CE5514/CE5012 Risk and Financial Management Sample

Introduction

Financial management of any business is a crucial factor which has assisted in minimising its risk and ensured better growth and performance level; in the future. The current study is based on the execution of profitability as well as the financial stability of five different business organisations belonging to the construction industry. The construction companies are Laing O’ Rourke, Kier, Balfour Beatty, Morgan Sindall and Carillion. Therefore, operating and net profit margin has been considered in executing the profitability level of companies. Apart from this, ROCE has been selected to observe the return on capital of each company as well as the whole industry. The gearing ratio has been selected to analyse the financial stability of any business as well as its role to sustain growth for the long term.

A. Analysis of Financial Analysis ratios

The financial ratio refers to the key financial performance indicator which has been selected to execute financial performance at a glance. In the current study, the financial performance of the companies has been executed through the use of operating, net profit margin ratio as well as ROCE and gearing ratio. As stated by Öztürk and Karabulut (2018, p.29), operating profit is the earnings of a business after deducting all operating as well as manufacturing costs. Whereas net profit is the profitability level which has been consumed by all stakeholders as well as received for further use in business. RICE has played a significant role to indicate a business efficiency level to generate revenue as well as net profit through the use of capital. Besides that, the gearing ratio has been indicating the capital structure of any business such as proportionate debt as well as equity in capital structure.

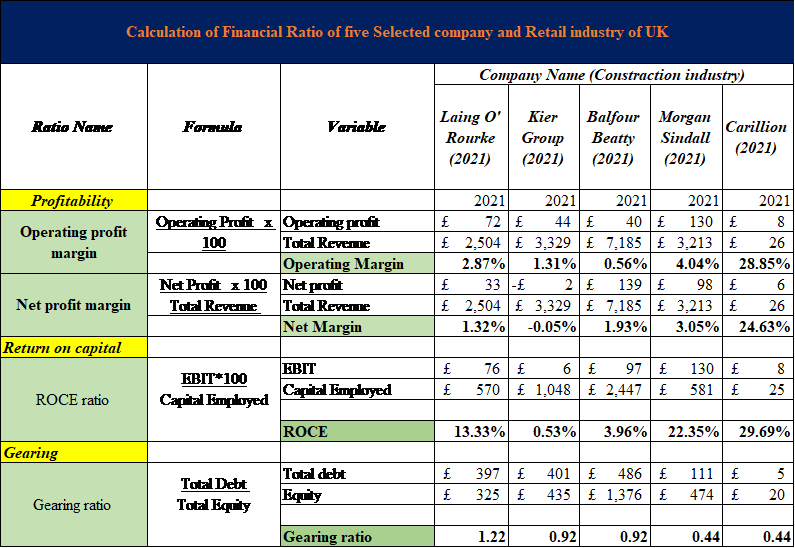

Figure 1: Financial ratios of five construction companies

(Source: Self-Created)

Based on ratio analysis it has been observed that Laing O’ Rourke has generated 2.87% and 1.32% operating as well as net profit (Laingorourke.com, 2022). However, Laing O’ Rourke has suffered from 13.33% as ROCE which indicates that Laing O’ Rourke does not have a better efficiency level as well as productivity level. The gearing ratio of Laing O’ Rourke has existed at 1.22 times (Laingorourke.com, 2022). Which has indicated that Laing O’ Rourke has more debt as compared to equity financial sources as well as here more chance of bankruptcy of Laing O’ Rourke.

Kier Group also plays a significant role in the UK construction industry and operates in more than 50 countries as well as performed business in more than 43 healthcare projects. At the current time, Kier Group has served nearly 74000 homes as well as maintained 27000 km of roads (Kier.co.uk, 2022). Kier Group has generated £1.4bn reverse as well as £65 million as operating profit from business revenue. Kier Group gas generated operating at 1.31% and suffered from -0.05% of net margin (Kier.co.uk, 2022). It has been observed that Kier Group suffered from low negative profitability which may be given the negative impact on financial sustainability. Apart from this, the ROCE of Kier Group has been existing at 0.53% indicating a low-efficiency level (Kier.co.uk, 2022). Further, the gearing ratio of Kier Group was calculated at 0.92 times which indicates that Kier Group has more equity as compared with equity which may assist to sustain its capital structure as well as minimising financing costs.

Balfour Beatty Plc is also a leading infrastructure company that has operated business for the last 110 years in the UK, US, and Hong Kong. At the current time, Balfour Beatty Plc has operated infrastructure activities with the assistance of 24500 employees (Balfourbeatty.com, 2022). Balfour Beatty Plc has also generated revenue of £8,280 million in 2021 which has declined from £8,587 in 2020. As a result, Balfour Beatty Plc will suffer from £197 of operating profit in 2021 and will increase from £51 million in 2020. Apart from this, the operating and net margin of Balfour Beatty Plc has existed at 0.56% and 1.93% which indicates that Balfour Beatty Plc has more net profit as compared with its operating profit. Apart from this, the ROCE of Balfour Beatty Plc has been also existing at 3.96% and the Gearing ratio at 0.92 times (Balfourbeatty.com, 2022). The ROCE of Balfour Beatty Plc has indicated that Balfour Beatty Plc has suffered from a low efficacy level as well as gearing ratio indicates that capital structure has been more stable as well as needs to incur low financing costs as compared with financing costs to manage its debt financial resource.

Morgan Sindall Group has been a key player in UK infrastructure as well as the construction industry operator business since 1977 and in more than 40+ countries. Morgan Sindall Group has increased its revenue from £3034 million in 2020 to £3213 million in 2021 (Annualreports.com, 2022). As well as its net margin has also increased from 65.4 million to £129.8 million in 2021. As a result, the operating and net margin exists at 4.04% and 3.05% in 2021 (Annualreports.com, 2022). Nevertheless, Morgan Sindall Group should increase its profitability in order to enhance its financial growth in future. Further, the ROCE of Morgan Sindall Group has existed at 22.35% which is acceptable nevertheless, Morgan Sindall Group needs to increase its revenue as well as net profit for an overall increment in efficiency as well as ROCE (Annualreports.com, 2022). The gearing ratio of Morgan Sindall Group has been existing at 0.44 times which is better and indicates a sustainable capital structure as well as increased financial performance in future.

Cerillion Plc has construction operations in nearly 45 countries as well as serving 80 internal consumers worldwide. Cerillion Plc was founded in 1999 as well as continuously increasing business growth as well as size (Annualreports.com, 2022). The total revenue of Cerillion Plc has increased from £20.8 million in 2020 to £26.1 million in 2021 which indicates that the revenue of Cerillion Plc has increased by 25%. Nevertheless, it has been observed from the operating and net margin of Carillion Plc that Carillion Plc has suffered from better profitability levels (Annualreports.com, 2022). As the operating and net margins of Cerillion Plc will exist at 28.85% and 24.63% in 2021. Besides that, the ROCE of Cerillion Plc also exists at 29.69% which is not too good. Nevertheless, it exists at a better level as compared with its competitor in the market (Annualreports.com, 2022). The gearing ratio of Cerillion Plc has been evaluated at 0.44 which is indicating a sustainable capital structure as compared with its compared.

Based on ratio analysis it has been observed that the profitability level of Cerillion Plc is better as compared with the other four construction companies that have been selected from financial performance execution.

On the other hand, the efficiency level of Cerillion Plc has also been better as compared with the other four construction industries in the UK construction industry. However, the gearing ratio of Kier Group is better as Kier Group is better proportionate to each capital source in their capital source as well as indicate that Kier Group minimised its financing costs as well as sustained its capital structure for the long term as well as short-term periods.

B. The average performance of the construction industry

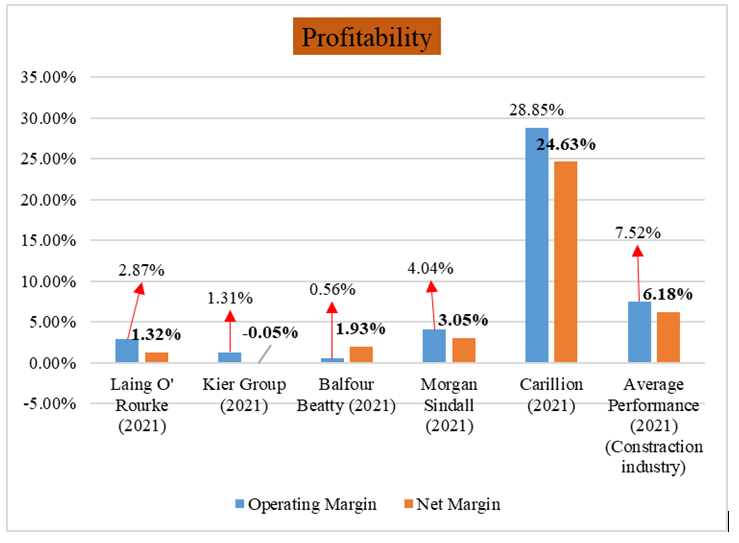

The average financial performance of the construction industry has been evaluated through the financial performance of 5 different companies in the construction industry. It has been observed that the operating profit margin of the construction industry has existed at 7.52 as well as the net profit margin has been evaluated at 6.18%. It has been observed that only the company has the average performance of the construction industry the rest of the four construction organisations are suffering from very low-profit ability levels as their profit margin are fluctuating between 0 to 5%.

Figure 2: Profitability of Five companies and the construction industry

(Source: Self-Created)

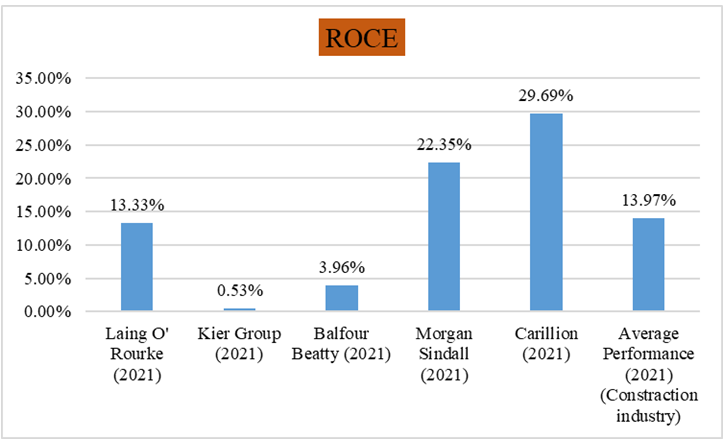

The efficiency level of any organisation has a significant role in the utilisation of different types of resources as well as in generating revenue and net profit. In the current scenario efficiency level of each organisation as well as the construction industry is evaluated through the use of the ROCE ratio. It has been observed that the average ROCE ratio of the construction industry has been evaluated at 13.97%. however, found that Morgan Sindall Group and Cerillion Plc has maintained an efficiency level of more than average industry efficiency beside the rest of the 3 construction organisations are suffering from low-efficiency level as their average ROCE ratio is below the average industry ROCE ratio.

Figure 3: ROCE ratios of five companies and the construction industry

(Source: Self-Created)

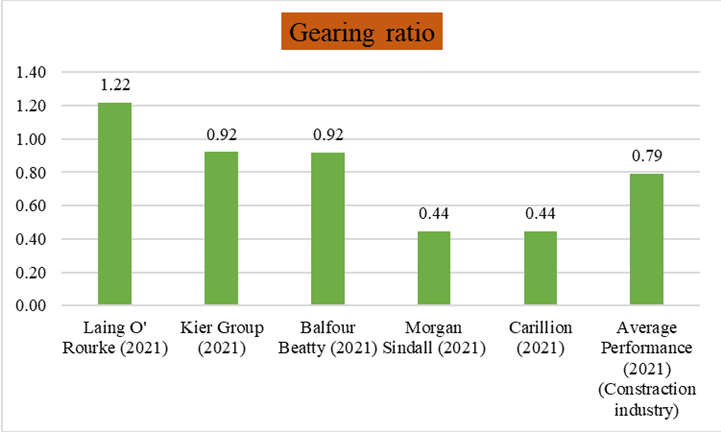

The gearing ratio of any organisation as well as company indicates capital structure as well as the sustainability of capital resources. As stated by Jermsittiparsert et al. (2019, p.42), the gearing ratios of an organisation are mainly based on the selection of different types of capital resources in order to enhance the growth and financial performance of a company. It has been observed that the getting ratio of the construction industry has existed at 0.79 which indicates that an organisation should consist of 0.79 times debt capital sources as compared with its equity capital services. Equity capital sources play a significant role to sustain capital structure for a long-term period. It has been observed that only Cerillion Plc and Morgan Sindall Group have maintained below-average industry gearing ratios nevertheless all three organisations have more dead in their capital structure as compared with equity Financial Services. In the current company selection, Cerillion Plc and Morgan Sindall Group have maintained more ROCE ratios such as 22.35% and 29.96%.

Figure 4: Gearing ratio of five companies and the construction industry

(Source: Self-Created)

C. Comparison between the performance of the construction industry and other industry

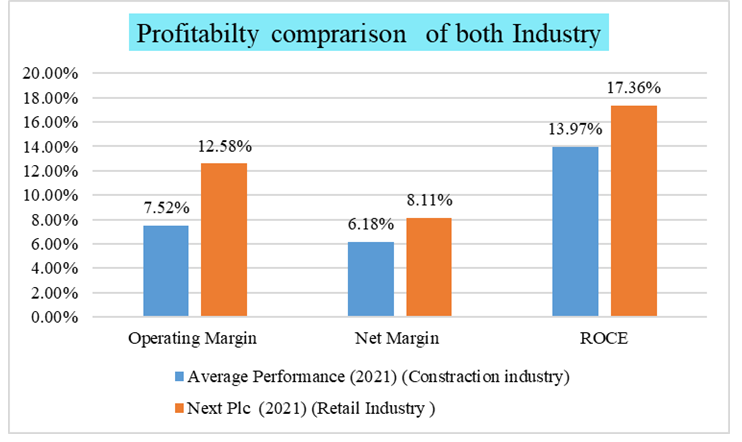

The performance of the industry is based on the financial performance of all key players and organisations of that industry. In order to compare the financial performance of the construction industry, Next Plc has been selected to compare with the retail industry. It has been observed that the Operating profit margin of the construction industry has been low compared with the operating retail industry of the UK. The operating margin of the construction industry has existed at 7.52% whereas the operating profit margin of the retail industry has existed at 12.58%. Besides that, the net profit margin of the construction industry also exists at 6.18% which is low compared with the net profit margin of 8.11% of the retail industry. The ROCE ratio of the construction industry also exists at 13.97% whereas the ROCE of the retail industry has fluctuated at 17.36%.

Figure 5: Comparison between financial performances of both industry

(Source: Self-Created)

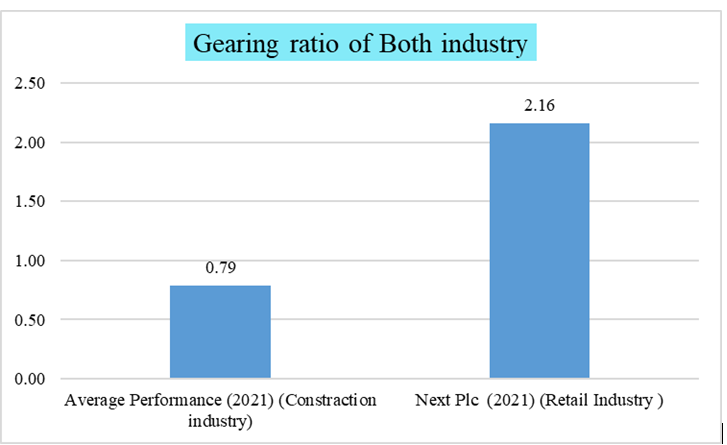

The getting ratio of the construction industry exists at 0.79 times whereas the retail industry exists at 2.16 times its equity financing sources (Nextplc.co.uk, 2022). It has been observed that fine fencing sources are the first difference in the detailing industry whereas equity capital sources are considered for business growth in the construction industry.

Figure 6: Average gearing ratio of both industry

(Source: Self-Created)

Based on a comparison between the construction industry performance level as well as retail industry performance. It can be concluded that this type of industry has also affected the performance of businesses. As it has been observed that the profitability of the retail industry is better as compared with the profitability of the construction industry. It has been found that the average profit of the construction industry has been 6.18% and the profitability of the retail industry has fluctuated at 8.11% (Nextplc.co.uk, 2022). Apart from this, the capital structure of the retail industry is sustainable for short-term periods. However, the capital structure of the construction industry has consisted of more equity as compared with debt capital sources. This indicates that the capital structure of the construction industry has been sustainable for a long-term period.

Conclusion

Based on the current report on financial performance comparison it can conclude that industry types of a business have also played a significant role in the performance as well as the financial stability of the business. It has been analysed from the financial performance of the construction industry as well as the retail industry that retail industries generate more profit compared with the construction industry. However, the capital structure of the construction industry is better in the long term as compared with the retail industry. The aims of this report have been achieved by effectively comparing the financial performance of five companies in the construction industry as well as the retail industry through the use of three significant types of financial ratios.

Reference

Journals

Afolabi, A., Olabisi, J., Kajola, S.O. and Asaolu, T.O., 2019. Does leverage affect the financial performance of Nigerian firms?. Journal of Economics & Management, 37, pp.5-22.

Jermsittiparsert, K., Ambarita, D.E., Mihardjo, L.W. and Ghani, E.K., 2019. RISK-RETURN THROUGH FINANCIAL RATIOS AS DETERMINANTS OF STOCK PRICE: A STUDY FROM ASEAN REGION. Journal of Security & Sustainability Issues, 9(1).

Öztürk, H. and Karabulut, T.A., 2018. The relationship between earnings-to-price, current ratio, profit margin and return: an empirical analysis on Istanbul stock exchange. Accounting and Finance Research, 7(1), pp.109-115.

Websites

Annualreports.com, 2022: Annual report of Cerillion Plc 2021 Available at: https://www.annualreports.com/HostedData/AnnualReports/PDF/LSE_CER_2021.PDF [Accessed on 5th November 2022]

Annualreports.com, 2022: Annual report of Morgan Sindall Group 2021 Available at: https://www.annualreports.com/HostedData/AnnualReports/PDF/LSE_MGNS_2021.pdf [Accessed on 5th November 2022]

Balfourbeatty.com, 2022: Annual report of Balfour Beatty Plc 2021 Available at: https://www.balfourbeatty.com/media/319342/balfour-beatty-annual-report-and-accounts-2021.pdf [Accessed on 5th November 2022]

Kier.co.uk, 2022: Annual report of Kier Group 2021 Available at: https://www.kier.co.uk/media/6966/kier-2021-ara-final.pdf [Accessed on 5th November 2022]

Laingorourke.com, 2022: Annual report of Laing O’ Rourke 2021 Available at: https://www.laingorourke.com/media/saul30h1/lor-corporation_annual-report-fy21.pdf [Accessed on 5th November 2022]

Nextplc.co.uk, 2022: Annual report of Next Plc 2021 Available at: https://www.nextplc.co.uk/~/media/Files/N/Next-PLC-V2/documents/2021/annual-report-and-accounts-jan21.pdf [Accessed on 5th November 2022]

Know more about UniqueSubmission’s other writing services: