uses a fintech solution to mitigate issues from business and enhance the future effectiveness of their company. In addition, also discuss business insights after using all types of solutions and mainly fintech solutions in this study. The main aim of this study is to shed light on the financial insights and business intelligence of a company and how they enhance business performance through the fintech solution.

2. Overview of the financial background of the company

The overview of the financial background of a company Tesco, a leading multinational company in the UK. This section discusses how a company stands in terms of gross revenues and how many shops they have in other countries of the UK. In addition, the financial insights and business intelligence merely provide a solution to how Tesco can manage its long-term availability. Therefore, business intelligence is used to support and provide in-depth financial analysis and consolidation of financial data. As per cumulative market research, it also discusses how Tesco acquired another grocery firm which is eventually expanding in other countries (Mention, 2019). This study further continues through the group balance sheet and the chart of financial operations discussed the depreciation of financial gain.

In this study a brief of this project area and mainly through the financial analysis it merely discusses also how Covid-19 affects the financial insights of this company and how much loss and how the online products are getting boon in such terms of productivity and mainly profitability Tescoplc (2019). In addition, the group’s balance sheet of Tesco analyzes and shows the significant loss in finance and it mainly justified how the company proposed a capital project for any types of changes from the area of investment of this company. Mainly this study is reviewing the financial insights and business intelligence which show that Tesco holds a good score in different nations after facing this pandemic situation and also discusses how this company expands their holding assets on every portion of the globe.

The NPV (net present value) of the company is stated to be in a stable and comparatively profitable position against the estimated value of its new project such as $50,000 Tesco plc (2019). In addition, there a company Tesco might have faced several challenges after this pandemic situation and their capital investment turns to give the better solution and profits in the next coming years.

3. FinTech solutions for financing

The rapid change and advancement of technology take a great interest in financing solutions and one most important thing has been discussed through the technical solutions. The important thing is focusing on customer expectations which can help to enhance business value and increase insights (Panos and Wilson, 2020). The company must take this fintech solution for a better chance in a financial statement through the following steps

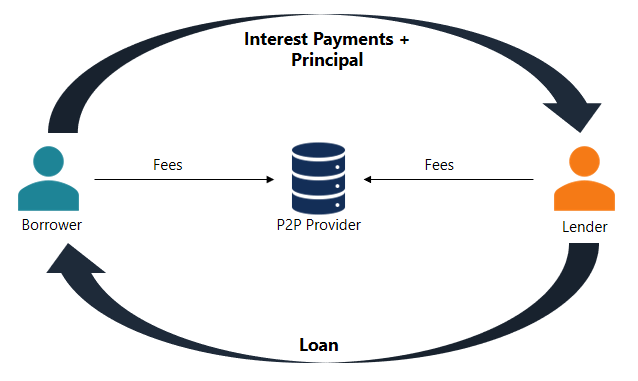

Peer-to-Peer (P2P) lending: This can be the best and winning solution to mitigate financial damages in business and in which both the borrowers and lenders of Tesco can use this platform. It is a solution of direct lending money that helps to make a proper solution for financial operations and match all requirements which can increase business productivity and efficiency (Ain et al. 2019).

Figure 1: Peer-to-Peer (P2P) lending

This helps to provide some significant advantages which help both borrowers and lenders. In addition, a fintech is a cost-effective option for consumers in peer-to-peer lending (Pointner and Raunig, 2018). Fintech can help both borrowers and lenders to make successful financial payments and strengthen competitive advantages. It includes Big Data & Artificial Intelligence (AI)-powered StartUs Insights Discovery Platform, which helps to create to mitigate the issues from financial solutions (Raisch and Krakowski, 2021). Fintech also helps to remove the credit risk and make proper legislation, for borrowers and lenders in a company.

Credit Scoring: It is one of the traditional methods which helps either big established companies or individuals with fixed jobs with appropriate salary slips which can give them loans. It mainly works with unbounded offerings in Tesco and this application also helps to support the loan application. The main advantage of this technology is that it needs to be more competitive and more scoring which could adopt the proper credit scores. In addition, Social signals are an innovative way to remove any types of barriers in credit scoring and help to increase the effectiveness of Fintech solutions in this company (Havrylchyk and Verdier, 2018). Fintech technology, on the other hand, helps to use a different credit scoring process which helps to evaluate the perspective of customers’ digital traces to establish creditworthiness (Bogusz, 2018). This includes some commercial data, telecom, residential and banking also.

Transaction delivery: In terms of using Big data and IoT tools helps to gather all possible data of subsequent expansion of financial operations. The main advantage of this technology is it helps to create management apps that help to create descriptions about free products and cross-p[olinate those data to use in business for clients (Sestino et al. 2020). The main benefit of using fintech in transnational delivery is that it is much more cost-effective to use and gather information. As per the view of Kethineni and Cao, (2020), The role of fintech also evolved into some kinds of innovation which can help to increase the proper solution in financial operations such as Cryptocurrency and digital cash.

4. FinTech solutions for investing decisions

Improvement innovation and efficiency: Fintech helps to transform the business insights and changes the investment banking in Tesco. It massively boosts innovation and increases the efficiency of this company (Liu, 2021). In order to discuss investment banking, it always helps to regulatory change in this company. It is such a helpful platform in implementations and cloud migrations are reshaping in which institutions think about compliance (Alruwaili and Gulliver, 2018).

Globally mobile workforce stimulation a better innovation: It is usable and portable to remove and mitigate the issues of investment decisions of this company named Tesco. In addition, the global mobile workforce helps to engage better customer services and other activities which can increase the efficiency of this company (Bogers et al. 2019). Therefore, it has also helped to achieve a better customer experience, add some business continuity, save travel costs and eliminate all types of commute times through the use of Fintech technology. As opined by Cegarra et al. (2019), the Mobile workforce has made a diverse change in Tesco and fintech proving its value in the case of investment decisions. On the other hand for an investment of Tesco, Fintech can also help to use such technologies which can help to maintain balance such as (Monese, Zenbanx), credit (Modernlend, Affirm), foreign exchange and money movement (Transferwise, Azimo, Revolut, World Remit) payments (Alipay, Astropaycard), and investments (Betterment, Goldbean, Nutmeg).

Equality of big data to accelerate: It is the biggest trend to democratize all data and it is one of the access keys for investment marketing of Tesco. In addition, Fintech helps to maintain and take numerous effects in areas of investment decisions. The big data accelerate also helps to maintain data and accelerate numerous areas (Raguseo and Vitari, 2018). The areas such as decision making, assessing options for holding financial accounts, harnessing new actionable data sources for systematic trading. On the other hand, using the numerous ways and also with effective use of Fintech a retail company like Tesco can increase their overall productivity and efficiency in investment decisions and increase the business worth. According to Sarta et al. (2021), There is no doubt that Fintech is a developing and essential technology that increases capability and business consumers for secured deals with other companies. In addition, it is also a valuable and faster-streamlined process that gives a better solution to a company and the main aim for use of this technology is to innovate and improve productivity.

5. FinTech solutions for operating decisions

Implementation of Taskize

The use of Taskize helps to remove problems of firms and brings seamless workflow between customers in Tesco which can increase better productivity. It can help Tesco for successful and relevant operational services by bringing on the right people. Fintech solutions can implement this technology which increases productivity and decision to make better financial decisions and also operating decisions (Márkus and Dombi, 2019). In addition, creates a better network that can collaborate removing and mitigating issues and it can take as a problem-solving network to operational decisions through also use of Fintech. In this context, Fintech is helping to reshape the overall services of this company named Tesco and many of them have mainly focused on customer experience which is the main aim of every company. In every company, there are many transactions made which have no human interventions, but using this technology like Fintech, can help to maintain the existing information and gather them for future use.

Improving front end customer experience

It helps to build a legacy to develop a better infrastructure of this company and which must be with all types of certain limitations. Fintech solution is one of the best solutions to improve the effectiveness and improve the ways of valuing the ideas of employees, using an important customer journey mapping. In addition, Fintech helps to deliver a high-quality business through delivering a high-quality customer experience (CX), which is another process of developing and reaching the target audience of this company, Tesco (Keiningham et al. 2020). Moreover, the technology also helps for customer satisfaction and engagement of customers which can increase business value. In addition, the operation management enhances the decision making strategy by using Fintech technology and increases the overall productivity of a company. As opined by Duan et al. (2019), the company can include “Artificial intelligence for predictive analytics”, which can help to maintain the balance of financial data and engagement of users in the company.

Figure 2: FinTech solutions for operating decisions

Implementation of machine learning

Implementation of machine learning also helps to make authentic data and Fintech also helps to make authentic data in Tesco which helps to maintain profitability in a company and successful work balance which need to be useful for this company. On the other hand, the implementation of machine learning can importantly focus on customer growth and which is the main backbone of a company (Maxwell et al. 2018). In addition, elements like Value exchange can be an option to explore the new area of enhancing the operational decisions of this company and which helps to develop competitive advantages. It also supports human decision making and is applied in operational data to provide authentic information and provide satisfaction. Therefore, Fintech solutions can also help to develop a successful environment for Tesco by monitoring and measuring the machine learning tools “system-related algorithms with minimal code revision” and this cycle helps in the constant improvement of the company (Huntingford et al. 2019). The company Tesco get such help from using the solution technology like Fintech and it helps to prove effective measures that can increase the value of a business,

6. Conclusion

As per this study, this section highlights the financial insights and business intelligence of a company named Tesco. In addition, also conclude a review which is critically based on some requirements and which helps to enhance business efficiency. On the other hand, the insights also conclude some potential FinTech solutions which need to be supported by the company and which will be most important and helpful for this company. In addition, the solutions conclude financial, investing and operating decisions which could help to mitigate company issues and give an effective structure to this company named Tesco. This study concludes an overall structure that could help to increase the business productivity and discuss some operating decisions which could make a better change in a company.

Reference

Journal

Ain, N., Vaia, G., DeLone, W.H. and Waheed, M., 2019. Two decades of research on business intelligence system adoption, utilization and success–A systematic literature review. Decision Support Systems, 125, p.113113.

Alruwaili, F.F. and Gulliver, T.A., 2018. Secure migration to compliant cloud services: A case study. Journal of information security and applications, 38, pp.50-64.

Bogers, M., Chesbrough, H., Heaton, S. and Teece, D.J., 2019. Strategic management of open innovation: A dynamic capabilities perspective. California Management Review, 62(1), pp.77-94.

Bogusz, C.I., 2018. Digital traces, ethics, and insight: Data-driven services in FinTech. In The Rise and Development of FinTech (pp. 207-222). Routledge

Cegarra-Navarro, J.G., Papa, A., Garcia-Perez, A. and Fiano, F., 2019. An open-minded strategy towards eco-innovation: A key to sustainable growth in a global enterprise. Technological Forecasting and Social Change, 148, p.119727.

Duan, Y., Edwards, J.S. and Dwivedi, Y.K., 2019. Artificial intelligence for decision making in the era of Big Data–evolution, challenges and research agenda. International Journal of Information Management, 48, pp.63-71.

Havrylchyk, O. and Verdier, M., 2018. The financial intermediation role of the P2P lending platforms. Comparative Economic Studies, 60(1), pp.115-130.

Huntingford, C., Jeffers, E.S., Bonsall, M.B., Christensen, H.M., Lees, T. and Yang, H., 2019. Machine learning and artificial intelligence to aid climate change research and preparedness. Environmental Research Letters, 14(12), p.124007.

Keiningham, T., Aksoy, L., Bruce, H.L., Cadet, F., Clennell, N., Hodgkinson, I.R. and Kearney, T., 2020. Customer experience driven business model innovation. Journal of Business Research, 116, pp.431-440.

Kethineni, S. and Cao, Y., 2020. The rise in popularity of cryptocurrency and associated criminal activity. International Criminal Justice Review, 30(3), pp.325-344.

Liu, C., 2021. FinTech and its disruption to financial institutions. In Research Anthology on Blockchain Technology in Business, Healthcare, Education, and Government (pp. 1679-1699). IGI Global.

Márkus, A. and Dombi, J.D., 2019. Multi-cloud management strategies for simulating iot applications. Acta Cybernetica, 24(1), pp.83-103.

Maxwell, A.E., Warner, T.A. and Fang, F., 2018. Implementation of machine-learning classification in remote sensing: An applied review. International Journal of Remote Sensing, 39(9), pp.2784-2817.

Mention, A.L., 2019. The future of fintech. Research-Technology Management, 62(4), pp.59-63.

Panos, G.A. and Wilson, J.O., 2020. Financial literacy and responsible finance in the FinTech era: capabilities and challenges. The European Journal of Finance, 26(4-5), pp.297-301.

Pierrakis, Y., 2019. Peer-to-peer lending to businesses: Investors’ characteristics, investment criteria and motivation. The International Journal of Entrepreneurship and Innovation, 20(4), pp.239-251.

Pointner, W. and Raunig, B., 2018. A primer on peer-to-peer lending: immediate financial intermediation in practice. Monetary Policy & the Economy, (Q3/18), pp.36-51.

Raguseo, E. and Vitari, C., 2018. Investments in big data analytics and firm performance: an empirical investigation of direct and mediating effects. International Journal of Production Research, 56(15), pp.5206-5221.

Raisch, S. and Krakowski, S., 2021. Artificial intelligence and management: The automation–augmentation paradox. Academy of Management Review, 46(1), pp.192-210.

Sarta, A., Durand, R. and Vergne, J.P., 2021. Organizational adaptation. Journal of management, 47(1), pp.43-75.

Sestino, A., Prete, M.I., Piper, L. and Guido, G., 2020. Internet of Things and Big Data as enablers for business digitalization strategies. Technovation, p.102173.

Website

Tescoplc (2019). Group balance sheet. [online] Tesco plc. Available at: https://www.tescoplc.com/investors/reports-results-and-presentations/financial-performance/group-balance-sheet/

………………………………………………………………………………………………………………………..

Know more about UniqueSubmission’s other writing services: