STRATEGIC PROJECT REVIEW – INDIVIDUAL WORK

Executive summary

The project is reflected on strategic development of financial and banking activities in Northern and Southern bank. Northern and Southern bank were merged to develop more sustainability in business. The impact of this merger on different stakeholders of the organization was studied in this project.

The project also focuses on decision-making process of the management, which influenced company’s internal and external stakeholders. The project also valued how merging of two companies can influence performance of the company. A valuable information on financial importance in banking sector also focused in this project.

Finally, the project interconnects with the importance of stakeholders in a baking sector to maintain sustainable growth and development of the organization.

The project is based on the strategic development of financial and banking industry. This project develops knowledge on the ways to develop and maintain competitive business growth.

This project helps to gain insight on how mergers and acquisitions provide impact on maintaining sustainability in the banking sector. The project also focuses on how inefficient mergers growth can affect the business in the banking sector. This project provides knowledge on active strategy development on implementation plans, employee laying off percentage, manager laying off percentage, HR practice and other essential banking works.

The project also generates information on the role of different stakeholders and business values in the banking sector to maintain sustainable growth and development of a baking organization.

The objective of the project was to develop an initial business plan in a certain amount of time, which can influence the business structure of Northern Bank (NB) as well asSouthern Bank (SB) and their annual growth.

The initial business plan also considered as the first step toward the company’s final business plan, which implemented in their business modelling. Another main objective of the project was developed solutions on maintaining sustainability in mergers as well as acquisitions in banking firms in UK.

| Key Objectives | Key decision relatable to objectives | Final decision | Initial decision |

| Consoliding operations | D2 Managers laid off percentage | 20% | 15% |

| D3 Employees laid off percentage | 20% | 5% | |

| D4 Practices of HR | Rationalize | Retain | |

| D8 IT Systems | Rationalize | Replace | |

| D9 Name of Bank | Retain | Retain | |

| Using new branch network for opportunities of leverage synergy | D5 Network of Branch | Rationalize | Rationalize |

| D8 IT Systems | Rationalize | Replace | |

| Using customer base for opportunities of leverage synergy | D6 Portfolios of product | Replace | Retain |

| D7 Process of Loan Approval | Replace | Rationalize | |

| Raising defense against Eastern bank merger threat | D1 Implementation Plan period | 6 months | 6 months |

| D6 Portfolios of product | Replace | Retain | |

| D7 Process of Loan Approval | Replace | Rationalize |

Table 1: Relevant decisions based on company objectives

3. Important decisions

A. D1 Implementation plan period

As an initial business plan by both management of NB and SB, six months is the time that has been provided for implementation. All banking stakeholders of these two companies were appreciated this proposal, which reflected their interests. Abunnasr et al. (2015, p.145) stated that implementation plan period is an essential step in developing business or implementing new plans in business.

According to the IT director of NB Ivan, six months was sufficient for replacing the It system of SB. Ivan was also satisfied with the initial implementation timeframe as they got opportunities or time to perform and test new systems before implementing the system in banking operations.

Stakeholders of the company, such as employees and managers, have also appreciated the timeline due to it enabled enough time to get training and gain knowledge on the procedures of this new system.

B. D2 Managers laid off a percentage

Mergers of two or more companies not only have a positive impact on the stakeholders, but it also affected stakeholders. According to Cândido and Santos (2015, p.246), managers are essential internal stakeholders of a company. However, in many cases, mergers of companies cause job loss of managers in the company.

The management board of companies are using several unique techniques according to their relations and business region to lay off managers from the company. NB and SB were decided that they laid off the same amount of managers from both companies.

To balance the work culture and to balance the employment structure with production, the management boards of these two banks were decided to be more organized and transparent in their decision making process.

Thus, they had agreed two laid off the same amount of managers from both banks to avoid any partiality. This plan proved successful in avoid independent work by both banks and allowed them to work collectively on their objectives. According to the initial idea, the management of both companies had been decided to lay off 20% managers from the companies, which was initially appreciated by the CEO of NB.

However, NB Hector’s HR Director and SB Elaine’s HR Director disagreed that decision and reduced the percentage of laid-off managers by 5%. After that, both the management board of two banks were decided to lay off 15% managers from their organizations.

According to the current employment plan, report the total numbers of managers existed in both banks were 103. However, after 15% lay off due to mergers, 87 managers were still served for the company.

| Current number of managers | 103 |

| Number of Managers after 20% layoffs | 82 |

| Number of managers after 15% layoffs | 87 |

Table 2: Overview Manager Layoffs

A useful initial business plan not only provides focus on the solutions and profits of the company but also give importance to employee satisfaction and benefits (Al-Habilet al. 2017, p.206).

The initial plan also involved support and compensation plans for the laid-off managers. This initial plan also included solutions to help those laid off managers to find new jobs through personal networks and organized consultancy programs.

C. D3 Employee laying off a percentage

Mergers of both NB and SB also affected the employment of employees in both organizations. The management of NB and SB decided to lay off a few employees as similar they planned for the managers. According to Kaltiainen et al. (2017, p.636), mergers of companies sometimes provide a harsh effect on the employees of the company.

Both the Banks were agreed to lay off the same percentage of employees to keep a balance between organizational structures and companies employment. Mergers of NB and SB caused laid off 5% employees from both banks.

However, during the planning process, HR Director of SB, Elaine demanded zero percentage layoffs of employees, but it was not considered due to overpopulation of employees.

Merger of these two banks resulted in the closure of 10 branches of NB and SB. Thus, the management of these two banks was decided to reduce quantity of employee to maintain a balance. However, the CEO of NB Jon, the CEO of SB Sue and the HR Director of NB Hector all were willing for higher employee layoff.

Thus, Elaine’s demand was not sustained for long. Davis et al. (2015, p.1434) opined that the management identified those employees that did not cope with new processes and procedures is a primary part of the laid-off process. The board then laid off those employees from the bank.

Before the mergers, the number of employees was 1485. However, after 5% layoffs, the total number of employees in the bank was reduced up to 1410.

| Current number of employees | 1485 |

| Number of employees after 20% layoffs | 1188 |

| Number of employees after 15% layoffs | 1410 |

Table 3: Overview Employees Layoffs

Therefore, 75 employees were laid off due to the merger of NB and SB. The similar approach was taken for employees that were applicable for early retirement plans. This approach resulted that the company had to pay less compensation amount and redundancies.

The initial planning also considered providing knowledge on the importance of HR practices to develop maximum efficiency from the employees of the company. According to Mostafa (2017, p.171), effective HR practices in an organization relating to safety, organizational culture, performance are essential to maintain sustainability in an organization.

The best HR practices of both NB and SB were identified through consulting. Then those HR practices selected to develop a combined and improved business plan. Few top HR chose methods and applied to all the staff in the organization. As a result, the company wanted to maintain sustainable growth and development in the banking sector.

The HR Director of NB was considered to justify those HR practices with proper explanation and reasons which preferred to replace HR practices of SB. However, the HR Director of SB Elaine disapproved with Hector’s opinion, and she considered that HR practices of SB were far better than the NB.

Thus, the management of two companies was agreed to retain both HR practices as a short-term solution. However, they also notified that the differences in HR practices in both companies could make unethical culture in an organization. They also identified that the salary structure, bonus and other benefits, holiday and pension schemes of these two companies are different.

Rauch and Hatak (2016, p.499) stated that different HR practices of two or more different companies could create a hazardous situation inside the organization if they merged. The consultant members were decided that employees and stakeholders of SB must be engaged in HR practices, which was not done correctly. The organization also considered re-engagement with stakeholders of SB.

At the initial stage of business plan, the existing branch network was studied and evaluated to take decisions on new branch network. The management was willing to explain the new branch network with logical reasons. LaPlante and Paradi (2015, p.37) opined that the stakeholders of the company always appreciate a new branch network with better qualities and solutions.

After merged, the new branch network was reduced up to 10 branches. Five of them were from NB, and other five were from SB. The management identified underperforming branches and decided to demolish them after the merge.

The organizations were willing to provide better customer experience and enhance their satisfaction level through better management and skills of workforce. As a study in new branch network, the result showed that the employees in SB operate better with their qualities and abilities than the NB.

| Median | NB | SB |

| Retain | 3.56 | 3.71 |

| Rationalize | 3.8 | 3.84 |

| Close | 3.56 | 3.88 |

Table 4: Median employee’s skills of NB and SB

The HR Directors of both Northern and SBs expressed their concern about the impact of closures and introduction of new business structure. They also considered the effect of this merger on customers to identify the business growth.

G. D7 Process of loan approval

The loan approval process of the NB seemed to be more efficient and plausible than that of SB. Therefore, it was advised that process of loan approval be to be changed in the pre-consultation plan. However, when the consultation took place, it was ‘rationalised’.

Each Head of Retail Banking at NB and SB disliked processes followed by each other’s bank and differed hugely in opinion. SB’s external stakeholder Patrick had majorly influenced the decision-making. It was pointed out, and concern was raised regarding none of the processes followed in each of the banks was sufficient (Ghooshchi et al. 2017, p.92).

There was a need for further change. It was under his influence that the decision to ‘rationalise’ was taken by combining practices of both the banking processes.

IT experts were lacking in both the banks and those who were concerned with this department, had limited skill range. This is why the initial plan was to ‘rationalise’ the IT systems. Ivan, IT Director of the NB, hugely opposed this idea.

Based on the recent crisis faced by Lloyds Banking Group, he pointed out that there is a massive possibility of risk regarding outage when customer data will be transferred (Theregister.co.uk, 2019).

Therefore, the IT system was replaced with a more advanced one. A six months implementation period was combined with it that resulted in high satisfaction among stakeholders. This time period will help testing and relevant reformatting of the database of SB that will help in establishing compatibility with the system of NB.

Renaming the bank could result in loss of brand loyalty because the customers tend to be loyal to a specific name. According to Weinstein (2016), when renaming occurs because of merging, customers tend to distance themselves. Furthermore, renaming would have led to expenditure of extra money.

Therefore, it was decided to retain the name of the bank. Stakeholders backed this decision, and as a result, the name of the bank remained unchanged.

During the initial pre-consultation period, the focus was majorly laid on saving costs through which total revenue generation could be boosted furthermore. In the post-consultation period, necessary changes were made that resulted in alteration in the overall structure of cost.

Replacement of the IT system acted as one of the main influencing factors for the need to save cost. As opposed to anticipated value, the post-consultation plan turned out to be lagging behind the cost-saving schemes. However, the overall revenue growth turned out to be positive, with an increase of $14.

Since this growth of revenue is positive, it is ideal that initial changes are maintained. There is a necessity to bring in further changes that will help in further boosting revenue growth. This creates space for ‘retention’ of the product portfolio.

| Pre-consultation | Post-consultation | Difference | |

| Cost savings | $90m | $68m | $22m |

| Revenue growth | $67m | $53m | $14m |

| Total earnings | $85m | $121m | $36m |

Table 5: Pre and post-consultation financial summary

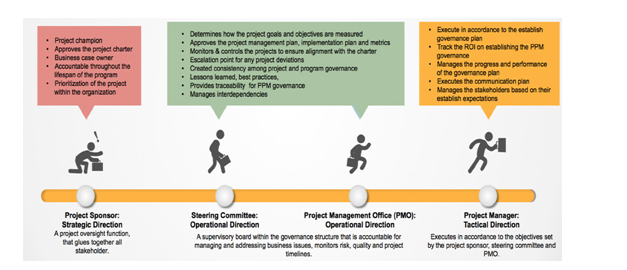

Project governance is a guiding principle for the manager who has to consider carefully all the essential elements included in the project. This governance tends to be a facilitator for more enhanced progress in a project.

For responsibilities of the executive team and board members of a project, it serves as a guidance and basic framework of instructions. As opined by Muller (2017), expected processes to be involved in the project are also delineated.

With respect to the merger activities, the project team of Northern and SB had utterly failed in implementation of an ideal framework of governance. The failure is visible in the initial strategic plan and consultation period.

For successful execution of project governance framework, four main roles should be clearly defined. [Refer to Appendix 1 Figure 1]

In the initial business plan, focus was on the micro and macro environment of Northern and SB, stakeholder strategy, risk analysis and strategy of implementation.

It would have been better if the framework of project governance and important roles had been explained and allocated at an early stage. This would have supported the consultation period.

Furthermore, communication plan was disregarded during consultation. This resulted in a lack of proper interaction with stakeholders. Expected behaviours among these stakeholders differed from that of the original one that proved contrary to expectations.

This resulted in disruption in integration of necessary changes because they differed in opinion, and some of them quarrelled to establish individual supremacy.

Engagement of stakeholders had not been good. Some stakeholders received more than required focus while others were neglected. SB’s most influential stakeholder Patrick was involved multiple times that resulted in negligence towards engagement of NB’s most significant stakeholder, Bill.

This created a negative satisfaction among stakeholders. Some stakeholders were consulted at wrong moment that prevented them from making useful contributions.

For example, NB’s CEO Jon was asked for his opinion regarding consultation and proposed plan. He was unable to comment because of the fact that discussion had not progressed much and that results have not yet been produced.

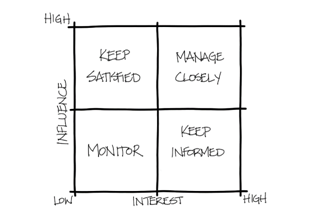

Stakeholders are mapped against relevant criteria of their importance through this process. [Refer to Appendix 2 Figure 2] Stakeholders are divided into sub-groups based on their influence over the organization and their interest regarding functioning in the organization.

In the pre-consultation period, Jon, Sue and Carla were kept satisfied. Patrick and Marie were managed closely. Employees were monitored, and the media and communities were kept informed.

This kind of structuring produced inefficiency in the functioning. As a result, in the post-consultation period, some changes were made. Bill was introduced into the ‘satisfaction’ zone and media was put into the ‘monitoring zone’. ‘Employees’ were also put into the ‘information’ zone.

B. Satisfaction of stakeholders

Satisfaction among stakeholders is the underlying principle for a business firm’s growth. The merger between Northern and SB is likely to fall apart if the stakeholders are not satisfied with the activities of the merging process.

| NB | Role | Stakeholder satisfaction (-3 to +3) |

| Jon Pettinger | CEO | 0 |

| Luke Stanio | Head of Retail Marketing | -1 |

| Hector Rice | HR Director | +1 |

| Carla Feinberg | CFO | -1 |

| Ivan Taylor | IT Director | +3 |

| SB | Role | Stakeholder satisfaction (-3 to +3) |

| Nick Liang | Head of Corporate Banking | +1 |

| Elaine Murphy | HR Director | 0 |

| Sue Beckermann | CEO | +1 |

| Tina Yoshiro | Head of Retail Banking | -1 |

| External stakeholders | Role | Stakeholder satisfaction (-3 to +3) |

| Patrick Green | CEO (People Power) | +1 |

| Bill Johnson | Director (Sunrise Pension Fund) | +1 |

| Marie Calperra | State Representative (American Banking Authority) | +1 |

Table 6: Stakeholder satisfaction

From the above table, it can be calculated that the total satisfaction level in NB is +2, in SB is +1 while for external stakeholders, it is +3. This shows that focus has been more on the external stakeholders due to which their satisfaction level is high.

It could be said that because of the lack of satisfaction among stakeholders of the two banks, merging process has faced difficulties and there has been trouble regarding deciding on a fixed process of functioning for the merger.

C. Communication to stakeholders

Effective stakeholder communication is required for the decided strategy to take effect and for this strategy to be communicated to stakeholders in time. It has been a part of the business plan that was decided through establishing change strategy based on McKinsey’s 7s model.

In order to make this communication a significant portion of the consultation plan, it had been mainly communicated to key stakeholders via email (Balali et al. 2018, p.526). In other cases, some parts were communicated through meetings, press releases and telephone calls.

With multiple changes in the decision-making process, the project team ultimately lost track of communication network and became confused regarding who received the information and who did not. This confusion had created dissatisfaction among the stakeholder community and had led to the breakdown of an active communication network.

- It is recommended that project governance requirements are communicated at an early stage of the project

- It is recommended that key stakeholders must be regularly engaged during merger activities and their feedbacks must be sought

- It is recommended that SB’s practices should be replaced with NB’s practices through proper negotiation between the two banking entities

- It is recommended that decisions should be reviewed once merging is complete so that necessary changes could be brought

It could be concluded that merger and acquisition, when succeeds, creates numerous beneficial values like saving cost, enhanced revenue generation and deeper market perforation. These benefits are the key factors for Northern and SB merging.

An extensive analysis had helped in strategic business planning. It has been possible to make use of stakeholder strategy, consultation period and assess risks that are associated with the merging. This has helped in making necessary changes to the final decisions.

The revelation regarding lack of project team’s experience has helped in learning lessons that will be useful in upcoming future projects. An attempt has been made to engage stakeholders and create satisfaction among them that could boost merging activities at present and in future.

Books

Muller, R., 2017. Project governance. Abingdon, United Kingdom: Routledge.

Weinstein, A., 2016. Superior customer value: Strategies for winning and retaining customers. Florida, United States: CRC Press.

Journals

Abunnasr, Y., Hamin, E.M. and Brabec, E., 2015. Windows of opportunity: addressing climate uncertainty through adaptation plan implementation. Journal of Environmental Planning and Management, 58(1), pp.135-155.

Al-Habil, W.I., Al-Hila, A.A., Al Shobaki, M.J., Abu Amuna, Y. and Abu Naser, S.S., 2017. The Impact of the Quality of Banking Services on Improving the Marketing Performance of Banks in Gaza Governorates from the Point of View of Their Employees. International Journal of Engineering and Information Systems (IJEAIS), 1(7), pp.197-217.

Balali, V., Noghabaei, M., Heydarian, A. and Han, K., 2018. Improved Stakeholder Communication and Visualizations: Real-Time Interaction and Cost Estimation within Immersive Virtual Environments. In Construction Research Congress 2018 (pp. 522-530).

Cândido, C.J. and Santos, S.P., 2015. Strategy implementation: What is the failure rate?. Journal of Management & Organization, 21(2), pp.237-262.

Davis, P.R., Trevor, C.O. and Feng, J., 2015. Creating a more quit-friendly national workforce? Individual layoff history and voluntary turnover. Journal of Applied Psychology, 100(5), p.1434.

Ghooshchi, N.G., Van Beest, N., Governatori, G., Olivieri, F. and Sattar, A., 2017, October. Visualisation of compliant declarative business processes. In 2017 IEEE 21st International Enterprise Distributed Object Computing Conference (EDOC) (pp. 89-94). IEEE.

Kaltiainen, J., Lipponen, J. and Holtz, B.C., 2017. Dynamic interplay between merger process justice and cognitive trust in top management: A longitudinal study. Journal of Applied Psychology, 102(4), p.636.

LaPlante, A.E. and Paradi, J.C., 2015. Evaluation of bank branch growth potential using data envelopment analysis. Omega, 52, pp.33-41.

Mostafa, A.M.S., 2017. High-performance HR practices, positive affect and employee outcomes. Journal of Managerial Psychology, 32(2), pp.163-176.

Rauch, A. and Hatak, I., 2016. A meta-analysis of different HR-enhancing practices and performance of small and medium sized firms. Journal of business venturing, 31(5), pp.485-504.

Websites

Kbp.media, 2019, Stakeholder map, Available at: https://www.kbp.media/stakeholder-map/ [Assessed on 20 December 2019]

Pmi.org, 2019, Project governance critical success 9945, Available at: https://www.pmi.org/learning/library/project-governance-critical-success-9945 [Assessed on 20 December 2019]

Theregister.co.uk, 2019, Lyolds Halifax bank problem, Available at:https://www.theregister.co.uk/2019/01/18/lloyds_halifax_bank_problem/ [Assessed on 20 December 2019]

Figure 1: Project governance roles

(Source: Pmi.org, 2019)

Figure 2: Stakeholder Mapping

(Source: Kbp.media, 2019)