A Study On Duration Gap Method and Interest Rate Risk Management Assignment Sample

1.0 Introduction

The duration gap is indeed a financial reporting phrase of institutions, investment companies, and many other investment companies have been using to assess their risk from currency movements. Resource discrepancies are amongst the types of abnormalities that can manifest.

The liability of a company’s fiscal health to severe changes in interest rates is known as “interest rate risk”. Taking such a risk is a standard element of the financial industry, and it may be a useful resource of profit for shareholders’ value. This proposal, there is discussed the literature review, intended contribution, research design, research question, ethical consideration, research plan, and conclusion.

2.0 Literature review

According to the authors, English, et al. (2018), banking institutions engage in maturation transformation when they take funds for a brief period and subsequently give it all out.

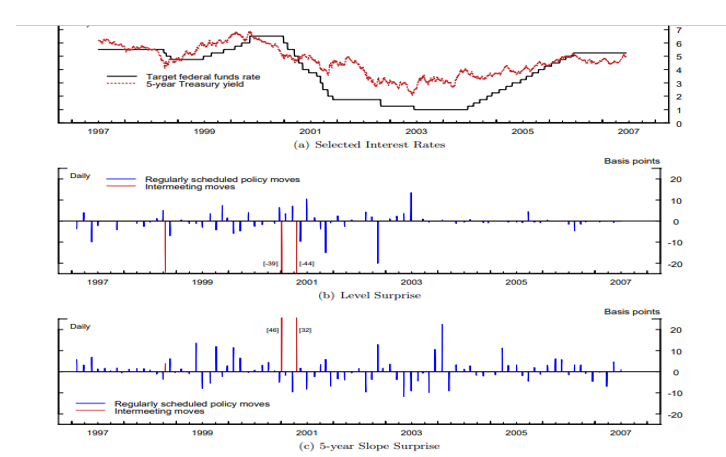

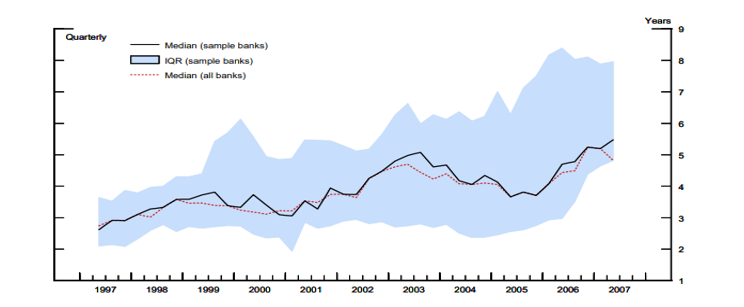

However, a big maturity difference reduces the adverse reaction of values to a gradient unexpected, which is commensurate with lenders’ position as maturity converter. The share value of banks is that rely substantially on retained earnings fall more in proportion to legislation bond yields, which is mostly due to deposit deregulation (Altavilla, et al. 2018). Though credit risk is inherent in the maturity development phase, businesses can mitigate it by using exchange rate contracts or by growing slowly loans at the exchange rate to reduce the influence on interest earned (Freeman, et al. 2018). Furthermore, fluctuations in unconsolidated affiliates aspects of revenues or expenditure, like as money by charges of credit losses, including change in shape and structure of banks ’ balance sheets, may counterbalance the benefit of currency fluctuations on loan growth [referred to appendix 1].

The bad response of bank stock markets to favourable slope shocks, on the other hand, is greatly reduced for banks having assets that do have a longer rebalancing interval or maturity than its assets is entities that participate in more mature transformations (Domanski, et al. 2017). This finding supports the widely held belief that banks profit from a higher lending rate because of their position as maturity changers (English, et al. 2018). It stresses just somewhat because a substantial reversible only moderates cash market yields’ negative sensitivity to steep shocks.

Figure 1: Chosen Interest rate and Related Interest rate slope

(Sources: English, et al. 2018)

Figure 2: Maturity Gap

(Source: English, et al. 2018)

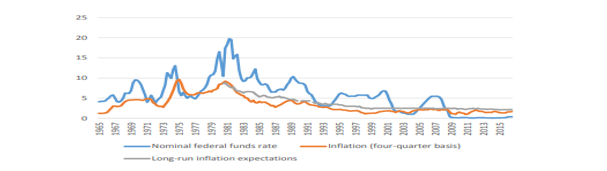

According to the author, Kiley, and Roberts, (2017) the financial institutions’ inflation targets are below the median rate of prices and projections of the cost of borrowing likely to reign supreme over the big scheme of things fall prominently. The short of the typical real interest rate witnessed over this period, interest’s rates may still be significantly just under the arithmetic mean during the last quarter (Drechsler, et al. 2021). Reducing interest rates over an extended period might result in continuous and costlier occurrences at the practical cutoff point (ELB). In an evolving (DSGE) model as well as a sizable analytical framework, the “FRB/US model”, researchers review the occurrence and possible costs of all of these crises in a moderate world [referred to appendix 2].

Firstly, whenever the maximum interest rates are falling, monetary policy measures based on classical policy norms contribute to a bad financial outlook, with economic growth and inflation becoming more unpredictable and routinely coming short of desired goals (Fan, et al. 2018). Furthermore, with such policy measures, the durations of ELB incidents are much larger than in earlier studies (Kiley, and Roberts, 2017). Secondly, a vulnerability to a basic rule wherein monetary authorities is more accommodating on average than what the rule permits makers to strive for volatility near 3% because when “ELB” is indeed not enforceable, ensuring that volatility meets its 2% target. Thirdly, between the “DSGE and FRB/US models”, dedication policies inside which monetary support is not eliminated until any inflation or business output exceeds their long-run goal are quite effective (Egli, et al. 2018). Third, the rate of interest is low, and monetary policy pursues a typical policy, the negative effects related to both the ELB may be significant at inflation expectations approaching 2%. If such negative consequences justified an increased inflation objective depends here on the feasibility of monetary policy measures that are significantly different than past methods, as well as an examination of the deflation target’s impact on economic stability [referred to appendix 3].

Figure 3: The Nominal Federal Funds rate, Inflation, and Long-run Inflation Expectation

(Sources: Kiley, and Roberts, 2017)

The lower trend in “nominal rates and inflation” is noteworthy, and it suggests that “nominal interest rates” might continue below historical levels for the foreseeable future.

3.0 Intended contribution

The researcher is helping each other and giving their best output throughout the project. The researcher is showing interest in the project and continuously solving the doubt in the project. They are recognizing their problems while they are working on the project. They are giving their effective dedication towards the project. They are identifying their interest so they can give their 100% effort regarding that topic. The researcher is getting so much information throughout the process. They improve their knowledge by regularly updating the knowledge.

4.0 Research design

The study design entails methodologies and demonstrates how the research should be prepared. The analysis has been conducted first, followed by the setting of some aims and goals for this study. The research questions were developed. After that, relevant literature reviews are gathered and given an idea about this study, it is giving information about the topic. Following the literature review and models are gathered to verify the literature’s opinions. The relevance of research is expressed by the enhanced information analysis that is why some data was collected for this project from secondary sources, and then analysis was offered. In this research

5.0 Research question

- How the bank is measuring the interest rate?

- How the bank can improve there their risk management?

- What are effects can be observed if changes the interest rate?

- What is gap analysis in an interest rate risk?

6.0 Ethical consideration

6.1 Integrity

The project integrity is where the researcher is showing their trust and confidence towards the project. While they are collecting the data they are performing well in the research field. The Rules and regulations are made for everyone. The research teams are following those aspects. the guideline of the project is maintained and it is giving the professional codes.

6.2 Objectivity

The objectivity of the project is well maintained and the researcher is seeking the scientific truth of the research. They are concerned about the project and carefully handling the project. The depth concept is helping the research objectivity. The researcher is analyzing from a biased perspective. The bias mentality always gives a positive attitude towards the project.

6.3 Confidentiality

Confidentiality is kept as a way of protecting everyone’s dignity, building relationships of trust with survey respondents, and maintaining moral guidelines and the research method’s authenticity.

6.4 Professional

Professional researchers while doing the research, they are maintaining the dignity of the research. Benign a professional researcher is maintaining the high quality of the result and giving a reliable opinion about the research. It is giving the integrity of the project. In this project, professionalism is maintained and the researcher is giving their 100% work efficiency towards the project.

7.0 Research plan

7.1 Overall

This proposal of the research is study based and the findings can be from the work that is undertaken by Lindop, Holland, and Zainudin (2016). In this research plan, there will be disclosure of different aspects of taxation and also its scandal. The Financial crisis is also focused in the study.

The overall project is where qualitative research is discussed. The secondary data is analyzed through the data analysis method. The project planning process is taking around 5 days and the researcher is doing the budget of the research together. It is taken more time compare to the expected time duration. For the budgeting, it is taken around 12 days. The project initiation is taken 2 days. The researcher is setting the aim and objective and it takes around 2 days. In the literature review part., the researcher is not able to find out the appropriate data and they are done this process with a period of 9 days. The data collection process is an important key aspect of the research. The data is collected through online articles, journals, and websites. The data collection process is taken around 10 days. Then the researcher is analyzing the data from the gathering data. It is giving more information about the topic. The researcher is facing so many challenges while they are doing the research. Still, they are doing their 100% work efficiently while they are doing this work. After the data analysis, all the researchers are verifying the results or outcome of the project. It is taken around 5 days. The closure date of the research is taken 2 days and then the project submission date is taken out 2 days.

7.2 Method consideration

In his qualitative research approaches where a case study is taken and the researcher are focusing on the topic. The research will be based on the qualitative methodology where different kinds of financial analysis have to be analyzed. Several secondary sources like report, online articles, websites, journals, etc. can be used for the financial statement analysis. It is helpful for standard financial analysis. Key term like asset, market, loans etc. will be focused for the analysis. Different tools and software like adobe reader can be used for the research and getting data and information.

7.3 Sample size

There are different banks in the list of UK FTSE100 and those can be the sample of the research. This banks’ information can show the current condition of the bank. Standard Chartered Bank has 13.52 (£bn) market capital and 86865 employees. HSBC has 88.11 (£bn) with its 267000 employees. Barclays has 150000 employees and 27.18 (£bn) market capital. Lloyds Banking Group has 120449 employees and 44.11 (£bn) market capital. Royal Bank of Scotland Group has the market capital of 28.60 (£bn) and it has 150000 employees across the world.

7.4 Data and time management

The secondary data is taken here through the journal and online articles. Time management is an important key aspect of the project. The project has been done with the period. The project starting date is 2.11.2021 and the submission date is 09.11.2021. The total project is where some people are not able to join due to the Covid-19 situation. Due to the lockdown situation, the researcher is working from the home and they are choosing social media, video calls, and conferencing their meetings through it. The team’s members are maintaining their time and showing their interest in the work. The team leaders are distributing their work throughout the teams according to their interest bases. The data collection process is helping them to take the information about the project.

The samples are collected from recent years mostly where standard legislation has to be focused. There are not so much difficulties in data management and the collection of data. The duration for each task has been provided in the time plan above. But it can be extended if the plan is not properly met.

7.5 Limitation

The references are taken from the website is not having accurate sources of the project. There is taking similar types of information which are helping the research partially. The research methods are giving the idea about the topic while doing the formatting it took a long time. The time is taken more and the limited access of the data is not giving accurate information about the topic. Due to the pandemic situation, the researchers are not able to research within the time. They can able to collect the data within the time duration. There can be limitation in connection to the legitimacy requirement. There can be issue from the response of banks on which the research has to be done. Besides, there are some human errors may affect the research.

7.6 Cost

The budget of the project is $50. The project planning cost is $5 and when the project is initiating the researcher invests their money to research materials and it is around $7. In the data collection process, they are invested $5 and the researcher is analyzing the data after gathering the data. As this is a proposal, there is not much effective cost. But the budget may be changed in the time of doing final project.

8.0 Summary

This proposal, in the introduction part, there is described the duration gap method and internet risk management. The literature review part, there is described the author’s opinion and their concept about the topic. The research design where is discussed the design structure. In this proposal, there is taken qualitative and secondary data. The research question gives an idea about the project. The ethical consideration is divided into four-part and is discussed here. The research planning is given the idea about the time is needed to do the research project and their planning strategy. In the method consideration where is discussed about the method which is analysis in here. The overall project idea is given brief information about the project planning. The research limitation is mentioned here and the cost of the project is analysis in above.

This proposal, has mentioned the review of different financial statement. The research has to be included the review of financial statements of the banks and the impact of the taxation. The budget of the research has been considered minimal.

Reference list

Journals

Altavilla, C., Boucinha, M. and Peydró, J.L., 2018. Monetary policy and bank profitability in a low interest rate environment. Economic Policy, 33(96), pp.531-586.

Domanski, D., Shin, H.S. and Sushko, V., 2017. The hunt for duration: not waving but drowning?. IMF Economic Review, 65(1), pp.113-153.

Drechsler, I., Savov, A. and Schnabl, P., 2021. Banking on deposits: Maturity transformation without interest rate risk. The Journal of Finance, 76(3), pp.1091-1143.

Egli, F., Steffen, B. and Schmidt, T.S., 2018. A dynamic analysis of financing conditions for renewable energy technologies. Nature Energy, 3(12), pp.1084-1092.

English, W.B., Van den Heuvel, S.J. and Zakrajšek, E., 2018. Interest rate risk and bank equity valuations. Journal of Monetary Economics, 98, pp.80-97.

Fan, Y. and Stevenson, M., 2018. A review of supply chain risk management: definition, theory, and research agenda. International Journal of Physical Distribution & Logistics Management.

Freeman, B.S., Taylor, G., Gharabaghi, B. and Thé, J., 2018. Forecasting air quality time series using deep learning. Journal of the Air & Waste Management Association, 68(8), pp.866-886.

Kiley, M.T. and Roberts, J.M., 2017. Monetary policy in a low interest rate world. Brookings Papers on Economic Activity, 2017(1), pp.317-396.

Kwak, D.W., Seo, Y.J. and Mason, R., 2018. Investigating the relationship between supply chain innovation, risk management capabilities and competitive advantage in global supply chains. International Journal of Operations & Production Management.

Lopez, J.A., Rose, A.K. and Spiegel, M.M., 2020. Why have negative nominal interest rates had such a small effect on bank performance? Cross country evidence. European Economic Review, 124, p.103402.

Rodnyansky, A. and Darmouni, O.M., 2017. The effects of quantitative easing on bank lending behavior. The Review of Financial Studies, 30(11), pp.3858-3887.

Rostamzadeh, R., Ghorabaee, M.K., Govindan, K., Esmaeili, A. and Nobar, H.B.K., 2018. Evaluation of sustainable supply chain risk management using an integrated fuzzy TOPSIS-CRITIC approach. Journal of Cleaner Production, 175, pp.651-669.

Appendices:

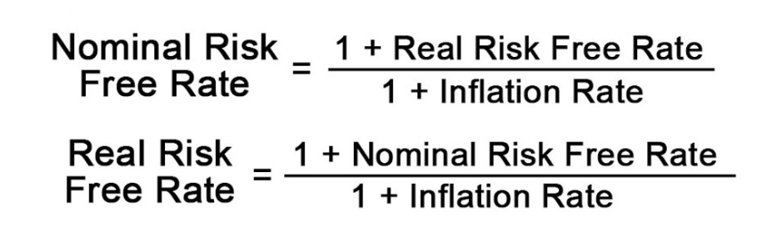

Appendix 1: Risk-free rate formula

(Sources: https://www.educba.com/risk-free-rate-formula/)

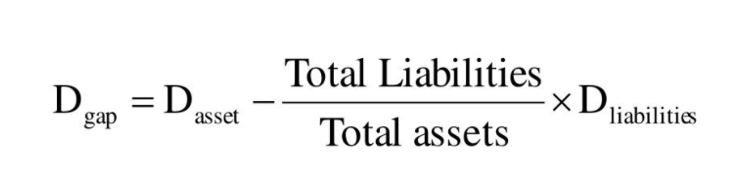

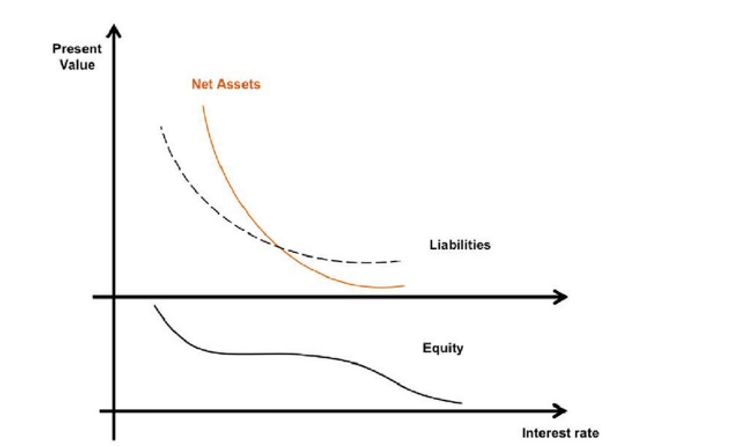

Appendix 2: Duration Gap formula

(Source: https://www.slideserve.com/todd/fin-603-week-5-powerpoint-ppt-presentation)

Appendix 3: Risk assessments

(Source: http://www.scielo.org.co/scielo.php?script=sci_arttext&pid=S0123-59232018000100034)

………………………………………………………………………………………………………………………..

Know more about UniqueSubmission’s other writing services: