Individual Written assignment

Introduction

Aggregated Telecom is a private telecommunication company based in the United Kingdom. It provides communication solutions to the business of the United Kingdom. It offers CallPort, an internet platform with voice over to the corporate markets, wide area network managed services, SIP trunking services, managed ISP services, network based firewall solution, business telephone services, collocation services for the business applications and solutions for the recovery of disaster. Additionally, the organisation also offers network operation centres, account management, project management and support services. The organisation has been actively running with a turnover under £2 million (Gov, 2021). In the year 2019, the company’s total assets were £5.47 thousand and it is also their net assets value.

Germany has been selected as the host country for the organisation. For expanding business, Germany is suitable for Aggregated Telecom as it has significant spending power and a very innovative climate with highly skilled workers. Thus, this assignment will lead to reasons for expansion with significant factors, which will help in the business growth. Additionally, the study will provide a beneficial mode of entry and set of recommendations for the organisation.

Reason for expansion

Germany has seen a huge growth in the telecommunication sector with revenue of landline services of over 27bn EUR. In 2019, the revenue of the telecommunication industry of Germany has amounted to over 5.67 billion Euros followed by 5.8 billion Euros in cable televisions. The total revenue of the telecommunication industry is 58bn EUR (Statista, 2021). The telecommunication industry of Germany is developing the economic growth of the country, as the country is the global player after the United States and China with high productivity rate. The workforce of the country is very innovative and excellent. Moreover, if Aggregated Telecom Limited expands their business in Germany this will benefit their organisation with huge profits and brand value. Expanding the business internationally will help the organisation in their business growth and success of the firm (He et al. 2019). This will lead to the economic sustainability of the organisation with advancement of the technological sector. Business expansion will help in learning creative and innovation in the business market. In addition, majorly it will flourish the brand value to another level. Taking business to the global market not only helps the business and organisation but it also makes the employees more intellectual with a clear vision of goal to achieve.

Factors

Business growth

Distinctive opportunities of business growth can be assumed for Aggregated Telecom in case of expanding into the German market. While serving as a telecommunication service provider, aggregator Telecom might obtain inclusive access to the German telecommunication industry. A total of around 171,000 employees were expected to serve for the telecommunications industry across Germany during 2019 (Koptyug, 2021). This skilled workforce defines distinctive opportunities for ensuring business growth from the perspective of Aggregated Telecom where the skills and knowledge level of employees might be helpful for the company. Moreover, the company could also achieve distinctive local market knowledge by referring to this skilled workforce from the telecommunication sector, which can drive the organization’s business growth furthermore.

Apart from that, the number of mobile phone connections across Germany has been also experiencing a rapid growth. During 2020, around 150 million users can be notified with mobile phone connections in Germany (Koptyug, 2021). Similar consequences can be suspected in the case of observing increasing smartphone usage in Germany throughout the last decade. It grows up to 60.74 million during 2020 from 6.3 million only in 2009 (Koptyug, 2021). Concerning the aforementioned statistics, distinctive opportunities of business growth can be certified for Aggregated Telecom with regards to the increasing number of consumers.

The German telecommunication market consumption volume was notified to enhance with a decent compound annual growth rate between 2016 to 2020. In this aspect, a total of 362.6 million subscriptions can be estimated across the German Telecom industry during 2020 (Market Research, 2021). With this attractive market consumption volume, Aggregated Telecom might be able to enhance their business growth. Moreover, the German market also accounts for 16.1 % of the entire European Telecom market, which has recognised the industry as the largest across the continent (Market Research, 2021). With this distinctive industrial reputation, Aggregated Telecom might be able to seek for the chances of achieving attractive business growth while expanding their services in Germany.

Aggregator Telecom also includes managed ISP services. In this regard, the German broadband sector can also be largely grabbed by the company with successful business expansion. Increasing growth can be suspected from the perspective of the German broadband market with rising proportion of user’s preference. For instance, it was notified that the number of broadband internet connections across Germany had been 25.3 million during 2019, which also came up from 1.9 million during 2001 (Koptyug, 2021). With increasing preference of broadband services, Aggregator Telecom might also look forward to enhancing their business growth under the shape of considering business expansion in the German market.

On the other hand, the company also provides account management, network operation centre, project management solutions, and support services (Crunchbase, 2021). As a result of these, distinctive opportunities of enlarging business growth can be suspected from the perspective of Aggregated Telecom where the wider German consumer market might be associated with the products and offerings of the company. Apparently, the German telecommunications market is already notified to include renowned competitors such as Vodafone Germany, Deutsche Telecom, Telefonica Germany, and others. With increasing possibility of obtaining business growth, Aggregated Telecom might be able to achieve competitive advantage by competing with the existing market rivals in Germany.

Economic sustainability

The German telecommunication industry has been observed to operate with distinctive financial sustainability and feasibility, which discloses the industrial effectiveness of maintaining further growth. For example, the context of the growth in telecommunication industry revenue can be undertaken into the discussion.

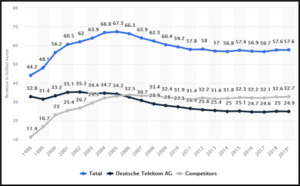

Figure 1: Telecommunication industry revenue in Germany from 1998 to 2019

(Source: Koptyug, 2020)

The German telecommunication sector was able to maintain distinctive stability in its revenue generation across the last two decades. Despite having gradual fluctuation in revenue generation, the above-mentioned figure illustrates financial stability of the industry. It has been notified that the German telecommunication sector generated over 57.6 billion Euro revenue during 2019 (Koptyug, 2021). Despite having the unfavourable consequences of ongoing covid-19 pandemic, the German telecommunication services were also able to obtain $ 38.4 billion in revenue during 2020 (Market Research, 2021). In this aspect, the combination of both landline phone connections and mobile communications can be predicted. This attribute might motivate Aggregated Telecom to suspect the industrial accountability in front of the wider German consumer market. Based on this factor, the company might think about business expansion in Germany.

Apart from that, the products and offerings of Aggregated Telecom have also disclosed increasing preferences towards innovation and advancement. Due to this concern, the provision of internet services, local area network managed services and others are highly preferred by the company. In this aspect, the German telecommunication sector has been observed to experience attractive growth over the wireless telecommunication services. With an increasing number of mobile users, the German wireless telecommunication services market had been able to generate total revenue of $ 20225.2 million during the previous year (Market Research, 2021.). Despite having the toxic impact of the ongoing coronavirus outbreak, the countrywide wireless telecommunication services were able to maintain decent market volume.

On the other hand, Germany has witnessed decent growth in the number of broadband lines. During the previous year, the number of broadband lines was expected to grow by 2.5 % that is about 36.8 million users (Telekom, 2021). In this concern, the service infrastructure of Aggregated Telecom discloses efficient compatibility with the German broadband market, which might drive the company towards its business expansion in Germany. Apparent consequences can also be observed through the German mobile market. The service revenue of the German mobile market head enlarged by 0.8% during 2019 that amounted to around Euro 20 billion (Telekom, 2021). These attractive financial standings define enormous opportunities for ensuring economic sustainability from the perspective of Aggregated Telecom by mitigating the market demand in Germany.

On the contrary, the German telecommunication market is also expected to witness strong growth over the forecast period to 2025. In this concern, rising adoption of mobile usage can be noticed across the country, which has been adding a greater value to enhance the credibility of the telecommunication market.

The above-mentioned evaluation disclosed distinctive opportunities for Aggregated Telecom concerning the maintenance of economic sustainability by mitigating the market requirements and consumer demands in Germany. From this standpoint, the aspects of industrial economic sustainability and increasing users can be suspected as a direct influential factor behind the decision of business expansion for Aggregated Telecom in Germany.

Technological advancement

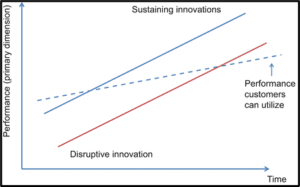

Figure 2: Disruptive innovation theory

(Source: Christensen et al. 2018)

Enormous technological advancement can be noticed in the German telecommunication market. In this aspect, greater preference for the disruptive innovation theory can be considered. The theory defines to offer better products and services with an intention to defend the business of the incumbents as compared with the existing market rivals (Reinhardt and Gurtner, 2018). This attribute might be encouraging for Aggregated Telecom to enlarge their service accountability concerning the association of innovative and advanced technologies while expanding their services across Germany.

For instance, the context of advanced 5G networks can be considered. The German telecommunication sector has largely emphasised on ensuring considerable progress over the adoption of 5G networks. In this aspect, around 80% of the population has been covered by 5G services by 2021 (Market Research, 2021). Moreover, 90% of the entire population coverage in Germany is also expected by the end of 2021 with 5G networks (Market Research, 2021).

On the other hand, rising adoption of the internet of things can also be noticed across the telecommunication sector of Germany. The consideration of 2G networks has been expected to be completely shut down by the end of 2025 in Germany. The majority of mobile connections in Germany are expected to be dependable on 5G networks by 2029 (Global Monitor, 2021). Distinctive support would be provided by the regulatory authorities in Germany with an intention to enlarge the telecommunication industrial market dynamics, which might play a major role in terms of success in adopting 5G network across the nation. Apparent consequences can be suspected from the perspective of having fixed broadband connections across Germany where millions of German customers are expected to be associated with fixed broadband services by 2025 (Global Monitor, 2021).

The provision of value added services can also be considered in this concern, which has been experiencing decent growth across the German telecom market with increasing rate of subscription. The network operators existing across the German Telecom industry are also keen to offer efficient mobile services to their potential consumers. Thus, increasing indulgence of the internet services under the shape of copper led network and wireless mode can be considered (Global Monitor, 2021). This is also suspected to replace the fixed voice traffic in the upcoming time period.

On the other hand, Germany has also paid attention to introducing telecom industrial development with innovative technologies such as FttP, DOCSIS 3.1 and others, which has been empowering the fixed and wireless broadband markets (Market Research, 2021). A 4.2 % growth was also noticed across Germany in information technology, which has been helpful to empower the telecommunication infrastructure of Germany (Telekom, 2021). High bandwidth lines are increasingly marketed in cables and vectoring networks across Germany. Distinctive support in this context is also provided by innovative hybrid connection technologies, which are helping the telecommunication industry to empower technological advancement (Telekom, 2021). Attractive growth of the consumer base can also be certified from the German telecommunication sector with the availability of high bandwidth and a large choice of video on demand and HD content services (Telekom, 2021). The existence of fixed mobile convergence (FMC) attributes is also benefiting the German telecommunication industry with increasing customer loyalty and retention rate (Telekom, 2021). Moreover, the inclusion of free IP messaging services like social networks and WhatsApp are increasingly preferred in the German market, which has been helping to replace traditional voice and text messaging services. The consideration of increasing usage of smartphones and tablets across the German telecom sector has been also pushing up the demand for mobile broadband speed and large data volumes.

With the growing industrial demand and rising digitisation, the Telecom market of Germany is also expecting to approach IT and cloud solutions for mitigating consumer demands. In this aspect, Aggregated Telecom might be succinctly encouraged to expand in Germany concerning enormous technological advancement and thereby ensuring business profitability.

Brand recognition

The German telecommunications sector is notified to achieve distinctive customer retention and loyalty by providing innovative technological advanced services. Moreover, increasing usage of smart phones and wireless communication, broadband services and others are playing a leading role to define the unique value proposition of the industry. From this standpoint, the German telecommunication market can be expected to ensure distinctive brand awareness with the inclusion of hybrid technologies, 5G networks and others.

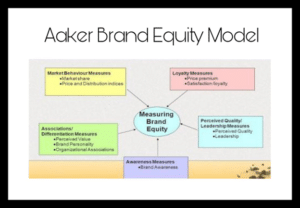

This attribute might emerge as an indirect influential factor behind encouraging Aggregated Telecom to expand their services in Germany. Serving as an SME in the UK, Aggregated Telecom has been looking forward to outline attractive brand image for ensuring increasing customer attraction and profitability. In this regard, the brand equity model of Aaker can be considered, which identifies relational components of brand equity such as brand loyalty, brand awareness, perceived quality, brand association and relational proprietary assets (Crunchbase, 2021).

Figure 3: Aaker’s brand equity model

(Source: Vasileva and Vasileva, 2017)

From the perspective of Aggregated Telecom, brand loyalty could be ensured by adopting innovative technological advancement like 5G networks, hybrid technologies and others existing across the German Telecom market (Telekom, 2021). Moreover, increasing preference can be provided by Aggregated Telecom across video on demand services and others based on which distinctive brand awareness could be achieved by the organisation. On the other hand, the proprietary assets can also be analysed on behalf of Aggregated Telecom that serves for disaster management solutions, accounts management services, firewall protection and others (Crunchbase, 2021). This diverse service portfolio might also encourage the organisation to consider business expansion in Germany concerning the brand image of the German Telecom industry. This attribute can also provide an attractive brand image to the company with increasing profit.

Recommended mode of entry

The market entry strategies are very important to prosper in the host market (Adeola and Boso, 2018). For Aggregated Telecom, the below mentioned market entry strategies will work for the business expansion.

Joint Venture: In a new market where the business has to be expanded, creating partnership with other host companies is one of the preferable market strategies. By creating an alliance, the company can get hold of the mastery of its partner’s local knowledge, infrastructure and reputation, which can help in the rapid expansion of the business (Killing, 2017). Creating a partnership with the top telecommunication companies can help the organisation to move forward in the business. German telecommunication companies like Deutsche Telekom, Vodafone Germany and Telefonica Germany can be beneficial for Aggregated Telecom to develop their market easily in the host country. Having a backup in an unknown country is much more helpful than doing it alone (Pedada et al. 2021). Partnership helps in developing the brand image among the customers and creating new ones for the organisation.

Licensing: Licensing refers to the legal rights, which are given to the organisation. In Licensing, there are two companies involved, one is the licensor, and the other one is the licensee who wants to expand business in another country (Cabaleiro-Cerviño and Burcharth, 2020). The licensor company gives rights to the licensee by granting the use of their intellectual property for a time being. Under licensing, the company can sell products under the brand name of the licensor. For Aggregated Telecom, this market entry strategy will work more than Joint venture because licensing is more quick and simpler. In Joint Venture there might be a question that arises whether the other companies will agree on the partnership or not, whereas in Licensing there is no such thing, just an amount to be paid for the grants, which are accessible to the licensee company (Chen, 2017). It helps the company to do business without any risk and requires very less capital. Licensing can help the organisation to succeed over the tariff barriers and borders for expansion.

However, the consideration of improving brand image can be successfully ensured by the organisation through joint venture mode of entry. It can also enlarge the organisational resources availability as an integral part of maintaining service flexibility in Germany.

Conclusion and recommendation

Based on the overall study, it is evident that expansion of Aggregated Telecommunication Limited will be beneficial if they set up their business in Germany. There is a colossal business growth in the telecommunication sector as the country has been experiencing rapid growth of mobile phone users throughout the last decades. The German telecommunication market is improving day after day. The economic sustainability of the country is to effectively maintain its growth with the help of various industries and one such industry is telecommunication. In the German market, there is a huge advancement of technological innovation. The 5G Networks is adopted by the population, and by the end of 2021, it will be fully covered by 5G networks across the country. Hence, the expansion of Aggregated Telecommunication Limited in Germany will flourish their business with advancement of technology and self-sustainability in the global market.

For ensuring successful business growth with consistent profit of Aggregated Telecommunication Limited in Germany, some set of recommendation is provided below:

- Aggregated Telecommunication Limited needs to develop their technological creativity according to the German market demands.

- The organisation should have a clear vision of the goal to achieve in the host country to maintain its position in the market.

- The organisation has to develop their management program for ensuring all the objectives are meeting their requirements.

- The organisation has to change their strategy to retain in the global market as long as possible without any loss.

References

Adeola, O., Boso, N. and Adeniji, J., 2018. Bridging institutional distance: an emerging market entry strategy for multinational enterprises. In Emerging Issues in Global Marketing (pp. 205-230). Springer, Cham.

Cabaleiro-Cerviño, G. and Burcharth, A., 2020. Licensing agreements as signals of innovation: When do they impact market value?. Technovation, 98, p.102175.

Chen, C.S., 2017. Endogenous market structure and technology licensing. The Japanese Economic Review, 68(1), pp.115-130.

Christensen, C.M., McDonald, R., Altman, E.J. and Palmer, J.E., 2018. Disruptive innovation: An intellectual history and directions for future research. Journal of Management Studies, 55(7), pp.1043-1078.

Crunchbase, 2021. Aggregated Telecom. [Online]. Available at: <https://www.crunchbase.com/organization/aggregated-telecom [Accessed 14 July 2021]

Ekinci, Y., 2018, June. A model of consumer based brand equity for holiday destinations. In 8th advances in hospitality and tourism marketing and management (AHTMM) conference (p. 830).

Global Monitor, 2021. Germany Telecommunication Market Report (2020-2025). [Online]. Available at: <https://www.globalmonitor.us/product/germany-telecommunication-market-report [Accessed 14 July 2021]

Gov, 2021. Aggregated Telecom LIMITED [Online]. Available at: <https://find-and-update.company-information.service.gov.uk/company/07731874.> [Accessed 14 July 2021]

He, G., Marginson, D. and Dai, X., 2019. Do voluntary disclosures of product and business expansion plans impact analyst coverage and forecasts?. Accounting and Business Research, 49(7), pp.785-817.

Killing, J.P., 2017. How to make a global joint venture work. In International Business (pp. 321-328). Routledge.

Koptyug, E., 2020. Revenue of the telecommunications industry in Germany from 1998 to 2019. [Online]. Available at: <https://www.statista.com/statistics/459858/revenue-telecommunications-industry-germany/> [Accessed 14 July 2021]

Koptyug, E., 2021. Telecommunications industry in Germany – Statistics & Facts. [Online]. Available at: <https://www.statista.com/topics/5057/telecommunications-industry-in-germany/ [Accessed 14 July 2021]

Market Research, 2021. Germany – Telecoms, Mobile and Broadband – Statistics and Analyses. [Online]. Available at: <https://www.marketresearch.com/Paul-Budde-Communication-Pty-Ltd-v1533/Germany-Telecoms-Mobile-Broadband-Statistics-14554080/ [Accessed 14 July 2021]

Market Research, 2021. Telecommunication Services in Germany – Market Summary, Competitive Analysis and Forecast to 2025. [Online]. Available at: <https://www.marketresearch.com/MarketLine-v3883/Telecommunication-Services-Germany-Summary-Competitive-14792164/> [Accessed 14 July 2021]

Market Research, 2021. Wireless Telecommunication Services in Germany – Market Summary, Competitive Analysis and Forecast to 2025. [Online]. Available at: <https://www.marketresearch.com/MarketLine-v3883/Wireless-Telecommunication-Services-Germany-Summary-14708908/> [Accessed 14 July 2021]

Pedada, K., Padigar, M., Sinha, A. and Dass, M., 2021. Developed market partner’s relative control and the termination likelihood of an international joint venture in an emerging market. Journal of Business Research, 135, pp.295-303.

Reinhardt, R. and Gurtner, S., 2018. The overlooked role of embeddedness in disruptive innovation theory. Technological Forecasting and Social Change, 132, pp.268-283.

Statista, 2021. Telecommunications industry in Germany – Statistics & Facts. [Online]. Available at: <https://www.statista.com/topics/5057/telecommunications-industry-in-germany/#:~:text=The%20leading%20German%20telecommunication%20companies,worked%20in%20the%20telecommunications%20industry.> [Accessed 14 July 2021]

Telekom, 2021. TELECOMMUNICATIONS MARKET. [Online]. Available at: <https://report.telekom.com/annual-report-2019/management-report/the-economic-environment/telecommunications-market.html [Accessed 14 July 2021]

Vasileva, I.V. and Vasileva, T.N., 2017. Brand equity management on the example of the Aaker model. Modern Science, (5-1), pp.102-107.