Business Strategy and Finance Sample

Introduction

Finance strategy is significant in terms of making or combining the financial and strategic plan. However, the outcome is to identify the main functions and roadmap that assess the budget and cost of the company to determine the strategic goals.Therefore, the present study mainly aims to evaluate the main concept of business strategy as well as to apply the requirements of organisations such as IAG Airlines.

In the context of the company, IAG Airline is a multi-holding Airline group that was formed in 2011, as it enlisted in the London stock exchange (LSE. However, several airways are owned by IAG to evaluate the largest shareholder partners. The group consolidated its annual revenue as £1.673 million and several cost benefits with its cargo flights.

The main aim and objectives of the company are to enable the technology to reach net zero by 2050 (iairgroup.com, 2022). It also includes or derives the ESG agenda to manage the investor’s relations for safe and best practices.

Discussion based on strategic financial business

External Analysis

The diversity of the company and group ranges from full service to low cost as well as managing the leadership positions within markets. Moreover, as per the External market analysis, the airline group IAG provide a resilient option to meet the current challenges and response based on consumers (Qin, 2020, p. 28). As a result, it affects the financial performance that affects the individual markets in different ways and at different times.

However, the Airline group recorded an operational loss of £2.907 million before its exceptional market items as well as £4.390 items lost due to the severe effect of a pandemic (iairgroup.com, 2022). It includes several strategic planning based on finances such as managing the cash flows, developing the savings plan, and maintaining focus on the future.

PESTLE Analysis

| Factors | Descriptions | Impacts |

| Political | IAG reflects its geopolitical issue and several changes in the landscape by playing a competitive role to manage the transitional issues of the EWC (European working councils) and its representative states.

However, it depicts the issue incurred in the UK as Brexit evaluates the significant changes to maintain the ownership rules. As a result, the country must have a licence regarding their territory. Looking forward to the external factors, Brexit airline emphasises the several needs for the leaders that might impact the business in real time. |

crucial |

| Economical | As per the financial data and review based on the IAG group or airline company, it has been identified that no details have been identified regarding the GDP rate of the company. As per the last review, it has been identified that the growth rate of the company has been remarked as 12% which is lower as per the IMF as compared to the other airline industry. Eventually, the GDP rate is higher at 7.3% in terms of Liberia and Vueling Airlines owned by the IAG.

|

favourable |

| Social | In the context of social factors, IAG airline determines its unemployment rate as 5.4% worldwide. Moreover, this is because several passengers have provided their less interest due to the lack of seats and facilities within the airways. However, it generates a huge impact on the annual turnover of the company along with its stock exchange rates worldwide. | Unfavourable |

| Technological | In the context of technological factors, IAG mainly reported a huge issue faced by the employee each day, because of technological issues. In such cases, the company utilised digital technology and innovations to manage the entire airline operations as per the consumer’s taste and preferences. There are several technological benefits used by the IAG industry such as Audio-visual and security systems. | favourable |

| Legal | It has been identified that the company has governed through these laws as “corporate Bylaws” along with the provisions of governing corporations and other applicability. Moreover, the company incorporate a code of conduct to establish strict laws regarding criminal violations. | |

| Environmental | In the context of the Environment, the company reached the global growing leadership positions regarding managing consumer sustainability and performance indicators. In such cases, the companies strictly follow the ESG derivatives. | More favourable |

Table 1: PESTLE Analysis

(Source: Self-created)

Internal Analysis

SWOT Analysis

| Strength | Weakness |

| 1. Strengths are the advantages that help the airline to stand out from the competitors, as the profitability of the company as IAG is the common choice to oversee the income benefits within the airline sectors.

2. Similarly, safety and speed are the major sources of gaining financial benefits. However, the passenger is more likely to buy tickets at a fair price to travel in a safe way and for the shortest time. 3. In the context of the company has been able to ensure the ESG factors to ensure technological goals. |

1. In the context of company weakness, weak infrastructure is a huge source of weakness, while the company makes a lot of spending to improve its potential improvements.

2. Huge cancelled rates are another weakness determined by the company, as the company. Moreover, the company reveals several mitigation tasks to reduce cancellation fares by implementing non-refundable policies. This is because the company faces huge losses and scarcity in terms of gaining consumer advantages. |

| Threats | opportunities |

| 1. In the context of threats, it has been identified that COVID-19 is a huge threat for the past few years. As it negatively impacts several airline industries.

2. Moreover, it has been identified as a huge threat to the industry. This is because of the multiple domestic airline facilities that entertained the public and passengers. 3. Weather reveals its greater threats as it can cause severe accidents and uplift or down light flight timings or delays. This has resulted in a severe loss of the passenger while booking tickets to gain facilities and service. |

1. In the context of several opportunities, Growth in the tourism industry is the main advantage of the company to gain huge experiences within the airline industry.

2. It has been identified that the company evaluate more specific techniques and technology benefits to determine the financial gains and benefits received each year. 3. Expansion is the huge reason for identifying growth and opportunities within the IAG airline company. Though this is because the consumer directly impacts based on the brands worldwide. |

Table 2: SWOT Analysis

(Source: self-created)

Financial Analysis

Financial performance through computing ratios

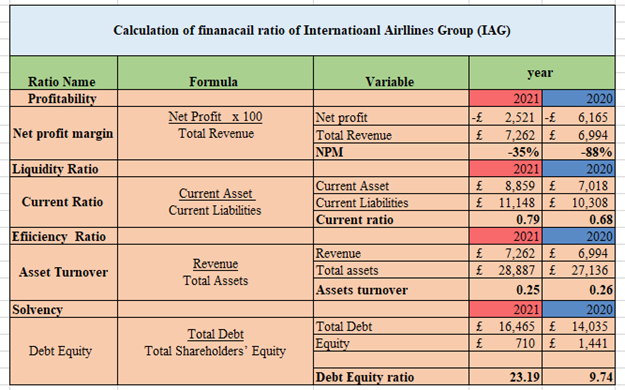

Figure 1: Financial ratios

(Source: Self-created)

Profitability

The profitability ratio mainly helps the company to identify the overall loss or gains within the business. Moreover, the company as IAG airlines mainly helps to determine the profit and overall loss through evaluating the net profit margin, as it significantly helps the investors to assess the company and management to generate more income or profits from its operating sales (Blišťanová et al. 2022, p. 2022). However, the above computation reflects the net profit ratio of the company as negative as -35% and -88% for both the years 2021-20. This is because of overdue and low-income benefits for the year. Therefore, the airline company needs to reduce its short terms dues and obligations to estimate the expenses and loss.

Liquidity ratio

The liquidity ratio is important in terms of identifying the company’s liquidity and position in the marketplace. However, the company’s financial leaders mainly identify the liquidity ratio by computing the current ratio, as it is important to understand the short and long-term debt to compare with the competitors (Brock et al. 2022). Further, it has been identified that the current ratio of the company reflects as higher as 0.79 times in the year 2021 as compared to the previous year 2020 as 0.68 times. Similarly, it generates a huge impact on the company to gain a good liquidity position within the marketplace. In such cases, the financial leader and the investors need to reduce their overdue loans to reduce the chance of facing loss.

Efficiency ratio

It is an important indicator that has been identified by the IAG airline groups to determine the company’s efficiency through using limited assets to generate annual profits. However, the company evaluates the efficiency by computing the assets turnover ratio, as it significantly identifies the current value and its assets usage performance within the company (Chen et al. 2022, p. 18). However, the company’s financial leader evaluates the efficiency through computing the assets turnover which will reflect as low as 0.25 times in 2021, as compared to the previous year 0.26 times in 2020. This is because of the huge revenue benefit within the company to manage the performance of the assets. Moreover, it generates a positive impact as the company achieves an ability to maintain efficiency based on assets and entire management performances from the further income benefits.

Solvency

The solvency ratio is important in terms of determining the company’s abilities regarding raising cash and capital. However, the company as IAG Airlines evaluates the solvency ratio by computing the debt-assets ratio to determine the company’s leverage and solvency. Moreover, it is important in terms of determining the sale volume and firms’ utilities (Kooli et al. 2021, p. 10). Thus, the above computation of solvency ratio reflects as higher in terms of 2021 as 23.19 times as compared to 9.74 times in the year 2020. This is because of the company’s huge operations and increases in the scale of sales managed by the firms. Moreover, airline companies such as IAG sell their tickets at a fair price by providing extra benefits to their passengers.

Therefore, the company financial leaders of the company need to improve their solvency by reducing their debts and obligations through regular payments and monitoring of transactions in a significant way.

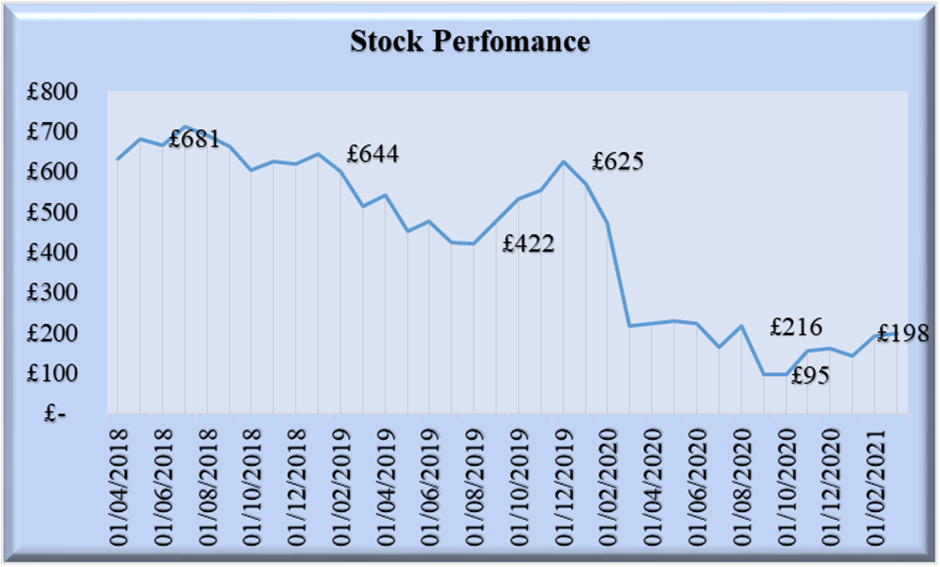

Figure 2: Stock performances

(Source: Self-created)

Stock performance is important as it allows the investors to identify certain degrees and determine stocks which are undervalued or overvalued as compared to the market price. However, the executive and board members of the company as IAG adopt the measures to protect the operating rights of the company subsidiaries. As per the company survey report, it has been identified that the company includes a maximum number of shares that have been able to be held by the non-qualifying shareholders who provided a maximum lower than 40% of the company share capital (Křupka et al. 2018, p. 14)

Furthermore, through the above-mentioned graphical representation, the stock performance of the company reflects as higher in the year 2019-20 at £625 million as it has been identified that currently, the company stands out on the estimated stock at £198 million.

Strategic position and business ESG practice

It has been identified that the board and executive members of the company as IAG developed annual general meetings regarding the environmental, social and governance practices within the airline industries. ESG continues to be an area mainly focused to engage with the investors’ relations teams. However, the investors of the company, comply with huge issues based on several interests and disclosures. In such cases, the ESG issue that has been chosen is the priorities and framework of a strategic plan to mitigate (Pylypenko et al. 2019, p. 18). However, the ESG practices such as reducing carbon emissions, and governance issues reduce the major risk regarding implementing to receive the first airline service sustainably linked with ESG targets. However, the companies owned by the IAG group such as British Airways and much more help the company to meet the net zero targets of enhancing the technology benefits within the company. Moreover, the aviation or airline group as IAG evaluates several strategies based on ESG practices as illustrated below.

Data Security

It is one of the important concerns in the airline industry along with the IAG, as the airline company must mitigate the issue based on sensitive data. Currently, the company, data breaches in the variations airlines have grown a huge concern to identify the cyber threats.

Consumer satisfaction

Consumer satisfaction is the top priority of every firm rather than the airline industry. Consumers feel dissatisfied and disengaged through fewer passengers and less costly tickets (Bak et al. 2022, p. 84). In such cases, the company implements a strategy based on a passenger satisfaction survey to acquire questions and answers regarding the queries.

Fair labour practices

In the context of the ESG factors or strategies as labour practices, it is very crucial to survive within the airlines to generate positive impacts through contributing the best efforts by the labour. However, the company as IAG airline has been unstable as per the regular fluctuations in the macro environments.

Carbon emission

In the context of the IAG airline group, the main aim of the company is to reduce carbon emissions by implementing the net zero target up to 2050 (Giese et al. 2021, p. 95). Moreover, the company Flight pathnet zero programme secured through the executives and the board levels to support the target and commitments related to climate issues and incentives.

Investment Recommendation An investment is important as it suggests several strategies and practices or simplicity regarding the financial investments and the issuers to represent the future value and opinion for distributing the channels by implementing the several strategies to boost the investment within the IAG airlines. It has been identified from the industrial performance of airline industries. Investors eagerly play the recovery steps by entering as per the IBD ratings regarding identifying better performances.

High-yield savings account

It is a relevant process of making an investment, as such improvement means companies might generate interest on the cash balances, as the airline industry has been able to generate the chance to determine more income benefits in the near future. This is because it has less chance to identify risk. Moreover, the company has been able to secure its risks through the financial institutions and deposits of the investors.

Short-term government bonds and funds

Government funds and benefits are the special securities issued by the government and its agencies, as such funds issued by government-sponsored enterprises might be best suited for beginning investors. Funds are the fastest because the government includes several safety bonds and credit rating benefits for investors.

Moreover, the company investors might invest among the best rating and return benefits of companies owned by the IAG group such as Liberia airways, and British ways. This is because British airways have determined its huge return benefits along with extraordinary interest rates.

Conclusion

It has been concluded that the overall study represents the business strategy based on finance. However, the company identifies the financial performance by computing the ratios as profitability, liquidity, solvency, and efficiency. Though the company also determined the stock performances based on each year consecutively by the company revenue performances and list exchanges. Moreover, it motivates the executives and staff of IAG Airlines to develop strategic-based financial decisions to provide innovative solutions regarding the strategic issues within the organisation. However, the company determines the ESG derivatives and range to meet the development goals and specifically to reduce the shortage of labour, and materials and improve consumer satisfaction. Therefore, the company needs to reduce the fair price of tickets and enhance the facilities to determine sales and revenue benefits appropriately. Moreover, the company needs to reduce overdue obligations regarding meeting financial needs and enhance consumer satisfaction strategy.

References

Website

iairgroup.com, 2022. Annual report. Available at: < https://www.iairgroup.com> [Accessed on: 18th October, 2022]

Journals

Bak, I., Ziolo, M., Cheba, K. and Spoz, A., 2022. Environmental, social and governance factors in companies’ business models and the motives of incorporated them in the core business. Journal of Business Economics and Management, 23(4), pp. 837-855. Available at : < https://journals.vilniustech.lt/index.php/JBEM/article/download/16207/10960> [Accessed on: 18, October 2022]

Blišťanová, M., Tirpáková, M. and Galanda, J., 2022. Proposal of Risk Identification Methodology Using the Prompt List on the Example of an Air Carrier. Sustainability, 14(15), pp. 9225.Available at : < https://www.mdpi.com/2071-1050/14/15/9225/pdf> [Accessed on 18th October, 2022].

Brock, A., Kemp, S. and Williams, I.D., 2022. Personal Carbon Budgets: A Pestle Review. Sustainability, 14(15), pp. 9238. Available at: < https://www.mdpi.com/2071-1050/14/15/9238/pdf> [Accessed on 18thy October, 2022].

Chen, W., Tian, S. and Ren, S., 2022. Modeling and probabilistic analysis of civil aircraft operational risk for suborbital disintegration accidents. PLoS One, 17(4), Available at : < https://journals.plos.org/plosone/article?id=10.1371/journal.pone.0266514> [accessed on 18th October, 2022].

Giese, G., Nagy, Z. and Lee, L., 2021. Deconstructing ESG Ratings Performance: Risk and Return for E, S, and G by Time Horizon, Sector, and Weighting. Journal of Portfolio Management, 47(3), pp. 94-111. Available at: < http://chapterzero-france.com/wp-content/uploads/2020/10/Research-Insight_Deconstructing-ESG-Ratings-Performance.pdf> [accessed on 18october, 2022]

Kooli, C. and Melanie, L.S., 2021. Impact of COVID-19 on Mergers, Acquisitions & Corporate Restructurings. Businesses, 1(2), pp. 102. Available at :, https://www.mdpi.com/2673-7116/1/2/8/pdf> [accessed on 18th October, 2022].

Křupka, J., Kantorová, K. and Haile, M., 2018. Swot analysis evaluations on the basis of uncertainty – case study. Scientific Papers of the University of Pardubice.SeriesD.Faculty of Economics and Administration, (43), pp. 135-146. Available at : < https://dk.upce.cz/bitstream/handle/10195/71495/SWOT%20ANALYSIS%20EVALUATIONS%20ON%20THE%20BASIS%20OF.pdf?sequence=1&isAllowed=y> [Accessed on 18th October,2022].

Pylypenko, A.A., Savytska, N.L., Vaksman, R.V., Uhodnikova, O.I. and Schevchenko, V.S., 2019. Methodical Maintenance of Management of Logistic Activity of the Trade Enterprise: Economic and Legal Support. Journal of Advanced Research in Law and Economics, 10(6), pp. 1723-1731. Available at: < http://aapil.ho.ua/phocadownload/pylypenko_article_16.pdf> [accessed on 18th October, 2022].

Qin, T., 2020, September. Elevating Value Marketing Strategies in Singapore Airlines Driven by Macro and Micro Environment. In The 3rd International Conference on Economy, Management and Entrepreneurship (ICOEME 2020) (pp. 271-279). Atlantis Press. Available at: < https://www.atlantis-press.com/article/125944408.pdf> [Accessed on 18th October, 2022].

Know more about UniqueSubmission’s other writing services: