CIS 4011-N AI in Insurance Sector Assignment Sample

Introduction

With the speed increase of global financial incorporation as well as the developing of Chinese change as well as opening up, Chinese insurance market is bit by bit opening up to outside nations. Chinese insurance industry is coordinating with the global market. Hazard examination as well as hazard the executives of the insurance business are getting increasingly significant, as well as have become the center substance of insurance innovation the board. The criticalness as well as significance of successful monetary danger the board are getting increasingly noticeable. The comparing hypotheses, innovations as well as techniques for conventional monetary danger the executives have been hard to manage the immense measure of information as well as data created by the advancement of current monetary business sectors. New related advancements need further examination as well as improvement. With the coming of the period of large information, arising discipline innovations, for example, information mining have started to create, as well as machine learning is quite possibly the most delegate advancements.

Search

In the present business as well as logical exploration, how to apply these arising advances is a riddle that is inexplicable by corporate pioneers as well as researchers. From the actual information, the qualities of its characteristic law are mined, as well as the new sort of misrepresentation can be immediately distinguished by occasionally changing the training tests, which incredibly saves the time as well as work expenses of the insurance company. Step by step instructions to viably control as well as forestall the comparing hazards while the scale of the insurance company is growing is a difficult worth contemplating. The dangers looked by insurance organizations mainly incorporate market hazards, credit chances, insurance chances, strategy chances, administrative dangers, etc. Considering this, the top to bottom investigation of insurance hazard is of extraordinary functional importance for advancing the joining of Chinese insurance industry with the global insurance industry, improving Chinese insurance market, creating Chinese danger the board science, improving the operational proficiency of Chinese public insurance industry as well as upgrading its market seriousness. Hazard alludes to the uncertainty of future misfortunes. The best as well as essential intends to oversee chances is insurance.

Insurance, as essential methods for spreading chances as well as moving dangers, has been generally utilized as well as grown quickly, as well as has become a significant segment in the financial fields of different nations. Insurance hazards mainly incorporate the accompanying classes: endorsing chances, the board chances, speculation dangers as well as good dangers. To contemplate the part of insurance in operational danger the executives as well as why insurance can be utilized to oversee operational danger, we should initially comprehend the recognizable proof as well as the board of operational danger. In any case, the techniques as well as devices of hazard the board have not grown altogether as of late, as well as the customary administration instruments are as yet utilized for subjective examination. With the broadening of monetary resources, it has been not able to address the issues of hazard the board. It is simple for staff to make emotional decisions dependent on past experience, which will make the evaluation abstract, prompting guaranteeing chances; as the cycle of worldwide monetary incorporation speeds up. The insurance market in different nations is likewise growing universally. Some worldwide insurance bunches are walking into their unfamiliar insurance market with their solid monetary strength as well as great administration innovation, as well as have become the overlord of the global insurance industry.

Lately, machine learning innovation is advancing quickly, as well as it is moving toward the AI focus in our souls. Picture identification, discourse acknowledgment, style relocation, machine interpretation as well as different innovations have been applied in our reality. Insurance hazard the executives can advance the improvement of insurance the board level. Insurance organizations regularly give pay as well as calamity anticipation administrations to clients for their own advantages as well as clients’ necessities. On the off chance that banks don’t buy insurance, they should embrace or buy such administrations from different spots. They gather credit information of the financial framework itself as well as different information of clients on the Internet, including relational connections, authentic buyer conduct, personality qualities, etc. For various clients, the pertinent components as well as attributes are not brought together, so the assessment results are likewise exceptionally emotional. Credit scoring technique is to track down the main source of default time. Insurance the board is another order created from insurance as well as actuarial science. After almost 50 years of improvement, it has become a significant branch in the field of the board science as well as has been applied to different kinds of big business the executives. After the bank buys the insurance, regardless of if there is a danger mishap, the bank will have adequate interior assets to put resources into new undertakings. Hazard the board of insurance organizations can likewise accelerate Chinese social insurance framework. From an authentic point of view, the comprehension of hazard marvels can be followed back to an early age.

Big data can have a host of effects on insurance. The most highly anticipated data analytics, but the term’s meaning is not always obvious from the topic coverage. The second category is pricing, with different views about how large data will affect it. The second field is pricing. Given how large data will improve customer behaviour, delivery and advertising are more clear paths. Big data will be used to modernise the collection of claims and complaints and to improve target advertising. Data analysis is defined as the study of collecting information from raw materials. The word data analytics applies to a number of methods for data processing. Data analytics can be used to acquire information about almost every kind of data, and can be used to improve comprehension and structures. Many techniques and applications in data science have been converted into robotic and equations.

There are four types of data analytics –

- Descriptive analytics: what happens during a certain time frame (analysis of past data).

- Diagnostic analysis: why this occurred, including a wider range of data observations and theory.

- Analytics predictive: what would probably happen in the immediate future.

- Customer ordered: a plan of action to be taken.

Insurers may use large data to utilise diagnostic and prediction tools to forecast potential policyholders’ behaviour and, through data analytics tools, to take measures based on the findings. The insurance sector has utilised traditional software to evaluate and market risks. This is a statistical way of estimating the association between the probability of winning a claim and different risk factors. Several organisations have, however, begun using other analytical approaches to establish GLM inputs. Examples of approaches utilised include predictive model or quasi methods, including deep learning models.

It is also useful to make a distinction between “costing” in the insurance sector (survey measurements) and “pricing”. Instead of actual rates, insurance premiums can be based on predictions. A statistic study of prior losses dependent on the multiple parameters of the protected calculates the majority of the premiums (cost). Premium variables are described by the best prediction variables. As more evidence can improve issuer behaviours or incidents’ predictability, the emergence of big data has led to an increased usage of uncertainty pricing. But insurers don’t tend to differentiated between policies of the same risk levels on the basis of risk tolerance or ability to change in the dynamic insurance sector. Risk profiling is the mechanism by which insurance providers pay rates to classes of persons with identical backgrounds, for example by race or sex for auto insurance. Big technology opens up new information channels for companies. To learn about health insurers and the classification of danger.

Carriers must position themselves to react to the shifting business environment as artificial intelligence (AI) becomes more fully incorporated into the sector. Insurance executives must be aware of the reasons that will contribute to this transformation, as well as how artificial intelligence will alter claims, distribution, underwriting, and pricing. With this knowledge, they may begin to develop the skills and talent necessary to compete in the insurance business of the future, as well as embrace new technology and develop the mentality and perspective necessary to be successful participants in the sector.

The fundamental technologies of artificial intelligence are already being used in our companies, homes, and cars, as well as on our bodies. As a result of the COVID-19 disruption, the timeframes for the implementation of artificial intelligence (AI) have been accelerated considerably, particularly for insurers. Organizations were forced to adapt almost immediately to accommodate remote workers, develop their digital capabilities to enable distribution, and update their online channels and infrastructure.

While most organizations are unlikely to have made significant investments in artificial intelligence during the pandemic, the increased emphasis on digital technologies and a greater willingness to embrace change will put them in a better position to incorporate AI into their operations in the future. Sensor-equipped equipment has been commonplace in industrial settings for some time, but the number of linked consumer gadgets is expected to skyrocket in the coming years.

New and fast-expanding categories such as apparel, eyeglasses, household appliances, medical devices, and shoes will join current devices (such as automobiles, fitness trackers, home assistants, smartphones, and smartwatches) while the penetration of existing devices continues to rise at a rapid pace. Experts predict that by 2025, there will be up to one trillion linked gadgets on the planet.

The avalanche of new data generated by these devices will enable carriers to better understand their customers, leading to the introduction of new product categories, more customized pricing, and the delivery of services in more real-time. Over the next decade, four fundamental technological developments, which are closely linked with (and occasionally facilitated by) artificial intelligence, will transform the insurance business.

Operationalization of the Solution

AI and related technologies will have a seismic impact on the profit market from supply to subscription and charging to claims. Advanced technologies and data now have control on sales and contracting, pricing, acquiring, and tying policies in almost real time. A close examination of what insurance will appear as a prediction shows dramatic changes in the entire business process of protection.

Distribution-

The shopping experience with risk is faster, and the insurers and consumers have fewer direct involvement. The cycle time for purchasing a vehicle, industrial or healthcare benefits policy may be cut to minutes and to also seconds with sufficient information on person behaviour and AI algorithms creating risk profiles. As telematics and IoT devices grow and price algorithms mature, the capacity of auto and real estate insurers to issue policies to a larger range of customers will keep improving.

Pricing and underwriting-

In personal safety and casualty products for most small and start – up business products, it will be outdated to underwrite it as we know today. A mixture of computer and learning techniques models integrated into the communication plan sets automates and helps the bulk of the underwriting phase to reduce it to only a few seconds. In powering these simulations are internal data and a wide set of data source access by Linux systems and third-party information and analytical suppliers.

Accusations/claims-

Carriers remain key claims, but more than half of these statements have been substituted by automation. Initial routing of claims is done with up-to-date, effective, precise algorithms. Thousands of Small Market Reports are entirely automated such that carrier settlement speeds of up to 90% can be achieved straightforwardly and the period to resolve claims greatly reduced from days to days or hours.

Traditional, manual first-time failure techniques have been increasingly substituted by Sensing devices and a range of data collection devices, including drones. If a loss happens, triage and remedy claims are also immediately triggered.

The existing complexities of the industry are likely to be aggravated by technology, which will accelerate businesses using big data analytics. If technology, particularly access to particular data analytics or AI technologies by some firms, needs to be monitored in order to avoid a structure of the oligopoly industry. In order to describe customer rights, some officials have been led by digitalisation to examine different standards and principles. This may be a crucial consideration to remember and closely watched by the insurance regulators. Market risk can participate in removal or cost, and cloud computing can help accelerate the method. Recognizing the kinds of Big Data to be utilised would be an important component of how insurance policies promote the equal and rational usage of Predictive Analytics.

In certain situations, the core Ai system, especially in the field of deep machine learning, is not obvious and biases can be unintentionally and purposefully integrated which can contribute to improper tips. It is uncertain how this affects the conduct of policyholders, and also the reputation and reliability of companies, and how regulations will react. As AI can ask for information from an accessible internet link or database that could damage the device, it will need techniques to avoid these safety accidents and to enforce backup steps when an incident happens. There is both a lack of AI-related expertise on the drug costs and on the industry. The lack of skills is a challenge for all industries, not just safety.

Generally speaking, insurance regulators will take action to help follow developments in AI by forcing insurance firms to establish a governance structure for managing AI. This will be particularly important to insurance regulators if the decision-making on AI would lead to unintentional impact or bias. Regulators may also have to examine whether unfounded biases or discrimination in machine intelligence is cause.

Large Data as well as Machine Learning Assess

Simultaneously, individuals started to receive different strategies to manage daily life as well as creation exercises early or purposefully. Hazard. The endorsing hazard mainly comes from the unfriendly determination as well as good peril of the guaranteed, as well as the impact of the debilitating of the insurable conditions under the outside climate. The evaluating hazard is mainly because of the essential guideline of insurance valuing. In the event that the boundless data gold mine contained in the information is used with cutting edge investigation innovation as well as changed over into very significant understas well asing, it can assist monetary ventures with carrying out continuous danger the board, become an amazing insurance safeguard for monetary endeavors, as well as guarantee the ordinary activity of monetary undertakings. The interior danger of an insurance company can embrace distinctive danger control techniques as per the qualities of each connection. The normally appropriate strategy is misfortune avoidance as well as misfortune decrease. The center substance of this strategy is the development of the inner control level of the insurance company; the utilization of measurements, PC, information mining As well as man-made brainpower as well as different intends to recognize as well as pass judgment on expected dangers in Internet account from the expanse of information; simultaneously, to guarantee insurance activity or benefit from insurance activity, insurance suppliers have reinforced the peril evaluation of hazard wonders, as well as made as well as applied an assortment of novel calamity counteraction as well as misfortune decrease innovation apparatuses.

Criteria

Article intelligence is growing quick, as is the requirement for specialists to evaluate the appropriateness of existing administrative prerequisites and build up new administrative systems that will set long haul norms for the utilization of this exceptionally information driven innovation. Nonetheless, the hole between the observation abilities of controllers and consistence groups is extending. All things considered, the appropriation of AI systems in the insurance business will straightforwardly prompt the gigantic test of dealing with the speed of innovative advancement and the degree of guideline in districts like Germany, Europe, and the United States. The General Data Protection Regulation (GDPR) in the EU influences the entirety of the change regions we have referenced. Information compactness and client information use exposure necessities are only two instances of the difficulties ahead (Oppong et al.,2019).

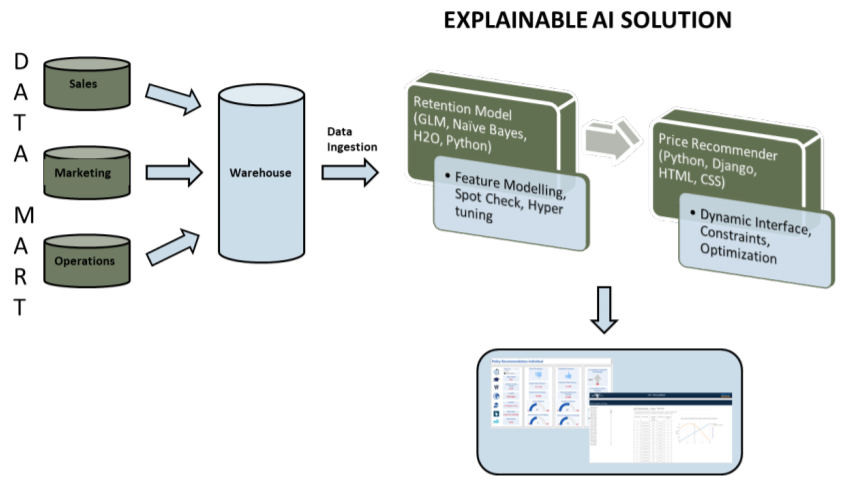

The fields of information examination and AI influence themes like evaluating enhancement, claims the board, and installment measures, just as individualized arrangements and digitalized deals techniques.It is actually an experience to gather, handle, and oversee GDPR-consistent information inside AI information secret elements. All the while, the Department of Defense in the US has set up a task for Explainable Artificial Intelligence (XAI). The point of this program is to give AI strategies through an open stage that offers models that are more clear and empower people to comprehend and oversee AI-driven innovation. Furthermore, the White House has proclaimed responsibility for just as its mindful and detectable use as a subject absolutely critical. The cases/costs change regions just as deal and client encounters are exceptionally determined by consistence angles, for example, approval and ban necessities, character approval, and information discernibility. These points are as of now under a microscope by experts in the entirety of the districts referenced.

In the case of guaranteeing is computerized, openings in endorsed nations could be covered. Installments could be handled in the interest of individuals or organizations that are on boycotts. Moreover, completely digitalized and computerized distinguishing proof cycles could fizzle. On the off chance that AI is utilized for data identifying with charge and monetary detailing, organizations need to keep the key figures and information handling techniques just as their relating specialized and useful documentation to guarantee historiographic straightforwardness and proof. Particularly with respect to deals change, the Insurance Distribution Directive (IDD) contains controller assumptions with regards to AI procedures that require activity (Balasubramanian et al.,2019). For instance, the IDD states that each client should be given the most ideal help in regard of cost and execution.

It can’t be ensured that exceptionally individualized information driven arrangements will meet this commitment and not deny the customer of admittance to other imminent administrations. The use of AI with regards to Pillar I of Solvency II likewise requires a significant degree of information quality. It is compulsory for information quality measures according to exactness, culmination, and suitability to be met by inner models. Also, the actuarial capacity is accountable for the information nature of specialized arrangements, for instance. It very well may be the situation that AI can’t guarantee equivalent treatment, e.g., paying little heed to sexual orientation and beginning. This can possibly bring about huge fines and results.

Recommendation

While organizations might want to clear most cases inside the most un-conceivable time, some due ingenuity is needed for each situation to get rid of questionable claims. In practically all cases, a certain measure of manual check of claim archives and other information is inescapable. The entirety of this builds insurance firms’ operational expenses even as there is some postponement, which irritates clients.

Thus, it is in light of a legitimate concern for both insurance organizations and claimants that the claims are settled at the most punctual. On account of innovation like AI, information investigation and other partnered devices, the start to finish claims measure has been smoothed out and speeded up. Starting with information catch, settlement commencement, endorsement and authorization, following of installment and recuperation, and the handling of legitimate issues to overseeing correspondence, AI and other tech apparatuses have definitely diminished the turnaround time (Zarifis, et al.,2019).

For example, today, bots are conveyed in evaluating claims, confirming approach details, checking for extortion and directing the installments interaction. Thus, the whole claims measure turns out to be a lot quicker and more productive. This advantages the two clients and safety net providers.

Under the prior conventional model of claims preparing, insurance organizations thought that it was hazardous to accelerate the interaction on account of the sheer volumes of daily claims. It’s trying to unravel explicit examples inside the claims information that may require nearer investigation through human oversight. In any case, with AI, it is just merely minutes and deft programming for advanced apparatuses to get explicit claim designs happening arbitrarily or at scale. In addition, this is managed without unduly swelling operational expenses or burning-through additional time.In dealing with the abovementioned, insurance players need to work with AI experts in incorporating tech instruments like ML (AI), NLP (common language preparing), and mechanical cycle robotization. Through these subject matter experts, similarity can be maintained between computerized devices and a company’s current heritage frameworks.

Today, these advancements are changing claims the board, profiting both legitimate claimants and safety net providers. For the previous, AI guarantees their claims are prepared and cleared with quicker turnaround times impractical prior.

Thinking about the advantages, it is in light of a legitimate concern for forthcoming clients to pick proficient insurance organizations, which convey computerized innovation in clearing claims a lot quicker than conventional substances. The educated organizations are likewise better situated to direct expected clients about bespoke arrangements, including term insurance, which suit singular prerequisites (Lamberton, et al.,2017).

Without a doubt, as AI-empowered claims settlement gets mainstream, consumer loyalty rates are set to contact new highs. Through solid IT and examination frameworks, insurance organizations can mechanize the identification of claims misrepresentation. For instance, NLP programming could help in pinpointing designs emerging in past deceitful claim applications. The second these examples are identified in new applications, the framework right away raises warnings. As is apparent, AI sends a deliberate methodology in identifying such inconsistencies.

Definitely, prescient investigation can help insurance substances find false claims a lot quicker and with incomprehensibly higher precision rates than people might accomplish. In reality, such programmed AI-based claims location programming could help insurance organizations distinguish cheats progressively even as a planned claimant might be collaborating with their group or recording a claim on the web.

Conclusion

AI is needed to change society. It could especially influence social and good threats. AI will make new practices, better methodologies for living and different joint efforts among people and machines. Human and AI collaborations may exhibit a test in the short to medium term as new and propelling positions and commitments are set up. AI will influence society in locales like people’s ability to find business. Discretionary effects of AI could be social tumult, for example if people trust AI has made more critical lopsidedness between the rich and poor. Until additional notification, it is difficult to predict absolutely how AI will influence the (re)insurance industry. Al may reexamine the insurance essentials, for instance, diminishing information lopsidedness among underwriters and secured on account of improved data and allowing better consistency and checking of threats. As a resulting demand sway, AI will improve efficiencies and thing headway yet moreover make new characteristic AI possibilities.AI is being utilized to improve clients’ involvement in insurance organizations and make it simpler for them to take out a strategy (for example by utilizing chatbot counselors). Clients are currently additionally better educated about their insurance needs using wellbeing sensor information, face planning apparatuses, AI empowered hereditary indicators and AI individual collaborators. The entirety of this could prompt conceivably diminishing the insurance hole. AI an affects corporate associations as far as worker cooperation, task robotization and the production of new information related positions. Organizations would now be able to utilize AI programming to assist them with distinguishing and select possibility for jobs and to survey work fulfillment inside their association. Organizations are additionally making more information related situations inside their associations so they can more readily use their information and tackle the chances given by AI. Notwithstanding, AI is likewise a danger to business. Insurance is based on the head of pooling dangers and (re)insurers capacity to unite as one enormous gatherings of comparable individuals or dangers. At some random time, the (re)insurer should pay out on claims around there yet ought to have sufficient cash in the pool from the premium gathered. Be that as it may, AI and the utilization of enormous information separates this head of pooled dangers and cross-endowment particularly for certain lines of business. (Re)insurers are currently ready to give substantially more explicit valuing and arrangements for customers’ specific requirements implying that the need to pool general gatherings vanishes.

Reference

Allam, Z., Dey, G. and Jones, D.S., 2020. Artificial intelligence (AI) provided early detection of the coronavirus (COVID-19) in China and will influence future Urban health policy internationally. AI, 1(2), pp.156-165.

Balasubramanian, R., Libarikian, A. and McElhaney, D., 2018. Insurance 2030—The impact of AI on the future of insurance. McKinsey & Company.

Lamberton, C., Brigo, D. and Hoy, D., 2017. Impact of Robotics, RPA and AI on the insurance industry: challenges and opportunities. Journal of Financial Perspectives, 4(1).

Oppong, G.K., Pattanayak, J.K. and Irfan, M., 2019. Impact of intellectual capital on productivity of insurance companies in Ghana. Journal of Intellectual Capital.

Zarifis, A., Holland, C.P. and Milne, A., 2019. Evaluating the impact of AI on insurance: The four emerging AI-and data-driven business models. Emerald Open Research, 1(15), p.15.

………………………………………………………………………………………………………………………..

Know more about UniqueSubmission’s other writing services: