Business Strategy and Finance Sample

Introduction

In this report, the market position of Brighton Pier Group Plc has been analyzed on the basis of the findings from the financial statements and journals of the company. A financial evaluation of the organization has been performed based on the information collected from the annual reports of the company. The strategic position and the steps taken by the management of the organization such as the ESG strategies have been mentioned in this report. Internal as well as external positions of the company are analyzed based on the practices undertaken. The relevant recommendation has been drawn based on the analysis and several investment recommendations have been suggested as well.

The main body

External analysis

PESTLE analysis

| Political

|

The travel & leisure company may face risks in the political system. The risk of military invasion is prevalent in many sensitive areas, which may result in the decline or complete closure of the operational activities in the area. A certain level of corruption may exist in the customer care sector of the company. Interference and Bureaucracy by local government in the leisure & travel sector may lead to slower operation in the organization. Trade regulation and tariff policies in relation to customer service may result in joint obstacles in the activities performed by the organization (Researchgate. 2018, p 14). Safety regulations in the industry implemented by the local political parties mayaffect the smooth service provider to the customer in the industry. |

| Economic

|

The inflation rate in the countries may vary, thus the charges imposed by the organization may also vary accordingly. This may cause confusion and possible economic decline in the organization as well. Exchange rates may differ from country to country, which may affect the stability of the business along with rising complications in financial recordings. The saving rate in the countries may differ, as the population may not be interested in spending money on the leisure industry. This may be one of the disadvantages faced by reorganization, which may lead to a decline in the priority margin. Labor costs may change in a particular financial year, which may affect reproduction in the economy, which has a direct impact on the organization (Researchgate. 2019, p 4). Economic factors like the interest rate offered by the financial institution in an economy and the unemployment rate may directly affect the position of the organization and the brand name. |

| Social

|

The demographic level of the population in society may affect the performance of the organization. The skill level of the population in which the organization has been operating is an important factor. The entrepreneurial spirit in society may affect the performance of the business as the broader nature of society depicts more spending boon the businesses existing in the market. The leisure interest in the social group is an important factor that may affect the profitability of the organization, as the interest of the society in spending in the leisure industry is directly related to revenue generation in the organization. |

| Technological

|

The Technological development in the competing organization may be a threat to Brighton Pier. The product offering to the customer may be different in the case of the existing competitors and adopting such, technology may lead to attracting more customers toward the form. The value chain in the customer care sector may decline for the inclusion of technology in this sector. Since the assistance needed by ten customers may vary, the technology may not provide such an opportunity to the customer resulting in a decline in customer satisfaction. |

| Environmental

|

Several environmental factors may affect the revenue of the organizations, including weather and climate change factors (Ub. 2019,p 9). The laws relating to environmental pollution may be one of the determinants of profit generation. A certain amount of revenue of the business is included in the waste management sector according to the needs of society, which may affect profitability as well. Renewable energy adoption in the organization may be expensive in many terms and the implementation may be a complicated process. |

| Legal

|

The lack of robustness in the protection of intellectual property in the leisure industry may be off the obligation towards growth in business (Researchgate, 2018,p 17). Copyright and participation are important factors that must be included by the organization in order to ensure smooth functioning. Health and safety law in the organization is one of the most important factors, which may help in boosting or declining the long-term sustainability of the organization in the market. |

Table 1: PESTLE analysis

(Source: Self-created)

Internal Analysis

SWOT analysis

| Strength

● Consistency maintained at all levels of the organization provides an opportunity to scale down and scale up based on the demand as well as market conditions. ● The dealer community of the organization is strong which helps in maintaining the standard of the product and services in the organization (Scholarship. 2018,p 12). ● The firm has been involved in a merger and acquisition strategy in order to remove competition and acquire a larger market share over the years. ● Customer satisfaction level in the organization is much higher, which indicates the quality performance in the firm. Thus, the brand name has been improvising to integrate more potential customers. ● Diversification by integrating technology and new features in the company. The internal structure is improved by conducting employee improvement programs on a regular basis. |

Weaknesses

● The company has faced challenges in integrating or involving other products and services in the organization. ● The research and development group of the organization has been acquiring a huge amount of revenue in order to find the market demand by undertaking a rigorous ground research strategy (Fardapaper. 2020,p 8). ● The inventory days in the organization are much higher as compared to its competing companies existing in the market. ● The work culture in various firms existing in different areas has been difficult for the concern. ● The change adoption by the employees of the organization has been difficult as it has a large employee group and it affects the employee retention rate in the organization. |

| Opportunities

● Taxation policies have been implemented by the government, which may help the organization to generate more revenue and generate profitability as well. ● The transportation cost may be decreased in the organization as the government has been providing funds for factory implementation (Theseus. 2019,p 16). This may help in saving a certain amount of revenue for the organization, which may be used in the future for expansion purposes. ● Low rate of inflation may bring stability to the market which may help the organization to make business establishes itself in the market as well. ● Different pricing strategies may be adopted by the organization as it has been implementing various strategies to implement technologies in the organization. Establishing flexible customer services and facilities may generate a loyal customer group leading to the development of the brand name. |

Threats

● The organization faced intense competition as it has been facing profitability issues due to increased competition in the market. ● The local distributors in the organization are provided a larger share of the profit as compared to the previous financial years. The higher margin for the local distributors has resultedin decreased profit margins in the company. ● Rising pay to the employees has been one of the main issues faced by the organization (Tudelft. 2019,p 10). Since the company has been operating with a large employee group, it is evident that the higher pay scale for its employees in a competing market is a serious threat to the organization. Since the company has been operating in the world market, it has been establishing various branches, which need the adoption of the liability, laws of the county as well (Wiley. 2019,p 14). However, it has been specifically challenging to cope with the liability laws imposed in different countries, which have resulted in fluctuation in the operating market. |

Table 2: SWOT analysis

(Source: Self-created)

Financial analysis

According to Yanto et al. (2021, p.12), analysis of the Financial performance of any organisation assists cancer management as well as investors to in turn different key risks and errors which are the main cause of the financial crisis of an organisation. Therefore it is necessary for any organisation’s performance in order to develop effective financial decisions to invest as well as in hems financial growth in future. In the current study paper key financial challenges as well as performance have been viewed in order to develop decisions for investing in a business.

Profitability: Net margin

The net margin of an organisation is the actual profitability which is distributed among different stakeholders as well as the owner of the organisation. Observe that the net profit margin of the company has been continuously increasing from 6% in 2018 to 42% in 2020 as well as 32% in 2021 (Brighton.tas.gov.au, 2022). This increment in profitability indicates that the company is able to sustain its financial growth in future.

Liquidity: current ratio

The liquidity of any organisation has played an important role to increase financial stability as well as developing a better operating management system. As opined by Estininghadi (2019, p.6), high liquidity in the financial management of an organisation assists in the organisation increasing better relationships between different investors as well as creditors of an organisation. It has been observed that the current ratio of the company has increased from 0.66 Times in 2018 to 0.71 times in 2021 (Brighton.tas.gov.au, 2022). The company is able to increase through current assets the company needs to increase more than once in order to indicate a better liquidity position as well as attract more investors in the organisation.

Figure 1: Financial performance analysis

(Source: Iairgroup.com, 2022)

Efficiency: Assets turnover

Efficiency of an organisation has support for use of different types of assets as well as resources to perform business activities such as manufacturing, providing services and generating profitability. As argued by Gustmainar and Mariani (2018, p.8), the assets turnover ratio supports investors to execute organisations efficiently to utilise different types of acid like “plant and machinery furniture patents and goodwill” to generate revenue as well as net profit in the market. It has been observed that the asset turnover ratio of the company existed at 0.70 times in 2018 which has been increased to 0.71 Times in 2019 as well as in 2021 to the value of 0.18 times (Brighton.tas.gov.au, 2022). That’s it turnover of the company has declined in 2020 to generate low revenue as compared with the past financial year even though the company has increased its assets.

Solvency: Debt-Equity

The solvency ratio of any organisation supports executing capital structure as well as utilisation of different financial resources to operate their business and generate revenue. As opined by Estininghadi (2018, p.5), it has been observed that the debt-equity ratio of the company has continuously increased from 0.79 Times in 2018 to 2.45 times in 2021. It has been observed that the company has been able to increase its debt ratio due to increased Deb financial resources to operate their business operations and increase capital structure. The debt equity ratio of the company has also indicated that the company is more reliant on debt financial resources as compared with equity financial resources. Therefore it is necessary for the company to decline its depth of financial resources in order to develop a better capital structure as well as sustain the capital structure.

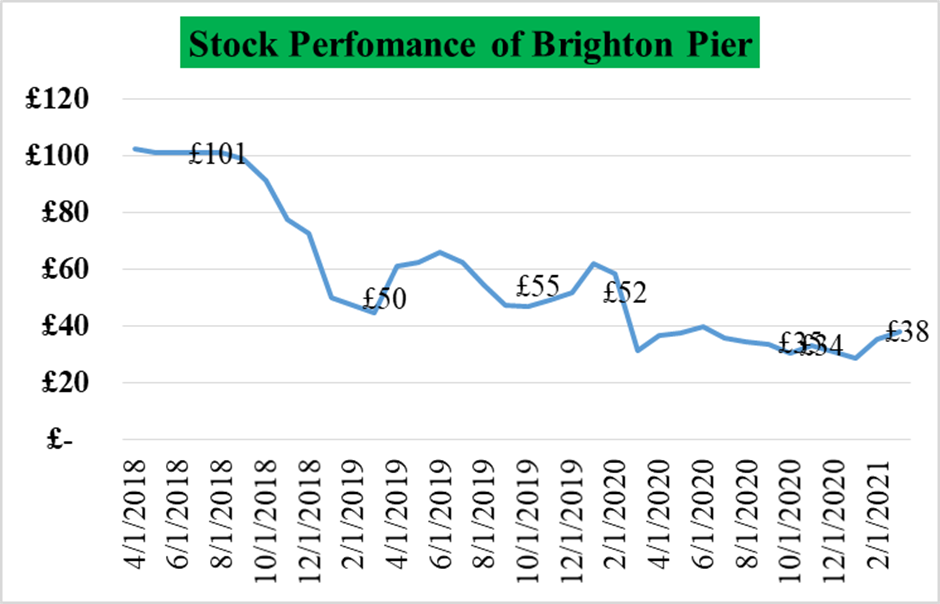

Stock performance

Figure 2: Stock performance

(Source: Yahoo.com, 2022)

The stock performance of any organisation has a significant role to execute business value in the market as well as attract more investors through increasing their price in the market. As stated by Hadi (2018, p.15), any organisation needs to be listed in different stock markets in order to acquire public funds to increase capital structure as well as increase business growth. The share price in the market existed at 101 in 2018 which has fluctuated to 50 in February 2019. After that share value of the company has been increased to 55 on November 2019.

Strategic position and ESG practice

The market cap of Brighton Pier Group Plc has been observed to be 22.74 million in the financial year 2022. The value of the enterprise is 41.29 million and ten gross profit has been recorded to be 34.89 million. The product-based strategies adopted by the organization include the “4 P’s strategy”. This strategy specifically involves the product, place, promotion, and pricing in the organization. The product or service offered by the organization is typically based on the evaluation of factors. The business adopted the “value-based pricing system” in the organization. This provided the organization an opportunity to keep its price according to the service quality and product offered by the company (Icer. 2022,p 13). The company adopts the strategy of elevating the market reputation, which may help in the development of the brand value in the organization. This further provides the business an opportunity to gain a larger customer base and eventually grow in the market by creating a place in the market. The organization has been following the “4c’s strategy” in the organization to develop its performance in the comparative market. The 4 c’s include consistency in performance, credibility, the competitiveness of the business, and clarity in the operating activities.

The Brighton Pier Group Plc undertakes “corporate climate policies” under the ESG strategy in the organization in order to lower the environmental risk and improvise the management facility in the organization in relation to sustainability practices (Ac. 2019,p 48). “Low carbon emission” and inclusion of the renewable energy have been one of the objectives of the organization. The organization invests in various social activities in the area of business operation. Furthermore, the business involves ethics, inclusion, social justice, and diversification in the employment process in the company (Wiley. 2019,p 35). The governance strategy includes various methods used by the organization in order to implement “accuracy and transparency” in the organization and its accounting system.

Investment recommendation

It has been suggested after analysis of all significant financial aspects and market value of the company that investors may be invested in the company as its financial performance profitability and liquidity continuously increases compared with last year’s performance. There are different financial aspects as well as variables which indicate that the company is able to increase its profitability and liquidity as compared with past financial years. Nevertheless, there are some key issues which may increase challenges as well as risk for the company such as the company being more reliant on debt as well as suffering from low liquidity levels. Besides that, the profitability of the company exists at 32% which indicates that the company is able to generate optimum profitability for the utilisation of different types of resources.

Conclusion

The above statements have been prepared based on the business strategies and finance of a company for measuring its performance in the market. It can conclude based on the ratio as well as the stock performance of the company that the company is able to increase its profitability and liquidity at the current time. Nevertheless, it is necessary for the company to increase current assets as well as equity capital as the company is more reliant on debt as well as short obligations which increase financial issues in future.

Reference List

Journals

Ac. 2019. 4c’s strategy. Available at: <https://core.ac.uk/download/pdf/327193486.pdf> [Accessed on 18th Oct 2022]

Estininghadi, S., 2018. Pengaruh Current Ratio (CR), Debt Equity Ratio (DER), Total Assets Turn Over (TATO) Dan Net Profit Margin (NPM) TerhadapPertumbuhanLabaPada Perusahaan Property And Estate Yang Terdaftar Di Bursa Efek Indonesia Tahun 2017. In SENMAKOMBIS: Seminar NasionalMahasiswaEkonomi Dan BisnisDewantara (Vol. 2, No. 1, pp. 82-91). Available at: <https://elearning.stiedewantara.ac.id/index.php/SENMAKOMBIS/article/download/280/210>[Accessed on 18th Oct 2022]

Estininghadi, S., 2019. Pengaruh Current Ratio, Debt Equity Ratio, Total Assets Turn Over Dan Net Profit Margin TerhadapPertumbuhanLaba. JAD: JurnalRisetAkuntansi&KeuanganDewantara, 2(1), pp.1-10. Available at: <https://ejournal.stiedewantara.ac.id/index.php/JAD/article/download/355/235>[Accessed on 18th Oct 2022]

Fardapaper. 2020. Research strategy in business. Available at: <https://fardapaper.ir/mohavaha/uploads/2020/06/Fardapaper-Customer-information-resources-advantage-marketing-strategy-and-business-performance-A-market-resources-based-view.pdf> [Accessed on 18th Oct 2022]

Gustmainar, J. and Mariani, M., 2018. AnalisisPengaruh Current Ratio, Debt To Equity Ratio, Gross Profit Margin, Return On Investment, Dan Earning Per Share TerhadapHargaSahamPada Perusahaan LQ 45 Yang Terdaftar Di Bursa Efek Indonesia Tahun 2010-2016. Bilancia: JurnalIlmiahAkuntansi, 2(4), pp.465-476. Available at: <http://download.garuda.kemdikbud.go.id/article.php?article=1056974&val=15818&title=ANALISIS%20PENGARUH%20CURRENT%20RATIO%20DEBT%20TO%20EQUITY%20RATIO%20GROSS%20PROFIT%20MARGIN%20RETURN%20ON%20INVESTMENT%20DAN%20EARNING%20PER%20SHARE%20TERHADAP%20HARGA%20SAHAM%20PADA%20PERUSAHAAN%20LQ%2045%20YANG%20TERDAFTAR%20DI%20BURSA%20EFEK%20INDONESIA%20TAHUN%202010-2016>[Accessed on 18th Oct 2022]

Hadi, W., 2018. Analysis of the effect of net profit margin, return on assets and return on equity on stock price (Case study on consumption industrial sector companies listed in Indonesian Sharia Stock Index at Indonesia Stock Exchange in 2016). The Management Journal of Binaniaga, 3(02), pp.81-92. Available at: <https://e-journal.stiebinaniaga.ac.id/index.php/management/article/download/261/213>[Accessed on 18th Oct 2022]

Icer. 2022. Value-based pricing system. Available at: <https://icer.org/wp-content/uploads/2022/01/Whittington.-Neurology.-2022.pdf> [Accessed on 18th Oct 2022]

Researchgate, 2018. Importance of intellectual property protection in business. Available at: <https://www.researchgate.net/profile/Josip-Stjepandic/publication/327064920_Intellectual_Property_Protection_of_3D_Print_Supply_Chain_with_Blockchain_Technology/links/5ca2761c299bf1116956a62c/Intellectual-Property-Protection-of-3D-Print-Supply-Chain-with-Blockchain-Technology.pdf> [Accessed on 18th Oct 2022]

Researchgate. 2018. Tariff policies in pastel analysis. Available at: <https://www.researchgate.net/profile/Elaheh-Yadegaridehkordi/publication/341190360_COMRAP_2018/links/5eb2ec0b45851523bd4708f1/COMRAP-2018.pdf#page=43> [Accessed on 18th Oct 2022]

Researchgate. 2019. Effect of Exchange rates on business. Available at:https://www.researchgate.net/profile/Manu-Ks/publication/330731430_Effect_of_Exchange_Rates_Volatility_on_Stock_Market_Performance/links/5e6b1752299bf12e23c054fd/Effect-of-Exchange-Rates-Volatility-on-Stock-Market-Performance.pdf> [Accessed on 18th Oct 2022]

Scholarship. 2018. Dealer community importance in business. Available at: <https://scholarship.law.columbia.edu/cgi/viewcontent.cgi?article=3843&context=faculty_scholarship> [Accessed on 18th Oct 2022]

Theseus. 2019. Transportation cost advantages in business. Available at: <https://www.theseus.fi/bitstream/handle/10024/745278/Seddiki_Karim.pdf?sequence=2> [Accessed on 18th Oct 2022]

Tudelft. 2019. Rising pay issue in business. Available at: <https://pure.tudelft.nl/ws/files/46671742/Pay_per_use_business_models_as_a_driver_for_sustainable_consumption_evidence_from_the_case_of_HOMIE_FINAL.pdf> [Accessed on 18th Oct 2022]

Ub. 2019. Effect of climate change on business. Available at: <https://mpra.ub.uni-muenchen.de/103317/1/MPRA_paper_103317.pdf> [Accessed on 18th Oct 2022]

Wiley. 2019. ESG strategy. Available at: <https://onlinelibrary.wiley.com/doi/pdf/10.1002/bse.3181> [Accessed on 18th Oct 2022]

Yanto, E., Christy, I. and Cakranegara, P.A., 2021. The influences of return on asset, return on equity, net profit margin, debt equity ratio and current ratio toward stock price. International Journal of Science, Technology & Management, 2(1), pp.300-312. Available at: <https://scholar.archive.org/work/6vkswog75fflhjzmzjo7etmwzm/access/wayback/https://ijstm.inarah.co.id/index.php/ijstm/article/download/155/90>

Websites

Brighton.tas.gov.au, 2022: Annual Report 2020–2021 of Brighton Council Available at: <https://www.brighton.tas.gov.au/wp-content/uploads/2021/12/Brighton-Council-Annual-Report-2021-Final.pdf> [Accessed on 12th October 2022]

Yahoo.com, 2022: Historical stock data of Brighton Pier Group PLC Available at: <https://finance.yahoo.com/quote/PIER.L/history?period1=1522540800&period2=1617148800&interval=1mo&filter=history&frequency=1mo&includeAdjustedClose=true>[Accessed on 18th Oct 2022]

Know more about UniqueSubmission’s other writing services: