010 Element MOD007667 Sample

Introduction

With amazing fortitude, the company managed to maintain high rental collection rates while simultaneously increasing occupancy levels to pre-pandemic levels by the end of the year. Taking advantage of the robust sales market, the company increased its asset recycling rate as a means of raising more cash for future projects. The business has been able to scale up its investment and make a number of new acquisitions with the support of an extra £209 million in gross capital obtained via another successful stock offering. These purchases have been added to the firm’s increasing acquisition pipeline. We would like to express our heartfelt gratitude to you and your colleagues on the Board of Directors for your continued support of our company’s development plan (Raco,2018).

Over 1,300 customers have benefited from Grainger’s fresh new, high-quality rental equipment and supplies so far this year. In addition, each of these six new projects has leased up far ahead of the planned completion dates, indicating that the business had a good year.

The burden of obligation that rests on your shoulders as a landlord is enormous. You also have a significant amount of duty to ensure that the health and safety of your tenants is not jeopardised. Our first aim is to complete this task as soon as possible, and we will not let it slide through our fingers. In our design specification, which was recognised by the Industry Safety Steering Group of the United Kingdom Government, we demonstrated a pioneering approach to health and safety as well as fire safety, which was recognised by the group.

Evaluate financial performance

We have met or exceeded all four of our long-term environmental, social, and governance commitments, and we are pleased with how far we have progressed in this regard. The specifics of this are detailed in the Environmental, Social, and Governance portion of this study, which begins on page 38 and continues until the conclusion of the report. We are pleased with the progress that has been made so far in our Diversity and Inclusion Program, despite the fact that it is still in its early stages. We also engage with students in educational settings to promote more diversity within our industry, and we continue to seek out, encourage, and support diverse and inclusive populations to be housed in and around our facilities. It is anticipated that the introduction of a new committee, the Responsible Business Committee, which will be responsible for all elements of environmental, social, and governance (ESG), would allow board members to devote an increased amount of time and attention to these important issues.

Our year has been fruitful since we have effectively integrated important components of our technological platform, despite the fact that we have had to operate from distant locations on a few occasions. We hope to see even more advantages in the coming years, including increased efficiency and scalability, as well as enhanced customer service, among other things.

Following Vanessa Simms’ resignation from the company, Rob Hudson was appointed to the post of Group Chief Financial Officer, as previously indicated in this article. Our newest member, Rob, joined our Board of Directors on September 1st, and he brings with him a lot of knowledge and experience in the real estate industry. Her replacement, Carol Hui, has been appointed to the Board of Directors as a Non-Executive Director, and she has been nominated to lead a new responsible business committee that began meeting on October 1st. Carol has experience working in a variety of industries and has been involved in the implementation of environmental, social, and governance programmes. Andre Carr-Locke, who has served as a Senior Independent Director and as the Chair of the Audit Committee, will step down from his post in February 2022, and we are appreciative for everything that he has done for the firm over the course of his tenure with the company.

It is with great gratitude that we acknowledge Andrew’s seven years of service, and we wish him every success in his future endeavours.

Because of this, we recommend a final dividend of 3.32 pence per share for the year, which would bring the total payout for the year to 5.15 pence per share. This is in accordance with our objective of distributing 50% of net rental revenue to our shareholders.

Budgeting and performance management

In the beginning of the year, occupancy levels were lower than typical, which might be linked to Covid-19 limits, which had an impact on the rental market. We have witnessed an increase in net rental income from new schemes, which has been somewhat offset by an increase in our asset recycling efforts. This has resulted in an increase in net rental revenue for us.

When we look to the future, we can see that Grainger’s course is unambiguous. The company will maintain its emphasis on driving expansion in the private rental sector in the United Kingdom, expanding on its solid roots while also offering amazing homes, beautiful settings, and exceptional service to customers.

We were allowed to return to our offices as of the beginning of the fiscal year, but by the conclusion of the first quarter, we had been thrown back into lockdown mode. We were able to do this because, rather than wallow in self-pity or despair, we rose to the occasion and provided outstanding service to our consumers.

Many of our clients, many of whom worked from home, were aided by our front-line Resident Services personnel in our BTR homes during this period of transition and transitional transition. The regulations for occupational health and safety were strengthened, and the teams were able to broaden the scope of services they could provide.

When our office-based team members returned to work at the end of September, they did so with high levels of engagement and a willingness to support us in our progress.

Customer satisfaction is a cornerstone of our customer service philosophy, and it is something that we take very seriously. We have a full grasp of our clients’ interests, wants, and preferences as a result of data and intelligence, as well as direct and independent client feedback. Moreover, we make use of this information to guide our decisions on capital allocation as well as design, operations, and marketing.

safeguarding the health and well-being of all individuals

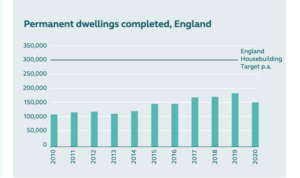

A force for good in a nation where there is a scarcity of affordable housing and an insufficient rental market in general, Grainger provides mid-market renters with high-quality houses and excellent service standards at a cheap price, in our opinion. Those commitments and objectives, which extend well beyond the scope of our current operations in the areas of the environment, social responsibility, and governance, are only the beginning.

The organisation is pushing itself to do more by incorporating environmental, social, and governance (ESG) and responsible business goals into every team, process, and decision, starting with the Board of Directors and working all the way down to operational teams and suppliers.

Because we are a socially and environmentally responsible organisation, Grainger’s environmental, social, and governance strategy and activities will help to ensure a more prosperous future for all of our stakeholders, which includes our customers, suppliers, and employees. It was a joy, as a business partner, to work with the COP26 Built Environment Virtual Pavilion on a variety of initiatives throughout the conference. Several awards and standards were conferred upon us this year in appreciation of our sustainability and environmental, social, and governance (ESG) initiatives, including a Gold Award from EPRA’s Sustainability Best Practice Reporting for the seventh consecutive year. In addition, our Prime Rating on the ISS ESG evaluation has remained unchanged over time as well.

With regard to the GRESB Public Disclosure Assessment, we received an A grade and were the highest-scoring residential organisation from a country other than England and Wales. Grainger, who previously worked on the Residential ESG Guidance from the British Property Federation and the UK Apartment Association’s Best Practice Guide, has established a more consistent approach to environmental, social, and governance performance and reporting in private rental property.

increasing the capacity of our system in order to accommodate more individuals

It was nevertheless possible to collect rent despite the epidemic, with a rate of between 97 and 99 percent of the total rentable square footage being collected by the company. Because of limitations imposed as a result of the coronavirus pandemic in the United States, occupancy levels were lower than typical at the start of the current fiscal year.

Our internal leasing staff helped us fill vacancies when they occurred. We also renovated and improved our older rental buildings, among other things, to make them more appealing to renters.

The Customer Service Desk, which was created in February and has been active since then, is now open to residents who have limited access to on-site Resident Services and can assist them with their needs.

Having lease professionals on staff enabled us to react swiftly to the spike in inquiries that happened when the market came up during the Summer. We are grateful for their efforts.

Rental agreements were signed all around the nation, breaking all previous records in the process (Ellinger2021).

Our PRS portfolio was only a few percentage points shy of 94 percent occupancy at the end of September, and we were back up to 95 percent occupancy within a few weeks. To far, we have leased more than 1,300 more rental flats, accounting for 91.5 percent of our overall portfolio, which is a new corporate record.

Our CONNECT platform has received a tremendous amount of attention and resources this year, and we expect this to continue in the future. New, market-leading technology has been introduced to assist with our customer relationship management (CRM), maintenance process and supply chain, asset management, and data reporting for our whole PRS portfolio via digital leasing. As a consequence of this change, we will be better able to service our clients, which will help us to expand our company in the future.

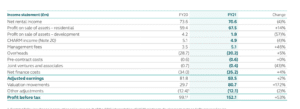

A combination of lower occupancy (-£5.3 million) and disposals (-£4.4 million) resulted in a 4 percent fall in net rental revenue during fiscal 2018, which was somewhat offset by a £1.5 million rental increase and a £5.2 million rise in PRS investment. According to data collected at the end of October, 91.5 percent of the 1,304 units that were constructed this year were already leased, suggesting that net rental revenue is expected to expand considerably in the next year as a consequence of this trend.

After accounting for inflation, net rental income increased by 15% to £80.9 million in the year ended December 31, 2016, driven by a significant increase in occupancy in the fourth quarter and new projects that have been successfully rented, resulting in strong growth momentum into the following financial year. The company has collected £6.2 million in void recovery, £5.5 million in lettings, and a net of £1.4 million in disposal impact from the fiscal year 21 /21. In addition to the remaining lease up of FY21 launches and FY22 pipeline deliveries, which will be heavily weighted in H2 and lease up primarily in FY23, and which will generate an additional £3 million in net rent, the remaining lease up of FY21 launches and FY22 pipeline deliveries will also generate an additional £3 million in net rent. As we continue to recycle our assets, we anticipate that disposals will be commensurate with recent years.

In the midst of a tough market environment, we maintained our resilience, delivering like-for-like growth of 1.0 percent in our PRS portfolio (compared to 2.5 percent in FY20) and 3.6 percent in our regulated tenancy portfolio (FY20: 3.0 percent ). (The number is 4.6 percent for fiscal year 2020.) The PRS saw just 1.6 percent like-for-like growth without these incentives, and we feel that we are now in an excellent position to restore rental growth levels of c.3 percent or greater to levels seen prior to the Pandemic of 2008.

Our London and regional portfolios have had somewhat different results in terms of occupancy rates and demand, but the difference has been rather small overall in comparison to our London portfolio.

Investment appraisal

Following the completion and stability of the project, we predict that net rental revenue will grow by about 90 percent, to approximately £137 million, over the following several years, bringing the total to around £137 million.

As a result of our tight asset recycling programme, we have been able to take advantage of favourable sales conditions, allowing us to sell to a large market and achieve a high sales volume while maintaining competitive pricing. Compared to previous evaluations, price realisations increased by 2.6 percent, and sales transaction velocity increased to 108 days, which was much higher than the national average (FY20: 120 days).

In order to dedicate our resources to growing our PRS pipeline, we have essentially ceased development for sale initiatives. Nonetheless, we have taken advantage of a number of critical site purchases in order to maximise potential. There was a profit of £1.8 million realised in the fiscal year under review, compared to a profit of £4.2 million in the preceding fiscal year.

It is estimated to be 2.4 percent for the fiscal year 2020. While our entire portfolio value climbed by 4.5 percent in FY20 (as opposed to a 2.4 percent increase in FY20), our operational PRS portfolio increased by 3.4 percent (as opposed to a 3.1 percent increase in FY20), and our highly regulated portfolio saw a 3.7 percent valuation increase (FY20: 4.0 percent ). Because of the institutional structure of the investing market, we have evaluated our PRS portfolio on a net rent/yield basis in order to properly reflect it. The completion and stability of projects, as well as a rise in ERV rental growth of 1.9 percent (referred to as the ‘ERV’), have all contributed to the increase in the PRS value in recent months. The increase is largely in line with increases in the market price of our regulated tenancy portfolio, which is mostly focused in the Greater London area (81 percent of our total real estate portfolio).

The funding and capital structure of a company are significant factors to consider.

Now that we have a secure financial structure in place, we can lay the groundwork for implementing our ambitious development goal, according to the company’s CEO.

Our LTV is covered by £641 million (compared to $650 million in FY20), ensuring that we can pay our commitments to the pipeline regardless of future capital needs or operating cashflows. If we included in this committed expenditure into our LTV calculation, our LTV would increase to 40.1 percent from the current value. This puts us well inside the 40-45 percent LTV zone.

In spite of $128 million in operating cashflows from operations, $64 million in asset recycling profits from asset recycling, and $204 million in equity offering, the company’s net debt remained at $1,042 million (compared to $1,032 million in FY20).

All of the profits from our equity offering were invested in three different projects, resulting in a total of £236 million in new investment capital.

Having finished a nine-month programme intended to prepare them for leadership positions within our organisation, our first class of future leaders has received their diplomas from the university.

The course had a female majority of 45 percent of the students, and it covered a wide range of subjects, from growing confidence to preparing for a board of directors interview. It was necessary for participants to research and analyse the possible consequences of new law and how it would affect their organisation while working on a group project for the Executive Committee as part of their work on the project. This offered them with a chance to exhibit their leadership abilities while working together on an important corporate initiative, which they took advantage of.

the process of identifying and nurturing fresh talent

As a result of this collaboration, we worked with our joint venture partner Transport for London to develop a new educational engagement programme to encourage young Londoners to consider a career in real estate. We also sponsored a bursary to enable a deserving student to pursue a real estate degree at the Worshipful Company of Chartered Surveyors.

In the course of this year’s operations, two new Resident Services positions were established as a result of our partnership with The Apprentice Academy and the introduction of our new apprenticeship programme. After completing their training, our Resident Services Apprentices will be placed with the Institute of Residential Property Management, a professional organisation where they will get hands-on experience in all aspects of building-to-rent operations after completing their training.

Giving back to the community via the use of our abilities and skills.

The LandAid pro bono effort allowed Grainger to put our employees’ expertise and experience to good use in order to help those who were in need. Throughout the year, I volunteered my time on pro bono tasks for charitable organisations, which included lease negotiations and building inspections.

It is with great pleasure that we announce our participation in LandAid’s First Step Campaign, which seeks to increase the availability of short-term shelter for young people who are experiencing homelessness by increasing the availability of short-term shelter. The initiative, which includes financial assistance and pro bono legal aid from Grainger, is benefitting an affordable housing project in North Tyneside, which is near to our home in Newcastle.

It is necessary to conduct a systematic identification and evaluation of developing hazards. Our internal committees must first identify current risks in order to identify prospective dangers in the future or existing hazards that are difficult to quantify. This is the first step in identifying future dangers or existing hazards that are difficult to quantify. In order to detect and monitor these potential hazards, we use a tool called a “risk radar,” which is examined on a regular basis by our team of specialists.

The interconnections between our core risks, as well as the ways in which one risk might raise the chance and/or effect of another risk, have been monitored in order to get a more complete and in-depth knowledge of the dangers we will face in the future. Our team used this information to establish whether or not the essential controls already in place were appropriate, as well as whether or not they were in contradiction with one another.

framework for risk management, as well as a willingness to accept risks are essential.

The Board of Directors is ultimately responsible for overseeing Grainger’s risk management and internal control systems, as well as determining the level of risk tolerance that the firm is willing to tolerate. Following a comprehensive evaluation of our risk appetite, the Board of Directors has determined that its risk tolerance for regulatory and reputational difficulties will remain low in 2021. In return for taking on a moderate level of development risk, the Board will be able to take advantage of the enormous potential in the PRS sector, notably in the area of build-to-rent projects, which is currently underutilised.

The Risk Management Framework prepared by the company’s Executive Committee has been granted the green light by the company’s Board of Directors. Each of our three lines of defence is supported by a unique internal governance system, which we have developed specifically for them. This building may be located at this location. A considerable number of important investment, operational, and business transactions are overseen by these committees, each of which has its own risk register.

Organizational risk assessments are carried out by the Executive Committee and its subcommittees, as well as by the management committees of the organisation. It provides assistance to the board of directors by keeping track of and analysing the effectiveness of internal controls and risk mitigation mechanisms in place.

Additionally, it guarantees that the most severe dangers are taken into account, as well. The Internal Audit department employs its monitoring approach as well as audit results in order to keep an eye on these risks in the organization’s internal control system.

It will be difficult to achieve our operational and strategic goals unless we are able to properly manage risk. In a highly competitive market, the ability to make informed decisions is vital to success. We need to be able to detect risks, put controls in place, and calculate returns with accuracy in order to be successful. Rather of responding to external demands, we have shown our ability to withstand risks by concentrating on internal controls and mitigants. Disaster recovery and business continuity practises help to achieve this by acting as a safety net for the organisation.

As part of our risk management approach, we strive to be responsive, forward-thinking, consistent, and responsible while maintaining the appropriate balance between company and personal requirements and responsibilities.

The risk management culture at Grainger, as well as the “three lines of defence” approach (as seen in the illustration on page 47), are two of the methods we use to achieve this goal. Our risk management systems and controls must be able to keep up with the expansion of our PRS strategy in order to be successful.

As a consequence of the Covid-19 epidemic, Grainger has shown its ability to persevere in the face of difficult economic conditions. It has been shown on several occasions throughout the course of this time period that our mature risk management system is capable of adapting to a rapidly changing environment on its own.

Summary

All risks, including those related to strategy, markets, finance, legal/regulatory compliance, and operations, are taken into account. An strategy that incorporates both “bottom-up” and “top-down” techniques is used to identify specific risks.

Each risk has two scores: a gross score (which is the score before mitigation) and a net score (which is the score after mitigation) (after mitigation). When it comes to threats, which ones are most dependent on internal mitigation mechanisms, and which ones need further intervention and treatment?

A risk-scoring matrix may be used to ensure that we are following a consistent process when assessing their overall effect. Keeping a rolling 12-month timeframe in mind, we calculate the chance of operational hazards arising over the course of the year. Departmental risk registers are used to keep track of the significance of hazards and the possibility of them happening. These risk registers, which are evaluated on a regular basis, are a representation of the ability to adapt to changing circumstances. In the corporation, a committee is in responsibility of reviewing these registers on a quarterly basis, and this committee meets once a month. Following that, a summary of the most significant risks affecting the organisation is submitted to the Executive Committee and the Audit Committee for consideration.

Following the implementation of this strategy, eleven big threats have been identified, and we are actively watching their progress (see pages 48 to 51). Throughout the year, the chance of many big threats happening and the possible effects of such occurrences have increased, with the possibility of these threats occurring increasing as well. In light of the general economic uncertainties as well as other external circumstances, this cautious evaluation was warranted owing to the durability of Grainger’s company as well as a significant demand for high-quality homes in the United Kingdom.

References

Chabot, M. and Bertrand, J.L., 2021. Complexity, interconnectedness and stability: New perspectives applied to the European banking system. Journal of Business Research, 129, pp.784-800.

Ellinger, A.E., Adams, F.G., Franke, G.R., Herrin, G.D., deCoster, T.E. and Filips, K.E., 2020. A triadic longitudinal assessment of multiple supply chain participants’ performance and the extended enterprise concept. International Journal of Physical Distribution & Logistics Management.

Evans, L., Owda, M., Crockett, K. and Vilas, A.F., 2021. Credibility assessment of financial stock tweets. Expert Systems with Applications, 168, p.114351.

Harvey, N.J., Dacre, H.F., Saint, C., Prata, A., Webster, H.N. and Grainger, R.G., 2022. Quantifying the impact of meteorological uncertainty on emission estimates and volcanic ash forecasts of the Raikoke 2019 eruption. Atmospheric Chemistry and Physics Discussions, pp.1-24.

Heckens, A.J. and Guhr, T., 2022. A new attempt to identify long-term precursors for endogenous financial crises in the market correlation structures. Journal of Statistical Mechanics: Theory and Experiment, 2022(4), p.043401.

James, N., Menzies, M. and Gottwald, G., 2022. On financial market correlation structures and diversification benefits across and within equity sectors. arXiv preprint arXiv:2202.10623.

Ku, S., Lee, C., Chang, W. and Song, J.W., 2020. Fractal structure in the S&P500: A correlation-based threshold network approach. Chaos, Solitons & Fractals, 137, p.109848.

Kuykendall, J., 2019. 5 Year Analysis of Company ESG Ratings Verses Financial Performance (Doctoral dissertation).

Raco, M. and Moreira de Souza, T., 2018. Urban development, small business communities and the entrepreneurialisation of English local government. Town Planning Review, 89(2), pp.145-166.

Ramos Nogales, J.J. and Elshani, K., 2020. The Impact of Finance Mergers and Acquisitions on Short-Term Performance of Acquiring Companies: An Event Study Focused on the British Isles.

Solana, J., 2020. Climate litigation in financial markets: a typology. Transnational Environmental Law, 9(1), pp.103-135.

Know more about UniqueSubmission’s other writing services: