Supply Chains Networks and Markets Assignment Sample

Introduction

Global supply chain has become a pivotal part for the fashion retailers to improve their delivery system and meeting the changing needs of their customers. The purpose of this study to analyse the challenges of M&S for re-entering Chinese market with its home and clothing product portfolio, while analysing its strategies of improving its operations in the market. The critical evaluation of the theories and concepts has also been done in this context.

Task 1: Evaluation and analysis

1. Evaluation and analysis of existing strategies and supply networks of M&S

Its home and clothing supply chain is multilayered and global with various types of sellers whom it has direct contact. The company do not own any factories and farms or produce the products which are to be sold in their stores. Its reputation for sustainability and quality innovation is dependent on its long-term relationships with its suppliers. It source its home and clothing line from its 1000 factories.

Its supplier sites are found in Sri Lanka, Bangladesh, Turkey, India, Vietnam, Cambodia and China. The conditions and terms in Our Home & Clothing helps it to meet its minimum standards that are required for the factories and suppliers for meeting its commitment to its customers for delivering products that have high quality, legal and safe compliances.

It also abides by particular policies like Non-Food Products Animal Welfare, Ethical Trade and Packaging which is found in its Supplier Exchange-its online website for distributing information with its suppliers. Its delivery concerning Plan A of Sustainability Programme is committed of delivering sustainable products to its customers (Marks and Spencer, 2019).

The existing strategies of the company are to devise strategies that can help its online customers to purchase now and make payment later. In the recent years, the company is witnessing a sharp fall in its sales for the last 7 years. The company has devised new strategies for enabling its customers to pay online through instalments.

The company has suffered a major setback in its clothing business for the last 18 months and its focus solely on womenswear and not on menswear have slipped its revenue by 1.5% (Wood, 2019).

The online sales of its clothing and home are 22% which has grown up by 3%. It has focussed in modernising its supply chains of its home and clothing so that it can gain competitive advantage.

The recent changes in the domestic market like weakening of pounds, skill shortage and changing customer preferences are hurting the fashion sector. Adding to its woes is the principles and guidelines of the regulators in implementing effective strategies for effective waste management policies since fashion industry contributes more pollution than any other industries. Despite these problems, the company is expecting to improve its share in its clothing sector so that it can contribute to its improved sales (Marks and Spencer, 2019).

2. Evaluation and analysis of supply network of global apparel market and industry

Figure 1: Global supply chain in apparel industry

(Source: Adamo, 2019)

The global fashion sector has been reported to be $2.5 trillion in the year 2017 with the top 20 firms making 97% profits. Estimates by Mckinsey have shown that the rate of growth in the industry is to be 4.5% from 3.5%. Along with the considerations of costs, the high turnover rates in the products have led to challenges in supply chain for most of the organisations. With the trade war between China and the US, global markets are facing uncertainties.

Forcing the apparel companies to re-examine their logistics and sourcing strategies. The industry has been comparatively slow in for adopting supply chain technologies while the businesses are rapidly transforming their operations through innovative processes and tools. However, the apparel industry has a vast network of its suppliers with nearly 1000 to 2000 on an average which can move from 20,000 to 50,000 sub-suppliers.

60% of the apparel executives opined that they anticipate that 20% of their products will arrive from their offshore facilities for the next 5 years (Slangerup, 2019). It is found that the global manufacturing market for apparel accounts for about 46% in Asia and 21% in Europe.

In this context, M&S is going to close its 30 stores in its domestic market while converting 45 of its stores into food-only stores. It is also looking for relocation of its underperforming stores which implies reduction of 10% of its space that is devoted trousers, jumpers, and skills. It is also involved in the closure of its 53 stores making losses in its 10 countries.

These include 10 in China, 7 in France, along with others in Hungary and Belgium, leading to 2100 loss of employees (Wood, 2016). The 2019 Fashion Transparency Index (FTI) has come up with the list of suppliers of the companies in the apparel market. About 45% of the companies have disclosed their supply chain network, resulting in more transparency in their supplier chain capabilities.

However, it is also found that most of the companies are unwilling to publish the details of their suppliers since they are unwilling to adopt main components of human rights with diligence (Adamo, 2019). Reports from Mckinsey shows that China is expected to become the largest market for fashion by overcoming the US. However, the external shocks will continue to hamper its growth.

It is predicted that the growth is to become 4.5% from 3.5% though risks of disruptions in the trade and slow growth in Asian economies can create problems for the companies to sustain growth (Mckinsey, 2019).

3. Evaluation and analysis of supply network of China’s apparel market and industry

Improved technology, effectiveness in its R&D activities and improved logistics and transport services, China has become one of the most dependable suppliers of international brands though there are disturbances in its supply chain system due to ongoing US-China trade war. Its 20th Apparel and Textile Trade Show has showcased textiles, fabrics and garments of more than 300 companies from 18 regions.

The companies in the country supply designing, development, processing, dyeing, garment making, retail and operations and weaving, making it the top fashion and textile country in the world.

It has processed about 54.6 million tons of fibres which accounts half produce of the world while its exports are worth 276.73 billion U.S. dollars in apparel and textile (Yanan and Shilong, 2019). The country is concerned with the use of multiple natural functional fabrics which help in restraining bacteria or removing bad smell from textiles and fabrics.

There is no doubt that the country remains dominant exporter of apparel in the world though its shares in the market have fallen by 33.7% from 38.6% (Lu, 2018). It also supplies its apparel and textiles to other countries. It shows that the country offers untapped potential opportunities for M&S to improve its business concerning apparel and textiles in the country.

However, the company has been facing intensive competitive pressures in its home country, followed by weakening of its pounds and increased costs of raw materials.

Though the company has remained the largest sellers of its clothing units in the UK, it has been dominated by Primark and Next. Its clothing share in its domestic country has fallen to 7% from 10.6% and its sole focus on its food sector has resulted in its decline of its stock of clothing wear.

Its prices of shares have become low which has hurt trust and loyalty of its shareholders. (Wood, 2019). Considering this position, the company can seek to re-enter Chinese market since its textile and apparel sector remains flourishing.

Task II: Proposed Strategies

1. Formulation of a market positioning strategy

Its brand positioning strategy and reputation needs to be restored and re-evaluated for improving its sales. A loyalty scheme can enable the company to help its customers in China for understanding the things that they can get, and ways they can make payment.

The consumers in China prefer to wear Western clothes like trousers, jeans, T-shirts, jackets, skirts and tops. Considering this demand, the company can improve its expansionist strategy by selling these clothes in this market. The integration of traditional designs with its new styles and designs can help the company to improve its demand in China.

M&S can improve its apparel sector in the country under its brand name Per Una. In its domestic market, the company has re-launched its brand taking to feminine from frilly. The main purpose of this brand is to shift perceptions of its customers to “stylishly feminine” from “too frilly” (Hammet, 2019) It has also improved its promotional and marketing activities for its brand which has garnered attention from all segments. These types of strategy can be implemented by the company in China.

The collection of its Per Una brand consists of denims, tops, dresses, and skirts, having luxurious fabrics, feminine prints and modern shapes. Its modern and contemporary florals bloom among its dresses, silk skirts and blouses, while its blazers and jeans for creating a stylish impression and being practical. This can help in creating the required demand among the customers as they will prefer to shop for its brand image.

The company generally targets its customers as per their shopping history in which it has found that most of its customers (54%) are over 50 years of age. It has classified its customers into three phases, the top customers, the core ones and the occasional ones (Rugby, 2017).

Based on these categories, the company produces its clothing products which can help in generating more revenue in the market. Keeping this in mind, the company should target the youth and the working professionals since they are more fashion and brand conscious than other groups.

The segmentation that can be followed by the company is demographic and behavioural segmentation while its target groups are to be women who are from 25 to 50 age groups. Jaradat (2017) stated that segmentation in the fashion market is derived from the purchasing style of the consumers and their perception of the brands.

In this context, the company can target this younger generations and working professionals since they are the larger groups who purchase and prefer Western wears. This will help the company to gain competitive advantage and improve its sales.

2. Formulation of a supply network strategy for supporting entry of M&S into China

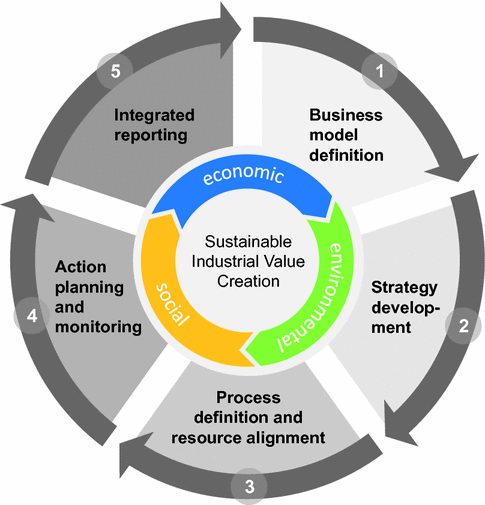

The positioning strategy of the company is based on the needs and preferences of its customers and also sales of its products. In recent times, the clothing sector of the company is seen as confusing and outdated since it does not have any focussed strategy for its clothing line. It has designed a 5 point proposed strategy for revitalising its brand and redefining its positioning in the fashion sector.

This strategy has been reflected in its “Spend it Well” campaign which implies that the life is very short so its customers should spend wisely in its products and services. The positioning of the company in China should be value based positioning strategy since the customers in the country are willing to spend money worth value of the products.

The smart technology and innovation in the country can help the company to produce new and innovative clothing and home products. Aigbogun et al. (2016) commented that as per the agency theory in supply chain management, the supply chain for the retailers is oriented in establishing agreements in its shareholders where one group hires another group for improving their business operations.

It denotes a close relationship between the suppliers and the management in which the company is able to procure raw materials in their quoted prices.

In this context, the supply chain network of the company should be based on the agreements among its suppliers for removing conflicts of interests. The company can form partnerships with the local suppliers for procuring required materials in low prices in China.

It can use eco-friendly substances like bamboo modal and tencel, and fabrics like coffee, coconut, and pearl fibres that can provide extra care for the skin and prevent bacteria or remove bad smell. In the global context, it is required to abide by the environmental practices and the Code of Conduct for ensuring that the textiles and fabrics are environmental friendly.

Its value based positioning system and customer focussed products can help it to sustain in the market. It is required to implement those materials in its clothing and home products that cause low pollution in the environment.

As per the view of Sun and Zhao (2017), smart production through technological innovation and aggressive marketing strategies can help the company to improve its position in fashion sector. The pricing strategy of the company should be geographical pricing and bundle pricing entry strategy and then it can shift to the premium and value pricing strategy.

3. Formulation of a collaboration strategy for entry of M&S’s into China

The entry mode strategy of the company should be franchising based as it is the form of arrangement in which the franchisor licences or grants some authorities to franchisee. It is the effective marketing strategy which helps in expansion while having minimal risks. Franchising is considered to be the best way for expanding business which can be implemented by M&S in China.

Considering the overall uncertainty in its domestic market and the flourishing fashion sector in China with its ever growing consumer market, this franchising will help it to build its brand name, improve goodwill and reach to more customers. It can help the company to improve its expansion without incurring extra costs on expansion.

This franchising agreement will help in setting clear conditions by which both franchisee and franchisor will get benefitted. It will also prevent the company to bear any kind of risks or incur extra costs for training its employees.

The mode of entry will help in easy expansion since the local retailers who will be the franchisee of its products have a great knowledge of culture and preferences of the customers in the region. This will result in minimal risks for the company as it will not have to implement extra strategies for analysing the culture, needs and preferences of the people.

It will also help in overcoming competition from the domestic players since the franchisee already knows the techniques of improving profits. It can manage its collaboration with its Chinese partners by adhering to the local rules and regulations and paying taxes as required.

The company should abide by the governmental policies and ensure that they deploy fair practices in its operations. This will help in establishing relationship with the local retailers, customers and partners. It will also enable the companies to bring more franchisees for improving its expansion strategy.

Task III: Reflection

Evaluation of concepts and theories

In tasks I and II, the theories and the concepts have helped in analysing strategies that can help in its re-entering mode into China. It is to be considered that the fashion industry of the country is booming and the company can explore these opportunities by adapting right strategies. Its concept of Plan A Programme is aimed at bringing sustainable operations in its supply chain management processes that can help in improving its relationship with its suppliers.

However, it needs to make more robust investments in its supply chain system for bringing more transparency. In this context, I have used this concept for gaining effective knowledge of supply chain system of the company. I have also used branding strategy for analysing brand value and image which is required for re-entering in a global market.

The strength of this branding strategy helps in analysing the strategies of a company that are required to be implemented for improving positioning in a new market. However, the problem of this branding strategy is that it may not influence those customers who perceive comfort and prices more than the brand name and image.

I have used segmentation and targeting approaches which helps in evaluating target customers for a company. The strength of this segmentation and targeting is that it helps in identifying the target customers before make the products available in the new market.

However, the weakness of this strategy is that it involves costly production, marketing, huge investment, storage and stock problems. I have also applied the concept of positioning system which helps in determining best communication strategies for meeting needs of the customers.

The weakness of this positioning strategy is that high level competition in the market can defeat the strategy of the company to sustain in the market. The concept of franchising has been implemented by me in this study as it helps in analysing the ways through which a business can be expanded easily on overseas.

Its strength lies in minimal risks on the part of the franchisor and the franchisee has to bear all the costs for assistance and training, giving a scope to the company to bear low expenses. The weakness of this franchising is that the franchisor cannot have total control over its products and services since the franchisor is dependent on the franchisee in all these aspects.

I have applied agency theory of supply chain system since it helps in analysing kind of relationship between the stakeholders and management. The weakness of this theory is that it does not consider transaction costs in supply chain system.

The above tools and techniques are used by me to gain a comprehensive view of the strategies that are required for expansion in a global market. For instance, franchising has been used over joint ventures since franchising involves lower costs and risks.

Similarly, value based positioning system has been stated as it helps in generating more customers than other strategies in a new market. Agency theory has been considered over other theories as it helps in understanding the ways collaborative relationships among suppliers can help in anticipating efficiencies in supply chain system.

The pricing and promotional strategies have further helped in analysing and determining prices and position in improving re-entering strategy in an overseas market. Thus, the above theories and concepts have helped me to enrich my knowledge regarding various strategies that can help in improving expansion aspects of a company.

References

Adamo, 2019, Fashion’s Next Trend, Human Rights Watch [online] 18 December 2019, Available from: https://www.hrw.org/report/2019/12/18/fashions-next-trend/accelerating-supply-chain-transparency-apparel-and-footwear [Accessed 28 April 2020]

Aigbogun, O., Ghazali, Z. and Razali, R., 2016. The mediating impact of Halal logistics on supply chain resilience: An agency perspective. International Review of Management and Marketing, 6(4S).

Hammet, E. 2019. M&S relaunches Per Una brand to take it from ‘frilly to feminine’, Marketing Week [online] 7 October 2019, Available from: https://www.marketingweek.com/ms-relaunches-per-una-brand/ [Accessed 28 April 2020]

Jaradat, S., 2017, August. Deep cross-domain fashion recommendation. In Proceedings of the Eleventh ACM Conference on Recommender Systems (pp. 407-410).

Lu, S. (2018) China’s Changing Role in the World Textile and Apparel Supply Chain, FASH455, [online] Available from: https://shenglufashion.com/2018/11/02/chinas-changing-role-in-the-world-textile-and-apparel-supply-chain/ [Accessed 28 April 2020]

Marks and Spencer, 2019, Strategic Report – Marks & Spencer [online] Available from: https://corporate.marksandspencer.com/documents/msar-2019/strategic-report.pdf [Accessed 28 April 2020]

Marks and Spencer, 2019, SUPPLIER MANAGEMENT [online] Available from: https://corporate.marksandspencer.com/sustainability/clothing-and-home/supplier-management [Accessed 28 April 2020]

Mckinsey (2019) The State of Fashion 2019 [online] Available from: https://www.mckinsey.com/~/media/McKinsey/Industries/Retail/Our%20Insights/The%20influence%20of%20woke%20consumers%20on%20fashion/The-State-of-Fashion-2019.ashx [Accessed 28 April 2020]

Rugby, C. 2017. Marks & Spencer: reaching core customers, Internet Retailing, [online] 21 March 2017, Available from: https://internetretailing.net/research-articles/research-articles/marks-amp-spencer-reaching-core-customers [Accessed 28 April 2020]

Slangerup, J. 2019 2019 Supply Chain Outlook for the Apparel Industry, Ris news, [online] 5 August 2019, Available from: https://risnews.com/2019-supply-chain-outlook-apparel-industry [Accessed 28 April 2020]

Sun, L. and Zhao, L., 2017. Envisioning the era of 3D printing: a conceptual model for the fashion industry. Fashion and Textiles, 4(1), p.25.

Wood, Z. 2016. M&S to close 30 UK stores and cut back on clothing, The Guardian. [online] 8 November 2016, Available from: https://www.theguardian.com/business/2016/nov/08/m-and-s-marks-spencer-close-80-stores-majoroverhaul [Accessed 28 April 2020]

Wood, Z. 2019. ‘Jeansgate’ exposes Marks and Spencer’s deeper fashion flaw, The Guardian [online] 13 July 2019. Available from: https://www.theguardian.com/business/2019/jul/13/jeansgate-exposes-marks-and-spencersdeeper-fashion-flaw [Accessed 28 April 2020]

Wood, Z. 2019. Marks & Spencer to offer ‘buy now, pay later’ option online, The Guardian. [online] 1 October 2019. Available from: https://www.theguardian.com/business/2019/oct/01/marks-spencer-to-offer-buy-now-paylater-option-online [Accessed 28 April 2020]

Yanan, L. and Shilong, Y. (2019) China remains reliable supplier of global fashion brands amid trade tensions with U.S. – industry, Xinhua News, [online] 8 August 2019, Available from: http://www.xinhuanet.com/english/2019-08/08/c_138293338.htm [Accessed 28 April 2020]

Know more about UniqueSubmission’s other writing services: