AAF043-6 Accounting and Financial Assignment Sample

Module code and Title: AAF043-6 Accounting and Financial Assignment Sample

Introduction

The following assignment is an analysis of the financial and management accounting techniques and concept method and approach through which an organization’s financial and non-financial performance can be evaluated. In this study, one of the renewed airline industries of the UK named Virgin Atlantic’s performances have been evaluated through which it can be possible to measure whether the goal and mission of the company are properly aligned with its business activity.

Moreover, in this study, the concept and role of contribution margin have been evaluated. This study aims to highlight the concept of a balanced scorecard to measure the financial and non-financial performance of the company and other management tools such as contribution margin and pricing strategy.

Question 1: The concept of a balanced scorecard and its implication

Concept of balanced scorecard

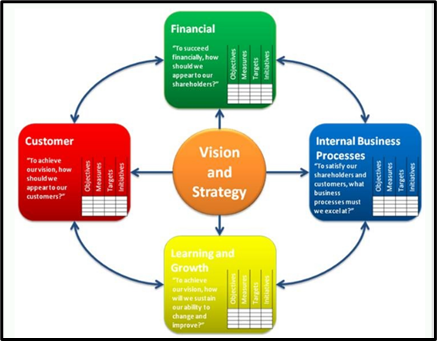

A balance score is a strategic management matrix through which an organisation’s various internal functions and its resulting outcome can be improved. The concept of a balanced scorecard has been given by David Nortan and Robert Kaplan. As stated by Syahdan et al. (2018), an analysis of the balance score highlights how the company has been performed from different perspectives of the business.

Based on this, an organisation can be able to assess its performance and find the scope for further development. This is an effective tool for the non-profit company by which an organisation not only increases its overall performance of the business but also increases its strategic position in the market. Thus the balance score is a tool through which the strategic goal of the company is being converted into a set of organisation activities.

This leads to ensuring management measures and monitors and changes if necessary for an organisation to attain the overall objectives of the company.

Figure 1: balanced scorecard (Source: Hamdy, 2018)

Figure 1: balanced scorecard (Source: Hamdy, 2018)

The balanced scorecard consists of various perspectives such as financial perspective, customer perspective, intern management perspective and learning & growth perspective. Based on these four protections this systematic tool measures how far this company’s ability to meet its objectives. As cited by Muda et al. (2018), the financial perspective of the company measures the income, return on investment and profitability of the company.

On the other hand, customer perspective measures how far an organisation is able to meet the expectation of customers and provide better satisfaction to them. On the other hand, the internal business perspective highlights whether the activity of a business is properly aligned with the business activity or not. Moreover, the learning and growth perspective measures the performance of an organisation in terms of employee retention and the information system of a company (Debnath et al. 2018).

This provides a more comprehensive view to stakeholders through which various stakeholders of the company can be able to assess whether this common y is operating its activity in meeting these perspectives or not. Thus it can be said that a balanced scorecard is an effective tool through which better stakeholder engagement can be possible. In this study performance of the UK-based airline industry named Virgin Atlantic has been measured through a balanced scorecard.

The implication of a balanced scorecard on the concerned organisation

Financial perspective

| Objectives | Measures | Current initiatives | Performance indicators |

| Economic utilisation of the financial resources of business | Better controlling activity and use of advanced tools and technology | Investment in the non-current asset stood at 665.3 million pounds | Asset turnover ratio |

| Attain economy of scale | Greate labour division and standardisation through economies of scale can be measured (Ardiansyah, 2019). | Cash outflow of 712.9 million pounds in the pandemic period (Virginatlantic.com, 2021) | Quality of product and market position |

| Increase in total revenue and profitability | Adaptation of effective marketing strategy and effective utilisation of resources | 868 million pounds of total revenue during the pandemic period. Loss incurred in financial years 2020 stood at 514 million pounds (Virginatlantic.com, 2021). | Net profit margin and gross margin and return on capital employed |

Learning and growth perspective

| Objectives | Measures | Current initiatives | Performance indicators |

| Increase in employee retention rate | Use a career development plan and provide training. | employee remuneration of £277m which is lower than the previous year. The reduction in the number of employees and a total number of employees stood at 5,907 from 10,016 (Virginatlantic.com, 2021). | Employee turnover |

| Ensures strong communication with the various level of the organisation | Adopt a feedback tool to assess the current position of the employee | Employee assistance program and provide 24/7 support for each employee and their family member during a pandemic. | Profit per Employee |

| Better management of information and ensuring effective flow of information | Use of digital tools and technology in business activity | Deploy digital tools and technology to minimise operational risks (Virginatlantic.com, 2021) | Decision-making ability |

Internal business perspective

| Objectives | Measures | Current initiatives | Performance indicators |

| Ensure effective control | Adaptation of effective strategy to create harmony and collaboration | Continuous focus on providing operational training during a pandemic to reduce cost and maintain quality. | Quality of product and intern control effectiveness |

| Minimisation of waste and unnecessary cost | Spending on strategic decision-making tools and use of cost control program | .adaptation of effective anything tools such as cost reduction and value chain analysis (Virginatlantic.com, 2021) | Cost per product or services |

Customer perceptive

| Objectives | Measures | Current initiatives | Performance indicators |

| Increase in customer retention rate | Procure the high-quality product and service | The implication of Counterparty credit quality is to maintain the quality of services (Virginatlantic.com, 2021) | Revenue and number of customer |

| More focus on sustainable quality | More spending on the research and development process. | Commitment to a long-term supporter of innovation | CSR activity and spending on R&D |

Table 1: Balance scorecard (Source: Estiasih, 2021)

Based on the table, provided it has been found that due to the pandemic the overall performance of the company has declined. A high reduction in total revenue has been noticed due to the pandemic period and lockdown. On the other hand, this company has also faced an issue regarding employee retention as it can be seen that a high reduction of employees from 10,016 to 5,907.

This signifies that due to the pandemic overall performance of the company has been reduced. Based on the above-mentioned table it can be said that due to the pandemic, the performance of the company from a customer perspective, financial perspective, internal business perspective and learning & growth perspective has declined.

Question 2: Pricing strategy types and its role

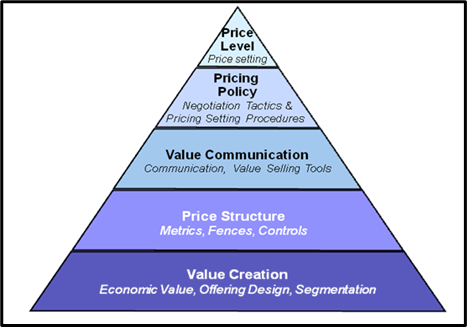

In the current era of the market where competition is increasing day by day thus, it is quite necessary for an organisation to adopt an effective tool through which competency in the market can be increased. Analysis of the current situation of the airline industry in the UK market has found various organisations such as EasyJet plc, and British Airways are the leading industry in the market (Ma et al. 2020).

In the presence of a high number of rival companies, an organisation needs to adopt effective tools through which better differentiation can be possible. On the other hand, analysis of the product differentiation strategy has shown that it is a systematic tool through which an organisation can be able to increase customer satisfaction and competitive advantages.

This strategy seems an effective tool in which value can be added to its product and service which increases the number of customers and their satisfaction. Pricing strategy is one of the effective tools which an organisation in the airline industry can be able to attract its customers and compete in the market in an effective way.

Figure 2: balanced scorecard (Source: Chen et al. 2019)

Figure 2: balanced scorecard (Source: Chen et al. 2019)

There are various types of pricing strategies such as price skimming, price premium, price economy and price penetration.

Price skimming:

Price skimming is a product pricing strategy in which a firm changes the high initial price that the customer will pay and then this price will be lower over a period of time. As stated by Wu et al. (2022), analysis of the price skimming role and its implementation in the business. It has been found that the goal of this pressing strategy is to top off the market and lower the price of the product through which an organisation can be able to reach each customer.

Value-based pricing:

This kind of pricing is an effective tool through which an organisation sets the pre of their product on the basis of the customer’s perception (Chen et al. 2019). If the company has a better brand value in the market and customers perceive that products or services provided by the company are higher and worthier then the organisation sets the price of produce at a higher rate.

Cost-plus pricing:

One of the simplest ways of pricing a product or service is cost-plus pricing in which an organisation sets its price on the basis of the cost incurred. The price under this strategy consists of the cost incurred and profit margin. In this situation, an organisation can be able to effectively price without any barriers (Wu et al. 2020). However, in the current era of a market, it is not good for an organisation to use such a pricing strategy as a firm may not be able to utilise competitive advantages.

Penetration pricing:

It is suitable in a highly competitive market where competition is quite intense. As the change in the environment is quite rapid and there is a direct impact of this change on the market position and its profitability. In this situation, the company is consistently focused on adopting effective tools for rising through which a firm can be able to compete in the market effectively (Ali, and Anwar 2021).

Under penetration pricing companies offer new products or services at a lower price than those available in the market. This leads to an increase in the overall performance of the market. Moreover, an organisation can also be able to increase the customer retention rate and brand value in the market which is quite good for the financial health of the business.

Dynamic pricing:

Another method of pricing products is dynamic pricing in which an organisation is continuously changing the price of a product to meet the demand of customers. This type of pricing method is not suitable for SaaS businesses as customers expect constantly on a monthly or yearly basis.

Based on an analysis of the various pricing strategies and their pros and cons, it has been found that in terms of launching new products or services in the market, the penetration pricing strategy seems an effective tool through which a business can compete with rival companies more effectively.

Question 3: Role of contribution technique in decision-making

Role of contribution:

Analysis of contribution in the current edge of a competitive market is quite necessary which assists an organisation to utilise competitive advantages in the business market. There are various costs associated with the production of a product or service such as fixed costs, variable costs and semi-variable costs. As stated by Alizadeh et al. (2020), Fixed costs are those costs which do not vary on the number of units. In this situation, fixed cost is not considered because the decision-making process sits the same at all levels of production.

On the other hand, variable costs are those costs which are the same per unit thus increasing or decreasing in the production units has a direct impact on the total cost. Thus under the decision of margin analysis of the decision-making process regarding the production of a product.

Based on this, an organisation can be able to analyse how much cost is attributed to the product and how much profit can be recovered from any product or service (Brouwer et al. 2019). Based on this, it can be said that the contribution analysis consists of sales and variable costs. Thus it suggests that the contribution is the amount of profit which is prior to fixed cost.

Contribution = sales – variable cost

The role of contribution is quite significant as it provides a basis for the management to make decisions regarding whether the product is manufactured or not and Whether the proposal is accepted or rejected (Morstyn et al. 2019). Based on this, an organisation can be able to access the strong and weak points of business through which it can take the necessary steps to make better decisions for the business.

Contribution analysis:

Based on the illustration below it has been provided the company has three options where the first option is about the hotel, the second option is for hotel cars and guides and the third option is to a hotel with full accommodation. All the three options and their profitability have been evaluated with the help of contribution margin.

The variable cost of option 1 stood at 333 pounds whereas its sales margin stood at 560 though its contribution margin stood at 73%. On the other hand, the company has a contribution margin of 68% from option 2 which is providing a hotel, guide and car at 890 pounds. Moreover, the full accommodation has a contribution margin of 63% on the sale price.

| Contribution analysis of Three new products | |||

| Particulars | Option 1 | Option 2 | Option 3 |

| Services | Hotel | Hotel+car+ tour guide | Hotel+Full

services available |

| Direct costs | |||

| Material | £ 100.00 | £ 190.00 | £ 270.00 |

| Labour | £ 50.00 | £ 95.00 | £ 180.00 |

| Total direct costs | £ 150.00 | £ 285.00 | £ 450.00 |

| Indirect costs | |||

| Hotel maintenance | £ 30.00 | £ 42.00 | £ 56.00 |

| Tour Guide | £ 30.00 | £ 36.00 | |

| Travelling costs | £ 10.00 | £ 35.00 | £ 70.00 |

| Hotel servent | £ 12.00 | £ 12.00 | £ 50.00 |

| Food and beverage | £ 15.00 | £ 22.00 | £ 50.00 |

| Other charges | £ 10.00 | £ 20.00 | £ 15.00 |

| Total indirect costs | £ 77.00 | £ 161.00 | £ 277.00 |

| Total costs | £ 227.00 | £ 446.00 | £ 727.00 |

| Profit per head | £ 333.00 | £ 444.00 | £ 473.00 |

| Charges per day per head | £ 560.00 | £ 890.00 | £ 1,200.00 |

| Contribution Margin | 73% | 68% | 63% |

| Profit Margin | 59% | 50% | 39% |

Table2: contribution analysis (Source: self-created)

The above table shows the calculation for contribution margin as well as the profit margin for the tourism industry of the UK. From the table, it can be stated that the difference between the contribution margin and the profit margin is more for the third product (Barnett et al. 2020).

The difference is 24% which implies that the third product acquires an enormous amount of fixed cost compared to the other two products. While analysing the situation it can be observed that a third product needs to be adopted as well as improvised in order to get proper. However, the contribution margin under option 1 is more than the other option thus companies need to adopt option 1. This leads to maximising the profitability of the business.

Conclusion

Based on the whole study it can conclude that the balanced scorecard is an effective tool to ensure that an organisation’s financial and nonfinancial can be measured. Based on an analysis of the performance of Virgin Atlantic it has been found that covid-19 has affected its overall performance.

On the other hand, it can be further concluded using a penetration pricing strategy in launching new products in a highly competitive market is suitable for the company. Furthermore, it has been found that contribution analysis plays a significant role in the decision-making process.

References

Journals

Alizadeh, R., Soltanisehat, L., Lund, P.D. and Zamanisabzi, H., 2020. Improving renewable energy policy planning and decision-making through a hybrid MCDM method. Energy Policy, 137, p.111174.

Ardiansyah, R., 2019, November. Penggunaan Metode Balance Scorecard Untuk Mengukur Kinerja Pekerjaan Pada PT. Bangun Cipta Karya Pamungkas (PT. BCKP). In Prosiding Seminar Nasional Darmajaya (Vol. 1, pp. 78-87).

Barnett, M., Brock, W. and Hansen, L.P., 2020. Pricing uncertainty induced by climate change. The Review of Financial Studies, 33(3), pp.1024-1066.

Brouwer, W., van Baal, P., van Exel, J. and Versteegh, M., 2019. When is it too expensive? Cost-effectiveness thresholds and health care decision-making. The European Journal of Health Economics, 20(2), pp.175-180.

Chen, D., Ignatius, J., Sun, D., Zhan, S., Zhou, C., Marra, M. and Demirbag, M., 2019. Reverse logistics pricing strategy for a green supply chain: A view of customers’ environmental awareness. International Journal of Production Economics, 217, pp.197-210.

Debnath, A., Roy, J., Chatterjee, K. and Kar, S., 2018. Measuring corporate social responsibility based on fuzzy analytic networking process-based balance scorecard model. International journal of information technology & decision making, 17(04), pp.1203-1235.

Estiasih, S.P., 2021. Measurement of Cooperative Performance with the Balance Scorecard Analysis Approach. International Journal of Economics, Business and Accounting Research (IJEBAR), 5(2).

Hamdy, A., 2018. Balance scorecard role in competitive advantage of Egyptian banking sector. The Business & Management Review, 9(3), pp.424-434.

Ma, J., Xu, M., Meng, Q. and Cheng, L., 2020. Ridesharing user equilibrium problem under OD-based surge pricing strategy. Transportation Research Part B: Methodological, 134, pp.1-24.

Morstyn, T., Teytelboym, A., Hepburn, C. and McCulloch, M.D., 2019. Integrating P2P energy trading with probabilistic distribution locational marginal pricing. IEEE Transactions on Smart Grid, 11(4), pp.3095-3106.

Muda, I., Erlina, I.Y. and AA, N., 2018. Performance audit and balanced scorecard perspective. International Journal of Civil Engineering and Technology, 9(5), pp.1321-1333.

Syahdan, S.A., Munawaroh, R.S. and Akbar, M., 2018. Balance Scorecard Implementation in Public Sector Organization, A Problem?. International Journal of Accounting, Finance, and Economics, 1(1), pp.1-6.

Wu, M., Ran, Y. and Zhu, S.X., 2022. Optimal pricing strategy: How to sell to strategic consumers?. International Journal of Production Economics, 244, p.108367.

Wu, W., Huang, X., Wu, C.H. and Tsai, S.B., 2022. Pricing strategy and performance investment decisions in competitive crowdfunding markets. Journal of Business Research, 140, pp.491-497.

Websites

Virginatlantic.com, 2021, about Virgin Atlantic available at: https://www.virginatlantic.com/in/en?cm_mmc=10.15.00.17.12.00.142&gclid=Cj0KCQjwkruVBhCHARIsACVIiOyat7hlj4qWyQKsQMB_DsGEn34YDEGyxvvpbMdyi1fkdafy-0amVLQaApIWEALw_wcB&gclsrc=aw.ds [acessed on 20 June 2022]

Know more about UniqueSubmission’s other writing services: