BMG704 MSc International Business Sample

1. Introduction

Microsoft is referred to as a multinational company that deals in the technology industry. As per the further details, it is opined that Microsoft‘s headquarter is located in Redmond Washington and it is also referred to as a multinational firm that operates in the territorial region of America. The company is further known for its software commodities, operating systems, internet explorer, the Microsoft Office suite, and Edge web browsers. Along with that, it has also been determined that Microsoft is one of the largest vendors of computer software in the entire world. Apart from that it is determined that Microsoft is one of the leading providers of video games, online searches, computer and gaming hardware, cloud computing services, and other online services (Microsoft. com, 2023).

Furthermore, it is articulated that the in last two years the financial condition of the company has enhanced to a great extent. As per the analysis, it is opined that in the year 2020, the revenue earned by the firm was $ 143,015, whereas, according to the 2021 and 2022 annual reports it is identified that the revenue earned by the company stands at $168,088, and $198,270 respectively (WSJ. com, 2023). It is further determined that the main purpose behind the maintenance and creation of this project is to determine the recent developments done by Microsoft and its impact on the financial stability of the company. Along with that the paper also discusses the financial sources and dividend policy implemented or utilized by Microsoft to attain its goals and objectives in the marketplace. On a further note, the ratio analysis method has also been implemented ion the further content to provide a brief knowledge in context to the financial position of Microsoft.

2. Section A: Identification of the two recent developments in the international business environment

2.1 Development one: Machine Learning (ML) and Artificial Intelligence (AI)

In accordance with the further interpretation it is opined that ML and AI both were invented by other companies but Microsoft developed the two Softwares to make the activities of the business entities easier (Mitić, 2019, p. 476). It is further also determined that in the last 2 years, ML, as well as AI, have been considered the frontrunners as per the implementation of cloud computing. The increased utilization of AI and MI in the last two years is all due to the development or improvement made by Microsoft in both the software.

The main reason that has been identified behind the initiation of such a development was to improve the method of performing the business operations and activities easier and more flexibly. In other words, it can be said that the development step was initiated by the business entity to bring out flexibility in the business activities and to enhance the productivity and efficiency of the business organization (Ulas, 2019, p. 666). Further, from the analysis, it is determined that in the last two years, the software has further enhanced the productivity of the company. Along with that, it has also derived two more benefits such as the deliverance of the commodities on the time, and the reduction in the restraints of the prominent resources of the company.

Further, it is also notified that Microsoft Azure is considered one of the leading cloud computing-based platforms in the entire world and it owns around 76% of the market share (Chak and Rana, 2021, p. 77). It is further also articulated that the company is looking further to introduce an end-to-end platform for machine learning services as per the suggestion of the current trends. Microsoft Azure is further notified as the trending technology which is expanding its offerings beyond the storage of the cloud massively (Hassan et al. 2019, p. 316). As per the given details, it is determined that Microsoft is referred to as the most enduring superstar in the technological industry.

Due to its developments in technology, the market capitalization of Microsoft has been enhanced. Additionally, it is also noted that the development has created a positive impact on the financial condition of the firm as its market capitalization in the year 2022 of Microsoft stands at $1.91 trillion. Among all the business entities around 70% of firms implements Microsoft Azure for their cloud services. Apart from that it is also noted that more than 95% of firms trust Microsoft Azure (investing. com, 2023). Therefore, concerning the given information it is determined that the development has created a positive impact on the overall business industry.

2.2 Development two: Microsoft 365 Copilot

Another artificial intelligence that is invented by Microsoft is 365 Copilot which is also referred to as a generative artificial intelligence (AI) technology based on GPT-4. As per the chairman and CEO of the company with the help of Microsoft 365, the firm is providing its people or users more agencies (Othman et al. 2019, p. 872). Apart from that it is also noted that the firm is making the utilization of technology more accessible by advancing AI software. It is further noted that the implication or introduction of Microsoft 365 Copilot has made it easier to make the corporate meeting presentation as well as essential institutional projects.

Concerning the findings and the provided details it is opined that the development made by Microsoft has not only created benefits for the business organizations. Along with that, it has also made the work of the students easier as due to the implication of 365 Copilot it has become easier for the students to make the school project presentation (Flyvbjerg, 2021, p. 542). Apart from that it is also perceived that with the help of 365 Co-pilot the users can easily draft a PPT sample on an existing written document. As per the company it is determined that the technology is introduced to make the procedure of creating a presentation simpler and to promote authenticity and reliability in the presentations.

As per their sayings, 365 Copilot can easily create simple decks including authenticated sources and speaker notes. Based on the further findings and interpretation it is advocated that the introduced technology or software can further draft the responses along with the summarization of the emails. It further obliges the users to unlock productivity, unleash creativity, and up level skills and capabilities (Microsoft. com, 2023). The main motto of the company behind the introduction of 365 Copilot is to introduce a new method of performing work in the corporate sector and to turn the words that are used by the employees while making presentations into the most powerful and productive tool of the entire planet (Engadget. com, 2023). As per the analysis, it is opined that the introduction of such an improvement has created a positive impact on the financial position of the company as the market share and revenue margin of the company are increasing abruptly. It is further perceived that the development has created a positive impact on the overall business activities and its financial position.

3. Section B: Dividend Policy and Sources of Finance

3.1 Discussion and Identification of the dividend theory of

According to the findings and interpretation, it is analyzed that the dividend policy that is implemented or used by Microsoft is the annual forward dividend. Along with that, it is also advocated that the firm pays a quarterly dividend of $0.68 per share. The current dividend yield that is paid by Microsoft is determined to be 1.27% which can further be referred to as $3.22 per Annual dollar dividend payment (indmoney. com, 2022). It is further advocated that most of the business entities dealing in the technology industry and services do not pay off the dividend. On the other hand, it is also ordained that Microsoft Corporation pays off its dividend to give its shareholders rewards.

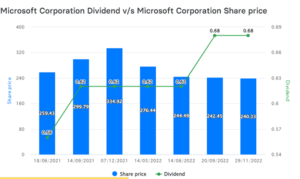

Figure 1: Statistical representation of share price of Microsoft corporation v/s It dividend

(Source: indmoney. com, 2022)

As per the given statistical image it is opined that the dividend of the company has enhanced abruptly. On the other hand, the image further entails that the rate of dividend has increased from 0.62 to 0.68 in 3 months. Based on the accumulated details it can be said that the increasing rates of dividends indicate that the cash flow statement of the company has improved (Widyasti and Putri, 2021, p. 272).

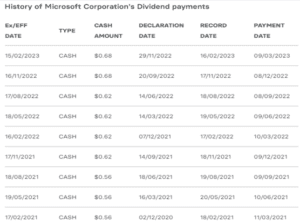

Figure 2: Dividend history of Microsoft Corporation

(Source: indmoney. com, 2022)

As per the analysis of the given dividend history and the policy that is used by the company to enhance its performance of the company it is identified that the dividend rates of the firm in the last three years have enhanced. In accordance with the accumulated information, it is advocated that the increasing dividends signify the improved financial performance of the company (Abdeldayem and Dulaimi, 2019, p. 463). As per the given image, it is further identified that in the year 2019, the number of dividends was 0.51 whereas; in the year 2020 it was notified to be 0.56. On the other hand, in the years 2021 and 2022 the amount of dividend is evaluated or determined to be 0.62 and 0.68.

The present dividend of the firm also stands at 0.68. In other words, it can be said that the dividend amount has enhanced abruptly which further indicates the company would attain expansion and growth in the mere future. Moreover, according to the accumulated details, it is noted that the dividends further indicate or represent the profits that are paid to the potential investors or shareholders of the business entity. Another reason that has been articulated behind the increasing dividend of the company is to shift the strategy of the company from growth to expansion (Sholichah et al. 2021, p. 888).

3.2 Sources of funding

Debt capital

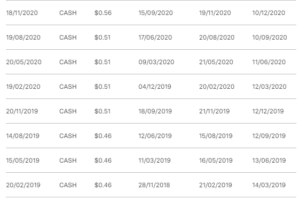

Figure 3: Debt capital of Microsoft

(Source: macro trends. net, 2023)

In the last three years, the debt capital of Microsoft is determined to be 0.19. As per the ending quarter it is also perceived that the long-term debts of the firm are evaluated or determined to be $44.119B which further signifies the reduction in debt capital by 8.58%. In the year 2021, the debt capital of the firm was $50.074B (macro trends. net, 2023). In accordance with the given details and further analysis, it is noted that in the last three years, the reduction in debt capital has been noticed.

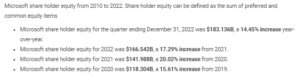

Equity financing

Figure 4: Equity financing of Microsoft

(Source: macro trends. net, 2023)

The annual shareholder equity of Microsoft is determined to be enhanced as per the interpretation of the last few years’ equity status and data set. As per the analysis, it is perceived that in the year 2022, the holdings of equity financing of the firm have enhanced by 14.45%. Moreover, it is also articulated from the given image that in the year 2021 the equity financing funding source of Microsoft signified the enhancement by 17.29%. The increasing equity further indicates the increased financial or funding source of the firm which further indicates the higher ability of the company to meet its obligations with the help of funding (Akbar et al. 2022, p. 105).

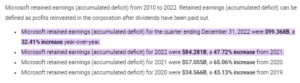

Retained earnings

Figure 5: Retained earnings of Microsoft

(Source: macro trends. net, 2023)

The interpretation of the given image states that the retained earnings of the company indicate an accumulated deficit. As per the interpretation, it is noted that the retained earnings of the firm also indicate enhancement. In the year 2021, the retained earnings of the company indicate an enhancement of 47.72% (macro trends. net, 2023).

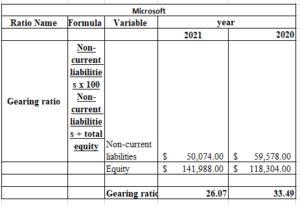

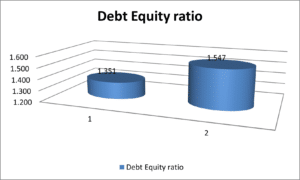

3.3 Gearing ratios of Microsoft

The core reason that has been determined behind the evaluation of the gearing ratio is to identify the financial risk associated with the company.

Figure 6: Calculation of gearing ratios of Microsoft

(Source: Self-developed)

In accordance with the given image, it is opined that in the last two years, the gearing ratio has declined. In the year 2020, the value of the gearing ratio was evaluated to be 33.49. On the other hand, as per the 2021 report the gearing ratio is evaluated to be 26.07 (Ibrahim and Isiaka, 2020, p. 132). The reduced value of the gearing ratio further indicates that the financial risk associated with the company is low. [Refer to appendix 1]

4. Section C: Ratio Analysis

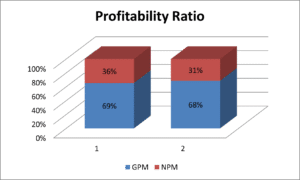

Profitability ratio

The reason behind the computation of the profitability margin is to evaluate whether the company is able to generate higher profits from its business operations (Nariswari and Nugraha, 2020, p. 93).

Figure 7: Evaluation of profitability ratios of Microsoft

(Source: Self-developed)

As per the given image, it is noted that to illustrate the profitability condition of Microsoft its GPM and NPM ratios have been evaluated. The GPM indicates an enhancement in the profitability margin by 1%. On the other hand, NPM signifies that the profitability capability of Microisosft has enhanced by 5%. Concerning the interpreted result it is advocated that the profitability condition of the company in the last 2 years has enhanced. [Refer to appendix 2]

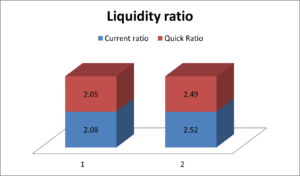

Liquidity ratio

The liquidity ratio is further calculated to identify whether the firm is capable to meet its short-term obligations or not (Dirman, 2020, p. 22).

Figure 8: Calculation of liquidity ratios of Microsoft

(Source: Self-developed)

The analysis indicates that the current ratio as well as the quick ratio of the company has reduced. In the years 2020 and 2021, the current ratio stands at 2.52 and 2.08 whereas; the quick ratio stands at 2.49 and 2.05 respectively. The reduction in quick and current ratio further signifies the weak liquidity status of the firm. The liquidity position of the company can further be improved by cutting back on costs, managing receivables and payables, paying off liabilities, and using long-term financing (Ngari and Kamau, 2022, p. 63). [Refer to appendix 2]

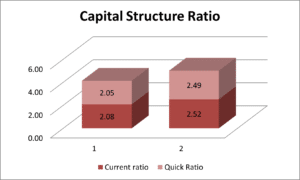

Capital structure ratio

In order to investigate and identify the financial position of the business entity in the market place the Capital structure ratio is evaluated (Ibrahim and Isiaka, 2021, p. 250).

Figure 9: Quantification of capital structure ratios of Microsoft

(Source: Self-developed)

The analysis states that the capital gearing ratio indicates an increase in the value of the ratio whereas, the debt to equity ratio states a reduction in the ratio. The increasing capital structure ratio indicates the fixed obligations enhancement. On the other hand, the declining debt-to-equity ratio states the shareholder’s equity is bigger and the firm does not require more money to fund its business (HASANUDDIN et al. 2021, p. 182). [Refer to appendix 2]

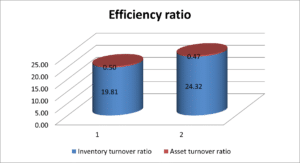

Efficiency ratio

The efficiency ratio is further calculated to identify the capability of the firm to use its assets for generating higher income (Rinaldo and Endri, 2020, p. 532).

Figure 10: Calculation of efficiency ratios of Microsoft

(Source: Self-developed)

The image states that the inventory turnover ratio of the company has declined whereas, the asset turnover ratio indicates an enhancement. Based on the analysis it can be said that the capability of the company to improve its financial condition with the help of its assets has increased to a great extent. [Refer to appendix 2]

5. Conclusion

As per the given details and further interpretation, it is concluded that the financial position of Microsoft in the international business market has been enhanced to a great extent. The analysis further states that the profitability, efficiency, and capital structure ratios indicate the higher capability of the company to enhance its position in the business market. On the other hand, the liquidity ratio of the company indicates a weak liquidity position. It is further recommended that the liquidity ratio can further be enhanced by implementing long-term funding sources. Further, it is concluded that the company can opt for equity financing and retained profit funding sources to introduce funds in its business. It is also concluded that the firm follows an annual forward dividend policy to provide profits to its shareholders.

References

Abdeldayem, M.M. and Dulaimi, S.H.A., 2019. Privatisation and financial performance in Egypt since 1991. Asian Economic and Financial Review, 9(4), pp.461-479.

Akbar, A., Jiang, X. and Akbar, M., 2022. Do working capital management practices influence investment and financing patterns of firms?. Journal of Economic and Administrative Sciences, 38(1), pp.91-109.

Chak, Y.N. and Rana, M.E., 2021, October. A Theoretical Review of Cloud Computing Services in Big Data Analytics. In 2021 International Conference on Data Analytics for Business and Industry (ICDABI) (pp. 76-83). IEEE.

Dirman, A., 2020. Financial distress: the impacts of profitability, liquidity, leverage, firm size, and free cash flow. International Journal of Business, Economics and Law, 22(1), pp.17-25.

engadget.com, 2023 Microsoft 365 ‘Copilot’ uses AI to automate everyday tasks in multiple apps Available at: https://www.engadget.com/microsoft-365-copilot-uses-ai-to-automate-everyday-tasks-in-multiple-apps-151133434.html (Accessed on 18th March 2023)

Flyvbjerg, B., 2021. Top ten behavioral biases in project management: An overview. Project Management Journal, 52(6), pp.531-546.

HASANUDDIN, R., Darman, D., Taufan, M.Y., Salim, A., Muslim, M. and Putra, A.H.P.K., 2021. The Effect of Firm Size, Debt, Current Ratio, and Investment Opportunity Set on Earnings Quality: An Empirical Study in Indonesia. The Journal of Asian Finance, Economics and Business, 8(6), pp.179-188.

Hassan, W., Chou, T.S., Pagliari, L., Pickard, J. and Tamer, O., 2019, May. Is Public Cloud Computing Adoption Strategically the Way to Go for All the Enterprises?. In 2019 IEEE 5th Intl Conference on Big Data Security on Cloud (BigDataSecurity), IEEE Intl Conference on High Performance and Smart Computing,(HPSC) and IEEE Intl Conference on Intelligent Data and Security (IDS) (pp. 310-320). IEEE.

Ibrahim, U.A. and Isiaka, A., 2020. Effect of financial leverage on firm value: Evidence from selected firms quoted on the Nigerian stock exchange. European Journal of Business and Management, 12(3), pp.124-135.

Ibrahim, U.A. and Isiaka, A., 2021. Working capital management and financial performance of non financial quoted companies in Nigeria. International Journal of Research in Business and Social Science (2147-4478), 10(3), pp.241-258.

indmoney.com, 2022 Microsoft Corporation Available at: https://www.indmoney.com/us-stocks/dividends/msft-microsoft-corporation-dividend (Accessed on: 18th March 2023)

investing.com, 2023 Microsoft: The Most Enduring Tech Superstar Available at: https://www.investing.com/academy/statistics/microsoft-facts/#:~:text=Microsoft%20earned%20%2472.7%20billion%20of,by%209%25%20to%20%24365%20billion. (Accessed on: 18th March 2023)

macrotrends.net, 2023 Microsoft Long Term Debt 2010-2022 | MSFT Available at: https://www.macrotrends.net/stocks/charts/MSFT/microsoft/long-term-debt#:~:text=Microsoft%20long%20term%20debt%20for,a%2015.95%25%20decline%20from%202020. (Accessed on: 18th March 2023)

macrotrends.net, 2023 Microsoft Retained Earnings (Accumulated Deficit) 2010-2022 | MSFT Available at: https://www.macrotrends.net/stocks/charts/MSFT/microsoft/retained-earnings-accumulated-deficit#:~:text=Microsoft%20retained%20earnings%20(accumulated%20deficit)%20for%20the%20quarter%20ending%20December,a%2047.72%25%20increase%20from%202021. (Accessed on: 18th March 2023)

macrotrends.net, 2023 Microsoft Share Holder Equity 2010-2022 | MSFT Available at: https://www.macrotrends.net/stocks/charts/MSFT/microsoft/total-share-holder-equity (Accessed on: 18th March 2023)

microsoft.com, 2023 Microsoft 365 Available at: https://www.microsoft.com/en-us/microsoft-365/blog/2023/03/16/introducing-microsoft-365-copilot-a-whole-new-way-to-work/ (Accessed on: 18th March 2023)

microsoft.com, 2023 Microsoft Available at: https://www.microsoft.com/en-in (Accessed on: 18th March 2023)

Mitić, V., 2019. Benefits of artificial intelligence and machine learning in marketing. In Sinteza 2019-International scientific conference on information technology and data related research (pp. 472-477). Singidunum University.

Nariswari, T.N. and Nugraha, N.M., 2020. Profit growth: impact of net profit margin, gross profit margin and total assests turnover. International Journal of Finance & Banking Studies (2147-4486), 9(4), pp.87-96.

Ngari, A.R. and Kamau, C.G., 2022. The Effect of Working Capital Management Cycle on Profitability of Retail Supermarkets in Mombasa, Kenya: A Case Study of Binathman Household Supermarket in Mombasa City. Asian Journal of Economics, Business and Accounting, 22(14), pp.54-70.

Othman, B., Harun, A., Rashid, W., Nazeer, S., Kassim, A. and Kadhim, K., 2019. The influences of service marketing mix on customer loyalty towards Umrah travel agents: Evidence from Malaysia. Management Science Letters, 9(6), pp.865-876.

Rinaldo, N.E. and Endri, E., 2020. Analysis of financial performance of plantation subsector companies listed on the Indonesia Stock Exchange for the 2014-2019 Period. International Journal of Innovative Science and Research Technology, 5(4), pp.530-537.

Sholichah, F., Asfiah, N., Ambarwati, T., Widagdo, B., Ulfa, M. and Jihadi, M., 2021. The Effects of Profitability and Solvability on Stock Prices: Empirical Evidence from Indonesia. The Journal of Asian Finance, Economics and Business, 8(3), pp.885-894.

Ulas, D., 2019. Digital transformation process and SMEs. Procedia Computer Science, 158, pp.662-671.

Widyasti, I.G.A.V. and Putri, I.G.A.M.A.D., 2021. The effect of profitability, liquidity, leverage, free cash flow, and good corporate governance on dividend policies (empirical study on manufacturing companies listed in indonesia stock exchange 2017-2019). American Journal of Humanities and Social Sciences Research (AJHSSR), 5(1), pp.269-278.

wsj.com, 2023 Microsoft Corp. Available at: https://www.wsj.com/market-data/quotes/MSFT/financials/annual/income-statement (Accessed on: 18th March 2023)

Appendix

Appendix 1: Gearing ratio

| Microsoft | ||||

| Ratio Name | Formula | Variable | year | |

| 2021 | 2020 | |||

| Gearing ratio | Non-current liabilities x 100 Non-current liabilities + total equity |

Non-current liabilities | $ 50,074.00 | $ 59,578.00 |

| Equity | $ 141,988.00 | $ 118,304.00 | ||

| Gearing ratio | 26.07 | 33.49 | ||

Appendix 2: Financial ratios

| Microsoft | ||||

| Ratio Name | Formula | Variable | year | |

| 2021 | 2020 | |||

| Profitability | (Dollar $) | (Dollar $) | ||

| Gross profit margin | Gross Profit x 100 Total Revenue |

Gross profit | $ 115,856.00 | $ 96,937.00 |

| Total Revenue | $ 168,088.00 | $ 143,015.00 | ||

| GPM | 69% | 68% | ||

| Net profit margin | Net Profit x 100 Total Revenue |

Net profit | $ 61,271.00 | $ 44,281.00 |

| Total Revenue | $ 168,088.00 | $ 143,015.00 | ||

| NPM | 36% | 31% | ||

| liquidty ratio | ||||

| Current Ratio | Current Asset Current Liabilities |

Current Asset | $ 184,406.00 | $ 181,915.00 |

| Current Liabilities | $ 88,657.00 | $ 72,310.00 | ||

| Current ratio | 2.08 | 2.52 | ||

| Quick Ratio (Acid | (Current Asset – inventories) Current Liabilities |

Current Asset | $ 184,406.00 | $ 181,915.00 |

| Inventories | $ 2,636.00 | $ 1,895.00 | ||

| Current Liabilities | $ 88,657.00 | $ 72,310.00 | ||

| Quick Ratio | 2.05 | 2.49 | ||

| Capital structure ratio | ||||

| Capital gearing ratio | Common stockholders equity/Fixed interest bearing funds | Common stockholders equity | $ 83,111.00 | $ 80,552.00 |

| Fixed interest bearing funds | $ 2,346.00 | $ 2,591.00 | ||

| Capital Gearing ratio | 35.43 | 31.09 | ||

| Debt Equity ratio | Total liabilities Total Shareholders’ Equity |

Total debt liabilities | $ 191,791.00 | $ 183,007.00 |

| Equity | $ 141,988.00 | $ 118,304.00 | ||

| Debt Equity ratio | 1.351 | 1.547 | ||

| Efficiency ratio | ||||

| Inventory turniver ratio | COGS/Inventory | COGS | $ 52,232.00 | $ 46,078.00 |

| Inventory | $ 2,636.00 | $ 1,895.00 | ||

| Inventory turnover ratio | 19.81 | 24.32 | ||

| Asset turnover ratio | Revenue/Total assets | Revenue | $ 168,088.00 | $ 143,015.00 |

| Total assets | $ 333,779.00 | $ 301,311.00 | ||

| Asset turnover ratio | 0.50 | 0.47 | ||

Know more about UniqueSubmission’s other writing services: