Supply Chains Networks and Markets Assignment Sample 2023

Introduction

This assignment is based on company “Marks and Spencer” (M&S), will demonstrate you with insight and analysis of inter-organisational relation, supply network of global and the target country market (china), along adequate market strategy to enter the market, inclusive of suggestions to adoption of distribution network and collaboration strategy (Stevenson and Cole, 2018).

M&S was established in year 1884 by Michael Marks and Thomas Spencer, headquartered in London. It is specialized in selling products like clothing, home products and food products. Currently, company has around 959 stores across UK and has 1463 stores worldwide.

This assignment has been, undertaken to provide a suggestive measure, whether company should re-enter the Chinese market or not. Failure experience in the Chinese market in year 2017, it date has been considered as one of the major fall of the company (Dong et al, 2019).

This assignment will provide with the entry-mode strategy to the company whether to use franchising or joint venture technique for its come back. On going through the annual report as well as by the news it is, assumed company is currently suffering from existential crisis. Since past seven years, it has experienced decline in sales, inclusive of declining share in UK clothing market from 11 per cent in 2004 to 7 per cent in 2019.

Apart from this, the company even noticed drop in its share price by 26 per cent in 2019 and considering the current “covid 19” existence, there might be a lot more that company could suffer from in the clothing unit. Even the company’s own chairman stated that, company is experiencing metaphorical drift since past 15 years.

Here a question arises, instead of being a major multinational company, with “n” numbers of stores, what is the force that is resisting the growth of the company? Is it the lack of innovation, lack of distribution channel or lack of competitive strategy (Voss et al, 2019)

Inter-Organizational Relations

Inter-organizational relations are the long lasting relation that exists between and among the organizations such as the suppliers, customers, trade associations, peers and so on). These organizations have a common interest, but are independent and autonomous, while retaining their separate interest area too.

These organizations may vary in terms of their relations like long-term agreement, partnerships, joint ventures and consortia (Cole et al, 2019). The inter-organizational relation network represents how their existence evolved from pattern, content, form, nature till distribution network.

This relation among the organizations defines the core reasons for the existence of the relation between them. Forming an inter-organizational relation is considered strategic, which is quite too. As it results out in driving back the falling position of the organization and create a new repo of its product in the market.

Due to increasing environmental issues, inequalities and need for innovative creation, consider the hygiene issues as priority, it is complicated as well as challenge to provide the world with service that satisfy their need in all aspects. It is tough for any organization to consider all this aspect and work on of them, thus it even result in high costs too.

Therefore, to get things done at cheap price without wasting time and resources, organizations collaborate. Resultant resources can be exchanged and used, organizations collaborated with are contacted on the basis of specialties they produce and offer.

And in the world of growing pandemic issues like covid 19, their need to collaborate with scientists, businesses, investors, government, NGOs etc. Considering all the above points, M&S believes that buying power will always not fall in your favour, so the changes depend on you. For instance, M&S uses a 0.01 per cent of world’s cocoa, which is produced each year.

Further, M&S states in order to accelerate in the market, it’s necessary to conceive the change by walking with others. The company is committed and honest towards its collaborative partners like the suppliers, customers, businesses, investors and others (Bek and Lim, 2018).

the inter-organizational relation of M&S with other organization below I have provided with the table, which indicates the M&S some of the collaborations and memberships concerning their food joint and have also highlighted the reason for this relation between the two.

Image 1:The organisations and their relationships

(Source: Caro and Sadr, 2019)

Distribution Network Followed in the Apparel Market

Distribution is one of the components of marketing mix. It is concerned with path, which starts with manufacturing a product and ends at the end consumer. Distribution path can be travelled directly by the producer or indirectly by the third-party.

Further, in the supply chain industry distribution network refers to path to existence of interconnection among manufacturer, storage facilities, transportation facilities, intermediaries and the consumers. Distribution network depend and varies from company to company (Robinson and Hsieh, 2019). A company needs to plan out the distribution network carefully, as it requires equipments, workers, IT and transportation facility. It is the company’s own choice to set a hub and spoke distribution network or a decentralized one.

Apparel supply chain network is considered one of the important basic necessities for the existence of clothing sector. It is a widely distributed in the entire world, because of the strong need for outsourcing of the fashion apparels.

The intensity of the distribution network depends upon the demand for that particular clothing need that is characterized on the basis of demand pyramid as stated in below figure.

As per the demand apparel market has always been subject to fashion fluctuations. And there always exits competitions among the peers to present their best. This increasing demand and market competition pushes the apparel industry to be efficient towards managing their supply chain. Moreover, the supply chain design of the organization depends upon clock-speed of that concern organization.

This clock speed refers to the speed at which as per the market demand, product portfolio and out look towards that product changes of that industry (Datta and Diffee, 2020).

Below figure indicates the configuration of apparel supply chain. The below figure has indicated a chronological process of supply change and has shown the inter-relation existence between the organization, suppliers and the customers. The figure has also indicated the direction of flow of demand and supply. Efficiency of supply chain depends in about reducing the inventory and increasing the customer base. As, it is noticed with time customers preferences change, therefore inventory and the customers preference are the main dimensions of supply change management.

Apparel Distribution Network in Chinese market

China is one of the fastest growing economies and has most of the foreign brand hub in their basket. But with the breakdown of current pandemic covid 19, which originated from china, all

the world players who have their investment in China are planning to exit from the Chinese ground. But concerning the older facts, it is assumed Chinese market is quite an attractive place to be, when considered foreign apparel brands. There are certain barriers to entry in the market which is intervening by the Chinese government.

The supply chain and distribution in Chinese market is quite lucrative, but is a complicated segment. It is essential to setup a effective distribution channel in china and it owns more hardship than in Europe and United states. One need to stand a reactive distribution network such as it can cure the loss of both sales as well as the profit (Fan and Stevenson, 2018).

The Chinese distribution network compress of 6-7 tiers process (LeBaron and Rühmkorf, 2017). It starts with the wholesalers, who further walk ahead towards the distributors, retailers and other wholesalers. It is believed if one needs to enter the Chinese market, he must adopt the robust distribution structure, which must be well-planned and stated.

And all the aspects of market the client, the distributor and the providers must agree to its implementation such as at later stages complication is avoided. Some of the problems that one can face at distribution channel in china are: the Chinese distribution network is fragmented, here logistic service providers might be unreliable and transportation service is complex as well as expensive (Alexander et al, 2017).

Then coming onto the statistics, China apparel market experienced and upswing in 2018 in its trend it was quoted as highest year-to year growth after 2014. This uptrend was result of upgraded consumption trend as a outcome of stable demand and hike in income of people.

When considering the in-built stores in the country, the apparel sales at the stores experienced a downfall in comparison to the e-commerce player’s presents. E-commerce market has delivered a strong growth, making china’s apparel market the fastest-growing retailing channel. Further, comparing the local apparel brands with the foreign one, there exits certain struggle for the foreign players (Zhu et al, 2019).

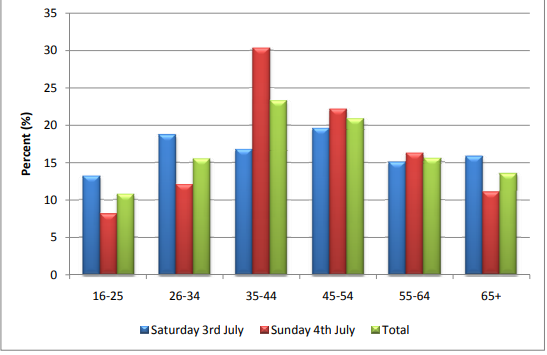

The figure given below indicates the trend of sales of apparel in China.

On comparing the local stores and the e-service platform, the apparel sales at stores have been declining over years, due to the challenges by the e-commerce industry. E-commerce industry has provided strong growth trends over past few years. Below figure indicates market share of stores and e-commerce services. Looking in the apparel segments there are women’s wear, menswear, children’s wear amd sportswear.

The women’s wear segment is the largest in terms of sales. While, both the spots and children’s wear accounted for double-digit year on year sales growth by outperforming the women segment (Kraft et al, 2018).

Supply Distribution Network of M&S

M&S is the UK based one of the largest retail apparel store by value. Company has a multi-layered and global supply chain network. It has to deal with different sort of suppliers.

The company doesn’t own any manufacture hub, it deals with concerned supplier of the product, whether he intermediary or the wholesaler (Buck, 2019). Though company is dependent on it suppliers for the products, still provides with excellent quality, innovation and sustainability, which is actually result of long-term trust of them in their suppliers.

The company source its products from around 1000 factories across the globe and top of the countries are from China, Cambodia, Vietnam, India, Turkey, Bangladesh and Sri Lanka. Company doesn’t compromise with the quality at any cost that is the reason for its excellence in quality. Company depends on only those suppliers, who meet up with their standard requirements (Perry and Wood, 2018).

The company follows supplier management approach that focuses on:

- Effective and comprehensive management system approach

- Staff competencies and awareness

- Responsible employment practices

- Fair price and payment (Kraft et al, 2018)

- Working towards a fair living

Further, the success of M&S depends upon how the act in their business that is they listen, learn, respond and work in accordance to the partnership. M&S works with “n” numbers of organizations in order to support supplier’s management activities. It is the founding member of “Supplier Ethical Data Exchange” that aims at driving the improvement and convergence in responsible sourcing practices (Carr, 2019).

Coming on the recent news, M&S has adopted single-tier clothing and home logistics network. This move will help the group to move the products from suppliers to stores faster and at cheap cost.

M&S Distribution Centre (DC) in Bradford will now be able to cope up with more capacity. DC is managed by a third-party logistics specialist XPO with the transportation facility provided by DHL. The move to adopt single-tier is one of the latest achievements added in the basket since past five years. This will help the company to remove complexity arising with the network and will result in increase in speed of the supply chain.

This launch can be taken up as a new strategy that the company has adopted to overcome its decline requirement. But the fact cannot be ignored that with the outbreak of covid 19 the company might have to suffer a loss in its clothing segment. Currently, as the situation is no strategy can work in the apparel sector, not only M&S, but the entire apparel sector will experience a gradual fall.

But the company has advantage to recover it loss by its food segment (Li et al, 2018). And in this time of crisis as noticed, things are available at the high price and people are stocking it for future. Therefore, company might have to suffer a hardship but can notice a positive look towards the food sector.

Competitive Advantage and analysis of market segment of M&S

In 1992, the M&S has 280 chain stores in UK with arrangements of 75 billion dollars. From the viewpoint on sales class, M&S speaks to 15% of the UK attire bargains and 4.6% food bargains. Guinness World Records reveals that volume of association’s head store in London Marble Arch is 3700 dollars for each square foot (Durocher-Yvon et al, 2019).

M&S offers dress having magnificent style, quality and motivating force for money and nuclear family thing, similarly as remarkable quality sustenance’s, all things experience careful screening, from more than 2000 suppliers around the world. M&S in the UK and various other countries, more than 75000 labourers in the UK, starting at 2018 has 622 stores in the overall settings; M&S is in like manner adequately making business.

In the 2007-08 money related year, bargains outperformed 90 billion pounds. From a market arranging perspective, since the 12th centaury, 30 years, M&S makes clerical class as an arrangement article, and make every effort to outfit them with quality-esteem extent appropriate items. For customers to eat well and sharp looking has reliably been proverb of M&S, which is moreover standard legitimate reason behind 100 years of food and clothing all while.

After the First World War, because of absence of material, a penny bargains framework is difficult to proceed. M&S authoritatively changed its thinking, making sell adventure focused on clothing and food and developing rapidly, with unprecedented turnover.

Intil 12th century the 80 and 90’s, M&S expanded sensational tribute to the extent quality, organization, widening is thought of. Regardless, from 1998 to 2001, M&S working advantage had been on the reduction. M&S decided to change the strategy, developed another program-in abroad sourcing and collecting items (Wolfe et al, 2019).

This saved a lot of costs, and advantages began ti improve. With the ascent of electronic business, organization moreover and creatively set up a webpage, getting customary retailing together with web business. It allowed the people to see extraordinarily old shop despite with the troubles and strength to change themselves and imaginative poor.

Most standard retail stores sells an arrangement of brands of product, clearly, there are in like manner some customary retailers furthermore selling a constrained amount of own-picture stock, for instance, planners for focus to sell uniquely crafted quality things. M&S has sold basically all own-picture items (Kendurkar and Tiwari, 2017).

Also, it has moreover for its own picture, sorts of item aren’t exhaustive, yet somewhat specific to outfit customers with the top of the line modest product. At present, 80% of M&S working product has the brand of “St.Michael”.

M&S approach is from store to accumulate from the customer points of view and demands for things, and a short time later from Martha’s particular headway division for things advancement and structure and subsequently pass on the maker to convey the last re-M&S deals through assignment system.

Along these lines, Martha has become the world’s greatest no plant producer. M&S keeps shaping its own picture into an image of a sound circumstance, in its own brands contains a sensible trade, down to earth, non-genetically balanced things, animal government help, and so on (Toms and Zhang, 2016). Essentially 100 % of the arrangements of own-picture are the best balance for M&S with the general retailers.

This common brand framework makes its own picture has gotten endemic in the United kingdom as a significant part of shopping society, while M&S thusly have unmatched brand esteem.

As per the annual report, M&S has come up with the objective to make it special again, to gain back the loosing positions. Last year company established nine pillars of the transformation phase.

This transformation stands for to restore the basics of the organization and infrastructure to transform company into a better, faster, low-cost and digital business and built platform for growth as indicated in the below figure.

Recommendation

On analysis and going through the entire assignment and getting insight about the china’s market for the apparel and M&S framework. The result for failure of M&S in China’s market was due to the popularization of local brand and various government barriers and intervention related to supply management. And by the help of various journals and news it is observed now the market is more prone towards e-services rather than local designated stores (Lawal et al, 2016).

When one can get service at a click at their place and at cheaper rate, why would one enter a store? Keeping this thinking intact, I would suggest M&S to go for a joint venture with a already established e-commerce platform, who has accounted for good result for years. I believe it’s better to go with a quality product maker rather than profit maker.

So there is need to search out for a manufacture with good quality of apparel stuff, and collaborate with him on providing the e-services. Collaboration of a popular brand with a manufacturer will provide consumers with a new insight of the market strategy (Tidy et al, 2016). Apart from this, strategy has to be adopted to differentiate your e-service from that of the competitor.

For example: M&S though is a big brand can come up with option of rental apparel service, like we have seen, specially women’s they don’t like repeating up the dresses and are jealous if someone wears a better attire than her.

Therefore, it would come out to be a great strategy. Instead of investing on producing same attire in bulk one will need to produce 10-20 samples of same attire with different colour and size and set up a laundry, to maintain its quality and cleanliness. I believe it will come out as a great strategy in the market that has basket of options, and no one has thought out of pocket in china yet (Shaw, 2019).

Conclusion

M&S is one of the top retailers in UK experiencing around 21 million individuals visiting their store per week. Nonetheless, going onto the savagely critical market situation and supply chain management techniques adopted can be significant for the retailers for success and prominent pay. In the assignment strategy to re-enter the Chinese market has been stated noticing the implication that might be imposed by the Chinese government.

Reference List

Alexander, R., Ashwin, S., Lohmeyer, N., Oka, C. and Schüßler, E., 2017. Garment Supply Chain Governance Project.

Bateman, A.H., Blanco, E.E. and Sheffi, Y., 2017. Disclosing and reporting environmental sustainability of supply chains. In Sustainable supply chains (pp. 119-144). Springer, Cham.

Bek, D. and Lim, M., 2018. The circular economy: A key approach for addressing strategic business challenges in supply chains. Social Business, 8(1), pp.95-102.

Buck, L., 2019. Modern Slavery and the Global Supply Chain: An Analysis of Published Preventative Statements and Frameworks to Protect Businesses and Individuals.

Caro, F. and Sadr, R., 2019. The Internet of Things (IoT) in retail: Bridging supply and demand. Business Horizons, 62(1), pp.47-54.

Carr, D., 2019. The Effectiveness of Collaboration Within Supply Chain Management: A Case Study of Adidas Group.

Cheng, Y., Kuang, Y., Shi, X. and Dong, C., 2018. Sustainable investment in a supply chain in the big data era: An information updating approach. Sustainability, 10(2), p.403.

Coates, B.E., 2016. Is There an Enhanced Role for Corporate Leadership to Integrate Its CSR Strategies into Supply Chain Management? A Conceptual Inquiry. Journal of Business Theory and Practice, 4(1).

Cole, R., Stevenson, M. and Aitken, J., 2019. Blockchain technology: implications for operations and supply chain management. Supply Chain Management: An International Journal, 24(4), pp.469-483.

Datta, P. and Diffee, E.N., 2020. Measuring Sustainability Performance: A Green Supply Chain Index. Transportation Journal, 59(1), pp.73-96.

Dong, C., Li, Q., Shen, B. and Tong, X., 2019. Sustainability in Supply Chains with Behavioral Concerns.

Durocher-Yvon, J.M., Tappin, B., Nabee, S.G. and Swanepoel, E., 2019. Relevance of supply chain dominance: A global perspective. Journal of Transport and Supply Chain Management, 13, p.10.

Fan, Y. and Stevenson, M., 2018. A review of supply chain risk management: definition, theory, and research agenda. International Journal of Physical Distribution & Logistics Management.

Kendurkar, P. and Tiwari, A., 2017. Cold Chain Supply and Public-Private Partnership: A Proactive Interaction. Int. J. Sci. Res. in Multidisciplinary Studies Vol, 3, p.9.

Kraft, T., Valdés, L. and Zheng, Y., 2018. Supply chain visibility and social responsibility: Investigating consumers’ behaviors and motives. Manufacturing & Service Operations Management, 20(4), pp.617-636.

Kuiper, M., Spencer, M., Kanyima, B.M., Ng, C.H., Newell, M., Turyahikayo, S., Makoni, N., Madan, D. and Lieberman, D.H., 2020. Using on-demand dry ice production as an alternative cryogenic cold chain for bovine artificial insemination outreach in low-resource settings. Translational Animal Science, 4(2), p.txaa012.

Lawal, N.T.A., Odeniyi, O.A. and Gazaly-Agboola, A.B., 2016. Performance Analysis Radio Frequency Identification Technology in Management of Fashion and Food Retail Supply. International Journal of Emerging Technology and Innovative Engineering, 1(7).

LeBaron, G. and Rühmkorf, A., 2017. Steering CSR through home state regulation: A comparison of the impact of the UK bribery act and modern slavery act on global supply chain governance. Global Policy, 8, pp.15-28.

Li, Z., Xu, Y., Deng, F. and Liang, X., 2018. Impacts of power structure on sustainable supply chain management. Sustainability, 10(1), p.55.

Perry, P. and Wood, S., 2018. The international fashion supply chain and corporate social responsibility.

Robinson, P.K. and Hsieh, L., 2016. Reshoring: a strategic renewal of luxury clothing supply chains. Operations Management Research, 9(3-4), pp.89-101.

Shaw, K., 2019. Implementing Sustainability in Global Supply Chain. Problemy Ekorozwoju, 14(2).

Stevenson, M. and Cole, R., 2018. Modern slavery in supply chains: a secondary data analysis of detection, remediation and disclosure. Supply Chain Management: An International Journal.

Tidy, M., Wang, X. and Hall, M., 2016. The role of Supplier Relationship Management in reducing Greenhouse Gas emissions from food supply chains: supplier engagement in the UK supermarket sector. Journal of Cleaner Production, 112, pp.3294-3305.

Toms, S. and Zhang, Q., 2016. Marks & Spencer and the decline of the British textile industry, 1950–2000. Business history review, 90(1), pp.3-30.

Voss, H., Davis, M., Sumner, M., Waite, L., Ras, I.A., Singhal, D.I.V.Y.A. and Jog, D., 2019. International supply chains: compliance and engagement with the Modern Slavery Act. Journal of the British Academy, 7(s1), pp.61-76.

Wolfe, D.G., Allen, S.W. and Melanson, A., Inmar Supply Chain Solutions LLC, 2019. Safety, management and tracking of hospital pharmacy trays. U.S. Patent Application 16/448,493.

Zhu, Q., Sarkis, J. and Lai, K.H., 2019. Choosing the right approach to green your supply chains. Modern Supply Chain Research and Applications.

Know more about UniqueSubmission’s other writing services: