BMG 625 PESTLE ANALYSIS OF ALLIANCE TRUST PLC.

Introduction

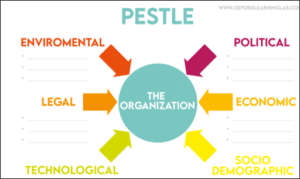

Alliance Trust is one of the powerful companies in the industry of investment and financial service. This company has successfully executed business all over the world, which has created a strong brand image of this company in the global market. This company helps the investors to grow their capital by giving assistance to raise their income. In this essay, the macro analysis of this company is going to be done by incorporating PESTLE analysis. PESTLE analysis will help to evaluate some areas such as political, economic, social, technological, legal and environmental. This PESTLE analysis will be very helpful in order to identify the potential threats and opportunities in the UK market. This will be beneficial for the company to take effective steps to mitigate risks and expand their business.

PESTLE analysis of the Organization

Political factors

Political factors play an important part in part in order to identify the factors that can affect the long-term profitability of the Alliance PLC trust company in the UK market. The political factors covered some areas such as political stability, taxation, level of corruption, and antitrust laws associated with this industry. The political stability is the strong factor of this country. Even, UK also tries to maintain cordial relations with other powerful countries to avoid unnecessary inconvenience from others (Christodoulou and Cullinane, 2019). The level of corruption is comparatively controlled in the UK. The government with stringent laws and regulations has controlled financial sectors. According to UK policies, around 19% trading profits are considered as tax that need to be paid by companies. In the UK, anti-competitive and anti-trust business are prohibited. According to competition Act 1988, under the articles 81, 82 of the EC treaty, these laws determine the prohibition of anti-competitive agreements between businesses (Achinas et al. 2019). The antitrust laws also allow the companies to have fair competition and protect the investors from any kind of unfair practices in business. Excessive political interference led to a financial crisis in the investment and financial services industry. Even, political crisis due to the Brexit has also affected the financial and banking sectors. Apart from that, stringent regulation can also hamper the trade investment business. Therefore, this can be considered that there are both positive and negative aspects of the political factors in the UK industry. Alliance Trust PLC should consider all these factors and implement effective steps to identify any potential threats existing within this financial services and trade investment industry.

Figure: PESTLE Analysis

(Source: David, 2019)

Economic factors

Economic factors play a pivotal part that determines some major areas of the UK industry. The UK is the fastest growing economy by its nominal GDP. The financial sector plays a crucial role in the UK economy. As per the reports of House of Commons library, it has contributed around 134 billion pound in the UK economy in the year of 2019. Due to the pandemic situation, the GDP got lower in 2020 at the rate of 2%. In 2021, the GDP of the UK will be 3.12 trillion which rank fifth in the global economy. Along with that, The UK is also a powerful country in terms of having foreign direct investment (FDI). Many business organizations from around the whole world have invested in several industries in the UK. This has increased the capital of the UK economy. Massive growth in business also instigates people to invest more in investment companies. The wage of the people increases every year with good percentile (David, 2019) .The income of the people is decent and that helps them to maintain a healthy lifestyle. This also encourages people from different backgrounds to invest more in trade investment organizations for better capital growth. The current corporate tax rate of the company is 19%.This has also been identified that the Bank of England has also provided around 100 billion into the economy in the year 2020. This contribution has helped the economy to fulfil the gap in the economy. The diverse economy is also one of the reasons that has helped the country enrich the economy (Shalhoub et al. 2019). The diverse economy also has also allowed the investors to expand their business in the competitive market. It also encourages people to invest more for their financial growth . In addition to that, the inflation rate did not grow over 2%. These economic factors have made it easier for the Alliance trust Plc to analyze potential opportunities and threats of the industry in the UK. Economic factors will also help the company to make effective changes in organizational structure for better growth in business.

Social factors

Social factors play an integral part that helps to evaluate the macro environmental situation of the UK. The UK is one of the biggest consumer markets in the global market. The population of the country is 68 million. The income level of the country is comparatively high , compared to other powerful countries. The unemployment rate in the UK is 4.8% and the inflation rate is 2%. Therefore, this can be considered that the convenient lifestyle of people has encouraged them to invest more in investment farms to get high returns. It has been identified that the people influence the lifestyle of the people in the UK. Diverse multicultural environment can also be seen in this country. The people in the UK are very much keen on enriching their financial growth by investing more on trade investment organizations and stock exchange markets. The investment and financial services industry is in high flux because of the huge earning sources of the people living in the UK (Walsh et al. 2019). Standard living style, growing population, diverse business culture, and lower unemployment rate are the main areas of the social factors. Even, cordial relationships with powerful business organizations also motivates investors to invest more in different financial sectors to gain huge returns. This social factor will be very beneficial for Alliance Trust PLC Company to evaluate potential popular and implement ideas to expand their business in a sustainable way in the UK market.

Technological factors

Technological factors play an important role in the Uk market of Alliance pl8c trust company. It is one of the most up-to-date countries in the world. London is the focal point of technological institutions and both financial. Day by day technologies is developing to offer the upgraded satisfaction of customers. According to Lember et al. (2018), upgraded business ideas are implacable for the new businesses personality to do marketing in the Uk. In the UK economy, the most powerful sector is Technology. Young talents and freshers are focusing on these genres and circulating the businesses across the globe. Though the UK is going forward day by day. Another important point is the development and research for the company. From where companies get new motivation and new ideas. For a company, the general problem arises when future benefits are researched with unknown pros and cons. Alliance plc trust company also follows some accounting measures to record their assets and materials. According to Adicic and Pinto, (2019) another technological factor is to buy computer software that is only for one purpose not usable for future applications. Indirect costs also hampered the company’s expenses. Tangible assets are also an impeccable fact of technology; these assets are also for a specific purpose. The cost is also incurred. There is a good deal of internal competition to invigorating growth. More innovative skills, qualities are needed in technological factors. There should be expertise in science and It.

Legal factors

Legal factors Play a pivotal part in the pestle analysis of the Uk. There is an uncertain factor that the difference between political and legal factors of the specific company. Legal factors led to the legal forces that a business person can do or not. Legal factors following some specific guidelines like Industrial Regulation, Licenses & Permits, Labor laws, Intellectual properties. Under this act, many other segments also available are maternity and paternity leave, holiday pay, minimum wage, sick pay, and some other rights also provided. An act was passed in 2010 to stop discrimination i.e., Equality Act to fight against gender, colour, or any other differences. According to Kleffner, (2019) a business follows some legal factors like tax restrictions, inflation costs, export restrictions. Basically, the important factor is to maintain the worker’s rights. Another discrimination happens when experts of university scholars assist in pestle analysis that many fashion retailers who sew clothes are from Asian countries. So, they dumped such a brand of Asia. According to Eu LaboIr Law, a worker can work for 48 hours a week. A rest of 11 hours in each 24-hour period. The UK allows workers who can work for more than 48 hours not on a direct payroll but with the help of the European Working Time Directive. Many changes occurred with the laws to remodify the workers’ beneficial parts. There are some legal factors that hampered the business-like Pyramid scheme legality, Employment law, Copyright law, Fraud Law. Legal factors are essential for the company to follow for its own benefits. Any law can save the company from losing prestige in front of the country.

Environmental Factors That Impact Alliance Trust Plc

To analyse the macro environment of the organization, Alliance Trust Plc PESTEL analysis is a skilful tool. PESTEL stands for – Political, Economic, Social, Technological, Environmental & Legal factors that impact the macro environment of Alliance Trust Plc.

Any changes in the macro-environment factors can have a direct impact on not only the Alliance Trust Plc but also can impact other players in the Financial Services. Individual firms can also be impacted by any changes. PESTEL analysis gives much detail about operating challenges Alliance Trust Plc will face in a dominant macro environment other than competitive forces. For example, an Industry may be highly profitable with a strong growth strategy but it won’t be able to achieve it if it is situated in an unstable political environment.

Political factors can impact Alliance Trust Plc’s long-term profitability in a certain country or market. Alliance Trust Plc runs Financial Services in more than dozen countries and exposes itself to different types of political environment and political system risks. They achieve success in such a dynamic Financial Services industry across various countries to diversify the systematic risks of the political environment.

Inflation rate, savings rate, interest rate, foreign exchange rate and economic cycle which are the macro environment factors, determine the aggregate demand and aggregate investment in an economy. Alliance Trust Plc can use the country’s economic indicators such as Financial Services industry growth rate, consumer spending etc. to forecast the growth of the organization.

Society’s culture and way of doing things also plays an important role in the culture of an organization in an environment. Abbas et al. (2019) mentioned that shared beliefs and attitudes of the population play a great role in how marketers at Alliance Trust Plc will understand the customers of a given market and how they design the marketing message for Financial Services industry consumers.

A firm should not only do technological analysis of the industry but also the speed at which technology disrupts that industry. Slow speed will give more time while fast speed of technological disruption may give a firm little time to cope and be profitable.

In many countries, the legal framework and institutions are not robust enough to protect the intellectual property rights of an organization. Amir et al. (2018) said that a firm should carefully evaluate before entering such markets as it can lead to theft of the organization’s secret sauce thus the overall competitive edge.

Various markets have various environmental standards which can impact the profitability of an organization in those markets. Even within a country often states can have different environmental laws and liability laws. For example, in the United States – Texas and Florida have different liability clauses in case of mishaps or environmental disaster. Similarly, a lot of European countries give healthy tax breaks to companies that operate in the renewable sector. The environmental risk score of Alliance Trust Plc is 3.8. According to Jang and Kim, (2018) over the past decade the concept of sustainable development has expanded from economic growth, environmental protection and social equity in business planning and decision making.

Before entering new markets or starting a new business in an existing market the firm should carefully evaluate the environmental standards that are required to operate in those markets. Some of the environmental factors that a firm should consider beforehand are -Weather, Climate change, Laws regulating environment pollution, Air and water pollution regulations in Financial Services industry, Recycling, Waste management in Financials sector, Attitudes toward “green” or ecological products, Endangered species, Attitudes toward and support for renewable energy etc.

Conclusion

The detailed analysis of the organization has helped to identify some strength factors which can help in gaining higher organization’s profits. Political, economic, social, technological, environmental and legal factors play an important role in the macro environment of Alliance Trust Plc. There are also some threats found in the study such as lack of supply regularity, pandemic situation, lack of skilled workers, different types of environmental changes etc. But some opportunity factors had provided information about the future requirements for the company which can help them to mitigate risks and gain their success.

Reference list

Achinas, S., Horjus, J., Achinas, V. and Euverink, G.J.W., 2019. A PESTLE analysis of biofuels energy industry in Europe. Sustainability, 11(21), p.5981.

Christodoulou, A. and Cullinane, K., 2019. Identifying the main opportunities and challenges from the implementation of a port energy management system: A SWOT/PESTLE analysis. Sustainability, 11(21), p.6046.

David, J., 2019. PESTEL analysis of the UK. Retrieved October, 30, p.2019.

Perera, R., 2017. The PESTLE analysis. Nerdynaut.

Shalhoub, J., Marshall, D.C. and Ippolito, K., 2017. Perspectives on procedure-based assessments: a thematic analysis of semistructured interviews with 10 UK surgical trainees. BMJ open, 7(3), p.e013417.

Walsh, K., Bhagavatheeswaran, L. and Roma, E., 2019. E-learning in healthcare professional education: an analysis of political, economic, social, technological, legal and environmental (PESTLE) factors. MedEdPublish, 8.

Lember, V., Kattel, R. and Tõnurist, P., 2018. Technological capacity in the public sector: The case of Estonia. International Review of Administrative Sciences, 84(2), pp.214-230.

adicic, D. and Pinto, J., 2019. Collaboration with external organizations and technological innovations: evidence from spanish manufacturing firms. Sustainability, 11(9), p.2479.

Kleffner, J.K., 2019. The Legal Fog of an Illusion: Three Reflections on” Organization” and” Intensity” as Criteria for the Temporal Scope of the Law of Non-International Armed Conflict. International Law Studies, 95(1), p.5.

Abbas, J., Mahmood, S., Ali, H., Ali Raza, M., Ali, G., Aman, J., Bano, S. and Nurunnabi, M., 2019. The effects of corporate social responsibility practices and environmental factors through a moderating role of social media marketing on sustainable performance of business firms. Sustainability, 11(12), p.3434.

Amir, R.M., Burhanuddin, B. and Priatna, W.B., 2018. The Effect of Individual, Environmental and Entrepreneurial Behavior Factors on Business Performance of Cassava SMEs Agroindustry in Padang City. Indonesian Journal of Business and Entrepreneurship (IJBE), 4(1), pp.1-1.

Jang, S.M. and Kim, K.I., 2018. The Effects of the Environmental Factors for ICT adoption on Globalization capabilities and business performance of SMEs. Journal of Convergence for Information Technology, 8(4), pp.219-224.

Know more about UniqueSubmission’s other writing services: