AFE_4_FEC Finance and the Economy Sample

Case Study 1: Anatomy of price and quantity changes

Question 1: Deductions on price and quantities for houses in the UK

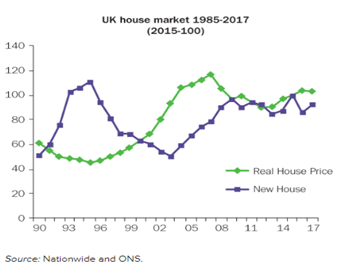

Figure 1: UK house market 1985-2017 (2015-100)

(Source: Given)

The graph represents the “point of equilibrium” in the market in the UK from 19 to 2017, where the green depicts the real home prices of the UK and the purple line depicts the equilibrium point of new houses in the UK market of UK. From the graph, it can be identified that the “price” of new houses in the UK market was decreasing from 1985 till the mid-1990s. Whereas the “demand” and “supply” of new buildings kept on increasing due to the lower “price level” of the houses in the market of the UK. On the other hand, there can be a positive relationship between the “supply and demand” and the “real price” of houses in the UK market. Hence, when the “demand” for housing in the market in the UK has increased the “real price” of the houses has risen. Therefore, there are several factors that have affected the “demand” and “supply” of the houses in the market of the UK such as the “Global Financial Crisis” in the year 2007 and other policies regarding the tariff on property. According to the point of view of Sun, et al, (2019, p.1315), if the government of the UK chooses to provide a subsidy on the housing price of the UK the market demand may rise even further. The government of the UK has introduced policies to achieve the affordable price of houses in London and several other locations in the UK to aid the general consumers of the economy.

Question 2: Underlying factors that drive prices and quantity of houses in the UK

The price is a dependent factor on the relationship between the components of the “demand and supply” in the housing market of the UK. The housing market of the UK along with the price level of the new houses and the quantity is majorly impacted by the level of “demand” in the market of the UK. There are a number of different factors that affect the level of “demand” for houses in the UK market such as the implementation of different policies in the market of the UK, the “Global Financial Crisis” and so on.

There is a major influence of the market demand of the UK housing market due to the GFC in 2007, due to this demand for houses has fallen. As stated by Browning, and Zupan, (2020, p.54), due to the lack of demand in the housing market of the UK the price level has also fallen, this phenomenon can be witnessed in the provided graph. In addition to this, the level of income of individuals in the UK has a major impact on the level of “demand” for houses in the UK housing market. Due to the lower income level, the consumers in the market are not able to afford the desired house; this has been affecting the behaviour of the consumers in the UK market of UK. Due to lower levels of income, individuals tend to save more due to uncertainty about their future income.

Question 3: Suggested policies to the government

Government policies and rates of tax play a significant role in terms of maintaining the characteristics of the market of the economy. There are several measures that can be taken into consideration to control the market “demand” and “price” so that the market of the UK operates normally. The government of the UK can set a “maximum price” and “minimum price” so that the piece level of the UK market can be controlled by the government of the UK. As per the point of view of Jeris, et al, (2020, p.503), this barring the process of the “price level” for houses in the UK market aids to manage the affordability of the houses. Hence, this has a direct impact on the level of price of houses along with the number of houses that are in demand. The minimum price level is referred to as the “price floor” whereas the maximum price can be referred to as the “price ceiling”. In addition to this, the government of the UK can introduce a subsidy for a certain group of people in the UK. To be specific, the government of the UK should provide a subsidy to the group of “lower-income” individuals so that demand for new houses in the economy of the UK does not saturate only the affluent ones in economy. This may impact the price level of the economy if there is a lack of a price-controlling policy in the market.

Case Study 2: Supply shocks: oil prices and inflation

Question 1: Reason behind the lower level of inflation in the economy of the UK

The cost of oil in any economy plays a major role in terms of the level of inflation along with several other aspects of ten economies that include the purchasing power of the individuals in the economy, the real wage, real income and so on. The economy of the UK was able to maintain a lower level of rate of inflation due to the acceptance of the reduced “wage rate” by the labour force in the economy of the UK. On the other hand, the firms in the UK are used to the decrease in the “real profit” margin. In addition to this, the increase in the price of oil was not sudden. It kept increasing with creation but at a gradual pace, due to this the price level of the economy was adjusted accordingly. This has aided the economy to maintain the rate of inflation in the economy. In addition to this, the “central bank” of the UK was able to take the right decision to keep the “rate of inflation” low. As per the point of view of Aye, et al, (2019, p.283), the “central bank” of the UK identified that the controlling measures to pass the increased energy cost would be more harmful to the economy of the UK as this would simply include the procedure of increasing the rate of interest in the economy. This enforcement of the increased rate of interest would lead the economy of the UK to a “recession”, which would be more dreadful for UK individuals.

Question 2: Impact of the financial crash on inflation

The “Global Financial Crisis” has affected the world economy by a significant margin. In this scenario, the economy of the UK has faced a steep incline in terms of the “rate of inflation” in the economy of the UK after the GFC took place. The impact of the “Global Financial Crisis” has a crucial consequence for the economy of the UK where this caused the deepest recession in the UK economy since World War II. In addition to this, this led to an increase in the level of “Unemployment” within the economy along with a rise in the debt. In addition to this, the economy of the UK faced home repossessions. Most economies of the world have faced a slowdown in terms of the rate of growth in the economy along with the rise in the “inflation rate”. The central bank of the UK estimated that the rate of inflation would reach up to 5% whereas the targeted rate of “inflation” was 2.5%. In addition to this, an increase in the “rate of interest” aided in the process of recovering the fragile production or the level of output of the economy. According to the point of view of Clift, (2020, p.281), the economy of the UK has taken “flexible inflation targeting” into consideration to gradually reduce “inflation”. This can be witnessed has decreased gradually during the time period of 5 years from 2012 to 2016. The implemented policies in the UK have aided in the process of controlling the rate of inflation in the economy along with an increase in the “unemployment rate”, increased level of income and so on.

Question 3: Role of the Bank of England to control of the rate of inflation

There are several measures that have been brought into interpretation by the “Bank of England” to reduce and control the rate of inflation in the economy of the UK. When the cost of oil increased by a significant margin most economies in the world were facing a higher level of inflation, whereas the “inflation rate” was significantly lower during that period in the economy of the UK. This has been successfully executed as the “Bank of England” decided not to increase the rate of “interest” in the economy. This has benefited the economy of the UK as this aid the economy of the UK in avoiding “recession”. In addition to this, when the “Global Financial Crisis” took place most of the economies were suffering from a higher rate of inflation in the economy coupled with a reduced rate of “growth”. According to the point of view of Bordo, and Levy, (2021, p.59), whereas the “inflation” rate was significantly lower in the UK economy in contrast with the world economy. In this scenario, the “Bank of England ” has increased the rate of interest in the economy while the targeted rate of inflation was 2.5%. In addition to this, the estimated rate of “inflation” has been evaluated at 5% and measures have been taken accordingly to prevent further increases in the rate of inflation.

Question 4: Inflation, the monetary and fiscal policy of the UK

The current rate of inflation is at its peak and the overall growth of the economy in the UK has stagnated due to several recent economic and geopolitical issues. The invasion of “Ukraine” by Russia has caused a significant level of increase in the “rate of inflation” along with a hike in the “rate of unemployment” within the economy. In addition to this, the recent political instability in the Nation has affected the performance of the economy. The “BREXIT” has caused a fall in the “rate of exchange”, hence a fall in the value of the currency of the UK. According to the report of view of the World Bank, (2019, p.13), this has affected the volume of “international trade”. In addition to this, the spread of “coronavirus” globally has affected several important factors of the economy, such as the “rate of unemployment” getting even higher, an increase in the rate of interest and so on. In addition to this, the government of the UK has implemented several policies that made a negative influence on the economy of the UK, the enactment of the policy that affects the tax rate has resulted in a decrease in the level of investment in the economy of the UK. In addition to this, the recent implementation of the free trade policy with India along with several other countries provides a glimpse of hope as this can boost the volume of international trade in the UK economy. Hence this can aid in the growth process of the economy of the UK.

Case Study 3: Financial Markets and Institutions

Question 1: Swift of the bank from the traditional banking model of originate-and-hold to a model of originate-and-distribute

The increase in the activities in terms of the “shadow banks” along with the rise in the “non-banking” financial services firms. These services or activities include the schemes like “Structured Investment Vehicles’ ‘ or the “svis’ ‘ that perform banking services. These reasons have caused the banks to change from the fundamental model of banking, hence, the “originate-and-hold” model in commercial banking activities to the banking model of “originate-and-distribute”. In addition to this, the implementation and the rise of the “shadow banking system” aid the consumers of the economy by investing their money in “mutual funds” and similar other funds. Furthermore, the “shadow banking system” takes the flow of reserve between “net borrowers” and “net savers” into consideration which is similar to the “traditional banking system”. In addition to this, the borrowers in the economy can avail of the services of loans and leases from the “shadow banks” with ease in constant with the “traditional banks” in the economy of the UK. As per the point of view of Adrian, et al, (2018, p.24), these financial institutions do not come to direct exposure of the “credit”, “liquidity”, and the potential risks of the “interest rates” in the traditional banking system of the UK. As this transition would lower the risks of investment this change has occurred.

Question 2: Effect of the boom in the housing market on the financial institutions

The housing market boom that began in 2001, particularly after the terrorist attacks, contributed to Financial Institutions’ shift away from “risk measurement” and “risk management”. In response to the terrorist attacks, regulators gave liquidity to financial institutions promptly in an attempt to stabilise the financial markets. The Federal Reserve, for example, reduced the short-term interest rate that banks and other financial institutions pay in the federal funds market. Unsurprisingly, the central bank’s increased liquidity and low-interest rates resulted in a significant increase in consumer, mortgage, and business debt finance. Both credit card debt and home mortgages are in high demand.

As per the point of view of Johnstone, et al, (2019, p.455), the original interest rates given by these teaser rates were incredibly low. Loan rates would, however, increase dramatically if market rates climbed after the original rate term ended two or three years later. House prices finally began to fall in 2006. The “Federal Reserve” began boosting “interest rates” around the same time it became concerned about inflation. Because many of the subprime mortgages created between 2001 and 2005 had adjustable rates, many low-income households found it difficult to meet their mortgage obligations. A surge in subprime mortgage defaults and foreclosures resulted from the interaction of falling home values, rising “rate of interest”, and rising “costs of mortgage”, which exacerbated the downward trend in housing prices.

Question 3: Nations with the most international debt securities outstanding

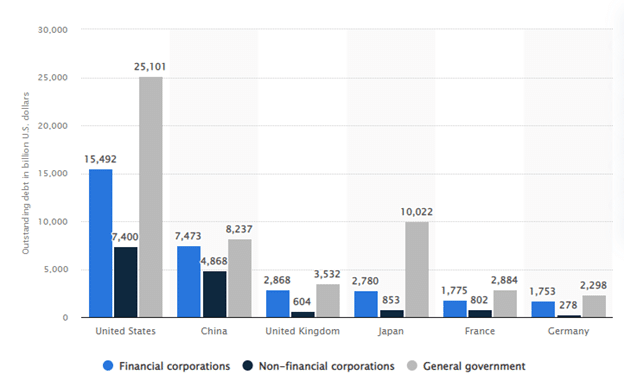

Figure 1: Nations with the most international debt securities outstanding

(Source: Statista.com, 2022)

The above figure depicts the amount of the debts of the countries in terms of the “Financial corporations”, and “non-financial corporations” along with the debts of the governments of the economies. The United States has the highest amount of debt in the international market (Statista.com, 2022). China stands second in terms of the total debt of the economy whereas if the debt of the general government is taken into consideration, then the government of Japan has the second highest amount of debt. In addition to this, the sum of the international debt of the UK, France and Germany would not be equivalent to the debt of the general government of the US though they are on the list of top borrowing economies.

Question 4: Nations with the largest commercial banks

The nation consists of a higher number of commercial banks in the economy of China. There are 11 banks in China out of the top 50 banks in the global marketplace. In addition to this, the United States consists of 6 banks within the economy out of the 50 greatest banks in the world (Worldatlas.com, 2022). France, Japan, And the United Kingdom each have 5 banks within their economy. The banks in this country have faced losses due to the recent financial crisis. In addition to this, the higher growth rate of the economy of China led to the expansion of the banks of China.

Reference

Adrian, T., Kiff, J. And Shin, H.S., 2018. Liquidity, leverage, and regulation 10 years after the global financial crisis. Annual Review of Financial Economics, 10, pp.1-24.

Aye, G.C., Clance, M.W. and Gupta, R., 2019. The effectiveness of monetary and fiscal policy shocks on US inequality: the role of uncertainty. Quality & Quantity, 53(1), pp.283-295.

Bordo, M.D. and Levy, M.D., 2021. Do enlarged fiscal deficits cause inflation? The historical record. Economic Affairs, 41(1), pp.59-83.

Browning, E.K. and Zupan, M.A., 2020. Microeconomics: Theory and applications. John Wiley & Sons.

Clift, B., 2020. The hollowing out of monetarism: The rise of rules-based monetary policy-making in the UK and USA and problems with the paradigm change framework. Comparative European Politics, 18(3), pp.281-308.

Jeris, S.S. and Nath, R.D., 2020. Covid-19, oil price and UK economic policy uncertainty: evidence from the ARDL approach. Quantitative Finance and Economics, 4(3), pp.503-514.

Johnstone, S., Saridakis, G. And Wilkinson, A., 2019. The global financial crisis, work and employment: Ten years on. Economic and Industrial Democracy, 40(3), pp.455-468.

Statista.com, 2022, International Debt, Available at: https://www.statista.com/statistics/1083067/outstanding-debt-securities-in-major-economies-sector/ [Accessed on: 14.12.2022]

Sun, H., Wan, Y., Zhang, L. And Zhou, Z., 2019. Evolutionary game of the green investment in a two-echelon supply chain under a government subsidy mechanism. Journal of cleaner production, 235, pp.1315-1326.

World Bank, 2019. Global financial development report 2019/2020: Bank regulation and supervision a decade after the global financial crisis. The World Bank.

Worldatlas.com, 2022, Number of commercial banks, Available at: https://www.worldatlas.com/articles/countries-with-the-biggest-banks.html [Accessed on: 14.12.2022]

Know more about UniqueSubmission’s other writing services: