KB7037/AT7024 Project Feasibility and Economics Assignment Sample

Module code and Title: KB7037/AT7024 Project Feasibility and Economics Assignment Sample

Section A: project description

Background

The project reflects the structural description which is based upon the financial strategy and economic factors of an organization. A feasibility analysis and its study is considered as the overall relevant of projects and its factors which includes technical, economic, scheduling and legal consideration for ascertaining the similar completing project which can be done successfully.

A project is eco economically useful in case the economic benefits of the project overtake its economic cost ate a time when need analysed for society as overall project. The importance of feasibility study reflects that it is beneficial to examine the potential risk factors for the identification “whether they are comprehensively worth the tasks” and involves the feasibility study which can categorize the actual economic opportunities from the failed investment.

Introduction of the project

This project is specially focused on the case study which is related to the development of electric vehicles by one of the famous groups in the world, called TESLA. Tesla is one of the world’s 1st ranked automobile manufacturing companies which is located in the United Kingdom (The Great Britain). For attending the analysis on the organization, Tesla would involve them in the estimation of financial ratio.

The financial ratio of Tesla will be calculated with the use of the company’s annual report and balance sheet. And the ratio will be computed for the previous two years, “2020 and 2021”, and this calculation aids in understanding Tesla’s present business success as well as financial analysts’ understanding of the company’s future performance and risk factor.

The ratio analysis will be widely addressed in the following section, which is the discussion section, and this report will present an assessment of the Tesla Company’s current business position in the automotive business market based on the ratio calculation. Tesla settled a business strategy which helped them to enhance their productivity throughout the world. Tesla involved them in making automobiles and recently they launched an electric vehicle which can run by it.

Project briefing information

This project is based on the case study of Tesla companies who are involving themselves in creating automobiles and recently, they are developing electric vehicles which help people to control the air pollution across the world. Tesla is dealing with the high range cars or automobiles which are quite not affordable by everyone.

Tesla‘s main motive is to reduce the greenhouse effects in the environment. By launching this unique product Tesla gets the chance to develop their marketing strategy across the world by involving their skills which includes stakeholders, business skills, labors, data analysis, cash flow etc.

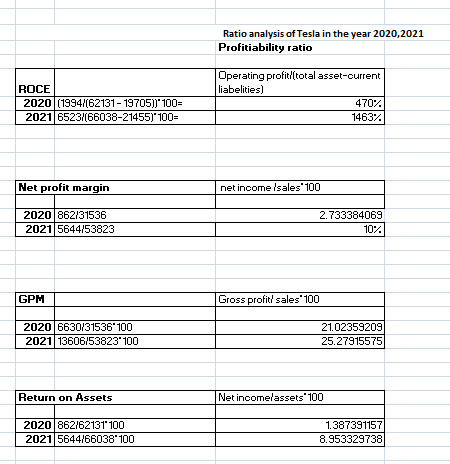

Figure 1: Grid resilience (Source: https://www.nature.com)

Figure 1: Grid resilience (Source: https://www.nature.com)

Project specification

a) A list of main stakeholders

In the list of stakeholder of Tesla Company find one of the largest stakeholders of tesla. The name of the stakeholder is Ron Baron. The largest stock holder said that he views 9.2% of the stack on Twitter. The stakeholders of Tesla are customers, investors and employees. The customers know about the Tesla income and they want to connect with Tesla.

Tesla is now one of the most demanding companies in the world right now. Tesla is trying to reduce the cost of the battery. For this the car is more affordable for the customer. Tesla employees directly impact the company’s performance. In the early years Tesla was highly dependent on the stakeholders group. They are performing a crucial role for the company’s cash flow.

Tesla always always tends to work in an unconventional way from the traditional method and always thinks of innovative business strategy. This out of the box business strategy helps Tesla’s product to penetrate the market as it understands the demand of the market and always fulfils its customers demand with high quality commodities.

For the benefit of this project, Tesla has founded a new battery creation instead of buying batteries from Panasonic group, it will decrease the manufacturing cost of the electric car and make it more affordable for people.

The new goal of the company is to establish a wide range of charging stations; this will improve the customer satisfaction and product quality. It has trustworthy supplier chains like Daimler, Panasonic, solar edge etc. Tesla would import high quality barking discs from Europe and japan. All these investors and suppliers would prove to be helpful in timely innovation and production as well customer service.

The initial years of Tesla were highly dependent on stakeholders, similar like other corporate groups. Investors and shareholders are a crucial part of the company as they always focus on the profitability and growth of the company and invest accordingly. Tesla is trying to use that previous interest of the investors to invest in this project and make the project successful and wants to become a useful part of this automotive world. Also, Tesla’s parent company can widen the range of products as it is based on electricity which has high demand on the market.

b) List of cost throughout the project life cycle

There are three main objectives of the list of cost throughout the project life cycle for the automotive vehicles; they are vehicle information, average daily mileage and trading vehicles in salvage value. In order to perform meaningful comparison and calculation, it is necessary to mention the number of miles per year to make their customer transparency. The mileage needs to be mentioned when the vehicle is new and also after using it and it is necessary to manage that mileage should be more than the usual vehicles which are operating with oil.

c) Macro environment surrounding of project by PESTEL analysis

PESTEL analysis on Tesla

PESTEL analysis is the type of framework which supports the company Tesla to understand the recent marketing business and this is done on the basis of their ability in improving their strategies of business continuously. The PESTEL analysis of the company Tesla includes political, economic, social, technological, environmental and legal factors. These factors will support the company to analyze the company Tesla and their strategy of business as well. Those factors are:

Tesla’s political factors: The Company Tesla is a worldwide automotive company which expands their strategies of business in several countries & nations throughout the world. In the recent situation they simply continue expanding their strategies of business and also optimize the services quality throughout the world. Focusing on this reason, this is the business where different kinds of political and legal needs can be found.

Within these needs they have less maintenance for their global marketing, they are influenced with various policies of trade of various nations. There are political factors which involve the leadership of the population and government of a single nation. Within this case Tesla has various types of government population and leadership due to their business run in different countries throughout the world. The population and the government indicate the factors which relate with the political rules and regulation.

It can simply be seen that when any company is managing their business strategy, they have to face many political restrictions. Thus, the operation related to business marketing by Tesla would vary in various nations as per the economic cycle of the nation and the aspects of political factors. The changes in the economic system or cycle brought up several factors of risk within the company.

For this single reason, there are several chances to raise the production cost and that puts an impact in raising the noticed cost in sales. To decrease the problems, the management of the company Tesla requires to give attention to various factors.

So, it can be simply explained that the factors of politics can impact the sale of Tesla that requires various safety measures. This supports them to recognize the risk of business rapidly and accordingly to overcome the risk factors which help their company to develop their strategy of business that supports them to provide a “sustainable business”.

Figure 2: Tesla PESTEL analysis (Source: https://research-methodology.net)

Figure 2: Tesla PESTEL analysis (Source: https://research-methodology.net)

Tesla’s economic factors: the economic factors or the way to generate income varies mostly in response to changes in external circumstances. Tesla automobiles are regarded as a luxury commodity in industrialized countries, where they primarily target the corporate market. As a result of Tesla’s dominance in the key markets, the car’s value in developed nations is high.

Because of their financial difficulties, not everyone can buy a Tesla automobile. As a result, not everyone is pleased with the Tesla car’s charge. To address these difficulties, Tesla firms work with the government to advertise their product and provide incentives to increase sales. Tesla currently develops automobiles in different economic countries based on the economic status of those countries.

Tesla’s social factors: Everyone in today’s world wants to contribute to a “sustainable society,” thus everyone wants to reduce carbon emissions. As a result, the electric car is more promising, and it may provide long-term commercial stability. Electric vehicles consume less gasoline and have fewer maintenance costs than conventional vehicles. The individual’s standing is mostly determined by social influences.

The creative design and performance of Tesla automobiles are able to attract a large number of consumers who are willing to pay a high price to preserve their status, which helps Tesla build brand value. Tesla has established their brand value in the electric car sector, which will provide lots of productivity in business market and profit

Tesla’s technological factors: Technology is a major component in today’s business world. Tesla has a significant technological edge. Because Tesla has sophisticated and unique technology, it is easier for them to create their brand value in the commercial world. Tesla has introduced a programed called “Smart Summon,” which is utilized in Tesla cars for self-driving capabilities.

Not only did they install software, but they also installed Netflix and karaoke in their vehicles. The consumer may use this technology to stream and view their favorite shows and music. Tesla will benefit greatly from these technological advancements. Tesla strives to innovate and develop more efficient technologies to meet the demands of its customers.

Tesla’s environmental factors: In the world of recent days, it has the ability to make a sustainable future for every living human in the world who can ride an electric vehicle which was recently launched by the company Tesla.

In recent conditions, the company Tesla, will help people to save money which normal people invest in buying fuels. Focusing on environmental factors it is seen that fuel cars are maximally responsible in creating air pollution whereas the Tesla Company’s production of electric vehicles will help to control the air pollution.

Tesla’s legal factors: Tesla has been able to conquer the key corporate markets in a relatively short period of time. In the present circumstances, Tesla wishes to extend their business in order to deliver their services to customers all over the world. As a result, Tesla must keep current on all international copyrights and patents, as well as the population of the region in which they seek to develop their company.

Because direct selling is prohibited in some countries, Tesla will have to work via the country’s chain supplier. That is why they must adhere to the rules and regulations of those countries. Every country has its own set of manufacturing rules that every firm should obey while doing business there.

Section B. Feasibility and Economic Analyses of the selected project

- Financial statement analysis of Tesla

| “Income statement of Tesla for the year 2020 and 2021 | ||

| Dec 31, 2021 | Dec 31, 2020 | |

| Total revenue | 53,823 | 31,536 |

| Revenue | 53,823 | 31,536 |

| Other revenue | – | |

| Cost of revenue, Total | 40,217 | 24,906 |

| Gross profit | 13,606 | 6,630 |

| Total operating expenses | 47,300 | 29,542 |

| Total selling, general, administration Expo | 4,517 | 3,145 |

| Research & development | 2,593 | 1,491 |

| Depreciation | – | |

| Net operating income(Interest Expo) | -128 | – |

| Unusual expenses(income) | 101 | 0 |

| Other operating expenses total | – | |

| Operating income | 6,523 | 1,994 |

| Interest income/ net non-operating | -218 | -832 |

| Gain/Loss sale of asset | – | |

| Net loss | 38 | -8 |

| Net income before tax | 6,343 | 1,154 |

| Provision for income tax | 699 | 292 |

| Net income after tax | 5,644 | 862 |

| Minority interest | -120 | -172” |

Table 1: Income statement of Tesla for the year 2020 and 2021 (Source: MS Excel)

| Balance sheet of Tesla for the year ended 2020 and 2021 | ||

| Particulars | 2021 | 2020 |

| Total current asset | 49,374 | 46,720 |

| Cash and Short Term Investments | 18,013 | 17,707 |

| Cash | – | |

| Cash & Equivalents | 17,505 | 17,576 |

| Short Term Investments | 508 | 131 |

| Total Receivables, Net | 2,311 | 1,913 |

| Accounts Receivables – Trade, Net | 2,311 | 1,913 |

| Total Inventory | 6,691 | 5,757 |

| Prepaid Expenses | 2,035 | 1,723 |

| fixed assets | 63,941 | 66,168 |

| Property/Plant/Equipment, Total – Net | 32,639 | 31,176 |

| Property/Plant/Equipment, Total – Gross | 35,096 | 39,828 |

| Accumulated Depreciation, Total | -8,143 | -8,691 |

| Goodwill, Net | 200 | 200 |

| Intangibles, Net | 254 | 257 |

| Long Term Investments | 1,261 | 1,260 |

| Note Receivable – Long Term | ||

| Other Long Term Assets, Total | 2,634 | 2,138 |

| Total asset | 1,13,315 | 1,12,888 |

| Accounts Payable | 11,171 | 10,025 |

| Payable/Accrued | – | – |

| Accrued Expenses | 4,325 | 4,303 |

| Notes Payable/Short Term Debt | 0 | 0 |

| Current Port. of LT Debt/Capital Leases | 1,659 | 1,589 |

| Other Current liabilities, Total | 4,300 | 3,788 |

| Total current liability | 21,455 | 19,705 |

| Non-current liabilities | 13,651 | 17,482 |

| Total Long Term Debt | 3,153 | 5,245 |

| Long Term Debt | 2,253 | 4,254 |

| Capital Lease Obligations | 900 | 991 |

| Deferred Income Tax | 24 | 24 |

| Minority Interest | 1,321 | 1,394 |

| Other Liabilities, Total | 6,000 | 5,574 |

| Total liability | 1,13,315 | 1,12,888 |

| Total equity | ||

| Total liability and shareholders’ equity | 66,038 | 62,131 |

Table 2: Balance Sheet of Tesla for the year 2020 and 2021 (Source: MS Excel)

From the above table it is seen that the income statement and balance sheet of Tesla for the year 2020 and 2021. This helps to understand the company’s current performance in those years. On the basis of the Tesla performance the new project of Tesla will be dependent.

In this current phase the new project of the Tesla Company is the electric vehicle which is a great innovation of this company. In the income statement of Tesla, it is seen that the company will gain profit through their business operation in the year 2020 and 2021 both.

But in the 2021 the amount of gained profit is higher than the 2020. The increased amount of gained profit helps them to make decisions about the new investment and helps them to assess their financial performance all over the year. To assess the current business performance more accurately it is necessary to calculate the Tesla Company’s ratio over those years.

This ratio estimation helps them to assess their business operation and their performance. By the help of the assessing the Tesla Company’s get knowledge about their current business status and this will help them to make decisions about their new investment in the project.

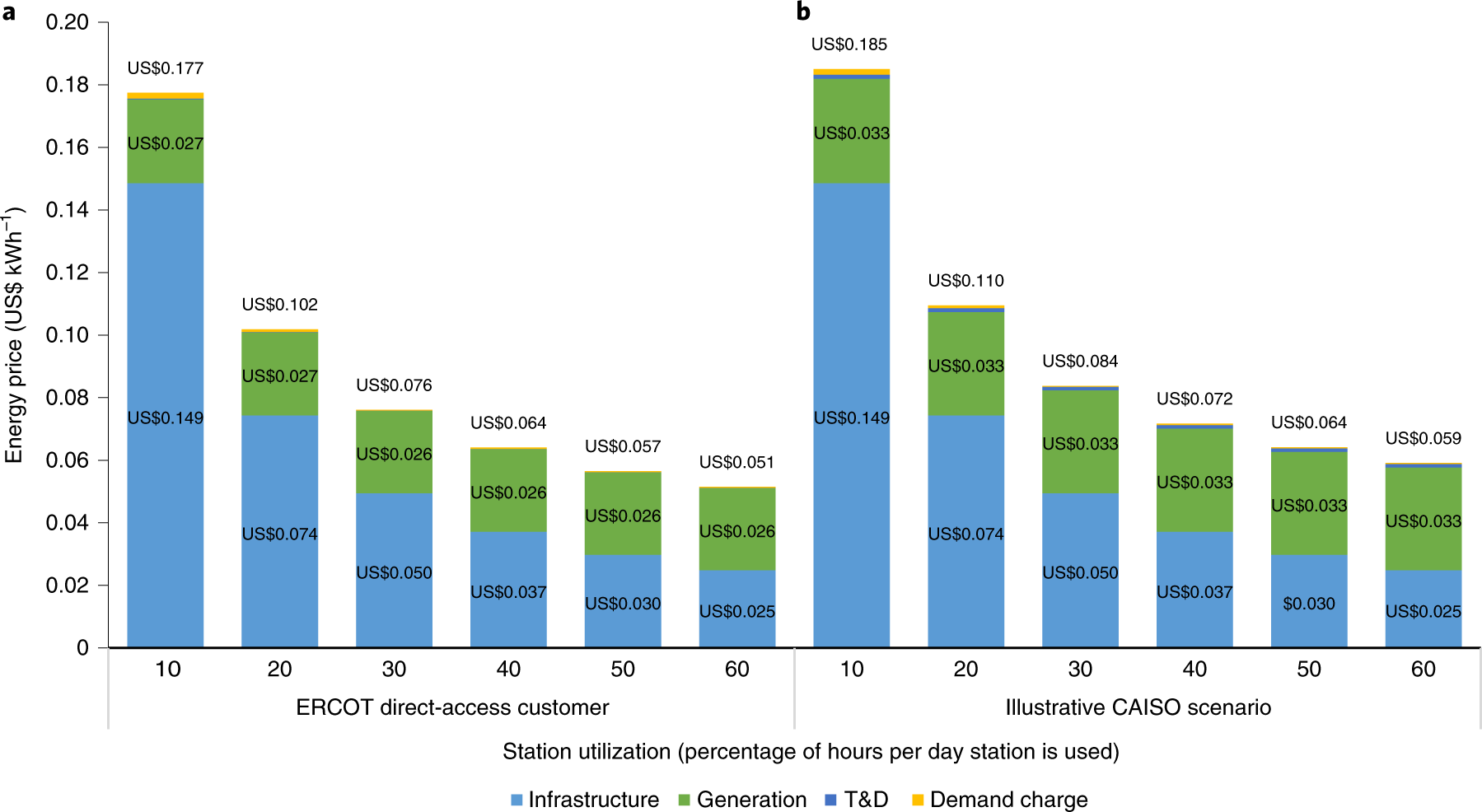

Ratio analysis of Tesla

For assessing the financial performance more accurately it will need to analyse the ratio of the Tesla. The measurement of the ratio helps them to understand their current financial performance and on the basis of this the management of Tesla and the investor will make decisions about their current investment. In the year 2020 total assets of tesla is 26.72 billion dollar and the current ratio of that year was 1.88.

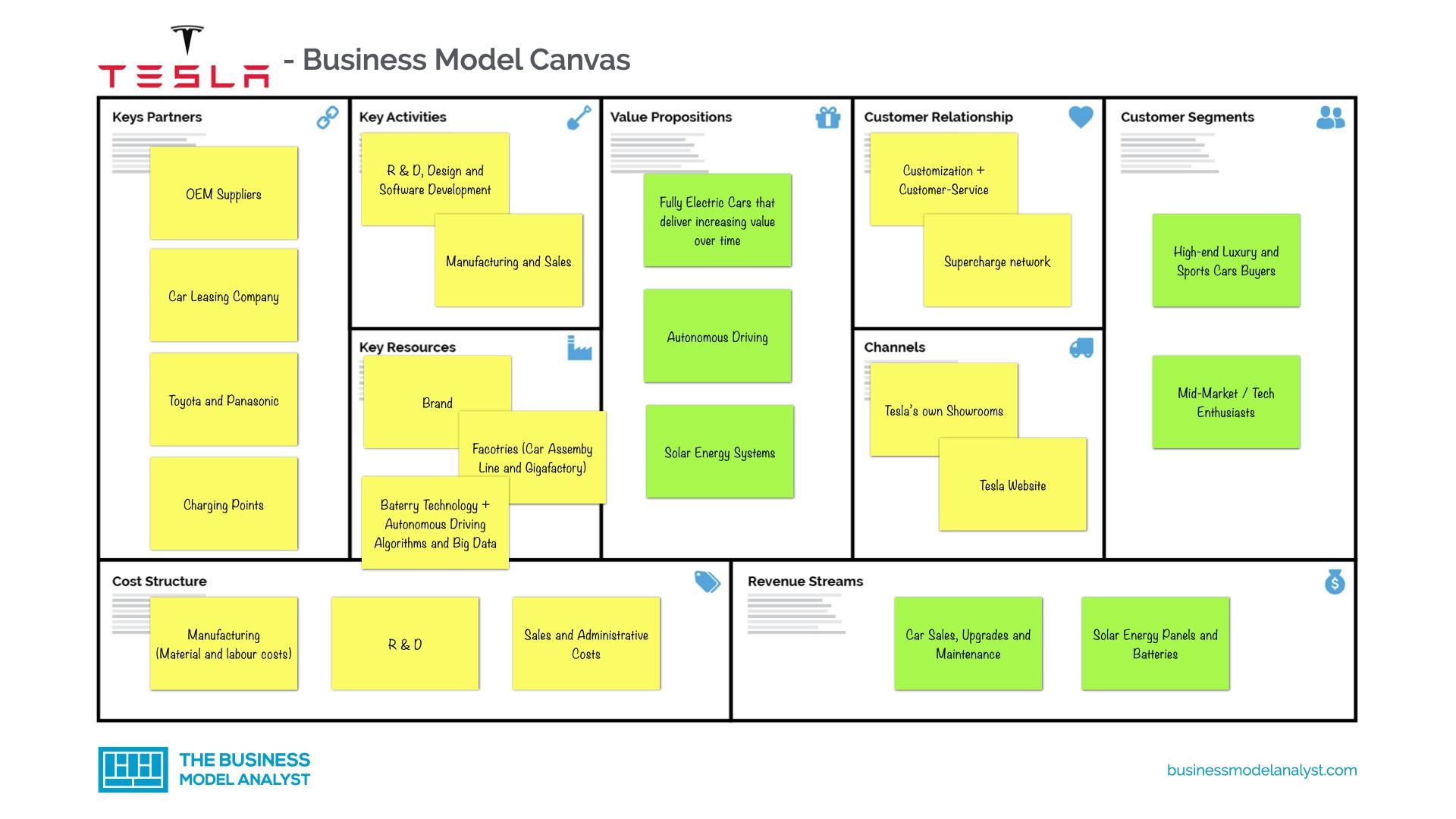

Figure 3: Tesla business model (Source: https://businessmodelanalyst.com)

Figure 3: Tesla business model (Source: https://businessmodelanalyst.com)

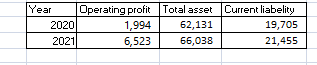

Table 3: Ratio analysis of tesla year of 2020 and 2021 (Source: MS Excel)

Table 3: Ratio analysis of tesla year of 2020 and 2021 (Source: MS Excel)

In the year 2020 total operating profit of Tesla is 470% and by 2021 the company will earn 1463% of operating profit. In the year 2020 the total net profit margin is 2.733384069 and in 2021 the margin increased to 10%. The total GPM of 2020 is 21.02359209 and in the year 2021 total GPM increased to 25.27915575. The total return of asset year 2020 was 1.387391157 and the total return assets of year 2021 was 8.953329738.

The year 2020 the total operating profit of Tesla was 1994, the total asset was 62131 and the current liability of that year was 19705. The year 2021 the total operating profit of Tesla was 6523, the total asset was 66038 and the current liability was 21455.

| liquidity ratio | ||

| 2021 | 2020 | |

| current Assets | 49,37,400 | 4,67,200 |

| current liabilities | 2145000 | 19705000 |

| current ratio | 2.301818182 | 0.02370972 |

| quick ratio | ||

| current Assets | 49,37,400 | 4,67,200 |

| inventory | 6691000 | 5757000 |

| current liabilities | 2145000 | 19705000 |

| quick ratio | 4937396.881 | 467199.708 |

Table 4: Liquidity ratio of Tesla for the year 2020 and 2021 (Sources: MS Excel)

In the year 2021 the current ratio of tesla was 2.30101818182. The current ratio of 2020 was 0.02370972. Quick ratio of 2020 was 467199.708and the quick ratio of 2021 was 4937396.881. In 2021financial year the company increased its current ratios which overtake the general limit of the current ratio of 2:1, this means the company has enough ability to pay its short-term debt.

The difference between the current ratio in the two financial years is 2%, which is a good mark from a business perspective and shows that the company has a huge ability to capture the maximum market and lead the automobile industry.

| Efficiency ratio | ||

| 2021 | 2020 | |

| inventories | $ 66,91,000.00 | $ 57,57,000.00 |

| COGS | $ 40,21,700.00 | $ 24,90,600.00 |

| efficiency ratio | 607.2593679 | 843.6942905 |

| Asset turnover | ||

| 2021 | 2020 | |

| sales | $ 5,38,23,000.00 | $ 3,15,36,000.00 |

| Total assets | $ 6,21,31,000.00 | $ 5,21,48,000.00 |

| Asset turnover | 0.866282532 | 0.604740354 |

Table 5: Efficiency ratio of tesla for the year 2020 and 2021 (Sources: MS excel)

The total efficiency ratio in the year of 2020 Tesla total cost of sales was 843.6942905and the year 2021 company total cost of sales was 607.2593679. The total asset turnover of Tesla in the year of 2020 was 0.604740354and the total asset turnover of 2021 was 0.866282532.

As per the above table it shows that the company decline their Efficiency ratios approx. 200.00 million in compared to previous years, since the automobile sectors survive to balance their supply and demand chain, hence most of the companies cut their production in 2021 finical years for various vital reasons and its direct effects on the company’s sales margin and its assets.

On the other hand, the table shows that the company increased the assets turnover ratio since globally rapidly adopts the electric car, as a valuable brand the company has lots of demand, but the production is limited, it needs that the company must increase the production units and capture the maximum markets.

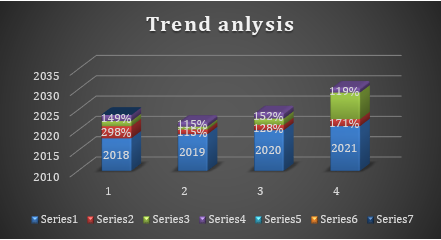

Trend analysis

| preparing trend analysis of finical data | |||||

| 2021 | 2020 | 2019 | 2018 | 2017 | |

| net sales | $ 5,38,23,000.00 | $ 3,15,36,000.00 | $ 2,45,78,000.00 | $ 2,14,61,268.00 | $ 72,05,100.00 |

| net income | $ 56,44,000.00 | $ 8,62,000.00 | $ 5,50,600.00 | $ 7,63,500.00 | $ 6,01,000.00 |

| total assets | $ 6,21,31,000.00 | $ 5,21,48,000.00 | $ 3,43,09,000.00 | $ 2,97,90,614.00 | $ 2,00,03,550.00 |

| 2017 | 2018 | 2019 | 2020 | 2021 | |

| net sales | 100% | 298% | 115% | 128% | 171% |

| net income | 100% | 127% | 72% | 157% | 655% |

| total assets | 100% | 149% | 115% | 152% | 119% |

Table 6: trend analysis (Source: self-created in excel)

Trend analysis is one of the financial analyses that analysis the company’s sales to know the company’s overall performance based on the company’s historical data. Here analyse Inc. data 4 years where the base year is the 2017 financial year, the table over the year the maintaining its overall sales growth.

Through the trend analysis to understand the company’s current situation about the net sales, net income and total assets, in the 2017 financial year, the total sales increased by 71% and the company’s total income increased by 555%, and the company’s total assets increased 19% over the last 4yaers.

Horizontal analysis

| particulars (in millions) | 2021 | 2020 | absolute change | % change |

| Net sales | $ 5,38,23,000.00 | $ 3,15,36,000.00 | $ 2,22,87,000.00 | 70.67161 |

| COGS | 40217000 | 2490600 | $ 3,77,26,400.00 | 1514.751 |

| Gross profit | $ 1,36,06,000.00 | $ 2,90,45,400.00 | $ -1,54,39,400.00 | -53.1561 |

| Expenses | $ 4,73,000.00 | $ 29,54,200.00 | $ -24,81,200.00 | -83.9889 |

| interest expenses | $ 3,33,000.00 | $ 3,17,000.00 | $ 16,000.00 | 5.047319 |

| income tax expenses | $ 71,654.00 | $ 2,970.00 | $ 68,684.00 | 2312.593 |

| net income | $ 1,27,28,346.00 | $ 2,57,71,230.00 | $ -1,30,42,884.00 | -50.6103 |

Table 6: Horizontal analysis (Source: self-created in excel)

Horizontal analysis is used to measure the company’s finical statement over the different periods, through the Horizontal analysis understand the Tesla Inc. financial growth and patterns.

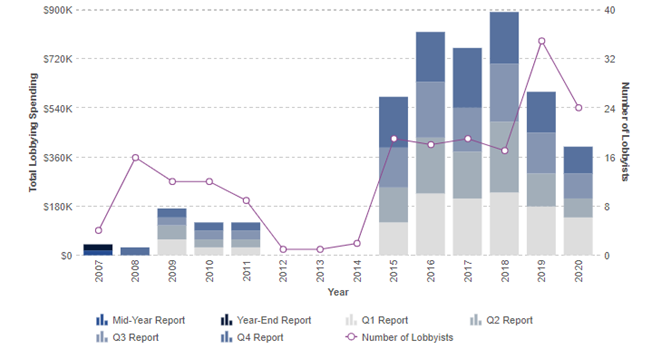

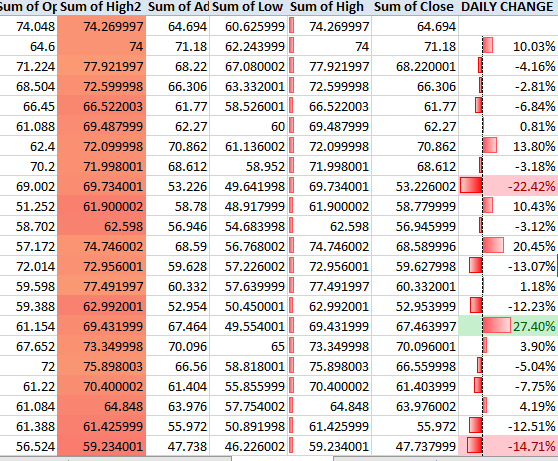

Stock analysis

Figure 4: stock Analysis (Source: self-created in excel)

Figure 4: stock Analysis (Source: self-created in excel)

Feasibility methods

Technical feasibility

The available technical resources would be assessed with the effective assessment of the technical feasibility. The capacity of the technical resources would be evaluated in this method of research. These technical feasibility assessments would be appropriate for the development of required working system for certain organizations.

Economic feasibility

The cost and benefit of that company would be properly assessed in this process. The viability, benefits and costing of these organizations would be properly determined and analysed. Different required services and improvements would also be recognized and improved with the effective use of these analytical methods.

Legal feasibility

Different legal factors related with these feasibility assessments are also required to be considered for the appropriate development of this analysis. Related business patterns and different aspects of the financial factors would be specified and assessed with this legal feasibility analysis methods.

Operational feasibility

Different study and analysis related stages would be required for the proper development of these feasibility assessments. For getting the insights of these financial aspects of this organizationthese operations are required to be appropriate.

Scheduling feasibility

Proper budgeting scheduling are essential for the proper assessment of these feasibility aspects of a certain organization. For that there required ot be proper examination of different areas of these feasibility aspects for this financial assessment.

Section C. Discussion

To analyze the feasibility and economic growth of the electric vehicle project introduced by Tesla we need to analyze the financial statement of this company. If the balance sheet comes positive, it shows that the company can support this project to make it successful. As the project is going to be introduced in the market in recent times, the 2020-2021 balance is going to be checked and after analyzing the financial statement, it is obvious that the company is running in profit as the total revenue has increased in December 2021 in comparison of December 2020.

It has raised around twenty thousand rupees. Although the manufacturing cost of the product has been increased but that covers as the gross profit also increases in high amounts. Another positive point for this company is that the company does not bear any debt from the market nor from any organization which means the total profit margin will not be divided. As the manufacturing cost price has increased, so that company has to pay the least amount of tax and that will be used in making a sustainable future.

This UK based reputed company Tesla never runs in loss as the company manages to keep its products quality up to the mark and the products are always loved by the people. Now in the discussion of the balance sheet of the company in the year 2020-2021, there could be seen that in order to make this product launch successful, the company has increased its investment in share market, there are short and long term investments. Tesla has increased its inventories and these inventories will collect funds for this project.

As the director board of the company is aware of the importance of the project, they have already invested a certain amount of funds on the resources of this project. Also the company possesses a huge amount of assets, so in case the project needs back up funds these assets could play an important role. In addition, the company has good relations with other investors, so in case the project comes in need of funding, those business relations will work on time.

In discussion on the net profit margin of the company, the profit margin has also been increased. The total shareholder equity in the year 2020 was 66,038 and shareholder equity in the year 2021 was 62,131. By this number it is obvious that the company taking all its shares under their own custody shows it is taking equity from others that is all about the company’s growth chart.

Figure 5: Tesla’s BMA (Source: https://leanmethods.com)

Figure 5: Tesla’s BMA (Source: https://leanmethods.com)

Section D: Executive summary

This executive summary is a detailed analysis about the Tesla Company discussing feasibility and balance sheets, income statement, liquidity ratio, efficiency ratio for the year 2020-2021. This case study reflects the structural description on financial strategy and managing an organization’s economical factor. It is an important factor for the development of the company to update its feasibility from time to time. This factor includes technical, economic, scheduling and legal facts for completing the project and making it successful.

This project basically focused on the case study and experiments going on electric vehicles. The financial ratio of tesla will be calculated according to the balance sheet of this UK based world-famous company. The main objective of this project is to make cars which will help to reduce air pollution and also to reduce greenhouse effect on the environment.

By introducing this unique product tesla would get world class popularity involving their skills which includes stakeholders, business skills, strategy, data analysis, cash flow etc. List of stakeholders, list of cost of the projects and also the macro environment project has been discussed in the project.

To mention the targeted market for this luxurious commodity, the company needs to focus on the corporate sector people that will be beneficial for them as the sector will get to promote a green environment and can contribute for the sake of the environment. In order to make a better and sustainable future, electric vehicles will be the main attraction in this time.

Reference list

Journals

Chaianong, A., Bangviwat, A., Menke, C., Breitschopf, B. and Eichhammer, W., 2020. Customer economics of residential PV–battery systems in Thailand. Renewable Energy, 146, pp.297-308.

Cho, S.H., 2018, June. Collective Intelligence and Decision Making: Method and Its Application in Preliminary Feasibility Analysis of Public R&D Program in Korea. In Global Conference on Business and Economics (GLOBE 2018) (p. 135).

Ghodusinejad, M.H., Tabasi, S. and Yousefi, H., 2021. Impacts of Demand Side Management Methods on the Feasibility of a Residential PV System. Environmental Energy and Economic Research, 5(2), pp.1-12.

Gustafson, J.O., Smith, J.D., Beyers, S.M., Al Aswad, J.A., Jordan, T.E. and Tester, J.W., 2018. Earth source heat: Feasibility of deep direct use of geothermal energy on the Cornell campus. GRC Trans, 42.

Hale, A.E., 2021. Feasibility of Thermal Restoration by Groundwater Additions in the Middle Fork John Day.

Holstenkamp, L., Report on Future Investments in Participating Municipalities-Feasibility Study for Šilutė, Lithuania.

Ibrik, I.H., 2020. Techno-economic Feasibility of Energy Supply of Water Pumping in Palestine by Photovoltaic-systems, Diesel Generators and Electric Grid. International Journal of Energy Economics and Policy, 10(3), p.69.

Jacot, J., Williams, A.S. and Kiniry, J.R., 2021. Biofuel Benefit or Bummer? A Review Comparing Environmental Effects, Economics, and Feasibility of North American Native Perennial Grass and Traditional Annual Row Crops When Used for Biofuel. Agronomy, 11(7), p.1440.

Keysser, R.D., 2021. Analyzing Project Feasibility Through Financial Mathematics.

Merzy, A.M. and Daryanto, W.M., 2018. Financial Feasibility Studies for Perusahaan Gas Negara (PGN) Project: A Case Study of City Gas Project in Indonesia for The Period of 2018-2038. South East Asia Journal of Contemporary Business, Economics and Law, 17(2), pp.28-35.

Merzy, A.M. and Daryanto, W.M., 2018. Financial Feasibility Studies for Perusahaan Gas Negara (PGN) Project: A Case Study of City Gas Project in Indonesia for The Period of 2018-2038. South East Asia Journal of Contemporary Business, Economics and Law, 17(2), pp.28-35.

Oyegoke, T., Owolabi, O.A., Bamigbala, O.A. and Tongshuwar, G.T., 2022. Sensitivity Analysis of Selected Project Parameter on the Feasibility of Converting Maize Cob to Bioethanol as a Means of Promoting Biorefinery Establishment in Nigeria. International Journal of Renewable Energy Research (IJRER), 12(1), pp.259-272.

Petrov, A. and Petrova, D., 2018. Economics of high-rise construction: The feasibility of skyscrapers building in the Russian cities.

Rahmawati, P.I. and Suarmanayasa, T.T.I.N., 2021, November. Feasibility of Developing Butterfly Park as Educational Tourism in Wanagiri Village Forest in Bali. In 6th International Conference on Tourism, Economics, Accounting, Management, and Social Science (TEAMS 2021) (pp. 22-27). Atlantis Press.

Tefera, A.H., 2021. Feasibility Study of Irrigation Development for Sustainable Natural Resources Management Under Changing Climate of JabiTehnanWoreda, Amhara Regional State of Ethiopia. American Journal of Environmental and Resource Economics, 6(2), pp.29-39.

Viswanathan, S.K., Tripathi, K.K. and Jha, K.N., 2020. Influence of risk mitigation measures on international construction project success criteria–a survey of Indian experiences. Construction Management and Economics, 38(3), pp.207-222.

Know more about UniqueSubmission’s other writing services: