BMP3005 Applied Business Finance Sample

Introduction

Organisations require an effective financial planning that helps them in managing the budget for continuing the operational activities. Financial management, in this regard, plays a significant role in improving the financial decision-making capability of organisations thereby improving the financial planning. Additionally, it further assists organisations to achieve the goals and objectives as set thereby improving the organisational value in the competition market.

The present report hereby integrates a discussion on the concept, importance of financial management along with the financial statements that are majorly used by organisations. In this regard, following the case study provided, financial statements and ratios have been calculated to understand the financial health of the company. However, based on the results, recommendations have also been included in this study.

Section 1

Financial management is referred to as the organisational function that assists financial managers in effectively using the financial resources that helps in gaining financial success thereby improving the return on investment. As per the words of Al Breiki and Nobanee (2019), financial management depicts organising, planning, directing and controlling the financial activities of an organisation thereby making effective use of the funding sources.

In addition to this, financial management potentially assists companies in efficiently using the financial resources that help in achieving the financial goals and objectives of the same thereby planning an effective capital structure.

The view sheds light on an understanding that financial management plays a significant role in organisations thereupon guiding the financial managers with proper and effective management of the sources of funds. Moreover, it also assists the companies in improving the financial situation with efficient planning that increases the investment return.

The study conducted by Onyebuchi (2022), stated that it is essential for companies to maintain a sound financial management system so that the profitability position improves. In addition, financial management is essential as it assists an organisation in developing financial and investment decisions thereby reflecting efficient financial planning.

It also improves the economic stability of organisations thereupon controlling the expenses. Therefore, this implies that in order to maintain a sound financial position in the competitive environment, it is of utmost importance for a company to incorporate an efficient system of financial management that improves the financial condition of the firm.

Section 2

Concerning financial planning, financial managers have been found to be using significant financial statements that potentially shed light on the income, expense, profit and loss of the companies along with the balance between the assets and the liabilities possessed by the organisations (Bismark et al., 2018). Financial statements, in this regard, assist organisations in gaining a clear insight on the financial performance thereby recording each financial activity conducted by the same within a specific period of time.

As per the opinion of Cioca (2020), financial statements represent the financial information in an organised and formal manner that helps in understanding the financial performance and position of a firm in a competitive business environment. It furthermore assists the managers in taking financial decisions thereby analysing the financial statements. This denotes that the incorporation of financial statements for organisations fall important as it significantly helps the managers in understanding the financial performance of a company with the evaluation of the financial activities integrated.

Upon further understanding, it came within purview that there are three major statements that companies usually integrate to analyse the financial performance such as the balance sheet, the income statement along with the cash flow statement (Tintor, 2019).

Balance sheet significantly assists companies in understanding the amount that can be possessed by an organisation with the payment of its debts and sale of the assists held (Wang and Dan, 2020). In other words, it sheds light on the assets and liabilities possessed by a company and helps in shedding information on the liquidity, efficiency and gearing ratios that the company holds.

The income statement, on the other hand, provides relevant information on the company’s expenses and incomes and the ultimate profit or loss obtained by balancing the revenues and costs (Obeki, 2018). It potentially assists firms in evaluating their profitability position in the market. Cash flow statement, however, depicts the inflows and outflows of cash during a specified period.

As stated, the financial statements help in calculating the different ratios of an organisation. Following the views of Prawirodipoero et al., (2019), financial ratios assists organisations in understanding their financial performance and position with the help of percentages. It specifically provides insights on the profitability, liquidity, efficiency and investment capabilities of an organisation and gives the opportunity of making comparisons with earlier year performances or other companies.

Based on this opinion, it can be mentioned that in order to evaluate a company’s financial health concerning a specific year, it is essential to incorporate ratio analysis. However, with the information of the profitability, efficiency, liquidity and investment positions, organisations can be capable of making potential financial decisions that can further improve the organisational value and position in the market.

Section 3

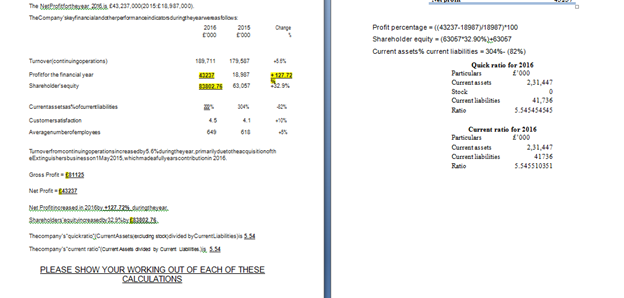

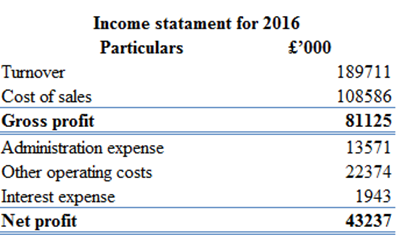

- ii) Income statement for the company has been added in the appendix section which has been done using excel.

iii) The balance sheet for the company for the year ended 2016 has been presented below which has been conducted in excel.

| “Balance sheet for 2016 | |

| Particulars | 2016 |

| £’000 | |

| Turnover (continuing operations) | 1,89,711 |

| Profit for the financial year | 43237 |

| Shareholders Equity | 83802.753 |

| Current assets as% of current liabilities | 222% |

| Customer satisfaction | 4.5 |

| Average number of employees | 649 |

Table 1: Balance Sheet”

(Source: Self-developed)

- iv) Ratio analysis

- Profitability

Gross profit margin

Gross profit ratio has been calculated for 2016 for the company that has helped in understanding the profitability position of the firm from its direct sales (Nariswari and Nugraha, 2020).

| “Gross profit margin for 2016 | |

| Particulars | £’000 |

| Net sales | 1,89,711 |

| Gross profit | 81125 |

| Ratio | 234% |

Table 2: GP ratio”

(Source: Self-developed)

As depicted in table 2, the gross profit ratio of the concerned firm has been found to be strongly high reflecting a percentage of 234% in 2016. As stated by Haralayya (2021), a percentage of 20% of gross profit ratio is considered to be good whereas 50% and above are considered to be excellent that implies the sound profitability position of a company.

Concerning this opinion and based on the percentage, it can be stated that the revenue earnings of the company from its direct sales have been strong reflecting a high profitability percentage. This also implies that the cost structure of the company has been sound as it increased the gross earnings.

Net profit margin

| “Net profit margin for 2016 | |

| Particulars | £’000 |

| Net sales | 1,89,711 |

| Net profit | 43273 |

| Ratio | 438% |

Table 3: Net profit ratio”

(Source: Self-developed)

Relating to the net profit of the company, it has been evident that the company’s operating costs have been a bit high that reduced the value of the net earnings of the firm. In this regard, it has been observed that the operating costs, interest costs and administrative cost of the firm has been potentially high reflecting a value of £38,068.

The net profit of the company was found to reflect a value of £43237, however, depicting a percentage of 438%. This denotes that the company’s profitability performance has been quite high, however, compared to the gross profit earnings, the net earnings of the firm has been low.

- Liquidity

Current ratio

| “Current ratio for 2016 | |

| Particulars | £’000 |

| Current assets | 2,31,447 |

| Current liabilities | 41736 |

| Ratio | 5.545510351 |

Table 4: Current ratio”

(Source: Self-developed)

Evaluation of current ratio potentially helps in understanding the capacity of an organisation to pay off its debts by selling off the current assets that it possesses. In this context, a ratio of 2 is considered to be good for companies as it depicts the liquidity capability of a firm (Jana, 2018).

In this area of discussion, it has been found that the current ratio of the company is valued at 5.54 which reflect a higher ratio value. In other words, it can be stated that the company has been possessing a high liquidity ratio that implies that the efficient use of the assets have been low. The company can be further stated to be inefficient as it fails to use the assets of the short-term facilities in an effective manner.

Quick ratio

| “Quick ratio for 2016 | |

| Particulars | £’000 |

| Current assets | 2,31,447 |

| Stock | 0 |

| Current liabilities | 41,736 |

| Ratio | 5.545454545 |

Table 5: Quick ratio”

(Source: Self-developed)

Concerning the quick ratio, the liquidity position of the company has been analysed, however, in this context, the value of the inventory has been deducted. In this regard, as per the balance sheet, the value of the inventory has been zero, which makes the value of the quick ratio and the current ratio same. Thus, it can be mentioned that there has been inefficient management of the company’s assets.

- Efficiency

Asset turnover ratio

| “Asset turnover for 2016 | |

| Particulars | £’000 |

| Sales | 1,89,711 |

| Average total assets | 298902 |

| Ratio | 0.634692976 |

Table 6: Asset turnover”

(Source: Self-developed)

Asset turnover ratio refers to the efficiency ratio that helps in understanding the management system of the firms concerning their assets (Qamara et al., 2020). In this context, it has been observed that the ratio depicted a value of 0.63, which potentially reflected that the organisation has been less efficient in managing its assets as the value has been higher than the standard value of 0.5. However, it also reflects that the asset management capacity of the firm has been weak reflecting a lower efficiency level.

Section 4

As per the above ratio analysis, it has been observed that the profitability position of the company has been stable reflecting a higher percentage. As per the words of Irman and Purwati (2020), when the profitability ratio depicts a higher value than the standard one, it depicts that the revenue earnings of the company have been sound. It further reflects that the cost structure of the organisation has been effective and has potentially assisted the firm in earning higher revenues. This indicates that the company is required to continue with the current operational system for revenue earnings.

On the other hand, based on the liquidity and efficiency ratio, it has been evident that the financial management of the firm has been low thereby reflecting higher values of current and quick ratio along with asset turnover. In this regard, it has been further observed that the liquidity value of the firm has been high reflecting the higher solvency position, however, with lower asset management capacity.

In this area of discussion, it can be stated that it is essential for the company to increase its operational efficiency thereby maintaining proper maintenance and usage of the assets of the firm. The company can be recommended to incorporate a financial manager for the company who would look after the company’s financial management system.

Concerning the opinion of Mohammadi et al., (2021), financial managers play a vital role in planning up the financial activities of an organisation thereupon effectively maintaining the financial performance. In addition to this, it has been mentioned that financial managers with the help of the financial statements make effective decisions for the company reflecting strong financial and investment decisions.

Depending on this opinion, it can be stated that it is beneficial for the company to recruit an expertise manager within the organisation who would look after the financial activities and plan up the sources of the firm efficiently. However, with the recruitment of the financial manager, the usage of assets can also be effectively made that can potentially assist the firm in improving its organisational position in the market.

Conclusion

The current report concludes that financial management is important for companies as it improves the profitability position. Moreover, it develops an effective financial planning that helps firms in deciding the sources of funds required by the company.

Financial statements such as balance sheet, income statement and cash flow statement are found to be part of the financial management system by the conduction of which organisations analyse their financial activities and performance. Concerning the ratio analysis of the company given, it can be concluded that it is essential for the company to recruit a potential financial manager to improve their efficiency level thereupon improving the overall financial condition of the firm.

Reference List

Al Breiki, M. and Nobanee, H., 2019. The role of financial management in promoting sustainable business practices and development. Available at SSRN 3472404.

Bismark, O., Kofi, A.F., Kofi, O.A. and Eric, H., 2018. Impact of financial management practices on the growth of small and medium scale enterprises in Ghana: The case of Birim Central Municipality. International Journal of Innovation and Research in Educational Sciences, 5(2), pp.177-184.

Cioca, I.C., 2020. The Importance Of Financial Statements In The Decision-Making Process. Annales Universitatis Apulensis Series Oeconomica, 1(22), pp.73-83.

Haralayya, B., 2021. Ratio Analysis at NSSK, Bidar. Iconic Research And Engineering Journals, 4(12), pp.170-182.

Irman, M. and Purwati, A.A., 2020. Analysis on the influence of current ratio, debt to equity ratio and total asset turnover toward return on assets on the otomotive and component company that has been registered in Indonesia Stock Exchange Within 2011-2017. International Journal of Economics Development Research (IJEDR), 1(1), pp.36-44.

Jana, D., 2018. Impact of working capital management on profitability of the selected listed FMCG companies in India. International Research Journal of Business Studies, 11(1), pp.21-30.

Mohammadi, S.M.H., Taftiyan, A., Heirani, F. and Eslami, S., 2021. Structural Analysis of the Interaction of Financial Managers’ Competency Model. International Journal of Economics & Business Administration (IJEBA), 9(3), pp.118-136.

Nariswari, T.N. and Nugraha, N.M., 2020. Profit growth: impact of net profit margin, gross profit margin and total assests turnover. International Journal of Finance & Banking Studies (2147-4486), 9(4), pp.87-96.

Obeki, O.S., 2018. Income statement preparation by small and medium enterprises.

Onyebuchi, O.M., 2022. Assessing the Importance of Firms Financial Management. BW Academic Journal, pp.9-9.

Prawirodipoero, G.M., Rahadi, R.A. and Hidayat, A., 2019. The Influence of Financial Ratios Analysis on the Financial Performance of Micro Small Medium Enterprises in Indonesia. Review of Integrative Business and Economics Research, 8, pp.393-400.

Qamara, T., Wulandari, A., Sukoco, A. and Suyono, J., 2020. The Influence of Current Ratio, Debt to Equity Ratio, And Total Asset Turnover Ratio on Profitability of Transportation Companies Listed On the Indonesia Stock Exchange 2014-2018. IJIEEB International Journal of Integrated Education, Engineering and Business eISSN 2615-1596 pISSN 2615-2312, 3(2), pp.81-93.

Tintor, Ž., 2019. The importance of audit as a quality indicator of the financial statements. Obrazovanje za poduzetništvo-E4E: znanstveno stručni časopis o obrazovanju za poduzetništvo, 9(2), pp.140-153.

Wang, D. and Dan, S., 2020, April. Evaluation on Information Disclosure of Rural Commercial Banks’ Off-Balance Sheet Activities. In International Conference on Education, Economics and Information Management (ICEEIM 2019) (pp. 233-239). Atlantis Press.

Appendices:

Appendix 1: Business review template

Appendix 2: Income statement

Know more about UniqueSubmission’s other writing services: