7FNCE042W Blockchain Technologies and Cryptocurrencies

Introduction

Blockchain technology and cryptocurrencies are two revolutionary technologies that have the potential to revolutionise the way the researchers do business, conduct transactions, and interact with each other. Blockchain technology is an immutable digital ledger system that can store digital records, such as financial transactions, digitally signed legal contracts, digital assets, etc. It is designed to be secure, transparent, and immutable, making it difficult to manipulate or alter the records. By using cryptographic techniques and a distributed network of computers, the blockchain allows data to be stored securely and efficiently, with all changes stored on a public ledger. Cryptocurrencies are digital assets that use blockchain technology to facilitate secure and anonymous transactions. Cryptocurrencies can be used to purchase goods and services, transfer funds, and even invest in other digital assets. Cryptocurrencies are decentralized and not controlled by any government or institution, making them more secure and transparent than traditional forms of payment here.

Hypothetical housing property

Blockchain Technologies and Cryptocurrencies can be used to facilitate the purchase, sale, or rental of a housing property. The process can be made more secure and efficient by using a distributed ledger system to store and manage contracts, properties, and transactions. Smart contracts can be used to automate the process of buying and selling, allowing for a faster and more secure transaction (Albayati et al. 2020). Cryptocurrencies can be used to make payments for the purchase or rental of the property, and blockchain-based tokens can be used to represent ownership of the property. Additionally, blockchain-based digital identities can be used to ensure that only legitimate buyers and sellers are involved in the transaction.

The potential of blockchain technologies and cryptocurrencies to revolutionize the housing market is immense. From smart contracts to tokenized ownership and automated settlements, the possibilities are endless (Choi, 2021). One potential application of blockchain technologies and cryptocurrencies within the housing market is the ability to create a secure and transparent system for property transactions (Boonpheng et al. 2021). By utilizing distributed ledger technology, transactions can be securely recorded, verified, and stored in a secure and accessible manner. This technology could revolutionize the way in which property transactions are tracked, verified, and settled.

A second application of blockchain technologies and cryptocurrencies within the housing market is the ability to tokenize property ownership (Ghosh et al. 2020). By creating digital tokens that represent fractional ownership of a property, buyers and sellers can securely and transparently transfer property rights between parties (Hashemi Joo et al. 2020). This could open up new opportunities for fractional ownership, allowing people to invest in property without having to purchase the entire asset.

Finally, by utilizing smart contracts, automated settlements can also be facilitated within the housing market. Smart contracts are digital agreements that are stored on a blockchain network, and they can be programmed to execute when certain conditions are met.

This technology could revolutionize the way in which real estate transactions are settled, providing an automated, secure, and transparent process for buyers and sellers With blockchain technologies and cryptocurrencies, buyers and sellers would be able to securely exchange funds and data in real time. The process would be secured with cryptographic keys and digital signatures, eliminating the need for an intermediary. Transactions would be immutable and traceable, providing an extra layer of security (Ertz and Boily, 2019). Smart contracts could be used to automate the process, allowing buyers and sellers to automatically execute the terms of the contract and transfer funds and documents as soon as the contract is signed (Ku-Mahamud et al. 2019). The blockchain could also be used to record property titles and deeds, providing an immutable public ledger of ownership and preventing fraud. In addition, smart contracts could be used to automate the payment of taxes, fees, and other associated costs (Liu et al. 2022). Finally, blockchain technologies and cryptocurrencies could be used to provide a platform for fractional ownership of properties, allowing investors to invest in a property without taking on the full risk of ownership. This could open up real estate investment to a much wider pool of investors.

Build an ERC-20 token with a specific Tracker

The ERC-20 token created would be a tracker of blockchain technologies and cryptocurrencies. This token would enable people to track and analyze the performance of different blockchain technologies and cryptocurrencies in a single, easy-to-use platform. The token would be built on the Ethereum blockchain and could be used to purchase access to services related to blockchain technology and cryptocurrency tracking (Lotfi et al. 2021). The token could also be used by developers to build more advanced applications that would allow users to more easily track and analyze the performance of different blockchain technologies and cryptocurrencies (Möhlmann et al. 2019). The token could be programmed to provide real-time data on the performance of the different blockchain technologies and cryptocurrencies, as well as on their current market prices and trading volume. This data could then be used to inform investment decisions and to help users understand the current state of the market. The token could also be programmed to provide access to tutorials and educational resources related to blockchain and cryptocurrency tracking, allowing users to gain a deeper understanding of the technology and the market.

Finally, the token could be used to reward users for their participation in the platform, allowing them to earn rewards for providing useful insights and data about the performance of different blockchain technologies and cryptocurrencies (Nasir et al. 2020). This could be used to incentivize users to help improve the platform and make it more reliable and accurate. Additionally, the token could be used to purchase premium services on the platform and as an internal currency for trading (Yen and Wang, 2021). No Ethereum address is specified in the prospectus.

Benefits to be gained by tokenising the housing property:

Tokenizing real estate property through blockchain technologies and cryptocurrencies can provide many benefits to both buyers and sellers.

- Lower Transaction Costs: Tokenizing real estate property with blockchain and cryptocurrencies can reduce transaction costs associated with traditional real estate transactions. This is due to the reduced need for paperwork, intermediaries, and other administrative costs associated with buying and selling real estate.

- Liquidity: Tokenizing real estate can provide investors with increased liquidity, as tokens can be easily traded on a variety of exchanges, allowing investors to easily convert their tokens into cash or other assets.

- Increased Transparency: Tokenizing real estate with blockchain and cryptocurrency can provide increased transparency, as all transactions are recorded on the blockchain and can be easily tracked and verified. This could help to reduce fraud and corruption in real estate transactions.

- Accessibility: Tokenizing real estate property can provide greater accessibility to those who may not have the financial resources to purchase physical real estate. Investors can purchase smaller fractions of tokens, allowing them to invest in real estate without having to purchase an entire property.

- Security: Tokenizing real estate property with blockchain and cryptocurrency can provide increased security. The blockchain can be used to verify ownership, ensuring that all transactions are secure and immutable. This means that buyers and sellers can rest assured that their transactions are safe from interference or fraud.

- Increased Liquidity: Tokenizing real estate property can make it more easily accessible and more liquid. By tokenizing the property, it can be more easily transferable, allowing for the quick sale or purchase of a property. This can also help to reduce fees and make it easier to invest in real estate.

- Transparency: By using blockchain and cryptocurrency, the entire transaction process can become more transparent. All transactions and data related to a property can be stored on the blockchain and made available to all relevant parties. This can help to reduce fraud and make the purchase and sale of a property more secure.

- Accessibility: Tokenizing real estate property with blockchain and cryptocurrency can make it more accessible to a larger number of buyers and sellers. This can help to increase competition and bring down the cost of purchasing a property. Furthermore, it can make it easier for buyers to purchase a property in a foreign country without having to go through the paperwork and hassle of dealing with banks and other financial institutions.

An ERC-20 token is a type of digital asset that is built on the Ethereum blockchain. ERC stands for Ethereum Request for Comment and 20 is the unique ID number assigned to this request. This type of token is used for the development and execution of smart contracts on the Ethereum blockchain. Smart contracts are pieces of code that are stored and executed on the blockchain. They are used to facilitate, verify and enforce the negotiation of a contract. ERC-20 tokens are typically created to represent a share in a company, a virtual currency, or a utility. They are designed to be easily transferable, allowing users to trade them on exchanges or use them as a form of payment. They can also be used to create new tokens, allowing developers to create their own Ethereum-based tokens. The creation of ERC-20 tokens is often used to launch Initial Coin Offerings (ICOs), allowing companies to raise money via token sales. The ERC-20 standard also defines a set of rules that all tokens must follow. These rules ensure that all tokens are compatible with the Ethereum network, allowing users to easily transfer and store them.

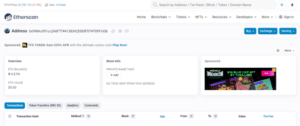

Figure 1: Buying, exchanging and sending money

(Source: Self-made in Metamask)

The above snip represents how the product is buying, exchanging and sending the money from this website. This figure is created with the help of “Metamask”.

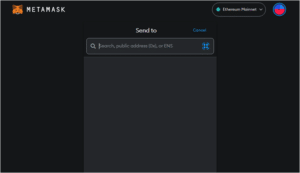

Figure 2: Sending page

(Source: Self-made in Metamask)

The above snip represents what is the actual design of the sending page. This figure is created with the help of “Metamask”. The send to page contains the necessary features such as public address(0x), or “ENS” based on which the money can be sent in this “Metamask” platform.

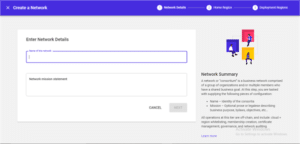

Figure 3: Creation of the network

(Source: Self-made in Metamask)

The above images show how to create the network using Mertamask software. This figure shows the network details. Entering of the network details and creation of the network with the necessary options are displayed in the above figure which is created in “Metamask” platform.

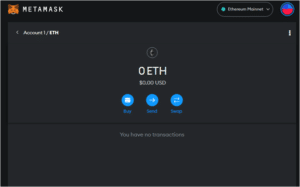

Figure 4: Home page of the network

(Source: Self-made in Metamask)

The above figure shows the homepage of the network. This page was created with the help of Metamask. This shows the options such as “Buy”, “Send”, and “Swap” for the given account which has been developed in the “Metamask” platform.

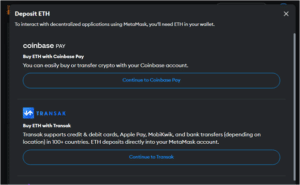

Figure 5: Deposit page of the network

(Source: Self-made in Metamask)

The provided figure shows how to deposit the page of the network. Thai is self created with the help of Metamask. The options such as “Continue to Coinbase Pay” and “Continue to Transak” are shown in the above snip which is related to “Deposit ETH” which has been developed in “Metamask” platform.

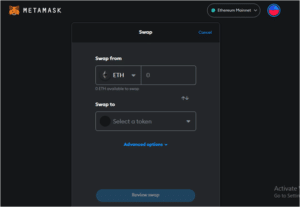

Figure 6: Swapping page of the network

(Source: Self-made in Metamask)

The provided image shows what is the interface of swapping pages of this network. This page is naked with the help of “Metamask”. The details such as “swap from” and “swap to” which are there in the “Swap” page are displayed in the above figure which is developed in the “Metamask” platform.

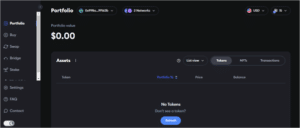

Figure 7: The portfolio home page showing the absence of tokens

(Source: Self-made in Metamask)

The provided figure shows what is the portfolio of the home page that shows the absence of tokens. This is created with the help of “Metamask” software. The portfolio values which contain the assets and the other necessary features are displayed in the above figure which has been developed in the “Metamask” platform.

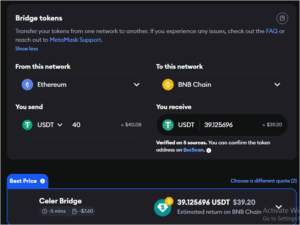

Figure 8: Bridging and building of the tokens and calculating the values with a specific tracker

(Source: Self-made in Metamask)

The above figure shows how to build and bridge the tokens and it is also applicable for calculating the values with a specific tracker of the metamask. The “best price” values and the other necessary values are displayed in the above snip of “bridge tokens” page.

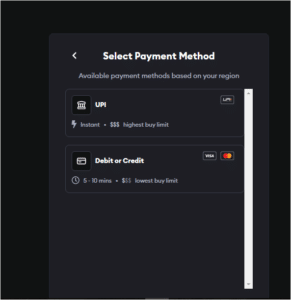

Figure 9: Buying and selecting payment method page

(Source: Self-made in Metamask)

The above figure represents the buying and selecting payment method page in which the “Select Payment method” options which are “UPI”, and “Debit or Credit” are displayed in the above figure as well.

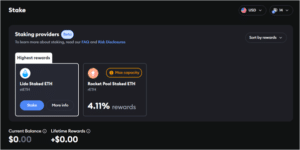

Figure 10: Stake page showing the staking providers and its respective values

(Source: Self-made in Metamask)

The above figure shows the stack page which shows the staking providers as well as its respective values in which the “highest rewards” and the amounts as well as rewards are displayed clearly as well.

Conclusion

It can be concluded here that all the values of the tokens as well as other features are discussed in this overall report which is necessary for “Blockchain and Cryptography” technologies which are given here. These two technologies have the potential to transform the way the researchers do business and the way the researchers interact with each other. By making transactions faster, more secure, and more transparent, they have the potential to revolutionise the way the researchers conduct business and interact with each other.

Reference List

Journals

Albayati, H., Kim, S.K. and Rho, J.J., 2020. Accepting financial transactions using blockchain technology and cryptocurrency: A customer perspective approach. Technology in Society, 62, p.101320.

Boonpheng, A., Kongsong, W., Kongbenjapuch, K., Pooworakulchai, C., Harnphanich, B. and Roikulcharoen, S., 2021. Blockchain technology and cryptocurrency are databases for contract management in construction engineering. International Journal of Advanced Research in Engineering and Technology, 12(1), pp.1073-1084.

Choi, T.M., 2021. Creating all-win by blockchain technology in supply chains: Impacts of agents’ risk attitudes towards cryptocurrency. Journal of the Operational Research Society, 72(11), pp.2580-2595.

Ertz, M. and Boily, É., 2019. The rise of the digital economy: Thoughts on blockchain technology and cryptocurrencies for the collaborative economy. International Journal of Innovation Studies, 3(4), pp.84-93.

Ghosh, A., Gupta, S., Dua, A. and Kumar, N., 2020. Security of Cryptocurrencies in blockchain technology: State-of-art, challenges and future prospects. Journal of Network and Computer Applications, 163, p.102635.

Hashemi Joo, M., Nishikawa, Y. and Dandapani, K., 2020. Cryptocurrency, a successful application of blockchain technology. Managerial Finance, 46(6), pp.715-733.

Ku-Mahamud, K.R., Omar, M., Bakar, N.A.A. and Muraina, I.D., 2019. Awareness, trust, and adoption of blockchain technology and cryptocurrency among blockchain communities in Malaysia. International Journal on Advanced Science, Engineering & Information Technology, 9(4), pp.1217-1222.

Liu, F., Fan, H.Y. and Qi, J.Y., 2022. Blockchain technology, cryptocurrency: entropy-based perspective. Entropy, 24(4), p.557.

Lotfi, R., Safavi, S., Gharehbaghi, A., Ghaboulian Zare, S., Hazrati, R. and Weber, G.W., 2021. Viable supply chain network design by considering blockchain technology and cryptocurrency. Mathematical problems in engineering, 2021, pp.1-18.

Möhlmann, M., Teubner, T. and Graul, A., 2019. Leveraging trust on sharing economy platforms: reputation systems, blockchain technology and cryptocurrencies. In Handbook of the Sharing Economy (pp. 290-302). Edward Elgar Publishing.

Nasir, A., Shaukat, K., Khan, K.I., Hameed, I.A., Alam, T.M. and Luo, S., 2020. What is core and what future holds for blockchain technologies and cryptocurrencies: A bibliometric analysis. IEEE Access, 9, pp.989-1004.

Yen, J.C. and Wang, T., 2021. Stock price relevance of voluntary disclosures about blockchain technology and cryptocurrencies. International Journal of Accounting Information Systems, 40, p.100499.

Know more about UniqueSubmission’s other writing services: