ECO9023M Business Economics 1 Assignment Sample

Here’s the best sample of ECO9023M Business Economics 1 Assignment, written by the expert.

Introduction

The outbreak of the Covid-19 has profoundly impacted the economic growth and development of all the countries and the UK is no exception to it where several significant changes have taken place in order to confront the situation in a successful as well as in a strategic way. The Government of the UK has taken all the required steps aiming towards a fast recovery from the economic crisis caused by the pandemic in the country as quickly as possible. In this assessment, a detailed discussion will be made on the various essential aspects of the changing role of the Government of the UK during the pandemic in order to deal with the unprecedented changes in the long run.

Assessment of the changing role of government in the economy during recent pandemic

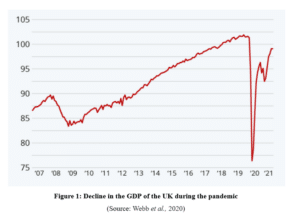

It may be asserted that the economy of the UK has undergone drastic changes due to the outbreak of the pandemic and due to this reason there has been a decline in the overall Gross Domestic Product (GDP) of the country. In a more specific way, it has to be mentioned that the GDP of the UK declined by almost 9.7% in 2020 and during the first phase of the lockdown, the GDP of the country declined by 25% (Refer to Appendix-1). However, it needs to be stated without any doubt that the implementation of better workplace security and providing competitive packages through several government schemes and policies will certainly generate a positive impact on the economy (Webb et al., 2020). On a broader note, it needs to be implied that the Government of the UK has provided support to several sectors in order to boost the economic development of the country which includes the construction sector, clothing retail industry, food retail industry and transportation sector through implementing changes in the policies of the government.

On the other hand, it may be opined that the Government of the UK and central banks of the country has made numerous policies and frameworks in order to support businesses to make a positive impact on the economy of the country. Moreover, it has to be proposed that maintaining social distance and reducing the workforce in companies and industries have directly impacted the economic output in a negative way (Pichler et al., 2020). On a contradictory note, it may be argued that the outbreak of the Covid-19 has also impacted the public finance of the UK in a profound way and due to this reason the Government has announced a financial package with the aim to provide support to businesses, public services and household swath £315 billion (Gov.uk. 2022). Additionally, it needs to be acknowledged that the Government of the UK has increased its budget investment and has allocated £150 billion which will definitely prove beneficial in providing better public services (Refer to appendix-2).

In other words, it needs to be stated that the Government of the UK has taken numerous steps to provide support to the common people and to businesses of the country through providing loans at low rates of interest and the Government has also provided tax exemptions. In addition to this, it may be implied that a real time increase of £90 billion in the budget is undoubtedly the biggest increase in the entire departmental spending done by the Parliament of the country (Refer to appendix-2). Along with this, the Government of the UK will increase the National Living Wage from April 2022 which will certainly provide an added advantage in generating positive results in boosting the economy in the long run (Refer to Appendix-3). Apart from this, it has to be mentioned that the fiscal recovery policies are to be aligned with the climate changes in order to deal with the issue of climate emergency along with the outbreak of the Covid-19 (Hepburn et al., 2020).

In an overview, it may be analysed that the Government has announced cash grants for the countries in the UK including Scotland, Wales and Northern Ireland under various localised schemes for supporting the economy (Refer to Appendix-4). On a contradictory note, it needs to be argued that the Government of the UK has implemented several laws in order to provide relief to various businesses and its employees through providing Statutory Sick Pay (SSP) refunds (Gov.uk. 2022). However, it has to be proposed that the Government of the UK has provided packages to support Small and Medium-sized Enterprises (SMEs) by supporting the firms based on innovation along with announcing future funds for high growth companies (Refer to Appendix-5).

Evaluation of the costs and benefits for the economy of having a greater government role in the economy

| Cost | Benefit |

| £315 billion | The Government of the UK has allocated £315 billion with the aim top support various business, public services and households (Gov.uk. 2022) |

| £360 million | Allocation of £360 million in order to provide financial assistance to charities offering various essential services will definitely become useful for the people of the UK in overcoming difficulties relating to domestic abuse (Gov.uk. 2022) |

| £370 million | The allocation of £370 million by the Government the UK will be given to small and medium sized charities through National Lottery Community Fund for the people residing in England which will reduce the suffering of the citizens (Gov.uk. 2022) |

| £750 million | The Government of the UK has granted £750 million for the Small and Medium-sized Enterprises (SMEs) which will enhance the growth of business through developing innovation and research (Gov.uk. 2022) |

| £500 million | The Government has allocated £500 million for the Future Fund loan scheme aiming to ensure investments in high growth companies during the Covid-19 (Gov.uk. 2022) |

| £1.57 billion | A grant of £1.57 billion has been made in order to support the growth and development in the field of industries related to art and culture in the UK (Gov.uk. 2022) |

Table 1: Evaluation of cost and benefits in the UK during the pandemic

(Source: Self-created)

According to the above table, it may be clearly stated that the Government of the UK has been making several necessary grants and allocations in different important fields in order to confront the post pandemic economic crisis in the country with great effort and strategic planning in order to provide benefit to industries and people. However, it has to be acknowledged that the outbreak of the Covid-19 has created a medical crisis as well as economic crisis which has further encouraged implementation of several policy experiments and frameworks to support and provide positive effects in the long run (Susskind and Vines, 2020). In addition to this, it needs to be opined that the outbreak of the pandemic has impacted the hospitality and tourism industry of the UK in a profound way and due to this reason the Chancellor of the UK has reduced Value Added Tax (VAT) from 20% to 5% (Refer to Appendix-6). In other words, it may be asserted that this will definitely prove beneficial in boosting the hospitality and tourism sector where customers will be encouraged to visit restaurants and hotels.

In a more specific way, it may be added that the Government has also provided opportunities to offer loans at lower rates of interest which will also prove beneficial in boosting the economy of the country in the post pandemic situation. Moreover, it may be proposed that in order to confront the challenges and issues generated due to the pandemic, the Government of the UK has introduced policies related to household incomes (Brewer and Gardiner, 2020). On a broader note, it needs to be argued that reduction in stamp duties and tax on house purchase has also been decreased in order to boost the economy of the country by encouraging customers to buy properties which will eventually improve the cash flow in the economy. Furthermore, it has to be asserted that allocation of £5.6 billion in infrastructure which will also include improvements of hospitals is a significant step taken by the government of the UK (Gov.uk. 2022). Apart from this, it needs to be implied that the allocation of funds and their benefits may be evaluated through measuring the outcomes of the schemes and policies and through an increase in the GDP of the country in the future.

Conclusion

From the above discussion, it may be clearly concluded that the outbreak of the Covid-19 has severely impacted the economic condition of all the countries throughout the world and the UK is no exception to it. Additionally, it has to be implied that the Government of the UK has taken various important fiscal decisions where allocation of funds and grants made by the government has eventually provided enough support to industries in order to bounce back successfully. In a concluding remark, it needs to be mentioned that without the intervention of the Government on a large scale, the economic growth of the UK would have faced adversities if the policies and packages were not implemented strategically.

References

Brewer, M. and Gardiner, L., 2020. The initial impact of COVID-19 and policy responses on household incomes. Oxford Review of Economic Policy, 36(Supplement_1), pp.S187-S199.

Gov.uk. 2022. Welcome to GOV.UK. [online] Available at: <https://www.gov.uk/> [Accessed 17 January 2022].

Hepburn, C., O’Callaghan, B., Stern, N., Stiglitz, J. and Zenghelis, D., 2020. Will COVID-19 fiscal recovery packages accelerate or retard progress on climate change?. Oxford Review of Economic Policy, 36(Supplement_1), pp.S359-S381.

Pichler, A., Pangallo, M., del Rio-Chanona, R.M., Lafond, F. and Farmer, J.D., 2020. Production networks and epidemic spreading: How to restart the UK economy?. Production Networks and Epidemic Spreading: How to Restart the UK Economy.

Susskind, D. and Vines, D., 2020. The economics of the COVID-19 pandemic: an assessment. Oxford Review of Economic Policy, 36(Supplement_1), pp.S1-S13.

Webb, A., McQuaid, R. and Rand, S., 2020. Employment in the informal economy: implications of the COVID-19 pandemic. International Journal of Sociology and Social Policy.

________________________________________________________________________________

Know more about UniqueSubmission’s other writing services: