Business Strategy and Finance Sample

Introduction

The financial performance of any business is a key factor which has affected the interest of investors as well as shareholders to invest in the business. In the current scenario financial performance of IAG (International Airlines Group) has been analysed in order to execute a proper environment for investments. Any investor needs to execute the internal and external financial performance of the business before investing in a business.

Internal analysis assists inventors to execute efficiency as well as productivity of the business. Whereas external analysis assists to observe competition as well as the market share of a business. Financial analysis assists investors to execute financial stability such as profitability, liquidity as well as effective capital structure to invest in that capital.

IAG was established in 2011 in the UK as an Anglo-Spanish multinational airline business entity, operating in more than 38 countries. At the current time, IAG has 56658 employees as well as operates 268 destinations Aircraft at present time. The total revenue of IAG exists at 7.26 billion which is an increase of 3.83% compared with the revenue of 2021 (Iairgroup.com, 2022).

There are 113 million passengers each year as well as before Covid-19 IAG provided services to over 118 million people as well as operated 531 aircraft. The main purpose to operate the business of IAG has been existing at “To connect people, businesses and countries” which indicates that IAG has considered different types of ESG practices.

Main body

External Analysis

Pestle analysis

| Factors | Analysis | Impact |

| Political | Political stability index of the UK has existed at 0.54 which is positive indicating that the political factor in the UK are more stable as compared with political stability of another country | IAG is able to sustain its business in the UK as well as take benefits of political stability. |

| Economical | The UK is a developed nation and GDP growth has been noted at 7.3% as well as a 9.9% inflation rate. | It has been observed that the GDP growth rate is low as compared with the inflation rate in the UK nevertheless, IAG takes benefits of a better economy as well as increasing FDI of the UK (Stevenson and Marintseva, 2019, p.15). |

| Social | The social factors of the UK are also better as compared with other countries. The literacy rate of the UK has existed at 99%. | The social factors of the UK also assist IAG to enhance its business growth as it has a better literacy rate. |

| Technological | The latest communication, as well as customer relationship technology, are already used by different global-based businesses. | IAG is also able to increase consumer satisfaction as well as better stakeholder management through increased existing technology and software which is used to manage employees as well as consumers. |

| Legal | The crime rate of the UK has been 79.52 out of 1000 people which is low and the UK government has also developed different types of legal regulations to protect the interest of business entities. | IAG needs to consider different legal rules and steps while operating business in the UK. |

| Environmental | The people of the UK are more interested in engaging in online marketplace. Further, people are also more attracted to invest in different global-based businesses. Nearly 49% of people are interested in engaging in online business. | IAG takes advantage of environmental factors such as investing activities as well as interest to attract different digital business industries. |

Table 1: Pestle analysis

(Source: Liu et al. 2022, p.13)

The financial performance as well as external performance is mainly affected by the practice of competitors as well as market environments. As it has been observed that the UK GDP has been growing fast nevertheless, in the past two years the GDP of the UK has declined due to the Covid-19 pandemic. Apart from this, in currency terms FDI of the UK has also declined due to the per capita income of people around the world has declined. As stated by So et al. (2019, p.8), these are key reasons that the economic performance of the UK has declined. As a result, the financial performance of IAG may be also affected due to negative GDP growth as well as low FDI. Apart from this. Day by day global airline players are increasing due to the entry of new airlines into the international airline industry. At the current time in the UK airlines industry, there are nearly 8 global airlines that operate businesses which may be affected by the business size as well as the market share of IAG. This is also a reason for the decline in the market share of IAG from 34% in domestic flights at the global level to 20% market share in 2021 in domestic flights in different countries (Iairgroup.com, 2022). Apart from this, it has been stated that IAG may get different benefits by considering different financial assistance during Covid-19 as well as in the current time to promote business activities in the UK. As stated by Kumar et al. (2022, p.16), the UK government has announced a decline in its corporate tax from 19% to 17% in order to reduce the tax burden on different businesses. As a result, different businesses are able to grow fast as compared with other businesses.

Internal Analysis

SWOT analysis

| Strengths | Weakness |

| ● 20% market share in domestic airlines industry

● IAG has to operate nearly 531 aircraft (Iairgroup.com, 2022). ● Holding company in five global airline companies such as British Airways and other airlines in the UK, Australia as well as other countries. ● Focus on premium product index |

● Revenue declined by -12.78% compared with the last five years’ revenue

● Net margin has been reduced by -34.71% ● Not having sufficient ROIC ● Having a small market share in Asia Pacific |

| Opportunity | Threats |

| ● Asia Pacific airlines industry growing fast

● Market growth of airlines industry 25.4% ● Market size of global airlines industry exists at $591.8 billion |

● Increasing competition

● Ryanair, EasyJet& Air France KLM. are a key competitor of IAG |

Table 2: SWOT analysis

(Source: Su and Zhao, 2019, p.16)

Financial Analysis

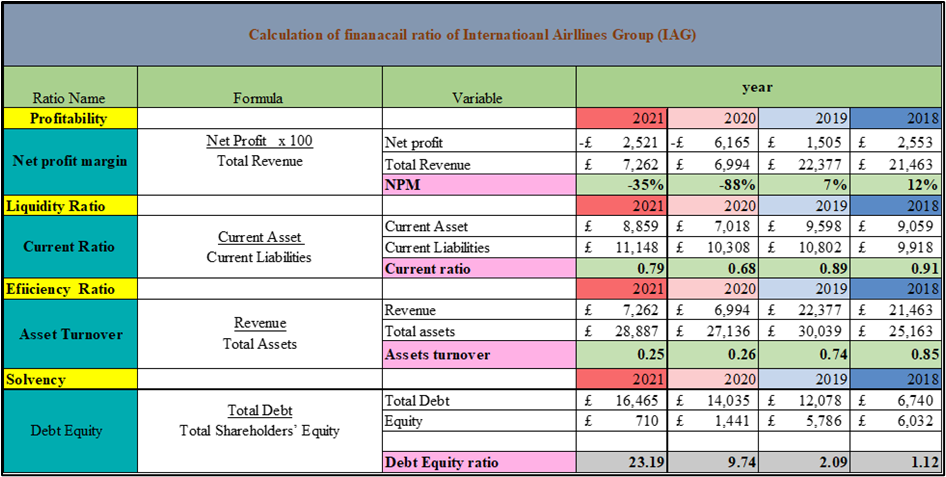

Financial performance of an entity has been affected through fluctuation in revenue as well as expenditure and costs incurred to operate the business. To execute the financial performance as well as stability of IAG four key ratios from four different categories have been considered. Net margin has been considered to analyse finances whereas the current ratio assists to analyse the liquidity of the business. Apart from this, to analyse its efficiency and solvency assets turnover and the debt-Equity ratio has been considered.

Profitability: Net margin

Net margin of any business indicates core profitability such as which has been enjoyed by its stockholders on their investment. As stated by Maisharoh and Riyanto (2018, p.5), the net profit of any business has been directly affected by revenue as well as operating costs to manufacture products as well as services that it provides to its consumers. Net margin of IAG has existed at -35% which fluctuates from 12%. It has been observed from the ratio that IAG has suffered from a massive loss in the current time as well as the financial crisis.

Liquidity: current ratio

Liquidity of any business may assist to pay off different obligations as well as effectively operating regular business activities. As argued by Yanto et al. (2021, p.18), current ratio indicates the ability of a business to pay off different short dues as well as obligations generated in the current period. It has been stated that the current ratio of IAG has declined from 0.91 times its current liability to 0.79 times (Iairgroup.com, 2022). It has been observed that IAG has suffered from a short term financial crisis.

Efficiency: Assets turnover

Efficiency of a business plays an important role in using different types of assets as well as equipment to generate profit. In the current case study assets, the turnover ratio has been selected to analyse the efficiency of IAG. The efficiency of IAG has continuously declined from 0.85 times in 2018 to 0.25 times in 2021 (Iairgroup.com, 2022). It has been indicated that IAG has faced the issue of generating revenue equal to its investments. As the assets turnover ratio has been below 1.

Solvency: Debt-Equity

Solvency ratio is mainly considered by many investors to identify the solvent position of a business to pay off long-term obligations such as long-term debt as well as loans through the use of different sustainable capital sources such as reserved capital as well as shareholders’ funds. In the current scenario debt-equity ratio has been considered to execute the capital structure of IAG. The debt-equity ratio of IAG has been read from 1.12 times in 2018 to 23.19 times in 2021. It has been found that IAG has a more debt budget, as well as being reliant on debt, and finding sources (Iairgroup.com, 2022) . Hence, it may be expected that IAG will face a long-term financial crisis as IAG does not have a better capital structure.

Figure 1: Financial performance analysis

(Source: Iairgroup.com, 2022)

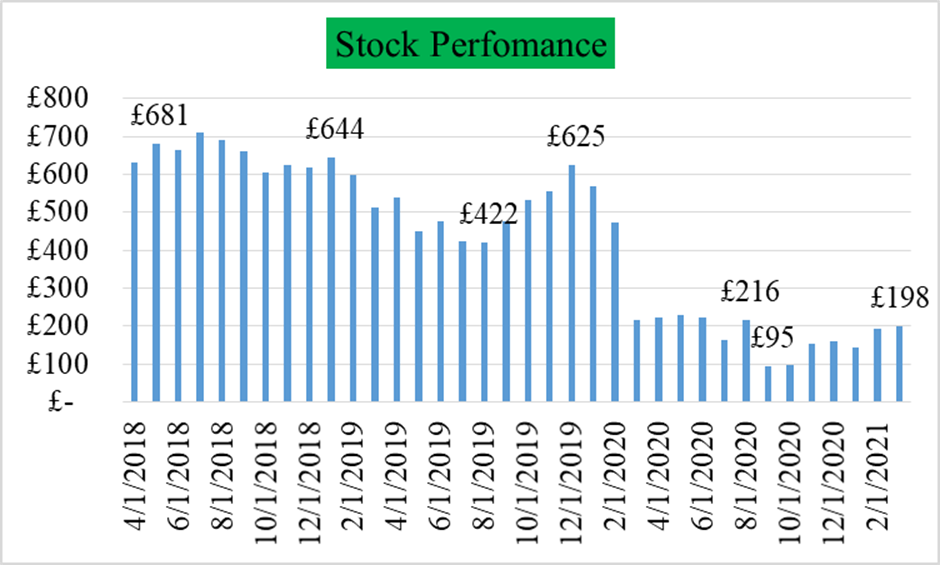

Stock performance

Stock of any business in the listed stock market has been affected by fluctuation in profitability as well as the financial stability of the organisation. As opined by Purnomo (2018, p.4), investors have also analysed the market performance of any stock before investing in that stock as well as a business. It has been observed from ratio analysis that IAG has suffered from low profitability as well as liquidity in 2021 compared with 2018. Further, the capital structure is more reliant on debt capital sources as compared with other capital sources.

The market price of stock existed at £681 in June 2018 which has declined to 644 in December 2018 (Yahoo.com, 2022). The stock value has continuously declined due to suffering from low profitability as well as a high debt burden on the financial stability of IAG. Apart from this, it has been observed that the share market value has fallen to £422 in august 2019 (Yahoo.com, 2022). After that period the price of IAG has been increased to £625 nevertheless again declined to £216 and £95 in august 2022 and October 2020 during the Covid-19 pandemic. It has been observed that the market value of shares has been more declined during Covid-19.

Figure 2: Stock performance

(Source: Yahoo.com, 2022)

Critical evaluation of the strategic position

The strategic position adopted by the IAG airline is as follows

Grow with customers

IAG focuses on the strength of the development of the brand. For meeting the needs of the consumers that are being involved. IAG increases all its customers to make the world safer for New Zealanders and Australians (Epub, 2022, pg.8). IAG delivers a great “outstanding personalized service” when the customers need it. They should assume all the confrontations for solving the problem and share all the similarities.

Creating values through digitally

IAG connects the experiences of the customers through the core of digitals. It assists seamlessly in rewarding all the customers (Researchgat, 2021, pg.13). They even unlock all the values of the “IAG’s networks”. IAG focuses on transforming the customer’s experience and shareholders’ needs so that they can invest in the company without any doubts.

Strengthening the portfolio of the world-class brand

IAG helps in demonstrating all the industry leaders. Maturing all the pathway transitions towards the “net zero business” (bitstream, 2021, pg.11). IAG discloses the leadership carbon. It continues the restructuring of the depth of the “group cost base” for optimizing all the unit costs. It shares all the values and all the ways for working, in managing the performance of the suppliers. Monitoring all the proactively for the potential suppliers mitigates for emerging all the issues as well as sledding them in sustainability that is committed by the suppliers. This strategy helps in improving the portfolio.

Enhancing integrated platform for IAG

Investing in all the efficient aircraft as well as delivering all the best practices towards operational efficiency. According to Havlovicet al.2020, investing and innovating for acerbating the progress in aviation of sustainability like future aircraft, fuels, and also other technologies for low carbon. According to Albers et al. 2020, IAG simply identifies all the threats relating to the profit. It devises all the methods for maximizing the performance of the competition. It delivers analytics and automation while using this strategy for optimizing the mix for the nearshore, and onshore work.

Managing the risks

IAG manages all the risks that the business has. It helps in controlling the management towards the risk of the customers and the shareholders. According to Villagrasaet al. 2021, it builds a strong and active culture of risk and then meets all its obligations to the communities in which they serve. IAG invests in the process manner, infrastructure, capability, and excellence of the operation. For creating a stable, efficient business, and scalable. IAG continues the innovation and strengthens the capital platform. It ensures the customer’s support that is appropriately related to the financial strength (Rosell Bueno et al. 2019). Driving all the synergies with help of leveraging all the existing platforms and also on boarding all the additional services. It includes all the critical rights of managing flight services. It measures all the performance in the areas that have different outcomes. Such as profitability, environmental safety, and so on.

Investment Recommendation

It has been recommended after executing a different ratio as well as the stock performance of IAG that IAG has suffered from massive loss which is respect -35% of its revenue as well as low liquidity. Apathy from that, the stock value of IAG has also continuously declined after 2018 due to a decline in profitability as well as low-efficiency level. Hence it has been suggested to investors to not give first preference to this company for investment. Even the share price has been low compared with other airlines in the UK. Investors should develop a weightage to invest in different businesses to ensure an optimum return in the short term as well as the long term. This strategy not only assists to minimise investment risk nevertheless also increases the profit of portfolio investment. Apart from this, investors may be investing in IAG to increase long-term returns as this company has operated business since 1971 and is more sustainable even suffering from a financial crisis at the current time due to Covid-19 and the war between Ukraine and Russia.

Conclusion

It has been concluded after preparing this report as well as External Internal and financial performance analysis that IAG has suffered from negative financial performance since having trouble loss as well as low liquidity. Besides that, in currency reports pestle and SWOT has been performed which would be considered by investors as well as IAG in order to develop effective financial and investment decisions. As a result, IAG was able to increase its profitability and liquidity. Apart from this, it has been suggested to invest in a selected alternative investment source to invest instead to invest in the stock of IAG. Detailed discussion on the overall performance of the company has been done in this aspect.

Reference

Journals

Albers, S. and Rundshagen, V., 2020. European airlines′ strategic responses to the COVID-19 pandemic (January-May, 2020). Journal of air transport management, 87, p.101863.

bitstream, 2021, Available at : <https://gredos.usal.es/bitstream/handle/10366/140383/TG_RosellBueno_Strategic.pdf?sequence=1&isAllowed=y>[Assessed on: 18 October 2022]

Epub, 2022, Available at: <https://epub.jku.at/obvulihs/content/titleinfo/6974586/full.pdf> [Assessed on: 18 October 2022]

Feng, M., Zhou, D. and Yang, Y., 2019, April. SWOT Analysis and Countermeasure of Jilin Province Aviation Logistics Industry Development Strategy Based on Low Carbon and Environmental Protection. In IOP Conference Series: Earth and Environmental Science (Vol. 252, No. 4, p. 042043). IOP Publishing. Available at: <https://iopscience.iop.org/article/10.1088/1755-1315/252/4/042043/pdf>[Assessed on: 18 October 2022]

Havlovic, S.J., 2020. European Works Councils in the Airline Industry. In Strategic Innovative Marketing and Tourism (pp. 1-6). Springer, Cham. Available at: <https://www.researchgate.net/profile/Mounir-Elatrachi/publication/339812910_Determinants_of_ICT_Integration_by_Teachers_in_Higher_Education_in_Morocco/links/5ec31c49299bf1c09ac8f187/Determinants-of-ICT-Integration-by-Teachers-in-Higher-Education-in-Morocco.pdf#page=27>[Assessed on: 18 October 2022]

Kumar, S.R., Gupta, S., Changkakati, B. and Uniyal, S.S., 2022. Cross-Sectional Qualitative Analysis Of The Current And Future Scenario Of The Aviation In North-East India. Journal of Positive School Psychology, 6(8), pp.4139-4151. Available at: <https://www.journalppw.com/index.php/jpsp/article/download/10560/6813>[Assessed on: 18 October 2022]

Liu, B., Chen, M. and Zhou, W., 2022. Internal and External Factors Analysis of Kenya Airways’ Strategic Management: A Mini-Review. Frontiers in Business, Economics and Management, 3(1), pp.13-17. Available at: <https://drpress.org/ojs/index.php/fbem/article/download/226/175>[Assessed on: 18 October 2022]

Maisharoh, T. and Riyanto, S., 2020. Financial Statements Analysis in Measuring Financial Performance of the PT. Mayora Indah Tbk, Period 2014-2018. Journal of Contemporary Information Technology, Management, and Accounting, 1(2), pp.63-71. Available at: <https://www.academia.edu/download/87676543/9.pdf>[Assessed on: 18 October 2022]

Páscoa, J.A.D., 2022. International Airlines Group (IAG): a strategic vision during the Covid-19 crisis (Doctoral dissertation). Researchgat, 2021, Available at <https://www.researchgate.net/profile/Mounir-Elatrachi/publication/339812910>[Assessed on: 18 October 2022]

Purnomo, A., 2018. Influence of the ratio of profit margin, financial leverage ratio, current ratio, quick ratio against the conditions and financial distress. Indonesian Journal of Business, Accounting and Management, 1(1), pp.9-17. Available at: <https://stei.ac.id/ojsstei/index.php/ijbam/article/download/218/138[Assessed on: 18 October 2022]

Rosell Bueno, J.M., 2019. Strategic analysis of the passenger air transport market in Spain. http://eprints.bournemouth.ac.uk/33349/7/RCIT1720624_snapshot.pdf>[Assessed on: 18 October 2022]

So, S.M. and Wang, R.R., 2022. China’s Aviation Industry During the COVID-19 Pandemic. International Journal of Social and Administrative Sciences, 7(1), pp.25-40. Available at: <https://archive.aessweb.com/index.php/5051/article/download/4576/7203>[Assessed on: 18 October 2022]

Stevenson, I. and Marintseva, K., 2019. A review of Corporate Social Responsibility assessment and reporting techniques in the aviation industry. Transportation research procedia, 43, pp.93-103. Available at: <https://www.sciencedirect.com/science/article/pii/S2352146519305903/pdf?md5=6f2b828f2ddc3a4cc32fbf2ed95b258f&pid=1-s2.0-S2352146519305903-main.pdf>[Assessed on: 18 October 2022]

Su, M. and Zhao, J., 2019, May. SWOT analysis of the development of Guangzhou airport economic zone. In 1st International Conference on Business, Economics, Management Science (BEMS 2019) (pp. 269-277). Atlantis Press. Available at: <https://www.atlantis-press.com/article/125907425.pdf>[Assessed on: 18 October 2022]

Yanto, E., Christy, I. and Cakranegara, P.A., 2021. The influences of return on asset, return on equity, net profit margin, debt equity ratio and current ratio toward stock price. International Journal of Science, Technology & Management, 2(1), pp.300-312. Available at: <https://www.yrpipku.com/journal/index.php/ijedr/article/download/26/11>[Assessed on: 18 October 2022]

Websites

Iairgroup.com, 2022: IAG Overview Available at: <https://www.iairgroup.com/en/the-group/iag-overview>[Assessed on: 18 October 2022]

Yahoo.com, 2022; Historical stock data of International Consolidated Airlines Group S.A. (IAG.L) Available at: <https://finance.yahoo.com/quote/IAG.L/history?period1=1522540800&period2=1617148800&interval=1mo&filter=history&frequency=1mo&includeAdjustedClose=true>[Assessed on: 18 October 2022]

Know more about UniqueSubmission’s other writing services: