International Operations Management Assignment Sample

Introduction

The study describes the operational strategy, currant issues, possible solutions, and the operational management of “BHP Group Company” in Australia. Operational management helps BHP group by supporting its strategic direction for achieving success and mitigates all possible risk factors. The study analyses the “International operations management” of BHP Group, which helps to redesign business processes, maintain manufacturing, and increase revenue and competitiveness in the international market. Operational management has a good contribution to the BHP group by making a brand image, valuable acquisitions, and developing fundamental skills of its employees. Therefore, business management is important for “BHP Group Company” in managing and organizing the company’s resources. BHP has a major contribution to Australia’s economy and it engages in the “development, exploration, and production” of iron ore, copper, and coal serving worldwide. Therefore, operational management creates the highest efficiency level for BHP and maximizes its overall profit. The recent report is effective in managing several constructions regarding IOM standards adopted by the Australian mining company BHP. To analyses the further context, the “Six Sigma” framework and VRIO analysis have been done for understanding the QM and SCM of BHP.

2. Operations Strategy

BHP or the “the Big Australian” started its market operation in 2001 and started urbanizing the mining products for the globalized venture. The operation strategies implied with BHP Group in Australia are associated with different professional issues, such as – empowered teamwork, job security, flexibility, and master programs (Lasrado, 2018). In order to implement a better OS in the service structure, BHP organized its merger with the South African company named Billiton dealing with mining production. A standard OS is effective in managing the marketing venture along with the sales hike and revenue with investment policies. As per FY2021, BHP operates with 64% of standard operational performance (Bhpgroup, 2022). It has proper sales mitigation of up to $37.4 billion with a direct financial contribution of $40.9 billion. BHP has its tax mitigation for $11.1 billion and with the government investment policies for $11.1 billion and the intensity is 84.7% in Australia.

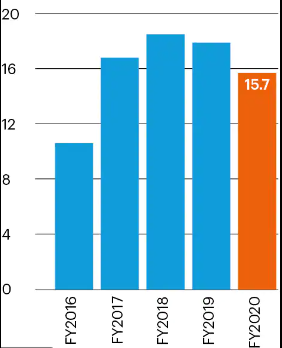

Figure 1: Operational Strategic Implementations by BHP Group

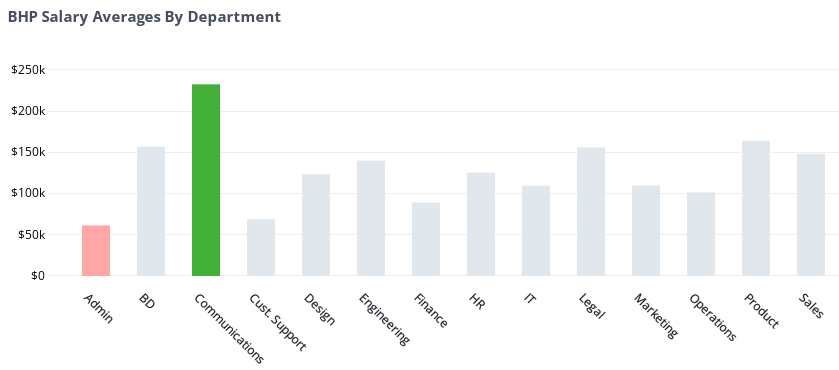

As per the Fiscal Years from 2016 to 2020 onwards, BHP started maintaining its OS regarding the management of service structure in the internal and external market-based scenario. In the Australian context, BHP implies its market share along with the royalty principles for salary hikes and value propositions for the employees are 84.7% with a $9.4 billion investment in payment structure. To maintain job security, BHP offers “full-time benefits” along with a flexible workforce (Scheltus et al. 2021). BHP manages an “18 weeks leave policy” as parental leaves for the optimization of a motivated workforce. The following figure incorporates the salary deviation in each BHP department. The bonus structure with the base salary for BHP employees is $129,389 with a pay hike of $62 for every single hour. BHP’s employee OS is effective by $128,265 as the median compensation rate. The competitive target market associates the commercial tendencies in mitigating the BHP-based OS prospect in the Australian target market with 100% brand reliability in the mining sector.

Figure 2: BHP Remuneration Structure

(Source: Bhpgroup, 2022)

In contrast, another OS management system associates the BHP Group’s market policies more suitable to the recent mining industry. As per the direct sales, BHP records $232,171 annually. To develop the operational strategies, BHP employs $101,308 for further advancements in Australia and mitigates to expand the global operations. 15% of the compensation policy connected to any financial loss by the merging and associated companies with BHP determines the annual sales and revenue hike (Norrish et al. 2019). BHP offers 10% of its income as personal and professional benefits for the associates and the stakeholders. In addition, the assessment of organizational support, BHP accommodates 80,000 employees along with an 81% of feedback rate in “90-days of interval” with OS assessment in Australia. The “BHP Operating System” employs an “Engagement and Perception Survey” for three years of duration for the OS analysis programme. The EPS for BHP records 84% of stakeholders’ engagement for a better OS management proposition (Innis and Kunz, 2020). The OS structure alone ensures 3,700 employees as the operational staff in the Australian mining industry with the training provided by “BHP FutureFit Academy”.

In addition, BHP undertakes several OS propositions for the “Capital Allocation Framework” with cash flow and instant benefits for the stakeholders. BHP determines 32.5% of the “Return on Capital Employed” in the Australian context. As per the OS issues, BHP experiences a 40.7% of sales hike according to FY2022. The financial growth depends on these OS perceptions as per BHP’s marketing consent in Australia (Nusinov et al. 2020). The association is implied with several strategic implementations regarding the employees, employee benefits, production system, and cost management issues. All these factors also determine the world’s venture in the competitive market scenario. BHP associates its target market to be shifted from the Australian ground to the other European and Asian regions. Approximately, 60%-80% of the market capture is possible with the standard OS of BHP in Australia. The general way of logistic control by flight services is for easy cross-continent delivery (Sierpińska and Kowalik, 2021). BHP can manage up to 98 tonnes of product transmission by “Boeing 747-200”. Therefore, the OS of BHP mitigates the brand value and product assurance in the Australian and global mining market.

3. Two areas

As per the recent report, two contemporary areas as per the success rate of BHP involve “Quality Management in Operations” and the “Supply Chain Management Issues”. These two issues are important in managing the system operational management of BHP in the Australian mining sector (Argus and Samson, 2021). The quality maintenance of the produced items and the supply chain mitigation are important grounds that the administrator requires to verify. BHP deals with the products, such as – metallurgical coal, copper, iron, potash and nickel (Miklosik and Evans, 2021). BHP started its market operation in 1885 with the products of “value-added flat steel”. By implying the two IOM statistical developments, BHP owns many subsidiary organizations, such as – “BHP Billiton Eurasia B.V”, “BHP Billiton Diamonds Inc.” or “BHP Billiton Energy Coal Inc.” (Samson, 2021). Consequently, BHP can conduct its annual production rate by 1.2 Mt by its FY policies. Therefore, BHP consists to be the second largest mining company with 43.6% across the world.

Alongside, the metallurgical products, BHP further produces barrelled oil with 38.7 million, especially the crude and condensates oil. The FY2019-2022 of Australia associates BHP’s profit margin up to $8.3 billion. As per the developed product quality and the supply chain, BHP survives in the competitive market scenario along with “Oil States International” from the US or Rio Tinto from the UK (Logan, 2018). The Australian stock exchange collaborates with 35 stocks for BHP with a “B grade for Value and Quality”. The B grade shares as per the stocks fall under the “rolling settlement system” in Australia. Therefore, the propositional adaptation of the standard supplies chain along with product quality with the management issues.

“Quality Management in Operations” for BHP Group

BHP follows CSMS or a “continuous stockpile management system” for product quality mitigation services in the mining sector of Australia. The live capacity for CSMS is 50 kt for BHP as a potential British-Australian mining company (Meney and Pantelic, 2019). 15-floor stocks and 4 benches alongside 12–13 kt rake carrying system BHP associates with Port Hedland in Australia. The “monthly mine plan” manages the product grading system along with their quality check with DSR Device. This device determines the PG temperature with quality testing based on the advanced management system of “ASTM D7175 standard” for BHP. The PAV or “Pressure Aging Vessel” tests the products with the “ASTM D6521 standard”. These standards are the metallurgical units to mitigate the quality products from consumer usage.

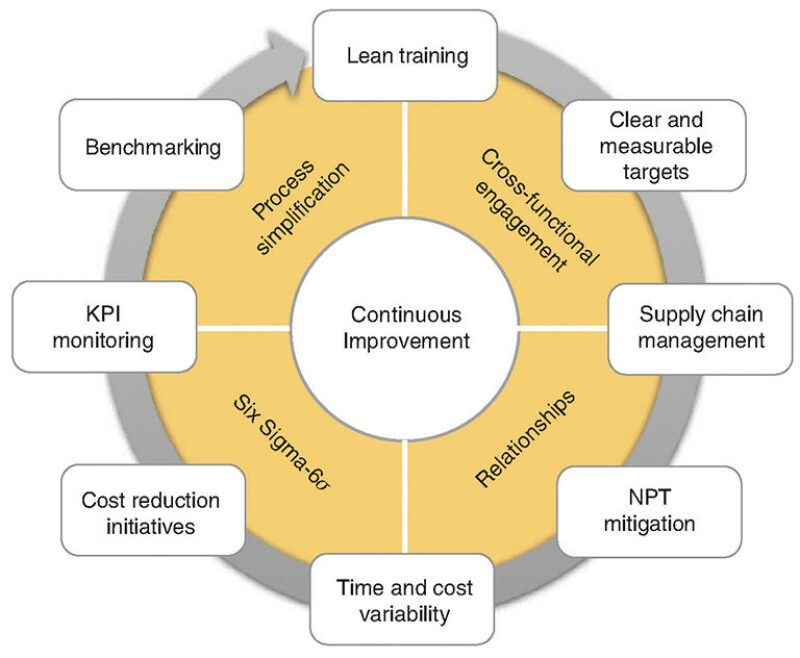

Figure 3: Quality Management Aspects for BHP

(Source: Toke and Kalpande, 2021)

The above-mentioned factors in the graphical presentation in close reference to BHP, the quality management involves several implications, such as product process, cross-functions, and variable initiatives. The floor stock grading system can determine the facilities of the product over 24 hours of the product review system. Henceforth, the quality services as per the mining production and the long-term strategic implementations are the effective workforce for BHP’s annual sales hike in Australia. The “six sigma factors” for the operations management as per BHP identifies a 3.4% defect mitigation rate along with the target of implying 99.99% of quality perfection as per the market analysis. All these associations related to quality management are also effective in mitigating different theoretical underpinnings. Hereunder, the report associates with the “Six Sigma Analysis” regarding BHP’s IOM standard.

Six Sigma Analysis of BHP

| Six Sigma Factors | Overview | Quality Assessment |

| D (Define) | The projects based on the operation management undertakes proper methodological overview and philosophical assessment | Moderate |

| M (Measure) | Reduction of the manual costs and evaluate “project delivery benefits” and “profit mitigation services” require the quality product assessment as per the grading system | High |

| A (Analyse) | Different banking sectors can invest with financial benefits to ensure the operational benefits with appropriate methodological implementations | Moderate |

| I (Improve) | The company can analyse the current market, consumer demand, and the operational strategies as per meaning trends likewise other companies | Low |

| C (Control) | The company can control the regional “tertiary establishments” with negotiated statistical overview | High |

Table 1: Six-Sigma Analysis of BHP

(Source: Self-created)

As per the practical assessment, BHP can mitigate the above-mentioned “Six Sigma model” with associated project constructions in the mining industry. The association can align with a simulated project on the “production life cycle” arranged by the merging sector of “BHP-Billiton’s Saraji Mine” in Australia (O’Donnell and Kessler, 2018). As per the defining terms of the project, the mitigation plan can associate at least $350,000 for the operation management. The measure is to understand the “Operating Excellence” with almost 793 fleets in the mining sector. The time consummation can be 22.8 hours with delivery benefits of $156,000. The financial support can come from the “Commonwealth Bank” in Australia for making the project practically possible. Apart from this analysis, the improvement policies can determine performance directors to control the assessment (Moran et al. 2020). Consequently, BHP can control the market situation with 90% of the affordability rate with cost-controlling effort.

Theoretical underpinning for BHP’s Quality Management

Regarding the quality management issues, an appropriate theoretical framework is essential for BHP in the Australian mining sector. The assessment can incorporate the mitigation plan as per Kaizen’s Model (Khan et al. 2021). The illustration is based on the following image that actualizes the practical force with 90%-95% of the quality management issues. At first, BHP needs to identify a problem; secondly, it requires analysing the present situation. Thereafter, BHP needs to search for solutions and examine them. Accordingly, BHP requires mitigating the analysing results and standardising solutions (Siegrist et al. 2020). All these factors can actualize the quality management process for BHP’s market proposition and the OS possibilities.

Identification

BHP can identify all problems regarding product quality, market profits, logistic protocol and employee retention rate. 60% of the reliability standard depends on the quality management issues with an appropriate profit margin of up to 75%-80% of the overall growth (Wang and Khan, 2022). The problems with project failure likewise the planning for a “single Australian listing” is very important to understand the problem for a global standard of product equity status.

Analysis

Alongside, the problem identification, BHP needs to observe the market situation in the Australian context. The Australian competitive market scenario associates BHP to combat with other companies, such as – Newcrest Mining or Fortescue Metals.

Resolutions

According to the problem’s intensity and the market evaluation, BHP can search for a possible resolution. As per the problem, such as – market competition or low sales rate, the company can implement its operation strategies for resolving the reality-based problems in Australia or in the global sectors.

Testing

Examining the solutions, it is already the market researcher or the analyst from BHP formed needs to understand their relevance and the market projections. As per the grading system in “1-5 points” regarding the measurement scale analysis, BHP can confirm whether it can implement the solution in reality or search for some other options.

Measurement

The measurement of the search results and the necessary implementations with analysis of the real outcome can determine BHP’s market problems and resolve the challenges finally. The outcome can construct the efficiency of BHP and the related stakeholders with problem-solving power.

Standardization

According to the market analysis and effective re-growth of market concern, the associated outcome in the commercial construct, BHP can form a standard effect with actual critical thinking. The OS structure, HRM strategies, and statistical overview can contribute to the assessment.

“Supply Chain Management Issues” related to BHP

FY2021-2022 accelerated the SCM issues as per the practical market scenario of BHP in Australia. The factor is connected to the inflation rate or the Covid-19 pandemic globally. These social issues can affect the SCM with new strategic implementations in the mining industry as per the market demand (Lee et al. 2020). SCM has contributed to material scarcity, logistics, and demand forecast. The SCM framework for BHP can imply an RBV or “Resource-Based View” for understanding resource availability. As per the metallurgical assessment, BHP is completely dependent on the availability of metal ores (Mann et al. 2018). From the mining industry, BHP avails the metals and refines them according to the market trend. Therefore, the issues can be applied to the lack of labour force, defective technology, no advanced digital implementation, and lack of financial sources.

Therefore, the application of RBV theory is effective in this recent report. Alongside the tangibility-intangibility part, the VRIO framework of BHP has been analysed in the following table. BHP frequently associates with its strong commercial strategies. It is possible in the global sector with close reference to its origin country Australia (Bhandari, 2018). Therefore, the segmentations as per the VRIO analysis are projected hereunder. Different value propositions for understanding BHP’s market range are effective. Moreover, the association of market credentials are associated with rare constructions and the inimitable tendencies to mitigate the mining target analysis. Furthermore, suggestive interchanges are possible with organized resources.

VRIO Analysis

| V (Valuable)

● Brand image ● CSR or “Corporate Social Responsibility” ● Supplier relations ● Innovation strategies |

R (Rare)

● Problem-solving power ● Global expansion ● Risk management factors ● Adaptability of a global trend in the mining industry |

| I (Inimitable)

● Quality products ● Location ● Marketing experience and communication strategies ● Competitive cost structure |

O (Organized)

● Financial strength ● Technological innovations and advancements ● Skill training process for employees ● Financial investment |

Table 2: VRIO Framework for BHP Group

(Source: Self-created)

All the above-mentioned aspects regarding the QM and SCM as per the preferred context of BHP Group in the Australian mining industry associates the necessary interchanges in the global standard. The propositional changes as per the practical issues and the current challenges that establish a necessary context for OS adaptation create the necessary interchanges as per the possible market contributions (Hellwig and Huchzermeier, 2022). Generally, BHP completes its undertaken projects in the different strategic workforces and maintains the lean management programmes; still, the mitigated adaptation process can manage BHP with its IOM constructions. Henceforth, the VRIO and the “Six Sigma” analysis help in understanding the Australian market context in this present scenario.

4. Current issues

Figure 1 shows that in 2016 the revenue of BHP was a minimum of 29 million US dollars approx and it became a maximum in 2021 with 60.8 million US dollars. From 2012 to 2016, BHP’s total revenue is decreasing and from 2017 it again starts increasing (Statista.com, 2022). In 2021, the annual revenue of BHP group amounted to 60.8 billion US dollars in approx.

“BHP Group Company” is known as a Mining giant because of its popularity, and brand image worldwide but there are a lot of issues faced by BHP. BHP’s current issues are safety problems in coal mining, management problems, stakeholder problems, and others (Sierpińska-Sawicz, 2021). Safety issues in BHP include incidents of tragic mining, which create costly penalties to the company, death, and physical damage to workers. According to the report, curb injuries, and accidents due to mining increased by 5% in 2018 and it implies weak safety procedures of BHP. “Lower grade metallurgical coal” creates a barrier to getting investors and stakeholders and so it needs to maintain high quality (Freeburn and Ramsay, 2021). Hard work makes the workers engaged in smoking, and taking drugs and they are providing rehabilitation, which costs more for the company.

Figure 2 shows that the total assets of BHP are increasing a little from 2018 to 2021 and in June 2021 it amounted to 108.9 billion US dollars. This is a little increase of 3.2 billion US dollars from 2020 and in 2019 total assets was 100 billion US dollars (Statista.com, 2022). BHP’s assets in 2014 were 151.4 billion US dollars with the highest assets. Another issue is that Abandoned Thermal coal in BHP makes exit for investors and 48 workers have faced sexual harassment during working in the mine. The mining company faced “intense scrutiny” in treating women at isolated sites and also reported allegations of sacked workers (Wang and Khan, 2022). Large operations in unearthing minerals like iron ore create issues and lower the overall productivity and value of BHP. Another issue is BHP’s investors are too optimistic and the mining becomes overvalued due to it. The use of Operational strategy in “BHP Group Company” helps tofocus on the maximization of value and returns and developing options for securing success (Bhp.com, 2022).

Figure 3 shows that from 2019 to 2021 the brand value of BHP worldwide decreased gradually and in 2021 it again increased to 7.38 million US dollars. In 2017, BHP’s brand value was the lowest at 3.947 million US dollars and in 2021 it was its highest (Statista.com, 2022). 2021 represents the highest peak of the brand valuation of BHP. According to the workers, the management behaves rudely; BHP fails to maintain the work-life balance, which is another issue. Salary problems are another issue in BHP, many workers do not get competitive salaries after their hard work, and BHP should focus on it. The technological fault is another problem, which causes accidents in the coal mine and is unable to operate workers’ safety. BHP should use the portfolio to maintain track records, develop activities for secure success and keep employees safe (Hu and Walter, 2022). These possible risks in BHP need proper recommendations for mitigation.

Solution with recommendations

The BHP group needs to provide safety kits to workers, nominate safety measurements, and build strict policies to ensure the safety of workers’ lives (Verchagina et al. 2021). “BHP Group Company” needs to strengthen its management and build effective communication with its workers and stakeholders for a better outcome to achieve success. BHP should implement safety rules, measurements for women workers, and strict rules to lower the risk factors (Sheldon and Thornthwaite, 2020). Operational strategy is beneficial for BHP in enhancing employees’ efficiency, maintaining its department cooperation, optimization of the supply chain, and managing its resources. The operating model of BHP focuses on developing its diverse portfolio to drive its growth and its “specific strategic action” increases workforce connectivity and value chain helps to lower mining costs, enhances output, and increases the safety of workers (Saenz, 2018). BHP is a “British-Australian mining” company with a “leading global player” in the mining sector. Management of BHP should focus on keeping workers safe, enhancing market valuation, and generating cash flow.

5. Conclusion

The operational management and management policies of BHP help to manage threats, build sustainable development, create new opportunities and manage risks in mining. The study concludes with recommendations for mitigating future risks in BHP to maintain its operations effectively. BHP faces problems in transactions and operating exposure and this decline in its global demand by affecting the international market. The operational management motivates the employees of BHP in managing the workforce, enhancing productivity, and building effective collaboration with stakeholders. Operational Management enhances creativity, and innovative ideas and it is the key factor for contributing to success for BHP Company. This creates responsibility toward people, builds a competitive edge, and keeps the maintenance good for creating opportunities in the future. The entire report contextualizes the professional emerging policies for the IOM purpose of BHP Group in Australia. The association is effective in managing the mitigation plan as per the current issues and the resolutions put forward by VRIO analysis and the “Six Sigma framework”.

References

Argus, D. and Samson, D., 2021. BHP (I): Environment. In Strategic Leadership for Business Value Creation (pp. 431-441). Palgrave Macmillan, Singapore.

Freeburn, L. and Ramsay, I., 2021. An analysis of ESG shareholder resolutions in Australia. University of New South Wales Law Journal, The, 44(3), pp.1142-1179.

Hellwig, D.P. and Huchzermeier, A., 2022. Distributed ledger technology and fully homomorphic encryption: Next-generation information-sharing for supply chain efficiency. In Innovative Technology at the Interface of Finance and Operations (pp. 31-49). Springer, Cham.

Hu, H. and Walter, T., 2022. Dividend imputation taxes and the curious case of a price premium between BHP and Billiton American depositary receipts. Accounting & Finance.

Innis, S. and Kunz, N.C., 2020. The role of institutional mining investors in driving responsible tailings management. The Extractive Industries and Society, 7(4), pp.1377-1384.

Khan, S.A.R., Razzaq, A., Yu, Z. and Miller, S., 2021. Industry 4.0 and circular economy practices: A new era business strategies for environmental sustainability. Business Strategy and the Environment, 30(8), pp.4001-4014.

Laig, R.B.D. and Abocejo, F.T., 2021. Change Management Process in a Mining Company: Kotter’s 8-Step Change Model. Organization, 5(3), pp.31-50.

Lasrado, F., 2018. Achieving OrganizationalExcellenceA Quality Management Programfor Culturally Diverse Organizations. Palgrave Macmillan.

Lee, J., Bazilian, M., Sovacool, B. and Greene, S., 2020. Responsible or reckless? A critical review of the environmental and climate assessments of mineral supply chains. Environmental Research Letters, 15(10), p.103009.

Logan, A.S., 2018. Integrated ground management–An essential component of our licence to operate. In Rock Support and Reinforcement Practice in Mining (pp. 259-265). Routledge.

Mann, S., Potdar, V., Gajavilli, R.S. and Chandan, A., 2018, December. Blockchain technology for supply chain traceability, transparency and data provenance. In Proceedings of the 2018 international conference on blockchain technology and application (pp. 22-26).

Meney, K. and Pantelic, L., 2019, September. Designing for success: applying ecological criteria to restoration at BHP Beenup, Australia. In Mine Closure 2019: Proceedings of the 13th International Conference on Mine Closure (pp. 185-198). Australian Centre for Geomechanics.

Miklosik, A. and Evans, N., 2021. Environmental sustainability disclosures in annual reports of mining companies listed on the Australian Stock Exchange (ASX). Heliyon, 7(7), p.e07505.

Moran, M.E., Sedorovich, A., Kish, J., Gothard, A. and George, R.L., 2020. Addressing behavioral health concerns in trauma: Using lean six sigma to implement a depression screening protocol in a level I trauma center. Quality management in health care, 29(4), pp.218-225.

Norrish, R., Lyon, B., Russell, W. and Price, G., 2019, September. Engaging stakeholders to achieve rehabilitation completion: a case study of the BHP Beenup Project. In Mine Closure 2019: Proceedings of the 13th International Conference on Mine Closure (pp. 1423-1436). Australian Centre for Geomechanics.

Nusinov, V., Ishchenko, M. and Polishchuk, I., 2020. Development of strategic guidelines for mining enterprises in the management of their business activities. Technology audit and production reserves, 6(4), p.56.

O’Donnell, R. and Kessler, R., 2018. Quality improvement, performance management, and outcomes: Lean Six Sigma for integrated behavioral health. In Training to Deliver Integrated Care (pp. 79-101). Springer, Cham.

Omah, P.C. and Horsfall, K.A., 2022. COST CONTROL PRACTICES AND CORPORATE PERFORMANCE OF MANUFACTURING COMPANIES IN RIVERS STATE. BW Academic Journal, 1(1), pp.7-7.

Saenz, C., 2018. The context in mining projects influences the corporate social responsibility strategy to earn a social licence to operate: A case study in Peru. Corporate Social Responsibility and Environmental Management, 25(4), pp.554-564.

Samson, D., 2021. BHP (E): Rejuvenation and Renovation Towards a New Century. In Strategic Leadership for Business Value Creation (pp. 331-351). Palgrave Macmillan, Singapore.

Scheltus, B., Guerin, T. and Pears, A., 2021. Is there a role for not‐for‐profit or for‐purpose organizations in supporting governance professionals to engage with climate‐related opportunities and risks?. Environmental Quality Management, 30(3), pp.5-15.

Sheldon, P. and Thornthwaite, L., 2020. Employer and employer association matters in Australia in 2019. Journal of Industrial Relations, 62(3), pp.403-424.

Siegrist, M., Bowman, G., Mervine, E. and Southam, C., 2020. Embedding environment and sustainability into corporate financial decision‐making. Accounting & Finance, 60(1), pp.129-147.

Sierpińska, M. and Kowalik, M., 2021. The role of net working capital in the financing of the operating activities of mining companies. Inżynieria Mineralna, 1(1), pp.123-128.

Sierpińska-Sawicz, A., 2021. Liquidity measurement problems in mining companies. Inżynieria Mineralna

Toke, L.K. and Kalpande, S.D., 2021. Strategic planning to investigate the decision index of organization for effective total quality management implementation–in context of Indian small and medium enterprises. Journal of Engineering, Design and Technology.

Verchagina, I., Kolechkina, I. and Grigashkina, S., 2021. Environmental aspects of the interaction of mining companies with the local community. In E3S Web of Conferences (Vol. 315, p. 04010). EDP Sciences.

Wang, Y. and Khan, I., 2022, May. From mining to fishing–how blockchain is addressing different challenges of supply chain in Asia. In East Asia Forum. Australian National University.

Wang, Y. and Khan, I., 2022, May. From mining to fishing–how blockchain is addressing different challenges of supply chain in Asia. In East Asia Forum. Australian National University.

Websites

Bhp.com, Our products help build a better, clearer future, Viewed on 06/08/2022, https://www.bhp.com/

Bhpgroup. 2022. [online] Available at: <https://www.bhp.com/> [Accessed 6 August 2022].

Statista.com, BHP’s revenue from 2005 to 2021 (in million U.S. dollars)*, Viewed on 06/08/2022, https://www.statista.com/statistics/264182/bhp-billiton-revenue-since-2004/

Statista.com, Brand value of BHP worldwide from 2015 to 2022, Viewed on 06/08/2022, https://www.statista.com/statistics/1261710/brand-value-of-bhp/

Statista.com, Total assets of BHP from 2010 to 2021*, Viewed on 06/08/2022, https://www.statista.com/statistics/669410/bhp-billiton-total-assets/

Statista.com. 2022. [online] Available at: <https://www.statista.com/> [Accessed 6 August 2022].

………………………………………………………………………………………………………………………..

Know more about UniqueSubmission’s other writing services: