01 Advances In IT Banking Assignment Sample

Here’s the best sample of 01 Advances In IT Banking Assignment, written by the expert.

Introduction

The nation economy has been largely dependent on the banking sector dependent to fulfil the capital needs for economic growth and raise capital in equity and debt markets. Many banks have generated good profits from the recovering economy owing to high interest rates on loans. The information asymmetry has an established incidence in the banking industry (Hollmayr and Kühl, 2016). It has also become a deciding factor of interest rates and its effects results in adverse selection and moral hazard that are unfavourable to banking sector.

The purpose of this essay is to analyse how the information technology revolution in baking sector mitigates the issues related to asymmetric information. This essay also contributes to identify how advance in information technology reduces the impact of information asymmetry and its related affect on pricing strategies and regulatory framework and market competition in the banking sector.

Economics of Imperfect information

Imperfect information can be referred to as incorrect and missing information that negatively impacts a buyer or sellers decision making process due to unknown facts. Thus, in real transaction imperfect information leads to a situation where the buyer-seller parties have different information and one of the parties has more information than the other. For instance, seller may have more familiarity and better information about a product or service features, specifications and quality than the purchaser/buyer that has less experience and knowledge. This leads to misunderstanding about a commodity good or basic product or services and the buyer do not understand the true benefits or costs derived from a product. This is also leads uncertainty about benefits and cost for products that require complex information. In some cases, the imperfect information occurs when buyer and seller have different information about same product/service (Neri and Ropele, 2012). Thus, the imperfect information may cause market failure and do not provide competitive advantage. This informational disparity when one party has more and better information relative to other is also known as asymmetric information. Thus, asymmetric information in transactions among the economic representatives may lead to adverse selection and moral hazard (Hollmayr and Kühl, 2016). This takes place when the buyer and seller are subjected to different prospects of a same happening taking place where the agent that has the superior information has an advantage. Under the moral hazard, the advantage takes place prior to the agreement which also alters the behaviour of agent as a result of its advantage position. This highlight situation where one party makes the decision regarding quantity of accepted risk when other party will bear the cost in negative circumstances (Klein et al., 2016).

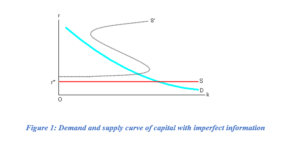

Asymmetric information in banking sector has been a problem in banking in terms of borrowers and lenders where borrowers have informed information about the economic condition than lender. Thus, lender faces difficulty in deciding about loan repayment. The lender seeks to look about borrower past credit history to judge about the credit risk and evidence of consistent income. Thus, lender has limited information so as a result, the lender may charge high interest rates to compensate additional risk. However, in presence of perfect information, banks or lending institution would not have charged risk premium (Roberts, 2015). At the same time, perfect information is not realistic as the borrowers or buyers tend to have better information and well informed about the goods or for making any investments than the seller or lenders. Thus, it can be noted that this information asymmetry and inability of other party to monitor the prospective buyers may lead to agency cost that increases the cost of outside financing. Thus, under the situation of imperfect information, the capital is available at an increased real interest rate. This will affect the supply curve that will be positively sloped at a point when outer financing rises which points that capital supply will not be infinitely elastic in a small open economy. The high dependence on outside financing would lessen the borrower equity stake and provide motivation to involve in high risk investments for more incentives and increases possible losses of lenders arising from adverse selection (D’Aurizio et al., 2015). To balance for risks, the lenders demand a superior rate of return. Also, the capital supply curve might be downward sloping as increase in interest rate may reduce funds supply from lenders as shown in below figure. The supply curve backward bend when interest rate maximises lenders expected rate of return and beyond that point lender will not loan funds as adverse selection would increases the chances of getting credit risk for non-repayment of loan.

Impact of Asymmetric information issues in banking sector

The impact of asymmetric information concerns outlines the organizations, rules and regulation presiding over the industry as well as the pricing strategies. According to Klein et al. (2016), the asymmetric information lead to problems of during closing transaction (adverse selection) and after transaction closure (moral hazard). The banks have uncertainty about the borrowers’ repayment and their creditworthiness which affects the decision of credit allocation in the loan market. The presence of asymmetric information banks affects the development of policies for allocation of credit and economic development with objective to lessen the inefficiencies. Moreover, the effect of asymmetry information in areas of areas of financial intermediates and markets has created needs for supervision and regulation of the banking system. Thus, regulation forms an important element of an all-inclusive information asymmetry. The information required to deal with asymmetric information issues comes at a cost that forms an endogenous barrier that restricts the entry of market entry of new firms by established banks. This causes competitive imbalance due limitation to market entry the where new firms compete with increased risk for in search of higher profit that eventually causes systemic market failures. Also, changes in regulatory structure of banks has enhanced liberalised structure that affected its spread of its branches caused less competition where the smaller banks were pressurised to move out of business or merge to form conglomerates (Berger et al., 2011).

The bank riskiness affects the pricing strategies of bank in terms of loan pricing associated with high interest rates. The high pricing impacts the bank profitability rate. It can be stated that the banks differentiate from its rivals by setting its product prices and related interest rates. According to Lambert et al. (2011), the increase in interest rate also affects the borrowers’ composition. The less risky one will withdraw therefore it would lessen the pool of borrowers of high prices. Thus, in response to this the bank may decrease its interest rate and lowers its marginal revenue to improve pool of borrowers and gain market share. On the other hand, banks require market power to cut down its prices as a retort to high adverse selection. At the same time, it can be noted that the banks would be required to charge high prices when adverse selection is rigorous under a perfectly competitive market where the prices equals the average costs (D’Aurizio et al., 2015). In addition to this, the reduction in information asymmetry and the bank choice to engage in spatial price discrimination in lending practices by gathering information about the position/place of the borrower. It also includes information about distance of borrowers from its rival bank and lending bank for spatial price discrimination. Thus, geographical credit rationing is a response of bank towards information asymmetry as per spatial rationing theory of information asymmetry (Fernandes and Artes, 2016).

Advances in information technology (IT) to improve asymmetric information issue in banking sector

The investment in information technologies in banking sector improved the bank performance by reducing the transactions and operating costs and problems associated with asymmetric information. The assess to better technology has improved the processing of information and lower the cost of accessing information thus, reduced the risk of information leakage. According to Gao and Zhu (2015)., the information technology advances has improved ability of banking institution to process information has resulted in decrease in competition in the banking markets. Thus, the markets have become less competitive due to such improvements as it has broaden the gap among rival firms who invest resources in obtaining information with firms who do involve in such activity (D’Amato. and Dijkstra, 2015). However, it is also argued that information technology has provided new ways to banking firms to compete with its rivals in a more effective way. Thus, it can be said that the advances in information technology have impacted the competition in varied ways in the banking sector. The information revolution is altering the industry structure by modifying the competition rules. It has also initiated new business from a firm existing business operations and has offered competitive advantage to the firm to discover new ways to perform better that its competitors.

The information technological progress enables that buyer-seller has equal information and knowhow about product/services. This is due to better provisions of information for product/services prices, quality, attributes and performance and nature of transactions. The availability of information from different sources and in cost effective way is coping with issue of moral hazard to a certain extent (Berger et al., 2011). This reduces the chances of more informed party to take information advantage in a fraudulent manner.

At the same time, information technological growth has also facilitates the information dissemination where market participants monitor information collected which makes the used information less costly. According to Ferri et al. (2014), easy access to information has impacted competition and grind downs bank rents and assisting borrowers keep away from limited information by informed intermediaries. Faster information dissemination has increased level of competition among banking institutions for lending and has been advantageous for borrowers to seek lower interest rates. This has increased bank return and incentives by reducing information asymmetry due to acquisition of information and lower screening cost of borrowers.

Alleviation of information asymmetry impact on future of banking sector

The consideration for informational consideration will holds relevance to is essential determine the competition level, pricing strategies and profitability of banks services and products to a greater extent in upcoming years. The lessening of information asymmetry with the help of technological innovation and progress will influence the ease of information availability and dissemination. Also, information technology improvements will ease out collection, storage and dissemination of information. The lending decision of bank can become less profitable relative to other non-banking entities in the market (Trönnberg and Hemlin, 2014). This can be possible due to increase in peer-to-peer lending and online lending providers. However, information technologies can also create interrelationships among the banking, insurance, and brokerage industries through mergers. This will impact the banking industry by changing the nature of competition in the information sensitive banking and financial markets. It can be said that mitigation of information asymmetry by information technology advancement will largely impact the competition in this sector. Also, the competition in banking industry will be high as new competitors like Bitcoin and other crypto currencies and PayPal with innovative information alters the nature of money/cash transactions and market structure (D’Aurizio et al., 2015). Apart from this, information technologies advance will demand large investments from the banking sector in area of hardware and software that acts a barrier for new banks to enter. For instance, banks differentiating its cash management services would need technological advanced and innovative software for its customers and corporate clients to fulfil their informational needs and online information of respective accounts.

Conclusion

It can be summarised that information asymmetry is an influencing factor in decision making process of lenders and borrowers towards a loan contract. Information asymmetry has led to issues in banking sectors i.e. adverse selection and moral hazard. This has led to demands of premium risk and impacted the industry structure, pricing strategies and completion level among banking markets. Advances in information technology impact the competition by offering competitive advantages and allow differentiation to outperform its competitors. Thus, improvements in information asymmetry would ease the ease of information availability, storage and dissemination, create interrelationship with other financial service providers and change the nature of competition in banking industry in upcoming years.

References

Berger, A. N., Espinosa-Vega, M. A., Frame, W. S., & Miller, N. H. (2011). Why do borrowers pledge collateral? New empirical evidence on the role of asymmetric information. Journal of Financial Intermediation, 20(1), 55-70.

D’Amato, A., & Dijkstra, B. R. (2015). Technology choice and environmental regulation under asymmetric information. Resource and Energy Economics, 41, 224-247.

D’Aurizio, L., Oliviero, T., & Romano, L. (2015). Family firms, soft information and bank lending in a financial crisis. Journal of Corporate Finance, 33, 279-292.

D’Aurizio, L., Oliviero, T., & Romano, L. (2015). Family firms, soft information and bank lending in a financial crisis. Journal of Corporate Finance, 33, 279-292.

Fernandes, G. B., & Artes, R. (2016). Spatial dependence in credit risk and its improvement in credit scoring. European Journal of Operational Research, 249(2), 517-524.

Ferri, G., Kalmi, P., & Kerola, E. (2014). Does bank ownership affect lending behavior? Evidence from the Euro area. Journal of Banking & Finance, 48, 194-209.

Hollmayr, J., & Kühl, M. (2016). Imperfect information about financial frictions and consequences for the business cycle. Review of Economic Dynamics, 22, 179-207.

Klein, T. J., Lambertz, C., & Stahl, K. O. (2016). Market transparency, adverse selection, and moral hazard. Journal of Political Economy, 124(6), 1677-1713.

Lambert, R. A., Leuz, C., & Verrecchia, R. E. (2011). Information asymmetry, information precision, and the cost of capital. Review of Finance, 16(1), 1-29.

Neri, S., & Ropele, T. (2012). Imperfect Information, Real‐Time Data and Monetary Policy in the Euro Area. The Economic Journal, 122(561), 651-674.

Roberts, M. R. (2015). The role of dynamic renegotiation and asymmetric information in financial contracting. Journal of Financial Economics, 116(1), 61-81.

Trönnberg, C. C., & Hemlin, S. (2014). Lending decision making in banks: A critical incident study of loan officers. European Management Journal, 32(2), 362-372.

________________________________________________________________________________

Know more about UniqueSubmission’s other writing services: