MAR042-6 Business Dissertation Sample

Module code and Title: MAR042-6 Business Dissertation Sample

1. Introduction

1.1 Background of the research

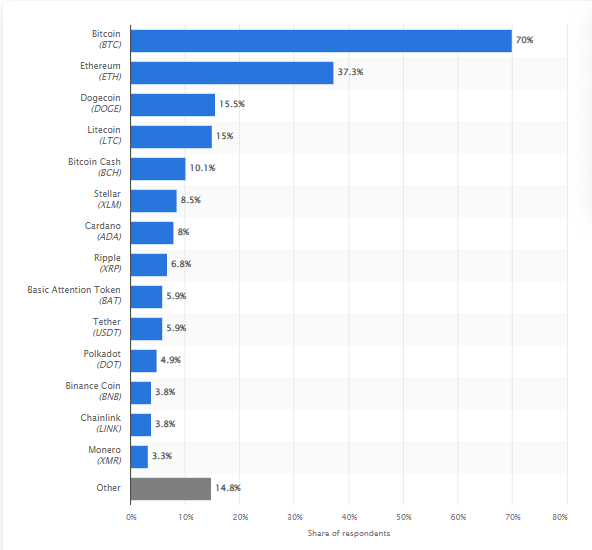

Figure 1.1: Ownership of different kinds of Crypto currencies around the UK (Source: Statista.com, 2021)

Figure 1.1: Ownership of different kinds of Crypto currencies around the UK (Source: Statista.com, 2021)

Crypto currency has been notified on the four kinds of strategic aspects related to security, utility, payments, and stable coins. In the United Kingdom, over 3.3 people have adopted crypto currency (Cybercrew.uk, 2022). This research will be based on the perspectives of crypto currencies and market analysis. Analyzing the latest information and developing the culture of trading currencies the ultimate rate of potentiality will be increased.

In addition, the market analysis will also include a review of Prominent Altcoins and Bicotin for the improved culture of decision-making attributes. Overviewed the graph it is clear that the ownership of Biotin around the UK is 70% (Statista.com, 2021).

1.2 Rationale

Crypto currencies have been considered faster and cheaper decentralized systems and money transfers that have not collapsed at a single point. Based on the topic future researchers will be getting successful to determine the various kinds of aspects related to security, transactional freedom, and ease of transaction system.

Improvements around the Crypto World have been considered the main issues that have created negative impacts on the investment ratio. It will also be exchanged the vulnerable cyber-attacks, which will be also increased the rate of volatility effectively. As a result, using the constantly increasing rates of Biotin the chances of fraud and hacking chances will be also developed.

1.3 Aims and Objectives

Aim

The aim of this research is to provide reliable information through trading currencies and analytics of the cryptocurrency news effectively.

Objectives

- To determine the issues regarding Financial Fraud and Data Theft of crypto currencies

- To analyze the aspects of market capitalizations and volume of trades effectively

- To evaluate the market analysis tools of crypto currencies for the expansion of market structures

1.4 Research Question

- What kinds of issues can an organisation face while dealing with crypto currencies with the development of the Stock Exchange Market?

- What are the necessary factors that can influence the crypto currency market?

- What are the modern trends of Crypto currencies for analyzing the market growth?

2. Literature review

2.1 Conceptual Framework

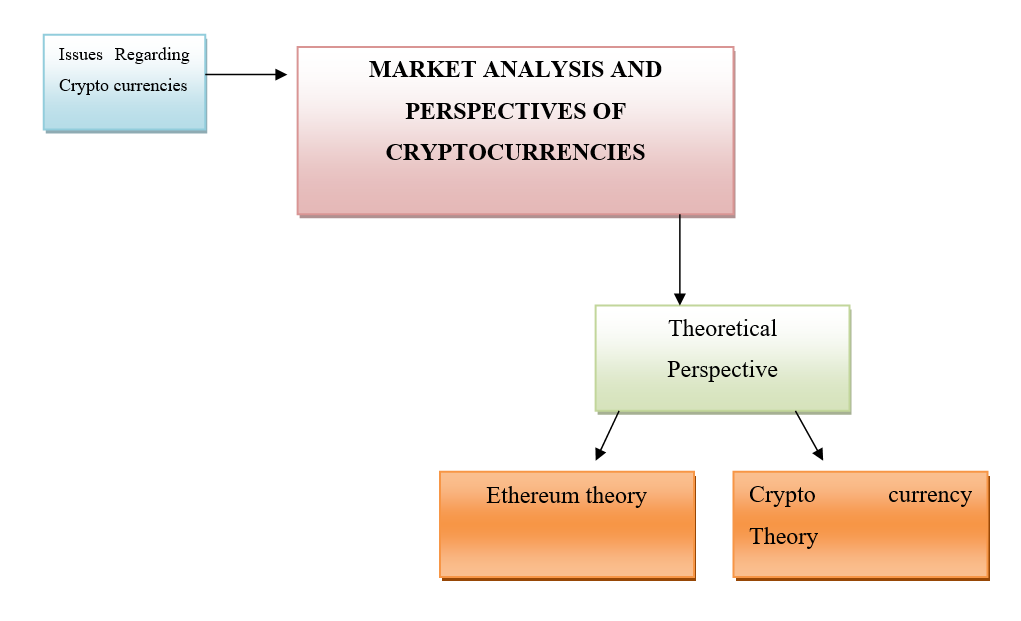

Figure 2.1: Conceptual Framework (Source: Self-developed)

Figure 2.1: Conceptual Framework (Source: Self-developed)

2.2 Modern trends of Crypto market trends

There have been presenting multiple kinds of innovative trends related to “Crypto currency Regulation”, “Crypto Warfare”, “NFT Market Growth Expected to continue”, “Bicotin to Remain Under Pressure”, “Crypto ETF Approval” and others.

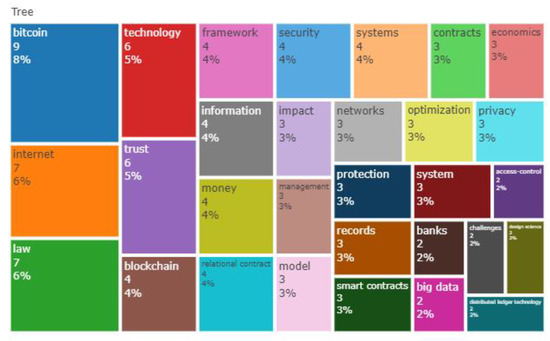

Figure 2.1: Implications of Crypto currencies and use rate of the different sectors (Source: Peláez-Repiso et al. 2021)

Figure 2.1: Implications of Crypto currencies and use rate of the different sectors (Source: Peláez-Repiso et al. 2021)

As opined by Dorofeyev et al. (2018), innovative technologies such as Block chain have increased the rate of the digital economy and promoted crypto currencies through the emergence of the recent period. However, Peláez-Repiso et al. (2021) have represented the entire concept by taking the used “Self-sovereign identity (SSI)” by collecting valuable feedback from 343 people.

It can be analyzed by notifying the figure that the rate of security and safety has been considered among 65% by optimizing the usage of technologies effectively (Peláez-Repiso et al. 2021). Used the theoretical perspectives of “Ethereum theory” in the developments of decentralized computer networks and improved the culture of tracking currency effectively. It has also developed the culture of “Block chain Technology Applications” by making a change in the operational module in an appropriate manner.

2.3 Factors affected by Crypto currencies

There are multiple kinds of factors such as “Supply, Market Demand, and Cost of Production, Regulations, Media Coverage’s, and Numbers of Competition”. As opined by Al-Amri et al. (2019), the constantly increasing rate of demand rates has been making a negative effect on the supply. The demand and supply of BTC have been increased by the rate of competition structures of making a change in the news, regulation, and cost of production.

The crypto market has also constantly increased the rate of market values and pricing modules appropriately. A technologically advanced mind choosing the wrong paths to become millionaires and to fulfill a materialistic lifestyle is a bane for the whole society (Alexander, 2018). New risks are evolving day by day and these need to be controlled globally. Another major concern is the sponsorship of terrorist activities through this money laundering; it is a rising concern for global peace and harmony.

Good hackers seem to be a need of the hour for combating this rising crime, blocking the transactions and trace mapping would diminish these crimes to a huge extent. However, Náñez Alonso et al. (2021) have argued that the crypto prices have been also focused on the multiple kinds of attributes related to “Potential recession, increasing the interest rate, high inflation rate and stock market exchanged module”.

Therefore, the chances of decentralized, as well as centralized, exchanged networking systems have been briefly affected due to not expansions of the “Stock Market Exchanging (SME)” rates. As a result, the multiple kinds of exchange rates such as “Kraken, Kucoin, and Coinbase” have also increased the rate of difficulties effectively. Using the theoretical perspectives of “Cryptocurrency Theory” the rate of networking ability has been also developed. The chances of government policies have been also under controlled and the rate of digital currency has been developed.

2.4 Role of Crypto currency in managing Money laundering through Global context

Crypto currencies are already a non-regulated entity which is a new means for old crimes internationally. It jumps the obstacles of law which restrains the intervening crimes from profound thriving. Transactions are unidentified, non-regulated, and depleted of regular inspections. Therefore it makes it a challenge for regulatory bodies to overcome growing crimes. Bit coin is the most common weapon in the world of crypto currency, with alt-coin being used as well to mask the illegal funding used globally for various unethical activities.

Spreading digital assets by avoiding regulatory bodies that can terminate the transactions is the most common way of money laundering in the crypto currency world. A cross-chain bridge named RenBridge has been used since 2020 to launder millions of cash all over the world (Cong et al. 2022). Using these methods hackers enter corporate networks and make them pay for retrieving their data. Theft and gambling is also a concern in this arena of crypto currency money laundering.

Crypto currency is neither authorized nor legal so it is accessible by all, which thrives money laundering as its demerit. In the UK, it is legal to operate crypto currency but with strict measures, in South Korea, it’s illegal in Global watchdogs for G-20 economies to regulate crypto currency strictly (Koenig et al. 2021). Uncontrollable exchanges, tumbling methods, using unsuspected third parties for shifting funds, integration methods, and hiding funds are the major ways of money laundering in the age of crypto currency. The recent pandemic showed major growth in this crime, it became a focal point of money laundering.

Money laundering, an age-old crime of converting illegal money into profits from profitable ventures, got the new edge of technology. Each and every legal body is trying to control this phenomenon to secure a global position in transparency. It would not be wrong to assume that the dark web and its widespread use all over the world is the rising point of such digital crimes.

3. Methodology

3.1 Research Method

Using the “Interpretivism philosophy” the research paper will be effectively conducted, as it will be helped for analyzed the Crypto currencies and providing a crucial analysis and in-depth concepts appropriately. In addition, the “Positivisms Philosophy” will be rejected as it will be reduced the entire quality of the research.

“Descriptive research design” will be taken for conducting the research successfully as it will provide precise concepts regarding the topics and also maintain the data authenticity (Influenced by Young et al. 2020). Besides that, “Explanatory research design” will be increased the rate of difficulties and reduced the quality of the research.

As opined by Breidbach and Tana (2021), the “Deductive research approach” has also been analyzed for the pre-existed information based on the topic and to maintain the quality of the research. Therefore, the Deductive research approach will be adopted for conducting the research regarding crypto currencies. Thus, “Inductive research” will be rejected, as it will be considered a time-consuming approach and an increased rate of cost structures.

A “Secondary data collection method” will be used to collect information regarding crypto currencies. Authentic sources such as Google Scholar and PubMed will be used for gathering relevant information thereby maintaining data authenticity.

3.2 Ethical consideration

“Copyright Act of 1956” will be used for maintaining the data authenticity thereby avoiding the chances of copyright issues. Copyright acts have been considered “Intellectual Property Rights” that can be protected through limited protections and copyright actions (Legislation.gov.uk, 2022). The data collected will be stored in the student’s university drive account for future study.

Besides that, the rules and regulations set by the “Data Protection Act, of 2017” will also be considered for the safe handling of data. At the time of the data collection, the permissions of researchers will also be taken for ignoring the copyright issues. The acts have provided an equity system of developed the culture of consumer preferences (Ctp.co.uk, 2022).

3.3 Data analysis

As opined by Young et al. (2020), using thematic analysis the chances of data leakages and misinformation rate can be reduced. Thus, based on the secondary data collected, a thematic analysis will be performed for analyzing the different aspects related to crypto currencies and market analysis to address the research objectives.

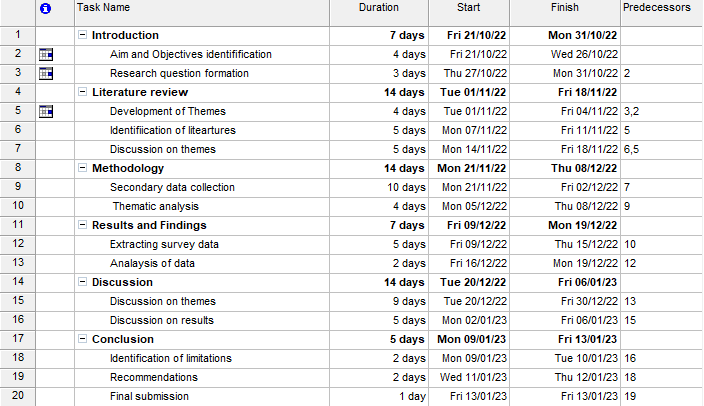

3.4 Time Plan

Figure 3.4: Time Plan (Source: Self-developed)

Figure 3.4: Time Plan (Source: Self-developed)

4. Potential outcome

| Objective | Key findings |

| Objective 1 | The issues regarding hacking of “Crypto currencies in business” will be addressed. Therefore, the appropriate measurements will also be founded. |

| Objective 2 | It will be provided precise concepts among differentiation of attributes related to “Volume Indicators”, “Trend Indicators”, “Momentum Indicators”, and “Volatility Indicators”. |

| Objective 3 | It will create a positive impact on the differentiation of aspects such as transaction systems, and security. |

Table 1: Potential outcome (Source: Self-developed)

Reference

Journals

Al-Amri, R., Zakaria, N.H., Habbal, A. and Hassan, S., 2019. Cryptocurrency adoption: current stage, opportunities, and open challenges. International journal of advanced computer research, 9(44), pp.293-307. http://dx.doi.org/10.19101/IJACR.PID43

Alexander, J.C., 2018. The societalization of social problems: Church pedophilia, phone hacking, and the financial crisis. American Sociological Review, 83(6), pp.1049-1078.

Breidbach, C.F. and Tana, S., 2021. Betting on Bitcoin: How social collectives shape cryptocurrency markets. Journal of Business Research, 122, pp.311-320. https://doi.org/10.1108/JABES-12-2018-0107

Cong, L.W., Harvey, C.R., Rabetti, D. and Wu, Z.Y., 2022. An Anatomy of Crypto-Enabled Cybercrimes. Available at SSRN 4188661.

Dorofeyev, M.A., Kosov, M., Ponkratov, V., Masterov, A., Karaev, A. and Vasyunina, M., 2018. Trends and prospects for the development of blockchain and cryptocurrencies in the digital economy. European Research Studies, 21(3), pp.429-445. https://doi.org/10.1109/IBCAST.2019.8667123

Koenig, P., Krautheim, S., Löhnert, C. and Verdier, T., 2021. Local global watchdogs: Trade, sourcing and the internationalization of social activism.

Náñez Alonso, S.L., Jorge-Vázquez, J., Echarte Fernández, M.Á. and Reier Forradellas, R.F., 2021. Cryptocurrency mining from an economic and environmental perspective. Analysis of the most and least sustainable countries. Energies, 14(14), p.4254. https://doi.org/10.3390/en14144254

Peláez-Repiso, A., Sánchez-Núñez, P. and García Calvente, Y., 2021. Tax regulation on blockchain and cryptocurrency: The implications for open innovation. Journal of Open Innovation: Technology, Market, and Complexity, 7(1), p.98. https://doi.org/10.3390/joitmc7010098

Young, J.E., Canay, A.M.L., Dizon, C.A.T., Magbanua, S.U., Peregrino, J.P. and Empleo, P.M., 2020. Selected Countries’ Financial Reporting Treatment of Cryptocurrency Transactions: Basis for PFRS Proposal. Editorial Policy, p.6. :10.1111/auar.12167

Websites

Ctp.co.uk (2022). UK GDPR & Data Security Online Training. Available at: https://www.ctp.co.uk/product/data-protection-e-learning/?gclid=CjwKCAjww8mWBhABEiwAl6-2RV9xliawFMc8pvNQI35Jk1puD8sco8VlLluVnHnqHCbfDMk-pm443BoCmF4QAvD_BwE Accessed on 11/09/2022

Cybercrew.uk (2022). Cryptocurrency Statistics UK Edition. Avaialable at: https://cybercrew.uk/blog/cryptocurrency-statistics-uk/ Accessed on 11/10/2022

Legislation.gov.uk (2022). Copyright Act 1956. Available at: https://www.legislation.gov.uk/ukpga/1956/74/contents/enacted Accessed on 11/10/2022

Statista.com (2021). Ownership of Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC) and 11 other cryptocurrencies in Great Britain in 2021 Available at: https://www.statista.com/statistics/1238453/crypto-ownership-uk-type/ Accessed on 11/10/2022.

Know more about UniqueSubmission’s other writing services: