Global Strategy and Sustainability Assignment Sample

Introduction

In this report, the business strategy of Tesla has been discussed with reference to the relevant business models that have been appropriately evaluated and determined with the application of different management models for the proper evaluation of Tesla’s strengths and weaknesses.

Part A – Business Report

Task 1 – The External and Internal Environment

1.1 Critical analysis of the external and internal environment for Tesla

Porter’s five forces

| Forces | Levels | Justifications | Threats/opportunities |

| Threat of new entrants | Low | High operating costs for entry in new market | Providing opportunity to Tesla |

| Threat of substitutes | High | There are several other leading electric automobile manufacturers such as Ford and BMW Group who create a storing market resistance against Tesla | Providing threat to Tesla |

| Customer bargaining power | Low | The customers of Tesla usually belong in the premium class of the society, where the company enjoys the inflation of the market price of its luxury electric cars | Providing opportunity to Tesla |

| Supplier bargaining power | High | Most of the parts that Tesla uses in the supply chain arrive from leading exporters of electric parts, such as United States, Germany, and Europe, where any economic catastrophe creates supplier threat to Tesla | Providing threat to Tesla |

| Competitive rivalry | High | There are different competitive market producers of Electric cars which take a close rivalry with Tesla’s electric cars on different factors such as low electric consumption | Providing threat to Tesla |

Table 1: Porter’s five forces

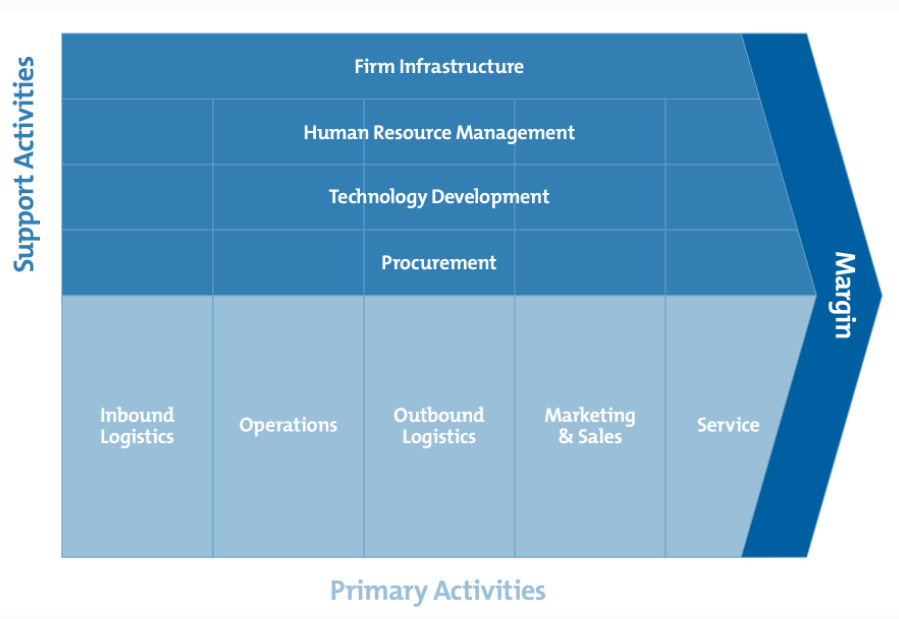

Value chain

The value chain analysis of Tesla may be discussed in the aspects of the different components that the company uses while the main production and the creation of utilities in the electric components of cars. The aspects of cost leadership and competitive price strategy differentiation of Tesla makes for most of the value chain analysis, where the individual elements of the value chain of Tesla are usually under the scope of improvement to reduce the costs of logistics management. The inbound logistics of Tesla has considerable strength in the global market, where the sourcing for the differentiated inputs consists of large exporters around the world. Tesla has established a cost-efficient supply chain in the larger market share of Mainland China, where the deductions of the nominal tax amounts in the company have got larger exemptions in China, owing to the economic policy of the nation, thus facilitating Tesla to a greater degree (Jing, 2020).

Figure 1: Value chain

(Source: Jing, 2020)

The outbound logistics of Tesla includes the different processes of warehousing that occur after the product manufacturing, where the company has been efficiently dealing in the warehousing supply stocks and customer feedback-oriented marketing.

1.2 Critical factors from analysis

One of the most interesting aspects of the analysis of Tesla’s market strategy is the fact that the company has been efficient in building a sound supplier and consumer relationship matrix, where the competitive advantage has been gained by the company in relation to the sustainability measures taken. The different hybrid electric automobile creation by the company in the space of the supplier base has been increased by Tesla, thus creating a narrow entry in the market it has exclusive ownership on. Tesla has been taking on the major challenge that environmentalists and different activists have made to the news, where the concern for an increased level of carbon emissions and loss of biodiversity made Tesla to enact strongly upon the models it creates (Akakpo et al., 2019). The customer bargaining power in the company has remained low owing to the fact Tesla have made a crucial change to the design of the automobiles.

1.3 Evaluation of Tesla’s competitive advantage

Tesla usually has the sorting and choosing on the suitable strategies that are available for Tesla to have a better opportunity in the market proportion size. Furthermore, there exist different products that are mostly expensive and have a strong collision with the existing energy sources provider by Tesla, which creates a field of threat for Tesla (Tesla.com. 2022). The company has been more focussed in the branding and energy renewing systems which provides the company a competitive advantage in the market. The brand marketing of Tesla where the company has received a suitable structure of public appreciation after the formal introduction of Roadster, which is one of the first electric automobiles having a better luxury outfit, has gained a wide media attention and built the conscious brand image (Khan and Ahmed, 2019). Tesla has been gaining on the competitive advantage by having a more detailed focus on environmental sustainability, which have been mostly disregarded by major producers.

Task 2 – Strategy in the Global Environment

2.1 Analysis of organizations entering foreign markets and evaluation of motives of Tesla’s strategy

The international market entry may be conducted through various modes, however, utilizing the right market entry mode is extremely crucial for businesses to ensure that no financial loss is experienced by an organization following their international venture. The various modes of international market entry are namely, franchising, licensing, joint venture, exporting, foreign direct investment (FDI) and so on and all these modes have some advantages and disadvantages attached to these. For global organizations entering a foreign market is a core strategic decision and it helps to determine to the extent a firm is committed towards the resources of a foreign market, risks the company has in the host country (Lin and Ho, 2019). In the case of Tesla, the given market entry mode that the company may select is exporting as that will help the organization to sell its vehicles and other products in different international markets. It needs to be mentioned that the process of exporting is about when a given organization manufactures and produces goods in a specific country and then ships those to other markets for sales or trades.

Thereafter, by choosing this approach, Tesla may be able to avoid the additional cost of establishing a physical store in a different international market, which will provide an added advantage to the company regarding the economic aspect. Moreover, direct exporting will also be beneficial for Tesla as there will be more potential for generating revenue owing to the absence of any intermediaries in the middle and the company will also have a direct control over a business, indicating a lesser number of risks. However, understanding the specific market and consumer needs are extremely imperative when it comes to generating profit through exporting and many organizations fail to properly conduct a market analysis before moving further with the process. Apart from the benefits there are several challenges that surround different foreign entry modes, such as the time required for recovering the profit margin from the given investment, rivalry in the market, quality of products, sources of capital and more (Tien and Ngoc, 2019).

2.2 Recommendations for Tesla’s strategy in global environment

In order to compete in an international business market, it is extremely imperative to have proper strategies developed beforehand, since every business in this era is attempting to enter the international market and thus, the competition has become even more daunting. For Tesla, it is recommended that the company conducts a proper market analysis before entering any global market and significant conduction of marketing mix will be beneficial for the corporation to have an explicit idea about its customer base as well. Marketing mix may be defined as the most important tool used in marketing and it is the operational aspect of the same and addresses the 4 main components of marketing, such as product, price, place, and promotions (Thabit and Raewf, 2018). On the other hand, it has already been mentioned that exporting may be the most appropriate choice for Tesla to enter an international market and for that thorough concept of the local market, hiring suitable individuals to look after the business is also quite imperative.

Therefore, it may be suggested that Tesla focused significantly on its International Human Resource (IHRM) and strengthened the department to ensure that all the employees in the host country are trained significantly for managing the business efficiently. IHRM as a genre of practice encompasses enhanced levels of complex aspects in comparison to domestic Human Resource Management (HRM) and is dependent upon several contexts under which global firms operate (Farndale et al., 2019). Moreover, another aspect that the company may focus on for sustaining in the competitive market is regarding its pricing strategy and use the approach of cost-leadership strategy by having relatively lower prices of its products than its competitors.

Tesla cars are known for being highly priced and thus, many people are unable to purchase those, which may be regarded as a disadvantage for the company and a reason for which Tesla may fail to compete with its competitors in each market. Furthermore, contributing to several social causes in different countries will also help Tesla to create a positive brand name for itself and that may also provide the company significant benefits in the competitive international market too.

Task 3 – Corporate Strategy

3.1 Evaluation of horizontal integration, vertical integration and outsourcing

Horizontal integration

Horizontal integration usually implies the merging of the several companies together by the parent company which holds the major market equity, and the valuation of such strategy lies in the fact that the electric automobile sector benefits from the collaboration. Tesla tales up the horizontal integration in a different aspect, where the company has been in the globally integrated market, having a better strategy to merge with the different leading automobile. Furthermore, the strategy implemented by Tesla has led the company to grow at an annual rate of 102.5% to 73% in the last years from 2012 to 2016, and the creation of different electronic navigation systems has made the company gain a giant share of the electric automobile industry (Kim, 2020).

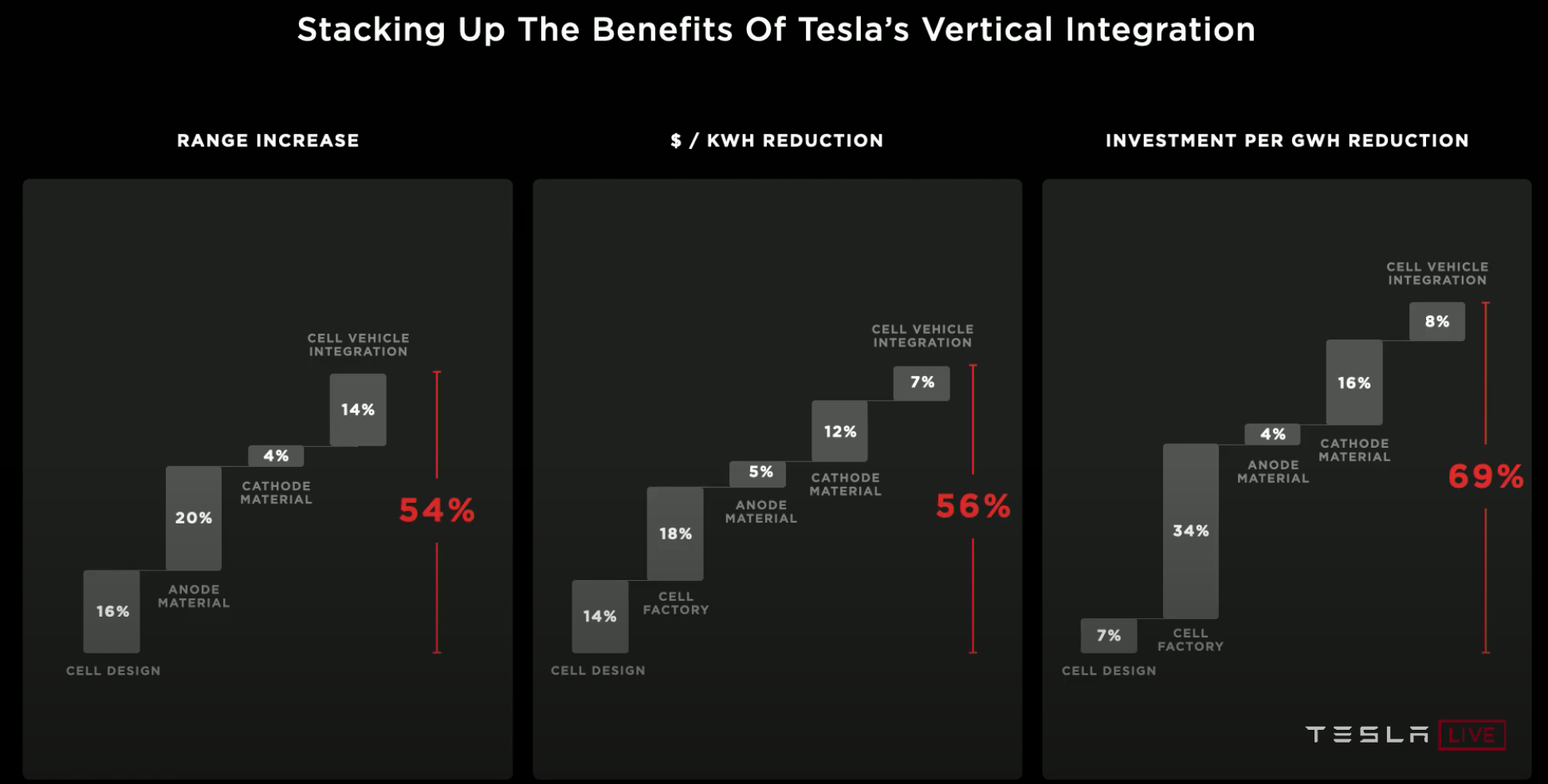

Vertical integration

Tesla usually has gained immensely from the vertical strategy application in the different operations of the inbound and outbound logistics department, where the company has been taking a strict competitive advantage due to the production of fuel-efficient batteries in the integrated electric cars. The inbound logistics of the company has the creation of such batteries which require the consumption of less electricity, because of the creative placement of the copper diodes. The inbound process has been enhanced by Tesla in terms of the acquiring of several vast business projects, where SolarCity has remained as one of the most ambitious one. Furthermore, Tesla has the benefit of having its own warehousing facility and the low dependency on the different market supplies, where the company usually creates a strong inter-network of local suppliers instead of hiring expensive global assembly chain lines. The outbound logistics of the company adds more efficiency to the vertical integration, where the company entirely has built its own virtual network and modified the battery to be of superior capacity (Chen and Perez, 2018).

Figure 2: Vertical integration strategy of Tesla

(Source: Chen and Perez, 2018)

Outsourcing

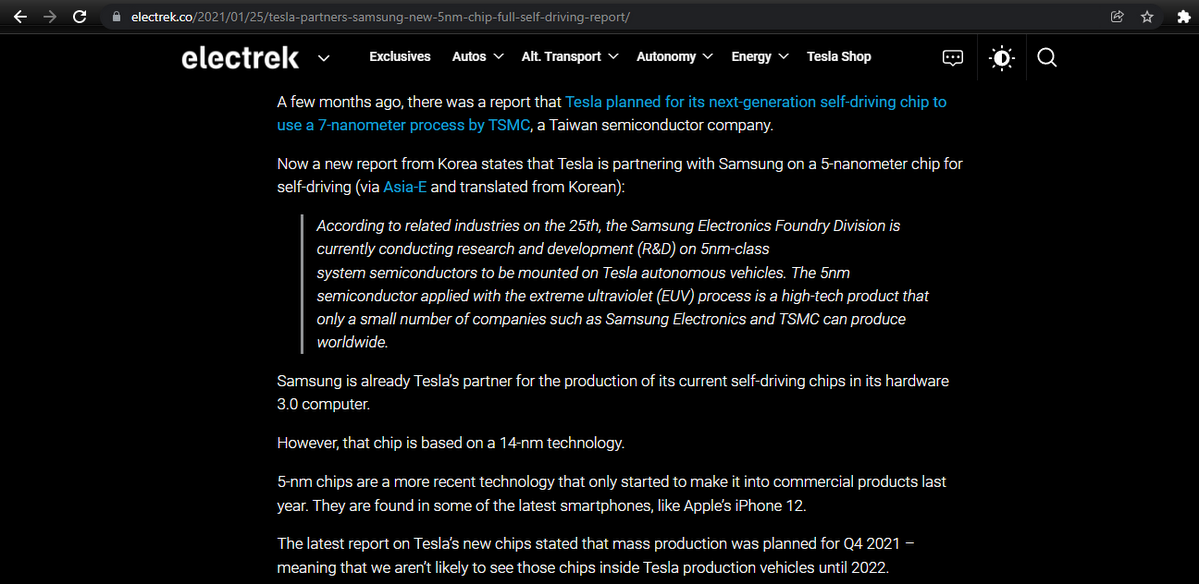

The fact that the company of Tesla creatively has used the production of such batteries which have the range of being charged in less than one hour, which makes it efficient in the building of the new age batteries. Tesla in this way, has created an opportunity for outsourcing the differentiated batteries and has been in collaboration with Samsung for making the electronic chipsets required for the fluent performance of the automobiles in a rigorous way (Refer to Appendix 1).

3.2 Recommendations for Tesla to increase profitability

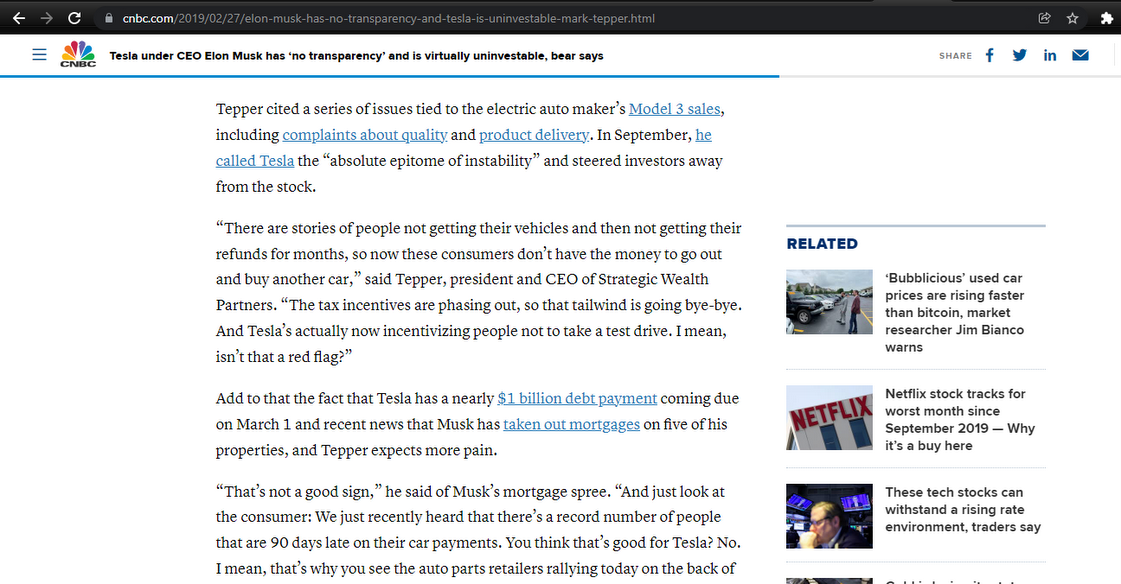

Tesla has the better opportunity of creating a higher customer base where it never fears the losing of customer preferences owing to the premium pricing, where the structure of the battery needs to be made less power consuming than its earlier models. Tesla has been in negative reviews in the market owing to the vague investment statements issued by the company’s CEO, Elon Musk, considering the Model 3, which has the quality issues, thus making a loose space for Tesla in the market of news (Refer to Appendix 2). There are several recommendations related to the company’s pricing gf strategy, where the company stands on the ground of being a large prospective investor in the market of crafting an enormous profit soon with being one of the most profitable companies by the year of 2023 (Li, 2019). Thigh Tesla has been gaining a strong competitive advantage in the market, it has the losing prospect of being in the hold of very poor communication with the investors where the CEO of Tesla has built a wall between the company and the medias, not revealing the information that may attract more monetary opportunities to the company. Tesla needs better modifications and creative analysis of the different electric cars that it produces, where the company has large plans although almost nothing incorporated for the physically challenged consumers. A greatest issue that Tesla has, arrives from the reality of a decentralized management system, where the Risk Management Officer almost has no special duty allocated, which Tesla needs to delegate more responsibility (Bučko, 2018). There is a severe problem with the mobility and self-driving issues of the car company, where Tesla stands to be having the lower solvency for the mobility. The manufacturing and logistics department of Tesla has been lying as one of the most poorly designed mobile units, and the company needs a better decentralization technique.

Task 4 – Strategic Purpose – Ethics and CSR

4.1 Evaluation of Tesla’s Corporate Social Responsibility (CSR) strategy

CSR basically states that an organization needs to be socially responsible towards the community and in accordance with the Carroll theory of CSR, there are mainly 4 stages corporates are required to fulfil its duty at, such as legal, philanthropic, ethical, and economic. Carroll’s theory has a significant relevance in an economy that is still developing and evidence suggests that disclosure of CSR in such an economy perseveres to take a philanthropic aspect and dominate the other dimensions that are economic, legal, and ethical (Hamid et al., 2020). Tesla fulfilled its economic responsibility by being a highly profitable business with the help of its business model to sell unique vehicles to a specific group of consumers in mostly developed countries. In addition to that, the company also adheres by all the legal and official laws while conducting business activities in any host country or parent country as well and thus, it may be stated that the company lives up to its CSR strategy according to the Carroll theory.

Figure 2: Carroll’s pyramid of CSR

The next aspect is to be ethically responsible in the framework of the Carroll theory as a company fails to complete its CSR strategies if it is involved in any unethical misconducts. It needs to be mentioned that Tesla has never been involved in any unethical practices and has always kept all the business activities of the corporation transparent to the general public as well as the government. The last aspect is about the need for corporations to complete their philanthropic duties and being responsible towards the society, which Tesla does efficiently by investing in various social causes across the globe in order to give back to the community. However, according to research, in most cases corporations follow the methodology of CSR that is reflected upon only the interests of its shareholders and neglect the interest of the community (Brin and Nehme, 2019).

4.2 Identification of ethical issues of Tesla

Tesla came in the news recently because the company usually has much less information to reveal the original sources for the different units needed to create the diversified model of cars, where the company lacks crucial ethical behaviour. Tesla remains in the stronghold of the public reputation owing to the self-driven cars, although, it has the severe issue with the origin of the different components, making the tracking and quality assurance parameter checking is possible. The supply chain management by Tesla has been raised on several ethical issues, with the performance of the company judged and criticized on the grounds of lacking a proper legal management structure. The safety of the consumers and the daily commuters in the public places where the automobile has been accelerating remains a wide concern for the general public, where Tesla has unethically delegated the responsibility for risks to the driver rather than blaming its autopilot mechanism (Nyholm, 2018). Furthermore, Tesla has been identified with the ethical issue of failures of the internal motor driving systems bringing a large exposure to risks of the driver, which has not been addressed by the company with effect.

4.3 Recommendations to resolve ethical issues

Tesla has several better opportunities to create such sustainable growth measures which may directly address the ethical issues lying in the foundation of the supply chain of the company. Although Tesla has been in the margin of a profitable proportion of the global market of the electric automobile industry, the company needs to hire more responsible executives to remain liable for the information about the source of the raw materials used in the manufacturing process. Tesla needs to modify and have better engineers where few of its self-driven electric cars have not passed the safety tests, running a great risk to the driver in public spaces.

Conclusion

From the above report, it may be concluded that Tesla has one of the most brilliant futures of profitability by 2023, where it still stands to direct some of its major outsourcing and logistics supply chain networks. The company has been in the controversy of introducing electric cars having serious defects, which the company has a scope to mitigate. The report has been discussed with references to the external and internal environment of Tesla applying relevant theories.

References

Akakpo, A., Gyasi, E.A., Oduro, B. and Akpabot, S., 2019. Foresight, organization policies and management strategies in electric vehicle technology advances at tesla. In Futures Thinking and Organizational Policy (pp. 57-69). Palgrave Macmillan, Cham.

Brin, P.V. and Nehme, M.N., 2019. Corporate social responsibility: analysis of theories and models.

Bučko, A., 2018. Protecting Reputation in Crisis: Case Study of Strategic Reputational Risk Management at Tesla Inc.

Chen, Y. and Perez, Y., 2018. Business model design: lessons learned from Tesla Motors. In Towards a Sustainable Economy (pp. 53-69). Springer, Cham.

Farndale, E., Horak, S., Phillips, J. and Beamond, M., 2019. Facing complexity, crisis, and risk: Opportunities and challenges in international human resource management. Thunderbird International Business Review, 61(3), pp.465-470.

Hamid, S., Riaz, Z. and Azeem, S.M.W., 2020. Carroll’s dimensions and CSR disclosure: empirical evidence from Pakistan. Corporate Governance: The International Journal of Business in Society.

Jing, X.U., 2020. Analysis of the Operation Strategy of Tesla Inc. in China. Frontiers in Economics and Management Research, 1(1), pp.21-25.

Kim, H., 2020. Analysis of How Tesla Creates Core Innovation Capability. International Journal of Business and Management, 15(6), pp.42-61.

Li, Q., 2019, October. Is it worth to invest in Tesla?. In 4th International Conference on Modern Management, Education Technology and Social Science (MMETSS 2019) (pp. 63-69). Atlantis Press.

Lin, F.J. and Ho, C.W., 2019. The knowledge of entry mode decision for small and medium enterprises. Journal of Innovation & Knowledge, 4(1), pp.32-37.

Nyholm, S., 2018. The ethics of crashes with self‐driving cars: a roadmap, II. Philosophy Compass, 13(7), p.e12506.

Tesla.com. 2022. Tesla Investor Relations. [online] Available at: <https://ir.tesla.com/#tab-quarterly-disclosure> [Accessed 15 January 2022].

Thabit, T. and Raewf, M., 2018. The evaluation of marketing mix elements: A case study. International Journal of Social Sciences & Educational Studies, 4(4).

Tien, N.H. and Ngoc, N.M., 2019. Comparative Analysis of Advantages and Disadvantages of the Modes of Entrying the International Market.“. International Journal of Advanced Research in Engineering and Management, 5(7), pp.29-36.

Assessment Self-Evaluation

From Task 1, I have analysed applying Porter’s Five Forces, where the threat of new entrants in the industry of electric automobiles have been quite low, which sully indicates the opportunity that the market has been gaining on. The Threat of substitute in Tesla lies higher, the electric automobiles that the company creates has strong competition for the electric cars manufactured by Ford Motors and Volvo, making Tesla run and lag in the market tier. The customer bargaining power lies as low, creating an opportunity, where the company has been constantly innovating the different units individually, raising the expectations of its customer base. The supplier bargaining power has been high, which is more of a threat to the company’s portfolio. The competitive rivalry of Tesla with the other global electric car manufacturers has been much higher in the market, a threatening case for the company due to which it constantly needs the innovative strategy to be implemented for being in the business of electric automobile manufacturing. The value chain of the company has been appreciated to be one of the cost-efficient policies implemented by the company, creating market synchronicity with the operating cost and the revenue shares. Tesla has the critical factor of being one of the leading producers of electric cars while the emission of carbon has been neutralized by the company’s distinct functional method. The company has a distinctive competitive advantage in the global market of cars, where the introduction of the new luxury electric cars with several promotional strategies adopted by the company have been in the news, making Tesla a leading exporter of the electric car industry. Tesla has been quite innovative and functional about the inclusion of the demand for the batteries that the company requires in its supply chain, to be less power-consuming.

From Task 2, I have evaluated that Tesla has chosen the strategy of exporting in the several pathways of business, which serves as the right path for such a giant procedure of electric cars competing with several leading brands. The company needs to be investing more in the International Human Resource Department, which is vital to the company’s outsourcing strategy, and the support structure of the company makes it suitable to lay down the revised modulation on the human resource department, which consolidates the business and creates better international relations.

From Task 3, I have concluded that the company of Tesla has a better infrastructure than most other electric car manufacturing companies, where the horizontal integration strategy of Tesla has been the acquisition of several firms and creating a unified management structure that governs the split partners of Tesla. In the vertical integration, Tesla has made a strong alliance with SolarCity and acquired the property rights of the company to increase the extent of the profitability measures. The activities of outsourcing of Tesla remains as one of the most profitable approaches, where the company has made a declaration to outsource the different products directly from Samsung and make a swifter gesture to the profitability quotient. I have found that the suitable recommendations that goes to Tesla for increasing the leverage of the profit margin elves from the fact that the company needs to redesign and consider different spaces for the physically disabled people, and create a more transparent management system which may be responsible in the industry tin the direct media houses that beings in large spotlight and hence, more revenue to Tesla.

From Task 4, I have deduced that Tesla company may be under the diagnosis of Carroll Theory to investigate more on the CSR of the company, where Tesla unions and lives to its mark. The company has been more functional in the grounds of being an actively participating worker in the terms of environmental awareness, by manufacturing low carbon emission products. Although, it may be said that the company surfers from few of the ethical issues that creates a negative image, where one of the ethical issue stands to the poor information supplied to recognisable and distinguished papers about the tracking of the sources of the minerals, and the several criticisms that have fallen on Tesla regarding the non-legal way to outsource such minerals. I have concluded the responsibility in terms of the company’s ethical issues may be resolved under the hiring of more ethically responsible engineers and creating better functionalities to have a better moderation on the automatic motor system, which I found is easily achievable by Tesla.

Appendices

PART B – PowerPoint Presentation

Slide 1

- Every organization in today’s age is attempting to move towards sustainable development

- Tesla is a global organization that has been attempting to focus more on sustainable development for the company’s business model

For the purpose of implementing the sustainable global strategies Tesla needs to focus on the above-mentioned three pillars and develop a business plan in accordance with it. However, the company needs to keep in mind that no financial losses are experienced by the management while implementing the sustainable strategies and thus, needs to build an efficient plan beforehand as well.

Slide 2

- The social or people aspect of sustainability is fundamentally based on the concept balancing the requirements of individuals with the needs of a group

- In Tesla the people aspect of sustainability may be maintained through the means of market specific training programmes

- Taking several safety initiatives for the workers, approving volunteer grants for local communities may also be included

It needs to be mentioned that the people aspect of acquiring a sustainable development strategy is basically about making contributions in a way that people of the community benefit from it. The above-mentioned strategies will help Tesla to focus on the people aspect of sustainability by catering to the needs of people and by taking care of the employees of the organization as well.

Slide 3

- Profit or also known as the economic pillar of sustainability is about the utilization of socio-economic resources for the benefit of an organization

- In order to obtain economic sustainability, the company will need to concentrate more on the social and environmental initiatives

- However, in 21st century humans are facing severe challenge regarding maintaining a balance between attaining sustainable growth of economy and avoiding degradation of environment (Saint et al., 2019)

It needs to be mentioned that a sustainable model of economy suggests an equal distribution and efficiently allocating the resources and focusing on social and environmental concerns will help profitability to follow. Thereafter, Tesla is building an economic model that facilitates the company to gain a significant amount of revenue without creating any environmental hazards.

Slide 4

- Planet is the environmental pillar of sustainability and it is achieved when the environment is not impacted by any activities in the society

- Tesla has been trying to attain so by making electric vehicles that do not create much impact on the environment

- The company also uses renewable energy sources, such as sunlight, rainwater preservation for its various activities

The usage of renewable energy sources, such as sunlight, the wind will not make its availability scarce and sunlight especially, which is a constant source of energy, is being utilized to meet the need of energy in today’s age (Qazi et al., 2019).

Slide 5

- For future sustainable development Tesla has focused on kinds of renewable energy and the proper utilization of those

- Moreover, batteries for storing energy is another key point of interest for Tesla in relation to future sustainable development

Tesla has addressed that by moving towards a sustainable energy model and developing electric vehicles the company will shift completely towards the sustainable energy economy at the earliest.

Slide 6

- The company should encourage the company’s consumers to be live a more energy-efficient lifestyle

- Tesla should also recycle the parts of the company’s vehicles once someone abandons a car

Tesla should also contribute a significant amount of capital in different initiatives taken by the governments of different countries in relation to acquiring a sustainable economic and energy model as well.

Slide 7-References

Qazi, A., Hussain, F., Rahim, N.A., Hardaker, G., Alghazzawi, D., Shaban, K. and Haruna, K., 2019. Towards sustainable energy: a systematic review of renewable energy sources, technologies, and public opinions. IEEE Access, 7, pp.63837-63851.

Saint Akadiri, S., Alola, A.A., Akadiri, A.C. and Alola, U.V., 2019. Renewable energy consumption in EU-28 countries: policy toward pollution mitigation and economic sustainability. Energy Policy, 132, pp.803-810.

Appendix 1

Appendix 2

………………………………………………………………………………………………………………………..

Know more about Unique Submission’s other writing services: