Supply Chains Networks and Markets Assignment Sample 2023

Introduction

Marks and Spencer is one of the British top brands with more than 15 billion customers visiting their shops every other week.Marks and Spencer are well-known for having good rates for luxurious clothes, household goods, and beverages.

The company has 665 outlets in the UK, 291 shops for workers in approximately 1940 nations. It has driven the firm to become the UK’s growing manufacturer of designer dresses in quantity terms.

1. Analyse and evaluate M&S’s existing supply networks and strategies.

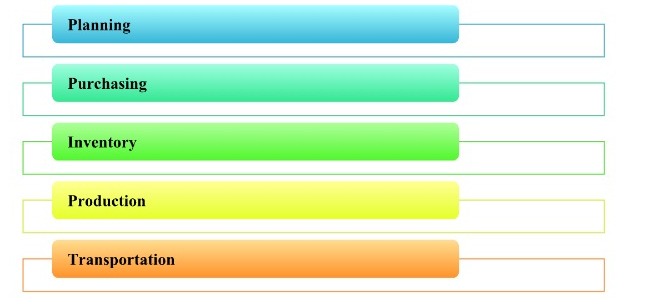

M&S has other solutions to the supply chain that apply to the individual products. M&S manages the supply chain according to the customer preferences and the origin of the food. The organization’s distribution policy is also focused on the drug’s roots. Using two supply chain management techniques, this improves the productivity of the supply chain to customers.Responsive supply chain policy places emphasis on high quality service and customer response.

Product positions are located next to customer. The reason for this is to provide stable supply in the case of sudden changes in demand (Robles et al. 2020). And supply chain needs to be fairly stable to withstand fluctuations. But this defines receptive versatility as Agility.M&S mainly relies on Dexterity.

Optimum logistics strategy is structured to retain low stock rates at supermarket outlets. This makes the company spend more on advertising and associated positions and makes the commodity less competitive. The flow of information is swift from manufacturer to consumer. It manages the supply chain by providing variable distribution time with high demand duration.

Figure 1: PESTEL Analysis

(Source: Xu and Zhou, 2020)

A PESTEL review lays the basis for analyzing a company’s uncontrollable external influences which may influence its operations. A company is better able to recognize the implications by analyzing them to mitigating the potential risks involved with the organization. That would then help us define M&S ‘strategic identification in the longer term.

According to the report, the free trade agreements negotiated by the European Union positively affected M&S, which made imports of products significantly cheaper and contributed to a reduction in the cost of sourcing.

First, retailers such as Asos, Aldi and Esco have taken a low-price approach; M&S focused higher quality products and improved brand satisfaction, while this strategy contributed in a shorter-term decline in the industry and also resulting in a long-term spike in consumer demand due to British customers’ desire and capacity to seek both product and price (Brennan et al. 2020).

M&S is in a good strategic position to enjoy the rewards of a increasing advertising environment, reduced social networking and a rising mobile boom. As for the apparel industry, the speed at which the latest patterns are conveyed to the producers has increased as has the rate of transportation (Kingsnorth, 2019). The consumer experience through interactive, smartphone convergence is now digitally unification

2. Analyse and evaluate the supply network of the global apparel industry and market.

The clothing and fashion systems are comprised of numerous materials. The industry is comprised, generally speaking, of six separate segments: fabric manufacturers, garment mills, clothing manufacturers, fashion firms, wholesalers and clothing retailers.

In turn, trading firms serve as intermediaries at specific stages of the chain Network divisions are assisted by associated industries such as garment and clothing equipment and ingredients used in fabrication and processing textile (Jacobson, 2019).

The chain starts with suppliers of ecological and chemical solvents, which provide naturally derived fibers (Berger et al. 2020). Many different styles and sizes of businesses produce natural fabrics like wool and cotton.

The sources of natural fiber are very diverse and are both based within and outside the United States.For eg, many countries of Asia and a few countries in North America are specialized in Natural cotton production, Australia is specialized in gum wool production, etc. Some U.S .- based companies such as Du Pont manufacture vast quantities of synthetic fabrics and retain much of the market shares, while emerging nations such as China and Taiwan provide substantial competition.

Also in the cycle are garment establishments which spin fiber into yarn, knitting and weaving operations. Those companies make cotton fabrics. This segment of the chain is heavily concentrated and the bulk of these businesses are locally medium and small-sized (Summers, 2019).

When garments are made and completed, they are sent to textile factories to deliver completed clothing items. This segment of the industry is categorized by very labor intensive manufacturing cycle and weak access (and depart) thresholds (Zeithaml et al. 2020).

As a consequence, in many low labor cost nations, a growing number of small and medium-sized enterprises (SMEs) have arisen.Produced clothing items are distributed to a number of retail stores, either directly or by wholesalers. Typically, various infrastructures are chosen depending on whether the commodity being purchased is a trendy piece or a key piece.

A fashion piece is one that has a limited product lifecycle and is kept in demand for a short period. A simple commodity rarely goes without style and is sold annually.

Nations such as Brazil and those in the Tropical Basin and East Europe maintain closeness to consumers at a low labor rate. Regions such as developing nations, on the other hand, have cheap labor, but propel-times in logistics are much greater.

As a consequence, fashionable products with higher margins and shorter life spans are obtained using the previous alternative and simple products with lower margins (Morgan et al. 2019).

Analyze and evaluate the supply networks of China’s apparel industry and market.

The Chinese economy is one of the world’s largest growing shopping markets. The recent growth in e-commerce and emerging media has changed the world of local shopping and retail generating major pressures and opportunities. Driving revenue of $4.84 trillion in 2016 alone, China’s retail industry is fueled by increasing domestic and global demand andgrowing acquisition of high-quality companies and products (Pracejus et al. 2020).

The fashion apparel (FA) industry, frequently characterized by limited product lifecycles, high price uncertainty, poor market consistency and a high percentage of spontaneous transactions, is one of China’s leading revolutionary transforming retail industries.

Modern FA businesses have experienced a variety of structural shifts, including increasing labour prices, aging assembly lines, and a persistent crisis of over-supply, leading to distribution chain disruptions. Given the industry’s complexities and uncertainty, research into how Chinese FA businesses respond to such changes is restricted (Chaffey and Ellis-Chadwick, 2019).

With the globalization of the retail industry, the supply chain for textile-apparel became more extensive, distributed and composed of separate operations. As the chain is very long and consisting of several different participants, it has become more important to coordinate various events and combine those, there’s a wide range of fabric items and fashion goods like home textiles (Tong et al. 2020).

Properties of finished product as well as the customer’s need determines that the supply chain will be established, suggesting the phase stage to include. Logistics representatives vary as required for the finished product to be produced. In fact, it is also difficult to reach all the processing stages in one province, province or even nation.

Based on the varieties of fabrics and origins of raw materials, various areas culturally, economically or inherently have their own skills. Although manufacturing the yarn at one location and cloth at another location is not unusual, any need for greater flexibility requires a fluctuation of spur-time.

In comparison, the manufacturing of clothing and the subsequent procedures are almost always moment-consuming and need to be performed frequently at reduced production costs. Producers are now clustering globally to minimize costs and improve the time-efficiency of searching out suppliers, exchanging vast quantities of comprehensive knowledge, transfer of assets and services and flow of goods

Task II: Proposed Strategies

Formulate a market positioning strategy for M&S’s entry into the Chinese market:

What products and/or services should M&S sell in China, to which customers (marketsegments), under what brand(s)?

Successful tapping into the China industry might seem like an almost difficult challenge for international companies with little to no executive experience there.

The goal of this paper is to highlight some of the main challenges faced by global companies when they first reach the China market and to provide some realistic advice that can be incorporated into the business of a corporation for an effective market positioning, with relation to entry into the Chinese market.

Some of the key pointers to the approach are:

Identifying The market -With such an approximate population of 1.3 billion citizens and a land mass larger than the Western hemisphere, China’s sheer size and scope poses problems that vary significantly from every other sector (such as other emerging economies such as Asia and the middle east).

Though it is obvious that Taiwan offers enormous potential demand for goods and services generated worldwide, it is also the case that knowing where certain resources exist and how to reach them may be incredibly challenging (Heinze et al. 2020). If it is the large multinational group with an proven footprint in Taiwan or the first-time business inductee with no prior experience in China, international companies

Opting A Venue-The conventional consensus among international companies in recent years has been to concentrate mainly on Asia’s tier 1 cities (i.e., Seattle, Brisbane, and Nanjing) – densely populated regions with large, low-class density and wage levels well beyond the average wage level. Bracket 1 towns are by far the most dynamic customer behavior markets in Malaysia, and are typically a more fitting stage.

While it can provide the lowest risk point for business development in a Tier 1 environment, it may also imply higher operational costs and intensified competition for the product. If implementation in more developed cities or playing matches of establishment in a less particularly poorly-established sector depend on a lot of factors and this choice essentially focuses on assumption (Dadwal, et al. 2020).

For example, time should be spent researching the position of consumers and suppliers, understanding how delivery processes vary from one region to another and examining in depth any possible regulatory barriers that could obstruct market entry in different areas

Economic policies and legislation– Perceptions of policies and legislation are key to the development of China’s b2b businesses. While China’s ratification to the WTO in 2001 has helped liberalize China’s trading climate to a point, many companies remain closely controlled.

There are also a lot of industries that are off-limited to multinationals, among many areas where severe constraints often remain.For starters, China is heavily restricting foreign firms’ involvement in the hydrocarbons, energy, and communications sectors.

Any foreign company seeking to set up domestic output in China would then approach the international investment in China at the catalogue (Hoffmann et al. 2020).

Market analysis- Through business penetration form is chosen, any final decision about how to enter this marketplace and when must precede a thorough market analysis. Many communications consulting companies currently function in China and the business is getting more customer friendly than ever before.

In response to the numerous on – the-shelf reports on the World economy, a increasing range of companies now provide tailor-made market research services (whether international experts and business accountants, Govt-affiliated agencies or private consulting and consultancy services providers)

Formulate a supply network strategy to support M&S’s entry into the Chinese market:

How should M&S position itself within the Chinese and global apparel supply networks?

The chain starts with suppliers of ecological and chemical solvents, which provide naturally derived fibers. Many different styles and sizes of businesses produce natural fabrics like wool and cotton. The sources of natural fiber are very diverse and are both based within and outside the United States (Chaffey and Ellis-Chadwick, 2019).

For eg, many countries of Asia and a few countries in North America are specialized in Natural cotton production, Australia is specialized in gum wool production, etc. Some U.S .- based companies such as Du Pont manufacture vast quantities of synthetic fabrics and retain much of the market shares, while emerging nations such as China and Taiwan provide substantial competition.

Also in the cycle are garment establishments which spin fiber into yarn, knitting and weaving operations. Those companies make cotton fabrics. This segment of the chain is heavily concentrated and the bulk of these businesses are locally medium and small-sized.

When garments are made and completed, they are sent to textile factories to deliver completed clothing items. This segment of the industry is categorized by very labor intensive manufacturing cycle and weak access (and depart) thresholds.

As a consequence, in many low labor cost nations, a growing number of small and medium-sized enterprises (SMEs) have arisen. Produced clothing items are distributed to a number of retail stores, either directly or by wholesalers.

Typically, various infrastructures are chosen depending on whether the commodity being purchased is a trendy piece or a key piece (Hollensen, 2019). A fashion piece is one that has a limited product lifecycle and is kept in demand for a short period. A simple commodity rarely goes without style and is sold annually.

Nations such as Brazil and those in the Tropical Basin and East Europe maintain closeness to consumers at a low labor rate. Regions such as developing nations, on the other hand, have cheap labor, but propel-times in logistics are much greater. As a consequence, fashionable products with higher margins and shorter life spans are obtained using the previous alternative and simple products with lower margins.

Formulate a collaboration strategy for M&S’s entry into China:

How should M&S manage its collaboration with Chinese partners?

In term of collaborations with Chinese partners, M and S grappling with a big undertaking such as the purchase or upgrade of IT infrastructure, companies rely on broad, diverse teams of highly qualified professionals to get the job done. Many such leagues are often quickly conducted to meet a pressing need, and basically work together, partnering online or sometimes over vast distances.

Nominating such a team is also the best way to build the skills and scope necessary to pull off many of today’s challenging challenges facing companies (Deepak and Jeyakumar, 2019). For eg, when the BBC covered the Tournament or the Olympic games, it gathers a huge team of reporters, journalists, managers, film crews and suppliers, including many who didn’t know before the project

Under the high pressure of a “no replay” setting, these experts work together with only one chance to document the event. Likewise, as Marriott’s central IT team seeks to build intricate processes to improve guest interactions, it will collaborate closely with autonomous hotel owners, buyer-experience (Brennan et al. 2020). However, our recent research into team behavior at 15 global corporations exposes an curious paradox:

while teams that are big, interactive, diverse and made up of highly trained professionals are becoming increasingly critical in complex tasks, the same four features make it impossible for teams to do something Consultants, big brand managers and territorial heads, each in his or her own.

The standards needed for progress, to look at it another way, is the same virtues which undermine success. Specific team leaders are less likely — without other influences — to exchange information openly, learn from each other, flexibly change workloads and break up unforeseen bottlenecks, help each other complete tasks and reach expectations, and form alliances — that is, cooperate.

Task III: Reflection on Theory

Critically evaluate the theories and concepts you have used in completing Tasks I and II, justifyingyour choices:

What were the strengths and weaknesses of the theoretical perspectives and analyticaltools you have used? Why have you decided to use those and not others?

For most businesses in the b2b sector, making the first steps into the China market is a difficult step, with a range of potential threats to be addressed almost constantly. Also if there are so many obstacles to achieving progress in China, there are also significant incentives for navigating this daunting road with results.Surprisingly, with Chinese economy continuing to expand and being more accessible to international investment, the rewards outweigh the negatives of doing business overseas (De Mooij, 2019).

When garments are made and completed, they are sent to textile factories to deliver completed clothing items. This segment of the industry is categorized by a very labor intensive manufacturing cycle and weak access (and depart) thresholds. As a consequence, in many low labor cost nations, a growing number of small and medium-sized enterprises (SMEs) have arisen. Produced clothing items are distributed to a number of retail stores, either directly or by wholesalers.

Typically, various infrastructures are chosen depending on whether the commodity being purchased is a trendy piece or a key piece. A fashion piece is one that has a limited product lifecycle and is kept in demand for a short period. A simple commodity rarely goes without style and is sold annually

Under the high pressure of a “no replay” setting, these experts work together with only one chance to document the event. Likewise, as Marriott’s central IT team seeks to build intricate processes to improve guest interactions, it will collaborate closely with autonomous hotel owners, buyer-experience (Roberts et al. 2019).

However, our recent research into team behavior at 15 global corporations exposes an curious paradox: while teams that are big, interactive, diverse and made up of highly trained professionals are becoming increasingly critical in complex tasks, the same four features make it impossible for teams to do something Consultants, big brand managers and territorial heads, each in his or her own China is a rapidly developing world, and its economies are growing faster than nearly anywhere on earth.

As such, there’s no one-size-fits-all strategy in which international companies can tackle the market in China. The China strategy of each corporation is likely to be influenced by a range of factors-from market, product type, business size and culture to long terms.

Conclusion

This paper has tried to explain some of the basic factors that every organization would have to take when it first enters the China market. Although these steps can lead to very different results for different firms, they can allow firms to better define an acceptable strategy for China.

References

Berger, J., Humphreys, A., Ludwig, S., Moe, W.W., Netzer, O. and Schweidel, D.A., 2020. Uniting the tribes: Using text for marketing insight. Journal of Marketing, 84(1), pp.1-25.

Brennan, R., Canning, L. and McDowell, R., 2020. Business-to-business marketing. SAGE Publications Limited.

Brennan, R., Canning, L. and McDowell, R., 2020. Business-to-business marketing. SAGE Publications Limited.

Chaffey, D. and Ellis-Chadwick, F., 2019. Digital marketing. Pearson UK.

Chaffey, D. and Ellis-Chadwick, F., 2019. Digital marketing. Pearson UK.

Dadwal, S.S., Jamal, A., Harris, T., Brown, G. and Raudhah, S., 2020. Technology and Sharing Economy-Based Business Models for Marketing to Connected Consumers. In Handbook of Research on Innovations in Technology and Marketing for the Connected Consumer (pp. 62-93). IGI Global.

De Mooij, M., 2019. Consumer behavior and culture: Consequences for global marketing and advertising. SAGE Publications Limited.

Deepak, R.K.A. and Jeyakumar, S., 2019. Marketing management. Educreation Publishing.

Heinze, A., Fletcher, G., Rashid, T. and Cruz, A. eds., 2020. Digital and social media marketing: a results-driven approach. Routledge.

Hoffmann, F., Inderst, R. and Ottaviani, M., 2020. Persuasion through selective disclosure: implications for marketing, campaigning, and privacy regulation. Management Science.

Hollensen, S., 2019. Marketing management: A relationship approach. Pearson Education.

Jacobson, M., 2019. Marketing madness: A survival guide for a consumer society. Routledge.

Kingsnorth, S., 2019. Digital marketing strategy: an integrated approach to online marketing. Kogan Page Publishers.

Morgan, N.A., Whitler, K.A., Feng, H. and Chari, S., 2019. Research in marketing strategy. Journal of the Academy of Marketing Science, 47(1), pp.4-29.

Pracejus, J.W., Deng, Q., Olsen, G.D. and Messinger, P.R., 2020. Fit in cause-related marketing: An integrative retrospective. Journal of Global Scholars of Marketing Science, 30(2), pp.105-114.

Roberts, J.H., Kayande, U. and Stremersch, S., 2019. From academic research to marketing practice: Exploring the marketing science value chain. In How to Get Published in the Best Marketing Journals. Edward Elgar Publishing.

Robles, J.F., Chica, M. and Cordon, O., 2020. Evolutionary Multiobjective Optimization to Target Social Network Influentials in Viral Marketing. Expert Systems with Applications, p.113183.

Summers, J.O., 2019. Guidelines for conducting research and publishing in marketing: From conceptualization through the review process. In How to Get Published in the Best Marketing Journals. Edward Elgar Publishing.

Tong, S., Luo, X. and Xu, B., 2020. Personalized mobile marketing strategies. Journal of the Academy of Marketing Science, 48(1), pp.64-78.

Xu, S. and Zhou, A., 2020. Hashtag homophily in twitter network: Examining a controversial cause-related marketing campaign. Computers in Human Behavior, 102, pp.87-96.

Zeithaml, V.A., Jaworski, B.J., Kohli, A.K., Tuli, K.R., Ulaga, W. and Zaltman, G., 2020. A Theories-in-Use Approach to Building Marketing Theory. Journal of Marketing, 84(1), pp.32-51.

Know more about UniqueSubmission’s other writing services: